xeone 2025 Review: Everything You Need to Know

Abstract

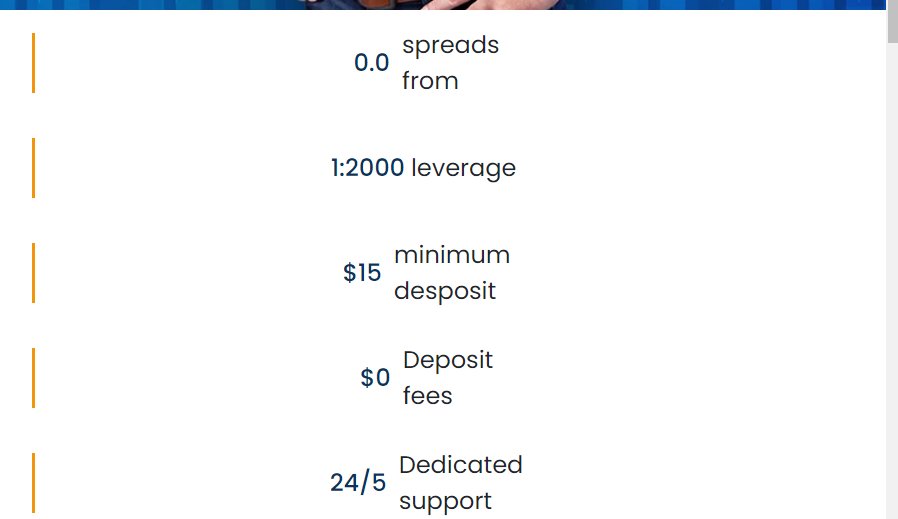

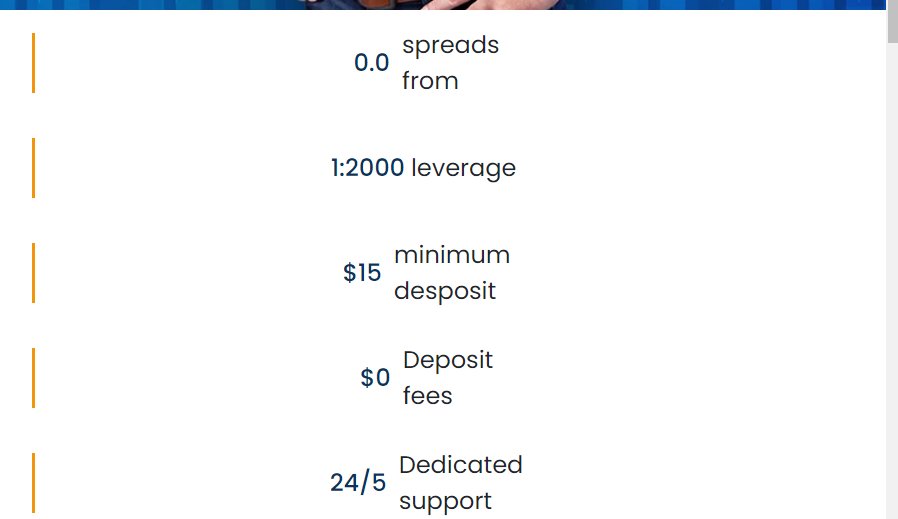

XeOne has become a promising forex broker with notable strengths and some concerns about its legitimacy. This xeone review highlights its competitive trading conditions, including spreads starting from 1 pip and a high leverage ratio of up to 2000. The broker targets traders with limited capital and those seeking high-leverage opportunities. XeOne offers accessible account conditions with a minimum deposit of just $15 and no deposit fees. Despite its strong trading features, some users worry about its regulatory standing and potential risks from limited oversight. The broker operates under the authorization of the Mauritius Financial Services Commission , which forms the foundation for its trading operations. XeOne offers a wide array of CFDs on currencies, stocks, indices, and precious metals to meet diverse investor needs. The broker focuses on enhancing the trading experience with advanced platforms compatible with multiple devices and dedicated customer support. While the high leverage and tight spreads are major attractions, potential users should consider the varying regulatory environments that may impact overall trust. This balanced xeone review provides a comprehensive snapshot of the broker's potential and inherent challenges.

Important Notices

Due to regulatory differences across regions, XeOne is currently regulated solely by the Mauritius Financial Services Commission . This may result in varying oversight depending on the user's location. The evaluation in this review comes from combined user feedback and publicly available information, providing an objective perspective on the broker's offerings. Users should exercise caution and perform additional research, particularly regarding region-specific regulatory impacts. It is crucial to understand that while many trading conditions appear attractive—such as low minimum deposits and competitive spreads—potential concerns over legitimacy persist. This review reflects the data available as of the latest published reports, ensuring that the analysis is up-to-date and relevant for prospective traders.

Rating Framework

Broker Overview

XeOne is part of the XeOne Group, a collective that aims to redefine the trading experience in financial markets. The broker specializes in offering both forex and Contract for Difference trading. While the specific founding year is not detailed in the available information, XeOne's connection with a larger financial entity provides some assurance of its operational scale. The broker serves primarily smaller investors and those who appreciate high leverage opportunities—its minimum deposit of only $15 makes entry highly accessible. XeOne emphasizes competitive spreads that begin at 1 pip and also boasts a maximum leverage of 2000, which is particularly attractive for traders willing to take on higher risk exposure.

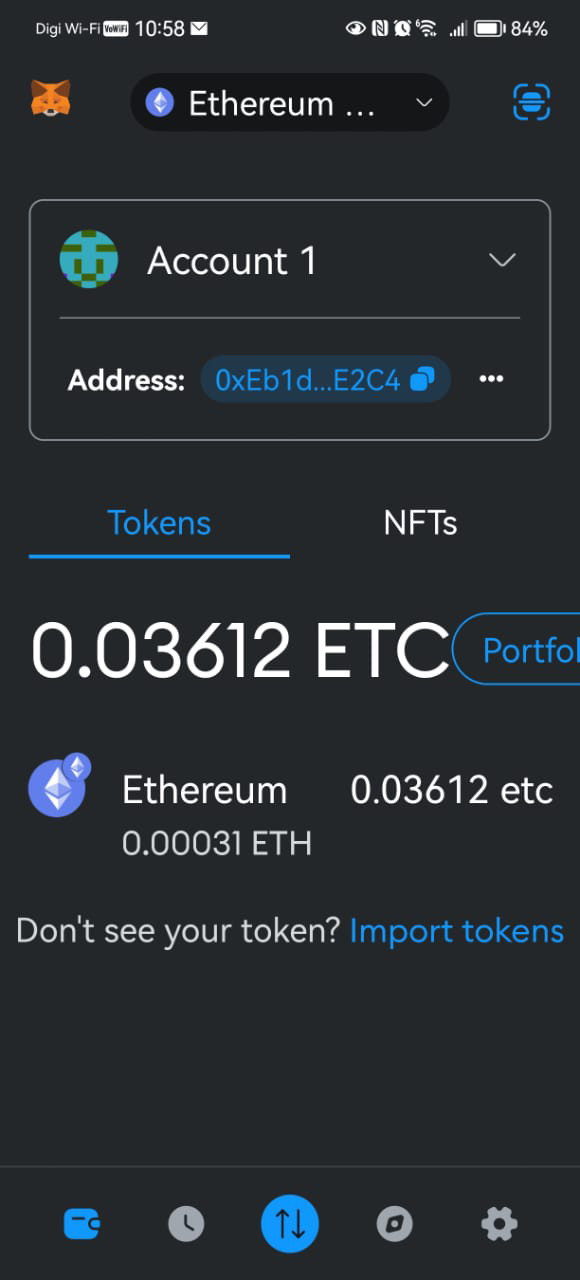

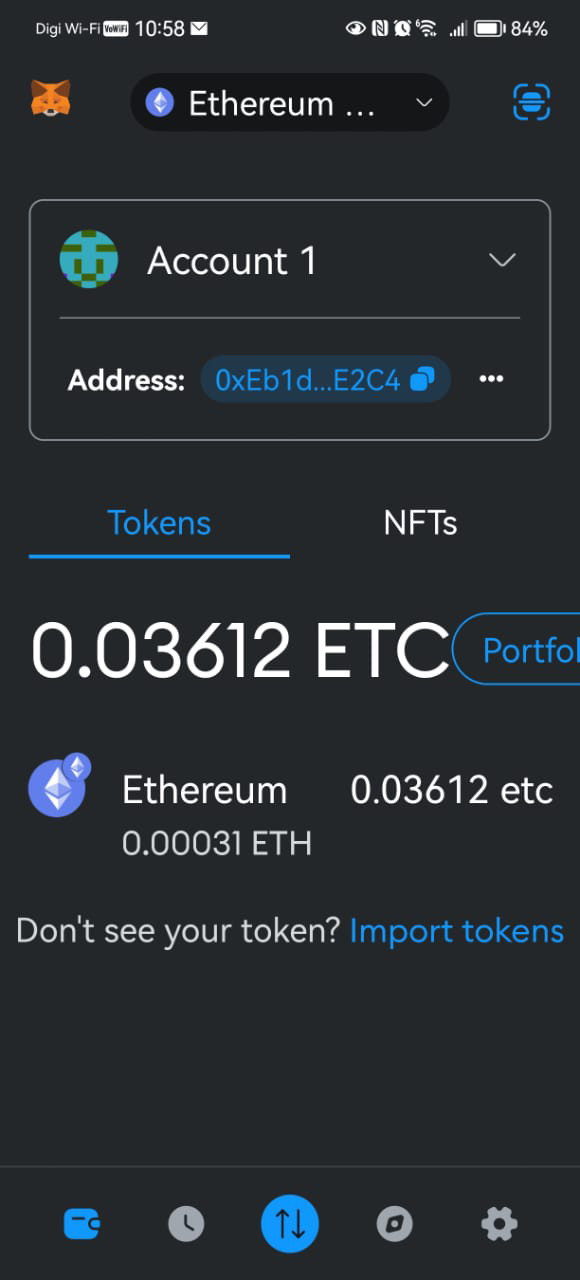

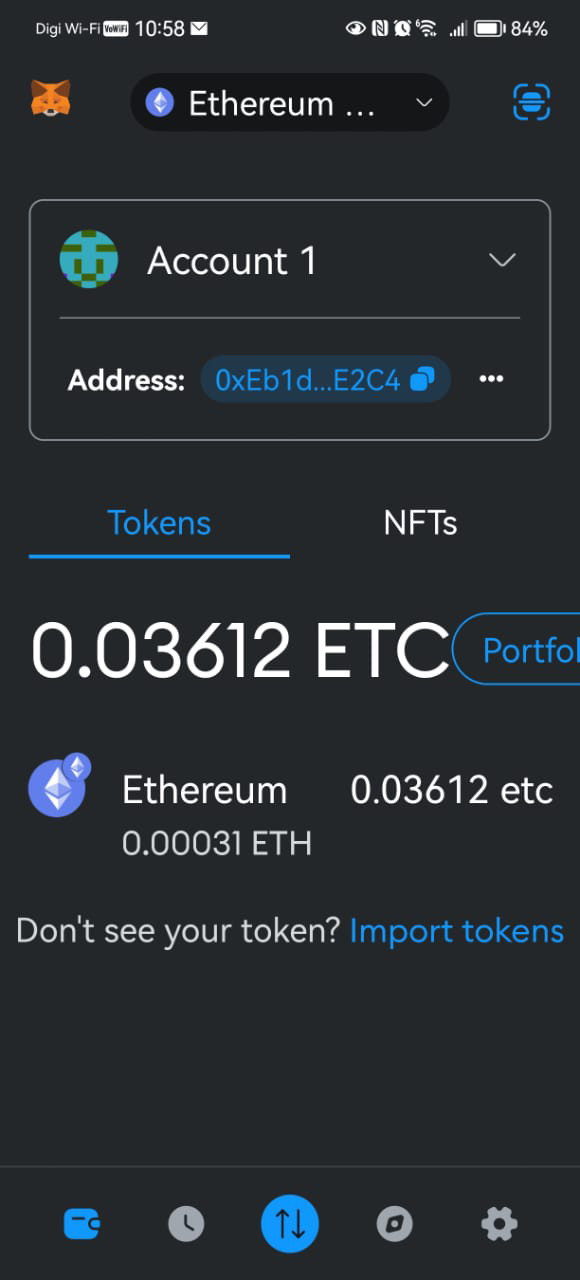

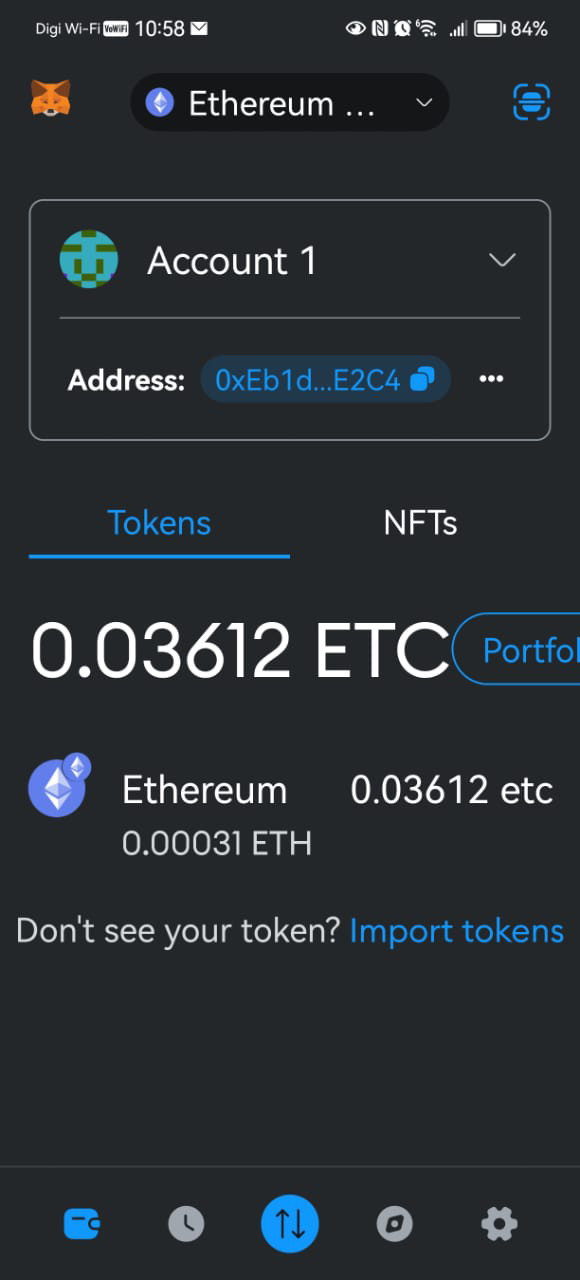

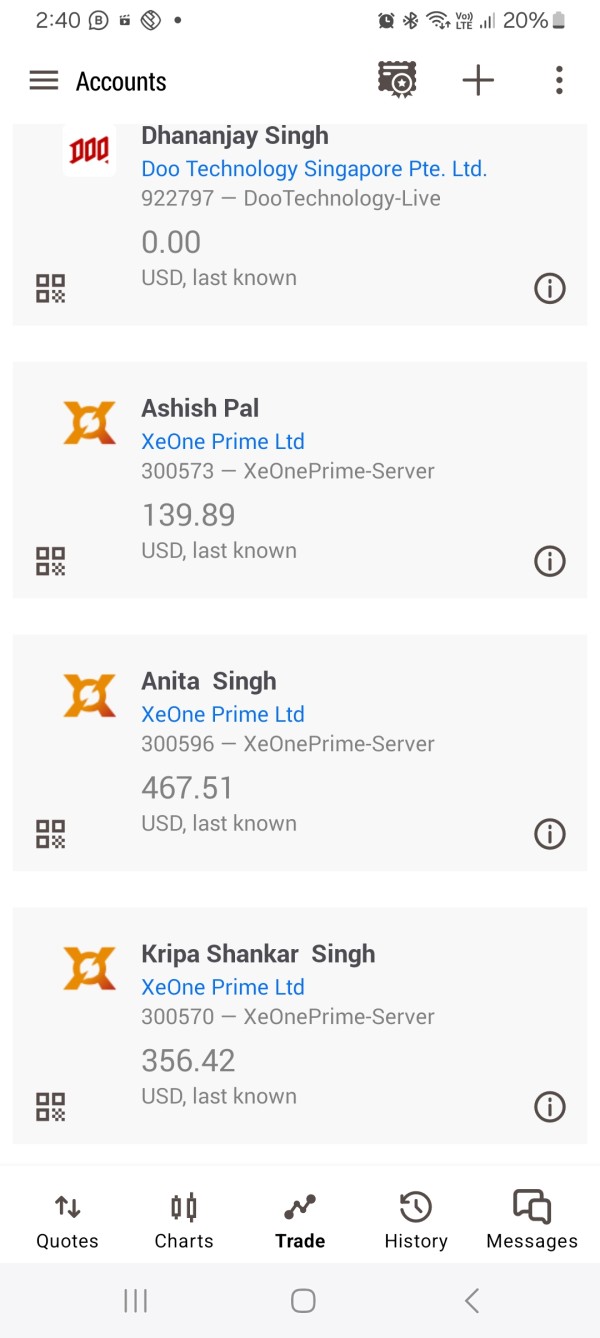

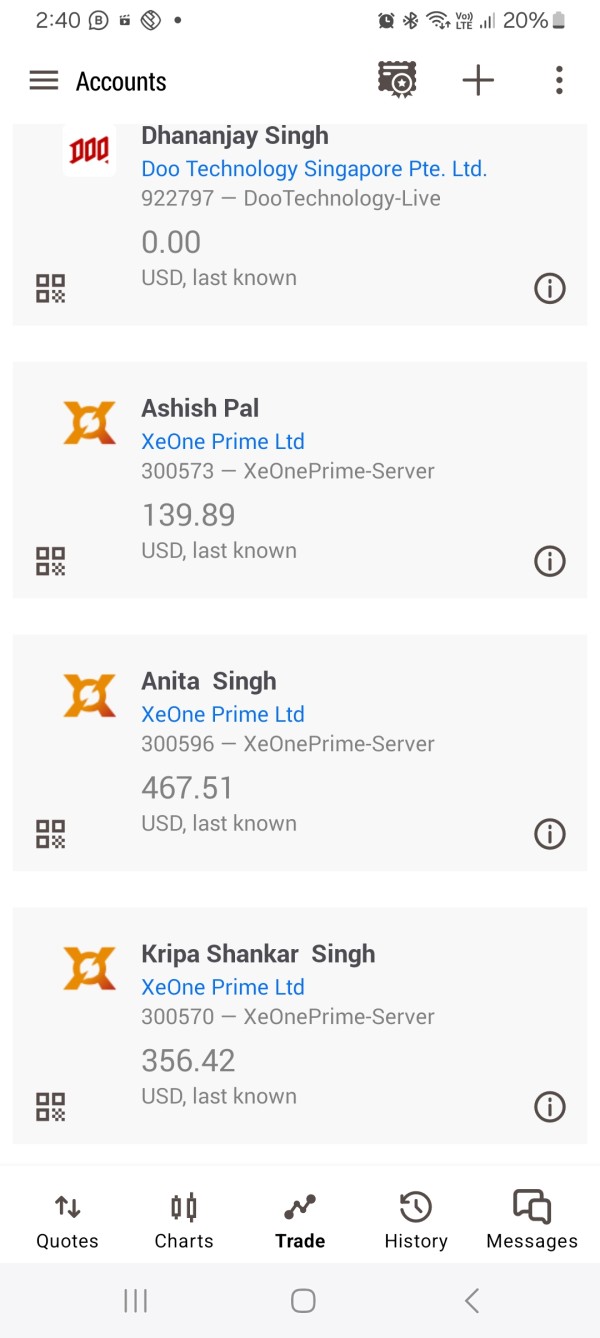

In its operational model, XeOne provides advanced trading platforms that work with various devices including desktop, iOS, and Android applications. The broker offers a range of financial instruments including currencies, stocks, indices, and precious metals through CFDs. XeOne is regulated by the Mauritius Financial Services Commission and attempts to build confidence among its users despite some lingering questions about its overall transparency. The emphasis on technology is evident, with an interface designed for swift execution and comprehensive trading tools. This second xeone review highlights both the advantages of low capital entry and competitive trading conditions, and the need for improved transparency to fully reassure potential clients.

XeOne operates under the regulatory oversight of the Mauritius Financial Services Commission , ensuring a foundational level of compliance and operational control. Users can take advantage of a variety of payment methods supported by multiple Payment Service Providers, making deposits and withdrawals seamless. The broker requires a minimal deposit of only $15, making it an attractive option for beginners and those with limited capital. Although information on bonus promotions is not explicitly provided, the absence of deposit fees further enhances its cost-effectiveness.

Tradable assets at XeOne include a comprehensive range of CFDs on currencies, stocks, indices, and precious metals. This diversity enables traders to diversify their portfolios with relative ease. The cost structure is competitive, with spreads starting at 1 pip and no extra deposit fees, although details regarding commission charges remain unspecified. With a maximum leverage of 2000, traders have access to significant exposure, thereby amplifying both potential profits and risks. The platform itself supports both iOS and Android applications, ensuring that traders can manage their portfolios on the go with robust functionality and user-friendly interfaces.

Regional restrictions are not explicitly detailed in the available sources, leaving potential users to verify their eligibility based on local regulations. Customer support is available in multiple languages, ensuring that non-English speakers also have access to assistance, although the specific language options are not detailed. This comprehensive third xeone review covers the essential trading conditions and platform features offered by XeOne, while also signaling areas that require further clarification to ensure a fully informed trading decision.

Detailed Rating Analysis

1. Account Conditions Analysis

The account conditions at XeOne form one of its most attractive features, particularly for novice traders. With a minimum deposit set at only $15, the barrier to entry is notably low compared to many competitors. This affordability allows traders with limited initial capital to venture into the markets without significant financial risk. The absence of deposit fees further enhances the appeal of their basic account structure, ensuring that funds are fully used towards trading rather than administrative costs. Despite the lack of information on diverse account types or any special accounts like Islamic accounts, the fundamental offering remains strong. User feedback generally praises this low-threshold approach, as traders feel more comfortable knowing they can start trading without large financial commitments. Moreover, the spread starting from as little as 1 pip serves as an additional incentive, indicating competitive trading costs that can contribute to lower overall expenses during active trading sessions. While the account opening procedures and any potential additional verification steps remain unspecified, the transparency surrounding basic account costs is commendable. This detailed xeone review of account conditions highlights key aspects that set the broker apart from others for those who prioritize starting small and building experience gradually.

XeOne provides a robust set of tools and resources designed to support a broad spectrum of traders. The platform supports multiple financial instruments, including currencies, stocks, indices, and precious metals, giving traders the diversity needed to create well-rounded portfolios. The underlying trading platform is said to be advanced and reliable, featuring intuitive navigation and compatibility across desktop and mobile devices. Even though specific details on research tools or educational resources are not explicitly provided, user feedback suggests that the available trading tools are sufficient for everyday trading needs. The platform's capabilities, such as real-time market data, technical analysis tools, and charting functions, are geared towards enhancing the decision-making process. While automated trading and the availability of APIs for algorithmic trading are not highlighted, the overall infrastructure still manages to satisfy a wide segment of retail traders. Some users have also noted the beneficial integration of risk management tools that help shield traders from overly volatile market conditions. Overall, while there is room for enhancing the educational and research segments, the choice of instruments and technical support provided by XeOne remains solid enough for the majority of active traders to feel confident in their trading strategy implementation.

3. Customer Service and Support Analysis

Customer service at XeOne is designed to cater to traders who require quick and efficient support. The broker offers multi-channel assistance including telephone support, email, and live chat, ensuring that users have ready access to help whenever needed. With dedicated support available 24/5, clients can expect timely responses to queries and issues, which is essential given the dynamic nature of trading. User reviews often highlight the professionalism and efficiency of customer service representatives, noting that they are both knowledgeable and responsive in addressing concerns. The provision of assistance in multiple languages further broadens the accessibility of the service, ensuring that clients from various regions can communicate comfortably. Although detailed examples or case studies of problem resolution have not been extensively documented in the available resources, the overall satisfaction rate remains positive. This reflects XeOne's commitment to maintaining a support system that aligns well with its technological offerings and operational demands. By prioritizing both speed and quality of support, the broker effectively minimizes potential downtime or miscommunication during critical trading periods, reinforcing the reliability of their customer service framework.

4. Trading Experience Analysis

The trading experience at XeOne is characterized by a blend of competitiveness and user-oriented design. The platform is widely reported to be stable, with fast execution speeds that help traders capitalize on market opportunities without significant delays. Users appreciate the straightforward interface, which is designed to minimize the learning curve and allow for seamless navigation between various financial instruments and market data. Order executions are generally consistent, although specifics regarding slippage and re-quoting intervals are not extensively detailed in the available resources. Mobile trading is a strong point, with both iOS and Android versions providing full functionality, ensuring that users can execute trades and monitor their portfolios while on the move. The broker's focus on providing consistently competitive spreads, starting at just 1 pip, further enhances the overall trading experience by keeping transaction costs low, especially for active traders. This detailed xeone review within the context of trading experience highlights the broker's commitment to combining technical efficiency with intuitive design, although there is always scope for further detailing aspects like advanced order types and risk management tools.

5. Trust Analysis

Trust in XeOne is a mixed scenario due to the regulatory limitations and some user concerns. The broker is regulated by the Mauritius Financial Services Commission , which provides a baseline level of oversight, yet this single-regulator framework has led some users to question the overall legitimacy and security of their funds. Specific measures related to client fund protection or transparent financial disclosures are not thoroughly detailed in the available literature, contributing to an air of uncertainty. Some users have reported concerns about potential risks and unclear policies, especially when compared with brokers regulated by more widely recognized financial authorities. While the regulatory status does offer some reassurance, the lack of comprehensive transparency and the absence of additional layers of oversight have affected the industry reputation. Moreover, historical records do not provide clear incidents of misconduct, which suggests that while there are concerns, there hasn't been any verifiable major failure. This balanced evaluation highlights that while trust may not be outstanding at XeOne, it is not entirely negative either; traders are encouraged to conduct further research and ensure proper risk management when considering engagement with this broker.

6. User Experience Analysis

User experience with XeOne demonstrates a blend of positive interface elements and areas needing improvement. Overall, the platform's design is user-friendly, featuring a streamlined registration process and an intuitive layout that caters well to both new and experienced traders. Users appreciate the ease with which they can navigate through market listings and access trade execution tools. The availability of mobile applications on both iOS and Android further enhances convenience, allowing traders to manage their portfolios virtually anywhere. However, some user feedback has pointed to concerns regarding transparency in the verification processes and the clarity of fee structures, which slightly detracts from the overall experience. Although the trading platform itself is robust, the mixed reviews on aspects such as detailed account management and in-depth risk disclosures indicate that improvements could be made. In light of these observations, it is suggested that XeOne focuses on enhancing transparency and refining its user interface to address these pain points. Overall, the user experience reflects a competent trading platform that still has room for improvement to reach a truly high-standard service level.

Conclusion

In summary, XeOne presents itself as a broker with significant potential, particularly for traders with limited capital or those keen on high-leverage trading opportunities. Its low minimum deposit, competitive spreads from 1 pip, and extensive range of CFDs are strong selling points. However, concerns over regulatory transparency and trust remain, warranting caution from prospective users. This balanced xeone review highlights that while the trading conditions are attractive, users should perform thorough research before committing funds. With continuous improvements, XeOne could enhance its credibility and user experience, making it a more viable option for a wider audience.