Regarding the legitimacy of CPT Markets forex brokers, it provides FCA, FSCA and WikiBit, (also has a graphic survey regarding security).

Is CPT Markets safe?

Pros

Cons

Is CPT Markets markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

CPT MARKETS UK LIMITED

Effective Date:

2014-07-31Email Address of Licensed Institution:

info@cptmarkets.co.uk, kieran.howard@cptmarkets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.cptmarkets.co.ukExpiration Time:

--Address of Licensed Institution:

Level 7 One Canada Square Canary Wharf London E14 5AA UNITED KINGDOMPhone Number of Licensed Institution:

+4402039882277Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

CPT MARKETS (PTY) LTD

Effective Date:

2015-06-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

6 KIKUYU ROAD SUNNINGHILL JOHANNESBURG GAUTENG GAUTENG 2191Phone Number of Licensed Institution:

011 236 8696Licensed Institution Certified Documents:

Is CPT Markets A Scam?

Introduction

CPT Markets is a forex and CFD broker that has established a presence in the online trading landscape since its inception in 2008. With its headquarters in Belize, the broker claims to provide a diverse range of trading instruments, including forex, commodities, and indices. However, the forex market is rife with potential scams and unreliable brokers, making it crucial for traders to conduct thorough evaluations before committing their funds. This article aims to objectively analyze the legitimacy of CPT Markets by exploring its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and associated risks. The findings are based on a comprehensive review of various sources, including regulatory bodies, user feedback, and expert analyses.

Regulation and Legitimacy

The regulatory framework is a critical aspect of any broker's legitimacy. CPT Markets operates under multiple regulatory authorities, which is a positive sign for potential clients. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 606110 | United Kingdom | Verified |

| IFSC | 000314/126 | Belize | Verified |

| FSCA | 45954 | South Africa | Verified |

CPT Markets is regulated by the Financial Conduct Authority (FCA) in the UK, the International Financial Services Commission (IFSC) in Belize, and the Financial Sector Conduct Authority (FSCA) in South Africa. The FCA is known for its stringent regulatory standards, which include requirements for client fund segregation, regular audits, and the implementation of anti-money laundering (AML) policies.

However, it is essential to note that the IFSC is considered a tier-3 regulatory authority, which may not impose the same level of oversight as tier-1 regulators like the FCA. This disparity raises questions about the broker's overall compliance and the effectiveness of the protections offered to clients. While there are no significant regulatory complaints against CPT Markets, potential clients should be cautious, particularly regarding the operations of the offshore entity in Belize.

Company Background Investigation

CPT Markets was founded in 2008 and has since expanded its operations across various regions, with offices in the UK, South Africa, and Belize. The broker is owned by CPT Markets Limited, which operates under the jurisdiction of Belize, while its UK operations are managed by CPT Markets UK Limited. This structure allows the broker to cater to a diverse clientele while adhering to different regulatory requirements.

The management team behind CPT Markets consists of individuals with extensive experience in the financial services industry. However, information about the specific members of the management team is somewhat limited, which may raise concerns regarding transparency. A thorough background check on the company's executives could provide valuable insights into their professional qualifications and commitment to ethical trading practices.

In terms of transparency, CPT Markets has a reasonably informative website that outlines its services, trading conditions, and regulatory compliance. However, the level of detail provided may not be sufficient for traders seeking comprehensive information before making a decision. Overall, while the company's background appears stable, the lack of detailed management information could be a potential red flag for some traders.

Trading Conditions Analysis

CPT Markets offers a variety of trading conditions that cater to different types of traders. The broker's fee structure is primarily based on spreads, which can vary depending on the account type. Below is a comparison of the core trading costs associated with CPT Markets:

| Fee Type | CPT Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.4 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

CPT Markets provides two main account types: the Classic account, which has a minimum deposit of $100 and spreads starting at 1.4 pips, and the Prime account, which requires a minimum deposit of $5,000 and offers tighter spreads from 0.7 pips. While the spreads are competitive, they are slightly above the industry average for major currency pairs.

One notable aspect of CPT Markets' trading conditions is the high leverage offered, which can go up to 1:1000. While high leverage can amplify profits, it also significantly increases the risk of substantial losses. Traders should exercise caution when utilizing high leverage, as it can lead to rapid account depletion.

Additionally, CPT Markets does not charge deposit or withdrawal fees, which is a positive aspect for traders looking to minimize their overall trading costs. However, some payment providers may impose their own fees, which could affect the final costs incurred by traders.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's legitimacy. CPT Markets has implemented several measures to ensure the security of its clients' funds. The broker maintains segregated accounts, which means that client funds are held separately from the broker's operating funds. This practice helps protect clients' capital in the event of the broker's insolvency.

Furthermore, CPT Markets offers negative balance protection, ensuring that clients cannot lose more than their initial deposit. This feature is particularly important in volatile market conditions, where rapid price movements could otherwise lead to significant losses beyond the deposited amount.

Despite these safety measures, it is crucial to consider the regulatory environment in which CPT Markets operates. The IFSC's oversight may not be as rigorous as that of the FCA, leading to potential concerns about the overall safety of client funds. While there have been no reported issues regarding fund security, traders should remain vigilant and conduct their own research before investing.

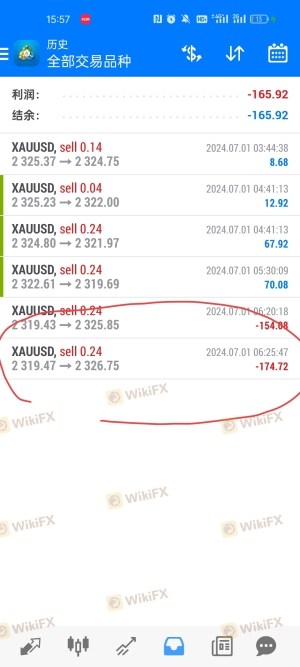

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reputation. CPT Markets has received mixed reviews from clients, with some praising its trading conditions and customer service, while others have reported issues related to withdrawals and account management.

Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Account Management Issues | Medium | Varies |

| Lack of Educational Resources | Low | Limited support |

One notable case involved a trader who experienced difficulties withdrawing funds, stating that the process was slow and cumbersome. While the company eventually resolved the issue, the delay raised concerns about the efficiency of its customer service.

Another trader reported satisfaction with the broker's trading conditions but expressed frustration over the lack of educational resources available to new traders. This feedback highlights a potential area for improvement in CPT Markets' service offerings.

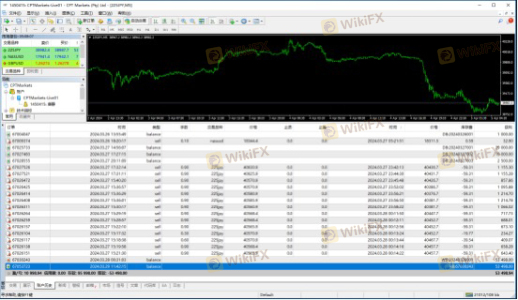

Platform and Execution

CPT Markets provides access to popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are well-regarded in the trading community for their user-friendly interfaces, advanced charting tools, and extensive analytical capabilities. The broker also claims to offer high execution speeds, which are crucial for traders looking to capitalize on market movements.

However, some users have reported experiencing slippage and rejected orders, particularly during periods of high volatility. While slippage is a common occurrence in the forex market, excessive slippage may indicate issues with the broker's execution quality. Traders should monitor their execution experiences closely and report any significant concerns to the broker.

Risk Assessment

Trading with CPT Markets involves several risks that potential clients should consider. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may offer less protection. |

| Leverage Risk | High | High leverage can lead to significant losses. |

| Withdrawal Risk | Medium | Some clients report slow withdrawal processing. |

| Execution Risk | Medium | Occasional slippage and rejected orders. |

To mitigate these risks, traders are advised to approach their trading with caution, utilize risk management strategies, and stay informed about market conditions. Additionally, it is essential to conduct thorough research before committing funds to any broker.

Conclusion and Recommendations

In conclusion, CPT Markets presents a mixed picture of legitimacy and potential risk. While the broker is regulated by multiple authorities, including the FCA, which provides a level of reassurance, the presence of an offshore entity raises concerns about the quality of oversight and client protection. The trading conditions, particularly the high leverage, may attract experienced traders but could pose significant risks for novices.

Overall, potential clients should carefully weigh the pros and cons before engaging with CPT Markets. For traders seeking a more secure environment, it may be prudent to consider alternatives with stronger regulatory frameworks and a proven track record of client satisfaction. Recommended alternatives include brokers regulated by tier-1 authorities, such as ASIC or the FCA, which provide more robust protections for traders.

Is CPT Markets a scam, or is it legit?

The latest exposure and evaluation content of CPT Markets brokers.

CPT Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CPT Markets latest industry rating score is 8.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.