GIB 2025年评测:您需要了解的一切

Executive Summary

This gib review provides a comprehensive analysis of GIB as a forex broker operating in the competitive financial services market. GIB presents itself as a medium-risk broker with a trust score of 67. This score indicates moderate reliability concerns that potential traders should carefully consider before opening accounts.

While the company has established a presence in the insurance brokerage sector with notable achievements, including recognition as the best insurance brokerage company in the UK and high ratings in the South African insurance market, its forex trading services present a more complex picture. The broker's primary appeal lies in its dual focus on forex trading and insurance brokerage services. This approach targets investors interested in diversified financial solutions across multiple financial sectors.

However, user feedback reveals significant challenges in equipment quality and management practices that impact the overall trading experience. GIB's regulatory status adds another layer of complexity to consider. The company is registered in the United States but operates without regulatory oversight there, while maintaining regulatory compliance with BAPPEBTI and ICDX in other jurisdictions.

According to available market analysis, GIB has received a 4-star rating in the supply chain planning solutions market. This achievement doesn't directly translate to forex trading excellence, however. The mixed user reviews and moderate trust score suggest that while GIB may serve certain market segments effectively, potential clients should approach with measured expectations and thorough due diligence.

Important Notice

Regional Entity Differences: Traders should be aware that GIB operates across multiple jurisdictions with varying regulatory frameworks. The company's registration in the United States without local regulatory oversight contrasts sharply with its regulated status under BAPPEBTI and ICDX in other markets. This regulatory disparity may significantly impact user protection levels and dispute resolution mechanisms depending on the trader's location and the specific GIB entity they engage with.

Review Methodology: This evaluation is based on available user feedback, regulatory disclosures, and industry analysis conducted according to established market assessment standards. Due to limited transparency in certain operational aspects, some evaluations rely on industry benchmarks and comparative analysis with similar brokers in the market.

Overall Rating Framework

Broker Overview

Company Background and Establishment

GIB was established in 2004. This marks over two decades of operation in the financial services sector. The company maintains its headquarters in the United States and has developed a business model that encompasses both forex trading and insurance brokerage services.

This dual approach represents GIB's strategy to provide diversified financial solutions to its client base. However, the integration between these services and their mutual benefit to traders remains unclear from available documentation. The company's longevity in the market suggests institutional stability, though this should be weighed against the evolving regulatory landscape and changing client expectations in the forex industry.

GIB's positioning as a provider of "secure and transparent trading environments" indicates awareness of industry standards. Implementation details require closer examination, however.

Operational Structure and Business Model

GIB operates through a multi-jurisdictional structure that includes registration in the United States alongside regulatory compliance in other markets through BAPPEBTI and ICDX oversight. This structure reflects the company's international ambitions while creating complexity in terms of client protection and regulatory clarity. The specific trading platforms utilized by GIB are not detailed in available materials.

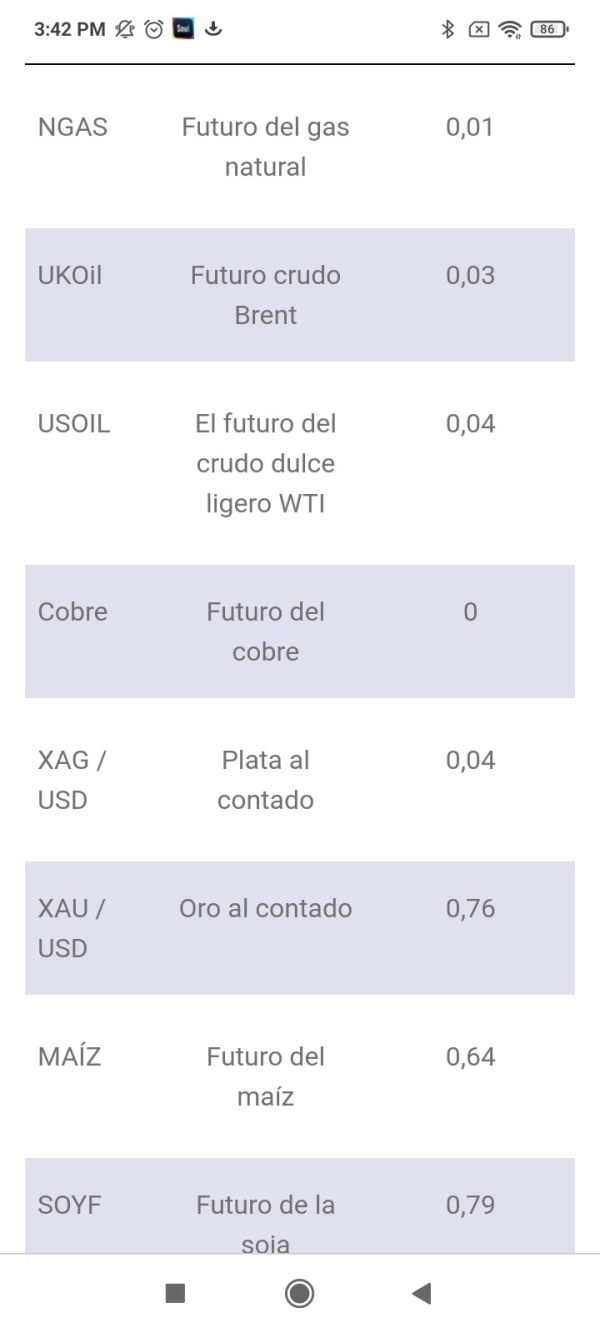

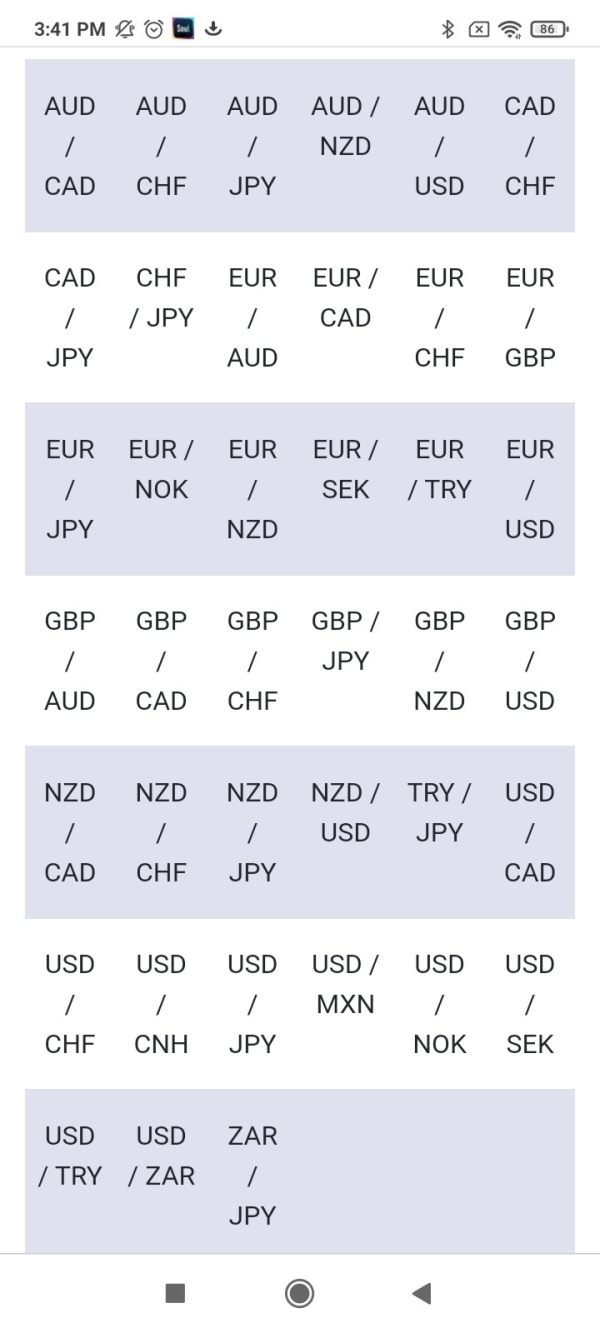

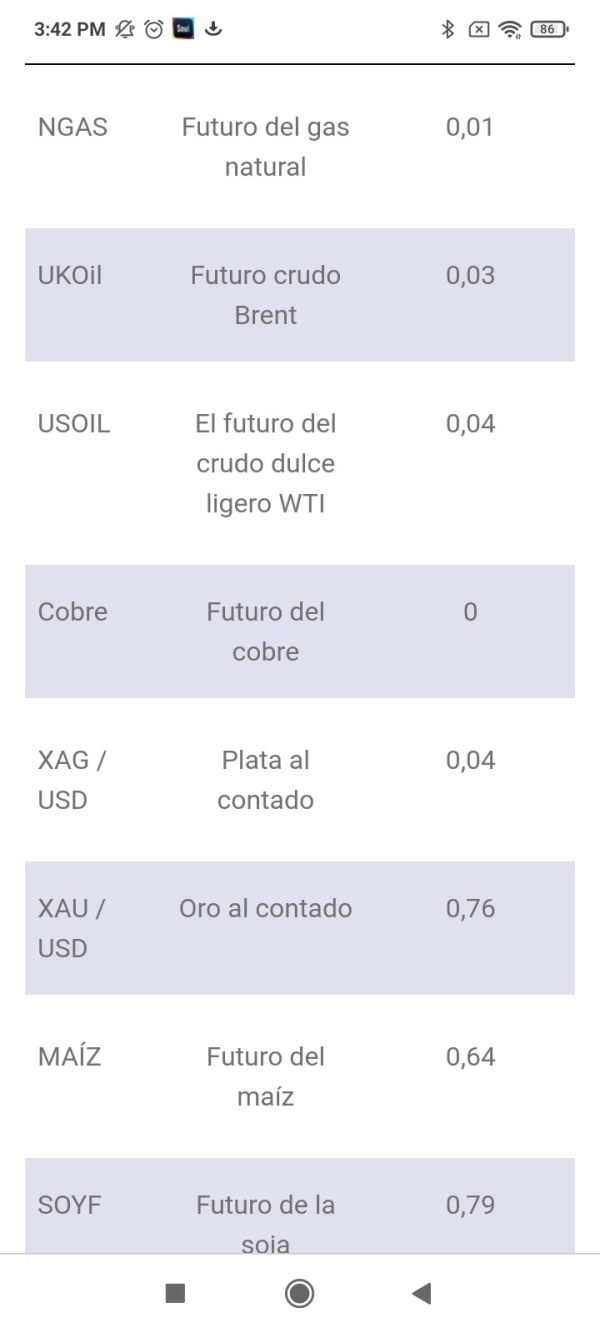

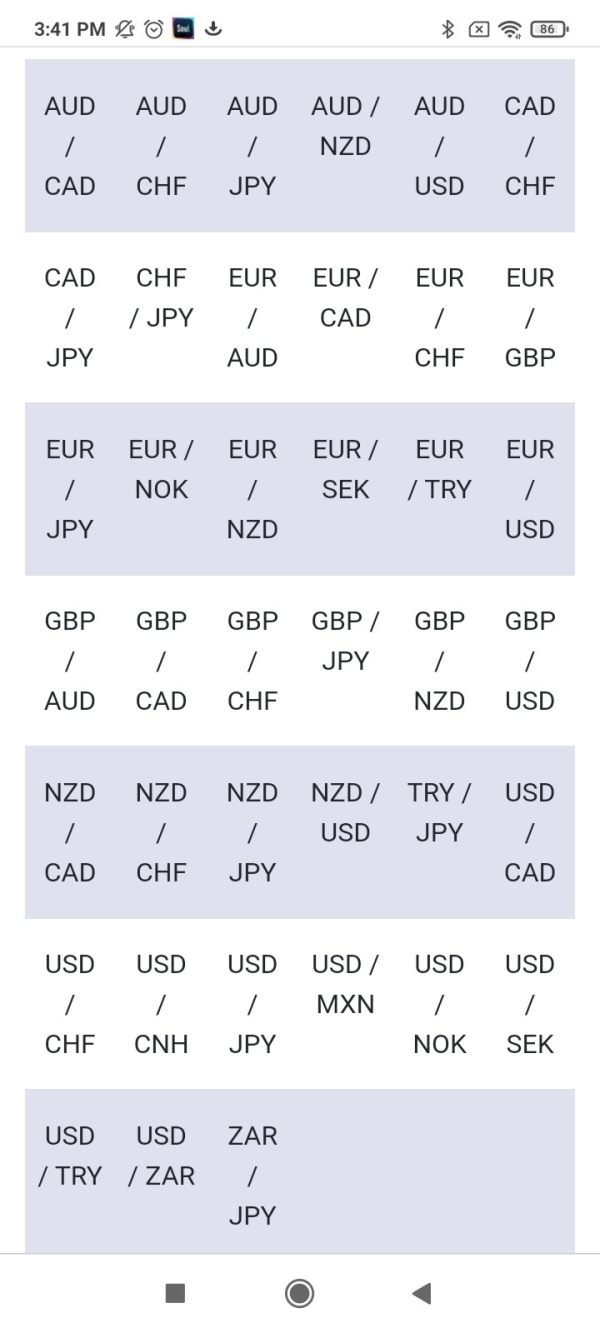

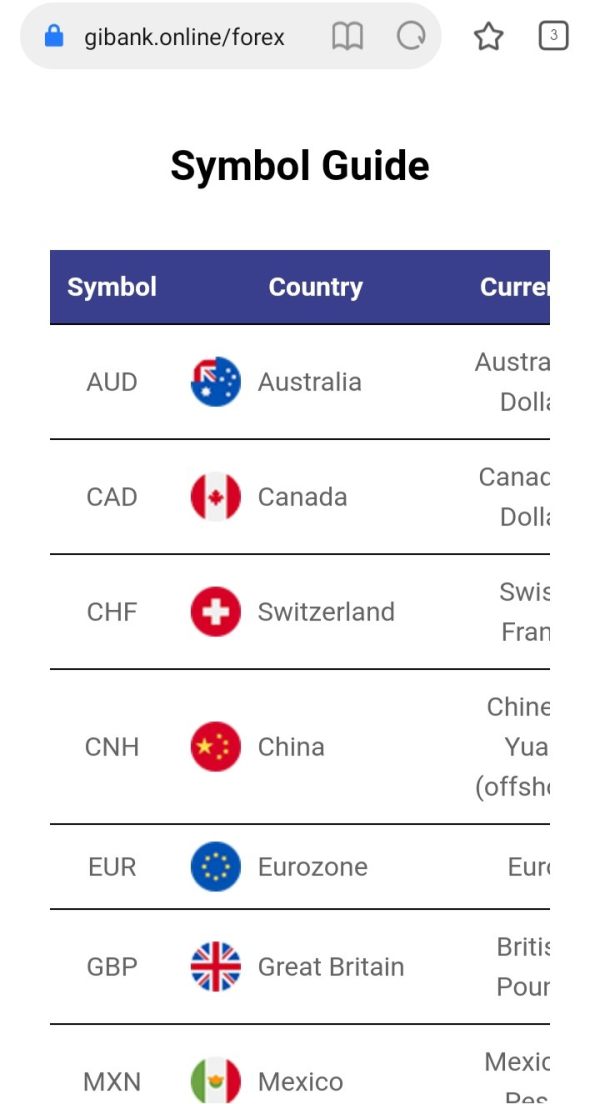

This raises questions about technological infrastructure and trading execution capabilities. The asset classes available through GIB focus primarily on forex trading, though comprehensive details about specific currency pairs, exotic options, or additional financial instruments remain undisclosed. This lack of transparency in service offerings may concern traders seeking detailed information before account opening.

Regulatory Framework and Compliance

GIB's regulatory status presents a mixed picture that requires careful consideration. While registered in the United States, the company operates without regulatory oversight from major US financial authorities such as the CFTC or NFA. However, international operations fall under BAPPEBTI and ICDX regulation, providing some level of oversight and client protection in those jurisdictions.

Account Structure and Requirements

Specific information regarding minimum deposit requirements, account types, and opening procedures is not available in current documentation. This represents a significant transparency gap for potential clients.

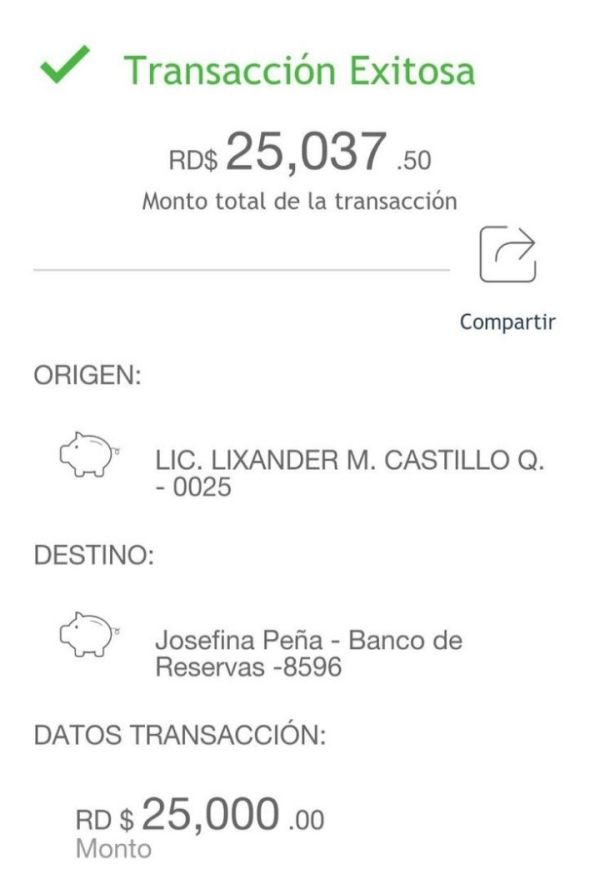

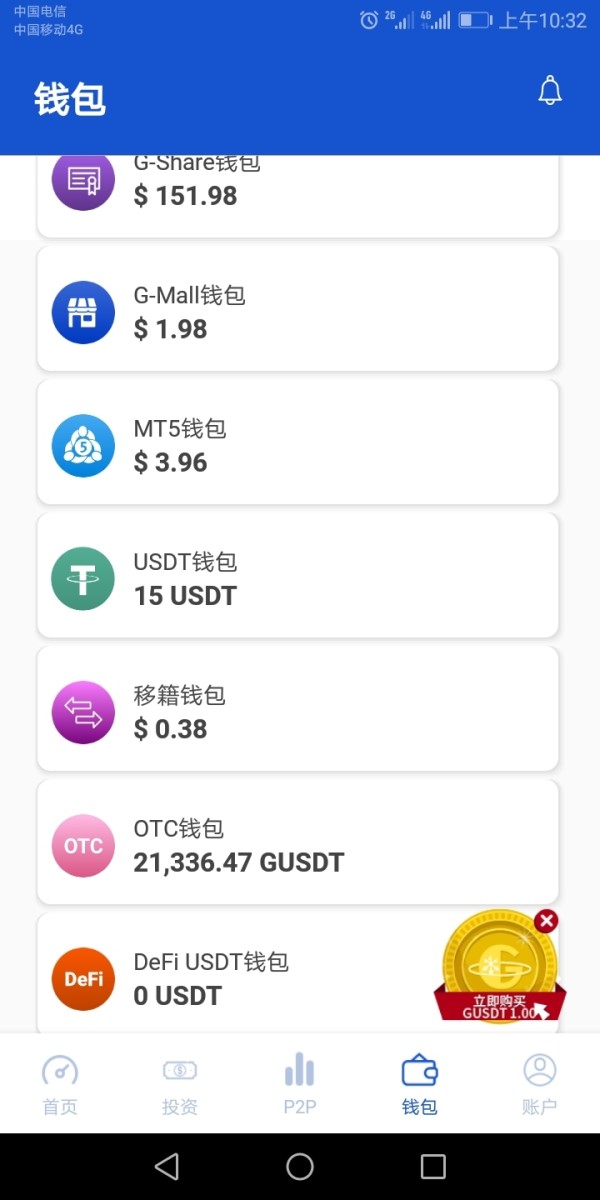

Payment Processing and Financial Transactions

Details regarding deposit and withdrawal methods, processing times, and associated fees are not disclosed in available materials. This may complicate client decision-making processes significantly.

Trading Costs and Fee Structure

The absence of specific information about spreads, commissions, swap rates, and other trading costs makes it difficult for traders to accurately assess the true cost of trading with GIB compared to industry alternatives.

Promotional Offerings

No specific information about welcome bonuses, promotional campaigns, or loyalty programs is available in current documentation.

Leverage and Risk Management

Leverage ratios and risk management tools offered by GIB are not specified in available materials. This is concerning given the importance of these factors in forex trading decisions.

This gib review notes that the lack of detailed information in multiple key areas represents a significant limitation for potential clients seeking to make informed decisions.

Comprehensive Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions offered by GIB present several concerns for potential traders. The most significant issue is the lack of transparency regarding basic account parameters such as minimum deposit requirements, account types available, and specific features included with different account tiers. This information gap makes it difficult for traders to understand what they can expect when opening an account with the broker.

Industry standards typically require brokers to clearly communicate account opening requirements, fee structures, and available features. GIB's failure to provide this information publicly suggests either poor marketing communication or potential issues with competitive positioning. The absence of information about specialized account types, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, further limits the broker's appeal to diverse trader demographics.

User feedback indicates dissatisfaction with account-related services. However, specific details about account management, funding processes, or withdrawal procedures are not well-documented. The overall lack of transparency and negative user sentiment contributes to the below-average rating in this category.

Without clear information about account conditions, traders cannot make informed comparisons with other brokers in the market. This represents a significant disadvantage for GIB in attracting new clients. This gib review emphasizes the importance of transparency in account conditions as a fundamental requirement for trader confidence.

GIB's trading tools and resources present a mixed picture based on available information. While the company claims to provide a "secure and transparent trading environment," specific details about trading platforms, analytical tools, and educational resources are notably absent from public documentation. This lack of specificity makes it challenging to assess the actual quality and comprehensiveness of tools available to traders.

The absence of information about trading platform options is particularly concerning. Platform quality significantly impacts trading success. Whether GIB offers MetaTrader 4, MetaTrader 5, proprietary platforms, or web-based solutions remains unclear.

Similarly, details about charting capabilities, technical indicators, automated trading support, and mobile trading applications are not available. Educational resources and market analysis tools are essential components of modern forex brokers' offerings, yet GIB's provision of these services is not documented. The lack of information about research capabilities, market commentary, economic calendars, or trading education materials suggests either limited offerings or poor communication of available resources.

The average rating reflects the uncertainty created by limited information rather than confirmed quality issues. However, the lack of transparency itself represents a significant limitation for traders seeking comprehensive trading support.

Customer Service and Support Analysis (Score: 6/10)

GIB's customer service infrastructure demonstrates some positive aspects while revealing areas for improvement. The company provides multiple contact channels including email, telephone, and social media platforms, which indicates recognition of diverse client communication preferences. This multi-channel approach aligns with industry best practices and provides flexibility for clients seeking assistance.

However, user feedback reveals concerns about service quality that temper the positive aspects of channel availability. Reports of negative customer experiences suggest that while access to support exists, the quality of assistance provided may not consistently meet client expectations. The specific nature of these complaints is not detailed in available documentation.

This makes it difficult to assess whether issues relate to response times, problem resolution effectiveness, or staff competence. The absence of information about support availability hours, multilingual capabilities, or specialized support for different account types represents additional limitations. Modern forex traders often require 24/5 support to align with global market hours, and the lack of clarity about GIB's support schedule may concern active traders.

Despite these limitations, the above-average rating reflects the company's effort to maintain multiple communication channels and some level of client support infrastructure. However, execution quality requires improvement.

Trading Experience Analysis (Score: 5/10)

The trading experience provided by GIB faces significant challenges based on available user feedback and information gaps. User reports specifically mention concerns about "poor equipment" and "management issues," which directly impact the quality of trading execution and overall client satisfaction. These fundamental problems suggest systemic issues that affect core trading operations.

Platform stability and execution quality are crucial factors in forex trading success. Negative user feedback in these areas raises serious concerns about GIB's technical infrastructure. Without specific information about order execution speeds, slippage rates, or platform uptime statistics, traders cannot adequately assess the reliability of trading conditions.

The lack of detailed information about available trading platforms, advanced order types, or specialized trading tools further complicates the assessment of trading experience quality. Modern traders expect features such as one-click trading, advanced charting, automated trading capabilities, and mobile platform access, yet GIB's provision of these features remains unclear. Spread stability, which significantly impacts trading costs and profitability, is not documented through available materials.

Similarly, information about market depth, liquidity provision, or execution models (market maker vs. ECN) is not available. This makes it difficult for traders to understand the trading environment they would encounter.

This gib review notes that the average rating reflects both documented concerns and uncertainty created by limited transparency. Both factors negatively impact trader confidence.

Trust and Regulation Analysis (Score: 6/10)

GIB's trust and regulatory profile presents a complex situation that requires careful analysis. The company's trust score of 67 indicates moderate risk levels, which places it in the middle range of broker reliability assessments. This score suggests that while significant red flags may not be present, traders should maintain appropriate caution when considering GIB for their trading activities.

The regulatory framework surrounding GIB creates both opportunities and concerns for potential clients. Registration in the United States provides some level of corporate legitimacy, though the absence of regulation by major US financial authorities such as the CFTC or NFA limits client protection in that jurisdiction. This regulatory gap is significant given the importance of oversight in forex trading operations.

However, GIB's compliance with BAPPEBTI and ICDX regulations in other markets provides some regulatory oversight and client protection mechanisms. These regulatory relationships demonstrate the company's willingness to operate within established frameworks, though the varying levels of protection across jurisdictions create complexity for international clients. The company's positive reputation in the insurance brokerage sector, including recognition as the best insurance brokerage company in the UK and high ratings in South Africa, provides some evidence of legitimate business operations.

However, success in insurance services does not automatically translate to forex trading excellence. These achievements should be considered separately.

The above-average rating reflects the mixed regulatory picture and moderate trust score while acknowledging the need for continued vigilance from potential clients.

User Experience Analysis (Score: 4/10)

User experience with GIB reveals significant challenges that impact client satisfaction and retention. Documented feedback specifically mentions "poor equipment" and "management issues," indicating systemic problems that affect multiple aspects of the client relationship. These fundamental concerns suggest that GIB struggles with basic operational requirements necessary for positive user experiences.

The lack of detailed information about user interface design, account management processes, and overall service delivery makes it difficult to assess specific areas of strength or weakness. However, the presence of negative feedback about core operational aspects suggests widespread issues that likely impact multiple touchpoints in the client journey. Registration and account verification processes are not well-documented, which may create uncertainty for potential clients about onboarding requirements and timelines.

Similarly, information about funding and withdrawal experiences is not available. These processes significantly impact overall user satisfaction, however. The absence of positive user testimonials or detailed success stories in available documentation suggests either limited client satisfaction or poor communication of positive experiences.

Modern brokers typically highlight client success and satisfaction as key marketing elements. GIB's apparent lack of such content may indicate underlying service quality issues.

The below-average rating reflects documented negative feedback and the overall lack of transparency about user experience elements that are typically highlighted by successful brokers. Improvement in operational quality and communication transparency would be necessary to enhance user experience ratings.

Conclusion

This comprehensive gib review reveals a broker with mixed performance across key evaluation criteria, resulting in an overall average rating that reflects both opportunities and significant concerns. GIB's position as a moderate-risk broker with a trust score of 67 accurately represents the complex picture that emerges from detailed analysis of available information and user feedback.

The broker appears most suitable for traders who prioritize diversified financial services and are particularly interested in insurance brokerage capabilities alongside forex trading. However, potential clients should carefully weigh the documented concerns about operational quality, transparency limitations, and mixed user feedback against their specific trading requirements and risk tolerance levels. GIB's primary advantages include its established market presence since 2004, recognition in the insurance sector, and multi-jurisdictional regulatory compliance.

These factors provide some foundation for institutional credibility and operational legitimacy. However, significant disadvantages include poor transparency in trading conditions, negative user feedback about equipment and management quality, and substantial information gaps in critical areas such as costs, platforms, and account conditions. Traders considering GIB should conduct thorough due diligence, request detailed information about trading conditions directly from the company, and carefully consider whether the broker's current service level aligns with their trading objectives and expectations for professional service delivery.