Klips Review 2025: Everything You Need to Know

Executive Summary

Klips is a regulated online CFD broker. It has built a solid reputation in the derivatives trading industry since it started in 2017. According to TradingBrokers.com, this Cyprus-based brokerage offers complete trading services across multiple asset classes including forex, stocks, commodities, indices, and ETFs. This complete klips review shows that the broker follows regulatory rules under the Cyprus Securities and Exchange Commission CySEC with license number 434/23, giving traders important regulatory protections.

The platform has received positive feedback from its users. It achieved an average rating of 4 out of 5 based on 31 user reviews, which shows above-average client satisfaction levels. Klips does especially well in customer service delivery, with users always highlighting the quality and responsiveness of support staff as a key difference. The broker's commitment to keeping high service standards has helped significantly in its growing reputation within the competitive CFD trading landscape.

The platform mainly targets investors seeking exposure to diverse trading opportunities across forex markets, equity derivatives, and commodity trading. With its headquarters located in Limassol, Cyprus, Klips uses the strong European regulatory framework to serve international clients while keeping strict compliance standards that ensure trading security and transparency.

Important Disclaimer

Traders should know that regulatory requirements and available services may vary greatly across different jurisdictions. The specific terms, conditions, and available features for Klips may differ depending on your country of residence and local regulatory requirements. According to available information, while Klips operates under CySEC regulation, potential clients should verify the applicable legal and tax implications in their respective regions before opening trading accounts.

This evaluation is based on complete analysis of available user feedback, regulatory documentation, and publicly available company information. The assessment method uses multiple data sources to provide an objective overview of Klips' services, though individual trading experiences may vary based on personal trading strategies, market conditions, and specific account configurations.

Rating Framework

Broker Overview

Klips started in the online trading sector in 2017. It established its operational headquarters in Limassol, Cyprus, a jurisdiction known for its strong financial services regulatory framework. According to TradingBrokers.com, the company has focused only on providing CFD trading services across multiple asset categories, positioning itself as a specialized derivatives broker rather than a full-service financial institution. The broker's business model centers on offering leveraged trading opportunities while keeping strict adherence to European regulatory standards.

The company's strategic location in Cyprus provides access to the broader European market while benefiting from CySEC's complete regulatory oversight. This positioning has enabled Klips to develop a focused approach to CFD trading, concentrating resources on platform development, customer service excellence, and regulatory compliance rather than diversifying into traditional banking or investment services.

Klips offers trading access across five primary asset categories: foreign exchange pairs, individual stock CFDs, commodity derivatives, major global indices, and exchange-traded fund derivatives. The broker operates under the regulatory authority of the Cyprus Securities and Exchange Commission, holding license number 434/23, which provides clients with investor protection schemes and regulatory recourse mechanisms standard within the European regulatory framework. This complete klips review shows that the broker has kept consistent regulatory compliance since its establishment.

Regulatory Jurisdiction: Klips operates under the supervision of the Cyprus Securities and Exchange Commission CySEC. This provides complete oversight of the broker's operations, client fund protection, and business practices. This regulatory framework ensures adherence to European MiFID II requirements and provides clients with access to investor compensation schemes.

Deposit and Withdrawal Methods: Specific information regarding available payment methods, processing times, and associated fees for deposits and withdrawals was not detailed in the available source materials. Potential clients should contact the broker directly for complete payment processing information.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in the available documentation. This information typically varies based on account tier and client jurisdiction.

Promotional Offers: Current bonus structures, promotional campaigns, or special offers were not detailed in the source materials reviewed for this analysis.

Tradeable Assets: The platform provides access to foreign exchange pairs, individual equity CFDs, commodity derivatives including precious metals and energy products, major international indices, and exchange-traded fund derivatives. This diverse asset selection enables portfolio diversification across multiple market sectors.

Cost Structure: Detailed information regarding spreads, commission structures, overnight financing rates, and other trading costs was not completely covered in the available materials. This klips review notes that cost transparency is essential for informed trading decisions.

Leverage Ratios: Specific leverage offerings across different asset classes were not detailed in the source documentation.

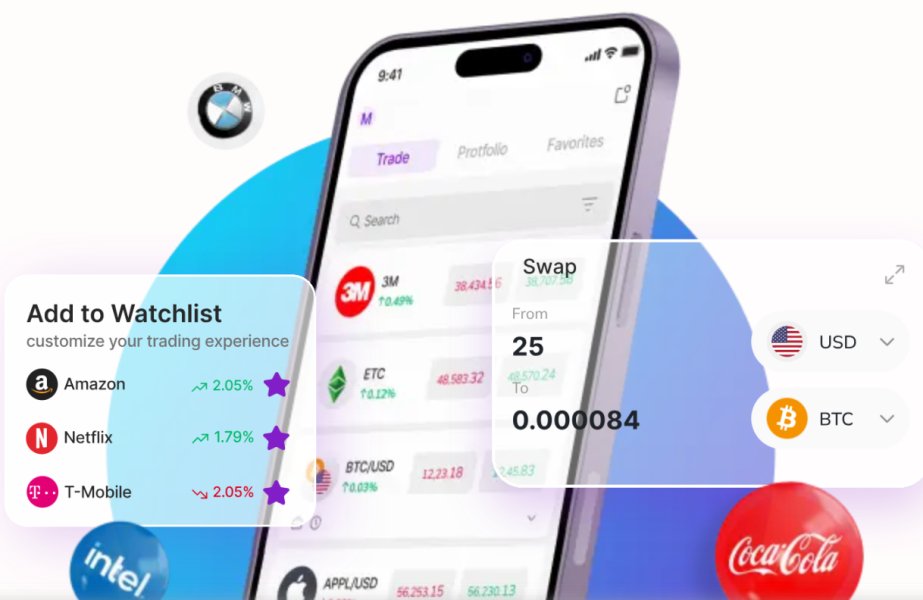

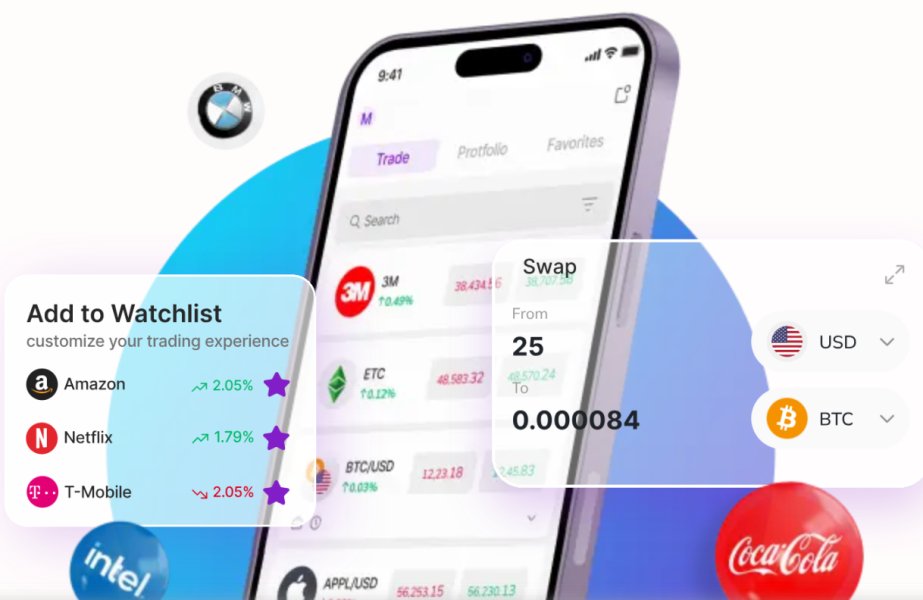

Platform Options: Information regarding available trading platforms, mobile applications, and web-based trading interfaces was not completely provided in the reviewed materials.

Geographic Restrictions: Specific country restrictions or regional limitations were not detailed in the available sources.

Customer Support Languages: The range of languages supported by customer service representatives was not specified in the reviewed documentation.

Detailed Rating Analysis

Account Conditions Analysis

The specific account structures, tier classifications, and associated benefits offered by Klips were not completely detailed in the available source materials. Traditional CFD brokers typically offer multiple account types designed to accommodate different trading volumes, experience levels, and capital requirements, though the exact configurations for Klips remain unspecified in current documentation.

Minimum deposit requirements, which greatly impact accessibility for new traders, were not clearly outlined in the reviewed materials. This information gap prevents a complete assessment of the broker's positioning within the competitive landscape regarding entry barriers for potential clients.

Account opening procedures, required documentation, and verification timeframes were similarly not detailed in available sources. These factors typically influence the initial client experience and can impact trader acquisition rates, particularly in competitive markets where streamlined onboarding processes provide significant advantages.

Special account features such as Islamic-compliant trading accounts, professional trader classifications, or institutional account structures were not mentioned in the source materials. This complete klips review notes that such specialized offerings often differentiate brokers within specific market segments and geographic regions.

Complete information regarding trading tools, analytical resources, and educational materials was not provided in the available source documentation. Modern CFD platforms typically integrate advanced charting capabilities, technical analysis tools, economic calendars, and market research resources, though specific offerings from Klips remain unspecified.

Research and analysis resources, including market commentary, daily analysis reports, and educational webinars, were not detailed in the reviewed materials. These resources often greatly impact trader success rates and platform stickiness, particularly for less experienced market participants.

Educational content availability, including trading guides, video tutorials, and complete learning modules, was not covered in the source materials. Educational resources typically serve as important differentiators for brokers targeting novice and intermediate traders seeking skill development opportunities.

Automated trading support, including expert advisor compatibility, algorithmic trading capabilities, and third-party integration options, was not specified in available documentation. These features increasingly influence platform selection among technically sophisticated traders seeking to implement systematic trading strategies.

Customer Service and Support Analysis

Customer service emerges as a standout feature in user feedback. Multiple reviews highlight the exceptional quality and responsiveness of support staff. According to user testimonials, the support team shows complete knowledge of platform features and maintains professional standards that exceed typical industry expectations.

Response times appear to be consistently rapid. Users report prompt resolution of inquiries and technical issues. This efficiency in customer support delivery has contributed greatly to the overall positive user experience and has been instrumental in building client loyalty and satisfaction.

Service quality extends beyond basic problem resolution. Users note that support representatives provide detailed explanations and proactive assistance that enhances their trading experience. The support team's ability to handle complex technical queries and account-related issues has been particularly appreciated by the user community.

While specific information regarding available support channels, multilingual capabilities, and operating hours was not detailed in source materials, the consistently positive user feedback suggests that Klips has invested greatly in developing a robust customer service infrastructure that effectively serves its international client base.

Trading Experience Analysis

Detailed information regarding platform stability, execution speeds, and overall trading environment performance was not completely covered in the available source materials. These technical aspects typically form the foundation of trader satisfaction and greatly impact trading outcomes, particularly for active traders and scalping strategies.

Order execution quality, including fill rates, slippage characteristics, and requote frequency, was not specifically detailed in the reviewed documentation. These factors critically influence trading costs and strategy effectiveness, particularly during high-volatility market conditions.

Platform functionality, user interface design, and feature completeness were not thoroughly described in available sources. Modern trading platforms typically integrate advanced order types, risk management tools, and customizable interfaces that adapt to individual trader preferences and strategies.

Mobile trading capabilities, cross-device synchronization, and offline functionality were not detailed in the source materials. Mobile trading has become increasingly important as traders seek flexibility and real-time market access regardless of location. This klips review notes that complete mobile solutions often differentiate modern brokers in competitive markets.

Trust and Reliability Analysis

Regulatory compliance represents a fundamental strength for Klips. The broker operates under CySEC license number 434/23. This regulatory framework provides essential client protections including segregated fund storage, investor compensation scheme access, and standardized business practice requirements that align with European regulatory standards.

Fund security measures, while not detailed specifically in available materials, benefit from the robust CySEC regulatory framework that mandates client fund segregation and provides oversight of broker financial stability. These protections offer clients recourse mechanisms and compensation schemes in unlikely scenarios of broker insolvency.

Company transparency regarding ownership structure, financial statements, and operational procedures was not completely detailed in reviewed sources. Transparency often influences client confidence and provides insight into broker stability and long-term viability.

Industry reputation appears positive based on available feedback. Users express confidence in the broker's reliability and business practices. The absence of significant negative incidents or regulatory actions in available documentation suggests consistent compliance and operational stability.

User Experience Analysis

Overall user satisfaction shows strong positive trends. The platform achieved an average rating of 4 out of 5 based on 31 user reviews. This rating suggests that the majority of clients experience satisfactory or excellent service levels across multiple interaction points with the broker.

Interface design and usability characteristics were not specifically detailed in available source materials, though positive user feedback suggests that the platform provides an intuitive and functional trading environment. User-friendly design typically correlates with higher adoption rates and reduced learning curves for new clients.

Registration and account verification processes were not completely described in reviewed documentation. Streamlined onboarding procedures often greatly impact initial user experience and can influence client acquisition rates in competitive markets.

Fund management experiences, including deposit processing, withdrawal efficiency, and account funding options, were not detailed in available sources. These operational aspects typically influence client satisfaction and platform stickiness, particularly for active traders requiring frequent fund movements.

Conclusion

Klips presents itself as a competent and reliable CFD broker with particular strengths in customer service delivery and regulatory compliance. The broker's CySEC regulation provides essential client protections while the consistently positive user feedback regarding support quality suggests a genuine commitment to client satisfaction and service excellence.

The platform appears well-suited for traders seeking exposure to diverse asset classes including forex, stocks, commodities, indices, and ETFs within a regulated environment. The strong customer service reputation makes it particularly appropriate for traders who value responsive support and professional assistance with platform-related inquiries.

However, this complete analysis reveals that detailed information regarding account conditions, trading costs, platform features, and specific service offerings requires further investigation directly with the broker. While the available information suggests a positive overall experience, potential clients should conduct thorough due diligence regarding specific terms and conditions that align with their individual trading requirements and objectives.