Dukascopy Bank 2025 Review: Everything You Need to Know

Executive Summary

This dukascopy bank review looks at one of Switzerland's top online banking and trading companies. Dukascopy Bank SA started on November 2, 2004, and works as a regulated Swiss bank under the Financial Market Supervisory Authority (FINMA), offering forex trading, CFDs, and many financial services through their own technology solutions.

The broker shows mixed results in today's market. User feedback data shows Dukascopy Bank gets a 2.1 rating with only 25% of reviewers recommending the service, which means they need to improve customer satisfaction a lot. But the company makes up for this with strong regulatory credentials and a wide range of trading instruments with over 1,200 assets across multiple platforms including MT4, MT5, and their own JForex platform.

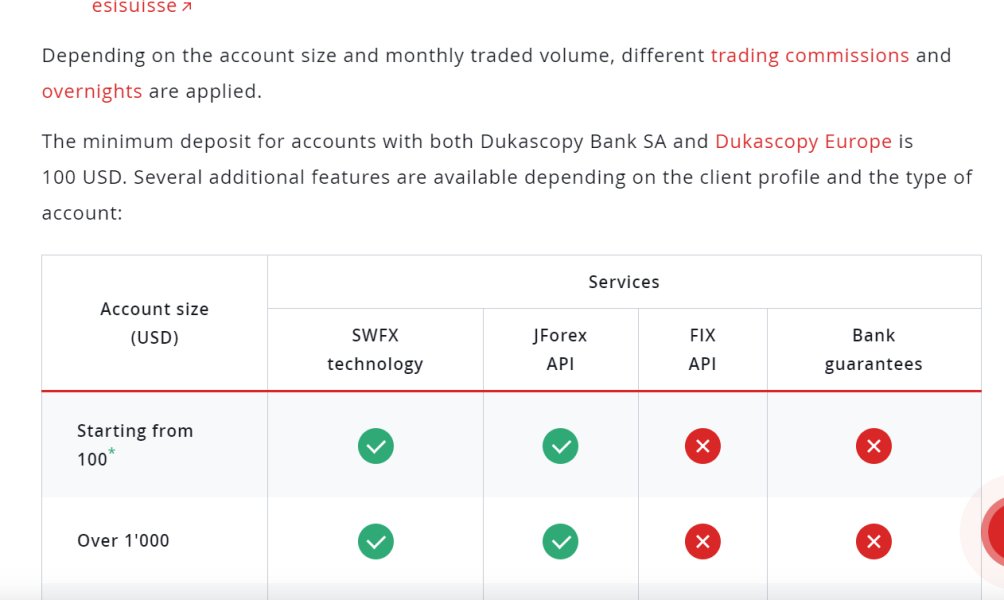

Dukascopy Bank mainly targets experienced traders and institutional clients who care about regulatory compliance, trading transparency, and execution quality more than excellent customer service. The broker's Swiss banking background and FINMA regulation give it strong credibility, while their different platform options work for various trading preferences and strategies. The minimum deposit of $100 makes the service available to retail traders, though the overall user experience suggests the platform works better for more sophisticated market participants who can handle potential service problems.

Important Disclaimer

Regional Entity Differences: Traders should know about big operational differences between Dukascopy entities across different areas. Dukascopy Bank SA offers leverage up to 1:200 with certain restrictions, while Dukascopy Europe IBS AS operates under EU regulations limiting leverage to 1:30. Dukascopy Japan K.K. operates as a Type-1 licensed broker with specific requirements for that area. These regulatory differences directly affect trading conditions, available instruments, and client protections depending on where you live.

Review Methodology: This evaluation combines data from multiple sources including official company information, regulatory filings, user feedback platforms, and industry analysis. All assessments reflect publicly available information and user experiences as of 2025, with focus on factual accuracy and balanced perspective.

Rating Framework

Broker Overview

Dukascopy Bank SA started in the Swiss financial world in November 2004. Andre and Veronika Duka founded the Geneva-based institution and still own 99% of it. The company positioned itself as an innovative online bank specializing in internet-based and mobile trading services, with particular focus on foreign exchange, precious metals, CFDs, and binary options trading. Operating under Swiss banking regulations, Dukascopy has expanded through subsidiary operations including Dukascopy Europe IBS AS in Riga and Dukascopy Japan in Tokyo, creating a multi-area presence while keeping centralized Swiss oversight.

The broker's business model focuses on providing complete financial services through their own technology solutions. This distinguishes it from many competitors who rely only on third-party platforms. According to company information, Dukascopy Bank serves active traders, hedge funds, banks, and financial professionals, showing a focus on institutional and sophisticated retail clients. The platform supports multiple trading environments including MetaTrader 4, MetaTrader 5, and their signature JForex platform, working with diverse trading preferences and strategies. With over 1,200 trading instruments spanning forex pairs, commodities, equities, and cryptocurrencies, the broker offers extensive market access under the supervision of Switzerland's Financial Market Supervisory Authority (FINMA), which regulates the institution both as a bank and securities firm.

Regulatory Jurisdictions: Dukascopy Bank SA operates under Swiss Financial Market Supervisory Authority (FINMA) regulation. This provides strong oversight as both a banking institution and securities firm. This dual regulatory status enhances client protection and operational transparency compared to broker-only entities.

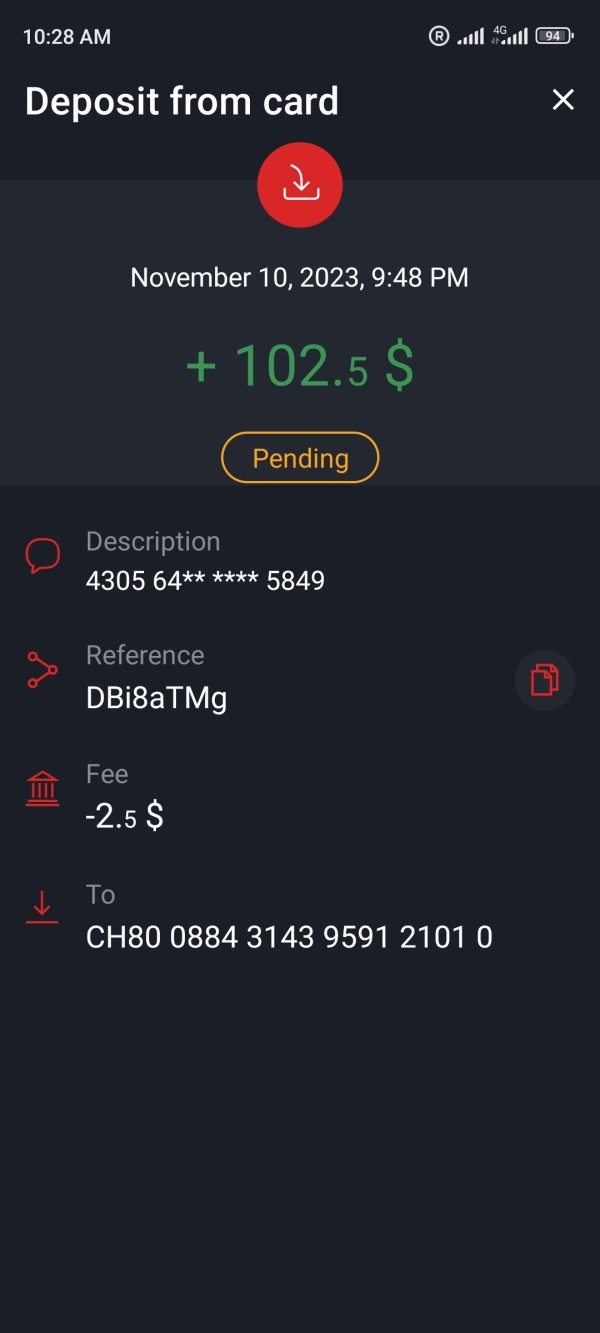

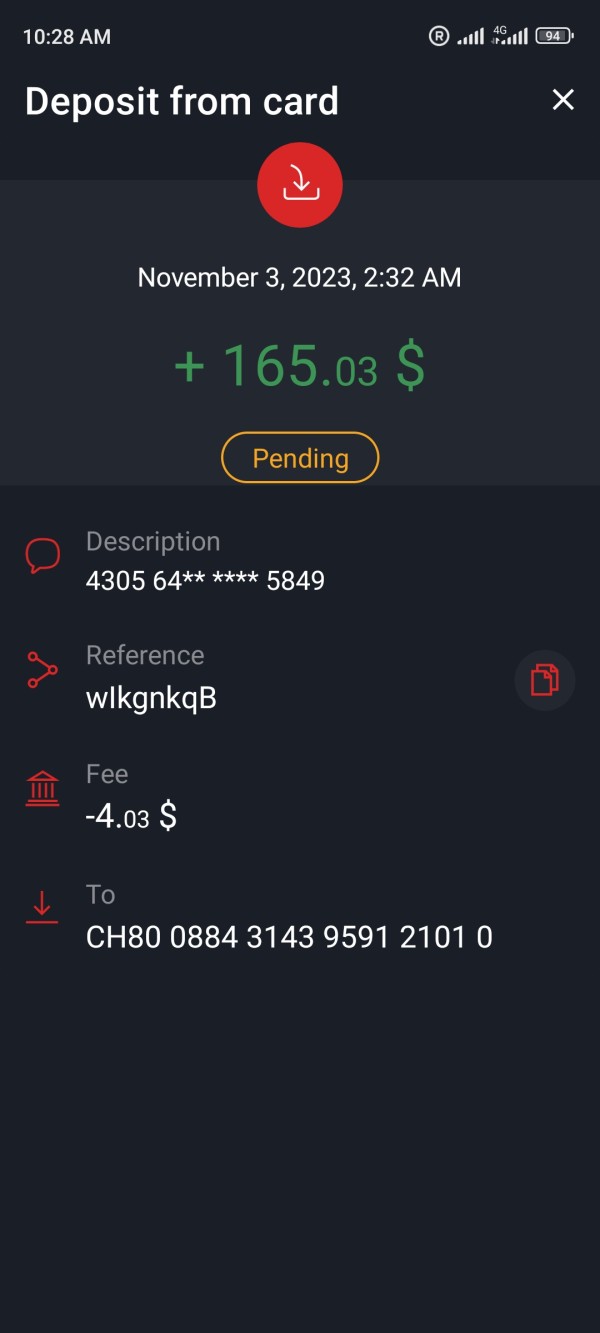

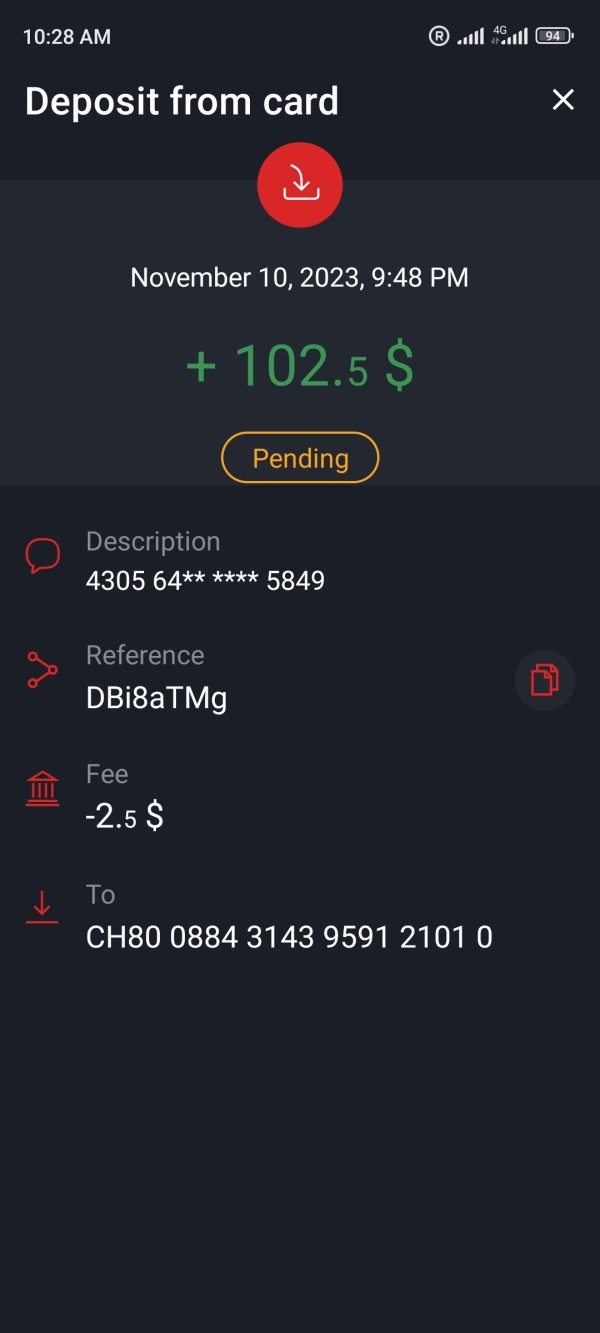

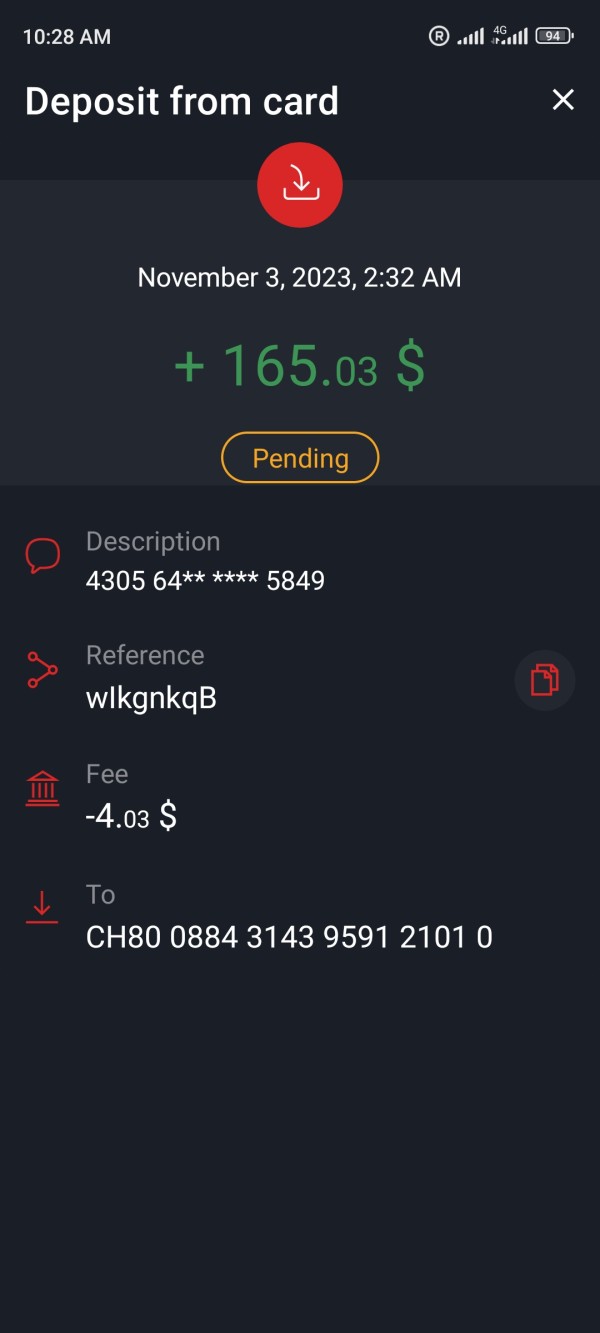

Deposit and Withdrawal Methods: Specific funding options are not detailed in available documentation. Swiss banking standards typically include bank transfers, credit cards, and electronic payment systems. The regulatory framework ensures segregated client funds for enhanced security.

Minimum Deposit Requirements: The platform requires a minimum deposit of $100. This positions it accessibly for retail traders while maintaining institutional service capabilities.

Promotional Offers: Current bonus and promotional information is not specified in available materials. This suggests the broker focuses on service quality over marketing incentives.

Available Trading Assets: Dukascopy provides access to over 1,200 trading instruments across multiple asset classes. These include foreign exchange pairs, precious metals, commodities, stock CFDs, and cryptocurrency products, offering comprehensive market exposure.

Fee Structure: Specific spread and commission details are not provided in source materials. The broker advertises competitive pricing structures typical of Swiss financial institutions, though traders should verify current rates directly.

Leverage Options: Maximum leverage reaches 1:200 for Dukascopy Bank SA clients. However, Dukascopy Europe IBS AS operates under EU restrictions limiting leverage to 1:30, demonstrating regulatory compliance across areas.

Platform Selection: The broker supports MetaTrader 4, MetaTrader 5, and proprietary JForex platforms. This accommodates various trading styles from automated strategies to advanced charting requirements.

Geographic Restrictions: Different regional entities operate under distinct regulatory frameworks. This affects available services, leverage limits, and client protections based on trader residence.

Customer Support Languages: Specific language support details are not documented in available sources. Swiss banking standards typically include multiple European languages.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

Dukascopy Bank's account structure reflects its dual nature as both a Swiss bank and online broker. The dukascopy bank review users get a foundation built on regulatory compliance rather than promotional incentives. The $100 minimum deposit requirement positions the service competitively within the retail trading space, though this accessibility contrasts with the platform's apparent focus on institutional and professional traders. According to available information, the broker maintains multiple account types across its various regional entities, though specific tier details and associated benefits are not fully documented in source materials.

The leverage offering demonstrates regulatory sophistication. Dukascopy Bank SA provides up to 1:200 leverage while European operations comply with ESMA restrictions at 1:30. This awareness of different areas indicates professional regulatory management, though it may create confusion for international clients. User feedback suggests account opening processes are straightforward, though some reviewers note documentation requirements typical of Swiss banking standards. The absence of detailed information about Islamic accounts or specific account features suggests either limited availability or inadequate marketing of these services. Overall, account conditions meet industry standards with regulatory compliance as the primary strength, though enhanced transparency about account types and features would improve the offering.

The platform's technology infrastructure represents a significant strength. It supports multiple trading environments including MetaTrader 4, MetaTrader 5, and the proprietary JForex platform. This diverse platform offering accommodates various trading approaches from algorithmic strategies to manual analysis, with JForex particularly noted for its advanced charting capabilities and institutional-grade features. According to user feedback, the platform stability and execution quality receive positive recognition, suggesting robust technological foundations supporting the trading infrastructure.

Educational resources appear comprehensive according to available information. These include webinars, tutorials, and market analysis, though specific details about content quality and frequency are not documented in source materials. The broker's research and analysis offerings are not extensively detailed, representing a potential information gap for prospective clients. Automated trading support through MetaTrader platforms and JForex provides algorithmic trading capabilities, appealing to systematic traders and institutional clients. The availability of over 1,200 trading instruments across multiple asset classes enhances the platform's utility for diversified trading strategies. However, the lack of detailed information about mobile trading capabilities and advanced tools suggests either limited offerings or insufficient documentation of available features.

Customer Service and Support Analysis (5/10)

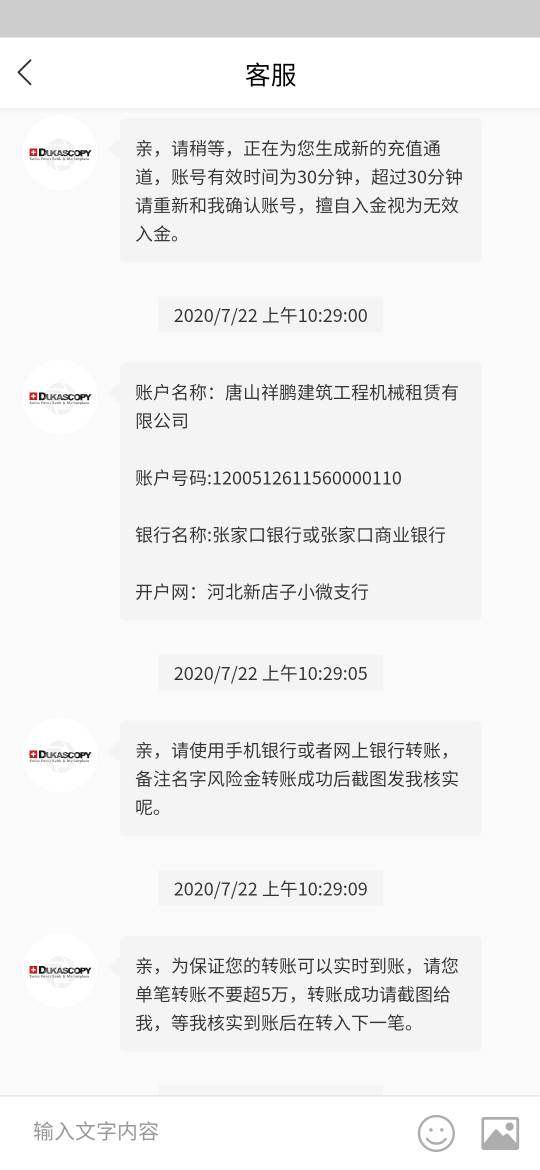

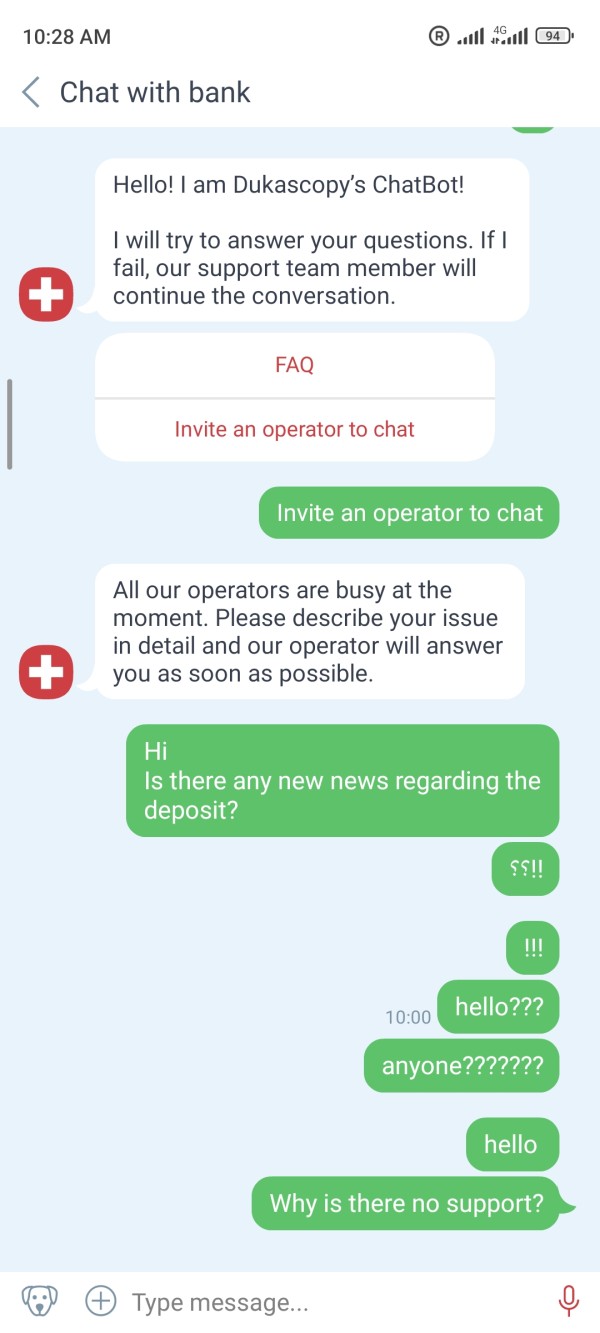

Customer service represents Dukascopy Bank's most significant challenge according to available user feedback. The 2.1 overall rating and 25% recommendation rate are largely attributed to service quality concerns. User reviews consistently highlight slow response times and inadequate support quality, suggesting systemic issues in customer service delivery rather than isolated incidents. The availability of phone, email, and online chat support channels meets industry standards, but execution quality appears to fall short of user expectations.

Response time concerns appear particularly problematic according to user feedback. Multiple reviewers cite delays in issue resolution and communication. This pattern suggests either insufficient staffing levels or inadequate training protocols for customer service representatives. The multilingual support capabilities are not specifically documented, though Swiss banking standards typically include major European languages. Service hour availability is not detailed in source materials, potentially indicating limited coverage or poor communication of available support times.

The disconnect between the broker's institutional positioning and retail customer service quality suggests a strategic focus mismatch. Institutional clients may receive adequate support while retail traders experience substandard service. This service quality gap represents a significant operational weakness requiring attention to improve overall client satisfaction and retention rates.

Trading Experience Analysis (7/10)

Platform stability and execution speed receive positive user feedback. This indicates robust technological infrastructure supporting the trading environment. Users consistently praise execution quality and transparency, suggesting the broker maintains professional standards in trade processing and pricing. The availability of multiple platform options allows traders to select environments matching their specific requirements, from MetaTrader's familiar interface to JForex's advanced institutional features.

Order execution quality appears satisfactory according to user experiences. However, specific data regarding slippage rates and requote frequency are not documented in available sources. The platform's technical analysis capabilities through multiple charting packages provide comprehensive market analysis tools, supporting informed trading decisions across various timeframes and strategies. Mobile trading support is mentioned but not detailed, representing a potential limitation in today's mobile-focused trading environment.

This dukascopy bank review indicates that while core trading functionality meets professional standards, the overall trading experience benefits from strong execution quality and platform stability. However, limited specific information about spreads, liquidity providers, and detailed execution statistics prevents a complete assessment of trading conditions. The competitive spread claims require verification through direct testing, as source materials do not provide specific pricing data for comparison purposes.

Trust and Safety Analysis (8/10)

Regulatory credentials represent Dukascopy Bank's primary strength. FINMA supervision provides comprehensive oversight as both a banking institution and securities firm. This dual regulatory status exceeds typical broker oversight, offering enhanced client protections and operational transparency. The Swiss regulatory environment maintains rigorous standards for financial institutions, providing substantial credibility for international clients seeking regulated trading environments.

Client fund segregation policies align with Swiss banking standards and FINMA requirements. This ensures customer deposits remain separate from operational funds. This protection mechanism provides security beyond typical broker segregation requirements, benefiting from Swiss banking privacy and security traditions. The company's ownership structure, with founders maintaining 99% control, provides operational stability and clear accountability, though it may limit external oversight compared to publicly traded entities.

Industry reputation appears solid based on regulatory standing. However, specific awards or recognition are not documented in available sources. The absence of reported negative regulatory actions or significant controversies suggests consistent regulatory compliance, supporting the trust profile. However, the limited transparency regarding financial reporting and management information represents a potential improvement area for enhanced client confidence. Overall, the regulatory foundation provides strong trust credentials, though operational transparency could be enhanced to match the regulatory credibility.

User Experience Analysis (6/10)

Overall user satisfaction metrics reveal significant challenges. The 2.1 rating and 25% recommendation rate indicate widespread dissatisfaction among the user base. This low satisfaction level appears primarily driven by customer service issues rather than platform functionality, suggesting operational rather than technological problems. User feedback indicates reasonable interface design and platform usability, though specific details about user interface quality are not extensively documented.

Registration and account verification processes are not detailed in available sources. Swiss banking standards typically require comprehensive documentation and verification procedures. These requirements may contribute to user frustration if not properly communicated or streamlined. Fund operation experiences are not specifically documented, though Swiss banking infrastructure typically provides reliable transfer capabilities.

Common user complaints center on customer service quality and response times. Multiple reviewers cite communication difficulties and slow issue resolution. This pattern suggests systemic service delivery problems requiring operational improvements. The user profile analysis indicates the platform may be better suited for experienced traders who can navigate service limitations while benefiting from platform capabilities and regulatory protections.

Improvement recommendations focus primarily on customer service enhancement. These include faster response times, improved communication protocols, and enhanced support quality. These operational improvements could significantly impact user satisfaction without requiring major technological changes to the trading infrastructure.

Conclusion

This comprehensive dukascopy bank review reveals a broker with strong regulatory foundations and technological capabilities but significant operational challenges in customer service delivery. Dukascopy Bank SA offers robust Swiss regulatory oversight, diverse trading platforms, and extensive market access through over 1,200 instruments, making it potentially suitable for experienced traders who prioritize regulatory compliance and execution quality over customer service excellence.

The platform best serves sophisticated traders, institutional clients, and those specifically seeking Swiss-regulated trading environments who can navigate potential service limitations while benefiting from strong regulatory protections and platform capabilities. However, retail traders expecting responsive customer support may find the service quality disappointing based on current user feedback patterns.

Key advantages include FINMA regulation, multiple platform options, competitive minimum deposits, and strong execution quality. Primary disadvantages center on poor customer service ratings, limited service transparency, and inconsistent user satisfaction metrics. Prospective clients should carefully weigh regulatory benefits against service quality concerns when considering Dukascopy Bank for their trading requirements.