Regarding the legitimacy of Royal forex brokers, it provides ASIC, CYSEC and WikiBit, (also has a graphic survey regarding security).

Is Royal safe?

Pros

Cons

Is Royal markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Market Making (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Market Making (MM)

Licensed Entity:

Royal Financial Trading Pty Ltd

Effective Date: Change Record

2012-06-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 15 60 MARGARET ST SYDNEY NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Royal Financial Trading (Cy) Ltd

Effective Date:

2016-08-10Email Address of Licensed Institution:

Compliance@oneroyal.com.cySharing Status:

No SharingWebsite of Licensed Institution:

www.oneroyal.euExpiration Time:

--Address of Licensed Institution:

152 Fragklinou Rousvelt, 3045 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 080 880Licensed Institution Certified Documents:

Is Royal A Scam?

Introduction

Royal, a forex broker operating under the name Royal Financial Trading, has made a notable entry into the foreign exchange market by offering a range of trading services. With its headquarters in Australia and various international branches, Royal positions itself as a global player in the trading industry. However, as with any investment platform, it is crucial for traders to approach it with caution and diligence. The forex market is rife with potential scams and unreliable brokers, making it essential for traders to thoroughly evaluate the legitimacy and reliability of any trading platform before committing their funds.

This article aims to provide a comprehensive analysis of Royal, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment. The evaluation is based on a combination of independent reviews, regulatory data, and user feedback to ensure a balanced perspective on whether Royal is safe or potentially a scam.

Regulation and Legitimacy

One of the foremost factors that determine the trustworthiness of any broker is its regulatory status. Royal claims to be regulated by several authorities, which is a positive sign for potential investors. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and providing a mechanism for recourse in cases of disputes.

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 420268 | Australia | Verified |

| CySEC | 312/16 | Cyprus | Verified |

| VFSC | 700284 | Vanuatu | Verified |

| CMA | N/A | Lebanon | Unverified |

| FSA | N/A | St. Vincent | Unverified |

Royal is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), both of which are considered top-tier regulators. This oversight indicates that Royal is subject to stringent rules designed to protect clients' funds and ensure fair trading practices. However, some claims regarding other regulatory bodies, like the Central Bank of Lebanon and the Financial Services Authority of St. Vincent, remain unverified, raising questions about the completeness of their regulatory claims.

The quality of regulation is paramount; brokers regulated by ASIC and CySEC are required to maintain segregated accounts for client funds, ensuring that traders' money is protected from the broker's operational funds. Additionally, these regulators conduct regular audits and impose penalties for non-compliance, which further reduces the likelihood of fraudulent activities. In this context, Royal's regulatory status suggests that it is relatively safe; however, the unverified claims with other regulators warrant caution.

Company Background Investigation

Royal Financial Trading was established in 2006, positioning itself as a reliable broker in the forex market. The company claims to have a transparent ownership structure; however, details about its management team and operational history are somewhat opaque. The lack of publicly available information on the management's qualifications raises concerns about the company's transparency and accountability.

The ownership of Royal is linked to the Goldman Global Group, which operates various subsidiaries across different jurisdictions. While this affiliation may lend some credibility, the absence of detailed disclosures about the management team limits the ability to assess their expertise and experience in the financial sector. Transparency is critical in the financial industry, and potential clients should be wary of brokers that do not provide sufficient information about their leadership.

Furthermore, the company's history does not indicate any significant scandals or controversies, which is a positive sign. However, the lack of detailed information about its operational practices and management may lead to uncertainty among prospective traders. Overall, while Royal appears to have a solid foundation, the need for greater transparency and detailed disclosures cannot be overlooked.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its legitimacy. Royal provides a variety of trading options, including forex, commodities, and cryptocurrencies. However, the overall fee structure and potential hidden costs are essential to consider.

Royal's fee structure includes spreads, commissions, and overnight interest rates. The following table summarizes the core trading costs:

| Fee Type | Royal | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.4 pips | 1.0 pips |

| Commission Model | $5 per trade | $3 per trade |

| Overnight Interest Range | 2% - 4% | 1% - 2% |

While Royal's spreads on major currency pairs are slightly above the industry average, the commission model is also higher than what many competitors offer. This discrepancy may indicate that traders could incur higher costs when trading with Royal compared to other brokers. Additionally, the overnight interest rates are considerably higher than the industry norm, which could significantly impact long-term trading strategies.

Moreover, the high minimum deposit requirement of $250 may deter novice traders or those looking to test the platform before committing larger amounts. Such practices are often associated with less reputable brokers, raising questions about Royal's overall trading conditions. It is essential for potential clients to weigh these factors carefully when deciding whether to engage with Royal.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Royal claims to implement various measures to ensure the security of client deposits. The broker states that it utilizes segregated accounts for client funds, which is a standard practice among regulated brokers. This separation ensures that client funds are not mixed with the broker's operational funds, providing a layer of protection in the event of financial difficulties.

Additionally, Royal offers negative balance protection, which safeguards clients from losing more than their deposited amount. This feature is particularly important in the volatile forex market, where rapid price movements can lead to significant losses.

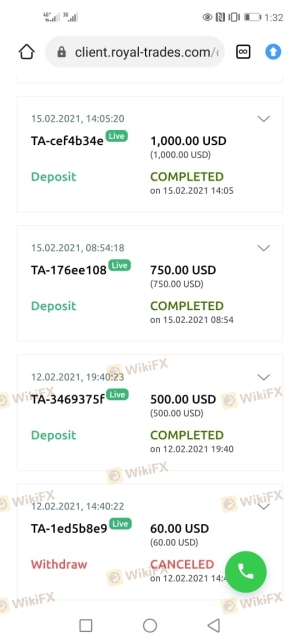

However, it is crucial to note that while Royal claims to have these safety measures in place, there have been reports of clients experiencing difficulties in withdrawing their funds. Some users have reported delays in processing withdrawal requests, raising concerns about the broker's operational integrity. The historical context of any fund security issues should be carefully considered by potential clients, as it can provide insight into the broker's reliability.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the reputation of a broker. Reviews of Royal reveal a mixed bag of experiences. While some users report satisfactory trading experiences, others have voiced significant concerns regarding customer service and withdrawal processes.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| High Fees | Medium | Acknowledged |

Common complaints include delays in fund withdrawals, poor customer support responsiveness, and a lack of transparency regarding fees. For instance, one user reported waiting weeks for a withdrawal to be processed, only to receive vague responses from customer support. Such experiences can deter potential clients and raise red flags regarding the broker's operational practices.

A notable case involved a trader who attempted to withdraw funds after a series of profitable trades. Despite multiple requests, the withdrawal was delayed for over a month, leading to frustration and distrust in Royal's services. This incident highlights the importance of considering customer experiences when evaluating a broker's reliability.

Platform and Trade Execution

The performance of a trading platform is critical for traders, as it directly impacts their trading experience. Royal offers a proprietary trading platform, which some users have reported as being user-friendly. However, there are concerns regarding the platform's stability and execution quality.

Many traders have experienced issues with order execution, including slippage and rejected orders. Such problems can be detrimental to trading strategies, particularly for those employing high-frequency trading techniques. Additionally, the absence of widely recognized platforms like MetaTrader 4 or 5 may limit traders' ability to utilize advanced trading tools and features.

Overall, while Royal's platform may cater to some traders, the reported issues with execution quality and stability raise concerns about the broker's reliability. Traders should carefully consider these factors when deciding whether to engage with Royal.

Risk Assessment

When evaluating the overall risk associated with trading with Royal, several factors must be considered. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Mixed regulatory verification status |

| Fund Safety | High | Reports of withdrawal difficulties |

| Trading Costs | Medium | Higher fees compared to industry norms |

| Customer Support | High | Inconsistent response times |

The combination of mixed regulatory verification, reports of fund withdrawal issues, and higher trading costs presents a moderate to high risk for potential traders. It is advisable for traders to approach Royal with caution and consider these risks before committing their funds.

Conclusion and Recommendations

In conclusion, while Royal presents itself as a legitimate forex broker with regulatory oversight, several factors raise concerns about its overall safety and reliability. The mixed customer feedback, reports of withdrawal issues, and higher-than-average trading costs suggest that potential clients should exercise caution when considering this broker.

For traders seeking a reliable platform, it may be prudent to explore alternatives with stronger regulatory backing and better customer experiences. Brokers regulated by top-tier authorities like the FCA or ASIC, with a proven track record of customer satisfaction and transparent practices, are generally safer options.

In summary, while Royal is regulated by ASIC and CySEC, the mixed reviews and potential issues with fund withdrawals indicate that it may not be the safest choice for all traders. It is essential to conduct thorough research and consider personal trading needs before making a decision.

Is Royal a scam, or is it legit?

The latest exposure and evaluation content of Royal brokers.

Royal Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Royal latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.