Is XeOne safe?

Pros

Cons

Is XeOne A Scam?

Introduction

XeOne is a relatively new player in the forex market, positioning itself as an online trading broker offering a variety of financial instruments, including forex, commodities, cryptocurrencies, and indices. The allure of low minimum deposits and high leverage options, such as 1:2000, has attracted many traders looking for accessible trading opportunities. However, the importance of thoroughly evaluating forex brokers cannot be overstated. In an industry rife with unregulated entities and potential scams, traders must exercise caution and perform due diligence to protect their investments. This article aims to provide an objective analysis of XeOne, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety.

Regulation and Legitimacy

The regulatory status of a broker is crucial for ensuring the safety of traders' funds and the integrity of trading practices. Unfortunately, XeOne operates without a valid license from any reputable financial authority. The broker claims to be incorporated in Mauritius, but it has not been found in the records of the Seychelles Financial Services Authority, raising significant concerns about its legitimacy. Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that XeOne is not subject to the same oversight and accountability as licensed brokers. This absence of regulatory scrutiny allows the broker to operate with minimal transparency, increasing the risk for traders. The quality of regulation is vital; regulated brokers are required to maintain segregated accounts, provide negative balance protection, and adhere to strict operational guidelines. Without such safeguards, traders' funds are at risk, and recourse for disputes or financial losses is severely limited.

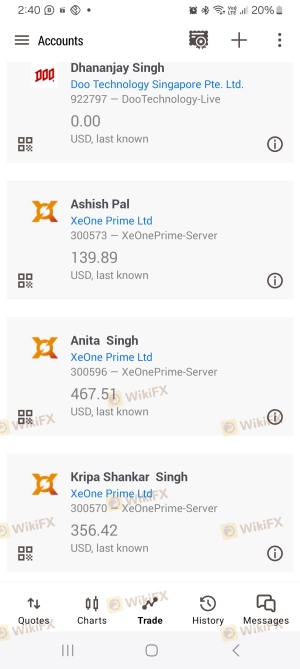

Company Background Investigation

XeOne is operated by a company that claims to be based in Mauritius. However, there is a notable lack of information regarding its ownership structure and the background of its management team. The company's website does not provide clear details about its founders or executive team, which is a common red flag in the industry. Transparency is essential for building trust, and the absence of such information raises concerns about the broker's credibility.

Furthermore, the company's establishment date is unclear, with some sources suggesting it has been in operation for only a short time. This lack of a proven track record in the industry can be alarming for potential investors, as inexperienced or newly established brokers may lack the necessary infrastructure and experience to manage client funds effectively.

Trading Conditions Analysis

XeOne offers a range of trading conditions that may seem attractive at first glance, including low minimum deposits and high leverage. However, the overall fee structure and trading costs require careful scrutiny. The following table outlines the core trading costs associated with XeOne:

| Fee Type | XeOne | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.0 - 1.5 pips |

| Commission Model | None | $5 per side |

| Overnight Interest Range | Not specified | Varies |

While the spread on major currency pairs is competitive, the lack of clarity regarding overnight interest and other potential fees is concerning. Unregulated brokers often have hidden fees or unfavorable trading conditions that can erode profits and make trading less favorable for clients. Moreover, the absence of a commission structure suggests that the broker may rely on wider spreads or other indirect methods to extract fees from traders.

Client Fund Security

When it comes to client fund security, XeOne presents several red flags. The broker does not provide information about the segregation of client funds, which is a critical safety measure that protects traders' deposits in the event of the broker's insolvency. Additionally, there is no evidence of investor protection schemes in place, leaving clients vulnerable to potential losses.

The lack of negative balance protection is another significant concern. In volatile markets, traders can incur losses that exceed their deposits, and without this safeguard, clients could find themselves in dire financial situations. Historical data regarding fund security issues or disputes involving XeOne is scarce, but the absence of regulatory oversight amplifies the risk associated with trading on this platform.

Customer Experience and Complaints

Customer feedback is a vital component of assessing a broker's reliability and performance. Reviews of XeOne reveal a pattern of complaints related to withdrawal issues, lack of customer support, and aggressive sales tactics. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Misleading Marketing Practices | High | Poor |

Many users have reported difficulties in withdrawing their funds, often citing delays or outright refusals. This behavior is characteristic of unregulated brokers, which may employ tactics to discourage withdrawals to retain client funds. Additionally, the quality of customer service has been criticized, with many users experiencing long wait times or unhelpful responses from support representatives.

Case Studies

-

Withdrawal Issues: One trader reported attempting to withdraw $1,500 but faced multiple delays, with the broker claiming technical issues. After several weeks, the trader still had not received their funds.

Poor Customer Support: Another user described their frustration with the lack of available support, stating that their inquiries went unanswered for days, leaving them feeling abandoned and concerned about their investments.

Platform and Trade Execution

XeOne claims to offer a trading platform called VertexFX, but reviews indicate that users have encountered technical issues when attempting to use the software. The reliability of a trading platform is crucial for executing trades efficiently, and any signs of manipulation or poor performance can significantly impact traders' experiences.

Concerns have been raised about order execution quality, with reports of slippage and rejected orders. Such issues can be detrimental, especially for traders employing high-frequency strategies or those relying on precise entry and exit points. A platform that fails to deliver on execution can lead to significant financial losses and frustration among users.

Risk Assessment

Using XeOne presents a variety of risks that potential traders should carefully consider. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of fund segregation and protection. |

| Withdrawal Risk | High | Frequent complaints about withdrawal issues. |

| Platform Risk | Medium | Technical issues and execution problems. |

To mitigate these risks, potential traders should consider using regulated brokers that offer robust investor protections, transparent fee structures, and reliable trading platforms. Researching and reading reviews about a broker's reputation can also help identify potential red flags before committing funds.

Conclusion and Recommendations

In conclusion, the analysis of XeOne raises significant concerns regarding its legitimacy and safety as a trading platform. The lack of regulation, transparency issues, and numerous complaints from clients suggest that this broker may pose a high risk to traders. While the promise of low minimum deposits and high leverage may be enticing, the potential pitfalls far outweigh the benefits.

Traders are advised to approach XeOne with caution and consider alternatives that are regulated and offer better protections for client funds. Brokers such as Fortrade or XM, which are licensed and have established reputations in the industry, may provide safer trading environments for those looking to invest in forex and other financial instruments. Always prioritize safety and regulation when selecting a broker to protect your investments.

Is XeOne a scam, or is it legit?

The latest exposure and evaluation content of XeOne brokers.

XeOne Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XeOne latest industry rating score is 2.13, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.13 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.