Regarding the legitimacy of InteractiveBrokers forex brokers, it provides ASIC, FCA, FSA, SFC, SFC, CIRO, NFA, ASIC and WikiBit, (also has a graphic survey regarding security).

Is InteractiveBrokers safe?

Pros

Cons

Is InteractiveBrokers markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

INTERACTIVE BROKERS AUSTRALIA PTY LTD

Effective Date: Change Record

2016-07-28Email Address of Licensed Institution:

regquery_apac@interactivebrokers.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 11 175 PITT ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0272510088Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Interactive Brokers (U.K.) Limited

Effective Date: Change Record

2002-02-06Email Address of Licensed Institution:

complianceuk@interactivebrokers.co.uk, ibukcomplaints@interactivebrokers.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.interactivebrokers.co.ukExpiration Time:

--Address of Licensed Institution:

Interactive Brokers (UK) Ltd 20 Fenchurch Street London City Of London EC3M 3BY UNITED KINGDOMPhone Number of Licensed Institution:

+442077105630Licensed Institution Certified Documents:

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

インタラクティブ・ブローカーズ証券株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都千代田区霞が関3-2-5Phone Number of Licensed Institution:

03-4588-9701Licensed Institution Certified Documents:

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Interactive Brokers Hong Kong Limited

Effective Date:

2004-01-07Email Address of Licensed Institution:

thhk@interactivebrokers.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.interactivebrokers.com.hkExpiration Time:

--Address of Licensed Institution:

香港金鐘道88號太古廣場1512室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

Interactive Brokers LLC

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

CIRO Derivatives Trading License (EP)

Canadian Investment Regulatory Organization

Canadian Investment Regulatory Organization

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Interactive Brokers Canada Inc.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

www.interactivebrokers.caExpiration Time:

--Address of Licensed Institution:

1800 McGill College Avenue Suite 2106 Montréal QC H3A 3J6Phone Number of Licensed Institution:

1-877-745-4222Licensed Institution Certified Documents:

NFA Derivatives Trading License (AGN)

National Futures Association

National Futures Association

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

INTERACTIVE BROKERS LLC

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Two Pickwick Plaza Greenwich, CT 06830 United StatesPhone Number of Licensed Institution:

203-618-5700Licensed Institution Certified Documents:

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RevokedLicense Type:

Forex Execution License (STP)

Licensed Entity:

INTERACTIVE BROKERS LLC

Effective Date: Change Record

2004-02-25Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2022-02-23Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Interactive Brokers A Scam?

Introduction

Interactive Brokers (IBKR) is a well-known brokerage firm that has established itself as a major player in the global financial markets, particularly in the realm of forex trading. Founded in 1978 by Thomas Peterffy, the firm has grown to become one of the largest electronic brokerage firms, offering a wide range of financial products, including stocks, options, futures, and forex. Given its extensive reach and the complexity of the financial services it provides, it is essential for traders to approach any brokerage with a critical eye, especially when it comes to evaluating their safety and legitimacy.

In the fast-paced world of forex trading, the stakes can be high, and the potential for loss is significant. Therefore, traders must carefully assess the credibility of their chosen broker to ensure their investments are secure. This article aims to provide a comprehensive analysis of Interactive Brokers, addressing key concerns regarding its regulatory status, company background, trading conditions, client fund safety, customer experience, platform performance, and overall risk assessment. Our investigation is based on a thorough review of various credible sources, including regulatory filings, user reviews, and financial reports, to present an objective overview of whether Interactive Brokers is a trustworthy platform or a potential scam.

Regulation and Legitimacy

The regulatory framework surrounding a brokerage is a critical factor in determining its legitimacy and the safety of client funds. Interactive Brokers is regulated by several top-tier financial authorities, which adds a layer of credibility to its operations. The following table summarizes the core regulatory information for Interactive Brokers:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| U.S. Securities and Exchange Commission (SEC) | 8-47257 | United States | Verified |

| Financial Industry Regulatory Authority (FINRA) | 36418 | United States | Verified |

| Commodity Futures Trading Commission (CFTC) | 0258600 | United States | Verified |

| Financial Conduct Authority (FCA) | 208159 | United Kingdom | Verified |

| Central Bank of Ireland | N/A | Ireland | Verified |

The significance of these regulatory bodies cannot be overstated. The SEC and CFTC are responsible for enforcing federal securities laws and regulating the financial markets in the U.S., ensuring that brokers adhere to strict compliance standards. Similarly, the FCA and the Central Bank of Ireland provide oversight in their respective jurisdictions, safeguarding investor interests.

Despite its strong regulatory standing, Interactive Brokers has faced scrutiny in the past. The firm has been fined for various compliance issues, including a notable $38 million penalty in 2020 for failing to maintain an adequate anti-money laundering program. Such incidents raise questions about the firm's operational integrity and adherence to regulatory standards. However, it is important to note that these fines are not uncommon in the brokerage industry and do not necessarily indicate fraudulent behavior. Instead, they highlight the importance of ongoing compliance efforts and the need for brokers to continually adapt to regulatory changes.

Company Background Investigation

Interactive Brokers has a rich history that dates back to its founding in 1978. Initially a market-making firm, the company evolved into a comprehensive brokerage service provider, catering to both retail and institutional clients. The firm operates under the ownership of Interactive Brokers Group, Inc., which is publicly traded on the NASDAQ under the ticker symbol IBKR. Over the years, the company has expanded its services globally, providing access to over 150 markets in 36 countries.

The management team at Interactive Brokers is led by Thomas Peterffy, the founder and chairman, who has been instrumental in shaping the company's innovative approach to trading technology. Under his leadership, the firm has pioneered several technological advancements, including the development of the first handheld computers used for trading and the introduction of automated trading systems. This strong leadership and vision have contributed to the firm's reputation as a technology-driven brokerage.

In terms of transparency, Interactive Brokers provides comprehensive information about its operations, including detailed financial reports and disclosures. The firm maintains a high level of transparency regarding its pricing structure, regulatory compliance, and operational practices, which is crucial for building trust with clients. However, the complexity of its fee structures and the vast array of services offered can sometimes lead to confusion among clients, particularly those new to trading.

Trading Conditions Analysis

The trading conditions offered by a brokerage significantly impact the overall trading experience. Interactive Brokers is known for its competitive pricing and low-cost trading options, which attract a diverse range of traders. The following table compares core trading costs associated with Interactive Brokers against industry averages:

| Fee Type | Interactive Brokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies (as low as 0.1 pips) | 1.0 pips |

| Commission Model | $0 (IBKR Lite) / $0.005 per share (IBKR Pro) | $0.01 per share |

| Overnight Interest Range | 0.75% - 5.83% | 2.0% - 6.0% |

Interactive Brokers offers two primary pricing models: IBKR Lite and IBKR Pro. The IBKR Lite model provides commission-free trading for U.S. stocks and ETFs, appealing to casual investors. In contrast, IBKR Pro caters to active traders with a per-share commission structure that can be as low as $0.005. This tiered pricing structure is designed to benefit high-volume traders, potentially resulting in significant cost savings.

However, some clients have raised concerns about the complexity of these fee structures and the potential for hidden costs. For instance, while IBKR Lite offers commission-free trading, users may be subject to payment for order flow, which can lead to less favorable execution prices. This trade-off can be a disadvantage for those who prioritize execution quality over cost savings.

Client Fund Safety

Ensuring the safety of client funds is paramount for any brokerage firm. Interactive Brokers implements several measures to protect client assets, including the segregation of funds and investor protection policies. Client funds are held in segregated accounts, separate from the firm's operational funds, which is a standard practice in the brokerage industry. This segregation helps to safeguard client assets in the event of financial difficulties faced by the broker.

Additionally, Interactive Brokers is a member of the Securities Investor Protection Corporation (SIPC), which provides insurance coverage of up to $500,000 per client, including a $250,000 limit for cash claims. For clients with larger accounts, the firm also offers excess SIPC insurance through Lloyd's of London, providing an additional layer of protection.

Despite these safeguards, it is important to note that the assets held in "street name" mean that the broker is the legal owner of the securities, while clients are the beneficial owners. This arrangement can complicate the process of recovering assets in the event of bankruptcy, as clients may need to claim their share of pooled assets rather than having direct ownership. However, the firm's robust financial position and conservative risk management practices contribute to a high level of confidence in the safety of client funds.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the overall experience with a brokerage firm. Interactive Brokers has received mixed reviews from clients, with some praising its low-cost trading and advanced technology, while others have expressed frustration with customer service and platform usability. The following table summarizes the main types of complaints received by Interactive Brokers:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Customer Support Delays | High | Slow response times reported |

| Platform Usability Issues | Medium | Ongoing improvements noted |

| Fee Structure Confusion | Medium | Clarifications provided |

Common complaints from users include difficulties in reaching customer support, particularly during peak trading hours. Many clients have reported long wait times when contacting the firm's support team, leading to dissatisfaction with the overall service experience. While the company has made efforts to enhance its customer service capabilities, including the introduction of AI-driven chat support, challenges remain in meeting the demands of a growing client base.

In contrast, some users have highlighted the effectiveness of the firm's educational resources and tools, which can help clients navigate the complexities of trading. For instance, the Traders' Academy offers a variety of courses and materials for traders of all skill levels, contributing positively to the overall customer experience.

Platform and Trade Execution

The performance and reliability of a brokerage's trading platform are critical for successful trading. Interactive Brokers offers several platforms, including the advanced Trader Workstation (TWS), which is highly regarded for its robust features and capabilities. However, the platform can be overwhelming for beginners due to its complexity.

In terms of order execution, Interactive Brokers is known for its high execution quality and low slippage rates. The firm employs advanced order routing technology that aims to achieve the best execution prices for clients. However, some users have reported instances of rejected orders or delays, particularly during periods of high market volatility.

Overall, while the platform's performance is generally strong, traders should be aware of potential challenges and familiarize themselves with the various tools and functionalities available to optimize their trading experience.

Risk Assessment

Using Interactive Brokers comes with a set of inherent risks that traders should consider. The following risk assessment summarizes key risk areas associated with the broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Past compliance issues noted |

| Platform Usability Risk | Medium | Complex interface for beginners |

| Execution Risk | Medium | Potential for slippage and rejected orders |

| Customer Support Risk | High | Long wait times reported |

To mitigate these risks, traders should conduct thorough research and ensure they understand the platform's features and functionalities before committing significant capital. Additionally, utilizing educational resources and customer support can help users navigate potential challenges effectively.

Conclusion and Recommendations

In conclusion, Interactive Brokers is a reputable brokerage with a long history in the financial markets. While it is not without its challenges, particularly concerning customer service and platform complexity, the firm is generally regarded as safe and reliable. The combination of strong regulatory oversight, robust fund protection measures, and competitive trading conditions makes it a viable option for serious traders.

However, potential clients should remain vigilant and aware of the risks involved. For those new to trading or seeking a more user-friendly experience, it may be beneficial to consider alternative brokers that offer more personalized support and simplified platforms. If you are an experienced trader looking for advanced tools and low costs, Interactive Brokers may be an excellent fit.

For those seeking alternatives, brokers like Charles Schwab, TD Ameritrade, and Fidelity offer strong customer support and user-friendly platforms while maintaining competitive pricing. Ultimately, the choice of broker should align with your trading goals, experience level, and personal preferences.

Is InteractiveBrokers a scam, or is it legit?

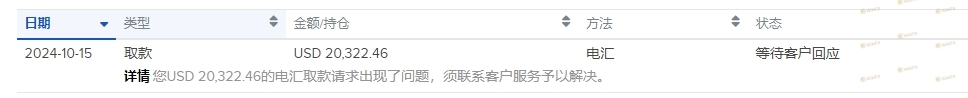

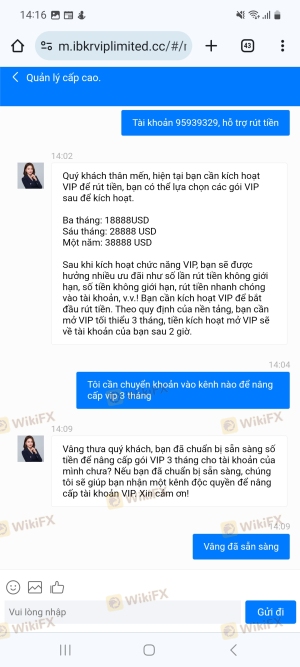

The latest exposure and evaluation content of InteractiveBrokers brokers.

InteractiveBrokers Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

InteractiveBrokers latest industry rating score is 8.14, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.14 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.