Regarding the legitimacy of Dukascopy Bank forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is Dukascopy Bank safe?

Pros

Cons

Is Dukascopy Bank markets regulated?

The regulatory license is the strongest proof.

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

デューカスコピー・ジャパン株式会社

Effective Date: Change Record

2010-06-08Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都中央区銀座2-14-4銀座スクエア6階Phone Number of Licensed Institution:

03-4332-7430Licensed Institution Certified Documents:

Is Dukascopy Bank A Scam?

Introduction

Dukascopy Bank, established in 2004 and headquartered in Switzerland, is a well-known player in the forex trading market. It operates as both a bank and a broker, combining innovative banking solutions with advanced trading technology. This dual role allows Dukascopy to provide a unique trading environment, particularly for forex and CFD traders. However, as the financial landscape continues to evolve, the importance of thoroughly assessing the credibility of forex brokers has never been more critical. Traders must remain vigilant against potential scams and unethical practices that can jeopardize their investments.

In this article, we will conduct a comprehensive analysis of Dukascopy Bank, focusing on its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk assessment. Our investigation is based on various sources, including regulatory databases, customer reviews, and financial analyses, ensuring a balanced and factual representation of the broker's operations.

Regulation and Legitimacy

Dukascopy Bank is regulated by several top-tier financial authorities, which is a significant factor in determining its legitimacy. Regulatory oversight is crucial in the forex industry, as it ensures that brokers adhere to strict financial standards and consumer protection laws. Below is a summary of Dukascopy's regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| FINMA | CHE-112.086.322 | Switzerland | Verified |

| FCMC | 40003344762 | Latvia | Verified |

| FSA | 3010401095833 | Japan | Verified |

Dukascopy Bank is regulated by the Swiss Financial Market Supervisory Authority (FINMA), which is known for its stringent regulations and high standards of financial integrity. The bank also holds licenses from the Financial and Capital Market Commission (FCMC) in Latvia and the Financial Services Agency (FSA) in Japan. This multi-jurisdictional regulation enhances Dukascopy's credibility, as it is subject to rigorous scrutiny and compliance checks from multiple authorities.

The historical compliance record of Dukascopy is commendable, with no significant regulatory breaches reported. This track record, combined with its robust regulatory framework, suggests that Dukascopy is a legitimate broker that operates within the confines of the law, reducing the risk of fraudulent activities.

Company Background Investigation

Dukascopy Bank was founded by Andre and Veronika Duka, who continue to hold a significant ownership stake in the company. Since its inception, the bank has evolved into a comprehensive financial institution, offering a range of services that extend beyond forex trading. The company's growth trajectory has been marked by the introduction of innovative technological solutions, including the SWFX Swiss FX Marketplace, which connects traders to a vast pool of liquidity.

The management team at Dukascopy is composed of experienced professionals with backgrounds in finance, technology, and banking. Their expertise is reflected in the bank's commitment to transparency and customer service. Dukascopy has made significant strides in maintaining a high level of operational transparency, regularly publishing financial reports and updates on its website. This commitment to information disclosure is essential in building trust with clients and stakeholders.

Overall, Dukascopy's strong foundation, experienced management, and transparent operations contribute to its reputation as a reliable broker in the forex market.

Trading Conditions Analysis

Dukascopy Bank offers competitive trading conditions, characterized by low spreads and a transparent fee structure. The overall cost of trading with Dukascopy can be broken down into several key components:

| Fee Type | Dukascopy Bank | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | 0.5 pips |

| Commission Model | $7 per million traded | $10 per million traded |

| Overnight Interest Range | Varies by position | Varies by broker |

The average spread for major currency pairs, such as EUR/USD, starts from a very competitive 0.1 pips, which is significantly lower than the industry average. Additionally, Dukascopy employs a commission-based model, charging $7 per million traded, which is also favorable compared to other brokers.

However, traders should be aware of potential hidden fees, particularly regarding overnight positions and withdrawals. While Dukascopy aims to maintain transparency, some users have reported confusion regarding specific charges, such as withdrawal fees and inactivity fees, which can accumulate if accounts remain dormant for extended periods.

In summary, Dukascopy's trading conditions are generally favorable, but traders should carefully review all fees and commissions associated with their accounts to avoid unexpected costs.

Customer Fund Security

The safety of customer funds is a paramount concern for any trader. Dukascopy Bank has implemented several measures to ensure the security of its clients' deposits. Client funds are held in segregated accounts, which means they are kept separate from the bank's operational funds. This practice is crucial in protecting client assets in the event of financial difficulties faced by the broker.

Additionally, Dukascopy is a member of the Swiss deposit insurance scheme, which protects deposits up to CHF 100,000. For clients of Dukascopy Europe, the protection limit is EUR 20,000. This insurance provides an added layer of security for traders, ensuring that their funds are safeguarded against potential insolvency.

While Dukascopy has maintained a strong record regarding fund security, it is essential for traders to remain vigilant and monitor any updates regarding the broker's financial health. Historical incidents of fund safety issues have not been reported, further reinforcing Dukascopy's reputation as a secure trading entity.

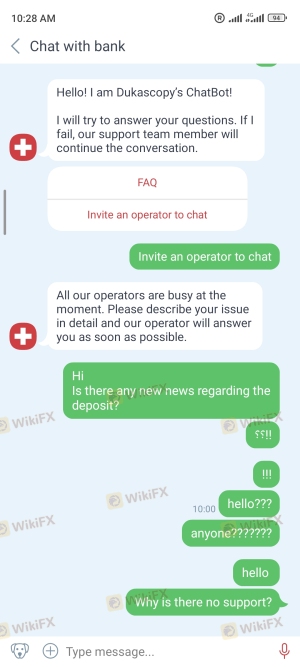

Customer Experience and Complaints

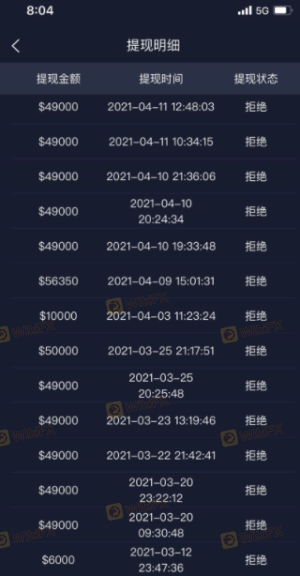

Customer feedback is a valuable indicator of a broker's reliability and service quality. Overall, Dukascopy has received a mix of positive and negative reviews from users. Many traders praise the broker for its competitive spreads, advanced trading platforms, and responsive customer support. However, some users have reported issues related to account verification and withdrawal processes.

The following table summarizes common complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Generally responsive |

| Account Verification Issues | High | Slow response times |

| Platform Stability | Medium | Ongoing improvements |

Typical cases include users experiencing delays in fund withdrawals, which can lead to frustration and distrust. In some instances, traders have reported that the account verification process can be lengthy and cumbersome, although this is often attributed to the broker's stringent compliance with regulatory requirements.

Despite these complaints, Dukascopy generally responds to user inquiries and concerns in a timely manner, indicating a commitment to customer service. The broker's active engagement with its client base through forums and social media further enhances its reputation.

Platform and Trade Execution

Dukascopy offers a range of trading platforms, including its proprietary JForex platform and the popular MetaTrader 4 (MT4). The JForex platform is known for its advanced features, including algorithmic trading capabilities and comprehensive charting tools. Users have reported that the platform is stable and user-friendly, although it may require a learning curve for beginners.

In terms of order execution, Dukascopy operates on a straight-through processing (STP) model, which eliminates the need for a dealing desk and minimizes the potential for price manipulation. Traders have reported low slippage rates and a high level of execution reliability, which are critical factors for successful trading.

However, some users have raised concerns about occasional platform outages or slow performance during peak trading hours. Dukascopy has acknowledged these issues and is actively working to enhance the platform's stability and performance.

Risk Assessment

Using Dukascopy as a trading platform comes with its own set of risks. Below is a risk scorecard that summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by top-tier authorities |

| Financial Risk | Medium | Market volatility can affect trading outcomes |

| Operational Risk | Medium | Occasional platform outages reported |

| Customer Service Risk | Medium | Complaints about withdrawal delays |

To mitigate these risks, traders should ensure they have a solid understanding of market dynamics, maintain a diversified portfolio, and stay informed about any updates or changes to Dukascopy's services.

Conclusion and Recommendations

In conclusion, Dukascopy Bank appears to be a legitimate and well-regulated broker with a strong reputation in the forex market. Its compliance with multiple regulatory authorities, robust security measures, and competitive trading conditions contribute to its credibility. While there are some areas of concern, such as occasional withdrawal delays and account verification issues, the overall feedback from users indicates that Dukascopy is a reliable choice for traders.

Traders looking for a reputable broker should consider Dukascopy, particularly those who value advanced trading platforms and a wide range of financial instruments. However, it is advisable for beginners to familiarize themselves with the platform and trading conditions before committing significant funds. For those seeking alternatives, brokers like IC Markets and OANDA may provide equally competitive trading conditions with different features that cater to various trading styles.

Is Dukascopy Bank a scam, or is it legit?

The latest exposure and evaluation content of Dukascopy Bank brokers.

Dukascopy Bank Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Dukascopy Bank latest industry rating score is 7.22, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.22 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.