Regarding the legitimacy of fXFLAT BANK forex brokers, it provides BaFin and WikiBit, .

Is fXFLAT BANK safe?

Pros

Cons

Is fXFLAT BANK markets regulated?

The regulatory license is the strongest proof.

BaFin Forex Trading License (EP)

Federal Financial Supervisory Authority

Federal Financial Supervisory Authority

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

FXFlat Bank GmbH

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Bahnstraße 47 40878 Ratingen DeutschlandPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FXFlat Safe or a Scam?

Introduction

FXFlat is a German online broker that has been operating since 1997, positioning itself as a reputable player in the forex market. With a focus on providing access to various financial instruments, including forex, CFDs, and futures, FXFlat aims to cater to both novice and experienced traders. However, as the financial landscape becomes increasingly populated with brokers, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. This article investigates the legitimacy and safety of FXFlat by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks.

In this assessment, we utilized a comprehensive research methodology that involved reviewing industry reports, user testimonials, and expert opinions. Our evaluation framework centers around key factors that impact a trader's experience and safety when using a broker like FXFlat.

Regulation and Legitimacy

The regulatory environment is a vital aspect of any broker's credibility, as it ensures adherence to strict operational standards. FXFlat is regulated by the Federal Financial Supervisory Authority (BaFin) in Germany, which is known for its rigorous oversight of financial institutions. The following table summarizes the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| BaFin | 109603 | Germany | Verified |

BaFin's regulation is significant because it mandates that brokers maintain high levels of transparency, segregate client funds from the company's operational funds, and adhere to strict capital requirements. FXFlat's regulatory history appears to be compliant with these standards, and there have been no significant complaints or violations reported against them. This regulatory framework provides a layer of security for traders, making it unlikely that FXFlat is a scam.

Company Background Investigation

FXFlat was founded in 1997 and has established itself as a reliable broker within the financial markets. The company operates under the legal entity FXFlat Wertpapierhandelsbank GmbH, which is a securities trading bank. The management team at FXFlat possesses extensive experience in the financial sector, contributing to the broker's solid reputation. Transparency is a hallmark of FXFlat, as it regularly discloses information about its services, fees, and regulations.

The broker's commitment to investor protection is evident in its membership with the CFD Verband e.V., an association aimed at promoting transparency and safeguarding investors' interests in Germany. Overall, FXFlat's long-standing presence in the market and its adherence to regulatory standards suggest that it is a legitimate broker rather than a scam.

Trading Conditions Analysis

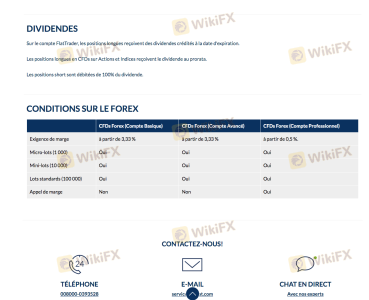

FXFlat offers competitive trading conditions, which are essential for attracting traders. The broker's fee structure includes spreads and commissions, which can vary depending on the trading platform used. Below is a comparison of the core trading costs associated with FXFlat:

| Fee Type | FXFlat | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.8 pips | 1.2 pips |

| Commission Model | €1.00 per contract | €3.50 per contract |

| Overnight Interest Range | Varies | Varies |

The spreads offered by FXFlat are generally lower than the industry average, which is a positive aspect for traders looking to minimize their trading costs. However, it is important to note that FXFlat does charge commissions on certain instruments, which could affect overall profitability. Traders should carefully review the fee structure to understand any potential hidden costs.

Client Fund Safety

Client fund safety is a paramount concern for traders, and FXFlat implements several measures to ensure the security of its clients' funds. The broker adheres to BaFin's regulations, which require the segregation of client funds from the company's operational funds. This means that in the event of financial difficulties, client funds remain protected.

Additionally, FXFlat offers negative balance protection, which prevents clients from losing more than their deposited amount. This is an important safety feature that enhances the overall trading environment.

While there have been no significant historical issues regarding fund security at FXFlat, traders should remain vigilant and aware of the potential risks associated with trading, especially in volatile markets.

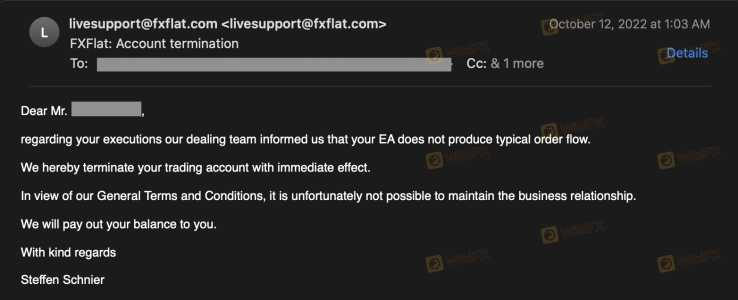

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's reliability. FXFlat has received mixed reviews from its users, with some praising its trading conditions and customer support, while others have raised concerns about withdrawal processes and customer service responsiveness. Below is a summary of common complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Poor Customer Support | Medium | Generally Positive |

| Slippage Issues | Medium | Inconsistent |

One notable complaint involved a trader experiencing significant delays in the withdrawal of funds, which raised concerns about FXFlat's operational transparency. While the broker has generally positive customer support ratings, the inconsistency in handling withdrawal requests could be a red flag for potential clients.

Platform and Trade Execution

FXFlat offers a range of trading platforms, including MetaTrader 4 and 5, as well as its proprietary Agenatrader platform. These platforms are known for their stability and user-friendly interfaces. However, it is essential to analyze the quality of order execution, slippage rates, and instances of order rejections.

Overall, FXFlat's platforms are regarded as reliable, with traders reporting satisfactory execution speeds. However, there have been occasional reports of slippage during high volatility periods, which is a common issue across many brokers. Traders should be aware of these potential execution risks when trading.

Risk Assessment

Using FXFlat comes with its own set of risks, as with any trading platform. Below is a summary of the key risk areas associated with FXFlat:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by BaFin |

| Fund Safety Risk | Low | Segregated accounts and protections |

| Execution Risk | Medium | Occasional slippage during volatility |

| Customer Service Risk | Medium | Mixed reviews on support responsiveness |

To mitigate these risks, traders are advised to conduct thorough research, utilize demo accounts before live trading, and be aware of market conditions that may affect their trading experience.

Conclusion and Recommendations

In conclusion, FXFlat is not a scam; it is a regulated broker that offers a range of trading instruments and competitive conditions. While it has received some negative feedback regarding customer service and withdrawal processes, its regulatory compliance and commitment to fund safety make it a legitimate choice for traders.

Traders should exercise caution and consider their individual needs when selecting FXFlat as their broker. For those who prioritize a regulated environment with a solid reputation, FXFlat may be a suitable option. However, potential clients should remain vigilant and consider alternative brokers if they seek a more robust customer support experience or have concerns about withdrawal processes.

In summary, FXFlat is a broker that can be trusted, but like all trading platforms, it requires careful consideration and due diligence on the part of the trader.

Is fXFLAT BANK a scam, or is it legit?

The latest exposure and evaluation content of fXFLAT BANK brokers.

fXFLAT BANK Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

fXFLAT BANK latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.