Noor Capital UK 2025 Review: Everything You Need to Know

Executive Summary

Noor Capital UK is a UK-based forex broker regulated by the Financial Conduct Authority (FCA). It was established in 2014 and primarily targets professional and institutional clients who need advanced trading services. The company used to be called House of Borse. It has positioned itself as a provider of flexible trading conditions with a focus on delivering professional-grade trading services to serious investors.

The broker's key highlights include zero minimum deposit requirements and the use of the MetaTrader 5 platform for trading operations. This gives traders access to over 60 currency pairs, indices, commodities, and stocks. The primary user base consists of professional and institutional clients. This makes it particularly suitable for investors seeking flexible trading conditions and professional-grade execution without high barriers to entry.

According to available information, Noor Capital UK operates under strict FCA regulations, ensuring compliance with UK financial standards. This noor capital uk review aims to provide comprehensive insights into the broker's offerings. It will help potential clients make informed decisions about their trading partnership with this regulated UK broker.

The broker's positioning in the competitive UK forex market reflects its commitment to serving sophisticated traders. These traders require reliable execution and regulatory compliance without the burden of high minimum deposit requirements that many competitors impose.

Important Disclaimer

Noor Capital UK, as a UK-registered broker, operates under different regulatory requirements and trading conditions compared to entities in other jurisdictions. Potential clients should be aware that regulatory frameworks, client protection measures, and available trading instruments may vary significantly from brokers operating in other regions around the world.

This review is based on currently available information and user feedback, compiled to provide the most comprehensive assessment possible. However, this analysis does not constitute investment advice. Prospective clients should conduct their own due diligence before making any trading decisions with any broker.

The information presented reflects the broker's status as of 2025, and conditions may change over time. Always verify current terms and conditions directly with the broker before opening an account.

Rating Framework

Broker Overview

Noor Capital UK was established in 2014 as an online trading services provider. It was specifically designed to cater to professional and institutional clients seeking sophisticated trading solutions that meet their advanced needs. The company's background reveals its previous identity as House of Borse, indicating a strategic rebranding effort to better align with its target market of serious traders and institutional investors.

The broker has focused on creating a user-friendly trading environment while maintaining the professional standards expected by its clientele. The company operates with a clear mission to provide accessible yet professional trading services. This approach is evidenced by its zero minimum deposit policy and comprehensive asset offerings that serve various trading strategies.

This approach reflects the broker's understanding that modern traders require both flexibility and professional-grade execution capabilities. Noor Capital UK utilizes the MetaTrader 5 trading platform as its primary trading interface. This provides clients access to over 60 currency pairs, indices, commodities, and stocks for diversified trading opportunities.

The platform choice demonstrates the broker's commitment to offering industry-standard tools that professional traders expect. The primary regulatory oversight comes from the UK's Financial Conduct Authority (FCA). This ensures that all business activities comply with stringent regulatory standards designed to protect client interests and maintain market integrity in the competitive UK forex market.

This noor capital uk review emphasizes the importance of this regulatory framework in establishing the broker's credibility within the competitive UK forex market.

Regulatory Jurisdiction: Noor Capital UK operates under the supervision of the Financial Conduct Authority (FCA). This ensures compliance with UK financial regulations and provides clients with regulatory protection standards that meet strict UK requirements.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods was not detailed in available materials. This would require further investigation for complete clarity about payment options and processing times.

Minimum Deposit Requirements: The broker offers an attractive zero minimum deposit requirement. This makes it accessible to traders across various experience levels and capital ranges without traditional barriers.

Bonus and Promotions: Current promotional offerings and bonus structures are not specifically mentioned in available documentation. These may require direct inquiry with the broker for current offers and terms.

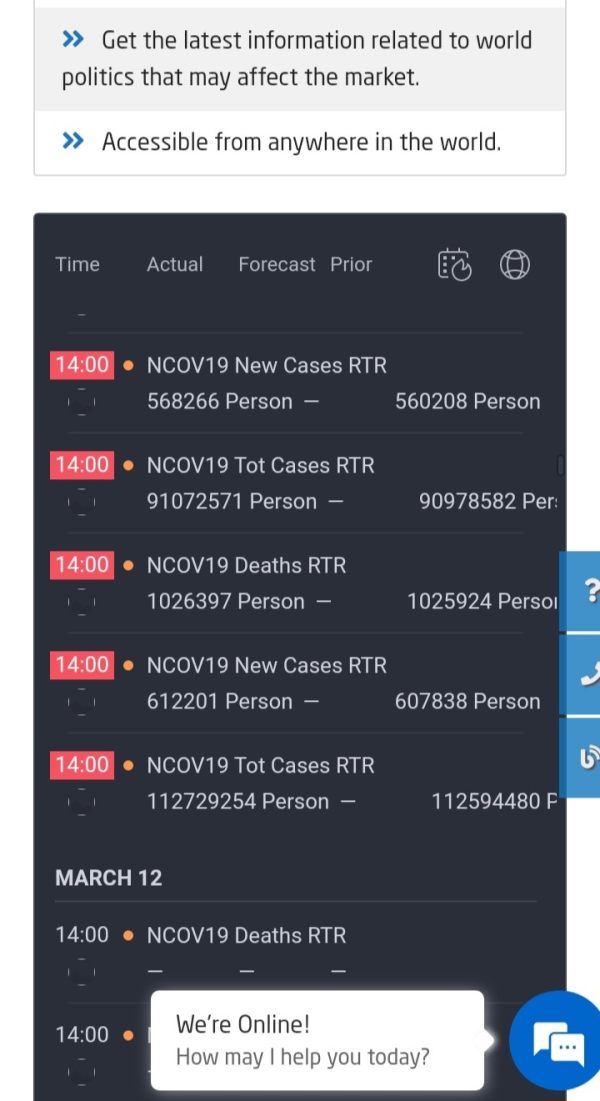

Tradeable Assets: The platform provides access to over 60 different trading instruments. These include foreign exchange pairs, stock indices, commodities, and individual stocks, offering diversification opportunities for various trading strategies and market approaches.

Cost Structure: Detailed information regarding spreads, commissions, and other trading costs requires further investigation. Specific pricing details were not comprehensively covered in available materials and should be verified directly with the broker.

Leverage Ratios: The broker offers leverage up to 30:1, which aligns with FCA regulations. This is suitable for traders with appropriate risk tolerance levels and understanding of leverage risks.

Platform Options: MetaTrader 5 serves as the primary trading platform. It provides advanced charting capabilities, automated trading support, and comprehensive market analysis tools that professional traders expect.

Geographic Restrictions: Specific information about regional limitations and restricted territories was not detailed in available sources. Prospective clients should verify their eligibility based on their location.

Customer Support Languages: Available language support options for customer service were not specified in the reviewed materials. This information should be confirmed directly with the broker's support team.

This noor capital uk review section highlights the need for prospective clients to conduct direct inquiries regarding specific operational details not covered in publicly available information.

Detailed Rating Analysis

Account Conditions Analysis (Score: 8/10)

Noor Capital UK demonstrates exceptional accessibility through its zero minimum deposit requirement. This effectively removes traditional barriers that often prevent new traders from entering the forex market and testing their strategies. This policy positions the broker favorably compared to competitors who typically require substantial initial investments, particularly appealing to both novice traders testing strategies and experienced traders seeking additional trading accounts without capital constraints.

The account opening process has received positive feedback from users, with many commenting on the straightforward documentation requirements and efficient verification procedures. User testimonials indicate that "the absence of minimum deposit requirements and simplified account opening process" significantly enhanced their initial experience with the broker. This streamlined approach helps traders get started quickly without unnecessary complications.

However, the review of available materials suggests limited information regarding specialized account types such as Islamic accounts or other religiously compliant trading options. Additionally, specific details about account tiers, premium services, or volume-based benefits were not comprehensively detailed in available documentation. This information gap may require direct inquiry with the broker for traders with specific account needs.

The flexibility offered through the zero deposit policy, combined with FCA regulatory protection, creates an attractive proposition for traders seeking professional services without significant upfront commitments. This noor capital uk review assessment reflects the broker's commitment to accessibility while maintaining regulatory compliance standards that protect client interests.

Noor Capital UK provides clients with access to the MetaTrader 5 platform, widely recognized as an industry-standard trading interface. It offers comprehensive charting tools, technical indicators, and automated trading capabilities that professional traders rely on for their strategies. The platform's robust functionality includes advanced order types, one-click trading, and extensive customization options that cater to both manual and algorithmic trading strategies.

The broker's asset selection encompasses over 60 trading instruments across major asset classes, providing sufficient diversification opportunities for most trading approaches. This range includes major and minor currency pairs, popular stock indices, essential commodities, and selected individual stocks. It offers traders multiple market exposure options within a single platform for comprehensive trading strategies.

User feedback indicates that "the platform remains stable with comprehensive tools available," suggesting reliable technical performance during regular trading sessions. However, detailed information regarding additional research resources, market analysis provisions, educational materials, or proprietary trading tools was not extensively covered in available documentation. This represents a potential area where the broker could enhance its service offering.

The absence of detailed information about supplementary research services, daily market commentary, or educational resources represents a potential area for improvement. Professional traders often value comprehensive market analysis and educational support, which could enhance the overall service proposition and client satisfaction.

Customer Service and Support Analysis (Score: 6/10)

Customer service performance represents an area where Noor Capital UK receives mixed feedback from its user base. Available information suggests that while the broker provides standard support channels, response times and service quality have generated varied user experiences. Some clients express satisfaction while others note areas for improvement in support delivery.

User feedback includes comments such as "customer service response times tend to be slower than expected," indicating potential challenges in support efficiency during peak periods or complex inquiry resolution. This suggests that while support is available, the quality and speed of service delivery may not consistently meet client expectations. Professional traders often require quick resolution of technical issues and account-related questions.

The specific details regarding available support channels, operating hours, multilingual capabilities, and escalation procedures were not comprehensively detailed in reviewed materials. This information gap makes it difficult to provide a complete assessment of the broker's customer service infrastructure and capabilities. Prospective clients may need to inquire directly about support options and availability.

Professional and institutional clients typically require responsive, knowledgeable support for technical issues, account management, and trading-related inquiries. The mixed feedback suggests that while basic support needs may be addressed, there may be opportunities for enhancement in service delivery standards and response efficiency.

Trading Experience Analysis (Score: 7/10)

The trading experience with Noor Capital UK generally receives positive feedback regarding platform stability and order execution quality. However, some users report occasional technical challenges that can affect their trading activities. The MetaTrader 5 platform provides a familiar interface for experienced traders while offering sufficient functionality for various trading strategies and market approaches.

User testimonials indicate that "the trading experience is generally good, though occasional slippage occurs," suggesting that while the overall execution quality meets expectations, there may be periodic issues during volatile market conditions or high-volume trading periods. This feedback aligns with typical challenges faced by many brokers during extreme market movements. Traders should be aware of these potential limitations when planning their trading strategies.

The platform's technical performance appears stable during normal market conditions, with users reporting reliable connectivity and consistent order processing. However, specific performance metrics such as average execution speeds, slippage statistics, or requote frequencies were not detailed in available documentation. These metrics would be valuable for traders evaluating execution quality.

Mobile trading capabilities and cross-device synchronization features, increasingly important for modern traders, were not specifically addressed in reviewed materials. Additionally, detailed information about advanced order types, partial fill handling, or sophisticated execution algorithms was not comprehensively covered in available sources.

This noor capital uk review section emphasizes that while the basic trading experience meets professional standards, specific performance metrics and advanced features require further investigation for complete assessment.

Trust and Reliability Analysis (Score: 8/10)

Noor Capital UK's regulatory status under the Financial Conduct Authority (FCA) provides a strong foundation for client trust and confidence. The FCA's reputation as a rigorous financial regulator ensures that the broker operates under comprehensive oversight. This includes capital adequacy requirements, client fund segregation, and operational transparency standards that protect client interests.

The regulatory framework provides clients with access to the Financial Services Compensation Scheme (FSCS), offering protection up to £85,000 per client in the event of broker insolvency. This protection mechanism significantly enhances the broker's trustworthiness profile compared to unregulated alternatives. Clients can trade with greater confidence knowing their funds have regulatory protection.

However, detailed information regarding specific fund protection measures, bank relationships, client money handling procedures, and operational transparency initiatives was not extensively covered in available materials. Additionally, third-party auditing reports, industry ratings, or independent assessments were not referenced in reviewed documentation. This information would strengthen the overall trust assessment.

The broker's establishment in 2014 provides a reasonable operational history, though specific information about past regulatory issues, client complaints handling, or industry recognition was not detailed. User feedback regarding fund security and withdrawal reliability appears generally positive, with clients expressing confidence in the broker's financial stability and regulatory compliance.

User Experience Analysis (Score: 6/10)

Overall user satisfaction with Noor Capital UK reflects a balanced perspective, with clients appreciating certain aspects while identifying areas for improvement. The user experience encompasses platform usability, service quality, and overall satisfaction with the broker's offerings. This balanced feedback suggests the broker meets basic requirements but has room for enhancement.

Positive feedback often centers around the platform's interface design and ease of use, with users noting the familiar MetaTrader 5 environment and straightforward navigation. The zero minimum deposit policy receives consistent praise for its accessibility and flexibility. It is particularly appreciated among traders seeking low-barrier entry options without compromising on regulatory protection.

However, user feedback also reveals areas of concern, particularly regarding customer service responsiveness and occasional technical issues. Comments suggest that while basic functionality meets expectations, service delivery consistency and support quality could benefit from enhancement. These improvements could significantly boost overall user satisfaction levels.

The user demographic appears well-suited to traders seeking professional-grade services without traditional barriers, including both developing traders and experienced professionals requiring additional trading accounts. User feedback suggests that improvements in customer service response times and enhanced communication could significantly improve overall satisfaction levels. The broker has the foundation for success but needs to address service delivery consistency.

Based on available feedback, the broker appeals to traders prioritizing regulatory compliance and platform stability while accepting potential limitations in service delivery and support responsiveness.

Conclusion

Noor Capital UK represents a regulated forex broker established in 2014, operating under FCA supervision and offering flexible trading conditions through the MetaTrader 5 platform. The broker's zero minimum deposit requirement and diverse asset selection make it particularly attractive to professional and institutional clients. These features provide accessible yet regulated trading services without traditional barriers that many competitors impose.

The broker's primary strengths include its regulatory compliance, flexible account conditions, and comprehensive platform functionality, while areas for improvement appear to focus on customer service responsiveness and enhanced support delivery. This noor capital uk review concludes that the broker suits traders prioritizing regulatory protection and platform reliability. However, potential clients should consider the mixed feedback regarding customer service consistency.

Prospective clients should consider their specific requirements regarding customer support expectations, trading volume needs, and service delivery preferences when evaluating Noor Capital UK as their trading partner.