Huajin 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Huajin is a Hong Kong-based brokerage service that markets itself as a comprehensive platform for trading forex and CFDs. Founded in 2013, the broker has positioned itself to provide a range of financial instruments at competitive rates, making it appealing to experienced traders who prioritize low costs. However, the absence of robust regulation and a troubling history of negative user experiences raise significant red flags about fund safety and overall trustworthiness. While Huajin offers potential opportunities for skilled traders willing to accept higher risks, its troubled reputation may deter more cautious investors. It is crucial for prospective clients to weigh the attractive trading options against potential operational drawbacks before making a decision.

⚠️ Important Risk Advisory & Verification Steps

Before engaging with Huajin, potential users should consider the following vital risk advisory:

- Risk Statement: Huajin operates without strict regulatory oversight, which exposes traders to possible risks in fund management and operational practices.

- Potential Harms: Users may face difficulties in withdrawal processes, market manipulation issues, and inadequate customer support.

Self-Verification Guide:

- Check Regulatory Status: Confirm if the broker holds any licenses from recognized financial authorities.

- Read User Reviews: Explore feedback from other traders regarding their experiences, particularly about withdrawal processes.

- Test Customer Support: Contact the support team to gauge their responsiveness and professionalism.

- Assess the Trading Platform: Start with minimal investments to evaluate the platforms functionality and reliability before larger commitments.

Rating Framework

Broker Overview

Company Background and Positioning

Huajin Financial (International) Holdings Limited, established in 2013, is centralized in Hong Kong, operating from Suite 1101, 11/F, Champion Tower, 3 Garden Road, Central, H.K. While the company seeks to capitalize on the rapidly-growing trading market, particularly in the Greater Bay Area, its reputation has been marred by concerns around governance practices and regulatory compliance. The firm's connection to the Zhuhai Huafa Group, a well-known state-owned enterprise, provides a degree of legitimacy; however, the brokerage's lack of comprehensive operational oversight and user issues significantly detract from its standing in the market.

Core Business Overview

Huajin primarily caters to retail traders by providing access to a diverse range of financial instruments, including forex trading, contracts for difference (CFDs), and commodity trading. The brokerage employs an in-house trading platform, but it does not offer widely recognized trading platforms such as MetaTrader 4 or MetaTrader 5, which can limit usability for traders accustomed to these tools. Therefore, its offerings appeal more to those seeking cost-effective solutions rather than a feature-rich trading environment.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

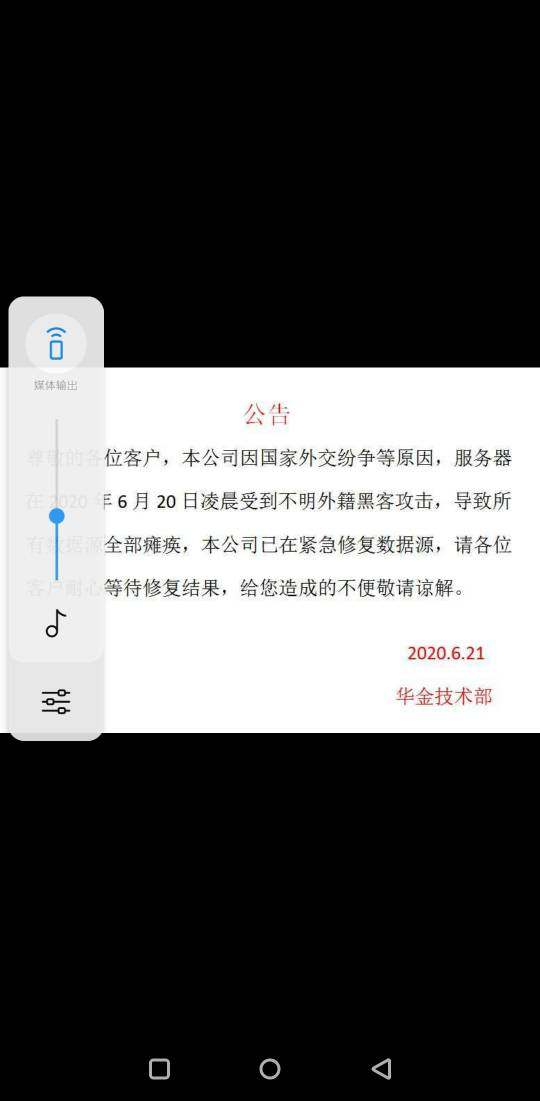

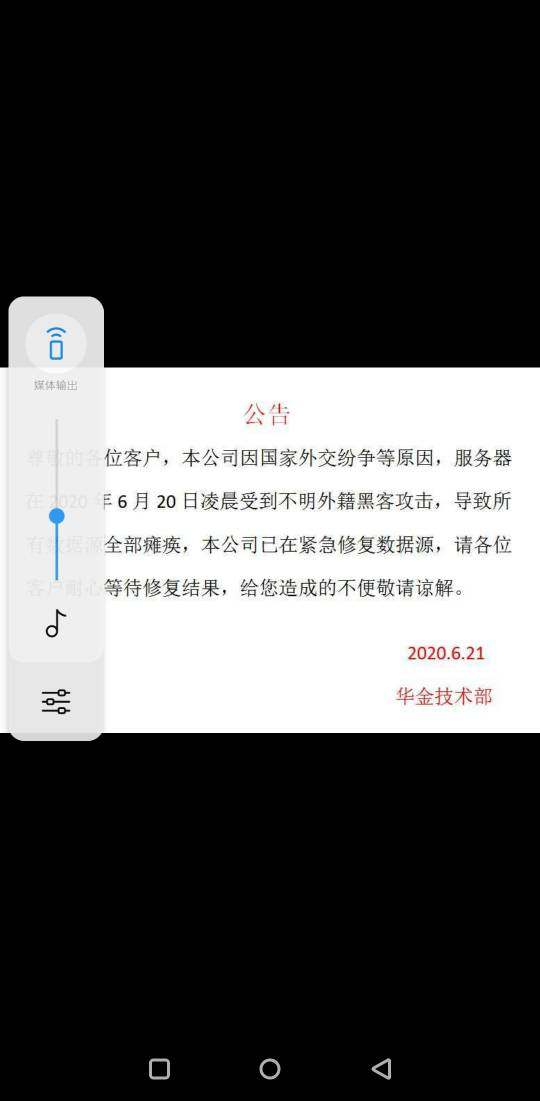

Huajin's operating status is heavily questioned due to its absence of regulatory oversight. This raises alarms about the safety of client funds and overall ethical practices.

The lack of robust regulation prompts significant doubts about the firm's reliability. Reports indicate a disparity between its marketed regulatory status and actual compliance with industry standards. As one review puts it:

“Huajin International is based in an unsafe tax haven with a very bad reputation and numerous complaints” ("Is Huajin International a scam? Opinions of 2023").

Given these inconsistencies, it is imperative for potential users to exercise caution.

To further assess Huajins legitimacy, prospective clients should consider the following self-verification steps:

- Visit the official regulatory body‘s website to verify the broker’s claimed licenses.

- Read through user testimonials on well-known trading review platforms.

- Investigate online forums for discussions about withdrawal issues or any potential scams related to Huajin.

- Contact the customer support team and gauge the effectiveness of their responses.

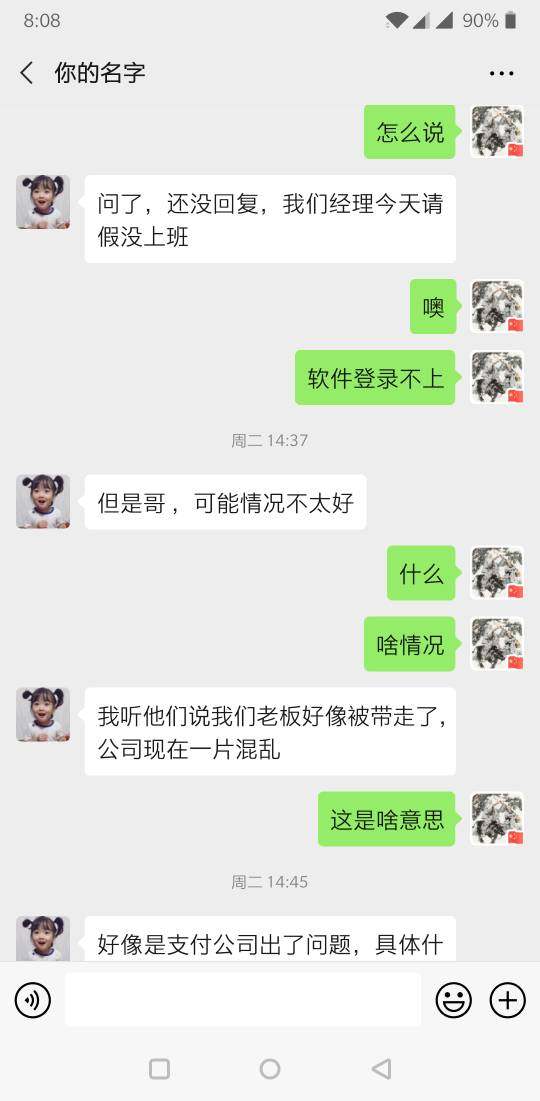

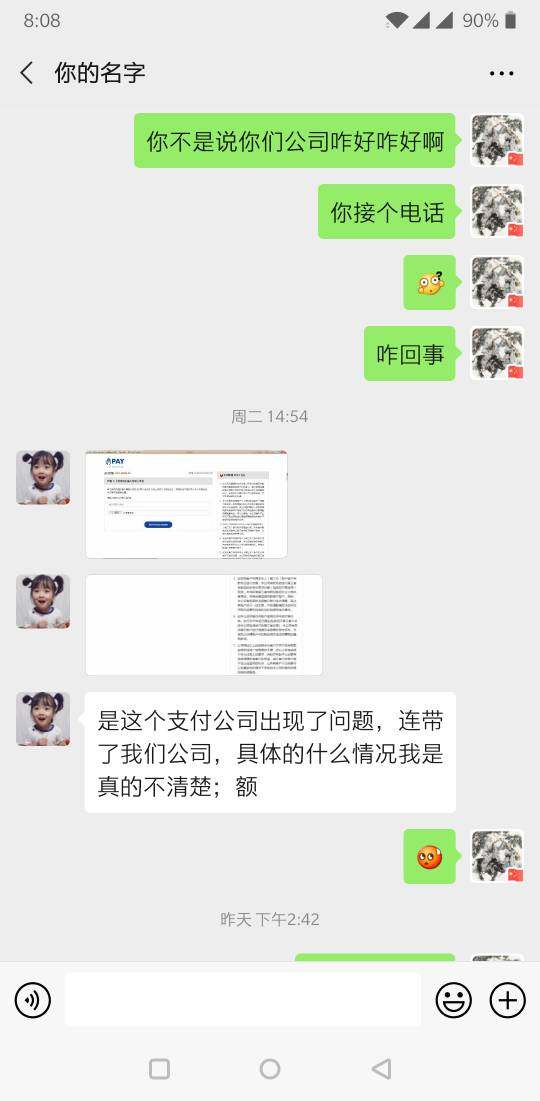

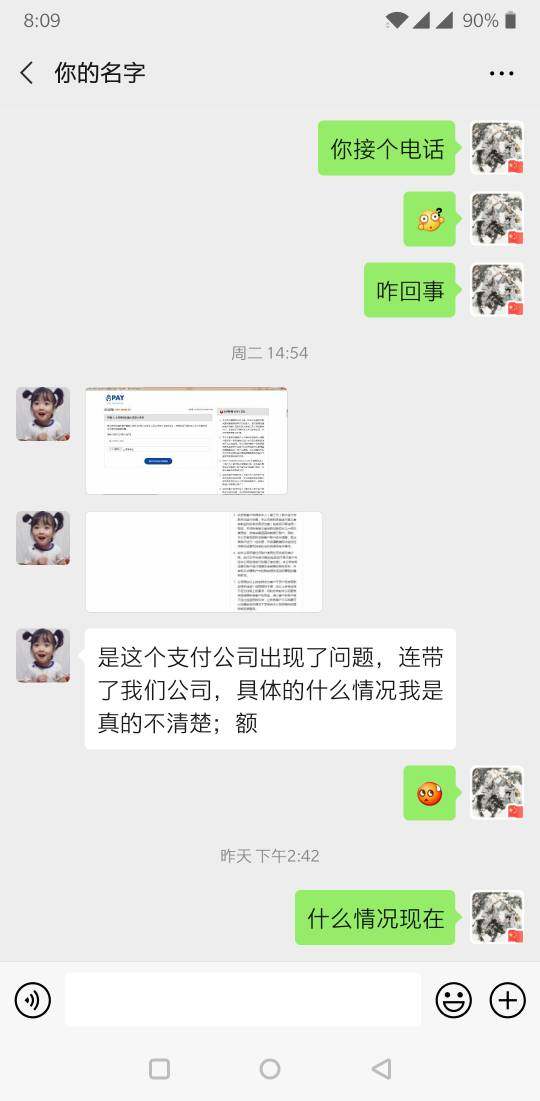

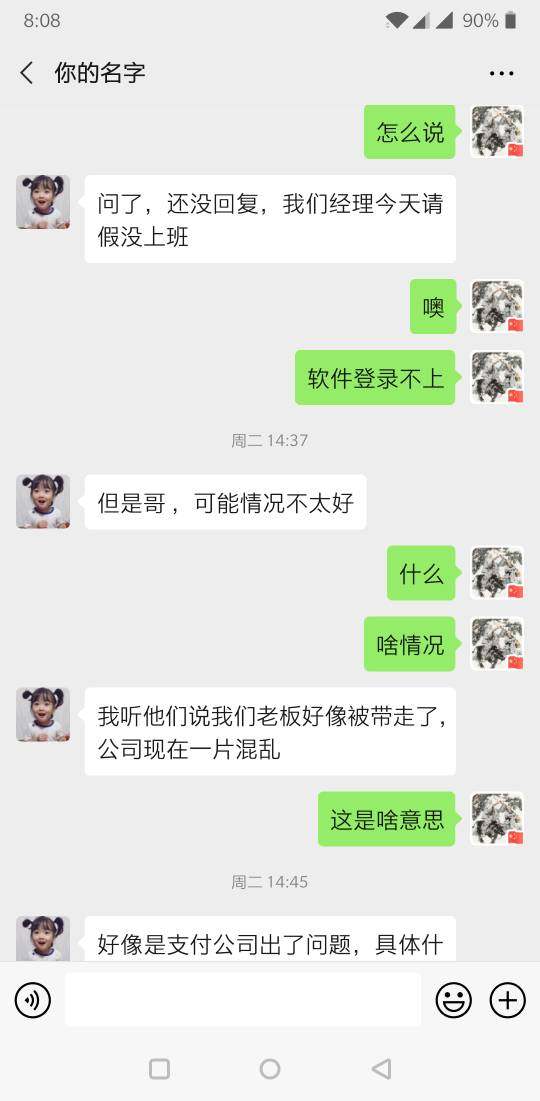

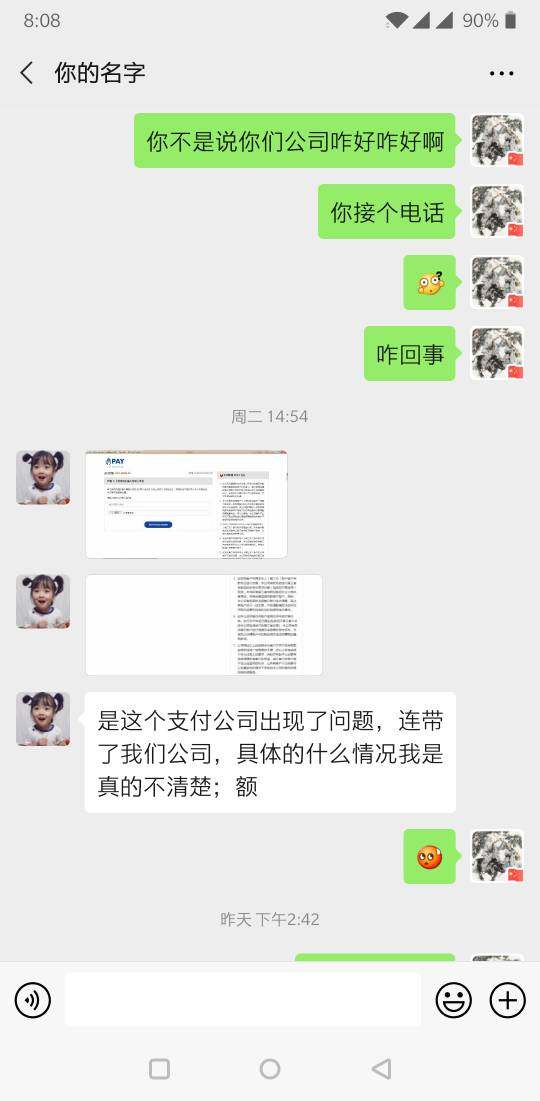

User feedback has pointed towards a worrying trend concerning fund safety, supporting the notion that operational inefficiencies may complicate the user experience.

Trading Costs Analysis

Huajin markets itself broadly on competitive trading costs, showcasing low commission fees on trades aimed at attracting savvy investors.

The pricing structure presents several advantages, particularly for active traders. For instance, trading costs can be significantly lower than those seen in regulated entities. However, the trading experience can present pitfalls related to non-trading fees:

“Users have reported hidden fees that surfaced during withdrawals, leading to frustration and distrust” ("Huajin International: Is it a scam?").

Investors should familiarize themselves with the total cost of trading, as things like account maintenance fees may apply, which detracts from the overall value proposition Huajin presents.

In summary, the cost structure may be appealing to certain trader profiles but should be thoroughly vetted against potential hidden costs and the overall satisfaction of trading.

When it comes to trading platforms, Huajins offerings fall short of industry standards. The platform is basic and does not include popular solutions such as MetaTrader 4 or MetaTrader 5, which many traders prefer for their robust features.

The limited array of platforms may alienate novice traders who could greatly benefit from more sophisticated tools. Reports indicate that the platform's analytics capabilities are lacking:

“The platform offers little more than basic functionality for trading” ("PediaFX Review on Huajin").

Moreover, the educational resources are not extensive, which hinders beginner traders attempting to enhance their trading skills. While experienced traders may make do with the available platform, the learning curve could prove challenging for novices.

In conclusion, while there is an initial appeal in Huajin's low costs, the subpar platform usability may deter clients who require a comprehensive trading environment.

User Experience Analysis

User experience feedback is mixed at best, with many reviews indicating dissatisfaction with execution speed and customer service. Traders have reported experiencing delays during trading executions—potentially leading to adverse outcomes in fast-moving markets.

Various traders have described their frustrations:

Not only did I experience significant delays in my trading executions, but I also found the customer support lacking when I needed assistance" ("Huajin Review 2023").

These complaints underline a troubling trend as they suggest that user experience may not foster a favorable trading environment.

Customer Support Analysis

The customer support arrangements at Huajin provide limited operational hours, which can pose a serious issue for traders who may need assistance at irregular hours due to market volatility. Feedback often highlights these deficiencies:

“Responses from customer support are often slow, leading to increased frustration especially when trying to address urgent issues” ("PediaFX Review on Huajin").

A solid customer support structure is fundamental, especially during significant market shifts, and it becomes a source of frustration when responsiveness and effectiveness fall short.

Account Conditions Analysis

Huajin offers a basic account setup with no separate types of trading accounts, which limits flexibility for trades. The absence of distinct account features that cater to varying trader needs delineates Huajin from many competitors in the market.

Additionally, new traders, in particular, may feel constrained by the lack of options typically available through regulated brokers. While some may find the single account sufficient, others seeking tailored trading conditions may need to look elsewhere.

In conclusion, while the company attempts to appeal to a broad audience, its one-size-fits-all account model can result in unmet expectations for diverse trading demands.

Final Thoughts

While Huajin presents an enticing prospect for experienced traders with its low-cost trading options and access to forex and CFDs, users must carefully consider the potential operational pitfalls. The lack of adequate regulation, persistent user complaints, and mixed feedback on the trading experience collectively raise significant concerns surrounding safety and reliability.

Prospective users should approach Huajin with caution, ensuring thorough verification of its claims while weighing the balance between opportunity and risk before committing their funds.