asiapro 2025 Review: Everything You Need to Know

Abstract

Asiapro started in 2006. This reputable futures brokerage firm specializes in forex and commodity trading services. The company has a strong foundation in social responsibility and provides customized solutions to its clients. This has earned the broker an overall positive evaluation in the industry. Asiapro has received the prestigious A++ Broker Rating from ICDX. This rating shows its operational quality and strong performance. Users also appreciate the firm's focus on maintaining a work-life balance. This reinforces its appeal among traders who value a stable trading environment and corporate responsibility. The broker operates under the strict supervision of BAPPEBTI. This ensures regulatory compliance and protects investors' interests. User ratings consistently show scores of 4.0/5 and 4.3/5 across various platforms. This comprehensive asiapro review presents a detailed investigation into its services, trading platforms , and asset offerings including forex, commodities, indices, and futures contracts. The review also highlights areas that require further details such as specific account conditions and cost structures. According to industry reports and regulatory information, this evaluation is based on publicly available data and user feedback.

Precautions

Different regions may experience varying regulatory requirements. This can influence trading conditions and overall user experience. This review is based on publicly available information and user feedback. The review aims to provide an objective analysis. While the broker is regulated by BAPPEBTI, some elements such as deposit methods, minimum deposit requirements, and customer service details have not been fully detailed in the available sources. Readers should be aware that certain information gaps exist. As such, specific details on account features and trading costs might differ across regions. Different information sources suggest slight differences in user experience. Therefore, potential investors are advised to verify all details directly with the broker before making any decisions. This asiapro review intends to serve as a general guide rather than a definitive endorsement.

Rating Framework

Broker Overview

Asiapro was founded in 2006 as a worker-owned commercial partner. The firm has a primary focus on futures brokerage. The firm has built a reputation in offering not only forex trading services but also a broad range of commodity trading options and indices. Its emphasis on social responsibility has been one of its defining features. This ensures that the firm remains committed to giving back to the community while providing tailored financial solutions to its clients. The organizational structure promotes a work-life balance. These qualities have resonated with investors seeking a stable and ethically sound trading environment. Asiapro's business model revolves around delivering consistent trading performance while nurturing a transparent and responsible relationship with its users. The firm's long history and diversified service portfolio have established it as a notable player in the competitive brokerage landscape.

Asiapro expanded its offerings to include trading on leading platforms such as MT4 and MT5. This catered to varying trader preferences and technical requirements. The broker supports a diverse array of asset classes including forex, commodities, indices, and futures contracts. This provides comprehensive market access for traders of different expertise levels. Regulatory oversight by BAPPEBTI further strengthens its credibility. This ensures that all trading activities meet stringent industry standards. This integration of advanced technological platforms and a broad asset range is a critical factor in distinguishing Asiapro from many of its competitors. As such, this detailed asiapro review reflects both the strengths and the areas for further enhancement, offering potential investors a balanced perspective on what to expect from the broker.

-

Regulatory Region: Asiapro is regulated by BAPPEBTI. This is the Indonesian commodity futures trading regulatory authority. This ensures that the broker adheres to high standards of compliance and investor protection as reported by official regulatory channels.

Deposit and Withdrawal Methods: Specific details on deposit and withdrawal methods have not been fully disclosed in the available resources. The available sources indicate that traditional methods are used. However, further confirmation is required as the exact options remain unspecified in current reports.

Minimum Deposit Requirement: The precise minimum deposit amount is not provided in the accessible information. This omission is noted in several industry comparisons and should be clarified directly with the broker for potential investors.

Bonus and Promotions: There is limited detailed information regarding bonus structures and promotional offers. While some broker promotions are occasionally mentioned in anecdotal reports, concrete data on bonus amounts or promotional criteria is missing in the reviewed documentation.

Tradable Assets: Asiapro offers a range of tradable assets including forex pairs, commodities, indices, and futures contracts. This diverse asset offering provides traders with multiple avenues to diversify their portfolios and mitigate risks effectively.

Cost Structure: Detailed data on trading costs such as spread, commission fees, and other associated costs are not comprehensively outlined in the information at hand. The absence of specified cost metrics could be a limiting factor for traders seeking clarity on fee structures.

Leverage Ratios: Similar to the cost structure, explicit information on available leverage ratios has not been detailed in the accessible documents. This aspect remains unspecified in the current asiapro review.

Platform Options: The broker supports the well-regarded MT4 and MT5 trading platforms. These platforms are known for their reliability and comprehensive suite of analytical tools, appealing to both novice and experienced traders.

Regional Restrictions: There are no explicit details on any regional restrictions mentioned in the documented sources. However, potential regulatory variations across different regions could imply some limitations.

Customer Service Language: Specific information regarding the languages supported by the customer service team is not detailed in the current resources. Further verification is necessary to confirm multilingual support and service availability.

This section of the asiapro review highlights both the strengths in terms of platform versatility and asset diversity. It also draws attention to the gaps in crucial operational details such as deposit methods, cost structures, and customer support specifics.

Detailed Rating Analysis

1. Account Conditions Analysis

The current evaluation of account conditions yields a score of 5/10 in this asiapro review. Despite the broker's reputable history and strong regulatory standing, detailed information regarding the specific account types, spreads, and commissions remains notably absent. The review notes that there is limited disclosure regarding minimum deposit amounts. This can be a critical deciding factor for novice and experienced traders alike. Additionally, the account opening process, including verification steps and documentation requirements, is not articulated in the available information. The lack of clarity on special account features, such as Islamic accounts or managed accounts, leaves potential investors with unanswered questions. Anecdotal evidence from some user comments suggests that while the basic account functions work well, the absence of comprehensive information may deter traders looking for a transparent fee structure. In comparison to other brokers with detailed fee schedules and clear account conditions, Asiapro's offering in this area appears to be less competitive. As a result, this review recommends direct inquiry with the broker to rectify these uncertainties prior to account setup or investment, ensuring traders are fully informed about all associated costs and terms.

The tools and resources provided by Asiapro contribute significantly to a score of 7/10 in this asiapro review. The broker offers both MT4 and MT5 platforms. These platforms are renowned for their robust trading functionalities, comprehensive charting tools, and compatibility with various automated trading systems. These platforms cater to a wide spectrum of traders, from beginners to professionals, enabling sophisticated analysis and a smooth trading experience. However, the review points out that while the technical aspects of these platforms are well-covered, there is a noticeable lack of detailed information on supplementary resources such as educational materials, market research, and expert analysis reports. There is also limited insight into the availability of advanced trading tools like algorithmic trading bots or expert advisors which have become valuable assets for modern traders. Although the primary toolset is strong, the supporting educational and research components are not as thoroughly detailed in the current documentation. Overall, the provision of both popular trading platforms is a major plus, yet the disparity in auxiliary resources suggests room for improvement. The review advises potential users to explore additional educational tools and third-party resources when considering Asiapro for their trading needs.

3. Customer Service and Support Analysis

Customer service and support remain a critical component of any brokerage evaluation. This results in a score of 6/10 in this asiapro review. While the regulatory environment and overall trustworthiness of Asiapro suggest a well-managed support structure, specific details regarding available customer service channels, response times, and multilingual support are not fully addressed in the current information. There is a general acknowledgment that the service quality is satisfactory. However, the absence of concrete data such as live chat availability, telephone support response times, and email ticket resolution statistics leaves a considerable gap in the evaluation. Anecdotal reports hint at acceptable support experiences from a select few users, but these insights lack consistency and comprehensive support details. Furthermore, potential investors may encounter uncertainty when trying to ascertain the exact operating hours of customer support or the variety of languages in which assistance is provided. This opaque service structure necessitates that users reach out directly to confirm the availability of support that meets their individual needs. Consequently, while the regulatory credentials reinforce a basic level of customer service, the lack of detailed operational insight places this criterion moderately in the middle of the rating scale.

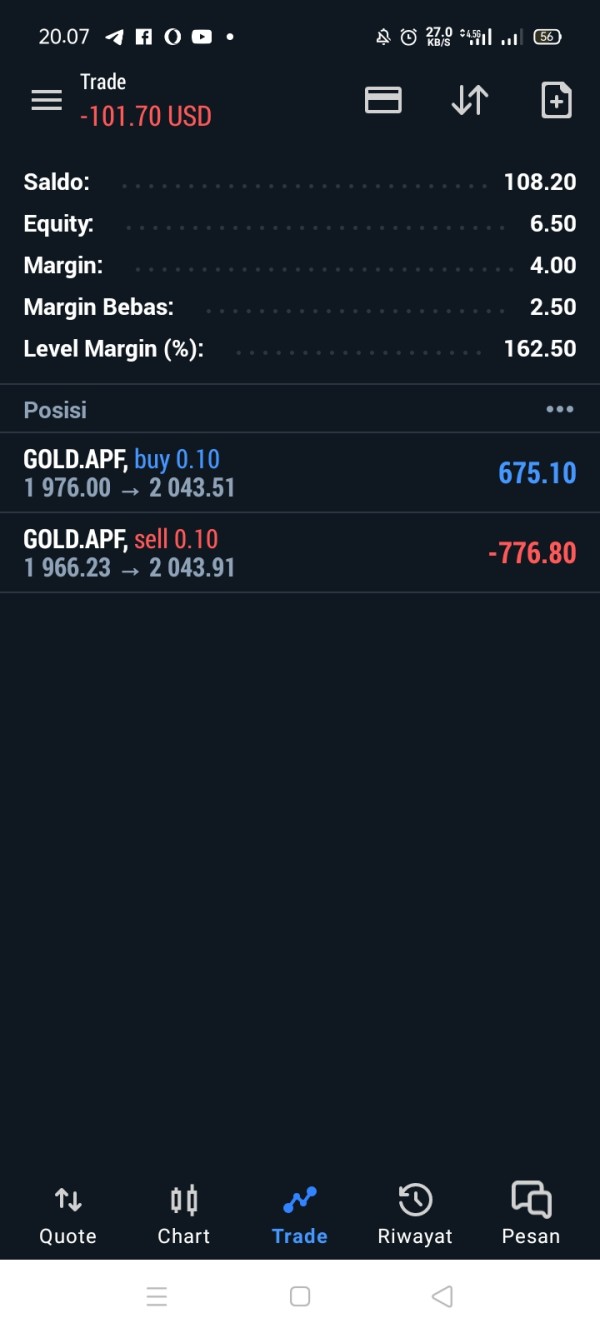

4. Trading Experience Analysis

The trading experience associated with Asiapro scores 7/10 in this asiapro review. This is largely owing to the robust platform options and diverse asset offerings. Users have access to both MT4 and MT5 platforms, which are known for their stability, speed, and integrated analytical tools. These platforms facilitate multidisciplinary trading activities and provide the necessary infrastructure for handling advanced trading strategies. However, despite these strengths, specific details regarding the execution quality, such as slippage rates, order processing speed, and liquidity during volatile market conditions, remain underreported. Some feedback from traders suggests that while the overall experience is satisfactory, the lack of documented technical performance metrics makes it challenging to fully evaluate the platform's efficiency. Furthermore, the mobile trading experience and user-friendly interface elements have not been extensively described, leaving potential improvements in user interface design and ease of navigation open to discussion. Overall, while the core trading environment is functional and reliable, additional transparency in execution quality would help solidify the broker's standing. Traders are encouraged to conduct their own tests and seek supplementary performance reviews to confirm that the trading experience matches their specific expectations.

5. Trustworthiness Analysis

Trustworthiness stands as one of the notable strengths of Asiapro. This asiapro review awards an 8/10 score to this dimension. The broker operates under the stringent regulations of BAPPEBTI, which is a key indicator of its commitment to regulatory compliance and investor protection. Additionally, the firm's achievement of the A++ rating from ICDX further reinforces its strong industry reputation and operational integrity. The combination of regulatory oversight and external recognition by reputable third-party organizations forms a solid foundation for building user trust. However, while the regulatory credentials are undisputed, certain aspects such as the prevention of negative events, clarity in capital protection measures, and detailed disclosures on company transparency have not been fully documented. Although various independent reports and user feedback indicate a generally positive sentiment towards Asiapro, more granular details on risk management strategies and data security protocols would further enhance its trustworthiness. Nonetheless, the current information strongly supports the broker's reliability, making it a viable choice for investors prioritizing safety and compliance in their trading decisions.

6. User Experience Analysis

User experience is a vital factor in evaluating any brokerage firm. It scores 6/10 in this asiapro review. The available data indicates that overall user satisfaction is good, with reported ratings averaging 4.0/5 and 4.3/5 from various sources. Many users appreciate the broker's commitment to maintaining a stable trading environment and its focus on promoting work-life balance. However, the review identifies several areas where detailed insights are lacking. For example, specifics regarding the user interface design, ease of navigation on the trading platforms, and the registration and verification process are not extensively covered in the accessible documents. Some users have provided positive feedback regarding the platform's stability, yet detailed descriptions of common user complaints such as delays in fund transfers or insufficient mobile app functionality are absent. This leaves room for further clarity on potential friction points that might affect newer investors. Although the overall sentiment remains positive, it is clear that enhancements in transparency regarding the user onboarding process and interface improvements would benefit future evaluations. Investors are advised to consider these factors and compare user experiences across multiple sources before finalizing their trading decisions.

Conclusion

In summary, Asiapro is a well-regulated futures brokerage firm. It has a solid history dating back to 2006. Its operation under BAPPEBTI and the prestigious ICDX A++ rating underscore its commitment to compliance and quality trading services. This asiapro review highlights the broker's strengths, including its robust platform options, diverse asset offerings, and strong regulatory framework, while also noting areas for improvement such as clearer account details, comprehensive cost structures, and enhanced customer support information. Suitable for traders who value a stable trading environment and corporate social responsibility, Asiapro remains an attractive option for those willing to seek further clarity on certain operational aspects before making their investment decisions.