Regarding the legitimacy of ZERO forex brokers, it provides FMA, ASIC and WikiBit, (also has a graphic survey regarding security).

Is ZERO safe?

Pros

Cons

Is ZERO markets regulated?

The regulatory license is the strongest proof.

FMA Market Making License (MM)

Financial Markets Authority

Financial Markets Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

ZERO MARKETS (NZ) LIMITED

Effective Date:

2018-08-27Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.zeromarkets.co.nzExpiration Time:

--Address of Licensed Institution:

Suite C, Level 28, Tenancy 1, The Sap Tower, 151 Queen Street, Auckland Cbd, Auckland, 1010, New ZealandPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

ZERO SECURITIES PTY LTD

Effective Date:

2003-12-16Email Address of Licensed Institution:

paddy.z@zerosercurities.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SE 303 10 BRIDGE ST SYDNEY NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Zero Markets A Scam?

Introduction

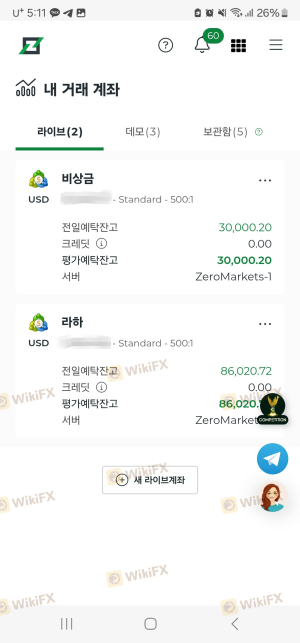

Zero Markets is a forex and CFD broker that has positioned itself as a player in the competitive trading landscape since its inception in 2017. Operating under various regulatory bodies, including the Australian Securities and Investments Commission (ASIC) and the Financial Services Commission (FSC) of Mauritius, Zero Markets aims to provide a wide range of trading instruments and services to both novice and experienced traders. However, the forex market is rife with brokers, and traders must exercise caution in evaluating their options. The importance of due diligence cannot be overstated, as traders risk their capital on the trustworthiness and reliability of their chosen broker. This article aims to provide a comprehensive analysis of Zero Markets, using a combination of qualitative assessments and quantitative data to evaluate its legitimacy and safety for potential traders.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy and the safety of client funds. Zero Markets claims to be regulated by multiple authorities. Below is a summary of its regulatory credentials:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001273819 | Australia | Verified |

| FSC | GB 21026308 | Mauritius | Verified |

| SVG FSA | 503 LLC 2020 | St. Vincent | Registered |

Zero Markets is primarily regulated by ASIC, a tier-1 regulatory body known for its stringent compliance requirements. However, it also operates under the FSC of Mauritius, which is considered a lower-tier regulator. This dual regulatory structure raises questions about the broker's overall safety, especially since the St. Vincent entity operates without stringent oversight. The lack of negative balance protection on the offshore entity could expose traders to significant risks, especially in volatile market conditions. Traders should be aware that while ASIC provides a higher level of consumer protection, the presence of an unregulated entity complicates the overall safety assessment.

Company Background Investigation

Founded in 2017, Zero Markets has quickly established itself in the forex trading sector. The broker operates under the umbrella of Zero Financial Pty Ltd, which is based in Australia. The ownership structure appears straightforward, with a focus on providing trading services globally. However, the management team's backgrounds are less transparent, with limited publicly available information regarding their experience and qualifications in the financial services industry.

In terms of transparency, Zero Markets has made strides in providing information on its website, including details about its services and regulatory compliance. However, the overall level of disclosure about its management and operational practices could be improved. The absence of detailed biographies or professional histories for key executives raises concerns about the broker's commitment to transparency.

Trading Conditions Analysis

Zero Markets offers a competitive trading environment, but potential clients should scrutinize the fee structure closely. The broker provides two primary account types: the Standard Account and the Super Zero Account, each with different fee structures. The overall cost structure is as follows:

| Fee Type | Zero Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.0 pips | 1.0 - 1.5 pips |

| Commission Model | $2.50 per lot (Super Zero) | $5 - $7 per lot |

| Overnight Interest Range | Varies by pair | Varies by pair |

The Standard Account features no commissions but has wider spreads, while the Super Zero Account offers tighter spreads with a commission, which can be attractive for high-frequency traders. However, the presence of withdrawal fees for certain payment methods, coupled with a minimum deposit requirement of $100, could deter some traders. The fee structure is generally competitive, but the lack of clarity regarding certain charges could lead to unexpected costs for traders.

Client Fund Safety

Safety of client funds is paramount in the forex trading industry. Zero Markets claims to implement several safety measures to protect client capital. The broker keeps client funds in segregated accounts, ensuring that these funds are separate from the company's operational funds. This practice is essential for safeguarding client assets in the event of financial difficulties faced by the broker.

Additionally, Zero Markets offers negative balance protection for its ASIC-regulated entity, which is critical for traders using high leverage. However, this protection is not guaranteed for clients trading under the unregulated entity in St. Vincent. The absence of a compensation scheme for the offshore entity further complicates the safety assessment, as traders may not have recourse in the event of broker insolvency.

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reliability. Reviews of Zero Markets reveal a mixed bag of experiences among users. Many clients have praised the broker for its competitive spreads and user-friendly trading platforms, while others have reported issues with withdrawal delays and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow to respond |

| Customer Support Issues | Medium | Inconsistent quality |

| Account Verification Problems | Medium | Lengthy process |

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and a lack of trust in the broker. The customer support team reportedly provided vague responses, which only exacerbated the situation. Such complaints highlight the importance of reliable customer service in maintaining trader confidence.

Platform and Trade Execution

Zero Markets utilizes the widely recognized MetaTrader 4 and MetaTrader 5 platforms, which offer robust trading features and tools. However, user experiences regarding platform stability and execution quality vary. Some traders have reported instances of slippage and order rejections, which can negatively impact trading outcomes.

Overall, the platforms are generally well-regarded, but traders should be cautious and conduct thorough testing before committing significant capital. The presence of advanced charting tools and automated trading capabilities enhances the trading experience, but traders should remain vigilant for any signs of manipulation or execution issues.

Risk Assessment

Engaging with Zero Markets presents several risks that traders should carefully consider. The following risk assessment provides a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Dual regulation raises concerns |

| Leverage Risk | High | High leverage can lead to significant losses |

| Customer Service Risk | Medium | Inconsistent responses may affect trader confidence |

| Withdrawal Risk | Medium | Delays reported by multiple users |

To mitigate these risks, traders are advised to start with a demo account, familiarize themselves with the trading environment, and withdraw funds regularly to ensure smooth transactions.

Conclusion and Recommendations

In conclusion, Zero Markets presents a mixed profile in terms of safety and reliability. While it is regulated by reputable authorities, the presence of an unregulated entity raises concerns about the overall safety of client funds. The broker's competitive trading conditions and robust platform offerings may appeal to traders, but potential clients should be cautious of withdrawal issues and inconsistent customer service.

For traders who prioritize regulation and security, it may be prudent to consider alternative brokers with a more robust regulatory framework and proven track record. Recommended alternatives include brokers such as IG, OANDA, or Forex.com, which offer strong regulatory oversight and reliable customer service. Ultimately, traders must conduct their own research and consider their individual risk tolerance before engaging with Zero Markets or any other broker.

Is ZERO a scam, or is it legit?

The latest exposure and evaluation content of ZERO brokers.

ZERO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZERO latest industry rating score is 6.11, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.11 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.