Regarding the legitimacy of OQtima forex brokers, it provides CYSEC, FSA and WikiBit, .

Is OQtima safe?

Pros

Cons

Is OQtima markets regulated?

The regulatory license is the strongest proof.

CYSEC Derivatives Trading License (STP) 18

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

Oqtima EU Ltd

Effective Date:

2021-11-02Email Address of Licensed Institution:

compliance@oqtima.euSharing Status:

No SharingWebsite of Licensed Institution:

www.oqtima.euExpiration Time:

--Address of Licensed Institution:

Franklin Roosevelt 247, Block C, 1st Floor, Office 101, Zakaki, 3046, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 585 379Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

OQTIMA INT. LTD

Effective Date:

--Email Address of Licensed Institution:

support@oqtima.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.oqtima.comExpiration Time:

--Address of Licensed Institution:

IMAD Complex, Office 7, Unit 204, 1st Floor, Ile Du Port, SeychellesPhone Number of Licensed Institution:

+248 4373113Licensed Institution Certified Documents:

Is Oqtima A Scam?

Introduction

Oqtima is a relatively new player in the forex market, established in 2022 and headquartered in Limassol, Cyprus. As a broker offering a range of financial instruments, including forex, commodities, and cryptocurrencies, Oqtima aims to cater to both novice and experienced traders. However, the rapid growth of online trading has also led to an increase in fraudulent activities, making it crucial for traders to carefully assess the legitimacy and reliability of their chosen broker. This article investigates Oqtima's regulatory status, company background, trading conditions, and customer experiences to determine whether it is a trustworthy broker or a potential scam.

To conduct this assessment, we utilized a comprehensive evaluation framework that includes a review of regulatory compliance, company history, trading costs, customer fund security, user feedback, and platform performance. By synthesizing data from multiple reputable sources, we aim to provide an objective analysis of Oqtima's credibility.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and trustworthiness. Oqtima operates under the oversight of two regulatory bodies: the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA) in Seychelles. CySEC is recognized as a tier-1 regulator, providing robust investor protection, while the FSA is considered a tier-3 regulator, offering more lenient oversight.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| CySEC | 406/21 | Cyprus | Verified |

| FSA | SD109 | Seychelles | Verified |

CySEC's stringent regulations require brokers to maintain a minimum capital requirement, segregate client funds, and adhere to strict reporting standards. This oversight is crucial for ensuring that client funds are protected and that the broker operates fairly. In contrast, while the FSA also mandates certain compliance measures, its regulations are less rigorous than those of CySEC, which may expose traders to additional risks.

Overall, Oqtima's dual regulatory framework suggests a commitment to transparency and compliance. However, potential clients should be aware that the presence of an offshore license may not provide the same level of security as a license from a more stringent authority. Historical compliance records indicate that Oqtima has not faced significant regulatory issues thus far, which adds a layer of confidence for prospective traders.

Company Background Investigation

Oqtima is operated by CDE Global Markets Ltd, a company that has positioned itself as a reliable broker in the competitive forex landscape. Established in 2022, the firm has quickly gained traction among traders due to its diverse range of financial products and user-friendly trading platforms. The ownership structure of Oqtima is relatively straightforward, with a management team boasting over 30 years of combined experience in the financial services industry.

The management team includes seasoned professionals who have previously held significant roles at well-known financial institutions. This experience is critical in fostering a culture of reliability and operational excellence within the brokerage. However, the company has faced scrutiny due to its relatively short history in the market, leading some traders to question its long-term viability.

In terms of transparency, Oqtima provides accessible information regarding its services, fees, and regulatory status. However, some reviews have pointed out that the broker lacks comprehensive educational resources, which could be beneficial for novice traders. As the company continues to grow, enhancing transparency and information disclosure will be essential to building trust with its client base.

Trading Conditions Analysis

Oqtima offers a competitive trading environment characterized by a variety of account types, low minimum deposits, and flexible leverage options. The broker features two primary account types: the ECN+ account, which offers spreads starting from 0.0 pips with a commission of $3.50 per side, and the One account, which provides commission-free trading with spreads starting from 1.0 pips.

| Fee Type | Oqtima | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips (ECN+) | 1.0 pips |

| Commission Model | $3.50 per side (ECN+) | $10 per lot |

| Overnight Interest Range | Varies | Varies |

The overall fee structure at Oqtima is competitive, particularly for the ECN+ account, which caters to active traders seeking low trading costs. However, the commission charged on this account type may be a deterrent for those who prefer a commission-free trading model. Additionally, Oqtima does not impose any fees for deposits and withdrawals, which is a positive aspect for traders looking to minimize costs.

While the trading conditions appear favorable, potential clients should be vigilant about any hidden fees or unusual policies that could affect their trading experience. It is advisable to read the fine print in the terms and conditions to fully understand the cost implications of trading with Oqtima.

Customer Fund Security

When choosing a broker, the security of customer funds is paramount. Oqtima employs several measures to ensure the protection of client assets. Client funds are held in segregated accounts, which means that they are kept separate from the broker's operational funds. This practice is essential in safeguarding traders' investments in the event of financial instability or bankruptcy.

Moreover, Oqtima offers negative balance protection, which prevents traders from incurring debts beyond their account balance. This feature is particularly important in volatile markets, where significant price swings can lead to substantial losses. Additionally, the broker is committed to utilizing secure payment gateways and encryption methods to protect sensitive client information during transactions.

Despite these measures, traders should remain aware of the potential risks associated with trading, especially with an offshore broker. While Oqtima has not reported any significant security breaches or fund mismanagement issues, maintaining a healthy level of skepticism is advisable.

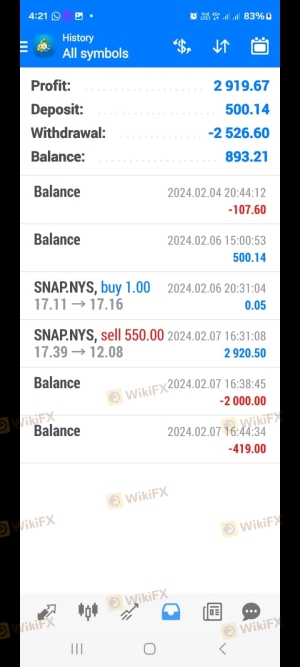

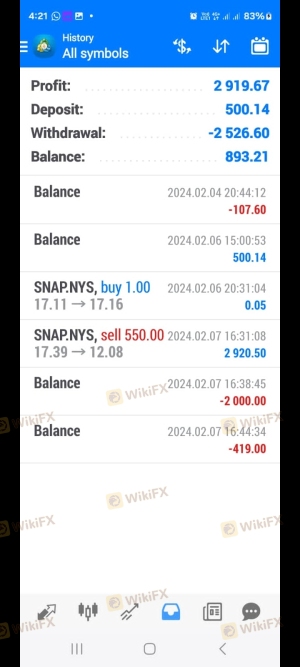

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability. Oqtima has received a mix of positive and negative reviews from users. Many traders appreciate the competitive trading conditions, low minimum deposits, and responsive customer support. However, some common complaints have emerged, particularly regarding withdrawal processing times and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Addressed but slow |

| Poor Customer Support | High | Inconsistent response |

| Lack of Educational Resources | Moderate | Under development |

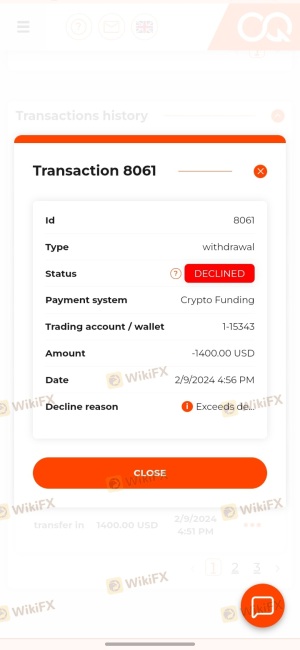

Several users have reported delays in receiving their withdrawal requests, particularly with bank transfers. While Oqtima claims to process withdrawals promptly, the actual experience has varied among clients. Additionally, complaints about customer support indicate that while some agents are knowledgeable, response times can be inconsistent, leading to frustration among traders seeking assistance.

One notable case involved a trader who experienced significant delays in withdrawing profits, leading them to question the broker's reliability. This case highlights the importance of efficient customer service and transparent communication in maintaining trust.

Platform and Execution

Oqtima utilizes two widely recognized trading platforms: MetaTrader 4 (MT4) and cTrader. Both platforms are known for their user-friendly interfaces and advanced trading capabilities. Traders can execute various order types, including market, limit, and stop orders, with the expectation of fast execution speeds.

However, some users have raised concerns about order execution quality and slippage, especially during high-volatility periods. While Oqtima claims to provide minimal slippage and fast execution, traders should monitor their experiences closely to ensure that the broker delivers on these promises.

Overall, the platforms offered by Oqtima are generally well-received, but traders should remain vigilant about execution quality and any signs of potential manipulation.

Risk Assessment

Engaging with Oqtima carries inherent risks, as with any trading platform. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may offer less protection. |

| Withdrawal Risk | High | Reports of delayed withdrawals raise concerns. |

| Customer Service Risk | Medium | Inconsistent support may lead to unresolved issues. |

| Trading Conditions Risk | Low | Competitive fees and conditions, but watch for hidden costs. |

To mitigate these risks, traders should conduct thorough research before committing funds, utilize demo accounts to familiarize themselves with the platform, and maintain a diversified trading strategy to manage exposure effectively.

Conclusion and Recommendations

In conclusion, Oqtima presents a mixed profile as a forex broker. While it is regulated by both CySEC and the FSA, which adds a layer of credibility, potential traders should remain cautious due to reports of withdrawal delays and inconsistent customer service. The competitive trading conditions and low minimum deposits make it an attractive option for many, but the mixed reviews and concerns about customer fund security warrant careful consideration.

For traders seeking a reliable broker, it may be wise to explore alternatives that have established a stronger reputation in the industry, such as brokers with a longer track record and consistently positive user feedback. Ultimately, the decision to trade with Oqtima should be based on individual risk tolerance and investment objectives.

Is OQtima a scam, or is it legit?

The latest exposure and evaluation content of OQtima brokers.

OQtima Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OQtima latest industry rating score is 6.08, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.08 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.