OQtima 2025 Review: Everything You Need to Know

Executive Summary

OQtima is a new forex broker that started in 2021. The trading community has mixed feelings about this platform. This oqtima review shows a broker that offers many different trading tools and platforms, but users have questions about how happy they are with the service and how clear the company is about its operations.

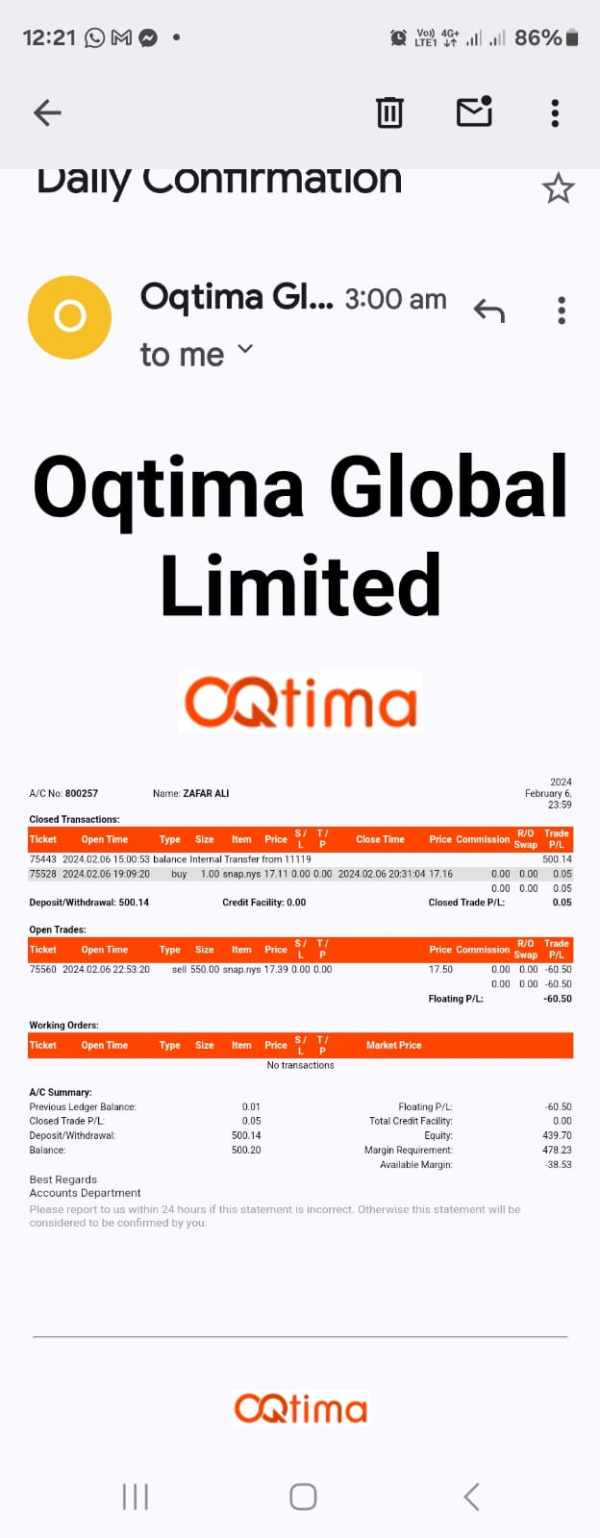

The broker has many different assets you can trade. It offers over 75 forex currency pairs, 45+ cryptocurrencies, 20 indices, 3 energy commodities, 91 stocks, 3 precious metals, and more than 100 ETFs. OQtima gives traders access to both MetaTrader 4 and cTrader platforms. They say this creates a stable and fast ECN+ trading environment.

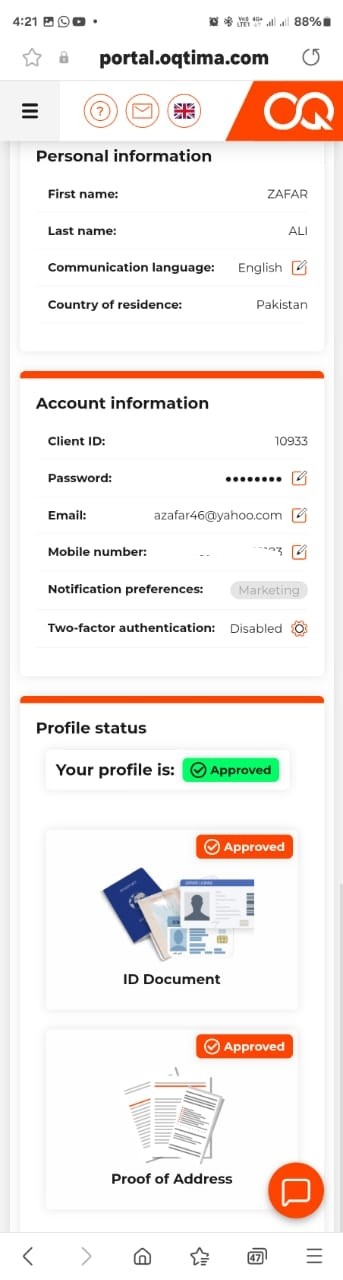

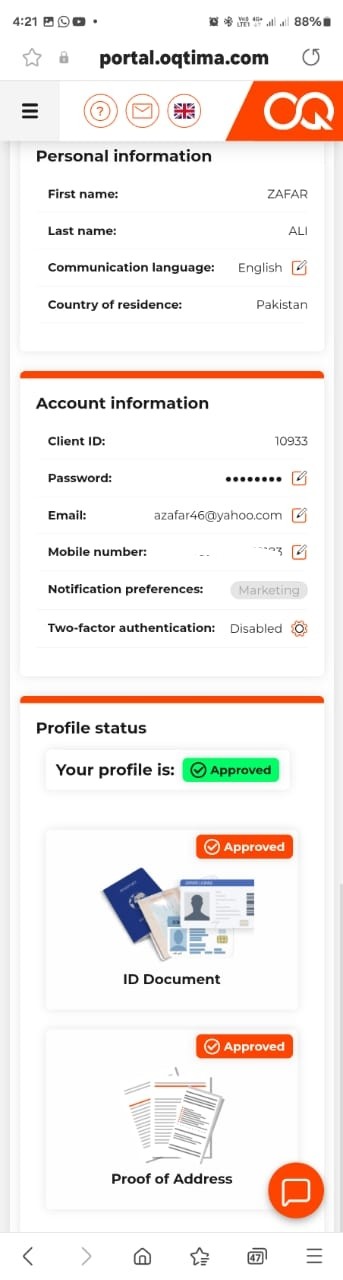

The Cyprus Securities and Exchange Commission (CySEC) regulates OQtima. The broker targets intermediate to advanced traders who want diverse assets and advanced trading tools. However, user feedback shows very different opinions, with trust scores around moderate levels (58 points according to available data) and more user complaints appearing on review websites.

People in the trading community debate whether the platform is legitimate. Some users report good experiences while others worry about different parts of how the company operates. This mixed response means traders should think carefully before choosing OQtima.

Important Notice

Regional Entity Differences: OQtima operates under different rules in different countries. Users should check the specific rules and requirements that apply to their region before using the platform. The rules may be very different between different areas, which affects how much protection and help traders can get.

Review Methodology: This evaluation looks at user feedback, how well the platform works, public regulatory information, and market intelligence. All information here reflects data available as of 2025 and should be considered alongside the most current regulatory filings and user experiences.

Rating Framework

Broker Overview

OQtima started in the competitive forex market in 2021. The company has its headquarters in Limassol, Cyprus. The company operates under CDE Global Markets Ltd and says it is a CFD broker committed to delivering quality services to traders around the world. Even though it is new to the market, OQtima has tried to stand out by offering many different assets and advanced trading technology.

The broker's business model focuses on providing Contract for Difference (CFD) trading across multiple asset classes. It targets traders who want exposure to different markets through one platform. According to tradingfinder.com, OQtima has built its reputation on offering "impressive variety" in its trading instruments, though this wide range of offerings comes with ongoing discussions about how reliable the platform is and how satisfied users are.

OQtima's technology supports both MetaTrader 4 and cTrader platforms. This serves different trader preferences and experience levels. The platform offers over 77 forex pairs, which puts it in a competitive position in the currency trading space, while its cryptocurrency offering of 45+ digital assets shows the broker's attempt to capture the growing crypto trading market. The inclusion of 20 indices, energy commodities, precious metals, and over 100 ETFs also shows OQtima's commitment to providing a complete trading system.

The regulatory foundation of OQtima is based on Cyprus Securities and Exchange Commission (CySEC) oversight. This provides a European regulatory framework for its operations. This regulatory status offers certain protections and compliance standards, though how effective these protections are and how satisfied users are with them remain subjects of ongoing evaluation in the trading community.

Regulatory Coverage: OQtima operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC). This provides European Union-compliant trading services. This regulatory framework ensures adherence to MiFID II requirements and offers investor protection schemes typical of CySEC-regulated entities.

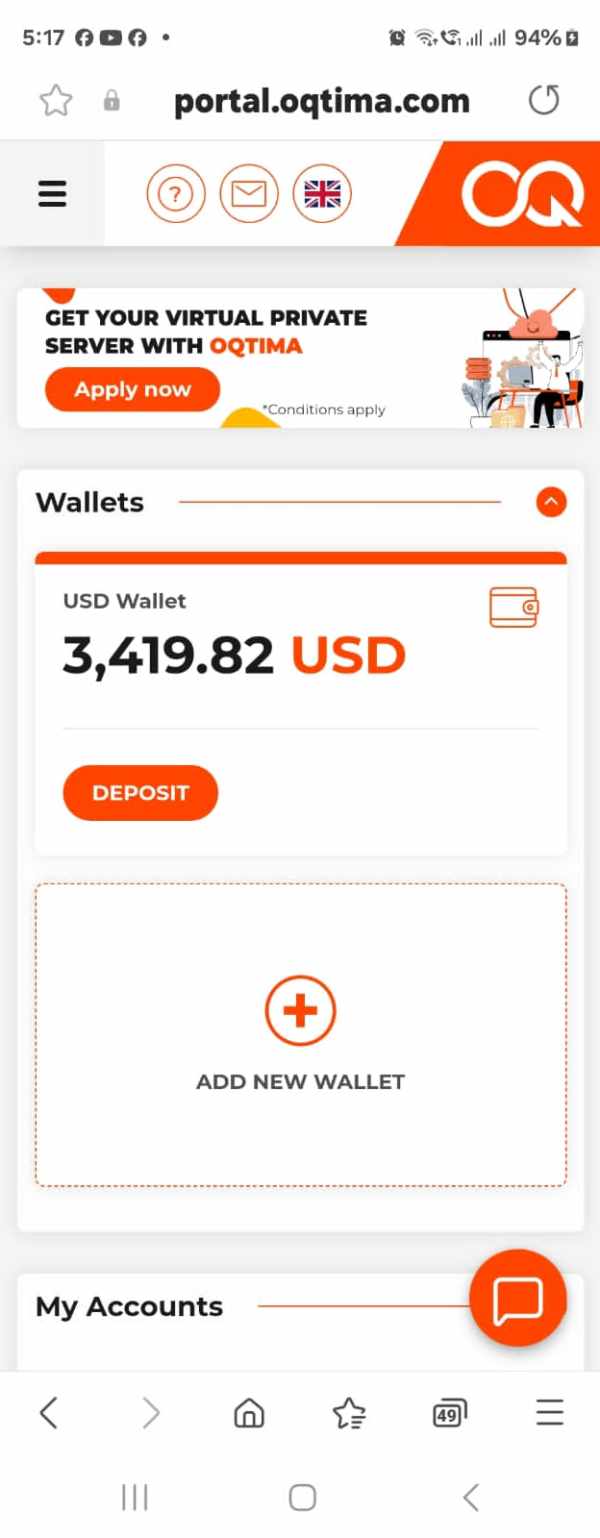

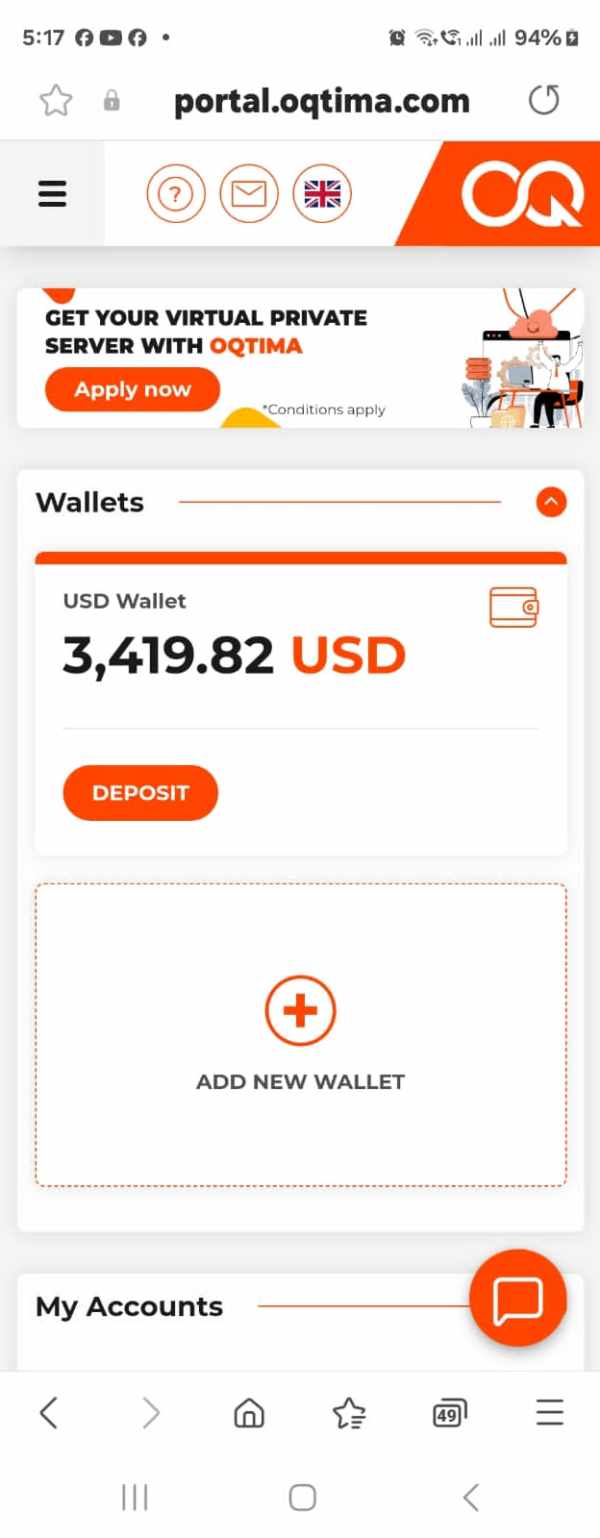

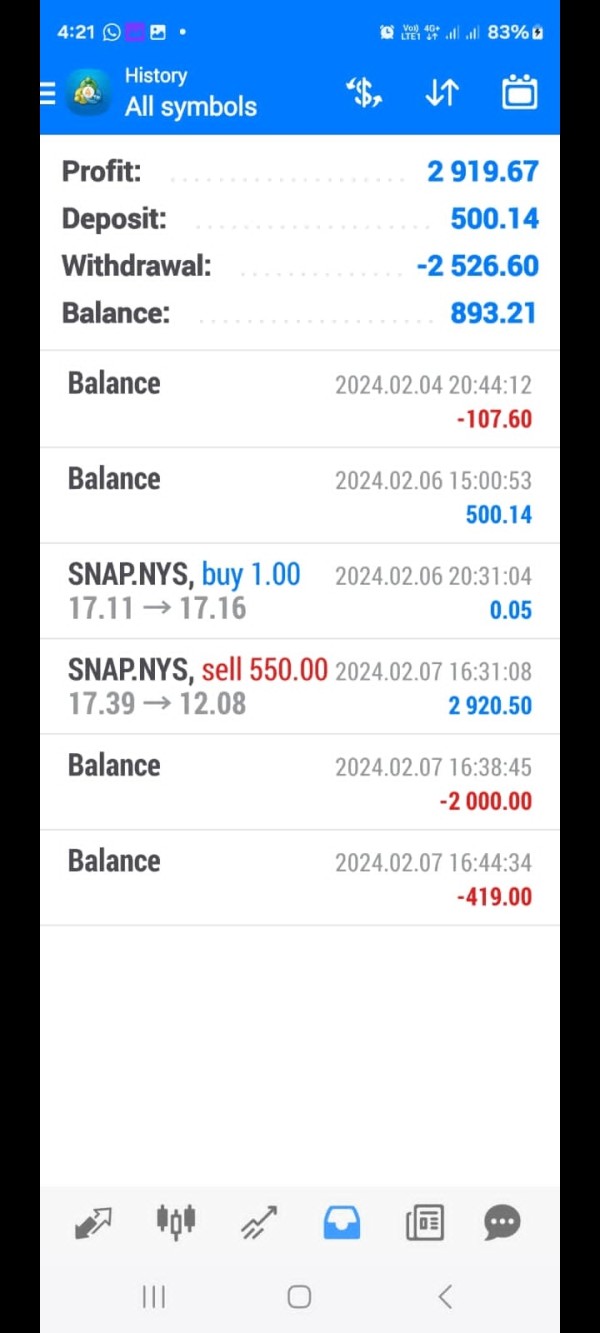

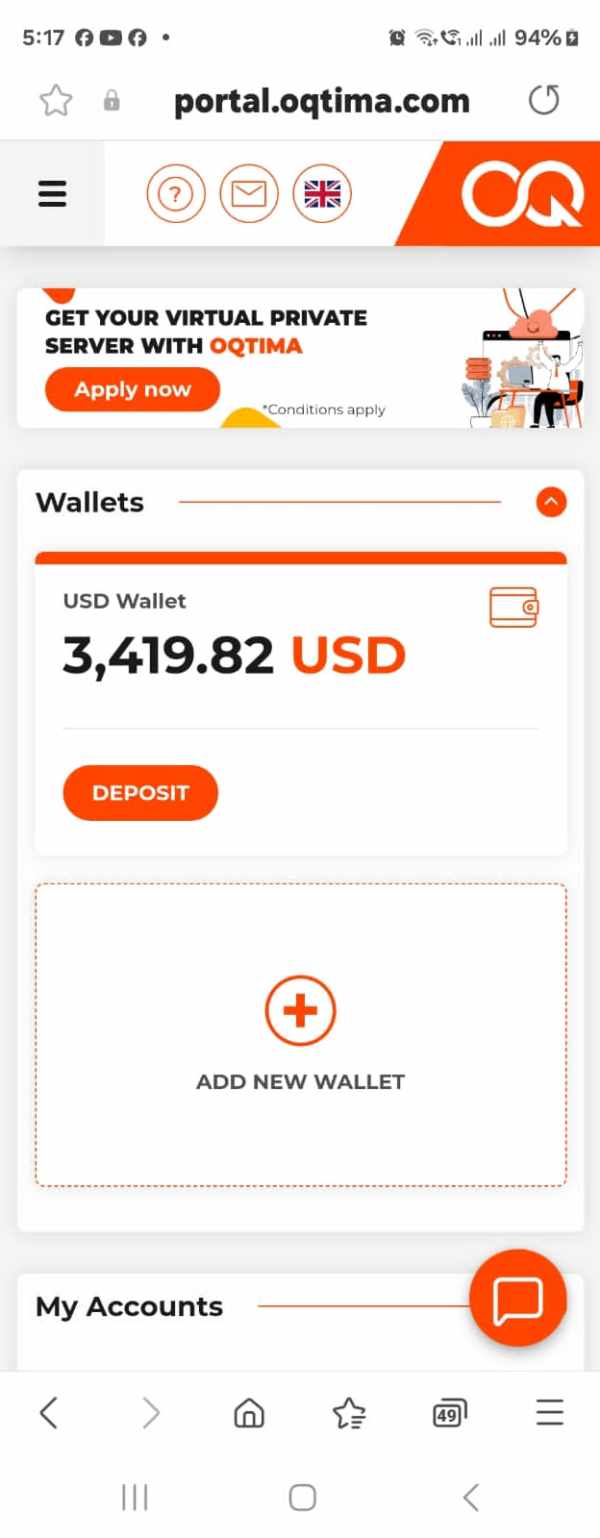

Deposit and Withdrawal Methods: The available resources do not detail specific information about deposit and withdrawal options. Potential clients need to contact the broker directly for complete payment method information.

Minimum Deposit Requirements: Public documentation does not specify exact minimum deposit amounts. This means potential clients need to contact OQtima directly for current account opening requirements.

Promotional Offers: Available materials do not detail current bonus and promotional structures. This suggests either limited promotional activities or the need for direct broker contact to understand available offers.

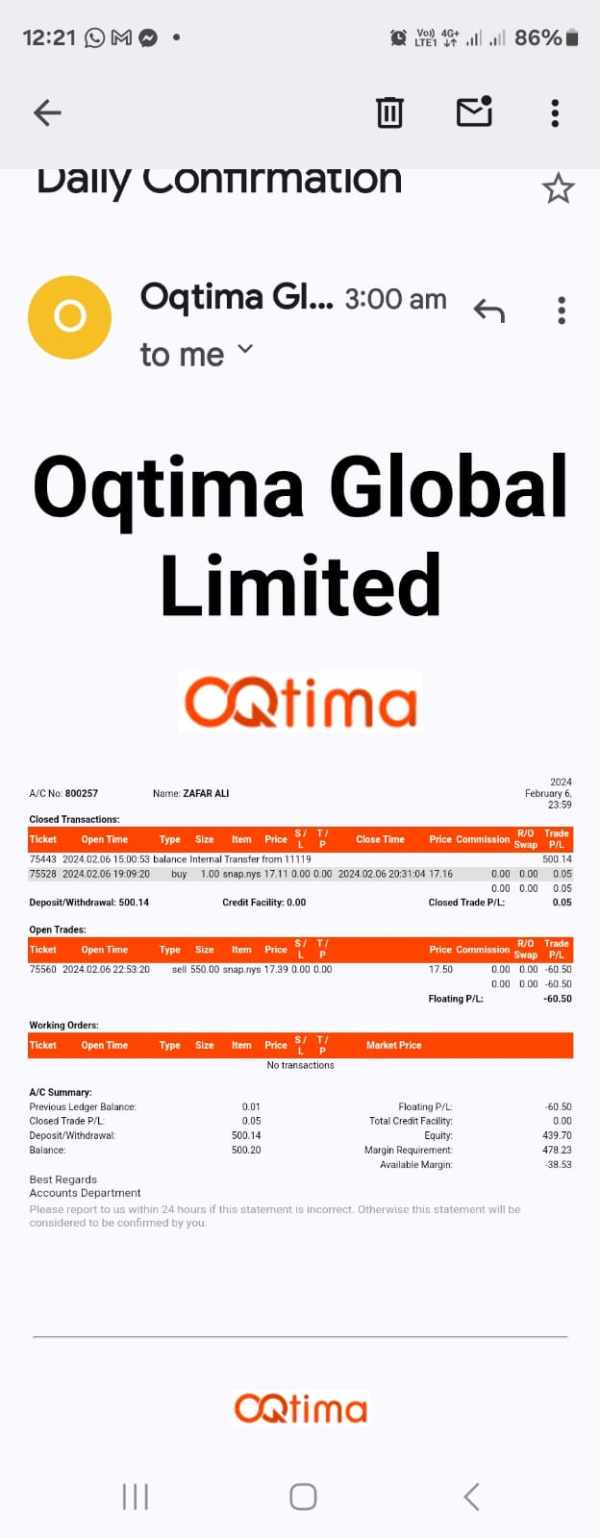

Tradeable Assets: OQtima provides access to many financial instruments including over 75 forex currency pairs, 45+ cryptocurrencies, 20 indices, 3 energy commodities, 91 individual stocks, 3 precious metals, and more than 100 ETFs. This offers significant diversification opportunities for traders.

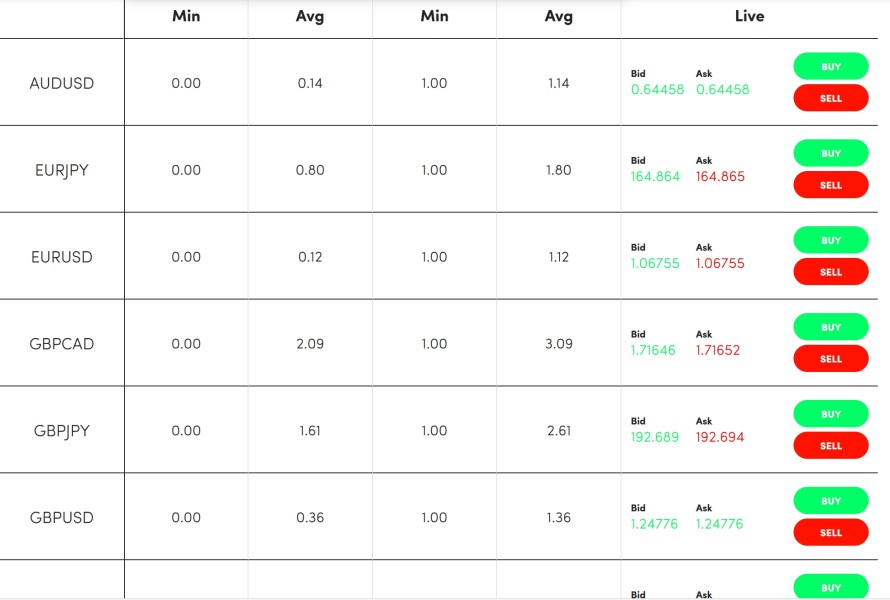

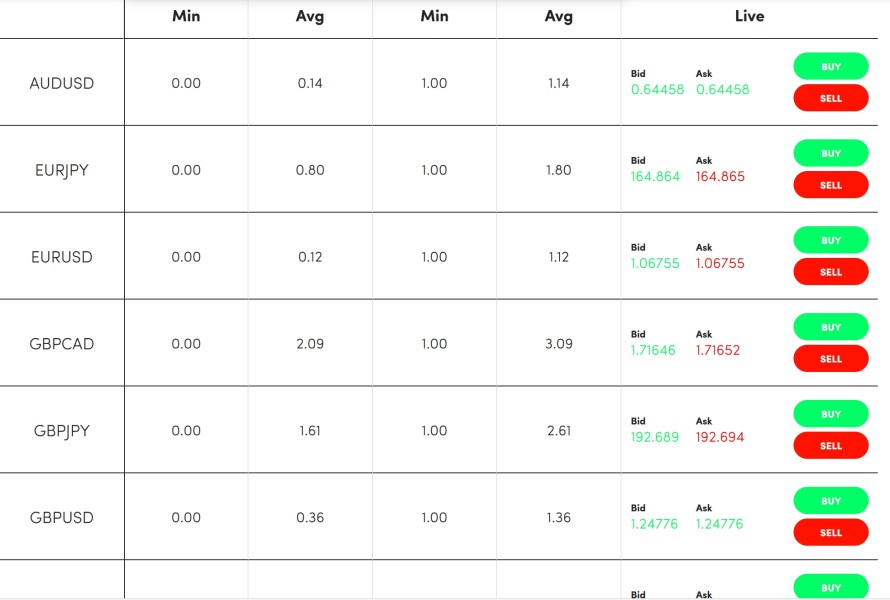

Cost Structure: Available sources do not comprehensively detail specific information about spreads, commissions, and fee structures. This requires direct verification with the broker for accurate pricing information.

Leverage Ratios: Available documentation does not explicitly mention leverage specifications. This makes direct inquiry necessary for current leverage offerings and their regulatory compliance across different asset classes.

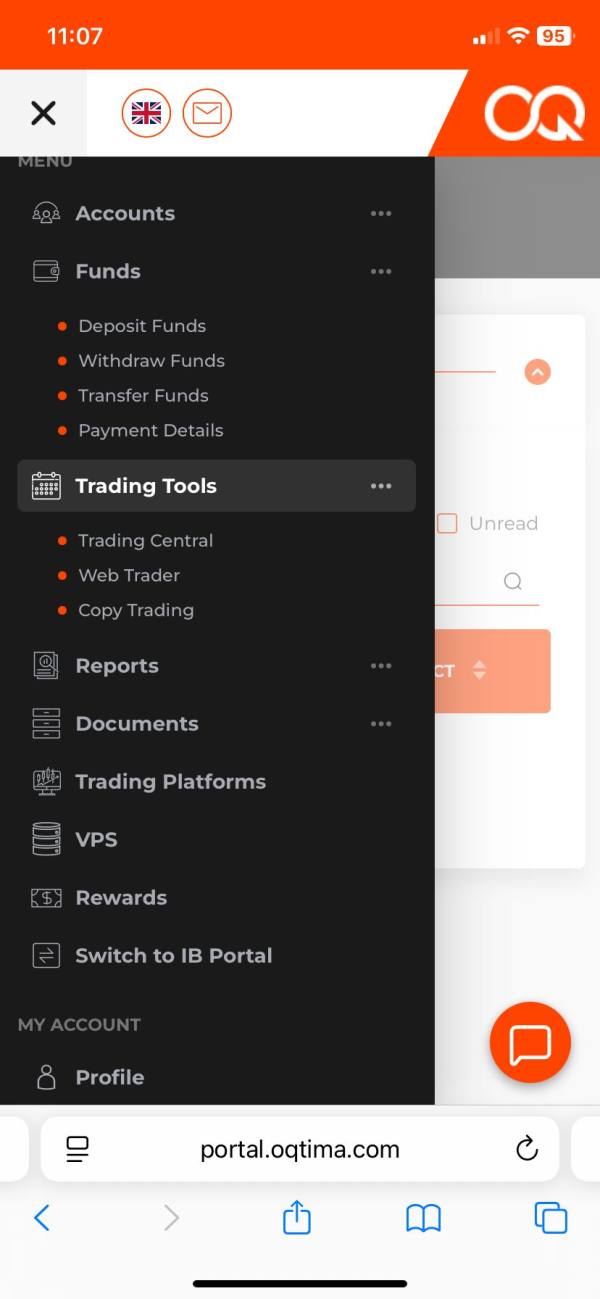

Platform Options: The broker supports both MetaTrader 4 and cTrader platforms. This provides traders with choice between the industry-standard MT4 environment and the more advanced cTrader interface, each serving different trading styles and preferences.

Geographic Restrictions: Available materials do not detail specific regional limitations and restricted territories. This requires verification based on individual geographic locations.

Customer Support Languages: Current documentation does not specify available customer service language options. This indicates the need for direct confirmation of multilingual support capabilities.

This oqtima review reveals several information gaps that potential traders should address through direct broker communication before making account opening decisions.

Detailed Rating Analysis

Account Conditions Analysis

Evaluating OQtima's account conditions presents big challenges because there is limited public information available. Many established brokers clearly show their account types, minimum deposit requirements, and specific terms, but OQtima's account structure remains mostly hidden in accessible documentation.

This lack of transparency about account opening procedures, minimum funding requirements, and account tier benefits creates uncertainty for potential traders. The absence of clear information about whether OQtima offers specialized accounts such as Islamic (swap-free) accounts, VIP tiers, or professional trader classifications makes the assessment process even more complicated.

Industry standards typically require brokers to clearly communicate account conditions. OQtima's limited disclosure is concerning. Potential clients must rely on direct broker contact to understand basic account parameters, which contrasts unfavorably with more transparent competitors.

The regulatory requirement under CySEC should mandate certain disclosure standards. However, the current availability of account-specific information suggests either inadequate marketing transparency or potential gaps in public communication strategies. This oqtima review identifies this as a significant area requiring improvement for user confidence and regulatory compliance clarity.

Without comprehensive account condition information, traders cannot effectively compare OQtima against competitors or make informed decisions about account suitability for their trading strategies and capital requirements.

OQtima shows strength in its platform and tool offerings. It provides access to both MetaTrader 4 and cTrader trading environments. MetaTrader 4 remains the industry standard, offering familiar functionality, extensive indicator libraries, and automated trading capabilities through Expert Advisors. The inclusion of cTrader provides more advanced features including Level II pricing, advanced charting tools, and sophisticated order management systems.

The diversity of tradeable instruments represents a significant resource advantage. There are over 75 forex pairs covering major, minor, and exotic currency combinations. The cryptocurrency offering of 45+ digital assets positions OQtima competitively in the growing crypto-CFD market, while the inclusion of traditional assets like indices, stocks, and commodities provides comprehensive market exposure.

However, available documentation lacks detail about additional analytical tools, market research resources, or educational materials. Many competitive brokers provide economic calendars, market analysis, trading signals, and educational content as standard resources. The absence of information about these supplementary tools suggests either limited offerings or inadequate communication of available resources.

The ECN+ trading environment mentioned by OQtima implies institutional-grade connectivity and potentially superior execution quality. However, specific performance metrics, server locations, or latency data are not publicly detailed. Advanced traders typically require detailed technical specifications to evaluate platform suitability for their strategies.

Customer Service and Support Analysis

Customer service evaluation for OQtima faces big limitations because there is not enough public information about support structures, response times, and service quality metrics. This lack of transparency about customer support capabilities raises concerns about the broker's commitment to client service excellence.

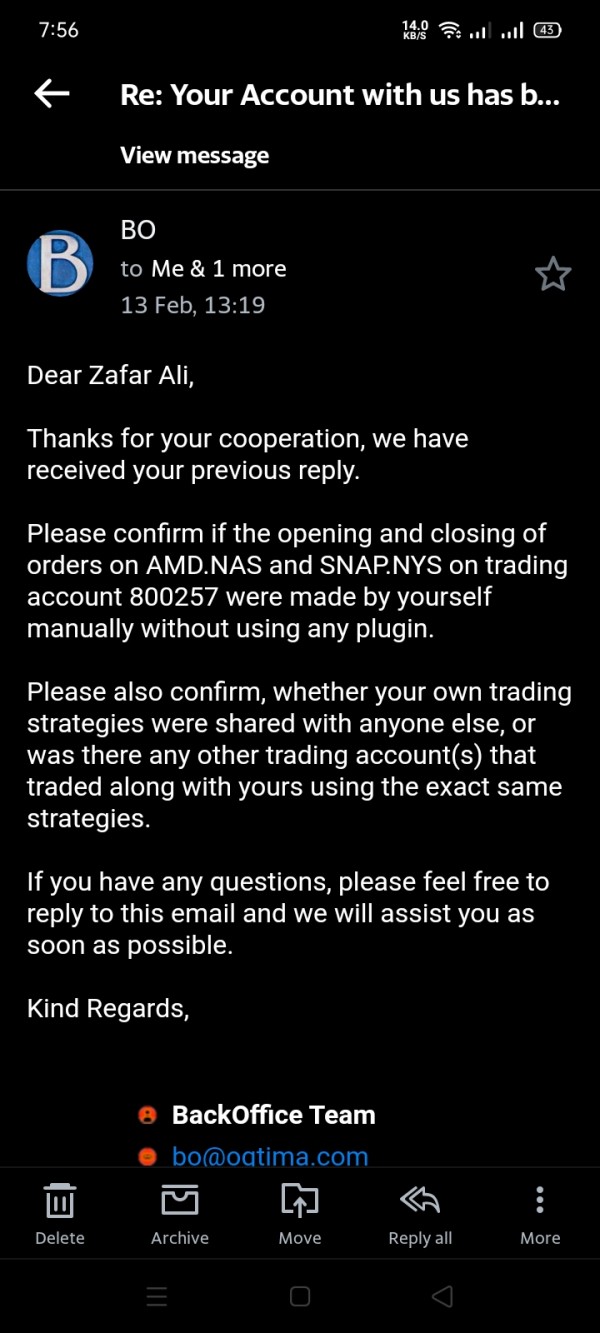

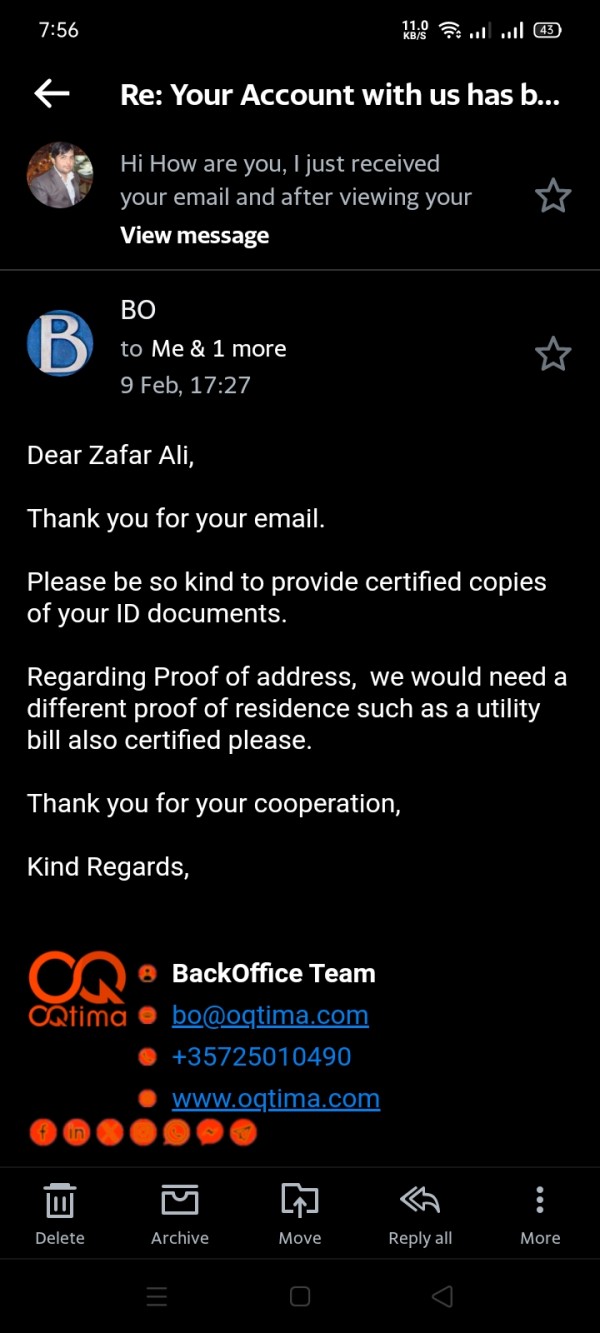

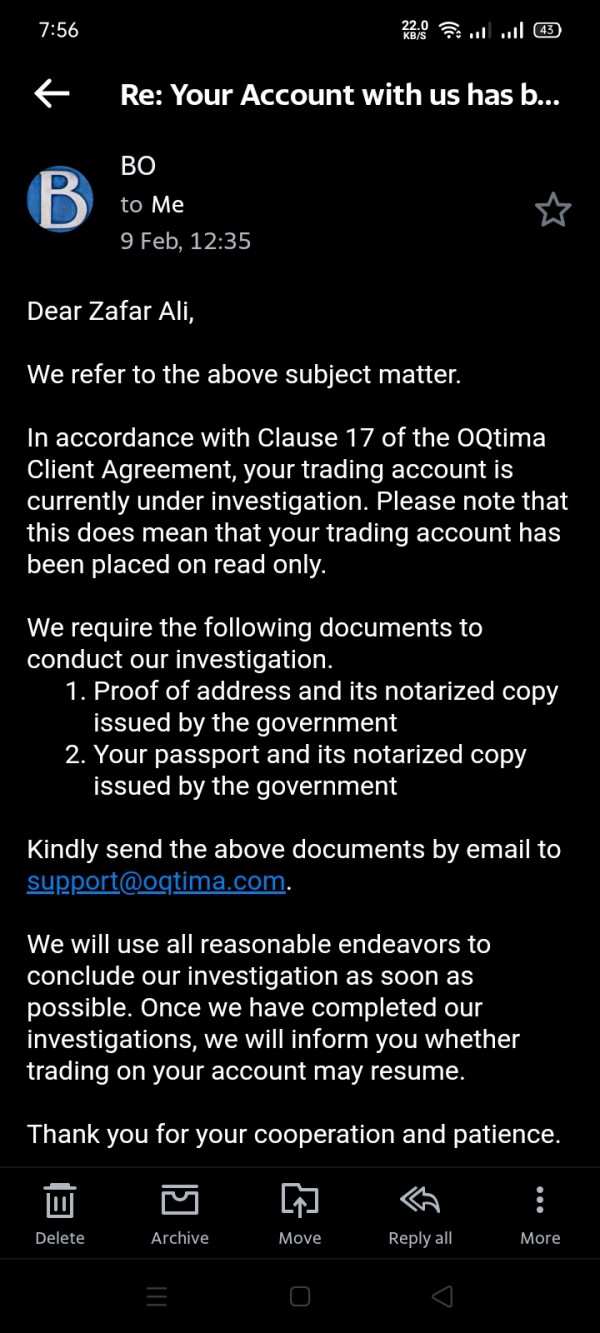

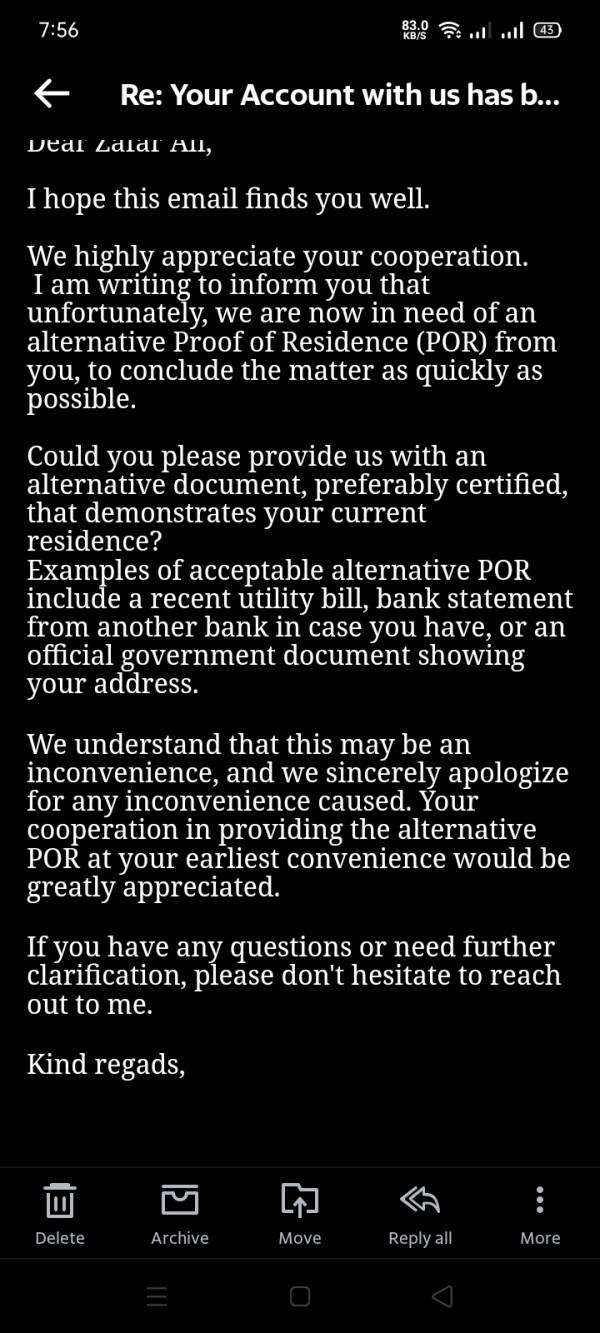

The growing number of user complaints mentioned in various reviews suggests potential service delivery challenges. However, without specific details about complaint categories, resolution timeframes, or broker responses, it becomes difficult to assess whether these issues represent systematic problems or isolated incidents.

Industry-standard customer support typically includes multiple communication channels (live chat, email, phone), extended operating hours, and multilingual capabilities. The absence of clear information about OQtima's support infrastructure makes it challenging for potential clients to understand available assistance levels.

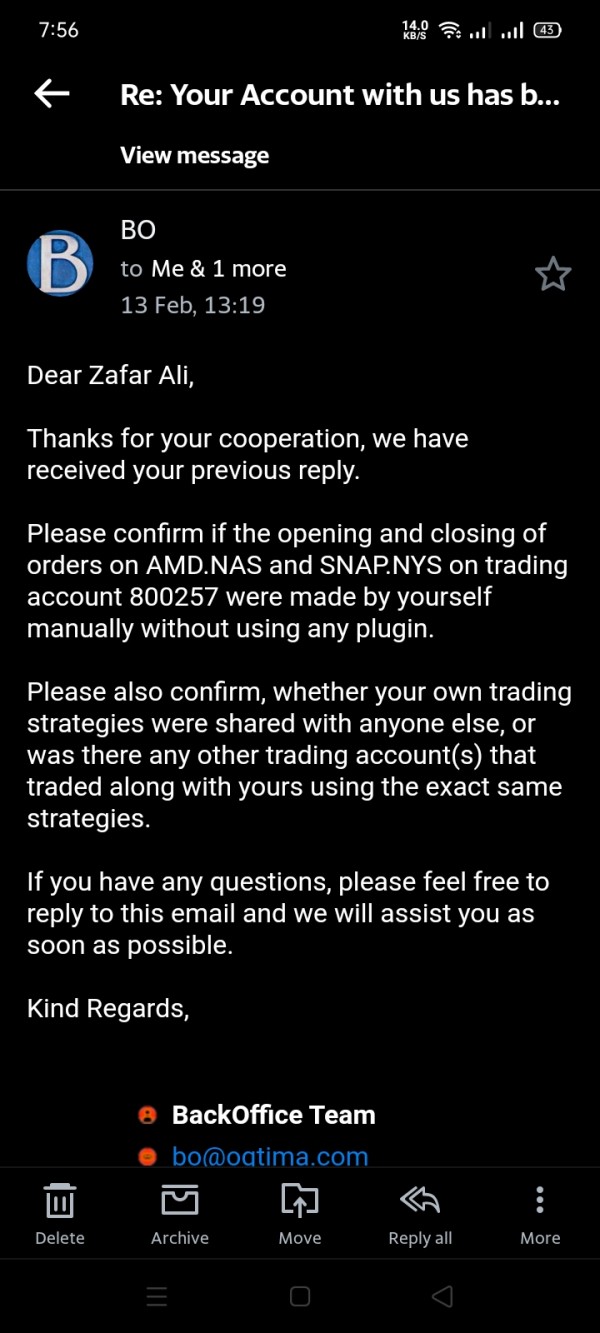

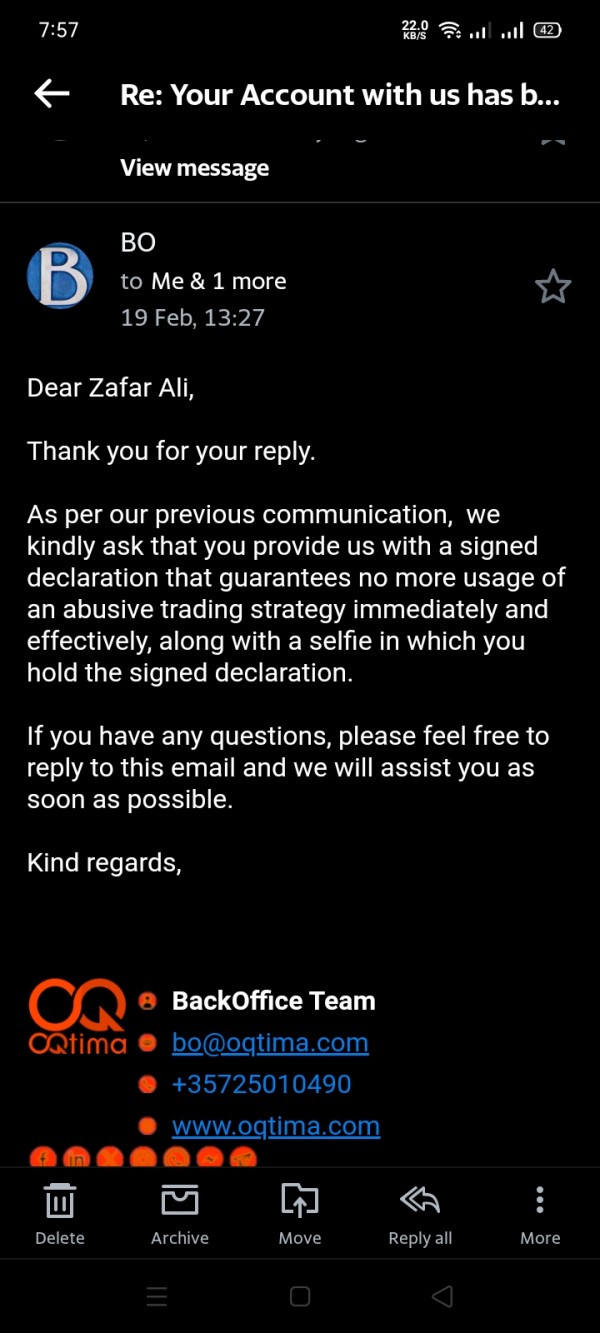

Regulatory requirements under CySEC mandate certain client communication and complaint handling procedures. The limited visibility of OQtima's compliance with these standards, combined with increasing user complaints, suggests potential gaps in service delivery or communication effectiveness.

Effective customer support becomes crucial during account issues, technical problems, or dispute resolution. The current information gap about OQtima's support capabilities represents a significant concern for traders considering the platform, particularly those requiring responsive assistance for time-sensitive trading activities.

Trading Experience Analysis

OQtima's trading experience evaluation centers on its claimed ECN+ environment and multi-platform support structure. The Electronic Communication Network (ECN) model typically provides direct market access with potentially tighter spreads and reduced conflicts of interest compared to market maker models. However, specific performance metrics supporting OQtima's ECN+ claims are not publicly detailed.

The availability of both MetaTrader 4 and cTrader platforms offers flexibility for different trading styles and experience levels. MT4's widespread adoption ensures familiarity for most traders, while cTrader's advanced features appeal to more sophisticated users requiring detailed market depth information and advanced order types.

Platform stability and execution speed represent critical factors in trading experience quality. While OQtima promotes a "stable and fast" environment, quantitative data supporting these claims, such as average execution speeds, server uptime statistics, or slippage metrics, are not publicly available for verification.

The extensive asset coverage potentially enhances trading experience by providing diversification opportunities within a single platform. However, the quality of pricing, liquidity depth, and execution consistency across different asset classes requires evaluation through actual trading experience rather than promotional materials.

This oqtima review identifies the need for more transparent performance reporting and user experience documentation to properly assess the platform's trading environment quality compared to industry benchmarks and competitor offerings.

Trust and Reliability Analysis

OQtima's trust and reliability assessment presents a complex picture combining regulatory oversight with concerning user feedback trends. The broker operates under CySEC regulation, which provides a foundational level of credibility through European Union financial services oversight and investor protection scheme participation.

CySEC regulation mandates segregated client funds, regular financial reporting, and compliance with MiFID II requirements. These regulatory protections offer baseline security measures, though their effectiveness depends on consistent implementation and regulatory monitoring. The Cyprus-based regulatory framework generally receives recognition within the EU financial services landscape.

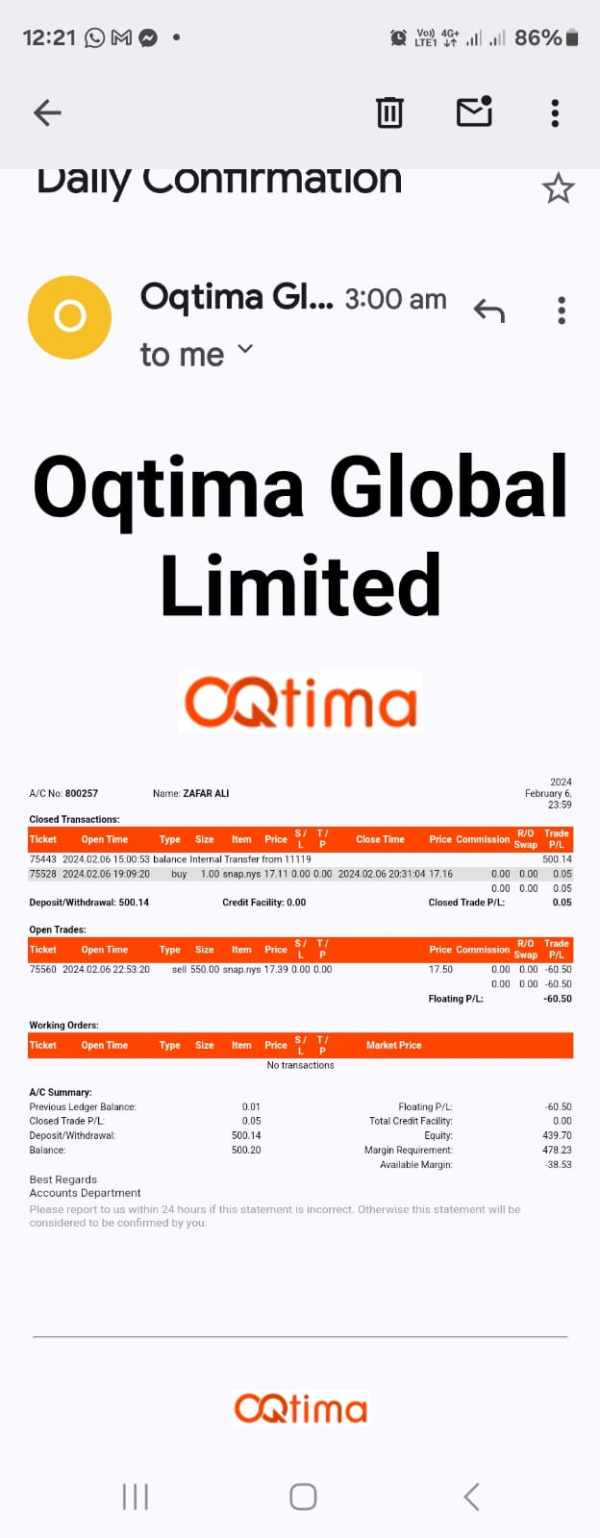

However, the moderate trust score of 58 points mentioned in available data, combined with reports of increasing user complaints, suggests potential gaps between regulatory compliance and user satisfaction. This disconnect raises questions about operational execution, customer service delivery, or communication effectiveness.

The broker's relatively recent establishment in 2021 means limited operational history for comprehensive reliability assessment. New brokers often face challenges in building market confidence and establishing consistent service delivery, making early user feedback particularly significant for future reputation development.

User reports indicate mixed experiences, with some traders expressing satisfaction while others raise concerns about various operational aspects. This polarized feedback pattern suggests inconsistent service delivery or potentially different user expectations versus actual platform capabilities.

User Experience Analysis

User experience evaluation for OQtima reveals a fragmented landscape of opinions and satisfaction levels. The polarized nature of user feedback suggests significant variations in individual trader experiences, potentially indicating inconsistent service delivery or platform performance across different user segments.

Some users report satisfactory experiences with the platform's functionality and trading environment. This suggests that OQtima can meet certain trader requirements effectively. However, the increasing number of complaints mentioned across review platforms indicates growing dissatisfaction among portions of the user base.

The broker's target demographic of intermediate to advanced traders suggests an expectation of sophisticated platform functionality and professional service standards. However, the mixed feedback indicates potential gaps between these expectations and actual delivery, particularly in areas requiring responsive customer support or complex problem resolution.

Interface design, navigation efficiency, and overall platform usability information are not comprehensively detailed in available documentation. Modern traders expect intuitive interfaces, efficient order management, and seamless account administration capabilities, making these factors crucial for user satisfaction.

The absence of detailed user experience metrics, satisfaction surveys, or platform usability studies makes it challenging to identify specific areas of strength or weakness in OQtima's user experience delivery. This information gap represents a significant limitation for potential traders seeking to understand the practical aspects of platform interaction and daily trading experience quality.

Conclusion

OQtima presents a mixed proposition in the competitive forex brokerage landscape. While the platform offers notable strengths in platform diversity and asset coverage, significant concerns about transparency, customer service, and user satisfaction create uncertainty about its overall suitability for most traders.

The broker's regulatory status under CySEC provides foundational credibility, and its comprehensive asset offerings appeal to traders seeking diversified market exposure. However, the combination of limited publicly available information, increasing user complaints, and moderate trust scores suggests potential operational challenges that prospective clients should carefully consider.

This oqtima review recommends that intermediate to advanced traders who prioritize asset diversity and platform choice may find value in OQtima's offerings. However, they should proceed with heightened due diligence and consider starting with minimal capital exposure to evaluate platform performance firsthand. The current information gaps and mixed user feedback make OQtima a higher-risk choice compared to more established and transparent alternatives in the market.