wisunofx 2025 Review: Everything You Need to Know

1. Summary

wisunofx is a new forex broker that started in 2019. The company is registered in Belarus and offers a completely digital way to open accounts along with the strong MetaTrader 4 trading platform. The regulatory information is limited since it's watched over by the Seychelles Financial Services Authority, but this broker has caught the attention of new and intermediate traders who want a simple and easy way to trade forex. Traders can sign up quickly and without hassle thanks to the fully digital process, which gives them a modern way to enter the forex market. The broker uses the well-known MT4 platform, so users get a familiar interface and access to many traditional trading tools and technical analysis indicators.

However, potential investors should know that the available information doesn't explain specific account conditions, asset classes, or deposit requirements. While the foundation looks solid with digital innovation and a trusted trading platform, we need more clarity on operational details for a better understanding. This article gives you a detailed wisunofx review based only on public information and user feedback.

2. Notice to Readers

You should know that wisunofx is registered in Seychelles. This means that its business practices and legal compliance may be different across regions because of different regulatory environments. Investors must be careful and understand that the regulatory protections from the Seychelles Financial Services Authority might be different from those in other places.

This review uses public information and user feedback that we collected together. Some details might not be fully current or complete. Several key factors like specific deposit requirements, trading conditions, asset classes, and bonus promotions are not explained in the available data. Therefore, potential users should do more research before making any investment decisions.

The analysis here reflects information available when we wrote this and might change as new details come out.

3. Scoring Framework

4. Broker Overview

wisunofx was founded in 2019 in Belarus. The company has quickly become a digital-first online forex broker that tries to offer modern trading solutions to clients around the world. The company has positioned itself as an easy-to-use platform for forex fans, especially targeting people who are new to trading or at an intermediate level.

Potential users enjoy quick and easy registration without needing lots of paperwork thanks to the completely digital account opening process. This feature has caught the interest of tech-savvy traders. The broker has set up its main operations in Belarus, but its regulatory licensing under the Seychelles Financial Services Authority aims to provide oversight, though important details about the licensing are limited.

The foundation looks promising because of its focus on technology. However, prospective customers should be careful until more detailed account conditions and trading parameters are made clear. This complete wisunofx review is built on available public data and user insights, giving you an essential view of its overall service offering.

wisunofx uses the highly praised MetaTrader 4 trading platform. This choice reassures many traders with its stability and wide range of functions. The MT4 platform is known for its reliable performance, technical analysis tools, and automated trading capabilities, which remain big draws for both new and experienced traders.

For regulatory oversight, wisunofx is governed by the Seychelles Financial Services Authority, offering a basic level of fund protection. However, the specific details about licensing regulations and compliance protocols are not clearly outlined in public documents, leaving some questions about transparency and trustworthiness. The broker's commitment to a digital approach combined with the established MT4 platform supports an efficient trading process, though the lack of complete asset listings and detailed operational parameters means you should do additional research.

Overall, the platform mainly appeals to traders seeking a simple, digital-first entry into forex markets while relying on industry-standard tools.

Regulatory Region:

wisunofx is regulated by the Seychelles Financial Services Authority. This provides a basic level of security and oversight for traders. This regulatory oversight is meant to ensure some degree of safety for investor funds, although specifics about licensing and compliance are not extensively detailed in the available resources.

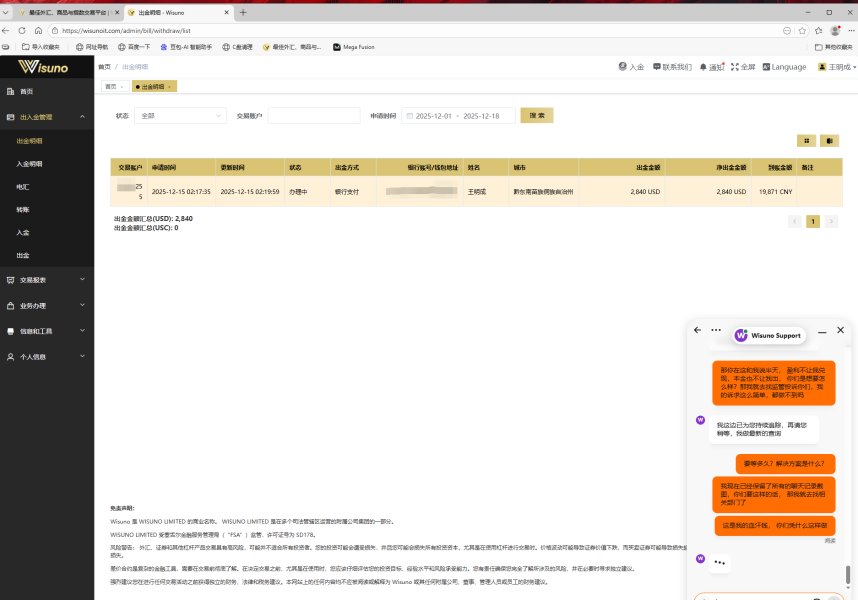

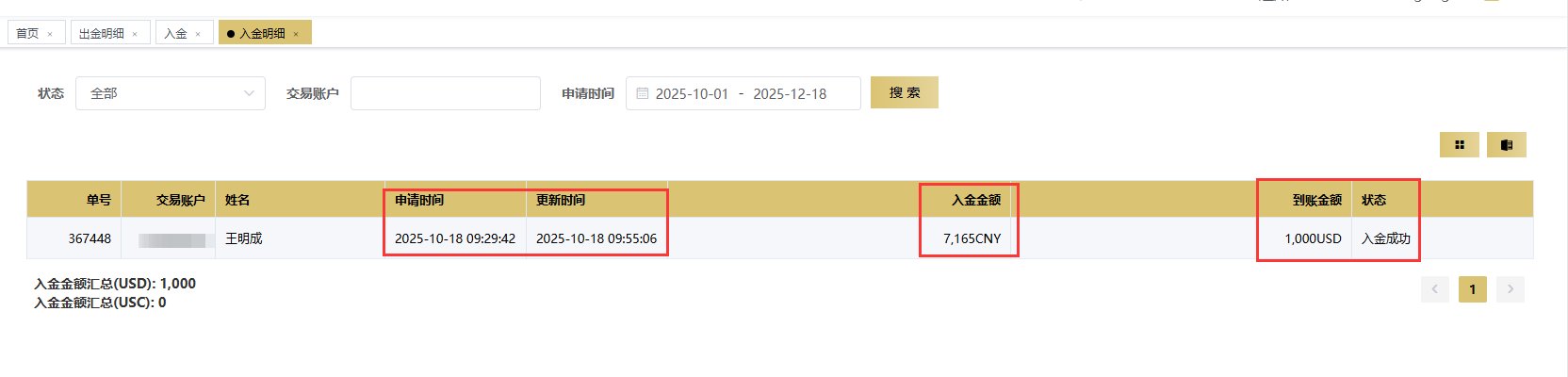

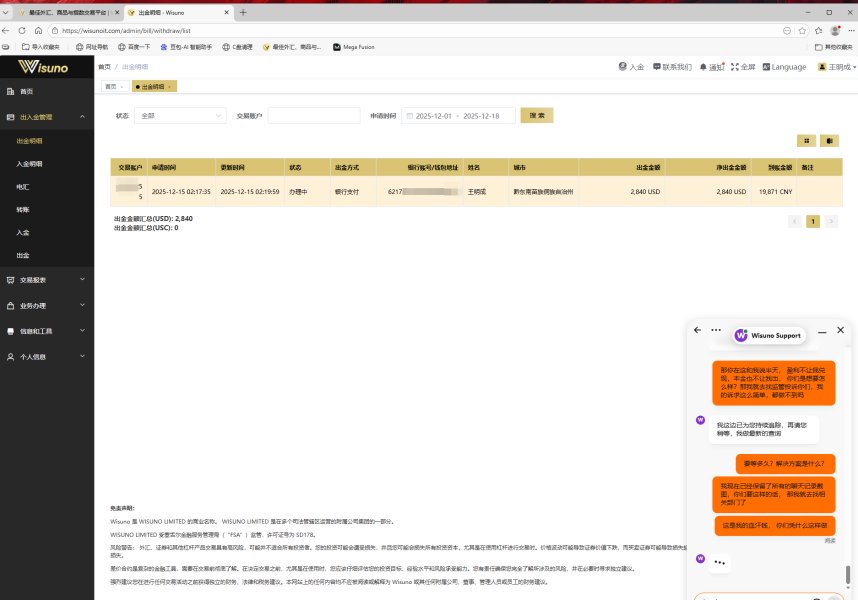

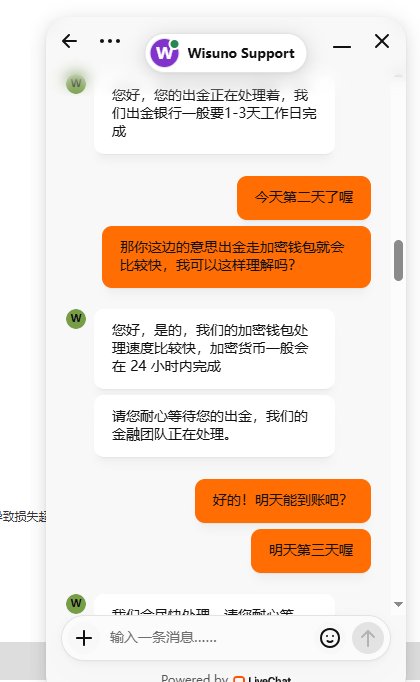

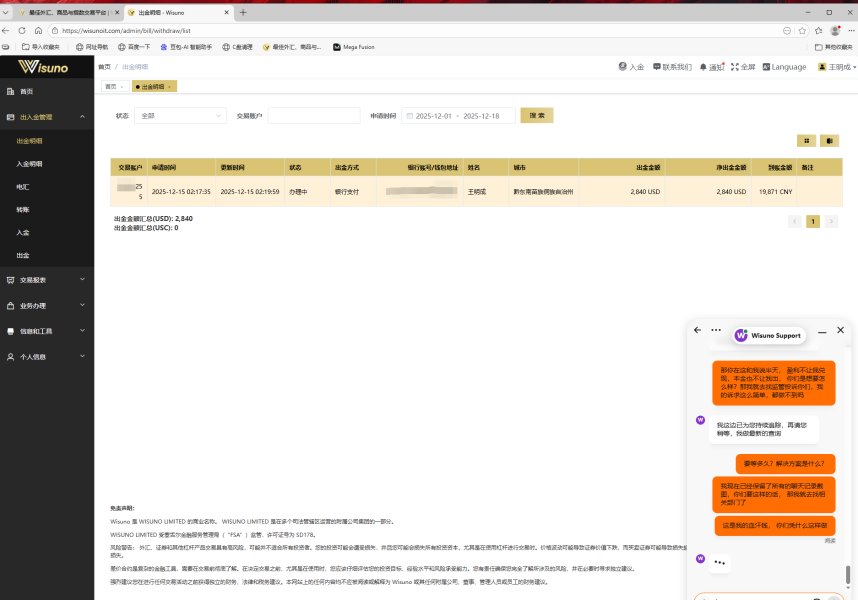

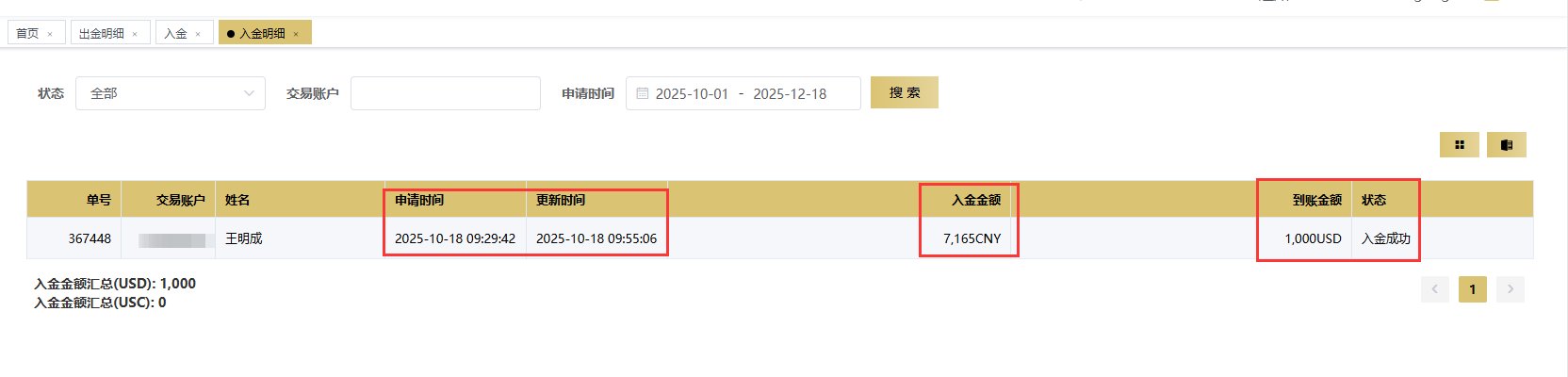

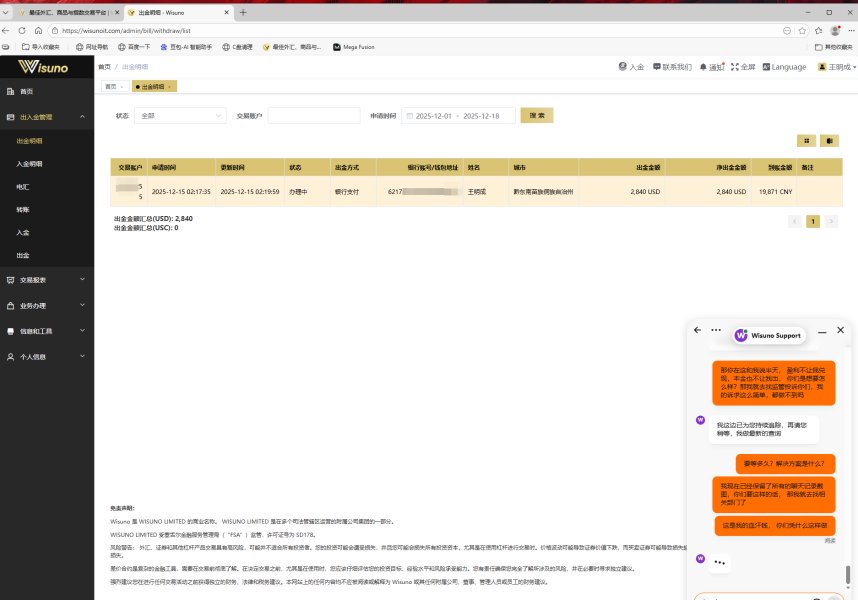

Deposit and Withdrawal Methods:

The current available information does not give precise details about the deposit and withdrawal methods supported by wisunofx. Users should refer to additional official updates to get clarity on the available payment options and associated processing times.

Minimum Deposit Requirement:

There is no publicly available data that clearly states the minimum deposit requirement for opening an account with wisunofx. This lack of clarity means potential clients should directly contact the broker for additional confirmation or verify through later updates.

Bonus and Promotions:

Information about any available bonuses or promotional offers is not detailed in the current summary. Traders seeking to benefit from additional promotional incentives should monitor future announcements or request more information from the broker.

Tradable Assets:

The precise list of tradable assets on the wisunofx platform is not specified by the available sources. While the focus is mainly on forex trading, the absence of detailed information on asset classes means that potential clients may find limitations if they are looking for a wide range of trading instruments.

Cost Structure:

Details on cost structures, including spreads and commissions, are not provided in the public information. Traders should be careful and seek clarity on potential transaction costs before engaging in active trading on the platform.

Leverage Ratios:

No concrete information about the offered leverage ratios is available. This is a notable omission, as leverage can critically affect both profits and losses, making it an essential factor for any trading strategy.

Platform Choice:

wisunofx exclusively supports the MT4 platform. This allows users to trade via personal computers with a user-friendly and feature-rich interface. The platform's capabilities are well-established in the trading community and contribute to an overall positive view of the broker's technological approach.

Regional Restrictions:

There is no detailed information concerning any restrictions on geographic regions or jurisdictional limitations for trading with wisunofx. Prospective users should confirm whether there are any local constraints that may affect access to the platform.

Customer Support Languages:

The broker provides customer support in English. This ensures that traders proficient in the language can receive assistance. However, the limited language support could be a drawback for non-English speaking users or those in multilingual markets.

This detailed overview clearly identifies several information gaps where specifics on deposit methods, cost structures, and available trading assets are not fully addressed in the provided public data. Prospective investors should take these omissions into account and directly approach wisunofx for further details before proceeding.

6. Detailed Scoring Analysis

6.1 Account Conditions Analysis

The available information does not provide detailed insights into the variety or specific features of the account types offered by wisunofx. The process of account creation is praised for its fully digital nature, making the onboarding experience smooth and particularly appealing for new entrants to the forex market. However, critical factors such as minimum deposit requirements, account segmentation, or the availability of specialized accounts are not discussed in the public data.

While the registration process appears to be streamlined and efficient, there remains considerable uncertainty about the finer details of account conditions. This is an essential aspect for any trader looking to understand cost implications and risk exposure. This lack of complete account information could be problematic for careful investors who require clarity on trading costs and account management functions.

When comparing this with more established forex brokers who transparently list account tiers, wisunofx falls short in offering a complete picture. Such gaps highlight the need for further inquiries directly with the broker. In summary, the current summary does not provide enough data to adequately score the account conditions, making it a notable shortcoming in our thorough wisunofx review.

The smart choice of using the well-known MetaTrader 4 platform as the exclusive trading interface for wisunofx shows the broker's commitment to essential trading tools and resources. The MT4 platform is universally recognized among forex traders for its stability, complete charting tools, and an extensive range of technical indicators that help with informed decision-making. Though the provided data does not identify additional resources like proprietary research, educational materials, or automated trading options, the solid foundation offered by MT4 often makes up for these gaps.

The platform's user interface is noted for supporting detailed technical analysis and algorithmic trading. However, it does not address the potential for integrating third-party research tools. While the availability of market news and expert analyses is not confirmed in the current public disclosures, the overall trading experience remains enhanced by the reliability and long-standing reputation of MT4.

Some traders might expect a broader array of analytical resources. However, given that this broker appears to mainly focus on simplicity and digital efficiency, the inclusion of MT4 is a significant advantage. Therefore, despite some missing elements in clear research and educational content, the tools and resources provided contribute positively to the trading environment, resulting in a score of 7/10 in this segment of our wisunofx review.

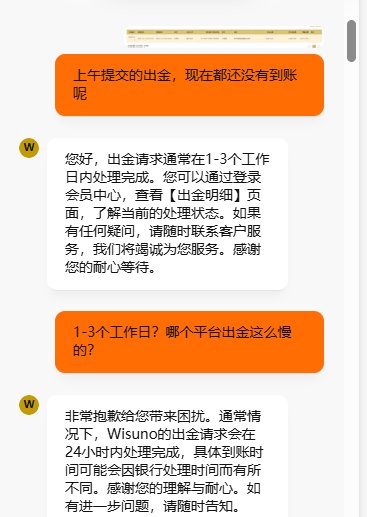

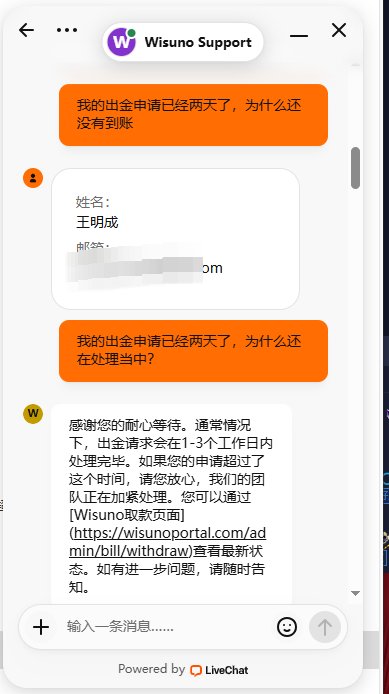

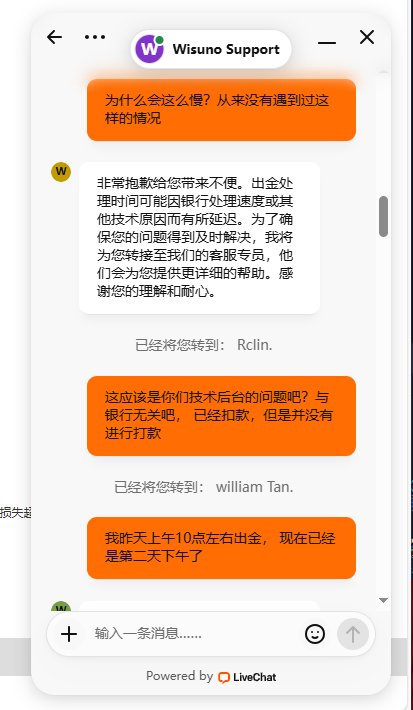

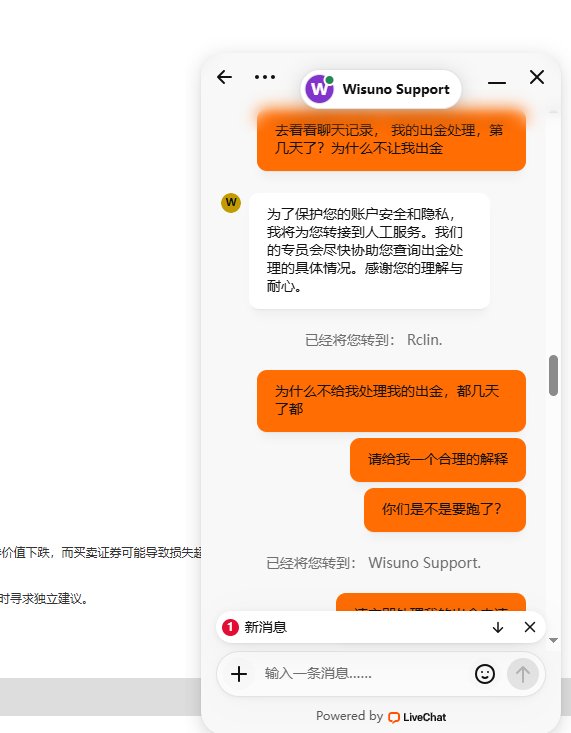

6.3 Customer Service and Support Analysis

Customer service is a critical part of any forex broker's offering. In the case of wisunofx, the available information highlights support provided in English. While this meets the basic requirement for many global traders, it is notable that the broker does not offer multilingual support—an omission that might challenge non-native English speakers.

The lack of detailed data on response times, service quality, available communication channels , and operating hours further prevents a complete assessment of customer support capabilities. Evidence from the public domain suggests that while the English customer support is functional, there is insufficient insight into how effectively the broker handles client queries or resolves issues, particularly during peak trading hours or in time-critical scenarios. In contrast to other brokers who typically provide multi-channel assistance and extended support hours, wisunofx appears to have room for improvement in enhancing accessibility for a more diverse customer base.

Therefore, while the basic provision of customer service is present, the limited language options and lack of complete service details prevent a higher score. This aspect of the service is an important consideration for traders who might value immediate and multilingual assistance as part of their trading strategy.

6.4 Trading Experience Analysis

The overall trading experience at wisunofx is closely tied to its reliance on the MetaTrader 4 platform, which is known for its strong functionality and user familiarity. However, detailed data about platform stability, order execution quality, and potential issues such as slippage or requotes are lacking in the available review materials.

While the MT4 platform is celebrated for its technical analysis capabilities and supports automated trading, the specific performance metrics concerning speed, reliability, and liquidity under varying market conditions are not explicitly discussed. For instance, aspects like mobile trading support, integration of advanced charting features, and overall system uptime remain unclear in the current documentation. In many established brokers, complete feedback on trading performance, including average execution times and user-reported stability, is common; unfortunately, such detailed assessments are missing here.

This shortfall means that despite the inherent strengths of MT4, the effectiveness of the overall trading environment at wisunofx remains partially unverified. Therefore, traders are encouraged to approach with caution and seek first-hand insights before fully committing. This portion of our wisunofx review underscores that while the platform offers many standard trading features, the absence of detailed performance data leaves important questions unanswered about the overall trading experience.

6.5 Trust Analysis

Trust is extremely important when selecting a forex broker. In the case of wisunofx, several mixed signals emerge from the available data. The broker operates under the regulatory oversight of the Seychelles Financial Services Authority, which nominally provides a level of investor protection.

However, the specific details about the licensing, regulatory conditions, and financial transparency remain vague. There is no clear disclosure of additional protective measures for client funds, nor is there detailed information on the company's financial health, making it difficult to confidently assess long-term trustworthiness. While the Seychelles regulatory framework does offer some oversight, comparisons with more strict regulatory bodies in other regions highlight potential weaknesses.

The lack of detailed user feedback, independent financial audits, or third-party reviews casts further doubt on the overall perception of reliability. This situation prompts a cautious approach among prospective traders. Essentially, while the basic regulatory approval is in place, the limited transparency and absence of supporting financial data reduce confidence, resulting in a trust score of 5/10 in our evaluation.

Different sources and reviews indicate that additional clarity on these issues is essential for building consumer trust.

6.6 User Experience Analysis

The user experience at wisunofx is mainly characterized by its streamlined digital account opening and the familiar interface provided by the MetaTrader 4 platform. New and intermediate traders are likely to appreciate the simplified onboarding process, which reduces the entry barrier and allows for quick access to the trading environment.

However, the available information does not go into other aspects that significantly influence user experience, such as the quality of the interface design, the ease of navigation within the trading platform, and overall satisfaction ratings from established users. Areas like fund management—particularly the deposit and withdrawal processes—remain unaddressed, leaving a gap in the overall assessment of user convenience. Feedback about potential bottlenecks or frustrations in system usability has not been prominently featured in the public disclosures.

While the digital-first approach and reliable MT4 functionality are definite positives, the absence of complete user reviews and system performance details introduces uncertainties. This incomplete information underlines the need for prospective users to independently verify aspects of the overall experience. As a result, the user experience dimension remains unscored due to insufficient detailed evidence within this wisunofx review, despite the initial appeal for novice traders.

7. Conclusion

wisunofx emerges as a relatively new forex broker with some appealing features. The fully digital account opening process and the use of the industry-standard MT4 platform are particularly attractive. However, the review reveals several areas where critical details are missing, such as specific account conditions, deposit methods, cost structures, and complete user feedback.

Despite its regulatory oversight by the Seychelles Financial Services Authority, the lack of transparency about licensing and account details underscores the importance of exercising caution. This wisunofx review suggests that while the platform may be attractive for novice and intermediate traders due to its ease of use and technological approach, potential users should conduct further research to address the existing information gaps before committing.