Zero Markets 2025 Review: Everything You Need to Know

Executive Summary

Zero Markets is a regulated forex broker. It has made a name for itself in the competitive trading world since starting in 2017. This zero markets review shows a broker that works under multiple rules including ASIC, FMA, and FSC, giving traders a complete trading environment across different areas including Australia, New Zealand, Saint Vincent and the Grenadines, and Mauritius.

The broker stands out through its STP (Straight Through Processing) and ECN (Electronic Communication Network) execution models. It provides traders with variable spreads and commission structures starting from $0. With leverage options reaching up to 1:500 and a reasonable minimum deposit requirement of 100 AUD, Zero Markets positions itself as an accessible option for both new and experienced traders.

The platform mainly attracts high-frequency traders, algorithmic trading fans, and cost-conscious traders seeking competitive trading conditions. Supporting both MetaTrader 4 and MetaTrader 5 platforms, Zero Markets offers access to many different tradeable assets including forex, commodities, metals, indices, stock CFDs, cryptocurrencies, and ETFs. The broker's multi-area approach allows it to serve a global client base while staying compliant with various regulatory requirements.

Important Notice

Zero Markets operates through different entities across multiple areas. Each is subject to distinct regulatory frameworks and compliance requirements. The Australian entity falls under ASIC regulation, the New Zealand operations are overseen by FMA, while other regions operate under FSC jurisdiction. Traders should know that terms, conditions, and available services may vary depending on their location and the specific Zero Markets entity serving their region.

This review is based on publicly available information, regulatory filings, and user feedback compiled from various sources. The analysis aims to provide an objective assessment of Zero Markets' services, though individual trading experiences may vary based on account type, trading strategy, and market conditions.

Rating Framework

Broker Overview

Zero Markets appeared in the forex brokerage world in 2017. It established its headquarters in Saint Vincent and the Grenadines while expanding its regulatory footprint across multiple areas. The company has built its reputation on providing direct market access through its STP and ECN execution models, which aim to eliminate conflicts of interest typically associated with market maker brokers. This approach positions Zero Markets as a technology-focused broker that prioritizes execution speed and cost efficiency.

The broker's business model centers on providing institutional-grade trading infrastructure to retail traders. It leverages advanced technology to offer competitive spreads and fast execution speeds. According to available information, Zero Markets has structured its operations to serve different market segments through various account types, though specific details about these offerings remain limited in public documentation.

Zero Markets supports comprehensive trading through the industry-standard MetaTrader 4 and MetaTrader 5 platforms. This ensures traders have access to advanced charting tools, automated trading capabilities, and extensive technical analysis features. The asset coverage spans traditional forex pairs, precious metals, energy commodities, major stock indices, individual stock CFDs, popular cryptocurrencies, and exchange-traded funds. This zero markets review indicates that the broker maintains regulatory compliance across its operational areas, with ASIC oversight in Australia, FMA regulation in New Zealand, and FSC supervision for other regions, providing traders with multiple avenues for regulatory protection depending on their location.

Regulatory Jurisdictions: Zero Markets operates under a multi-area regulatory framework. It maintains licenses with the Australian Securities and Investments Commission (ASIC), New Zealand's Financial Markets Authority (FMA), and the Financial Services Commission (FSC). This regulatory diversity allows the broker to serve clients across different geographical regions while maintaining appropriate oversight.

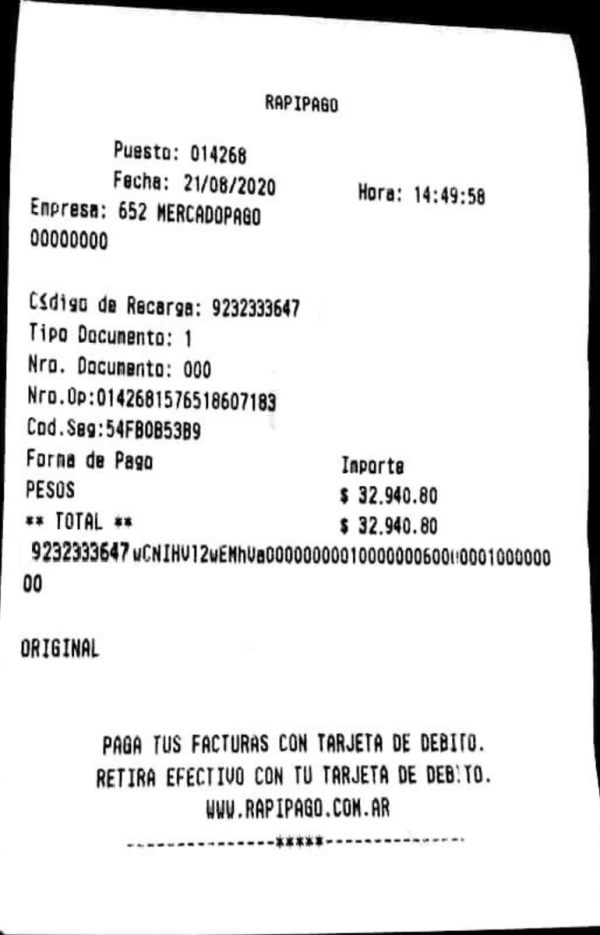

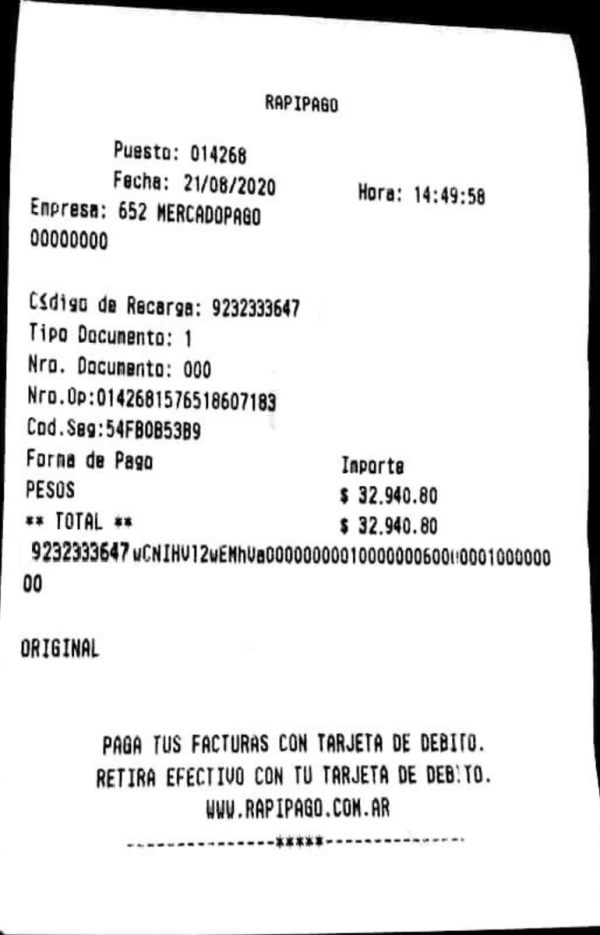

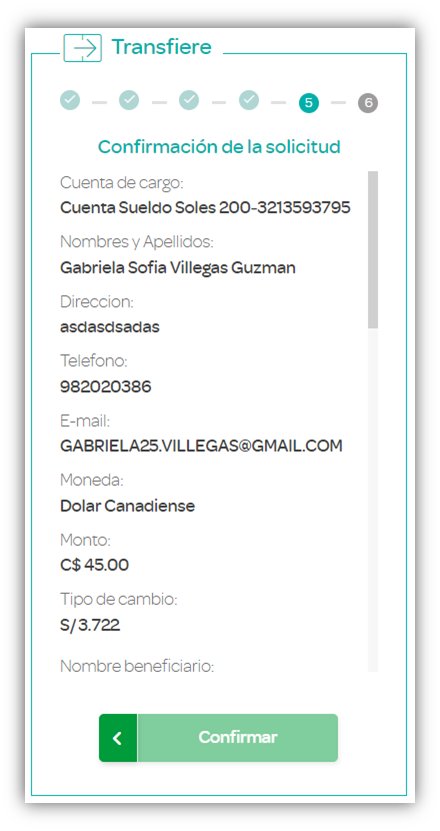

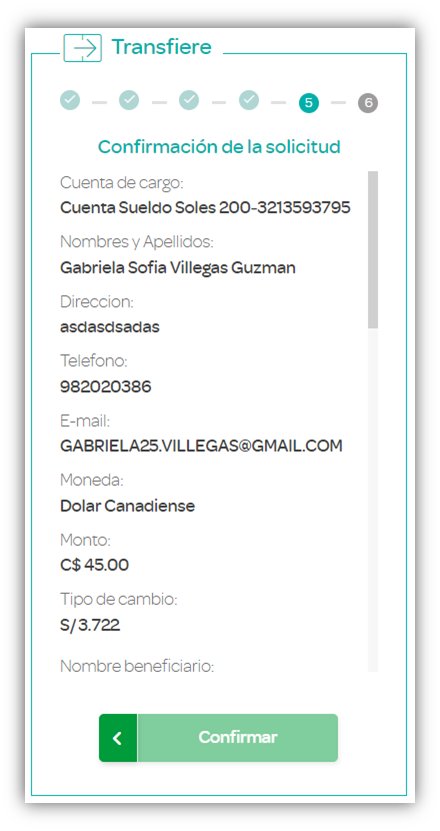

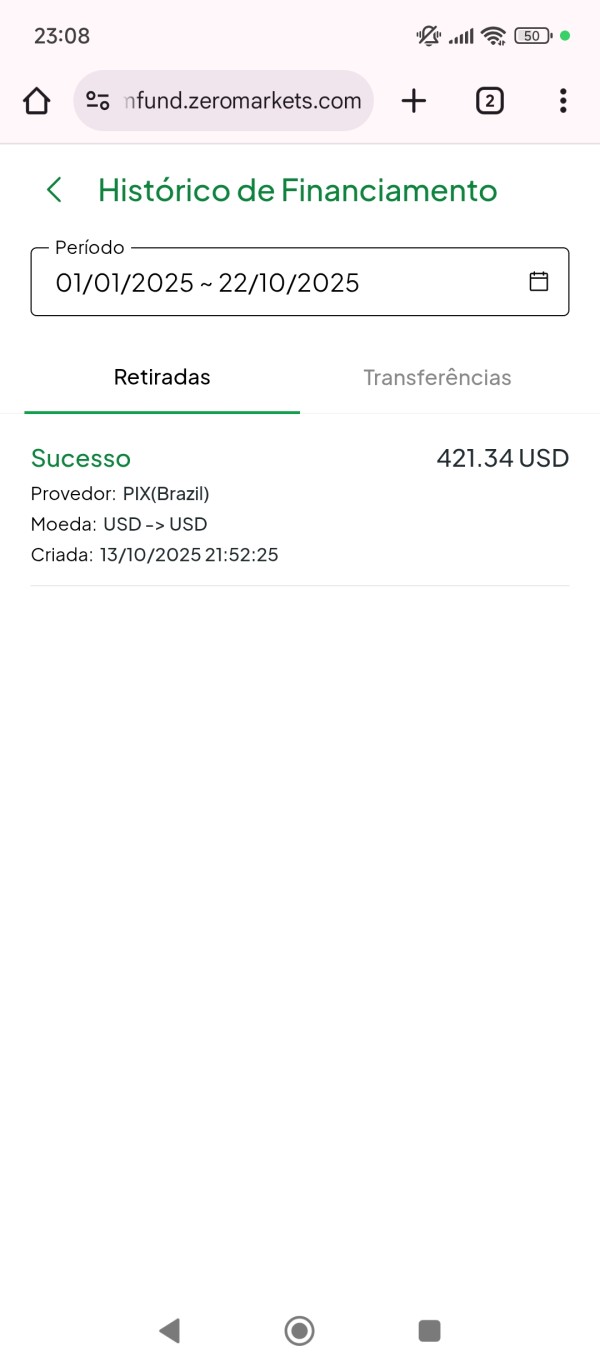

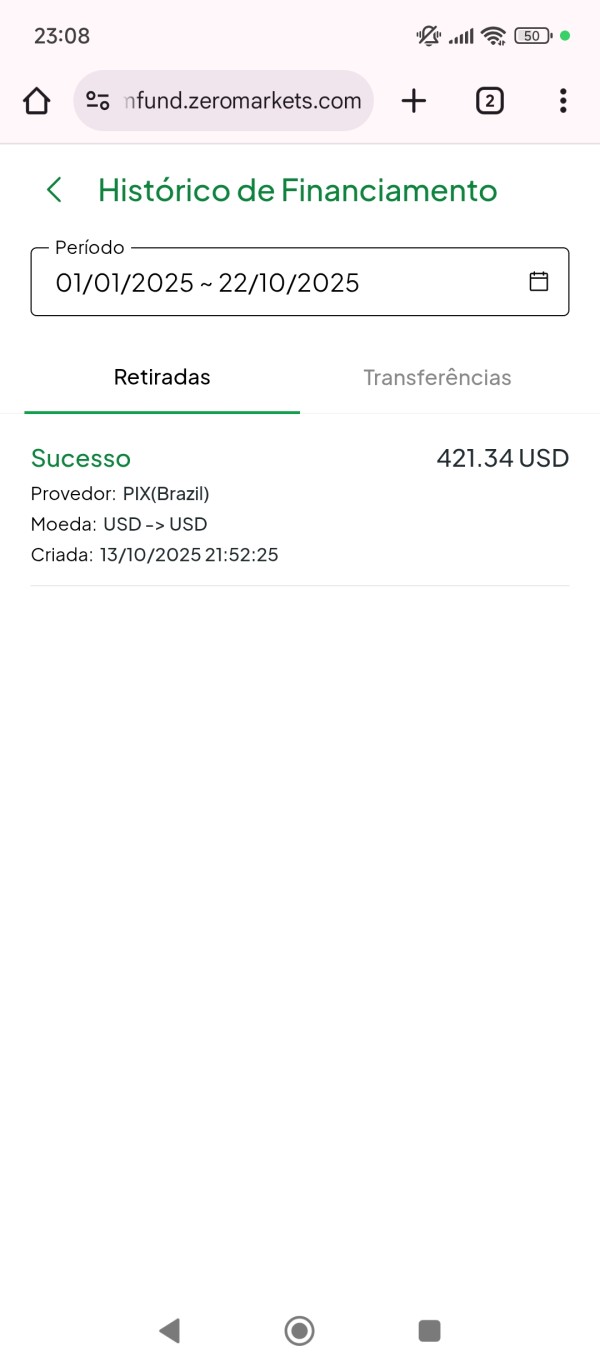

Deposit and Withdrawal Methods: The broker supports various funding options including traditional bank wire transfers, major credit and debit cards, and electronic wallet solutions. However, specific payment processors and processing times are not detailed in available sources.

Minimum Deposit Requirements: Zero Markets maintains an accessible entry point with a minimum deposit requirement of 100 AUD. This positions itself competitively within the retail forex market segment.

Promotional Offers: Current bonus and promotional information is not specified in available documentation. This suggests either limited promotional activity or region-specific offers not covered in general marketing materials.

Tradeable Assets: The platform provides access to a comprehensive range of financial instruments including major, minor, and exotic forex pairs, precious metals like gold and silver, energy commodities, global stock indices, individual stock CFDs from major markets, popular cryptocurrencies, and exchange-traded funds.

Cost Structure: Zero Markets implements a variable spread model with commission structures beginning at $0. However, specific spread ranges and commission rates for different account types require direct inquiry with the broker for current pricing.

Leverage Options: Maximum leverage reaches 1:500. However, actual leverage availability may vary based on account type, asset class, and regulatory area of the client.

Platform Selection: Trading is facilitated through MetaTrader 4 and MetaTrader 5. This provides comprehensive charting, analysis, and automated trading capabilities.

Geographic Restrictions: Specific information regarding restricted countries or regions is not detailed in available sources.

Customer Support Languages: Available customer service languages are not specified in reviewed materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 8/10)

Zero Markets demonstrates competitive account structuring with its 100 AUD minimum deposit requirement. This positions itself favorably against industry standards where minimum deposits often range from $50 to $500. This zero markets review finds that the broker's commission structure starting from $0 provides flexibility for different trading strategies, particularly benefiting high-volume traders who can potentially access lower commission rates based on their trading activity.

The account opening process, while not detailed in available sources, appears streamlined based on user feedback suggesting reasonable onboarding experiences. The broker's multi-area approach means account features may vary depending on the regulatory entity serving specific regions, with Australian and New Zealand clients likely receiving enhanced consumer protections under ASIC and FMA oversight respectively.

User feedback indicates satisfaction with the overall account conditions. Users particularly praise the cost-effective trading environment. However, specific information about Islamic accounts, VIP tiers, or premium account features remains limited in public documentation. The broker's STP/ECN model suggests that account holders benefit from direct market access, potentially resulting in better pricing and execution compared to market maker models.

The scoring reflects strong performance in accessibility and cost structure. However, the lack of detailed information about advanced account features prevents a perfect rating.

Zero Markets provides solid foundational trading infrastructure through its MetaTrader 4 and MetaTrader 5 platform support. This ensures traders have access to industry-standard charting tools, technical indicators, and automated trading capabilities. The platform selection covers the needs of most retail traders, from beginners requiring user-friendly interfaces to advanced traders utilizing expert advisors and custom indicators.

The broker's asset diversity spanning forex, commodities, metals, indices, stock CFDs, cryptocurrencies, and ETFs provides traders with comprehensive market exposure through a single platform. This variety enables portfolio diversification and cross-market trading strategies, particularly valuable for traders seeking to capitalize on different market conditions across asset classes.

However, this review notes limited information about proprietary research tools, market analysis resources, or educational materials that many modern brokers provide to differentiate their offerings. The absence of detailed information about economic calendars, market commentary, or trading signals in available sources suggests either limited provision of such resources or insufficient marketing of existing tools.

Automated trading support through MetaTrader platforms accommodates algorithmic traders and those utilizing expert advisors. This aligns with user feedback indicating the platform's suitability for high-frequency trading strategies. The scoring reflects solid platform infrastructure while acknowledging gaps in comprehensive resource offerings.

Customer Service and Support Analysis (Score: Not Rated)

Available sources provide insufficient specific information about Zero Markets' customer service infrastructure to warrant a numerical rating. The lack of detailed information regarding support channels, response times, service quality metrics, or multilingual capabilities prevents comprehensive evaluation of this critical service area.

Standard industry practice suggests that regulated brokers typically offer email support, phone assistance, and potentially live chat services. However, Zero Markets' specific support structure, operating hours, and service level commitments are not documented in reviewed materials. This information gap represents a significant limitation for potential clients seeking to understand the level of support they can expect.

The absence of user feedback specifically addressing customer service experiences in available sources further complicates assessment. While the broker's regulatory status across multiple areas suggests compliance with customer service standards required by ASIC, FMA, and FSC, specific implementation details remain unclear.

Prospective clients should directly contact Zero Markets to understand available support channels, response time expectations, and service availability in their preferred languages before committing to the platform.

Trading Experience Analysis (Score: 9/10)

User feedback consistently highlights Zero Markets' strength in execution quality. Traders report fast order processing and minimal slippage issues. The broker's STP and ECN execution models contribute to this positive trading experience by providing direct market access and reducing potential conflicts of interest inherent in market maker models.

The zero markets review reveals particular satisfaction among high-frequency traders and those utilizing automated trading strategies. This suggests robust platform stability and reliable execution during various market conditions. The absence of significant user complaints about requotes or execution delays indicates effective technology infrastructure supporting the trading environment.

MetaTrader 4 and MetaTrader 5 platform support ensures traders have access to comprehensive trading tools, advanced charting capabilities, and extensive customization options. The platforms' stability and feature completeness contribute significantly to the overall trading experience, particularly for users familiar with these industry-standard interfaces.

The low-cost trading environment, as noted in user feedback, enhances the overall experience by allowing traders to implement various strategies without prohibitive transaction costs. However, mobile trading experience details are not specifically addressed in available sources, representing a minor information gap in the overall assessment.

The high score reflects strong performance in execution quality and cost efficiency. These are core elements that directly impact trading success.

Trust and Regulation Analysis (Score: 8/10)

Zero Markets' regulatory framework spans multiple respected areas. These include ASIC in Australia, FMA in New Zealand, and FSC oversight for other regions. This multi-area approach provides diverse regulatory protections for clients depending on their location and the specific Zero Markets entity serving them.

ASIC regulation brings particular credibility, as the Australian regulator maintains strict capital requirements, client fund segregation mandates, and operational standards for forex brokers. Similarly, FMA oversight in New Zealand adds regulatory depth, while FSC supervision provides additional area coverage for international clients.

However, specific license numbers and detailed regulatory compliance information are not prominently featured in available sources. This could enhance transparency for clients seeking to verify regulatory status independently. The absence of information about client fund insurance schemes or compensation programs also limits the complete assessment of client protection measures.

The broker's establishment in 2017 provides several years of operational history. However, specific information about regulatory actions, compliance issues, or industry recognition is not detailed in reviewed materials. The lack of documented negative regulatory events suggests clean compliance history, though comprehensive verification would require direct regulatory database searches.

The scoring reflects solid regulatory foundation. However, it acknowledges information gaps that prevent maximum confidence rating.

User Experience Analysis (Score: Not Rated)

Comprehensive user experience assessment is limited by insufficient specific feedback about interface design, registration processes, account verification procedures, and fund management experiences in available sources. While general user satisfaction appears positive based on trading experience feedback, detailed usability metrics are not documented.

The broker's target demographic appears to include high-frequency traders, algorithmic trading enthusiasts, and cost-conscious traders. This suggests platform design accommodates more sophisticated trading approaches. However, specific information about user interface intuitiveness, mobile application quality, or onboarding experience clarity is not available in reviewed materials.

Account registration and verification processes, critical components of user experience, are not detailed in available sources. Similarly, deposit and withdrawal experience feedback, including processing times and fee structures, lacks specific documentation that would enable comprehensive evaluation.

The absence of documented user complaints about platform usability or operational issues suggests reasonable user satisfaction. However, this inference cannot substitute for detailed user experience analysis. Direct platform testing and user surveys would be necessary for comprehensive assessment of this important category.

Conclusion

This zero markets review reveals a broker that has established a solid foundation in the competitive forex market through its multi-area regulatory approach and focus on execution quality. Zero Markets appears well-suited for traders prioritizing cost efficiency, execution speed, and direct market access through its STP and ECN models.

The broker's strengths lie in its competitive account conditions, strong trading execution environment, and comprehensive regulatory coverage across respected areas. High-frequency traders, algorithmic trading enthusiasts, and cost-conscious traders will likely find Zero Markets' offering particularly attractive, especially given the positive feedback regarding execution quality and low-cost trading environment.

However, information gaps regarding customer service infrastructure, detailed fee structures, and comprehensive user experience metrics represent areas where prospective clients should conduct additional due diligence. While the available evidence suggests a competent broker with solid regulatory standing, the limited public information about certain operational aspects requires direct inquiry for complete evaluation.

Overall, Zero Markets presents as a viable option for traders seeking regulated, cost-effective trading conditions. However, individual suitability will depend on specific trading requirements and the importance placed on areas where information remains limited.