Regarding the legitimacy of ASIAPRO forex brokers, it provides BAPPEBTI and WikiBit, (also has a graphic survey regarding security).

Is ASIAPRO safe?

Pros

Cons

Is ASIAPRO markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. Asia Pro Berjangka

Effective Date: Change Record

--Email Address of Licensed Institution:

contact@asiaprofx.comSharing Status:

No SharingWebsite of Licensed Institution:

www.asiaprofx.comExpiration Time:

--Address of Licensed Institution:

Gold Coast Office Tower, Tower Liberty Lt. 17 B, Jl. Pantai Indah Kapuk, RT 006/RW 002, Kel. Kamal Muara Kec. Penjaringan, Jakarta Utara - DKI Jakarta 14470Phone Number of Licensed Institution:

021-50872318Licensed Institution Certified Documents:

Is AsiaPro A Scam?

Introduction

AsiaPro is a forex broker based in Indonesia, positioning itself as a platform for trading various financial instruments, including currencies, commodities, and indices. As an emerging player in the forex market, AsiaPro aims to attract both novice and experienced traders with its competitive offerings. However, the forex trading environment is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams in this industry necessitates thorough due diligence. In this article, we will investigate AsiaPro's legitimacy, regulatory status, financial practices, and customer feedback to determine whether it is a safe option for traders.

Our analysis will be grounded in a review of multiple credible sources, including regulatory databases, customer testimonials, and expert opinions. We will evaluate AsiaPro across several critical dimensions, including regulatory compliance, company background, trading conditions, customer funds security, and overall user experience.

Regulation and Legitimacy

Understanding the regulatory landscape is crucial when evaluating a forex broker. Regulation serves as a safeguard for traders by ensuring that brokers adhere to certain operational standards and practices. AsiaPro claims to be regulated by the Indonesian Commodity Futures Trading Regulatory Agency (BAPPEBTI). However, it is important to scrutinize the depth and credibility of this regulation.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| BAPPEBTI | 862/BAPPEBTI/SI/1/2006 | Indonesia | Verified |

While being regulated by BAPPEBTI provides a level of oversight, it is essential to note that this agency does not have the same level of authority as major regulatory bodies like the FCA or ASIC. The quality of regulation can vary significantly, and BAPPEBTI's oversight is often considered less stringent. Additionally, some sources suggest that AsiaPro may not fully comply with the expected standards of transparency and operational integrity.

The historical compliance of AsiaPro with regulatory requirements remains ambiguous. There are concerns about the broker's operational practices, including its ability to protect client funds effectively. Given that regulation plays a pivotal role in safeguarding investor interests, potential clients should approach AsiaPro with caution.

Company Background Investigation

AsiaPro operates under the name PT Asia Pro Berjangka and has been active in the forex market for several years. The company's ownership structure and management team are critical factors in assessing its reliability. However, detailed information regarding the management team's qualifications and experience is limited. This lack of transparency raises questions about the broker's operational integrity and ability to provide quality service.

A well-established management team with a robust background in finance and trading can significantly enhance a broker's credibility. Unfortunately, AsiaPro does not provide sufficient information about its executives, which may indicate a lack of commitment to transparency. Furthermore, the company's website offers limited disclosures about its operational practices and financial health, making it difficult for potential clients to gauge its reliability.

The absence of detailed company history and management profiles can be a red flag for traders. A broker that prioritizes transparency typically shares information about its founders, key personnel, and operational history. In AsiaPro's case, the lack of such information could suggest potential underlying issues that traders should consider seriously before engaging with the platform.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is vital. AsiaPro offers various account types with different features, including standard, variable, and gold accounts. However, the fee structure and trading costs associated with these accounts warrant careful examination.

| Fee Type | AsiaPro | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | Starts at 1 pip | 0.5 - 1.5 pips |

| Commission Structure | Varies | Typically 0 - 5 USD |

| Overnight Interest Range | Not specified | 2-3% |

The spreads offered by AsiaPro are relatively standard, starting at 1 pip for major currency pairs. However, this is on the higher end compared to industry averages, which can be as low as 0.5 pips. Additionally, the lack of clarity regarding commission structures raises concerns. Traders often expect transparent pricing models, and any ambiguity in this area can lead to unexpected costs.

Moreover, the absence of information on overnight interest rates can be a significant drawback. Traders who hold positions overnight need to be aware of the costs associated with these trades, and a lack of clear guidance can lead to confusion and dissatisfaction.

Overall, while AsiaPro offers a range of account types, the trading conditions may not be as favorable as those offered by more established brokers. Traders should weigh these factors carefully against their trading strategies and financial goals.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. AsiaPro claims to implement various measures to ensure the security of client deposits. However, the effectiveness of these measures is critical to assess.

AsiaPro reportedly segregates client funds from its operational funds, a practice that is essential for protecting investor capital. However, the specifics of these measures are not clearly outlined on the broker's website. Moreover, the absence of information regarding investor protection schemes, such as negative balance protection, raises additional concerns.

Historically, there have been instances where brokers operating in less regulated environments have faced issues related to fund mismanagement or insolvency. As such, traders must be cautious when dealing with brokers like AsiaPro, especially given the regulatory environment in Indonesia, which may not provide the same level of protection as more stringent jurisdictions.

In summary, while AsiaPro claims to prioritize fund security, the lack of detailed information and transparency regarding its protective measures may pose risks to potential clients. Traders should consider these factors when deciding whether to invest with this broker.

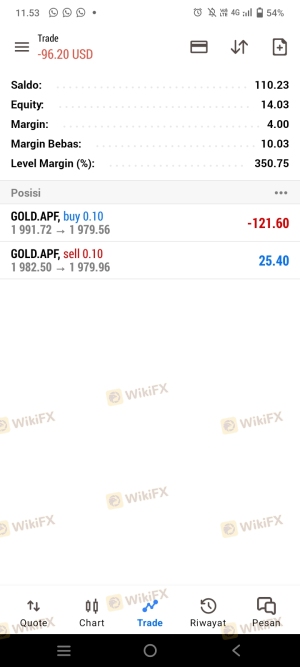

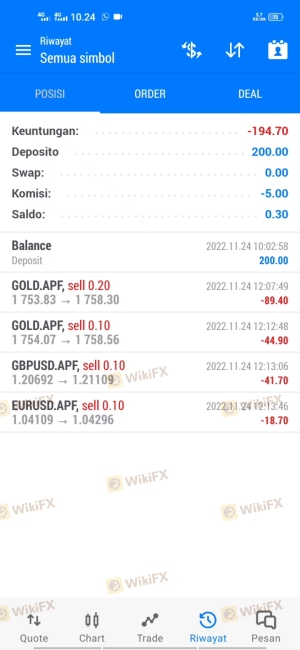

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. Reviews of AsiaPro reveal a mixed bag of experiences, with some users reporting positive interactions while others highlight significant issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Lockouts | Medium | Limited assistance |

| Poor Customer Support | High | Unresolved queries |

Common complaints include difficulties with fund withdrawals and account access. Many users have reported delays in processing withdrawal requests, which can be a significant concern for traders who prioritize liquidity. Additionally, some users have expressed frustration with the quality of customer support, citing slow response times and inadequate assistance.

One typical case involves a trader who attempted to withdraw funds after a profitable trading period but encountered delays and unresponsive customer service. This situation illustrates the potential risks associated with using AsiaPro, as delayed withdrawals can lead to a loss of trust and financial distress for traders.

Overall, the feedback from customers indicates that while some traders have had satisfactory experiences, the prevalence of complaints regarding withdrawals and customer service should not be overlooked. These issues could impact the overall trading experience and raise concerns about the broker's reliability.

Platform and Execution

The trading platform is a critical aspect of any trading experience. AsiaPro utilizes the MetaTrader 5 (MT5) platform, which is widely regarded for its user-friendly interface and advanced trading features. However, the performance and reliability of the platform are essential to assess.

Traders have reported mixed experiences with AsiaPro's platform execution. While MT5 is known for its speed and efficiency, some users have experienced slippage and order rejections during high volatility periods. Such issues can significantly impact trading outcomes, especially for scalpers and day traders who rely on precision execution.

Furthermore, any signs of platform manipulation or unfair practices should raise red flags. Traders must be vigilant and monitor their trading experiences closely to identify any anomalies in execution quality. The absence of transparent execution policies can exacerbate concerns about the broker's integrity.

In conclusion, while AsiaPro provides access to a reputable trading platform, the reported execution issues and potential signs of manipulation warrant caution. Traders should consider these factors when deciding whether to engage with this broker.

Risk Assessment

Using AsiaPro as a trading platform comes with inherent risks that traders must evaluate. Understanding these risks can help traders make informed decisions and implement effective risk management strategies.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Limited oversight by BAPPEBTI |

| Fund Security Risk | Medium | Lack of clear investor protection measures |

| Customer Service Risk | High | Frequent complaints about support responsiveness |

| Execution Risk | Medium | Reports of slippage and order rejections |

The regulatory risk associated with AsiaPro is notably high due to the broker's limited oversight by BAPPEBTI. Additionally, the lack of clear investor protection measures can expose traders to potential fund security issues.

Customer service quality is another significant risk area, with many users reporting difficulties in receiving timely assistance. This can exacerbate issues related to fund withdrawals and account management.

To mitigate these risks, traders should consider implementing robust risk management strategies, such as setting strict limits on their trading capital and diversifying their investments across multiple brokers. Additionally, maintaining clear communication with the broker and documenting all interactions can help address potential issues more effectively.

Conclusion and Recommendations

In light of the evidence presented, it is clear that AsiaPro presents several red flags that potential traders should consider seriously. The regulatory environment surrounding the broker is less stringent than that of more reputable jurisdictions, raising concerns about the protection of investor funds. Additionally, the mixed customer feedback regarding withdrawal issues and customer service further complicates the broker's reliability.

While AsiaPro may offer competitive trading conditions and access to a popular trading platform, the risks associated with using this broker are significant. Therefore, it is advisable for traders to exercise caution and thoroughly assess their individual risk tolerance before engaging with AsiaPro.

For traders seeking safer alternatives, consider brokers that are regulated by leading authorities such as the FCA or ASIC. These brokers typically offer better investor protection, transparency, and overall service quality. Some recommended options include [Broker A], [Broker B], and [Broker C], which are known for their reliability and strong regulatory frameworks.

Is ASIAPRO a scam, or is it legit?

The latest exposure and evaluation content of ASIAPRO brokers.

ASIAPRO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ASIAPRO latest industry rating score is 6.27, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.27 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.