Bank of China 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive bank of china review examines one of China's largest state-owned financial institutions and its international operations. Based on available user feedback and credit assessments, Bank of China presents a mixed profile for potential clients. According to Yelp user evaluations, the bank faces significant challenges in customer service delivery. This results in mostly negative user experiences and poor overall reputation among retail customers.

However, the institution demonstrates notable strengths in its financial stability and creditworthiness. Fitch Ratings has assigned Bank of China an "A" credit rating. This indicates strong government support potential and solid financial fundamentals. The bank's extensive international presence and cross-border services make it particularly relevant for clients requiring global custody services and cross-border investment solutions, especially within Asian markets.

The bank's service portfolio includes RQFII funds, offshore RMB public funds, and QDII products. This positions it as a potential option for investors seeking exposure to Chinese markets. Despite these institutional strengths, prospective clients should carefully consider the reported service quality issues when evaluating Bank of China for their financial needs.

Important Notice

Regional Entity Variations: Bank of China operates through various subsidiaries and branches across different jurisdictions. Each entity is subject to local regulatory frameworks. For instance, Bank of China Hong Kong Limited Jakarta Branch operates under Indonesian regulatory oversight, including supervision by the Financial Services Authority and Bank Indonesia. Services, products, and regulatory protections may vary significantly between different regional entities and should be evaluated independently.

Review Methodology: This evaluation is based on publicly available information, user feedback from platforms such as Yelp, credit rating assessments from Fitch Ratings, and official regulatory disclosures. Given the limited availability of comprehensive trading-specific data, this review focuses on available institutional information and user experiences.

Rating Framework

Broker Overview

Bank of China stands as one of China's four largest state-owned commercial banks. It has an extensive international footprint spanning multiple continents. While specific founding details are not detailed in available materials, the institution has established itself as a significant player in international banking and cross-border financial services. The bank operates as a long-term foreign currency issuer with substantial government backing. This contributes to its strong institutional credit profile.

The bank's business model encompasses traditional banking services alongside specialized international offerings. According to Fitch Ratings, Bank of China maintains an "A" long-term issuer default rating with a stable outlook. This reflects the institution's solid financial foundation and the high probability of government support. This rating positions the bank among the more creditworthy financial institutions globally.

Regarding trading and investment services, Bank of China provides cross-border and global custodian services through its well-established international network. The institution offers access to RQFII funds, offshore RMB public funds, and QDII products. These services cater to clients seeking exposure to Chinese markets and cross-border investment opportunities. The bank's regulatory oversight varies by jurisdiction, with operations such as the Jakarta Branch supervised by Indonesian financial authorities including the Financial Services Authority and Bank Indonesia.

Regulatory Oversight: Bank of China Hong Kong Limited Jakarta Branch operates under dual supervision from the Financial Services Authority and Bank Indonesia. It has deposit insurance protection through the Deposit Insurance Corporation.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available materials. However, the bank operates an extensive branch network in Hong Kong and provides internet banking services.

Minimum Deposit Requirements: Detailed minimum deposit thresholds are not specified in the available documentation.

Promotional Offers: No specific bonus or promotional programs are mentioned in the available information.

Available Assets: The bank provides access to RQFII funds, offshore RMB public funds, and QDII products. It also offers traditional banking services and cash management solutions for institutional clients.

Cost Structure: Specific information regarding spreads, commissions, and fee structures for trading services is not available in the current documentation.

Leverage Options: Leverage ratios and margin requirements are not specified in the available materials.

Platform Selection: Trading platform details are not provided in the accessible information. However, the bank offers internet banking services.

Geographic Restrictions: Services may vary by jurisdiction. Different regulatory frameworks apply to various international branches and subsidiaries.

Customer Support Languages: Specific language support information is not detailed in the available materials. However, the bank operates internationally across multiple regions.

This bank of china review highlights the significant information gaps regarding specific trading conditions and retail client services. Potential clients should investigate these details directly with the institution.

Account Conditions Analysis

The available information does not provide comprehensive details about Bank of China's account types, structures, or specific conditions for retail trading clients. This represents a significant limitation for potential clients seeking to understand the bank's account offerings and requirements.

Regarding minimum deposit requirements, the documentation does not specify particular thresholds for different account categories. This lack of transparency may pose challenges for prospective clients attempting to assess their eligibility and initial investment requirements.

The account opening process and associated procedures are not detailed in the available materials. Without information about documentation requirements, verification timelines, or onboarding procedures, potential clients cannot adequately prepare for the account establishment process.

Specialized account features, such as Islamic banking options or specific regional account variants, are not mentioned in the accessible documentation. This bank of china review cannot provide guidance on whether such specialized services are available.

The absence of detailed account condition information suggests that prospective clients should contact Bank of China directly. They need to obtain comprehensive details about account types, requirements, and associated terms and conditions.

The available documentation does not provide specific information about trading tools, analytical resources, or technological platforms offered by Bank of China for retail trading clients. This represents a significant gap in understanding the bank's technological capabilities and support infrastructure.

Research and analysis resources that might be available to clients are not detailed in the accessible materials. Without information about market research, economic analysis, or investment guidance tools, potential clients cannot assess the bank's value-added services.

Educational resources, including training materials, webinars, or market education programs, are not mentioned in the available documentation. This lack of information prevents evaluation of the bank's commitment to client education and skill development.

Automated trading support, algorithmic trading capabilities, or API access for institutional clients are not addressed in the current materials. The absence of such information limits understanding of the bank's technological sophistication and support for advanced trading strategies.

The limited information available suggests that Bank of China may focus more on traditional banking services rather than comprehensive trading tools and resources. However, this cannot be definitively concluded without more detailed documentation.

Customer Service and Support Analysis

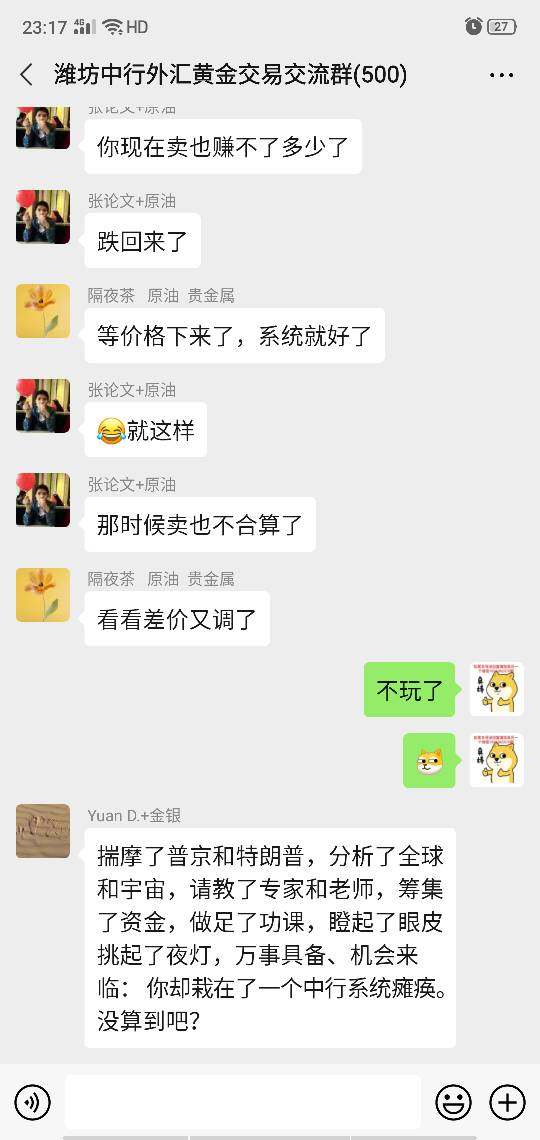

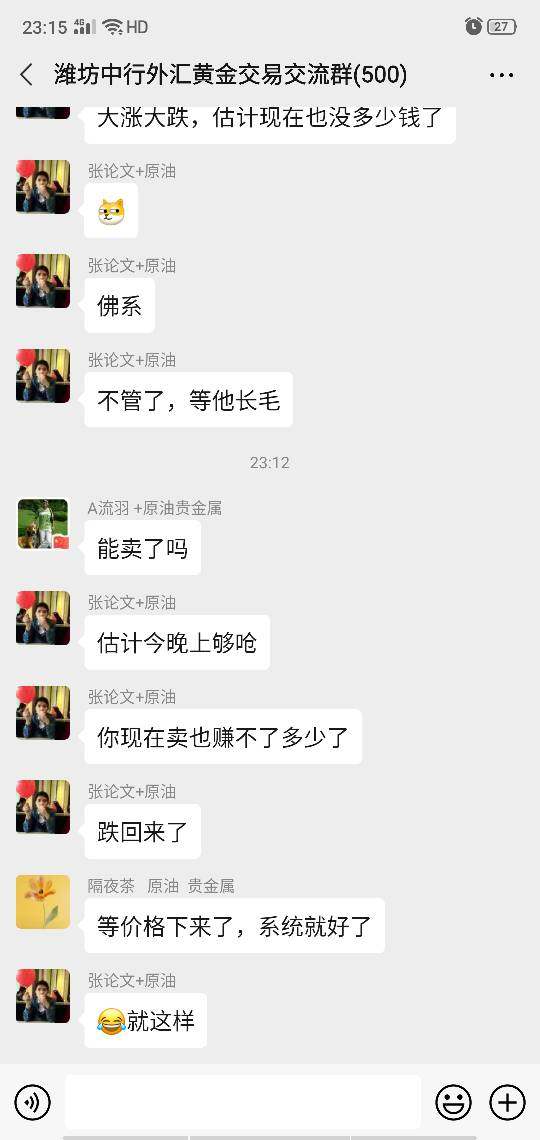

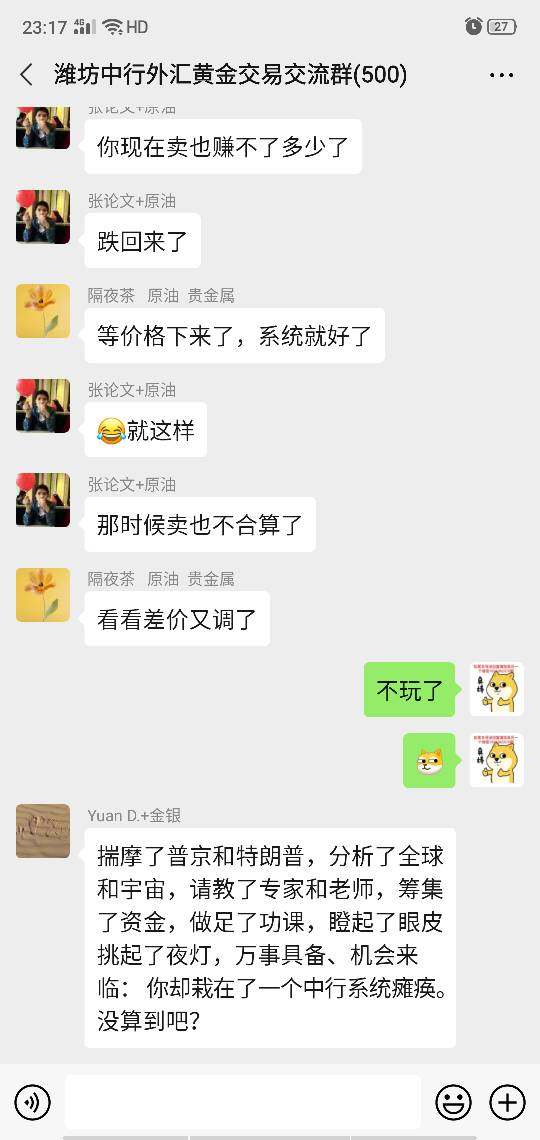

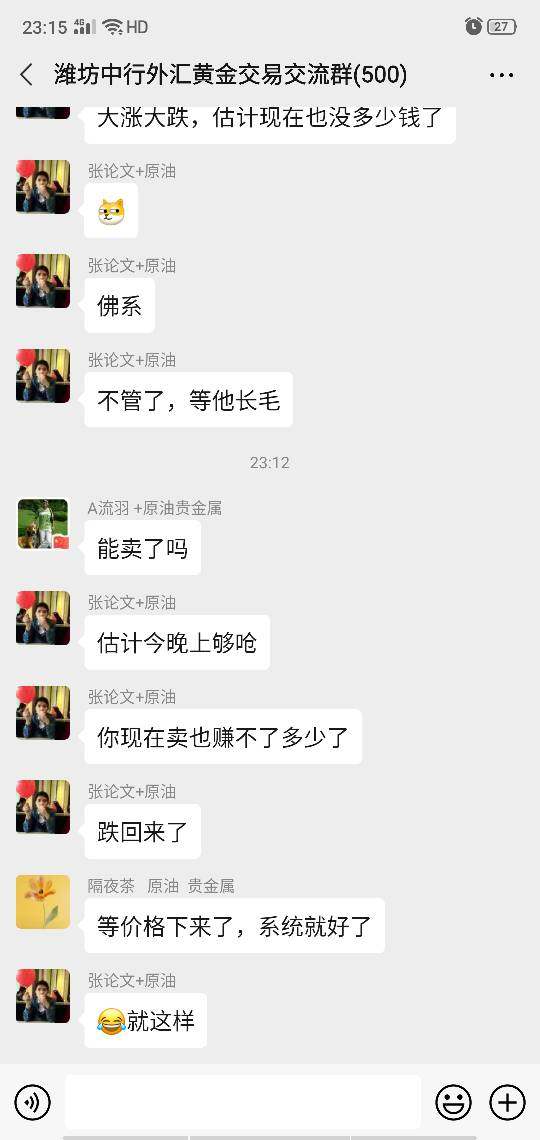

Customer service quality emerges as a significant concern based on available user feedback. According to Yelp user evaluations, Bank of China receives criticism for poor customer service. Users specifically highlight service deficiencies as a primary complaint.

The specific customer service channels, availability hours, and support mechanisms are not detailed in the accessible documentation. This lack of information prevents comprehensive evaluation of the bank's customer support infrastructure and accessibility.

Response times for customer inquiries, complaint resolution procedures, and service quality metrics are not provided in the available materials. Without such data, potential clients cannot assess the bank's commitment to timely and effective customer support.

Multilingual support capabilities, while likely given the bank's international presence, are not specifically documented in the available information. This represents another area where potential clients would need to inquire directly with the institution.

The negative user feedback regarding customer service quality suggests that Bank of China may need to address service delivery improvements. This would help enhance client satisfaction and retention. This aspect should be carefully considered by prospective clients when evaluating the bank for their financial service needs.

Trading Experience Analysis

The available documentation does not provide specific information about trading platform stability, execution speed, or overall trading environment quality at Bank of China. This represents a critical information gap for potential trading clients.

Order execution quality, including fill rates, slippage characteristics, and execution transparency, is not addressed in the accessible materials. Without such information, traders cannot assess the bank's ability to provide competitive execution services.

Platform functionality, user interface design, and trading features are not detailed in the available documentation. This bank of china review cannot provide insights into the technological sophistication or user-friendliness of the bank's trading platforms.

Mobile trading capabilities and mobile application features are not specified in the current materials. Given the importance of mobile trading in today's market environment, this information gap represents a significant limitation for potential clients.

The trading environment characteristics, including market access, product availability, and trading conditions, remain unclear based on the available documentation. Prospective trading clients would need to contact Bank of China directly to obtain comprehensive information about the trading experience and platform capabilities.

Trust and Safety Analysis

Bank of China demonstrates strong institutional credibility through its credit rating profile. Fitch Ratings has affirmed Bank of China's long-term IDR at "A" with a stable outlook. This indicates solid financial fundamentals and high probability of government support. This rating reflects the institution's creditworthiness and financial stability.

The bank operates under regulatory supervision in various jurisdictions, including oversight by the Financial Services Authority and Bank Indonesia for its Jakarta Branch operations. This regulatory framework provides institutional oversight and compliance monitoring, though specific safety measures and client protection details are not elaborated in available materials.

Fund safety measures, segregation policies, and client asset protection protocols are not specifically detailed in the accessible documentation. While the bank's strong credit rating suggests institutional stability, specific client protection mechanisms require direct inquiry.

The institution's transparency regarding operations, financial reporting, and client communications is not comprehensively addressed in the available materials. However, the bank's status as a publicly rated institution suggests adherence to certain disclosure standards.

Industry reputation, while supported by the strong credit rating, faces challenges from negative user feedback regarding service quality. This mixed profile requires careful consideration by potential clients weighing institutional strength against service delivery concerns.

User Experience Analysis

Overall user satisfaction with Bank of China appears problematic based on available feedback. User evaluations from Yelp indicate predominantly negative experiences. Service quality emerges as a primary concern among retail customers.

Interface design and platform usability are not specifically addressed in the available documentation. This prevents assessment of the bank's digital experience quality and user interface sophistication.

Registration and account verification processes are not detailed in the accessible materials. This leaves potential clients without insight into the onboarding experience and associated timelines.

Fund operation experiences, including deposit and withdrawal processes, are not comprehensively documented in the available information. This represents a significant gap in understanding the practical aspects of banking with the institution.

Common user complaints center on poor customer service quality, according to available feedback. This consistent theme in user evaluations suggests systematic service delivery challenges that may impact overall client satisfaction.

The user profile most suitable for Bank of China may include clients prioritizing institutional strength and cross-border services over retail service quality. However, the negative feedback regarding customer service should be carefully considered by all prospective clients when evaluating their banking options.

Conclusion

This bank of china review reveals a complex profile combining institutional strength with service delivery challenges. The bank's "A" credit rating from Fitch demonstrates solid financial fundamentals and government support potential, making it a credible institutional choice. However, poor customer service feedback and limited transparency regarding retail trading conditions present significant concerns.

Bank of China may be most suitable for clients requiring cross-border investment services, particularly those seeking access to Chinese markets through RQFII and QDII products. The institution's international presence and regulatory compliance across multiple jurisdictions support its cross-border capabilities.

Key advantages include strong credit rating and institutional stability, while primary disadvantages encompass poor customer service quality and limited transparency regarding retail services. Potential clients should carefully weigh these factors and conduct direct due diligence before engaging with Bank of China for their financial service needs.