SW Markets, founded in 2019, operates from Hong Kong and claims to be regulated by the Vanuatu Financial Services Commission (VFSC) under license number 40357. The company positions itself as a low-cost trading platform for experienced traders willing to navigate high-risk environments, promoting three different types of trading accounts. Users are often drawn by the promise of a user-friendly trading experience but must remain critical of the potential regulatory gaps that characterize this brokerage.

SW Markets offers a variety of trading services, including Forex, CFDs (Contracts for Difference), commodities, and indices. Their primary account types include premium, standard, and mini accounts, each with varying deposit requirements starting from $5000. The broker claims to support various trading strategies, including automated trading, although notable complaints about customer service and withdrawal practices have emerged. Traders must also be aware that while the VFSC regulates SW Markets, the authority is viewed as less stringent compared to renowned regulatory bodies.

Understanding a broker's regulatory status is paramount for user safety. In the case of SW Markets, while it claims oversight from the VFSC, many view this regulation as lax. User self-verification is crucial; thus, prospective traders should follow these steps:

- Check for the broker's registration on the VFSC website.

- Review user testimonials from diverse sources to evaluate the credibility of experiences shared by fellow traders.

- Ensure clarity regarding the terms of trading and withdrawal procedures.

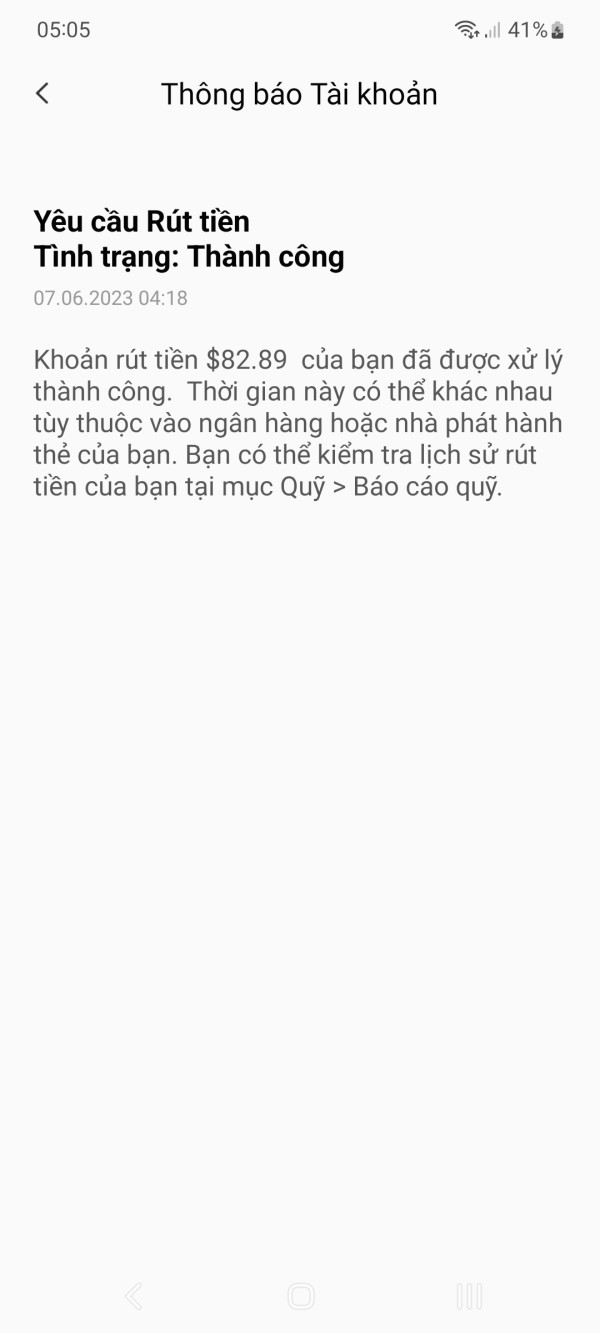

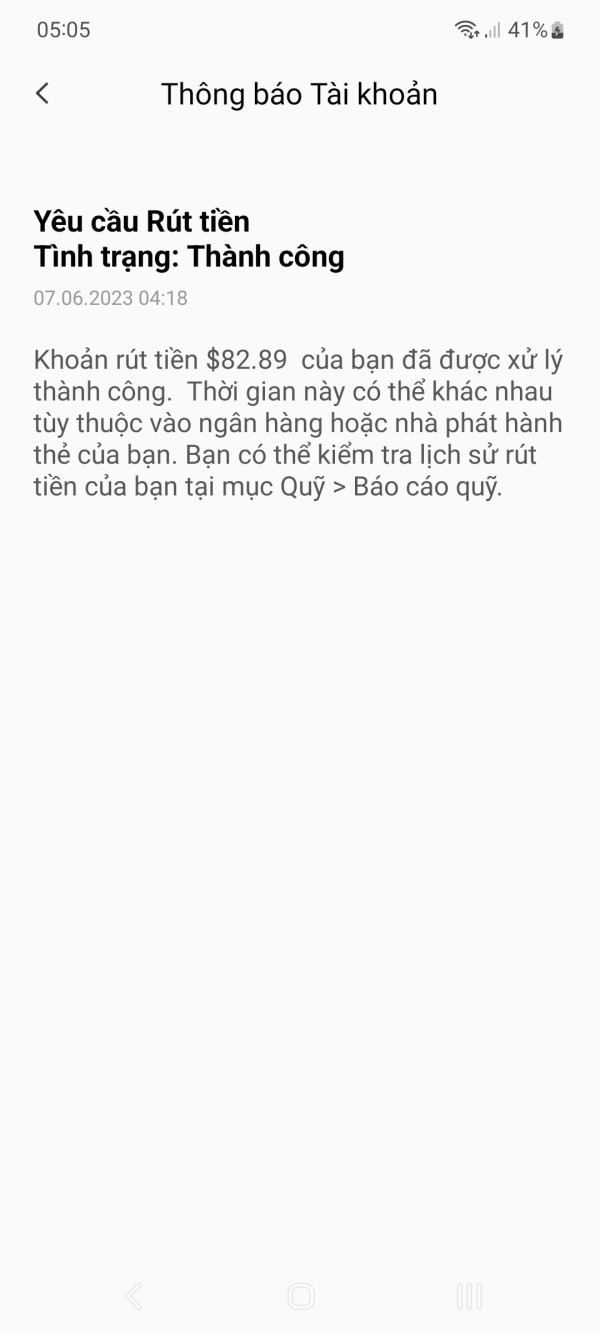

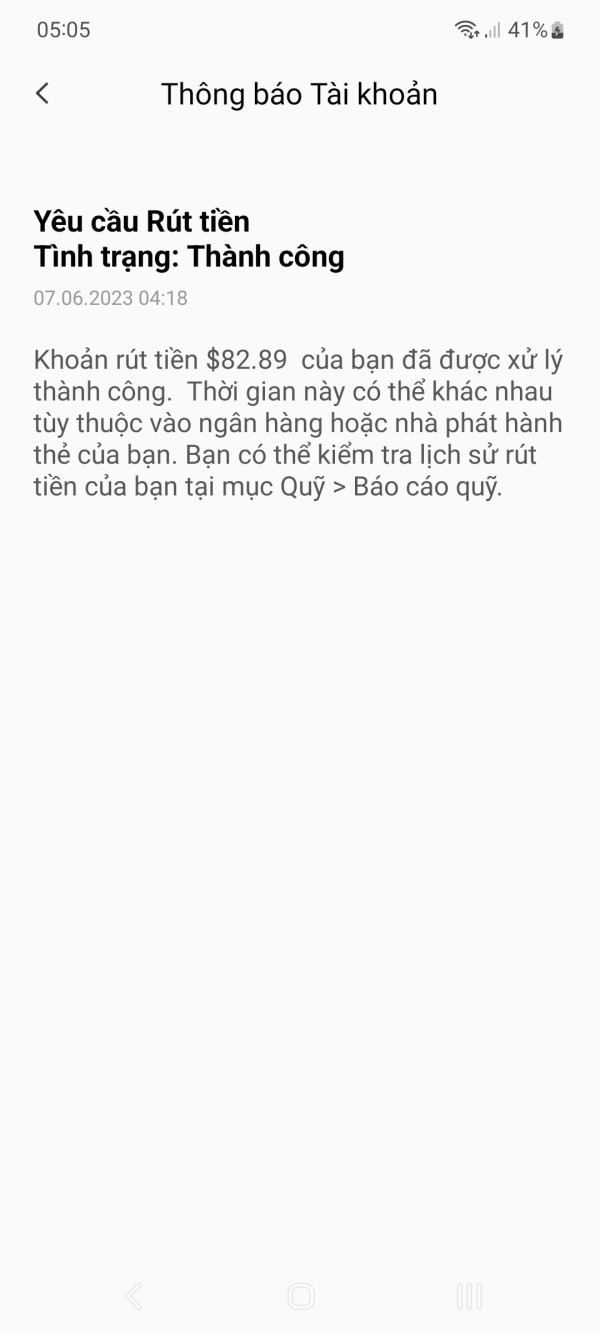

"I opened an account and was given $30 for trading. However, when I checked the next day, there was no money left, and I received a message stating that my withdrawal request was successful—even though I didnt initiate one." – Anonymous review.

By staying informed, users can better manage their investment risks when dealing with such entities.

Trading Costs Analysis

The double-edged sword effect.

SW Markets touts low trading costs, especially in terms of commissions, making its platform enticing for high-frequency traders. Current data suggests a commission structure that undercuts many competitors. However, users have reported significant withdrawal fees, often described as convoluted or unclear.

"SW Markets charged me $30 to withdraw. I was shocked at how high it was, especially when compared to what other brokers offer." – User complaint.

This cost structure creates a vexing dichotomy: the allure of low commissions versus the threats presented by high withdrawal costs that can erode profit margins.

Professional depth vs. beginner-friendliness.

The trading platform offered by SW Markets is described as user-friendly but lacking depth in advanced trading tools. Traders have noted basic functionalities like charting tools and analytics but feel the platform falls short in comparison with leading ones like MetaTrader 4 or 5.

"I find the app convenient but limited in features. It's easy to navigate, which helps beginners, but more advanced traders might feel constrained." – Mixed review.

While this platform is accessible, its simplicity may not cater to seasoned traders looking for robust tools and features.

User Experience Analysis

Navigating the user journey.

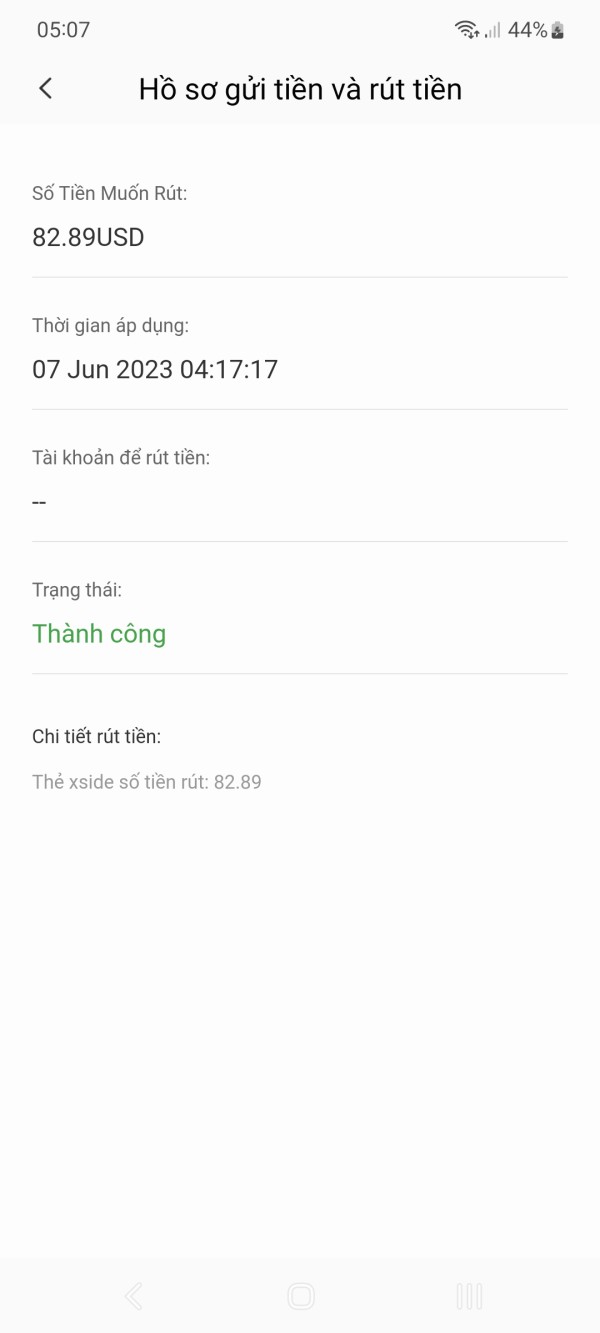

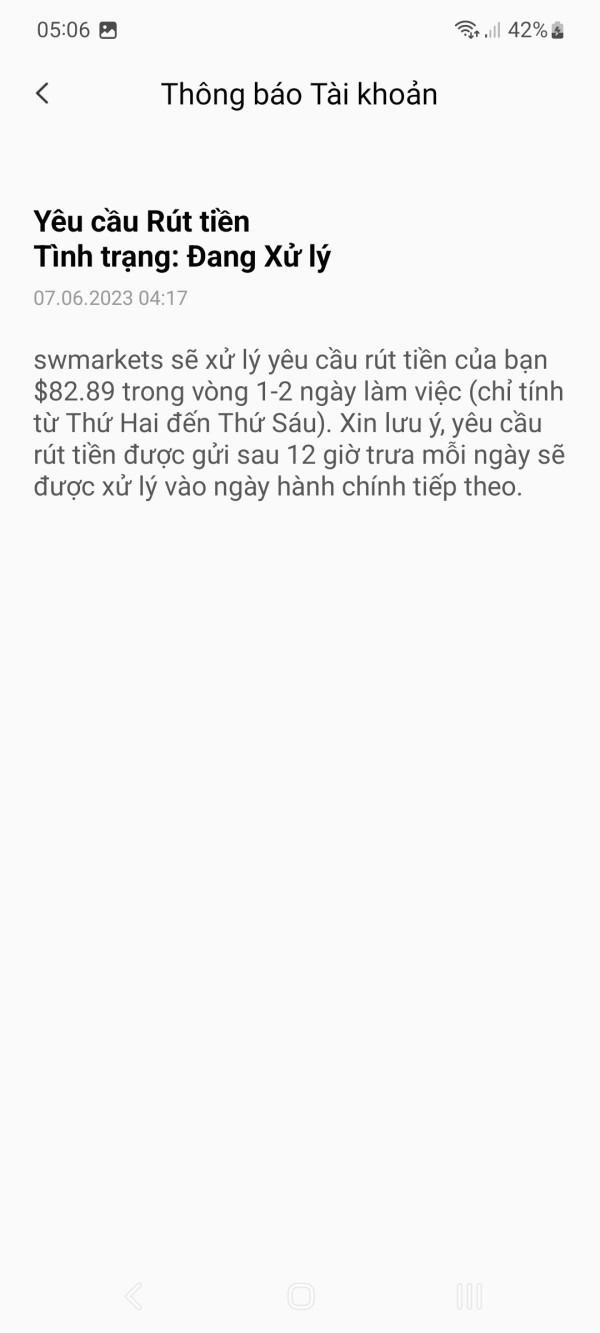

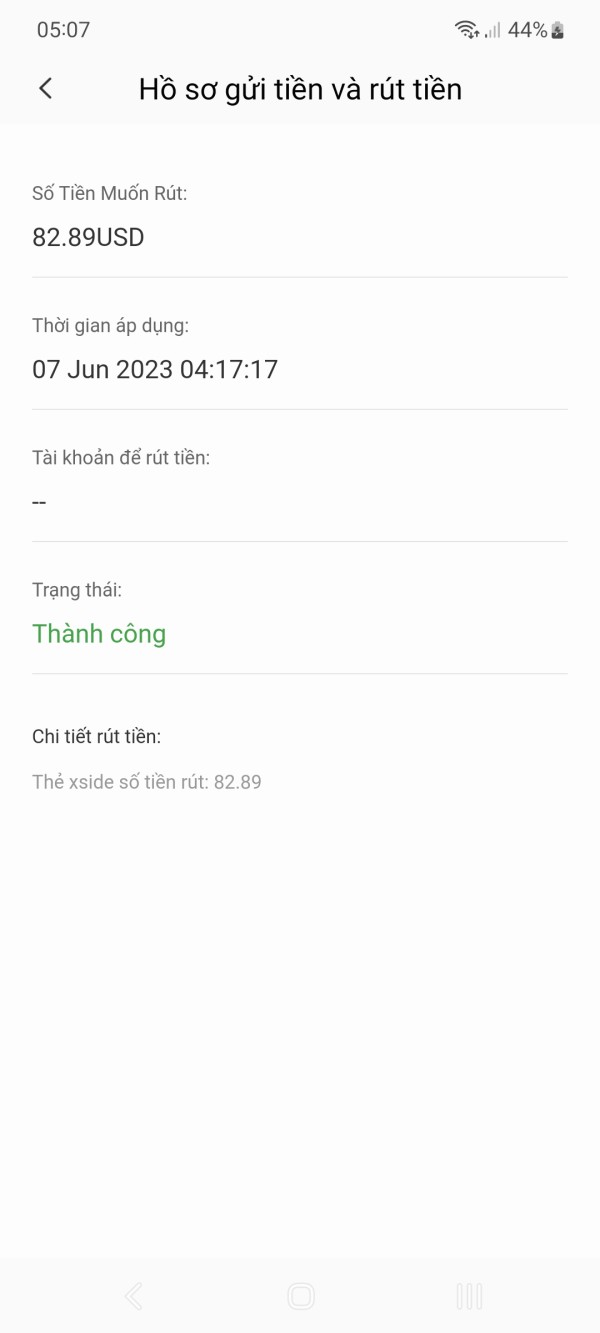

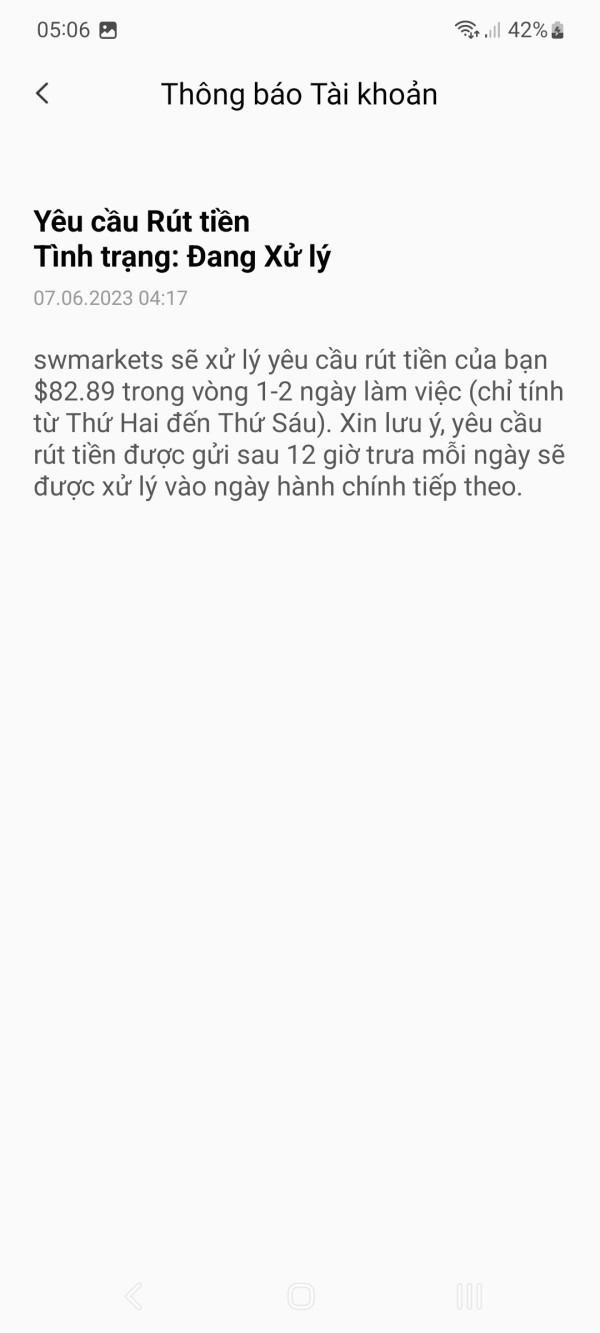

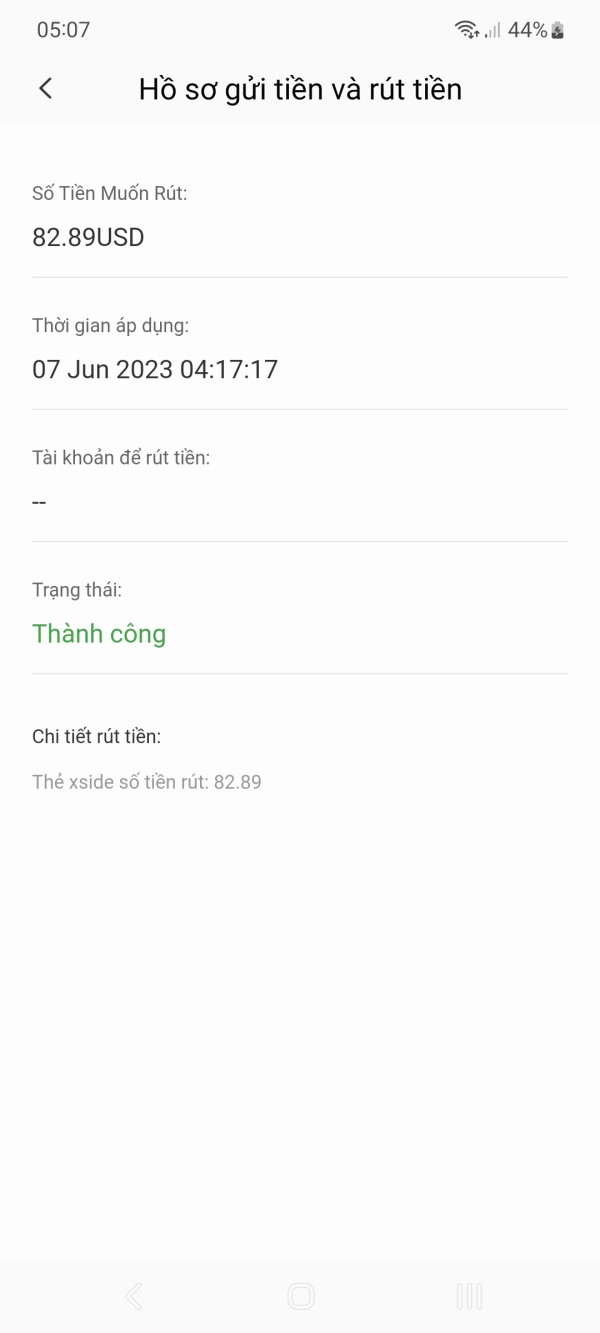

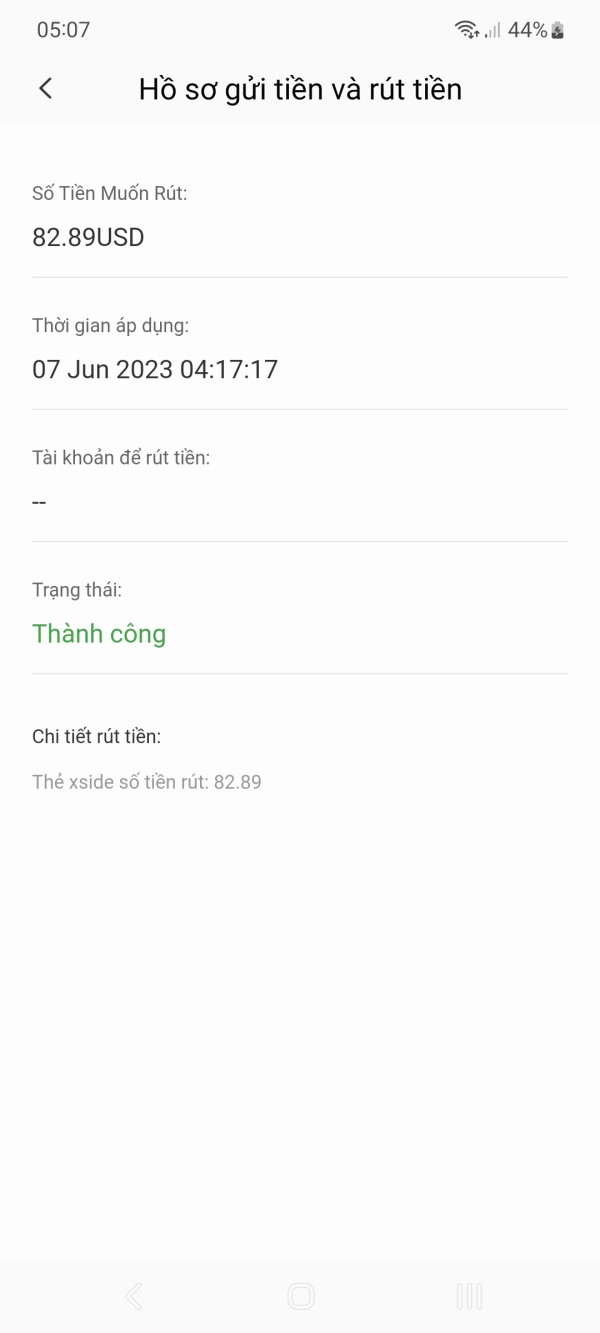

The onboarding process with SW Markets is automated and reported to be relatively smooth; however, traders have shared mixed experiences executing trades. Users have documented incident reports where withdrawal requests faced excessive delays, leading to frustration.

"Once I made a profit and wanted to withdraw it, I never received my funds. The support was unresponsive." – User feedback.

Such sentiments reflect an overarching concern about the overall user experience, which remains inconsistent across varied accounts.

Customer Support Analysis

The importance of reliable support.

The customer support framework at SW Markets has received significant criticism. Multiple reports suggest that users endure long waiting times when trying to resolve issues, with some facing a complete lack of response.

"I tried contacting support multiple times, but no one ever got back to me. Its like they disappear once they get your money." – User experience.

This critique emphasizes the critical need for responsive customer service, which is currently lacking.

Account Conditions Analysis

Understanding the conditions.

SW Markets presents multiple account types, each with specific conditions and high minimum deposit levels, starting at $5000. This creates barriers for new traders seeking entry. Feedback suggests that the terms of account conditions are often unclear, creating potential issues down the line regarding withdrawals and fund accessibility.

"I was shocked by how much I'd need to deposit just to get started. They dont make it clear upfront." – User complaint.

An assessment indicates that while account diversity exists, the prerequisites may hinder potential traders from joining.

Conclusion

SW Markets embodies a low-cost trading option but is ultimately marred by considerable risks inherent in its regulatory landscape and customer experience. Self-verified accounts reveal a profound lack of trust, exacerbated by user testimonials that caution against fund safety. For the experienced trader willing to accept risks, SW Markets may seem attractive, but its combination of negative feedback, withdrawal complications, and poor customer support places it in a precarious position for potential investors. Overall, engaging with SW Markets requires a vigilant approach and substantial risk management understanding.