Regarding the legitimacy of GULF BROKERS forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is GULF BROKERS safe?

Pros

Cons

Is GULF BROKERS markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Gulf Brokers Ltd

Effective Date:

--Email Address of Licensed Institution:

akj@gulfbrokers.comSharing Status:

Website of Licensed Institution:

https://www.alpho.com, https://www.gulfbrokers.comExpiration Time:

--Address of Licensed Institution:

Office 2, Suite C, Orion Mall, Palm Street, Victoria, Mahe, SeychellesPhone Number of Licensed Institution:

(+248) 4326402Licensed Institution Certified Documents:

Is Gulf Brokers Safe or Scam?

Introduction

Gulf Brokers, established in 2017 and based in Seychelles, positions itself as a forex and CFD trading provider. With a focus on offering a wide range of trading instruments, including forex pairs, commodities, and indices, Gulf Brokers aims to attract both novice and experienced traders. However, the online trading landscape is fraught with risks, prompting traders to exercise caution when selecting a broker. Evaluating the legitimacy of a trading platform is crucial, as the consequences of choosing an unreliable broker can be severe, including financial loss and difficulties in fund recovery. This article investigates Gulf Brokers' safety and legitimacy by analyzing its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory environment is a critical aspect of any brokerage's credibility. Gulf Brokers claims to be regulated by the Seychelles Financial Services Authority (FSA). However, the quality of this regulation is often questioned due to the lax standards compared to more stringent regulatory bodies in regions like the UK or Australia.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 013 | Seychelles | Verified |

While Gulf Brokers is indeed licensed by the FSA, the regulatory framework in Seychelles does not provide the same level of investor protection as that offered by agencies like the UK's Financial Conduct Authority (FCA). The FSA requires a minimal operational capital of about $50,000, which is significantly lower than the capital requirements imposed by more reputable regulators. This raises concerns about the broker's ability to safeguard client funds effectively. Moreover, the FSA lacks the capacity to conduct thorough oversight, leading to potential compliance issues and concerns regarding the broker's operational integrity.

Company Background Investigation

Gulf Brokers operates as Gulf Brokers Ltd, with its headquarters located in Victoria, Seychelles. The company has been in operation since 2017, and while it claims to offer a transparent trading environment, the details surrounding its ownership and management team remain vague. Limited information is available about the individuals behind the broker, which can be a red flag for potential clients.

The lack of transparency extends to the company's operational history. While Gulf Brokers has been functioning for several years, there have been reports of negative experiences from clients, indicating potential issues with trust and reliability. A transparent brokerage should provide clear information about its management and ownership structure, enabling clients to make informed decisions. The absence of such information raises questions about the broker's commitment to transparency and accountability.

Trading Conditions Analysis

Gulf Brokers offers a single account type with a minimum deposit requirement of $500, which is higher than the industry average. The broker provides leverage of up to 1:500, which can be appealing to traders looking to maximize their trading potential. However, high leverage also increases the risk of significant losses.

| Fee Type | Gulf Brokers | Industry Average |

|---|---|---|

| Spread on Major Pairs | 3 pips | 1.5-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Variable | Variable |

The spread for major currency pairs at Gulf Brokers is set at 3 pips, which is notably higher than the industry average. This can significantly impact trading profitability, especially for high-frequency traders. Additionally, while no explicit commissions are charged on forex trades, traders should be cautious of any hidden fees or unexpected charges that may arise, as the terms and conditions indicate that the broker reserves the right to implement fees in the future.

Client Fund Security

The safety of client funds is paramount when evaluating a forex broker. Gulf Brokers claims to implement various security measures, including holding client funds in segregated accounts. However, the effectiveness of these measures is questionable given the regulatory backdrop.

The Seychelles FSA does not provide a compensation scheme for clients in the event of broker insolvency or fraud, which increases the risk of potential losses for traders. Furthermore, there have been no significant reports of fund security breaches or scandals associated with Gulf Brokers, but the lack of robust regulatory oversight leaves clients vulnerable.

Customer Experience and Complaints

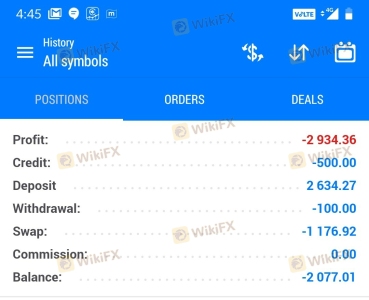

Customer feedback is a vital indicator of a broker's reliability. Reviews of Gulf Brokers reveal a mix of experiences, with several clients reporting difficulties in withdrawing funds and poor customer support. Common complaints include high spreads, lack of transparency regarding fees, and aggressive marketing tactics encouraging clients to deposit more funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Inconsistent |

| High Spreads | Medium | Minimal Response |

| Customer Support Accessibility | High | Slow |

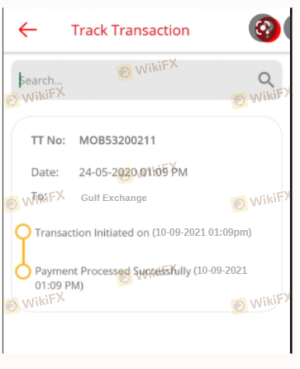

One notable case involved a trader who reported being unable to withdraw funds after several attempts, leading to frustration and financial loss. The company's response was slow and unhelpful, highlighting potential issues with customer service. Another trader expressed dissatisfaction with the high spreads and lack of clarity regarding trading costs, further emphasizing the need for prospective clients to approach Gulf Brokers with caution.

Platform and Trade Execution

Gulf Brokers utilizes the MetaTrader 5 (MT5) platform, known for its advanced features and user-friendly interface. However, the platform's performance can vary, and some users have reported issues with order execution, including slippage and rejected orders. These problems can significantly impact trading outcomes, particularly for those employing automated trading strategies.

The broker's claims of providing a seamless trading experience may not align with the actual user experience reported by clients. There are concerns about the platform's stability, particularly during high-volatility market conditions, which can lead to execution delays and increased trading costs.

Risk Assessment

Engaging with Gulf Brokers presents several risks that potential clients should consider. The combination of high leverage, limited regulatory oversight, and mixed customer feedback contributes to an overall high-risk profile for traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight. |

| Fund Security Risk | High | No compensation scheme for clients. |

| Trading Cost Risk | Medium | High spreads and potential hidden fees. |

| Customer Support Risk | High | Inconsistent responses and support issues. |

To mitigate these risks, traders should limit their initial investment, thoroughly research the broker's terms and conditions, and consider using a demo account to familiarize themselves with the trading platform before committing significant funds.

Conclusion and Recommendations

In conclusion, while Gulf Brokers is a licensed broker, several factors raise concerns about its overall safety and reliability. The combination of offshore regulation, high trading costs, and mixed customer experiences suggests that traders should exercise caution. Is Gulf Brokers safe? The evidence points to a broker that may not fully protect client interests, particularly in terms of fund security and customer support.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that offer stronger regulatory oversight, lower trading costs, and a proven track record of positive customer experiences. Brokers regulated by reputable authorities, such as the FCA or ASIC, provide a more secure trading environment and are likely to offer better protections for client funds.

Is GULF BROKERS a scam, or is it legit?

The latest exposure and evaluation content of GULF BROKERS brokers.

GULF BROKERS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GULF BROKERS latest industry rating score is 3.02, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.02 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.