VS Market Limited Review 13

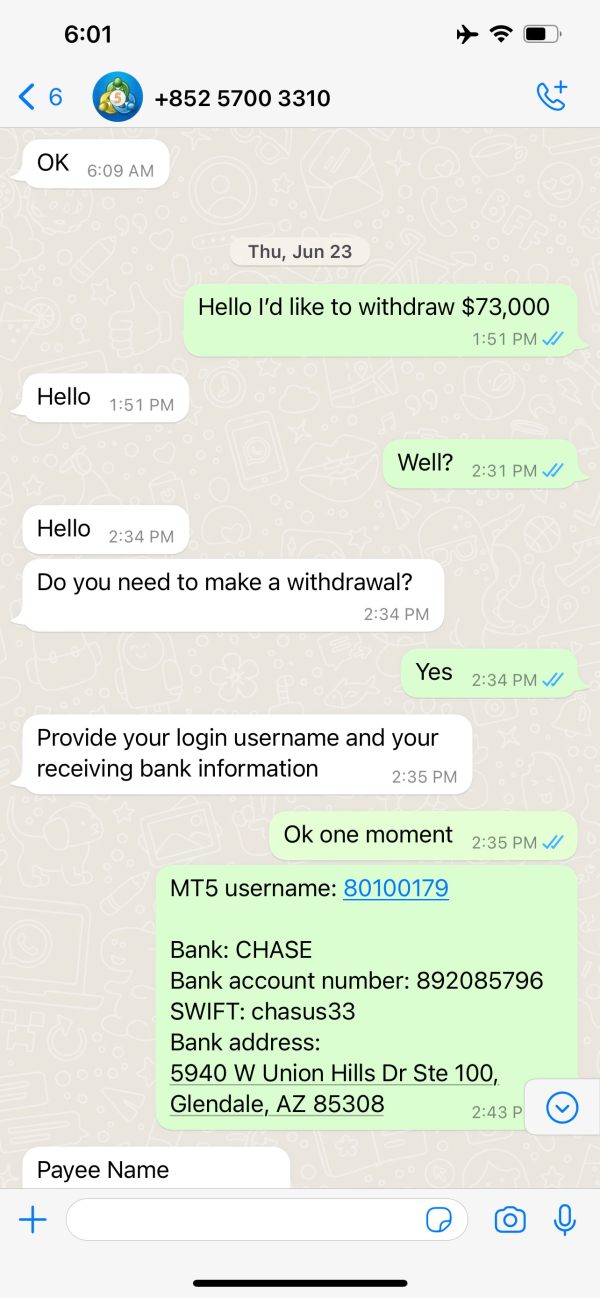

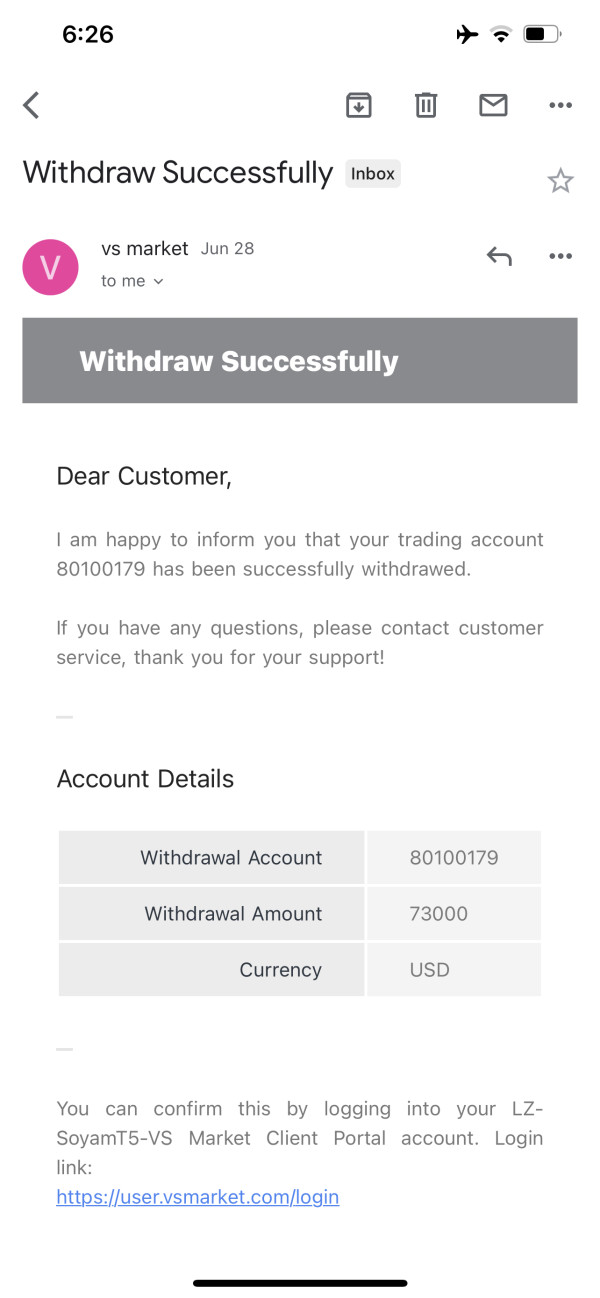

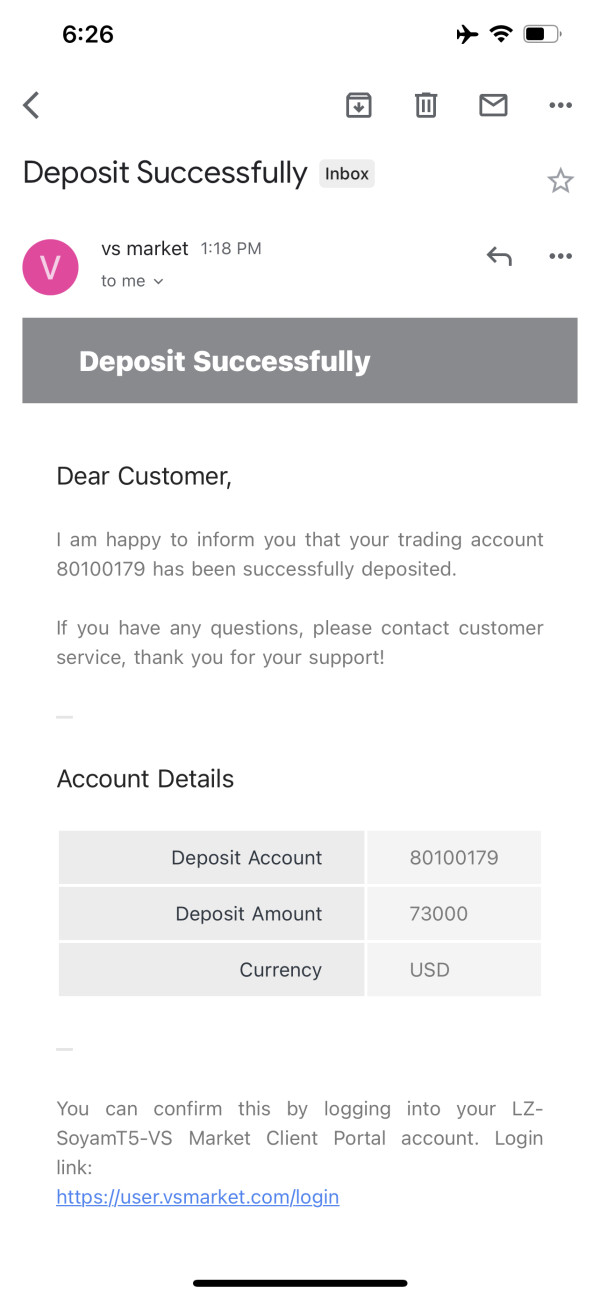

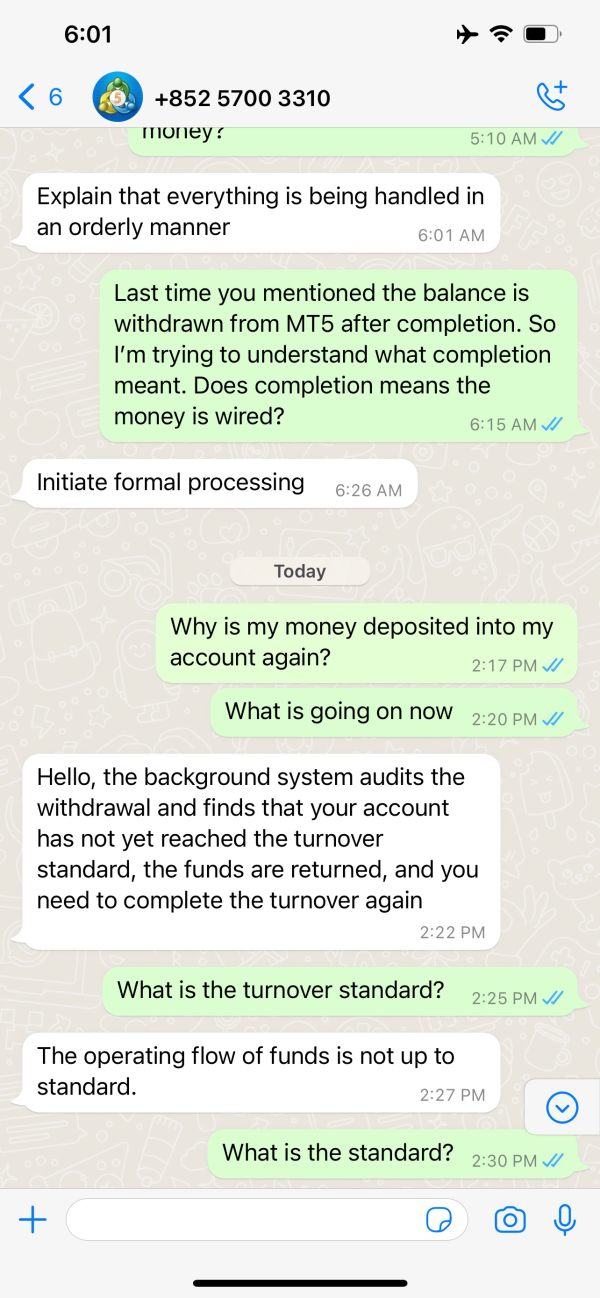

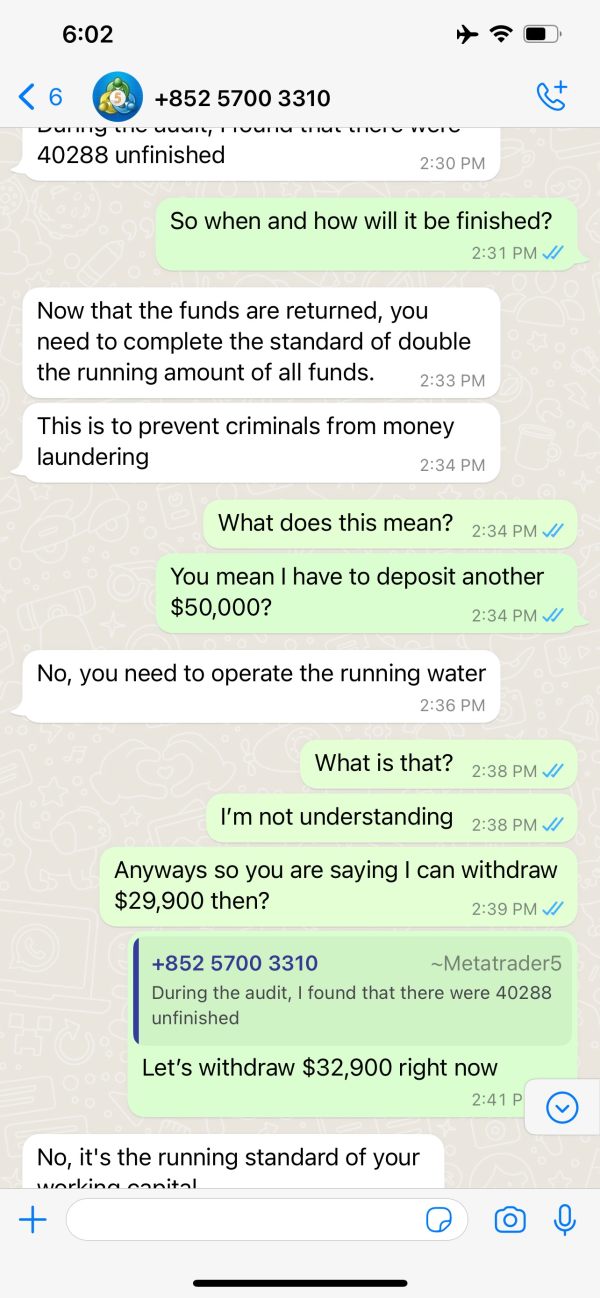

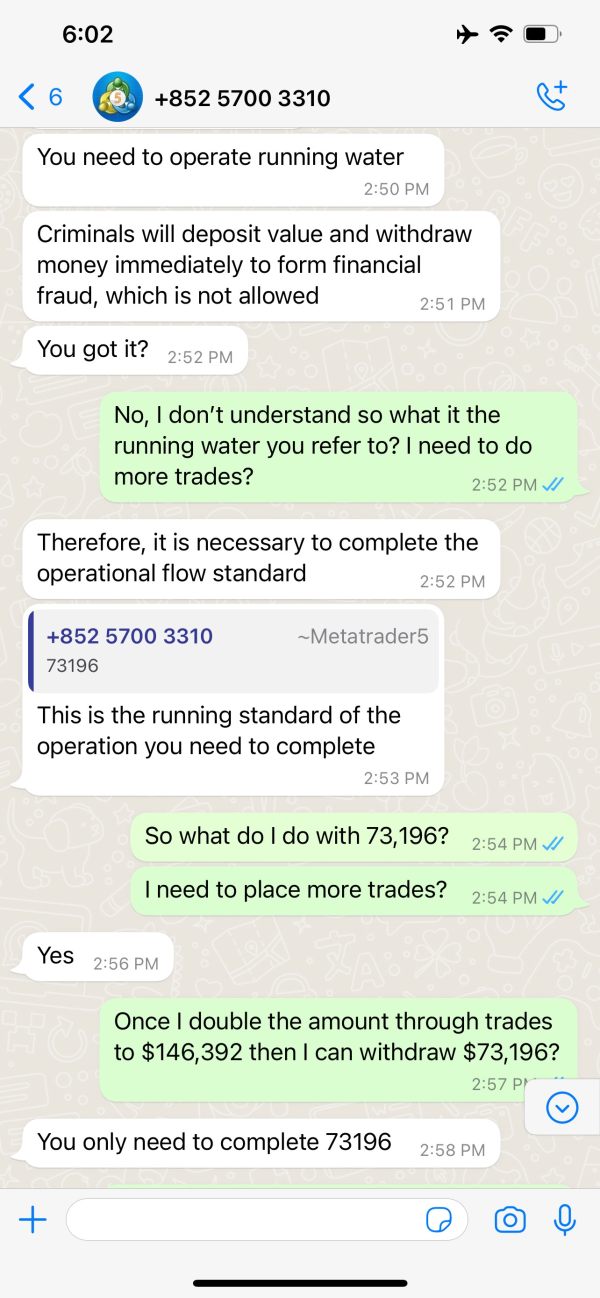

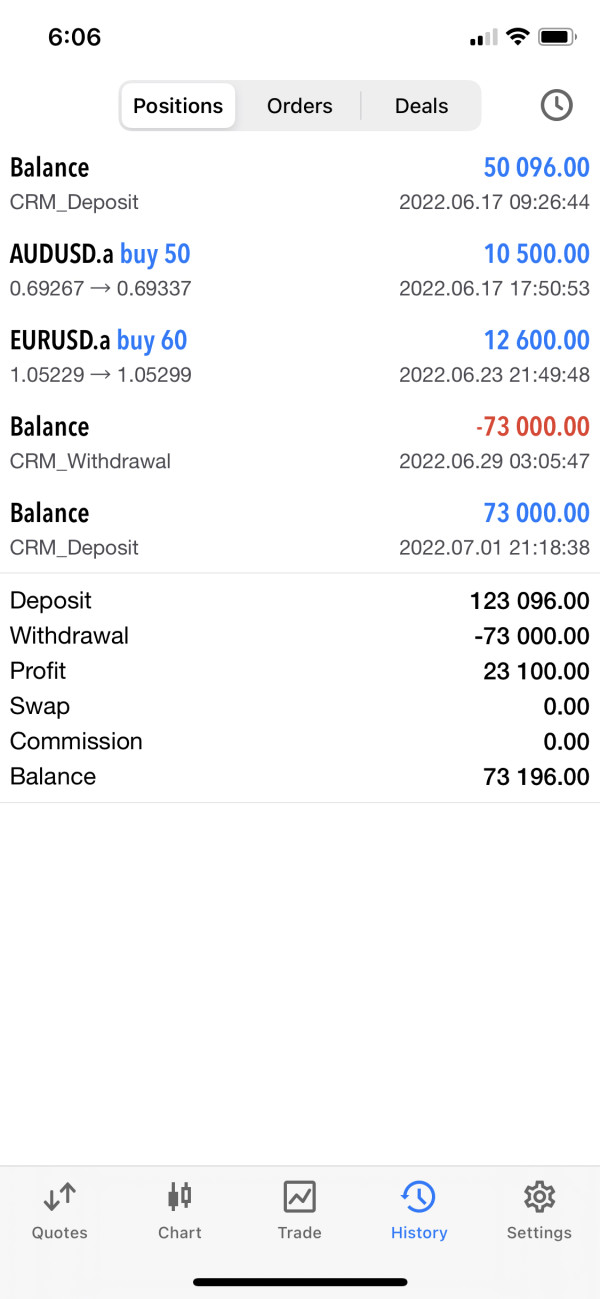

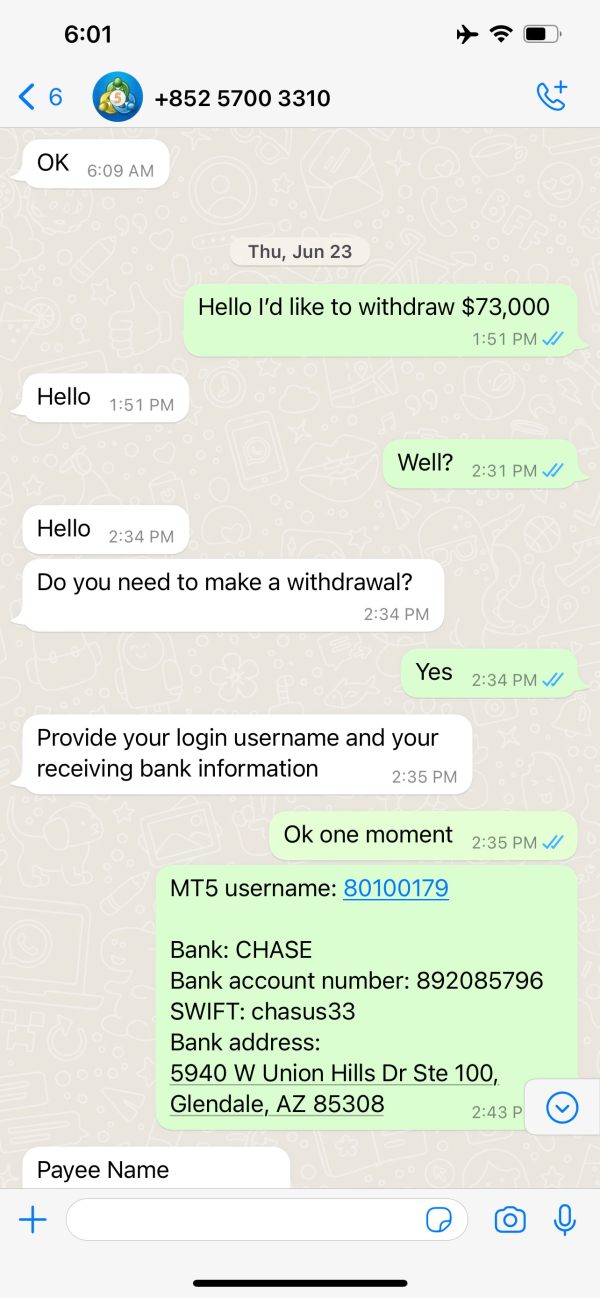

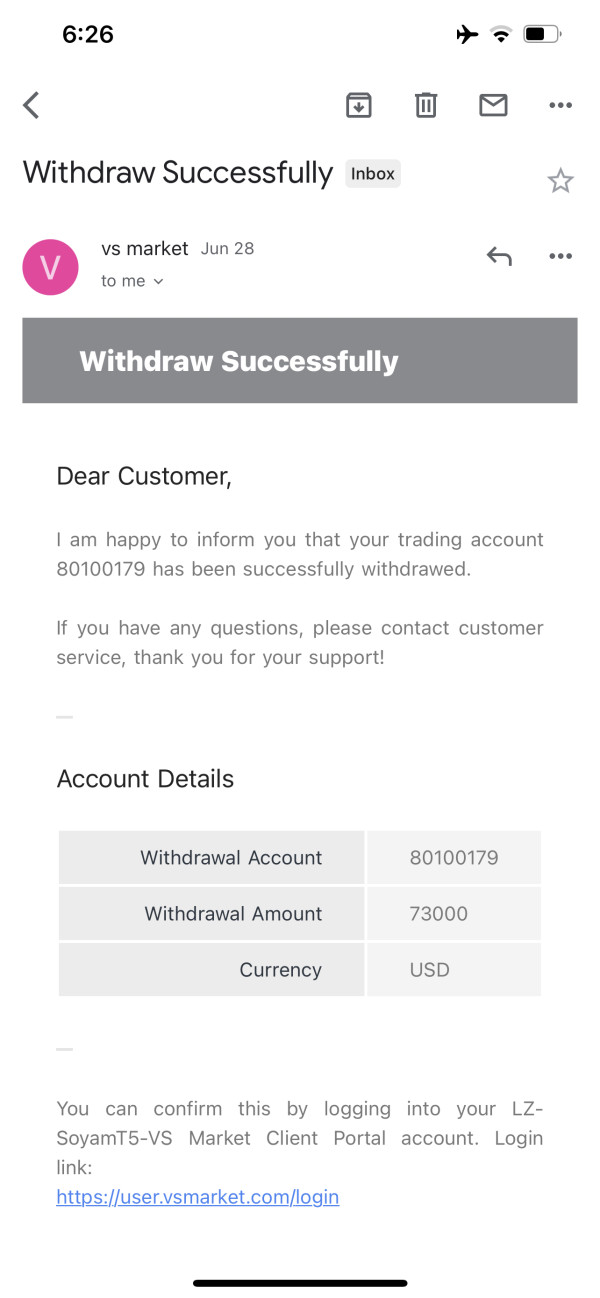

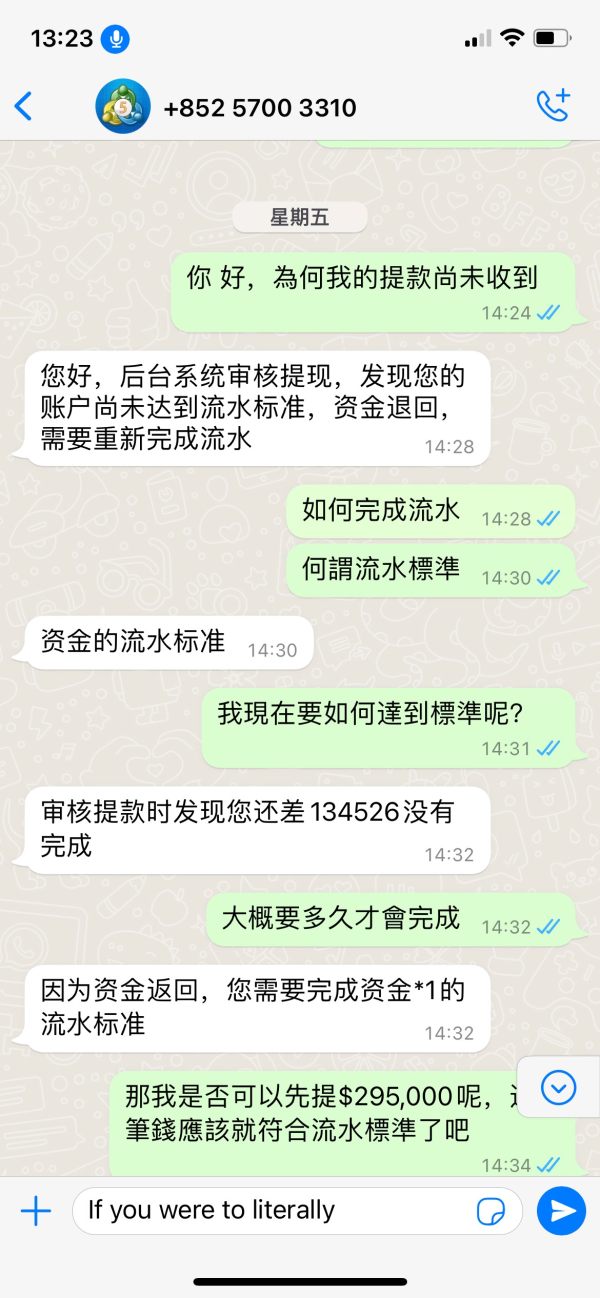

I went to the bank to wire $50k to the broker. I received notification from VS MARKET that the $50k has been deposited into the broker account. Made $23k profit and when I try to withdraw they asked for bank information and then told me they submitted. They said once is complete they will withdraw the balance from the broker account. I received email stating that the money was removed from the broker account, but it never reached my bank account! Today I got an email stating that the money was deposited into the broker account. I was very confused and messaged the representative and they started making excuses saying I can’t withdraw and need to do more trade. That withdrawing is criminal activities such as money laundering.

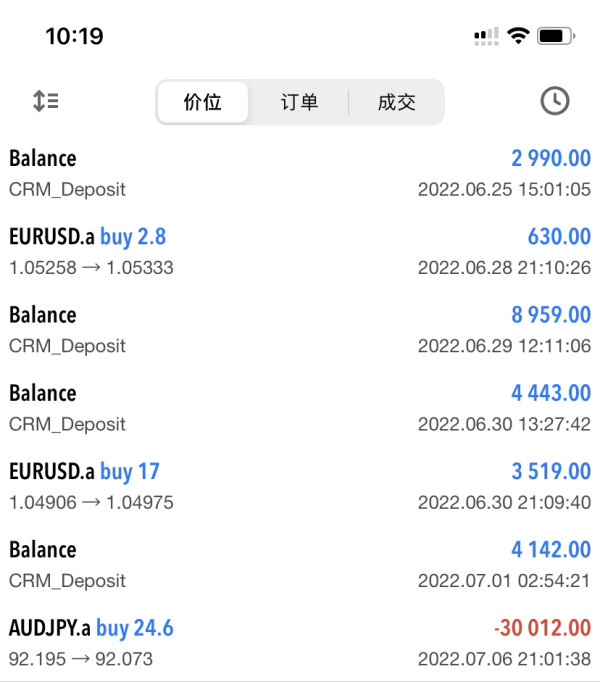

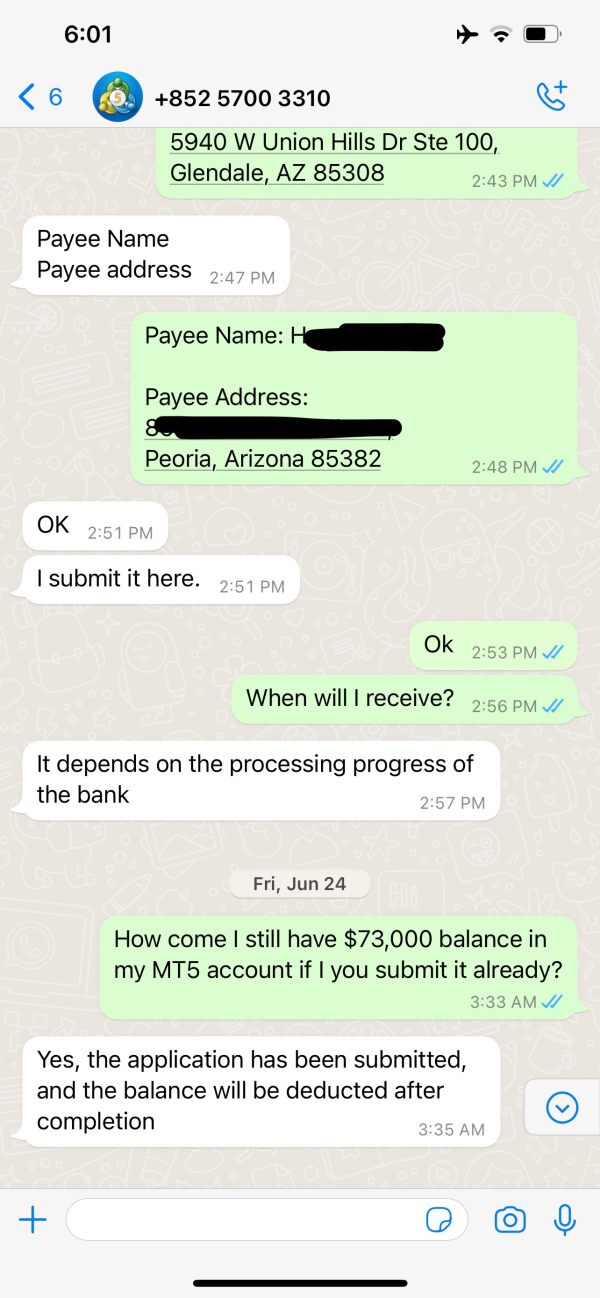

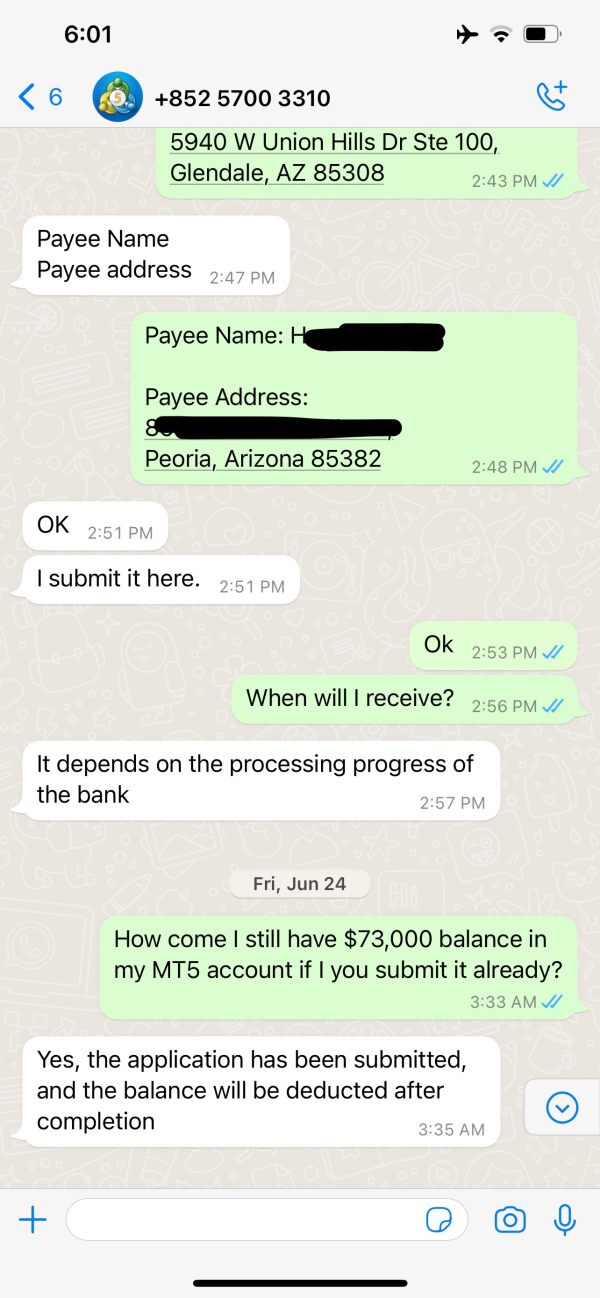

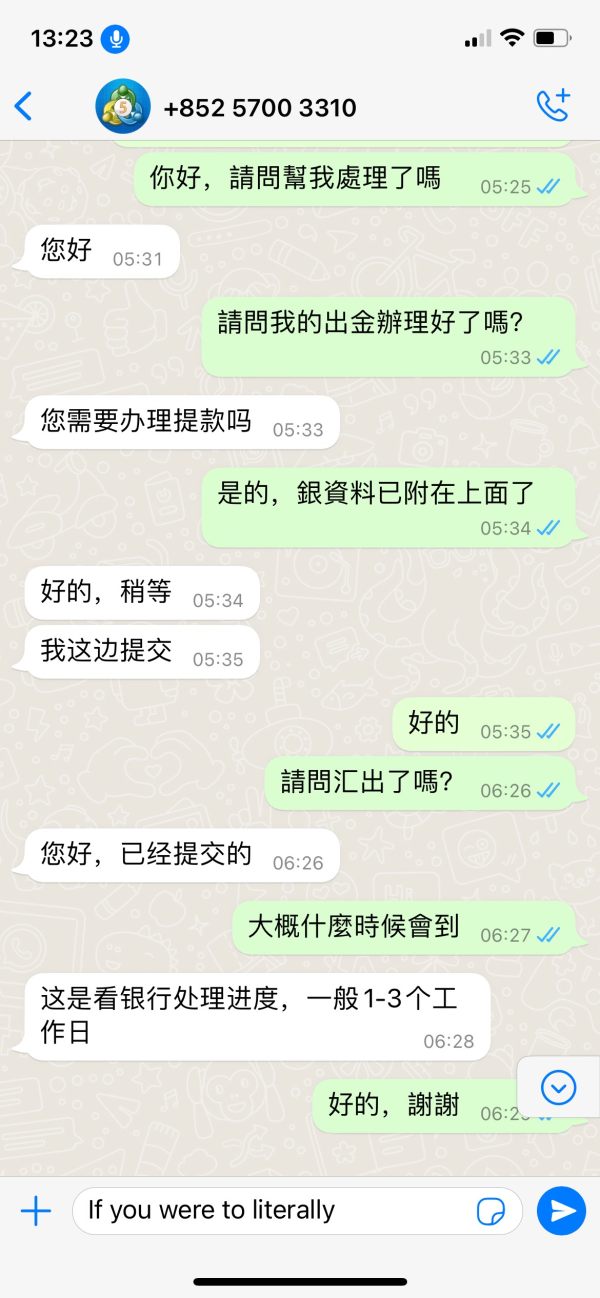

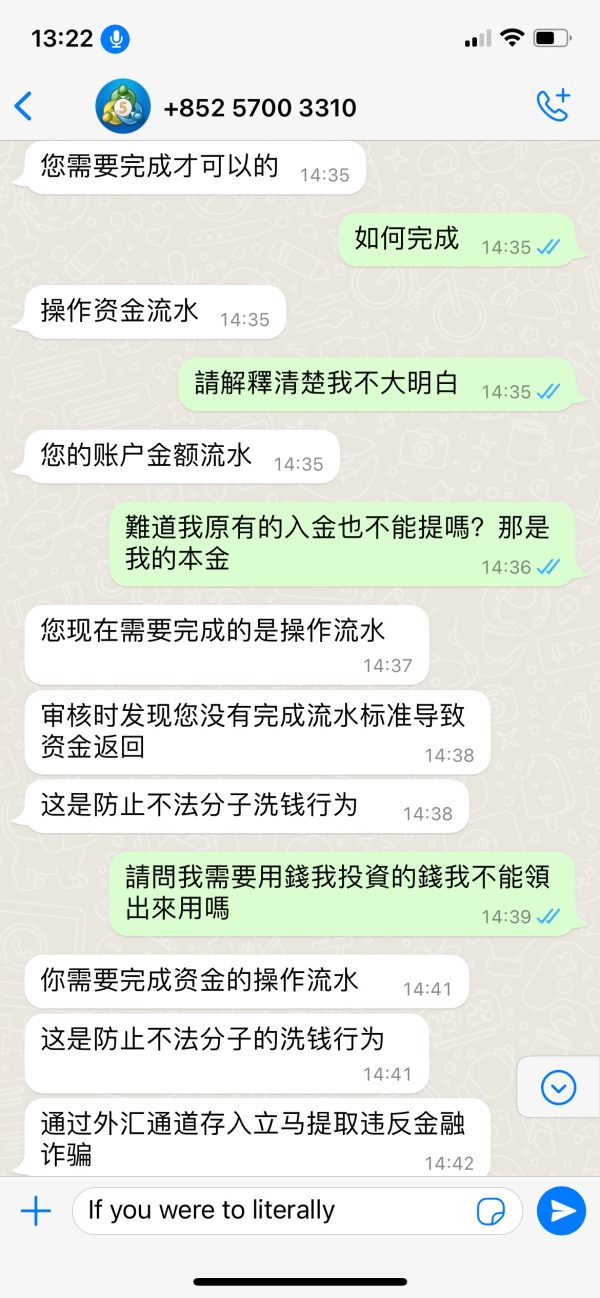

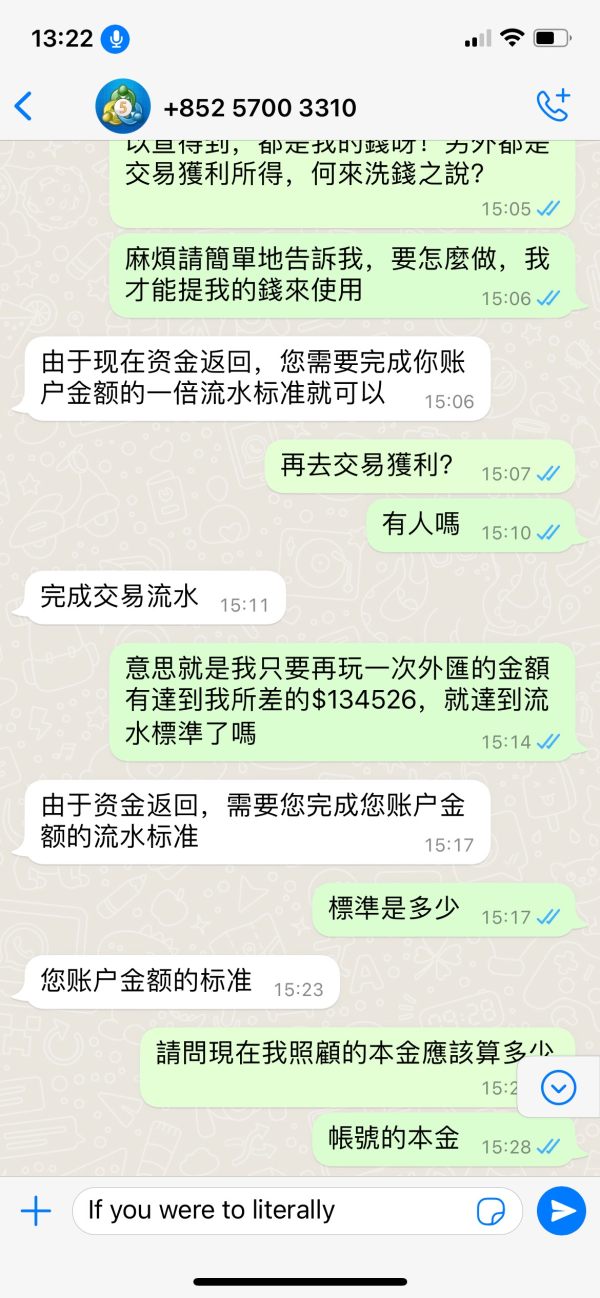

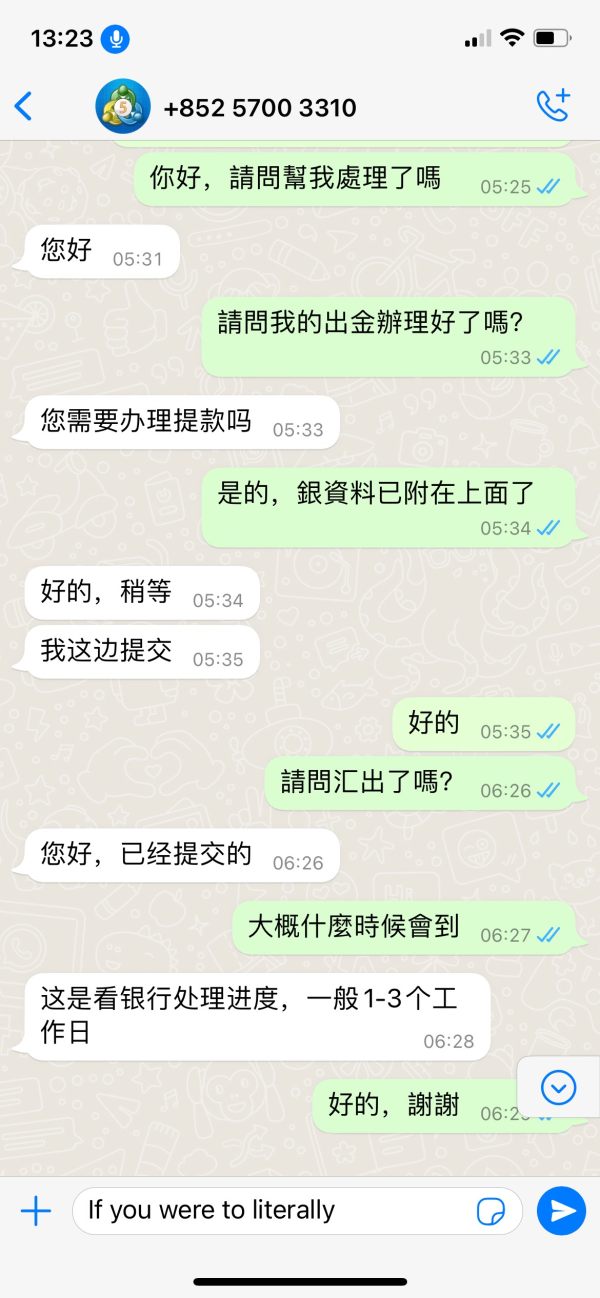

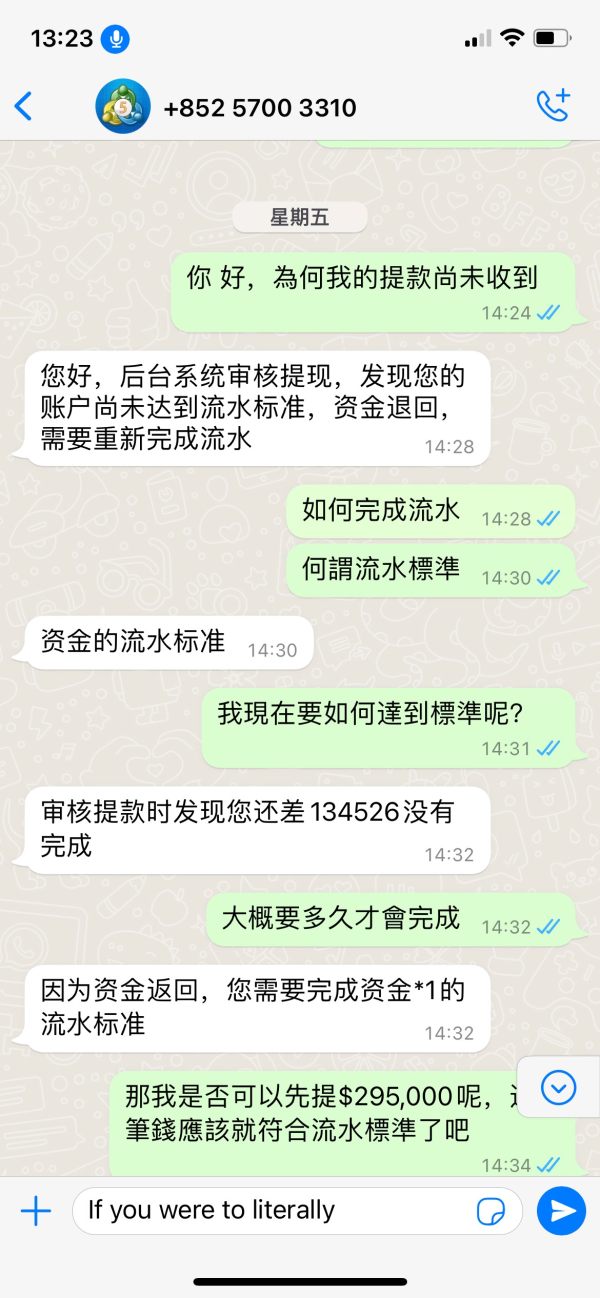

I opened an account with VS market limited on May 24th this year via WhatsApp. Account: 80100131. Every time I make a deposit (deposit), I have to ask the commissioner for bank remittance information. Each time it is a different company or private account. (both in Hong Kong). The WhatsApp account of the commissioner of VS Market Limited is 85257003310 1) Deposited $109,905 on May 27, bought 109 lots of EUR on May 30, and made a profit of $23,871; 2) Deposited $102,381 on June 2 and bought it on June 3 236 lots of AUD, profit of $46,020; 3) Deposit $27,246 on June 14, buy 309 lots of AUD on June 17, profit of $46,350; 4) Buy 355 lots of EUR on June 23, profit of $74,550; 5)6 Apply for withdrawal of USD 430,000 on June 26, 6) Deposit $44,842 on June 27; 7) Buy 45 lots of EUR on June 28, and make a profit of $9,045; 8) Received an email on June 30 that the withdrawal was successful, 9) However, on July 1st, I deposited it back into the account, because it did not meet the standard turnover. In order to prevent money laundering, I had to wait until my turnover reached the standard before I could withdraw! 10) On July 3rd, I bought 10 lots of ether each , making profits of $834 and $465, respectively. 11) Later bought 485.5 lots and 498.47 lots of Ether on July 5, making profits of $12,962.85 and $8,374.30, respectively. 12) On July 5th, because the current flow rate has reached the standard, the commissioner did not respond to the information at all when he wanted to withdraw money. The current balance in the account is $506,846.15. I don’t know if this money can be withdrawn, or if I encounter fraud, I would also like your professional assistance to see if you can help me get the money back. I would be very grateful! people suffer! The attached photo is the last conversation with the commissioner on Whatsapp, please refer to it. If you need more detailed information, please feel free to contact me, and it will be sent immediately.

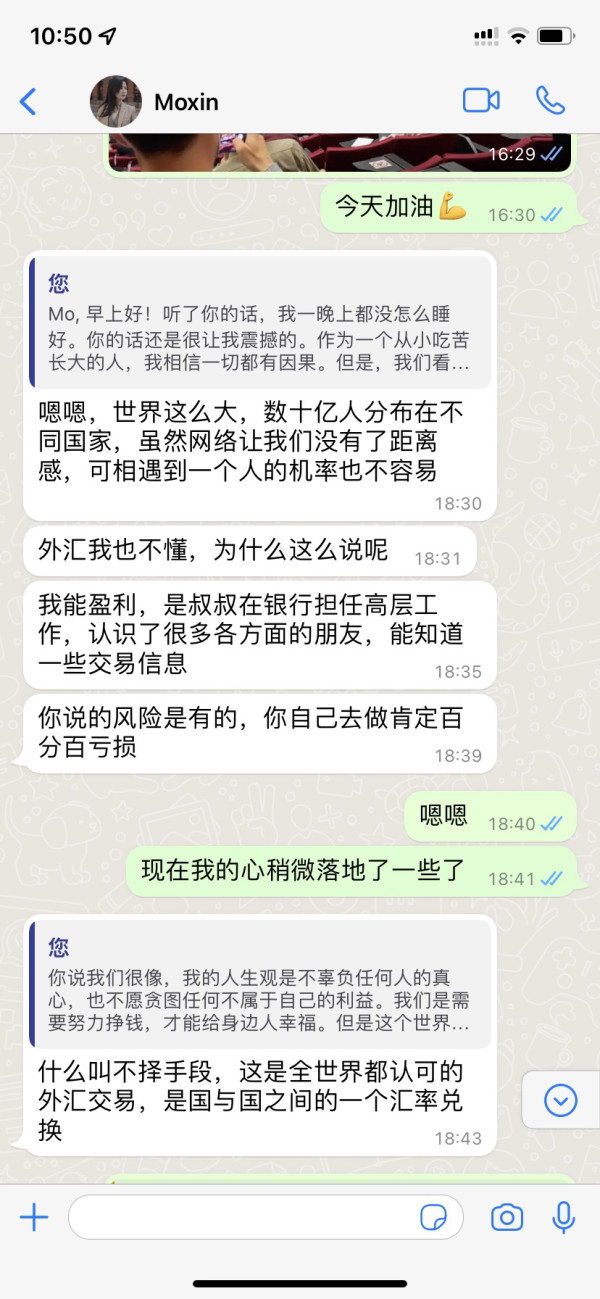

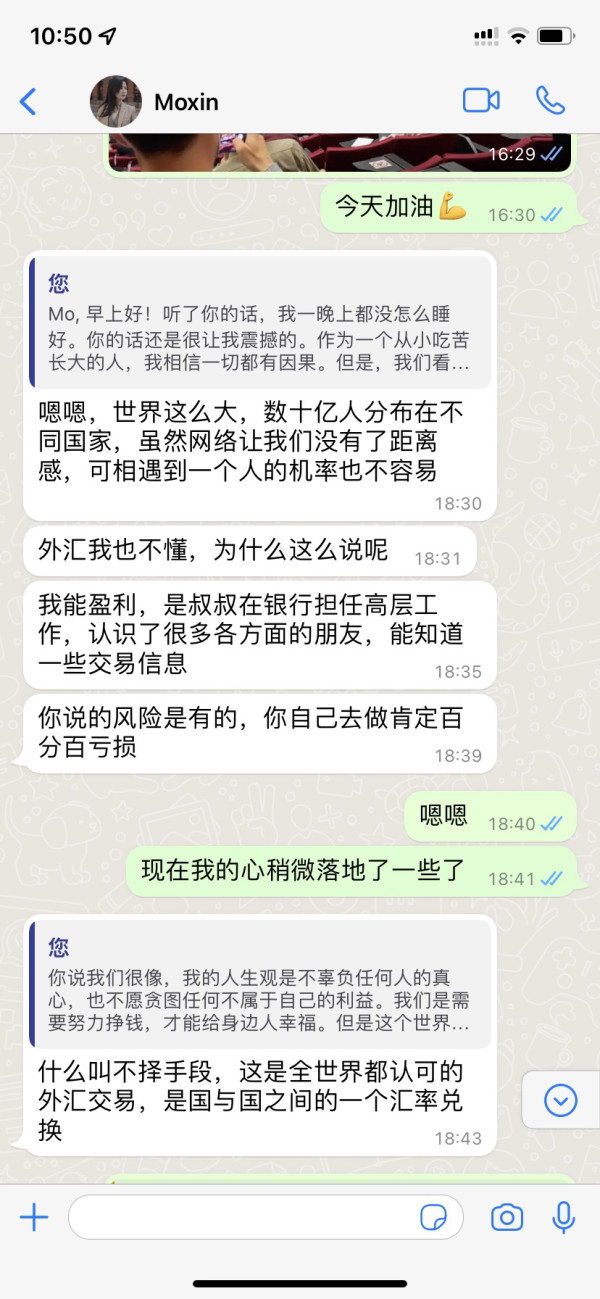

Liars use the national karaoke software to attract the attention of deceived people, and then chat in the way of boyfriend and girlfriend. He claimed that his relatives worked at the top of the Bank of New York in the United States, knew insider trading information, and could conduct illegal foreign exchange manipulation. In the end, the deceived person is induced to download MetaTrader5. A specific customer service is introduced separately, and the so-called deposit and withdrawal are carried out through the customer service. The customer service claimed to use a random account with cooperation to recharge and deposit (multiple accounts filled in above). After being cheated, the customer service notified MletaTrader5 that the recharge was successful. Then, under the leadership of the crooks, I made several foreign exchange transactions on MetaTrader5, and the first few times were successful, and each time I made a profit of 20%. So the deceived people continue to deposit money wildly. Then, on the fourth time, the scammer deliberately selected a volatile foreign exchange transaction, which eventually caused the illusion that the market was volatile and led to liquidation. In fact, the money has already entered various so-called random accounts when the deceived people make money. Afterwards, the scammer claimed that the deceived person had insufficient funds to cause the liquidation, and even asked the deceived person to continue to borrow money (deposit). The deceived wakes up after losing more than 100,000