AIMSCAP 2025 Review: Everything You Need to Know

Executive Summary

AIMSCAP's legitimacy in the forex market faces significant scrutiny. Multiple independent sources raise concerns about the broker's credibility and operational transparency, which creates serious red flags for potential traders. This aimscap review reveals a trading platform that offers competitive leverage ratios up to 1:500 and maintains a relatively accessible minimum deposit requirement of $100. However, the platform struggles with fundamental trust and regulatory clarity issues that potential clients should carefully consider before investing their money.

The broker primarily targets retail and institutional clients across Asian markets. It positions itself as a comprehensive trading solution provider that can meet diverse trading needs. However, user feedback predominantly skews negative, with particular concerns regarding customer service quality and unclear regulatory status that make many traders hesitant to use the platform. AIMSCAP operates from multiple regional offices, including locations in Malaysia, Vietnam, Japan, and South Korea. The regulatory oversight in these jurisdictions remains questionable and lacks proper verification.

According to available market data, AIMSCAP offers CFD trading across various asset classes including forex pairs, indices, precious metals, and commodities. Despite these offerings, the lack of transparent regulatory information and consistently poor user reviews suggest serious problems with the platform's operations. Traders should exercise extreme caution when considering this platform for their trading activities.

Important Notice

Regional Entity Variations: AIMSCAP operates through multiple regional branches across different countries. The service offerings and operational standards vary significantly between these locations. The regulatory status and oversight mechanisms differ significantly between jurisdictions, and specific licensing information remains unclear across most operational territories.

Review Methodology: This evaluation is based on available user feedback, publicly accessible information, and standard market analysis criteria. Due to limited transparent disclosure from AIMSCAP itself, some assessments rely on third-party observations and user-reported experiences rather than verified company data.

Rating Framework

Broker Overview

AIMSCAP operates as a financial services provider headquartered in Phnom Penh, Cambodia. The company focuses on delivering trading execution, clearing services, and technological support to both retail and institutional clients across multiple markets. The company has established its primary market presence across Asian territories. However, specific founding details and corporate history remain largely undisclosed in publicly available materials.

The broker's business model centers around providing CFD trading access across multiple asset classes. It places particular emphasis on forex trading, indices, precious metals, and commodity markets that appeal to diverse trader preferences. Despite maintaining offices across several Asian countries including Malaysia, Vietnam, Japan, and South Korea, the company's regulatory compliance and licensing status across these jurisdictions lacks clarity and transparent verification.

According to this aimscap review, the trading platform offers leverage ratios reaching 1:500. This positions it competitively within the high-leverage broker segment that attracts risk-seeking traders. However, the absence of clearly disclosed trading platform specifications, detailed fee structures, and comprehensive regulatory information raises significant concerns. These transparency issues create serious questions about operational standards and client protection measures.

Regulatory Status: Available information indicates unclear regulatory oversight. No specific regulatory body or license numbers are disclosed in accessible materials, which raises significant compliance concerns.

Deposit and Withdrawal Methods: Specific payment processing methods and withdrawal procedures are not detailed in available sources. The minimum deposit requirement is established at $100, which makes the platform accessible to entry-level traders.

Minimum Deposit Requirements: AIMSCAP maintains a $100 minimum deposit threshold. This positions the platform as accessible to entry-level traders seeking lower capital requirements.

Promotional Offerings: No specific bonus programs or promotional activities are mentioned in available source materials. This suggests limited marketing incentives for new traders.

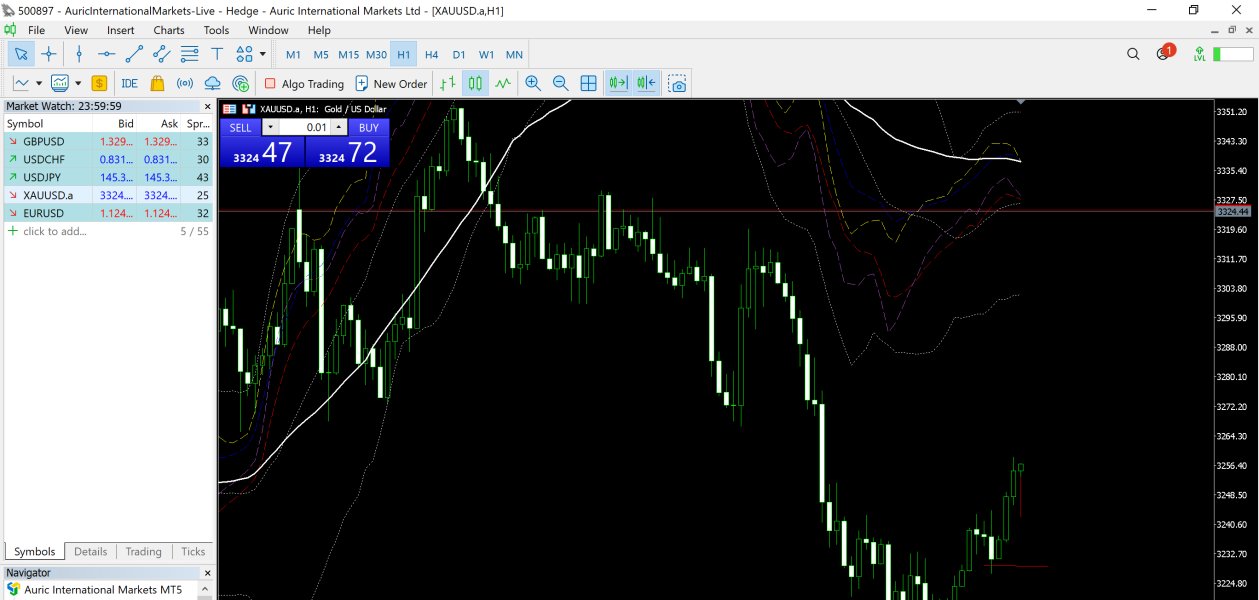

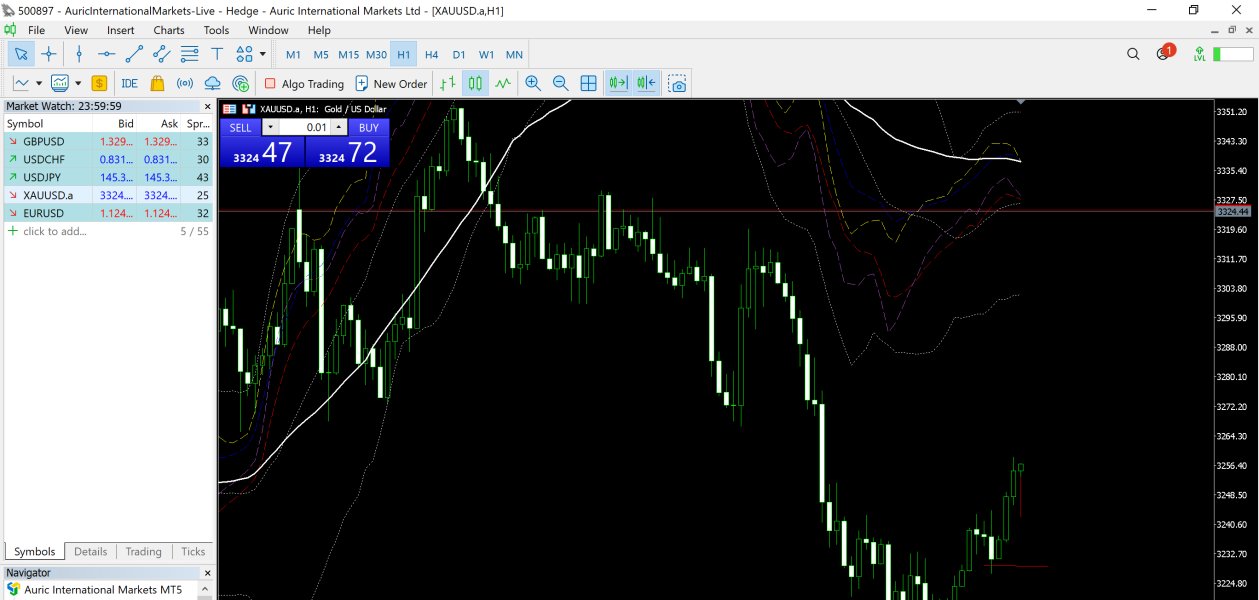

Tradeable Assets: The platform provides access to forex pairs, CFDs on indices, precious metals including gold and silver, and various commodity markets. This offering provides reasonable asset diversity for different trading strategies.

Cost Structure: Detailed information regarding spreads, commission rates, overnight financing charges, and other trading costs remains undisclosed. This prevents comprehensive cost analysis and makes it difficult for traders to evaluate true trading expenses.

Leverage Ratios: Maximum leverage extends to 1:500. This represents a competitive offering within the high-leverage broker category, though this comes with increased risk exposure that can lead to significant losses.

Platform Options: Specific trading platform software and technological infrastructure details are not provided in available materials. This limits platform assessment capabilities and makes it difficult to evaluate system quality.

Geographic Restrictions: AIMSCAP maintains operational presence in Malaysia, Vietnam, Japan, and South Korea. Service availability and restrictions in other regions remain unspecified, which creates uncertainty for international traders.

Customer Support Languages: Available source materials do not specify supported languages for customer service communications. This indicates potential communication barriers for international clients who may need assistance in their native language.

This comprehensive aimscap review highlights the significant information gaps that potential clients face when evaluating this broker's services.

Detailed Rating Analysis

Account Conditions Analysis

AIMSCAP's account structure presents a mixed picture for potential traders. The $100 minimum deposit requirement represents one of the few genuinely competitive aspects of their offering that makes trading accessible to beginners. This relatively low barrier to entry makes the platform theoretically accessible to beginning traders and those with limited initial capital. However, the lack of detailed information about different account types, tier structures, or progressive benefits significantly undermines the overall account offering.

The absence of clearly defined account categories means traders cannot understand what features, tools, or support levels they might access at different deposit levels. Most reputable brokers provide transparent information about standard, premium, and VIP account tiers, each with specific benefits and requirements that help traders choose appropriate service levels. AIMSCAP's failure to provide this basic information suggests either a very simplified account structure or poor transparency practices. Account opening procedures and verification requirements remain undisclosed, which creates uncertainty about the onboarding process and compliance standards that new traders must meet.

Additionally, no information is available regarding specialized account options such as Islamic accounts for Muslim traders, professional trading accounts, or institutional account features. This aimscap review finds that while the low minimum deposit appears attractive, the overall account conditions lack the transparency and comprehensiveness expected from professional forex brokers.

The trading tools and educational resources offered by AIMSCAP represent a significant weakness in their service portfolio. Available information suggests a basic CFD trading setup without detailed specifications about analytical tools, charting capabilities, or advanced trading features that modern traders expect from their platforms.

Research and market analysis resources appear to be either non-existent or poorly promoted. No mention of daily market commentary, economic calendars, or fundamental analysis tools appears in available materials, which leaves traders without essential market information. This absence is particularly concerning for traders who rely on broker-provided research to inform their trading decisions.

Educational resources, which are increasingly important for broker competitiveness, seem to be entirely absent from AIMSCAP's offering. No mention of trading guides, webinars, video tutorials, or educational articles appears in source materials that could help traders improve their skills. This lack of educational support significantly limits the platform's value proposition, particularly for novice traders who require guidance and learning resources.

Automated trading support, including Expert Advisor compatibility, API access, or algorithmic trading tools, remains unspecified. In today's trading environment, where automation plays an increasingly important role, this information gap represents a serious limitation for technically sophisticated traders who rely on automated systems.

Customer Service and Support Analysis

Customer service quality emerges as one of AIMSCAP's most significant problem areas. User feedback consistently highlights poor support experiences that frustrate traders and create negative impressions. The lack of clearly defined customer service channels, operating hours, and support methodologies creates immediate concerns about client assistance availability.

Response times and service quality metrics are not disclosed. User reports suggest lengthy delays and unsatisfactory resolution rates for client inquiries and issues that require prompt attention. This pattern indicates systematic problems with customer support infrastructure and training, rather than isolated incidents.

Multi-language support capabilities remain unspecified. This is particularly problematic given AIMSCAP's multi-regional operations across diverse Asian markets where different languages are spoken. Effective customer service requires native language support for complex financial discussions, and the absence of this information suggests potential communication barriers for many clients.

The availability of dedicated account managers, technical support specialists, or escalation procedures for complex issues is not mentioned in available materials. Professional forex brokers typically provide tiered support systems with specialized assistance for different types of problems, and AIMSCAP's apparent lack of these features represents a significant service gap.

Trading Experience Analysis

The trading experience offered by AIMSCAP suffers from a fundamental lack of transparency regarding platform specifications, execution quality, and technological infrastructure. Without detailed information about trading platforms, order execution speeds, or system reliability, traders cannot adequately assess the technical quality of the trading environment.

Platform stability and performance metrics remain undisclosed. This prevents evaluation of system uptime, server response times, or handling of high-volume trading periods that can affect trading success. These factors are crucial for active traders who require consistent platform availability and rapid order processing.

Order execution quality, including slippage rates, requote frequencies, and fill rates, lacks documentation or user verification. Professional brokers typically provide detailed execution statistics or third-party verification of their order processing quality, and AIMSCAP's absence of such information raises concerns about execution transparency.

Mobile trading capabilities and cross-device synchronization features are not specified. This is increasingly important as traders expect seamless access across desktop, tablet, and smartphone platforms for flexible trading opportunities. The trading environment assessment in this aimscap review reveals significant gaps in basic information that traders need to evaluate platform suitability.

Trust and Credibility Analysis

Trust and credibility represent AIMSCAP's most serious weakness. Fundamental concerns about regulatory compliance and operational transparency create major red flags for potential clients. The absence of clearly disclosed regulatory licenses or oversight from recognized financial authorities creates immediate concerns for potential clients considering fund deposits.

Financial security measures, including client fund segregation, deposit insurance, or negative balance protection, remain unspecified in available materials. These protections are standard features offered by reputable brokers and are essential for client fund safety in volatile market conditions.

Corporate transparency issues extend beyond regulatory status to include unclear disclosure of company ownership, management structure, and operational history. Professional financial services providers typically maintain comprehensive corporate information disclosure, and AIMSCAP's opacity in these areas raises significant concerns about accountability.

Industry reputation assessment reveals predominantly negative user feedback and limited positive verification from independent sources. The absence of industry awards, professional recognition, or positive third-party reviews suggests serious reputation challenges that potential clients should carefully consider before choosing this broker.

User Experience Analysis

Overall user satisfaction with AIMSCAP appears consistently low based on available feedback. Multiple areas of user dissatisfaction create a poor overall experience profile that discourages long-term client relationships. The combination of unclear regulatory status, limited platform information, and poor customer service creates significant user frustration.

Interface design and platform usability cannot be adequately assessed due to limited available information. User feedback suggests the platform lacks the sophistication and user-friendly features found in leading forex brokers that prioritize client experience.

Registration and account verification processes remain undocumented. This prevents assessment of onboarding efficiency and user-friendliness that affects first impressions. Smooth account opening procedures are essential for positive initial user experiences, and the lack of information suggests potential complications.

Funding and withdrawal experiences represent another area of user concern. Unclear procedures and limited payment method options create uncertainty about money management processes that are essential for trading operations. Common user complaints focus on communication difficulties, unclear policies, and general lack of professional service standards expected from financial service providers.

Conclusion

This comprehensive aimscap review reveals a broker with significant credibility and operational concerns that outweigh any potential benefits from competitive leverage ratios or low minimum deposits. The combination of unclear regulatory status, poor customer service feedback, and limited transparency makes AIMSCAP a high-risk choice for forex traders who prioritize safety and reliability.

While the platform may theoretically appeal to traders seeking high leverage ratios up to 1:500 and accessible entry requirements, the fundamental trust and reliability issues present unacceptable risks for most trading scenarios. The lack of regulatory clarity, combined with consistently negative user feedback, suggests that traders should exercise extreme caution or consider alternative brokers with better regulatory standing and user satisfaction records.