Founded in 1986, SogoTrade, based in Chesterfield, MO, was initially designed to cater to price-sensitive traders looking for a low-cost trading experience. It has evolved to accommodate both self-directed investors and those seeking options for cost-effective trading strategies. While SogoTrade positions itself as a viable option for active traders, it lacks some modern features that other brokers offer, making it potentially less appealing for more sophisticated trading techniques.

SogoTrade specializes in various asset classes, primarily focusing on U.S. stocks, options, and ETFs, with a recent expansion into cryptocurrency through partnerships with third-party providers. The broker provides different platforms aimed at varying levels of trading expertise: SogoOnline for general trading, SogoOptions specifically for options trading, and SogoElite aimed at traders handling higher volumes with more advanced needs. Overall, SogoTrades reliance on minimal fees does attract a particular demographic but might alienate others looking for extensive investment opportunities.

The reliability of SogoTrade is a critical component for potential users, particularly given the conflicts in regulatory information and user feedback.

- Check the claims of regulation by verifying through regulatory body websites.

- Research the broker's reputation via independent review sites.

- Inquiries into user experiences around fund safety are crucial.

Industry Reputation Summary: Feedback highlights a mix of experiences. For example:

"I had no issues trading at first, but attempts to withdraw my funds led to long delays and unresponsive customer support."

Trading Costs Analysis

While SogoTrade generally offers low commission rates, the fact that other trading platforms now offer commission-free trading shifts the competitive landscape significantly.

Advantages in Commissions: The brokerage charges $2.88 per trade for active traders executing more than 150 trades per quarter. For lower volumes, this rises to $4.88. Given the option to purchase prepaid trades, users may also enjoy rates as low as $2.88 or $3.88 depending on the package chosen.

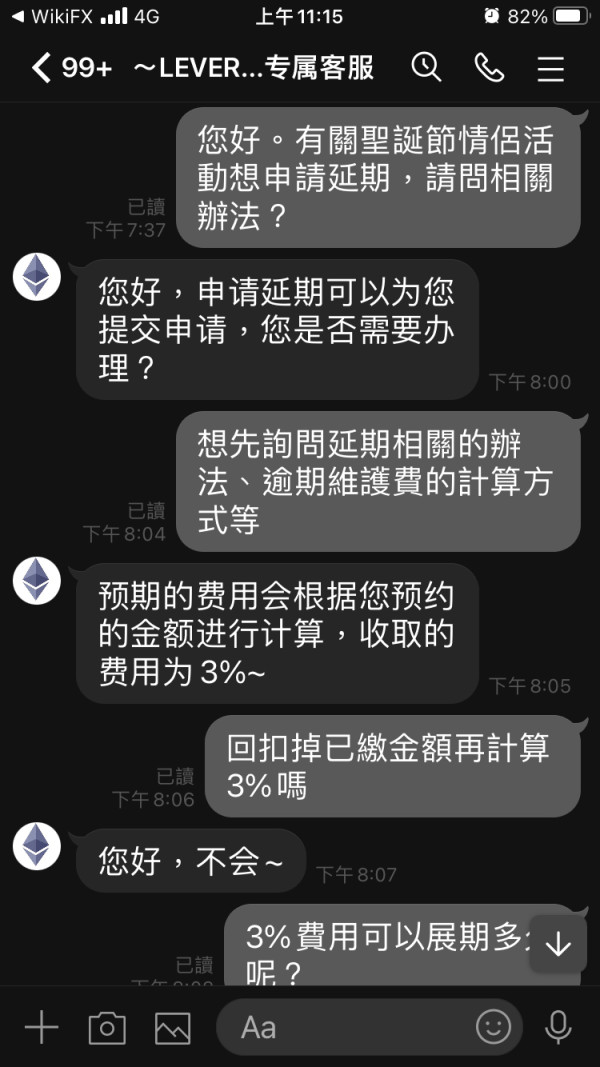

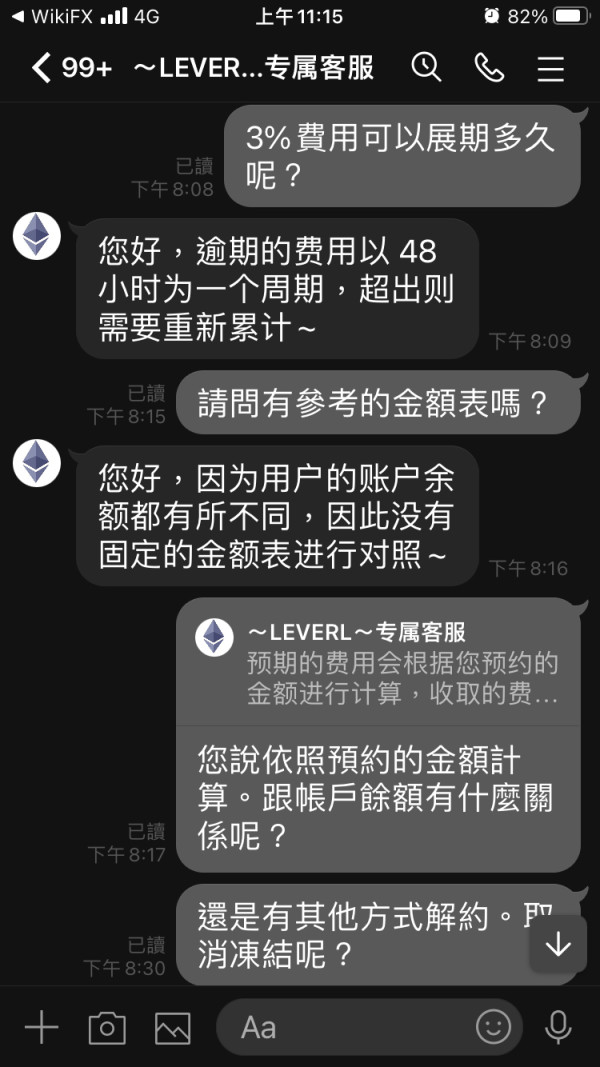

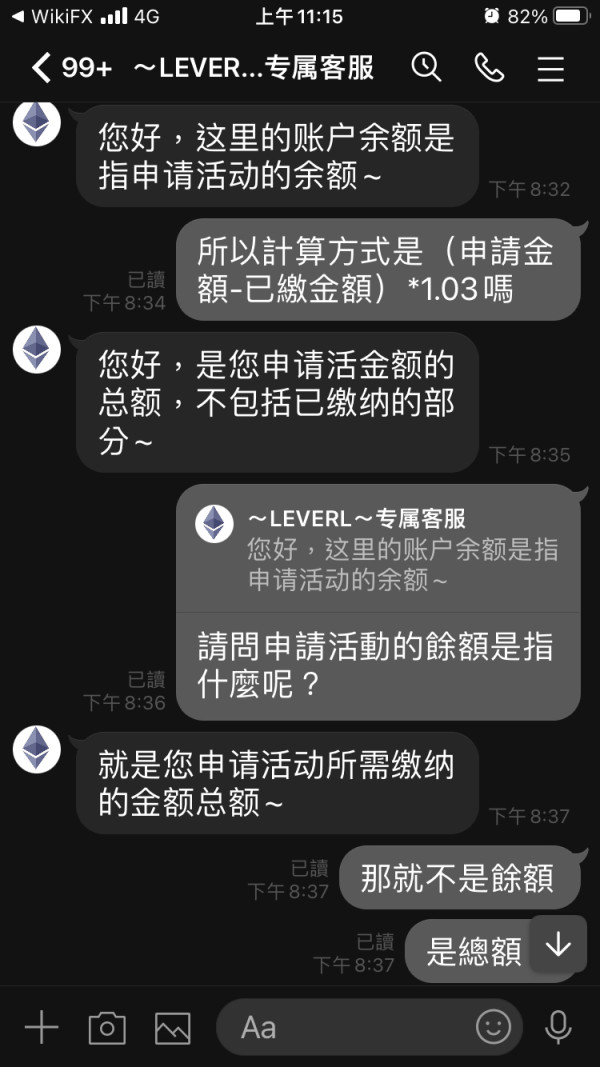

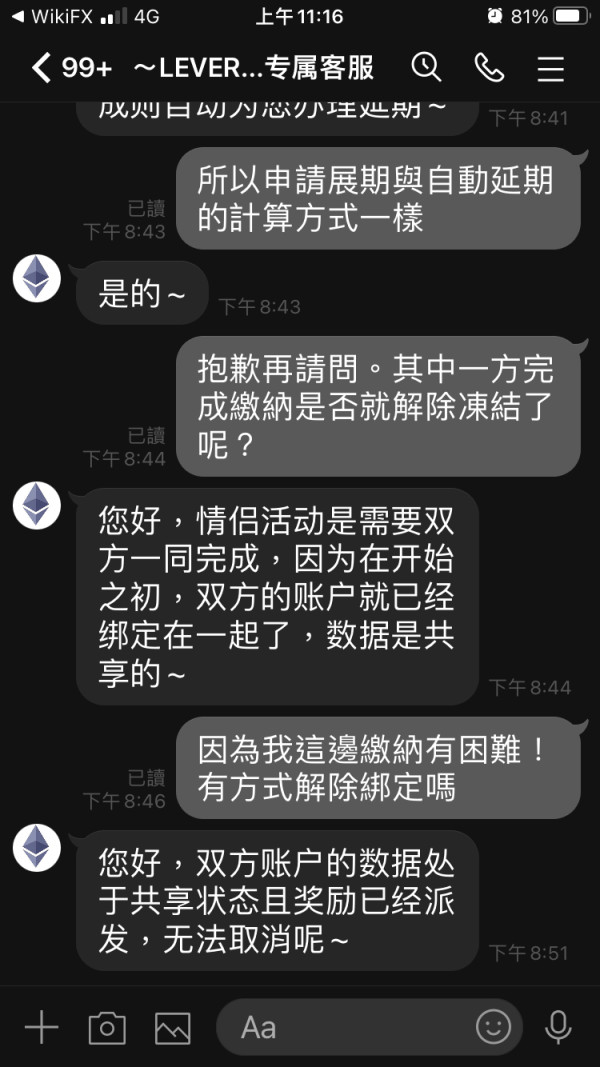

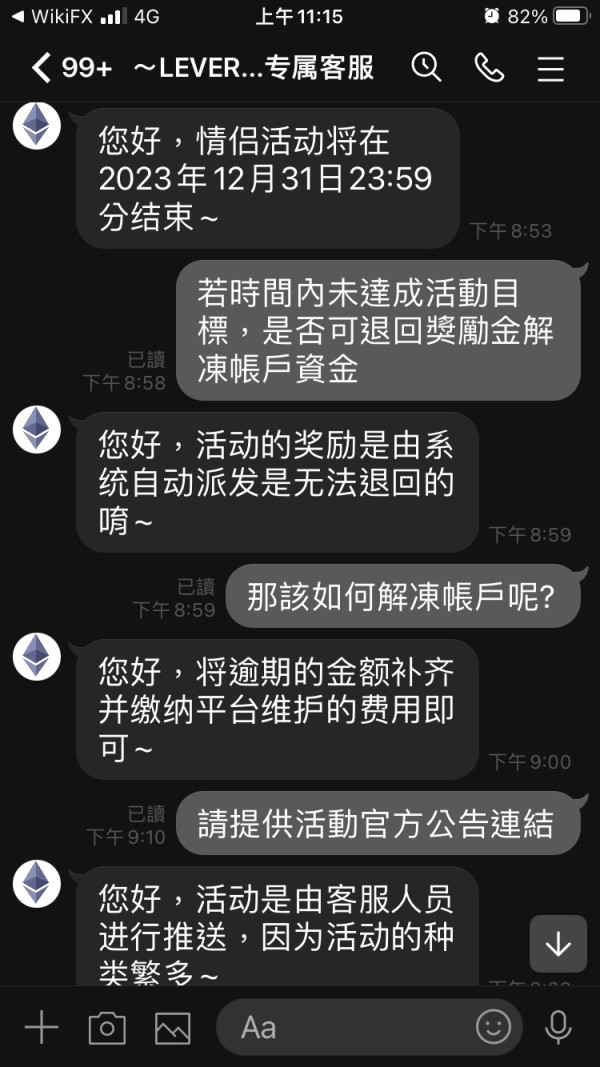

Non-Trading Fees: Users have expressed dissatisfaction over fees such as $50 for withdrawals outside the U.S. and complaints about the hidden costs associated with certain trading actions. For instance:

"I incurred a $30 withdrawal fee that was not clearly specified initially."

Cost Structure Summary: In summary, while the commissions may initially appear attractive, hidden fees can diminish the benefits for infrequent traders.

Platform Diversity: SogoTrade provides various platforms but typically lacks the modern features that serious traders demand. The primary platforms include SogoOnline for basic trading and SogoOptions for options trading, which has received higher praise for its capabilities.

Quality of Tools and Resources: Despite the array of platforms, users report limited access to advanced charting and analysis tools, leading to mixed reviews about usability and overall functionality, particularly compared to other brokers using more robust platforms.

Platform Experience Summary:

"While the SogoOptions platform satisfies options traders' needs, the main trading platform feels dated with basic features."

User Experience Analysis

User Interface and Accessibility: SogoTrade's interface has received varied responses; it is accessible but not particularly user-friendly for complex trades.

Educational Resources: The educational offerings on SogoTrade are deemed insufficient for beginner investors, with many materials being basic and lacking the depth required for newer traders to feel empowered in their decisions.

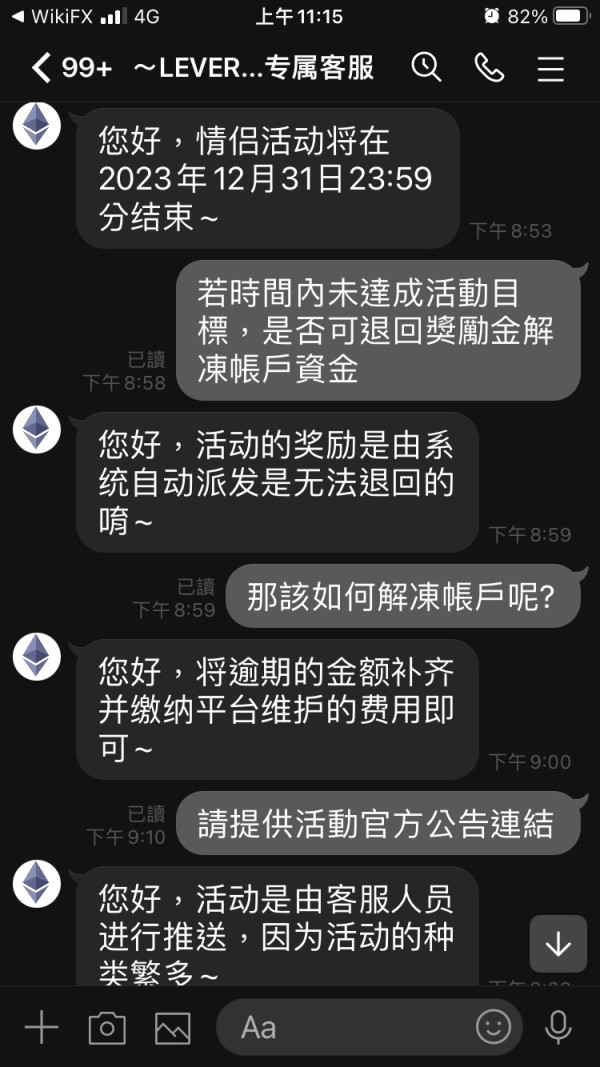

Overall User Sentiment: Many reviews indicate dissatisfaction with customer support, which exacerbates many users' trading experiences.

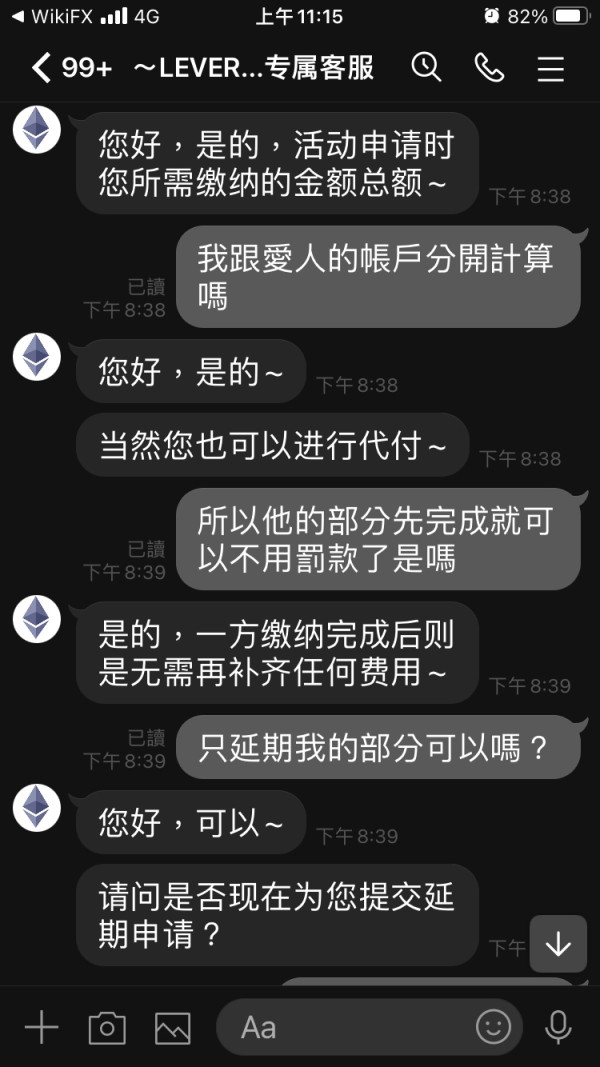

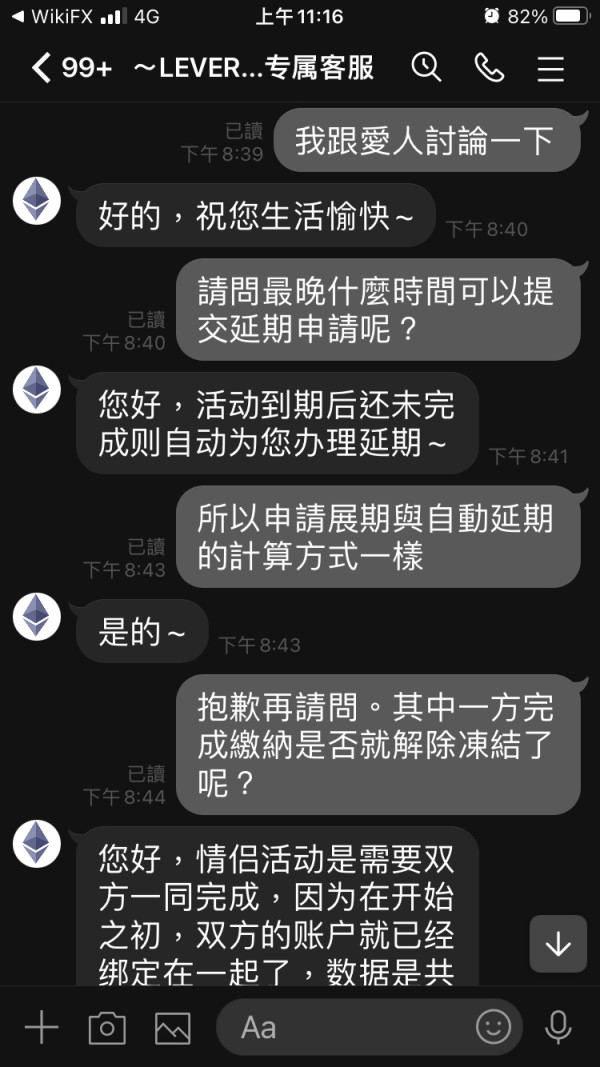

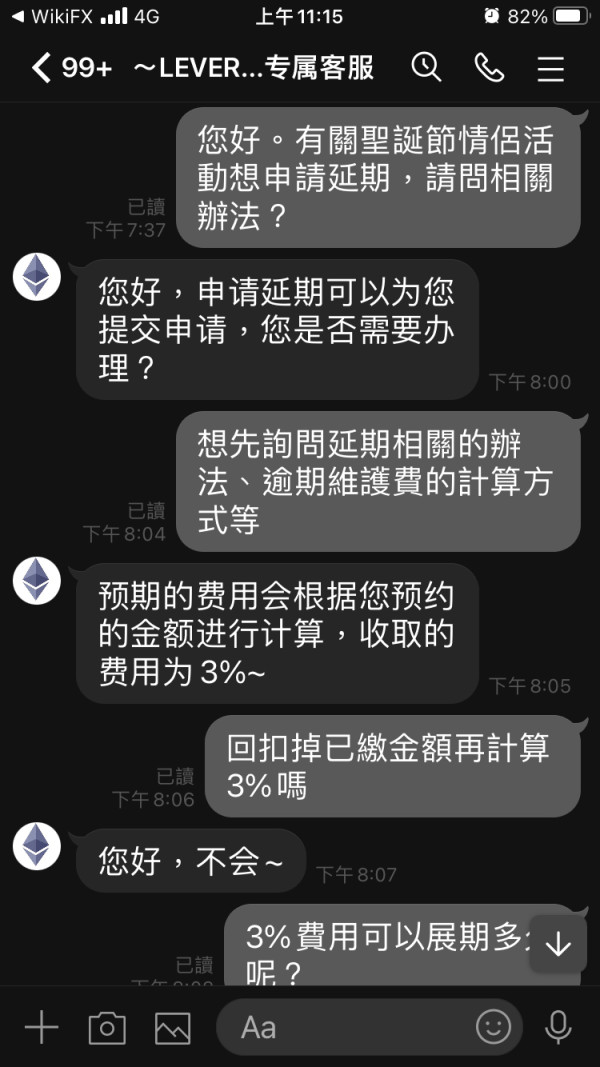

Customer Support Analysis

Availability of Support: Customer support is operational from Monday to Friday, 7 AM to 8 PM ET, but lacks 24/7 availability which can frustrate users requiring help during market hours.

Quality of Support: Reviewers have criticized the quality of customer interactions, citing long wait times and unhelpful responses as a recurring issue. For example:

"It took over 30 minutes to get through, and when I finally was helped, my question remained unanswered."

Comparison with Competitors: Compared to other brokers, SogoTrade's customer service appears lacking, with some firms offering more immediate assistance.

Account Conditions Analysis

Account Types Offered: SogoTrade provides various account types including individual, joint, business, and IRA accounts—all without a minimum deposit requirement on standard accounts.

Minimum Deposit and Fees: Opening an account is straightforward, requiring only personal identification information. However, users should remain mindful of a $50 charge specifically for wire withdrawal to non-U.S. customers.

Withdrawal Policies: Complicated feedback from the user base indicates withdrawal processes raise concerns. Many users report delayed access to funds and intricate workflows to retrieve money.

Quality Control

It's critical to balance both positive and negative aspects by addressing user experiences across different platforms to give potential traders an accurate view of SogoTrade.

Further clarity is needed regarding customer service response times, regulatory affiliations, and user experiences specifically relating to the withdrawal process.

In conclusion, while SogoTrade may present an attractive low-cost trading option for experienced and active traders, prospective users should weigh the significant risks highlighted in this review and proceed with due diligence to ensure their trading experience is as seamless and beneficial as possible.