Gulf Brokers 2025 Evaluation: Everything You Need to Know

Gulf Brokers, an online trading platform established in 2017, has garnered mixed reviews from users and experts alike. While it offers a range of trading instruments and utilizes the popular MetaTrader 5 platform, concerns about its regulatory status and customer service persist. This comprehensive review aims to distill key insights about Gulf Brokers, including user experiences, expert opinions, and the broker's offerings.

Note: It is important to recognize that Gulf Brokers operates under varying regulatory frameworks depending on the geographical region, which may impact user experience and fund safety.

Rating Overview

How We Rate Brokers: This evaluation is based on a comprehensive analysis of user reviews, expert insights, and factual data gathered from multiple sources.

Broker Overview

Founded in 2017, Gulf Brokers operates under the regulatory oversight of the Financial Services Authority (FSA) of Seychelles, which is often considered a less stringent regulatory environment compared to major financial hubs. The broker primarily offers trading through the MetaTrader 5 platform, which is well-regarded in the trading community for its advanced charting tools and automated trading capabilities. Gulf Brokers provides access to a variety of asset classes, including forex, commodities, indices, and stocks.

Detailed Insights

Regulatory Regions

Gulf Brokers is regulated by the FSA of Seychelles. However, this regulatory framework is often criticized for its leniency and lack of robust consumer protection measures compared to regulators like the UK's FCA or Australia's ASIC. Thus, traders should exercise caution when engaging with this broker, especially considering the potential risks associated with offshore trading.

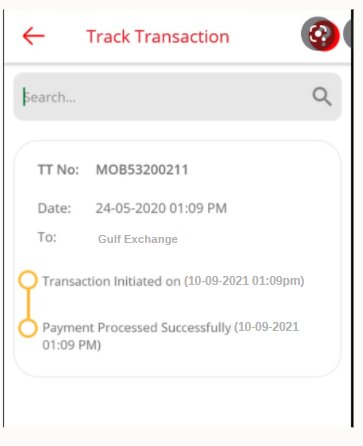

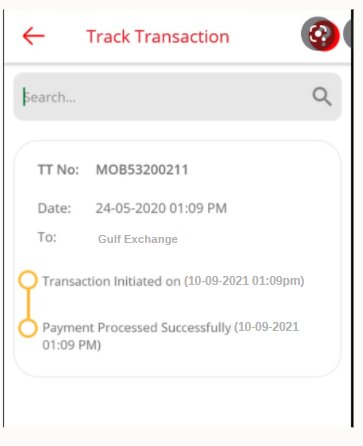

Deposit/Withdrawal Options

Gulf Brokers accepts deposits through various methods, including bank wire transfers and credit/debit cards. The minimum deposit requirement is set at $100, which is relatively accessible for new traders. However, the lack of options for popular e-wallets, such as PayPal or Skrill, may limit flexibility for some users.

Gulf Brokers offers promotional bonuses, including a matching bonus for deposits, which can be attractive for new traders. However, the specific terms and conditions surrounding these bonuses are not always clearly outlined, leading to potential misunderstandings.

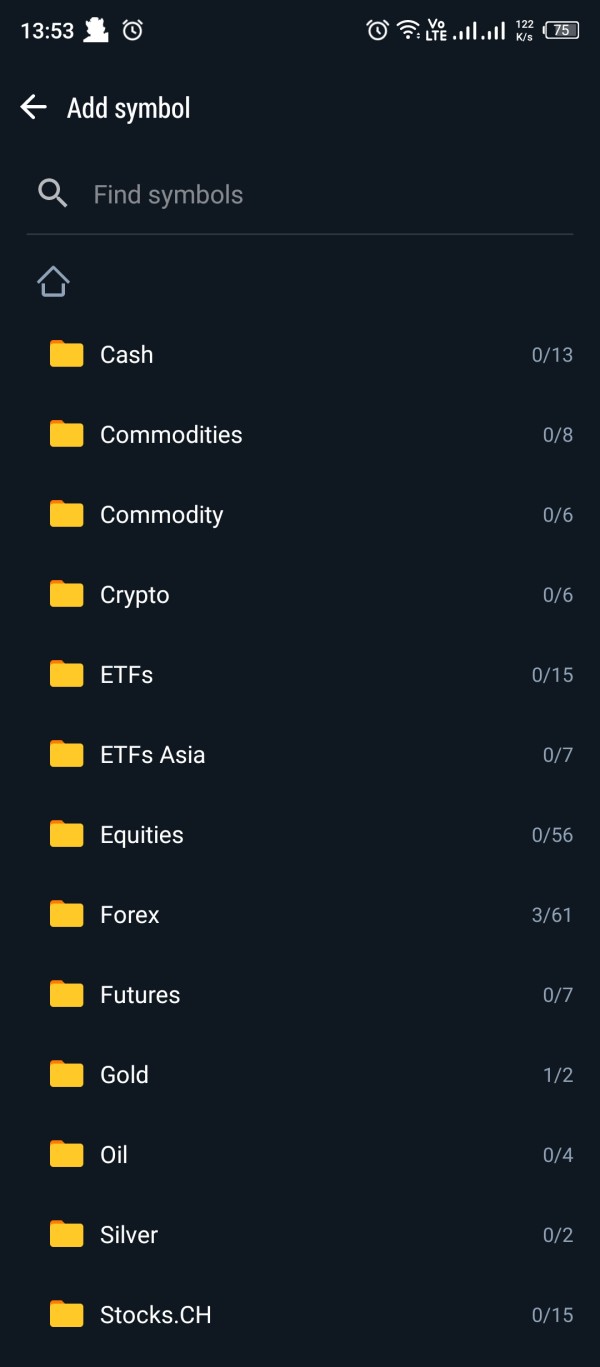

Tradable Asset Classes

The broker provides access to a diverse array of financial instruments, including over 60 currency pairs, several commodities, and a selection of indices. However, it is worth noting that Gulf Brokers does not offer cryptocurrency trading, which may be a drawback for traders interested in this rapidly growing market.

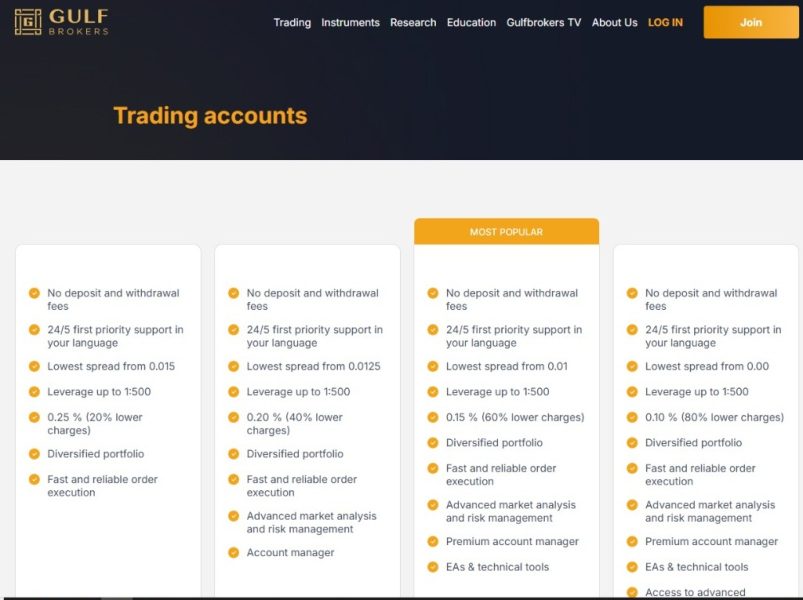

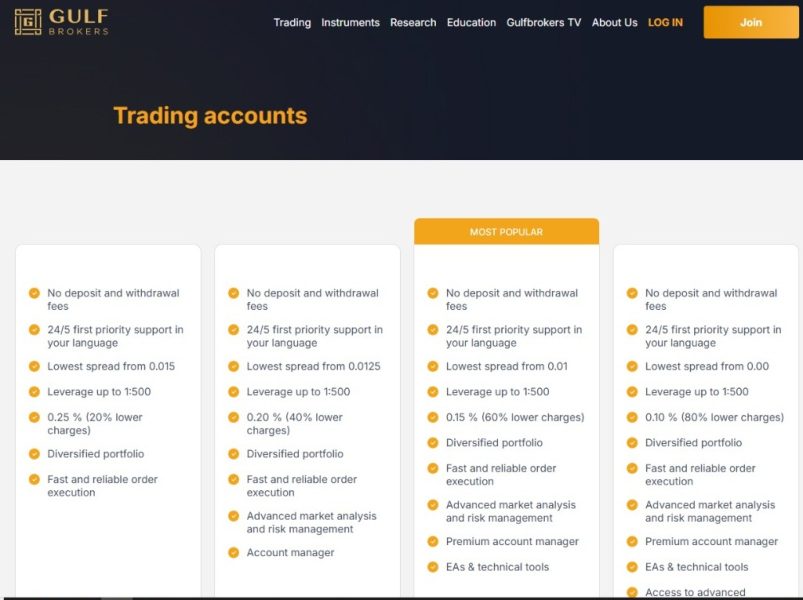

Cost Structure

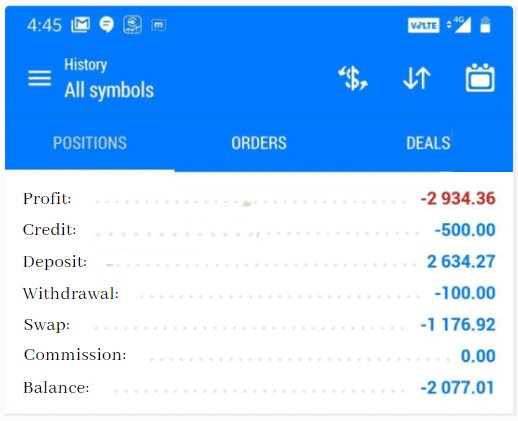

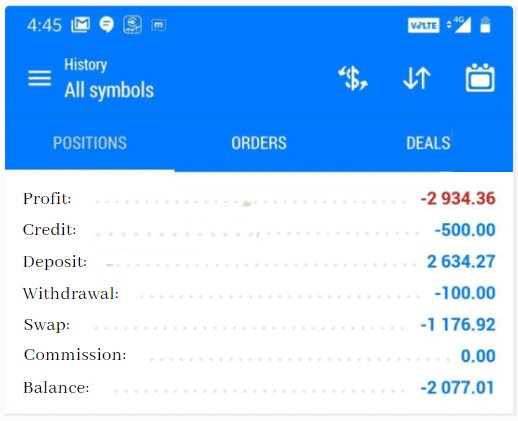

Gulf Brokers operates with variable spreads that can start from 3 pips, which is higher than many competitors in the market. While there are no commissions for trading forex, users have reported concerns regarding hidden fees and high swap rates, which can significantly impact profitability.

Leverage

Gulf Brokers offers a maximum leverage of 1:500, which can be appealing for experienced traders looking to maximize their positions. However, such high leverage also increases the risk of substantial losses, particularly for inexperienced traders.

The primary trading platform offered by Gulf Brokers is MetaTrader 5, which is compatible with desktop, web, and mobile devices. This platform is known for its user-friendly interface and extensive analytical tools, making it suitable for both novice and experienced traders.

Restricted Regions

Gulf Brokers is not available to residents of several countries, including the United States, Canada, and various countries under international sanctions. Prospective clients should verify their eligibility before attempting to open an account.

Customer Support Languages

Gulf Brokers provides customer support in multiple languages, including English, Arabic, Chinese, and several others. However, users have reported delays in response times, particularly through email, which can be frustrating for those seeking immediate assistance.

Repeated Rating Overview

Detailed Breakdown

Account Conditions

The account conditions at Gulf Brokers are relatively standard, with a minimum deposit of $100. However, the higher spreads and limited account types may deter some traders.

Gulf Brokers provides a selection of trading tools, including market news and an economic calendar, which can aid traders in making informed decisions.

Customer Service and Support

Customer service has been a point of contention, with many users reporting slow response times and limited support options, particularly the absence of live chat.

Trading Setup (Experience)

The trading experience is mostly positive due to the use of the MetaTrader 5 platform, though high spreads and potential hidden fees can diminish overall satisfaction.

Trustworthiness

Trustworthiness remains a significant concern, primarily due to the offshore regulatory status and mixed reviews from users regarding fund safety and withdrawal processes.

User Experience

Overall user experience is average, with some traders appreciating the platform's features while others express frustration over customer support and cost structures.

In conclusion, while Gulf Brokers does offer a range of trading opportunities and utilizes a reputable platform, potential clients should conduct thorough research and consider the risks associated with trading through an offshore broker. The mixed reviews and concerns over regulatory oversight suggest that traders should approach with caution. This Gulf Brokers review highlights the importance of understanding the broker's operational landscape before committing funds.