Regarding the legitimacy of BANK OF CHINA forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is BANK OF CHINA safe?

Pros

Cons

Is BANK OF CHINA markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Bank of China Limited London Branch

Effective Date:

2001-12-01Email Address of Licensed Institution:

jon.sartoris@uk.bankofchina.comSharing Status:

No SharingWebsite of Licensed Institution:

www.bankofchina.com/uk/Expiration Time:

--Address of Licensed Institution:

1 Lothbury London EC2R 7DB UNITED KINGDOMPhone Number of Licensed Institution:

+4402072828863Licensed Institution Certified Documents:

Is Bank of China Safe or a Scam?

Introduction

Bank of China (BOC) is one of the oldest and largest banks in the world, with a significant presence in the foreign exchange (forex) market. Established in 1912, BOC has evolved into a global financial institution, providing a wide range of banking and financial services to clients worldwide. However, as the forex market continues to grow, traders must exercise caution when choosing a broker. The potential for scams and unreliable services makes it imperative for traders to thoroughly evaluate their options. In this article, we will investigate whether Bank of China is safe or if it raises any red flags for potential traders. Our analysis will be based on regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and an overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its safety and reliability. Bank of China operates under the supervision of various financial authorities, with its UK branch regulated by the Financial Conduct Authority (FCA). The FCA is known for its strict regulatory standards, which aim to protect consumers and ensure fair trading practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 170910 | United Kingdom | Active |

The importance of regulation cannot be overstated; it ensures that brokers adhere to specific guidelines designed to protect traders' interests. Bank of China has maintained a relatively clean regulatory history, with no significant negative disclosures reported during its operational period. However, it is essential to note that not all regulatory bodies enforce the same level of scrutiny. While the FCA is regarded as a reputable authority, some brokers may operate under less stringent regulations, which could pose risks to traders. Therefore, it is prudent for traders to verify the regulatory status of any broker they intend to use.

Company Background Investigation

Bank of China has a rich history dating back over a century, having been established to facilitate China's foreign trade and international banking needs. The bank has expanded its operations globally, with branches in major financial centers such as London, New York, and Hong Kong. BOC is a state-owned enterprise, which adds a layer of credibility to its operations. The bank's ownership structure is transparent, with the Chinese government being the primary stakeholder.

The management team at Bank of China comprises experienced professionals with extensive backgrounds in finance and banking. This expertise is crucial in navigating the complexities of the forex market and ensuring that the bank adheres to regulatory requirements. Furthermore, the bank's commitment to transparency is evident in its regular disclosures and updates regarding its financial performance and operational strategies.

However, while the bank's history and management team are commendable, it is vital to consider the level of transparency in its operations. BOC has faced criticisms regarding its customer service and responsiveness to client concerns, which can affect its overall trustworthiness. Therefore, potential traders should assess the bank's reputation based on user reviews and experiences.

Trading Conditions Analysis

When evaluating whether Bank of China is safe for forex trading, one must consider its trading conditions, including fees and spreads. BOC offers a variety of trading options, but its fee structure has come under scrutiny. The overall cost of trading can significantly impact a trader's profitability, making it essential to analyze the fees associated with the broker.

| Fee Type | Bank of China | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.5 pips |

| Commission Model | Not specified | Varies |

| Overnight Interest Range | Variable | 2% - 5% |

The trading conditions at Bank of China may not be as competitive as those offered by other forex brokers. Traders have reported instances of hidden fees and unclear commission structures, which can lead to unexpected costs. Additionally, the lack of transparency in the overnight interest rates can further complicate the trading experience. Therefore, traders should carefully review the fee structure before committing to any trading activities with Bank of China.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Bank of China employs various measures to ensure the security of its clients' deposits. The bank adheres to the regulatory requirements set forth by the FCA, which mandates the segregation of client funds from the bank's operational funds. This segregation helps protect traders in the event of financial difficulties faced by the bank.

Moreover, BOC offers investor protection schemes that safeguard client deposits up to a certain limit. However, it is important to note that these protections may vary depending on the jurisdiction and the specific account type. Traders should be aware of the limitations of these protections, especially when trading with a global institution like Bank of China.

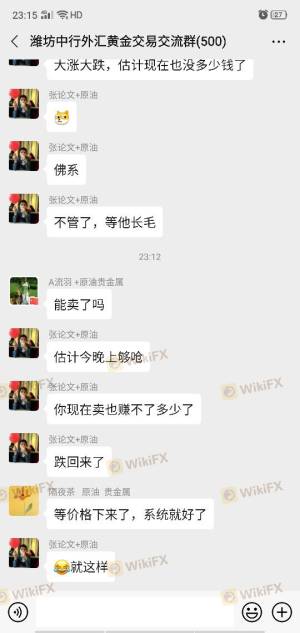

Despite these safety measures, there have been historical incidents that raise questions about the bank's commitment to client fund security. Reports of system malfunctions and operational issues have led to significant losses for some traders, raising concerns about the bank's reliability in managing client funds. Therefore, it is crucial for potential clients to weigh these risks against the safety measures in place.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Bank of China has received mixed reviews from clients, with some praising its range of services and others highlighting significant issues. Common complaints include slow customer service response times, difficulties in accessing funds, and technical issues with trading platforms.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| System Malfunctions | Medium | Acknowledged |

| Poor Customer Service | High | Inconsistent |

Several clients have reported experiencing delays in withdrawing funds, which can be particularly concerning for traders who require quick access to their capital. Additionally, there have been instances of system malfunctions during critical trading periods, leading to significant losses for traders. While Bank of China has acknowledged some of these issues, the inconsistency in its responses raises questions about its commitment to customer satisfaction.

One typical case involved a trader who faced difficulties closing a profitable position due to a system error. When attempting to reach customer support, they reported long wait times and inadequate solutions. Such experiences can deter potential clients from trusting Bank of China with their trading activities.

Platform and Trade Execution

The performance of a trading platform is crucial for a trader's success. Bank of China's trading platform has garnered mixed reviews, with users noting both strengths and weaknesses. While the platform is generally user-friendly, there have been reports of instability and slow execution times during high volatility periods.

Traders have expressed concerns regarding order execution quality, particularly regarding slippage and rejection rates. These issues can significantly impact a trader's bottom line, especially in the fast-paced forex market. Additionally, there are indications of potential platform manipulation, which further complicates the trustworthiness of Bank of China's trading services.

Risk Assessment

Using Bank of China as a forex broker carries certain risks that traders must consider. While the bank is regulated and has a long-standing history, the operational issues and customer complaints highlight potential vulnerabilities.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Subject to regulatory scrutiny |

| Operational Risk | High | History of system malfunctions |

| Customer Service Risk | High | Inconsistent support and response |

To mitigate these risks, traders should conduct thorough research and consider diversifying their trading activities across multiple platforms. Additionally, maintaining a cautious approach and only investing what one can afford to lose can help manage potential losses.

Conclusion and Recommendations

In conclusion, while Bank of China has established itself as a significant player in the forex market, there are several factors that raise concerns about its safety and reliability. The bank's regulatory status and long history provide a level of credibility; however, the operational issues, customer complaints, and lack of transparency in certain areas warrant caution.

For traders considering Bank of China, it is essential to weigh the potential risks against the benefits. Those seeking a more reliable trading experience may want to explore alternative brokers with better customer service and more competitive trading conditions. Overall, while Bank of China is not outright a scam, potential clients should proceed with caution and conduct thorough due diligence before engaging in trading activities.

Is BANK OF CHINA a scam, or is it legit?

The latest exposure and evaluation content of BANK OF CHINA brokers.

BANK OF CHINA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BANK OF CHINA latest industry rating score is 8.03, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.03 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.