LMAX Group 2025 Review: Everything You Need to Know

Executive Summary

LMAX Group is a well-regulated and transparent foreign exchange broker. The company has built a strong position in institutional trading since 2010. This lmax group review shows a company that works as a pure agency broker. It offers direct market access without betting against its clients. The broker's main strengths are its own trading platform, tight spreads, and many different assets including forex, cryptocurrencies, metals, and indices.

LMAX Group mainly works with institutional clients like funds, banks, asset management companies, and retail brokerages in over 100 countries. The company follows rules from several regulators, including the UK's Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), and Gibraltar Financial Services Commission (GFSC). MarketsWiki says LMAX Group is a global financial technology company that runs multiple institutional trading venues for FX and cryptocurrency trading. Its special feature is changing the world's largest asset class into an open, transparent marketplace.

The broker has earned recognition in the industry for fair, precise, and consistent execution. Users generally feel satisfied with the trading execution quality and overall service.

Important Notice

LMAX Group operates across different regulatory environments, so traders should know that terms, conditions, and protections may vary. This depends on which regulatory entity covers their operations. The FCA-regulated LMAX Exchange works as a Multilateral Trading Facility (MTF). LMAX Global operates under both FCA and CySEC regulation, and LMAX Digital works under GFSC regulation for institutional cryptocurrency trading.

This review uses publicly available information, regulatory filings, and user feedback from various sources. Traders should check current terms and conditions directly with LMAX Group. Regulatory requirements and service offerings may change over time.

Rating Overview

Broker Overview

LMAX Group started in 2010 as an innovative force in the foreign exchange industry. The company became the leading independent operator of institutional execution venues for FX and digital asset trading. Based in London, UK, the company built its reputation on providing transparent, institutional-grade trading infrastructure. This eliminates the traditional conflicts of interest that come with market maker models.

The company works as an Electronic Communication Network (ECN) broker. It functions purely as an agency broker that connects traders directly to institutional liquidity without taking the opposite side of trades. This approach means that LMAX Group's interests align with those of its clients, as the company profits from spreads and commissions rather than client losses. The company's LinkedIn profile says LMAX Group serves funds, banks, asset managers, and retail brokerages. It transforms forex trading into "an open, transparent marketplace with fair, precise & consistent execution."

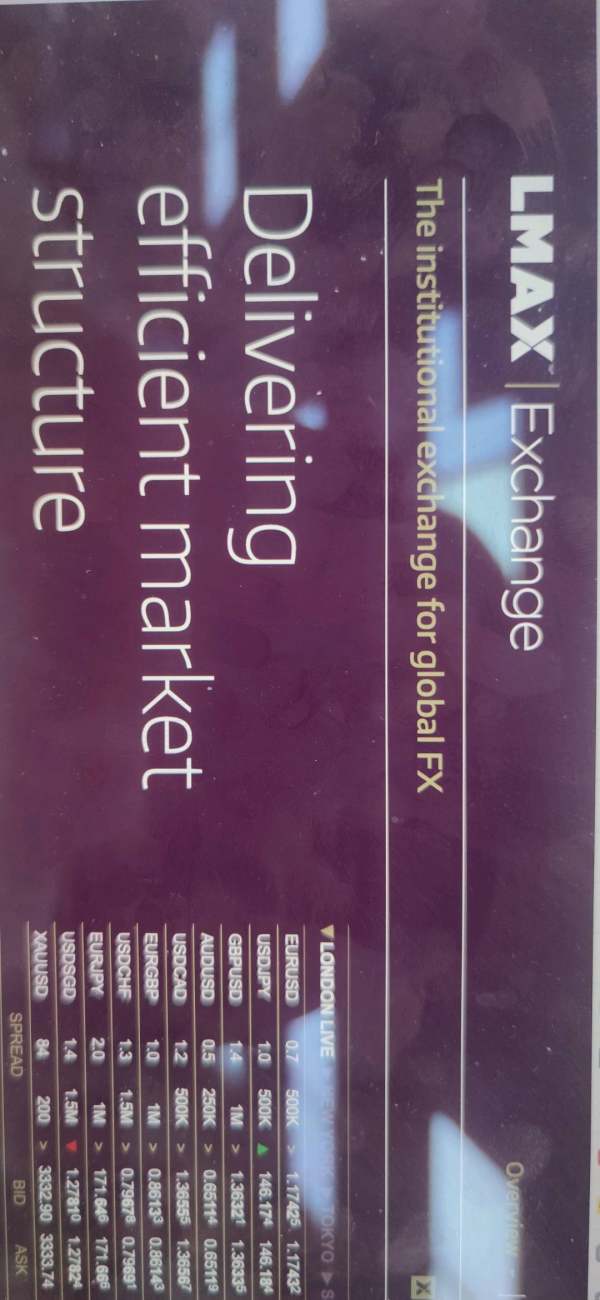

LMAX Group's business model centers around its own trading platform and ultra-low latency exchange infrastructure. The company has built a global presence across major FX markets in Europe, North America, and Asia-Pacific. Its portfolio includes three main brands: LMAX Exchange (institutional FX exchange operating as an FCA-regulated MTF and MAS-regulated RMO), LMAX Global (FCA and CySEC regulated brokers), and LMAX Digital (GFSC regulated institutional spot cryptocurrency exchange). The broker supports trading across multiple asset classes including forex, metals, indices, and cryptocurrencies. LMAX Digital specifically serves institutional cryptocurrency trading in Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ripple.

Regulatory Coverage: LMAX Group operates under a comprehensive regulatory framework spanning multiple jurisdictions. The FCA regulation covers LMAX Exchange and LMAX Global operations in the UK. CySEC provides additional oversight for European operations through LMAX Global. LMAX Digital operates under GFSC regulation, specifically focusing on institutional cryptocurrency trading services.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not extensively detailed in available public materials. However, institutional-grade banking relationships suggest support for wire transfers and other traditional banking methods suitable for institutional clients.

Minimum Deposit Requirements: Exact minimum deposit amounts are not prominently disclosed in public materials. This reflects the broker's institutional focus where deposit requirements are typically negotiated based on client type and trading volume expectations.

Bonuses and Promotions: Available information does not indicate standard retail-style bonus programs. This aligns with the broker's institutional positioning and regulatory compliance approach across multiple jurisdictions.

Trading Assets: LMAX Group offers a comprehensive range of over 100 financial instruments across multiple asset classes. The forex offering covers major, minor, and exotic currency pairs. The metals section includes precious metals trading. Index trading provides exposure to major global equity indices, and the cryptocurrency division through LMAX Digital offers institutional access to major digital currencies including Bitcoin, Ethereum, and other leading cryptocurrencies.

Cost Structure: The broker operates on a transparent commission-based model with competitive spreads. According to available information, LMAX Group offers "competitive commission and overnight financing rates" along with "tight spreads on streaming, firm limit order institutional liquidity." The exact spread and commission figures vary based on account type and trading volume.

Leverage Ratios: Specific leverage information is not detailed in available public materials. However, regulatory compliance across FCA, CySEC, and GFSC jurisdictions suggests adherence to applicable leverage limits in each region.

Platform Options: LMAX Group provides proprietary trading platforms designed for both web and mobile environments. The platforms feature "intuitive and powerful" interfaces backed by "ultra-low latency exchange infrastructure" with ongoing performance optimization.

Geographic Restrictions: While LMAX Group serves clients in over 100 countries, specific geographic restrictions are not detailed in available materials. These would depend on local regulatory requirements and the specific LMAX entity providing services.

Customer Support Languages: Specific language support information is not extensively detailed in available public materials. However, the global institutional focus suggests multilingual capabilities.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

LMAX Group's account structure reflects its institutional focus. However, this lmax group review finds that specific account type details are not extensively publicized. The broker's approach differs significantly from typical retail forex brokers, as it primarily serves institutional clients with customized account solutions rather than standardized retail account tiers.

The minimum deposit requirements are not prominently disclosed. This is typical for institutional brokers where account terms are often negotiated based on client size and trading requirements. This approach may present challenges for smaller retail traders seeking transparent, standardized account information. However, the broker's commission-based model ensures transparent pricing without hidden markups in spreads.

Account opening procedures appear streamlined for institutional clients. However, specific KYC and documentation requirements are not detailed in public materials. The absence of standard retail account features like micro accounts or cent accounts reflects the broker's positioning toward professional and institutional trading communities.

The broker's strength lies in its transparent execution model and competitive cost structure, particularly for high-volume institutional clients. However, the lack of publicly available account tier information and minimum deposit requirements may limit accessibility for smaller retail traders seeking clear account options and requirements.

LMAX Group excels in providing institutional-grade trading infrastructure. Its proprietary platform serves as the cornerstone of its technological offering. The platform features "ultra-low latency exchange infrastructure" designed for professional trading environments. Ongoing performance optimization ensures competitive execution speeds.

The trading platforms are available for both web and mobile environments. They are described as "intuitive and powerful" with features suitable for professional trading requirements. The infrastructure supports "precise and superior execution with no 'last look' rejections" and implements "strict price/time priority order matching." These are critical features for institutional trading.

However, specific details about analytical tools, research resources, and educational materials are not extensively documented in available public information. This reflects the broker's institutional focus, where clients typically have their own research capabilities and require execution services rather than comprehensive retail support tools.

The broker's technology infrastructure receives high marks for reliability and scalability. It features "robust, scalable technology" that supports the demands of institutional trading volumes. The absence of detailed information about automated trading support and specific analytical tools represents an area where more transparency would benefit potential clients.

Customer Service and Support Analysis (7/10)

LMAX Group's customer service approach aligns with its institutional client base. It focuses on professional support for sophisticated trading operations. While specific details about support channels, response times, and availability are not extensively detailed in public materials, the broker's institutional positioning suggests dedicated relationship management for larger clients.

The global presence across Europe, North America, and Asia-Pacific indicates regional support capabilities. However, specific language support and local presence details are not comprehensively documented. This geographic coverage suggests the ability to provide support across different time zones, which is crucial for institutional forex trading operations.

Response time expectations and service quality metrics are not publicly detailed. This is typical for institutional brokers where support is often provided through dedicated relationship managers rather than standardized retail support channels. This approach may limit accessibility for smaller retail clients who require standardized support procedures.

The broker's professional focus suggests high-quality support for institutional needs. However, the lack of detailed information about support procedures, availability, and response standards represents an area where greater transparency would benefit potential clients seeking to understand service expectations.

Trading Experience Analysis (8/10)

User feedback consistently indicates high satisfaction with LMAX Group's trading execution quality. Users particularly praise the broker's transparent execution model and competitive spreads. According to available information, users "generally express satisfaction with the trading execution quality." They appreciate the absence of conflicts of interest inherent in the agency broker model.

The platform's stability and execution speed receive positive recognition. The "ultra-low latency exchange infrastructure" provides competitive advantage for institutional trading requirements. Users report satisfaction with "slippage and requote situations," indicating reliable order execution even in volatile market conditions.

The broker's commitment to "fair, precise & consistent execution" translates into positive user experiences. This is particularly true regarding spread stability and execution transparency. The absence of "last look" rejections and implementation of strict price/time priority order matching contribute to predictable trading conditions.

This lmax group review finds that the trading environment particularly benefits institutional and professional traders who value execution quality over retail-focused features. The platform's institutional design may present a learning curve for retail traders accustomed to more simplified trading interfaces. However, the superior execution quality often compensates for any initial complexity.

Trust and Security Analysis (9/10)

LMAX Group demonstrates exceptional regulatory compliance across multiple jurisdictions. It operates under FCA, CySEC, and GFSC oversight. This multi-jurisdictional regulatory approach provides comprehensive protection for clients across different regions and trading activities.

The broker's transparency as a pure agency broker eliminates traditional conflicts of interest. LMAX Group does not take positions against client trades. This structural transparency enhances trust, as the company's profitability depends on client trading volume rather than client losses. According to available information, users "generally show high trust in LMAX Group" based on this transparent operating model.

The company's regulatory standing includes operating LMAX Exchange as an FCA-regulated Multilateral Trading Facility (MTF). This provides additional regulatory oversight and client protection. The GFSC regulation for LMAX Digital ensures appropriate oversight for cryptocurrency trading operations.

Industry recognition supports the broker's trustworthiness. Finance Magnates awarded LMAX Group "Best Execution Venue for the fourth consecutive year." The company also received the "2024 Azul Java Hero Award: Excellence in Application Performance." These third-party recognitions validate the broker's technological and operational excellence.

User Experience Analysis (7/10)

Overall user satisfaction with LMAX Group appears positive, particularly among institutional and professional traders. They appreciate the broker's execution quality and transparent operating model. The lmax group review indicates that users value the absence of dealing desk intervention and the competitive execution environment.

The platform interface, while powerful and feature-rich, may present complexity for retail traders. These traders are accustomed to simplified trading environments. However, institutional clients generally appreciate the comprehensive functionality and professional-grade tools available through the proprietary platform.

Account opening and verification processes are not extensively detailed in public materials. However, the institutional focus suggests streamlined procedures for qualified clients. The absence of detailed information about onboarding procedures may create uncertainty for potential clients seeking to understand requirements and timelines.

User demographics clearly favor institutional and professional traders. The broker's service model is optimized for funds, banks, asset managers, and retail brokerages rather than individual retail traders. This positioning creates excellent user experiences for the target demographic while potentially limiting appeal for smaller retail traders seeking more accessible trading solutions.

Conclusion

LMAX Group establishes itself as a premier choice for institutional and professional forex trading. It offers transparent execution, competitive pricing, and robust regulatory oversight across multiple jurisdictions. This comprehensive lmax group review reveals a broker that excels in serving its target market of funds, banks, asset managers, and retail brokerages through its agency broker model and institutional-grade infrastructure.

The broker's main strengths include its transparent market access, superior execution quality, comprehensive regulatory coverage, and elimination of conflicts of interest through its pure agency model. However, potential limitations include limited transparency regarding retail account options, minimum deposit requirements, and support resources for smaller retail traders.

LMAX Group is ideally suited for institutional clients, professional traders, and retail brokerages seeking transparent execution, competitive pricing, and reliable institutional-grade trading infrastructure. Individual retail traders should carefully consider whether the institutional focus aligns with their trading requirements and support expectations.