Regarding the legitimacy of LMAX GROUP forex brokers, it provides FCA, CYSEC, FSPR and WikiBit, (also has a graphic survey regarding security).

Is LMAX GROUP safe?

Pros

Cons

Is LMAX GROUP markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

LMAX Broker Limited

Effective Date:

2017-12-15Email Address of Licensed Institution:

compliance@lmax.com, kevin.barnes@lmax.comSharing Status:

No SharingWebsite of Licensed Institution:

www.LMAX.comExpiration Time:

--Address of Licensed Institution:

Yellow Building 1 Nicholas Road London W11 4AN UNITED KINGDOMPhone Number of Licensed Institution:

+442031922555Licensed Institution Certified Documents:

CYSEC Forex Execution License (STP) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

LMAX Broker Europe Ltd

Effective Date:

2016-08-08Email Address of Licensed Institution:

compliance.europe@lmax.comSharing Status:

No SharingWebsite of Licensed Institution:

www.lmax.com/global//euExpiration Time:

--Address of Licensed Institution:

Evagora Papachristoforou 10, SEMELI BUSINESS CENTER Flat/Office 101, 3030 Limassol,Phone Number of Licensed Institution:

+357 25 056 217Licensed Institution Certified Documents:

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

RegulatedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

LMAX NEW ZEALAND LIMITED

Effective Date:

2018-05-24Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 10-12, 11 Britomart Place, Britomart,, Auckland, 1010, New ZealandPhone Number of Licensed Institution:

+048894510Licensed Institution Certified Documents:

Is LMAX Group A Scam?

Introduction

LMAX Group is a prominent player in the foreign exchange (FX) market, known for its high-performance trading technology and a focus on institutional clients. Established in 2010, the firm operates multiple trading venues, including LMAX Exchange and LMAX Global, catering to both retail and professional traders. Given the complexity and potential risks associated with trading in the forex market, it is essential for traders to conduct thorough due diligence before engaging with any broker. This article aims to provide an objective evaluation of LMAX Group by examining its regulatory status, company background, trading conditions, customer fund safety, and user experiences. The analysis is based on a review of various credible sources, including regulatory filings, user feedback, and industry reports.

Regulation and Legitimacy

The regulatory framework governing forex brokers is crucial in ensuring the safety and security of traders' funds. LMAX Group operates under the supervision of several reputable regulatory authorities, which adds a layer of credibility to its operations. Below is a summary of LMAX Group's regulatory information:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | 509778 | United Kingdom | Verified |

| CySEC | 310/16 | Cyprus | Verified |

| FMA | FSP612509 | New Zealand | Verified |

LMAX Group is regulated by the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC), among others. This tier-1 regulation is significant as it ensures compliance with stringent financial standards, including capital requirements and client fund segregation. The FCA, for instance, offers protection for clients up to £85,000 in case of broker insolvency, while CySEC provides coverage of up to €20,000. However, it is worth noting that some entities under LMAX Group are regulated by tier-2 and tier-3 regulators, which may not offer the same level of protection. The company's history shows a commitment to compliance, although there have been instances of regulatory scrutiny that warrant attention.

Company Background Investigation

LMAX Group was founded in 2010 and has since established itself as a significant player in the FX market. The company operates under multiple brands, including LMAX Exchange, which is a regulated multilateral trading facility (MTF), and LMAX Global, which serves retail and institutional clients. The firm's ownership structure includes private equity investments, with a notable stake acquired by JC Flowers in 2021, valuing the company at approximately $1 billion.

The management team at LMAX Group comprises experienced professionals with extensive backgrounds in finance and technology. This expertise is crucial in maintaining the firm's competitive edge and ensuring high-quality service delivery. Transparency is a key aspect of LMAX Group's operations, with the company providing detailed information about its services, regulatory status, and trading conditions on its official website. However, some reviews have raised concerns about the level of information available to clients, particularly regarding fees and potential risks associated with trading.

Trading Conditions Analysis

LMAX Group offers a range of trading conditions that are generally favorable for experienced traders. The broker's fee structure is primarily based on spreads and commissions, which can vary depending on the trading volume and account type. Below is a comparison of core trading costs:

| Cost Type | LMAX Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 0.5 pips |

| Commission Model | $2 - $4.5 per $100,000 traded | $3 - $6 per $100,000 traded |

| Overnight Interest Range | Varies | Varies |

The spreads offered by LMAX Group are competitive, particularly for major currency pairs, which can start as low as 0.2 pips. However, the minimum deposit requirement of $10,000 may be a barrier for novice traders. Furthermore, the firm charges a monthly platform fee of $300, which is relatively high compared to industry standards. This fee structure may not be suitable for all traders, especially those who prefer lower-cost options.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a broker. LMAX Group employs several measures to protect client assets, including segregated accounts and negative balance protection policies. Client funds are held in separate accounts, ensuring they are not used for the company's operational expenses. Additionally, the broker participates in the Financial Services Compensation Scheme (FSCS), providing further assurance to clients in the event of insolvency. However, it is essential to note that the level of protection can vary depending on the regulatory jurisdiction under which the client operates.

Historically, LMAX Group has maintained a strong reputation for fund safety. However, like many brokers, it is not immune to occasional complaints regarding fund withdrawals and account management. Transparency in reporting any past issues is critical for maintaining trust with clients.

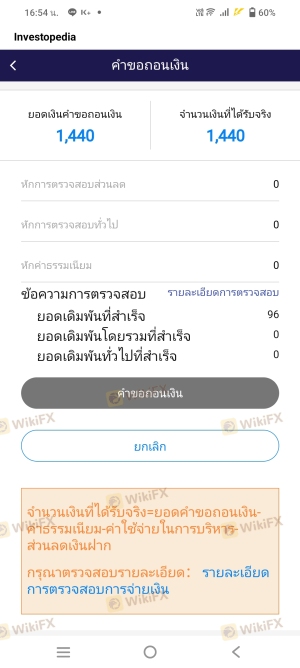

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. LMAX Group has received mixed reviews from users, with some praising its execution speed and trading conditions, while others have raised concerns about withdrawal processes and customer support responsiveness. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Management Issues | Medium | Moderate response |

| High Fees | Low | Acknowledged |

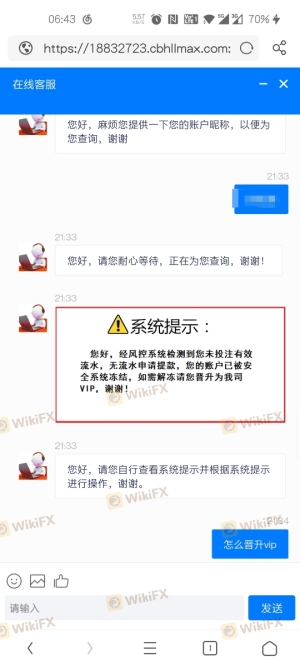

Typical complaints include difficulties in withdrawing funds and slow customer service responses during peak times. For instance, some users have reported delays in processing withdrawal requests, which can lead to frustration and mistrust. The company has made efforts to address these issues, but the response time can vary significantly based on the nature of the complaint.

Platform and Execution

The trading platform offered by LMAX Group is designed for professional traders, featuring advanced technology and tools for market analysis. The execution quality is generally high, with minimal slippage reported during normal trading conditions. However, some users have experienced issues during periods of high volatility, leading to delays in order execution.

The platform is equipped with features that allow for efficient trading, including real-time market data and analytics. Nevertheless, there have been indications of potential platform manipulation, particularly during significant market events, which could affect order execution quality.

Risk Assessment

Engaging with LMAX Group carries certain risks that traders should be aware of. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Variations in regulatory oversight across jurisdictions. |

| Operational Risk | High | Potential for execution delays and withdrawal issues during high market volatility. |

| Financial Risk | Medium | High minimum deposit and monthly fees may deter less experienced traders. |

To mitigate these risks, traders are advised to thoroughly understand the broker's fee structure, maintain realistic expectations regarding trading outcomes, and ensure they are comfortable with the minimum deposit requirements before opening an account.

Conclusion and Recommendations

In conclusion, LMAX Group is a regulated broker that offers competitive trading conditions and advanced technology for professional traders. While the firm has a solid reputation in the industry, potential clients should remain cautious due to the high minimum deposit requirement and occasional complaints regarding withdrawal processes.

There are no significant signs of fraudulent activity; however, the broker's fee structure and customer service responsiveness warrant careful consideration. For traders who are new to the market or those with limited capital, it may be prudent to explore alternative options with lower entry barriers and more favorable fee structures. Recommended alternatives include brokers like IG Group or Pepperstone, which provide robust trading environments with lower minimum deposit requirements. Ultimately, traders should assess their individual needs and risk tolerance before committing to any broker.

Is LMAX GROUP a scam, or is it legit?

The latest exposure and evaluation content of LMAX GROUP brokers.

LMAX GROUP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LMAX GROUP latest industry rating score is 7.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.