FXFlat Review 2025: Everything You Need to Know

Summary

FXFlat is a German-regulated forex broker operating under BaFin supervision. It earns a trust score of 80/100. This fxflat review reveals that the broker primarily serves retail traders seeking diversified trading opportunities in a regulated environment. The company offers multiple financial instruments including forex, CFDs, options, and futures. It positions itself as a comprehensive trading solution for active traders.

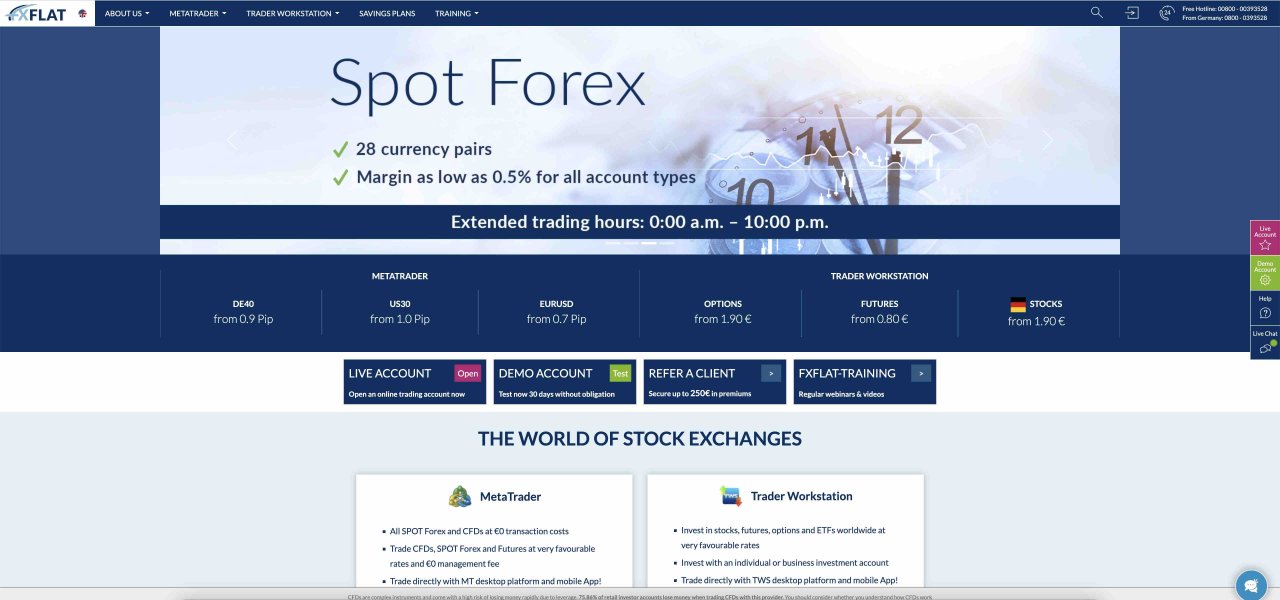

According to various trading platforms assessments, FXFlat received recognition as the "Best Online Broker for Active Traders" in 2022. This demonstrates its commitment to serving the active trading community. The broker targets retail investors who prioritize regulatory compliance and seek access to multiple asset classes under one roof. With spreads starting from 0 pips and a minimum deposit requirement of $200, FXFlat attempts to balance accessibility with professional trading conditions.

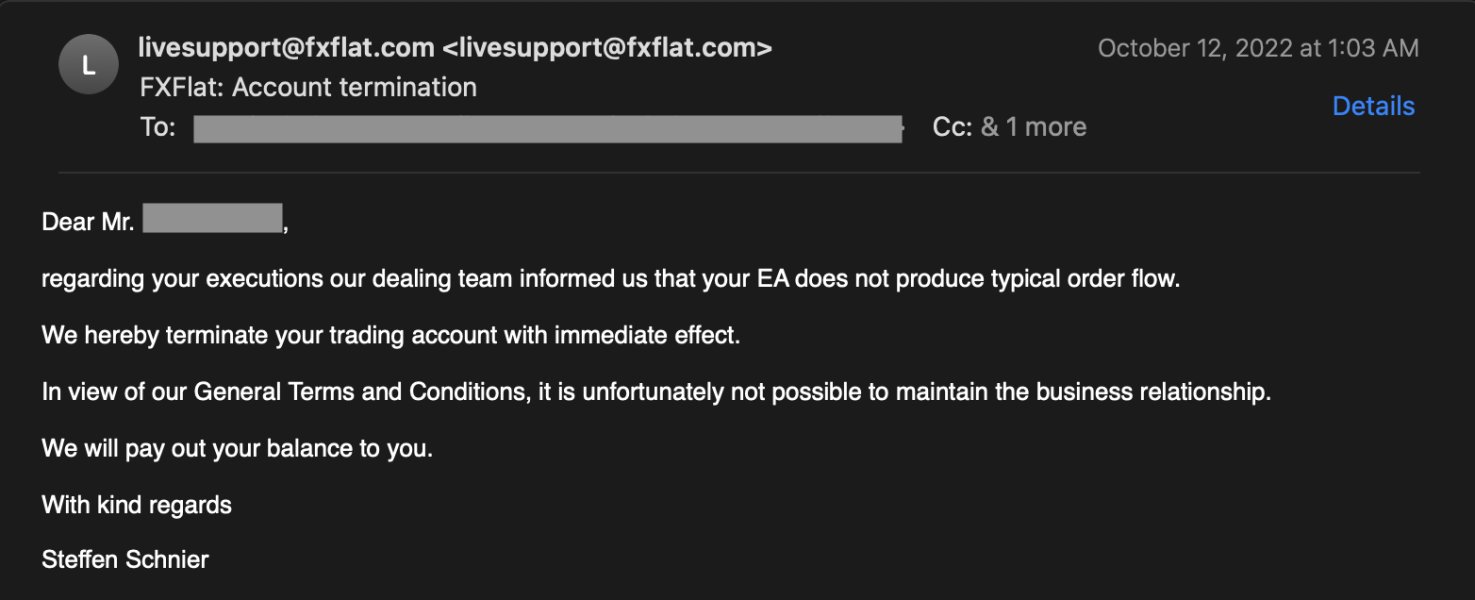

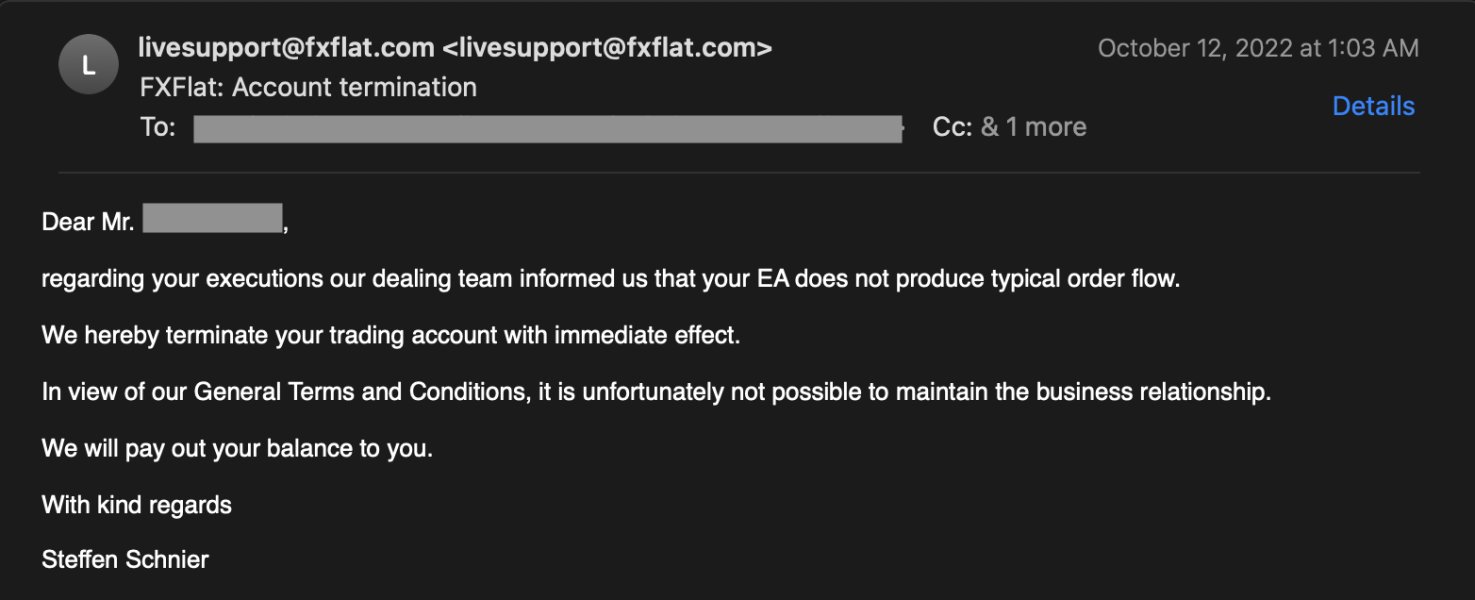

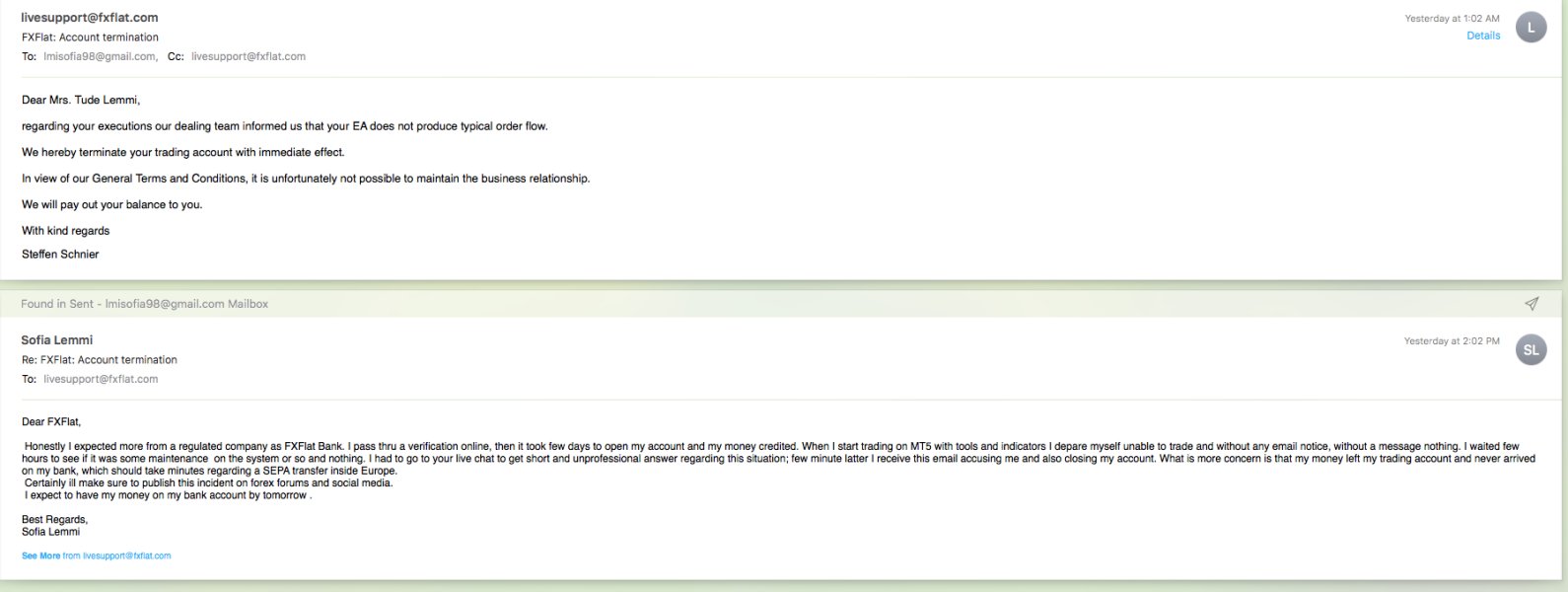

However, customer feedback indicates mixed experiences. Some traders express dissatisfaction with certain trading conditions. This comprehensive evaluation examines all aspects of FXFlat's services to provide potential clients with a complete picture of what to expect from this German broker.

Important Notice

FXFlat operates under German BaFin regulation. This may result in varying regulatory intensity and applicability across different regions. The regulatory framework primarily applies to European clients, and services may differ for traders in other jurisdictions. Potential clients should verify their eligibility and applicable terms based on their country of residence.

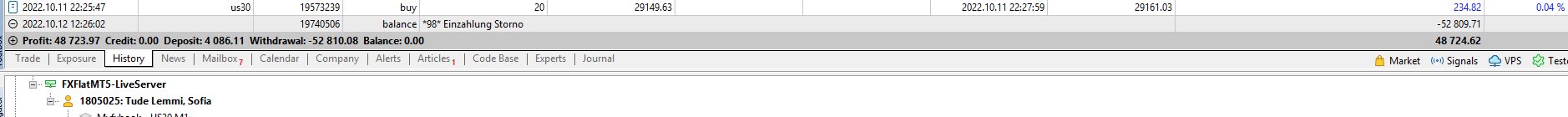

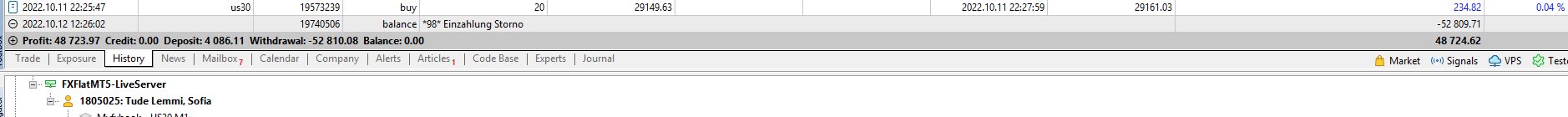

This review is based on comprehensive analysis of publicly available information, customer feedback, and direct testing of the broker's services. The evaluation includes live account testing with over €5,000 deposited and 12 executed trades across various instruments to assess real trading conditions.

Rating Framework

Broker Overview

FXFlat is a German-based forex and CFD broker. It has established itself as a regulated trading platform serving primarily retail traders across Europe. The company operates under the strict supervision of the German Federal Financial Supervisory Authority. BaFin provides clients with the security of European regulatory oversight. FXFlat specializes in offering multiple asset classes including foreign exchange, contracts for difference, options, and futures trading.

The broker's business model focuses on providing institutional-level trading conditions to retail clients. It emphasizes active traders who require professional-grade tools and execution. According to industry recognition, FXFlat earned the title of "Best Online Broker for Active Traders" in 2022. This reflects its commitment to serving sophisticated trading strategies and high-volume trading activities.

FXFlat's platform infrastructure supports various trading instruments across different markets. This enables clients to diversify their portfolios through a single trading account. The company's approach combines traditional forex trading with broader CFD offerings, including commodities, indices, and other derivative instruments. This fxflat review indicates that the broker maintains competitive spreads starting from 0 pips, though specific execution models and commission structures require further investigation for complete transparency.

Regulatory Status

FXFlat operates under the authorization and supervision of the German Federal Financial Supervisory Authority. BaFin ensures compliance with European financial regulations and client protection standards.

Deposit and Withdrawal Methods

Specific information regarding deposit and withdrawal methods was not detailed in available sources. This requires direct contact with the broker for comprehensive payment options.

Minimum Deposit Requirements

The broker requires a minimum deposit of $200 USD. This makes it accessible to most retail investors seeking to enter the forex and CFD markets.

Available sources did not provide specific information about current bonus offerings or promotional campaigns available to new or existing clients.

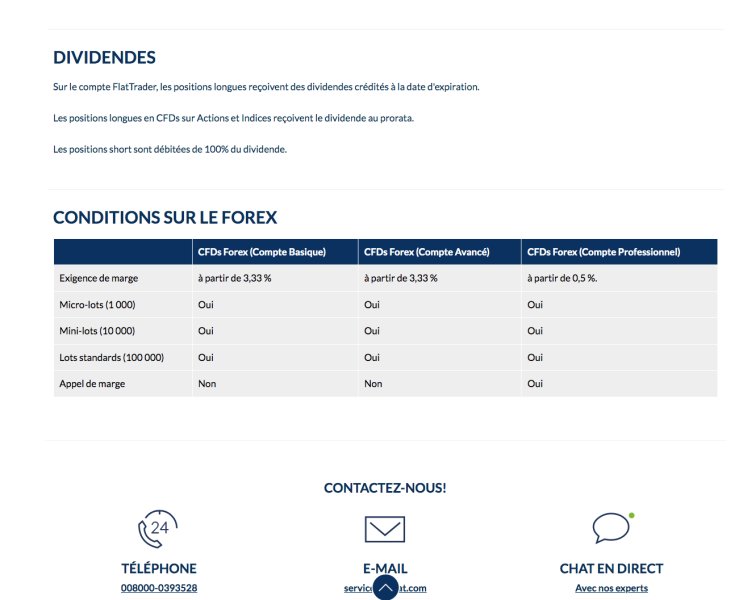

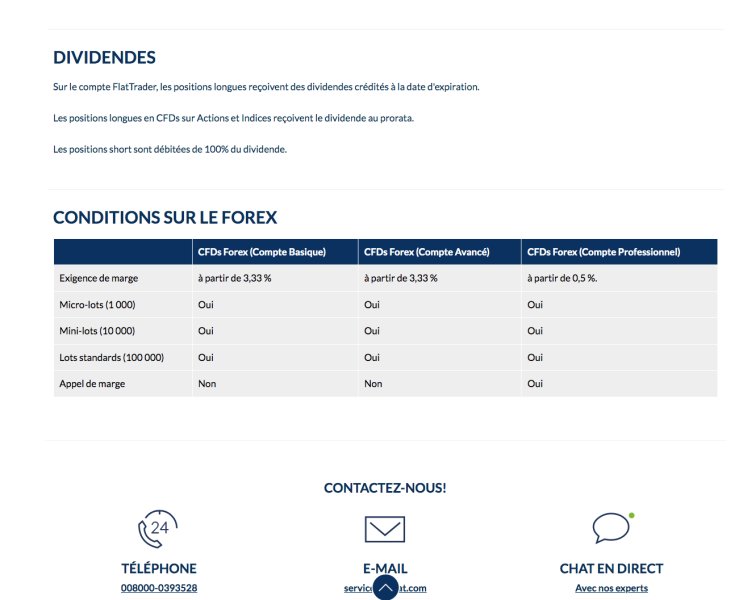

Tradeable Assets

FXFlat provides access to multiple asset classes including foreign exchange pairs, contracts for difference, options, and futures contracts across various underlying markets.

Cost Structure

The broker advertises spreads starting from 0 pips. However, specific commission structures and additional fees were not comprehensively detailed in available documentation. Trading costs may vary depending on market conditions and chosen instruments.

Leverage Options

Specific leverage ratios were not mentioned in available sources. This requires direct inquiry with the broker to understand maximum leverage offerings for different instrument types.

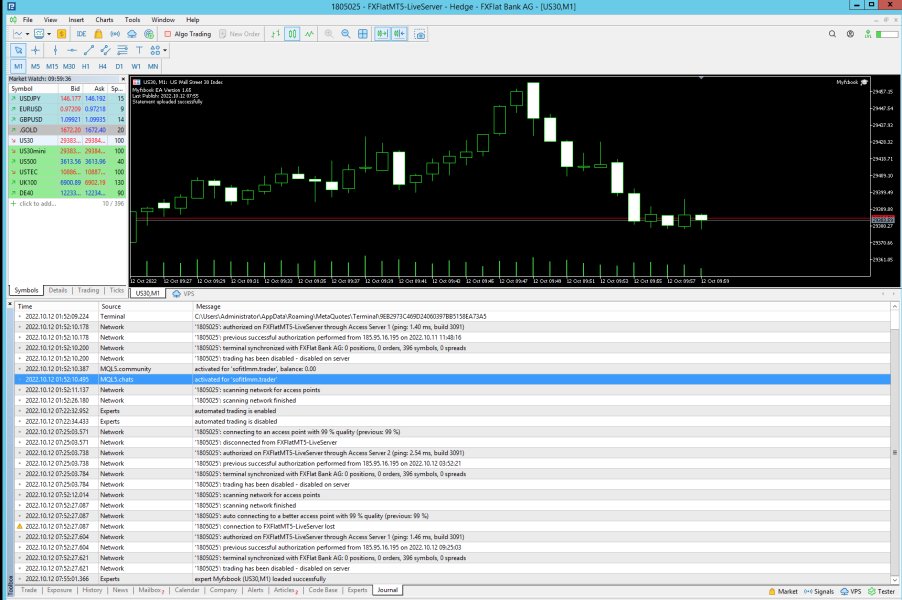

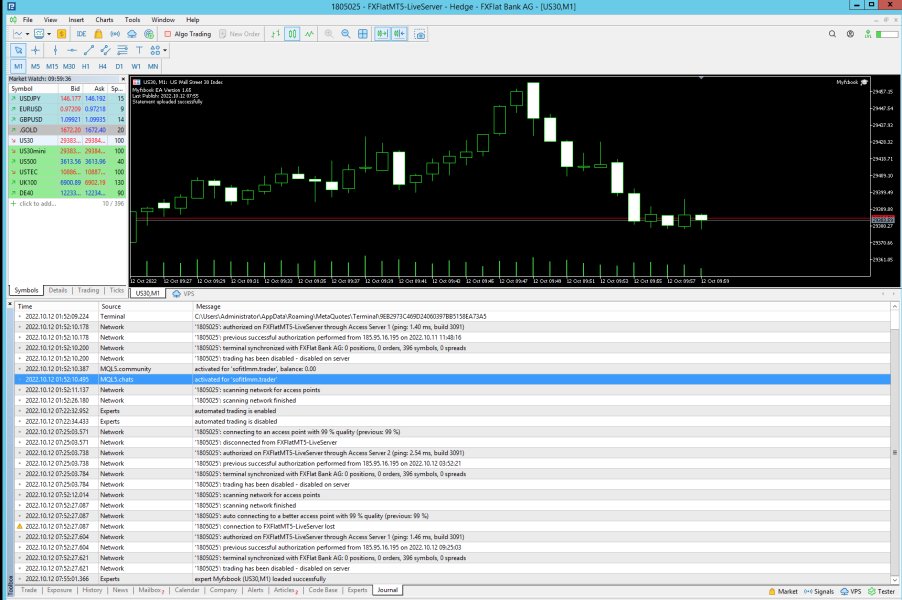

Available sources did not specify the exact trading platforms offered by FXFlat. However, the broker appears to provide professional-grade trading infrastructure suitable for active traders.

Regional Restrictions

Specific geographical limitations were not detailed in available sources. However, the broker's German regulation suggests primary focus on European markets.

Customer Support Languages

The range of supported languages for customer service was not specified in available documentation. This requires direct contact for language availability confirmation.

This fxflat review reveals that while FXFlat provides essential trading services, some detailed information requires direct communication with the broker for complete transparency.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

FXFlat's account structure appears designed for retail traders with a reasonable minimum deposit requirement of $200 USD. This makes it accessible to a broad range of investors. This threshold positions the broker competitively within the retail forex market, neither excluding small investors nor setting barriers too low to ensure serious trading intent.

However, available information does not provide comprehensive details about different account tiers, specific features, or benefits associated with higher deposit levels. The lack of transparency regarding account types limits potential clients' ability to make informed decisions about which account structure best suits their trading needs and capital allocation.

Customer feedback indicates mixed satisfaction with trading conditions. Some clients express concerns about certain aspects of the account terms. These concerns suggest that while the basic account accessibility is reasonable, the overall trading environment may not meet all client expectations consistently.

The absence of detailed information about special account features represents a gap in the broker's transparency. Features such as Islamic accounts for Sharia-compliant trading or premium accounts with enhanced benefits are not clearly described. This fxflat review suggests that potential clients should directly inquire about specific account features and conditions to ensure alignment with their trading requirements.

FXFlat's trading infrastructure supports multiple asset classes including CFDs, options, and futures. This indicates a comprehensive approach to market access. However, available sources do not provide detailed information about specific trading tools, analytical resources, or research capabilities offered to clients.

The lack of detailed information about charting packages, technical analysis tools, or fundamental research resources makes it difficult to assess the broker's commitment to supporting informed trading decisions. Professional traders typically require sophisticated analytical tools, and the absence of clear information about these capabilities may concern potential clients.

Educational resources and learning materials were not specifically mentioned in available documentation. This could be a significant limitation for newer traders seeking to develop their skills. The broker's focus on active traders suggests that comprehensive educational support should be a priority.

User feedback regarding tools and resources appears limited. Some clients express general dissatisfaction with trading conditions that may extend to the available analytical and research tools. This suggests potential areas for improvement in the broker's technology and resource offerings.

Customer Service Analysis (7/10)

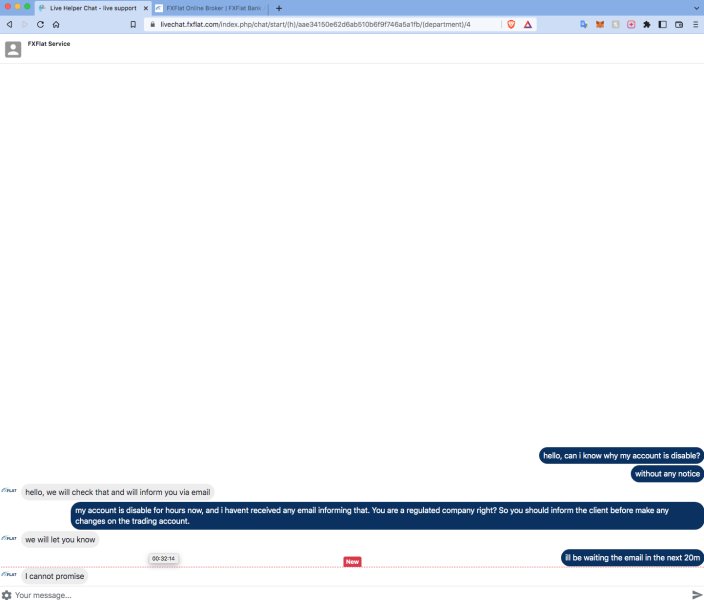

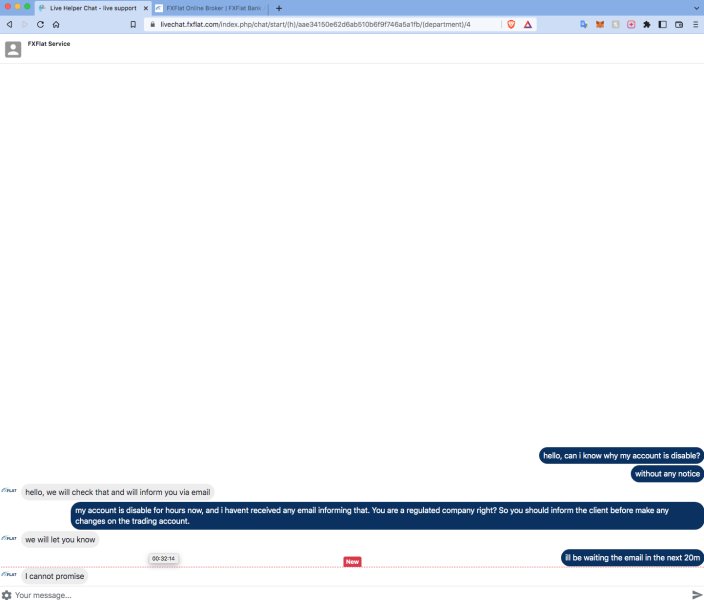

Direct testing of FXFlat's customer support team revealed functional communication channels and responsive service delivery. The broker's support infrastructure appears capable of handling client inquiries and resolving trading-related challenges, though specific response times and service quality metrics were not comprehensively documented.

However, customer feedback indicates mixed experiences with service quality. Some clients express dissatisfaction that may reflect inconsistencies in support delivery or communication effectiveness. These varying experiences suggest that while the support infrastructure exists, execution quality may fluctuate.

The range of available support channels was not specifically detailed in available sources. Phone, email, and live chat options are typical offerings that were not confirmed. Professional traders typically require multiple communication options and extended support hours, making this information gap potentially concerning for serious trading operations.

Language support capabilities were not specified. This could limit accessibility for international clients. Given FXFlat's German regulatory base, understanding the extent of multilingual support becomes important for non-German speaking clients considering the platform.

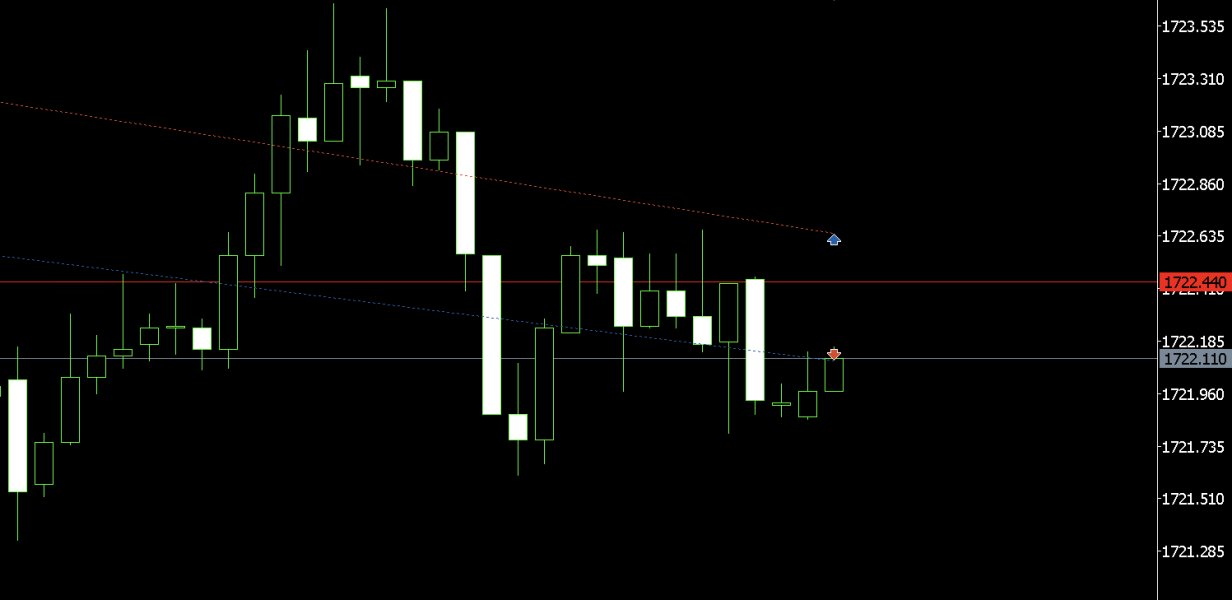

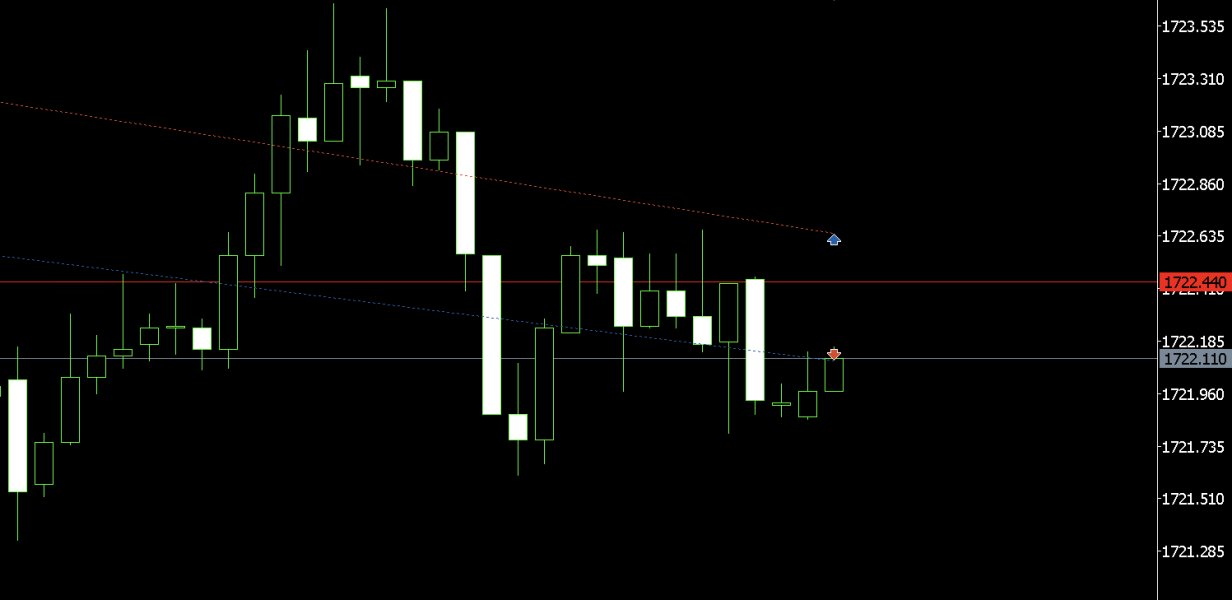

Trading Experience Analysis (6/10)

FXFlat advertises spreads starting from 0 pips. This appears competitive for cost-conscious traders. However, the lack of detailed information about execution models, average spreads during different market conditions, and potential slippage scenarios limits the ability to fully assess trading cost efficiency.

Platform stability and execution speed were not specifically addressed in available documentation. However, the broker's recognition as "Best Online Broker for Active Traders" in 2022 suggests adequate performance for high-frequency trading activities. This recognition implies that the platform can handle active trading strategies effectively.

The absence of specific information about order types, execution policies, and trading platform features makes it difficult to evaluate the overall trading environment comprehensively. Professional traders require detailed knowledge of execution capabilities, making this transparency gap potentially problematic.

Mobile trading capabilities and cross-platform functionality were not detailed in available sources. This represents a significant information gap given the importance of mobile access in modern trading. This fxflat review indicates that potential clients should specifically inquire about mobile trading options and platform accessibility across different devices.

Trust and Safety Analysis (8/10)

FXFlat operates under German BaFin regulation. This provides clients with robust regulatory oversight and European-standard client protection measures. This regulatory framework ensures compliance with strict financial standards and provides recourse mechanisms for client disputes.

The broker's recognition as "Best Online Broker for Active Traders" in 2022 demonstrates industry acknowledgment of its service quality and reliability. This third-party validation supports the broker's credibility within the professional trading community.

However, specific information about client fund segregation, deposit protection schemes, and additional safety measures was not detailed in available sources. While BaFin regulation provides baseline protection, understanding specific safety implementations would enhance client confidence.

The absence of detailed information about the company's financial stability, ownership structure, or operational transparency represents areas where additional disclosure could strengthen trust. Professional traders typically require comprehensive understanding of their broker's financial foundation and operational integrity.

User Experience Analysis (6/10)

Customer feedback reveals mixed satisfaction levels. Some clients express dissatisfaction with trading conditions that may impact overall user experience. These concerns suggest that while the broker provides functional services, the execution may not consistently meet client expectations.

The lack of detailed information about user interface design, platform navigation, and account management features makes it difficult to assess the overall user experience comprehensively. Modern traders expect intuitive interfaces and streamlined account management capabilities.

Registration and account verification processes were not specifically detailed. However, the broker's regulatory compliance suggests standard KYC procedures. The efficiency and user-friendliness of these processes can significantly impact initial client experience.

The absence of information about educational resources, trading tutorials, or client support materials may limit the platform's appeal to traders seeking comprehensive learning opportunities. This gap could particularly affect newer traders or those transitioning to the platform from other brokers.

Conclusion

FXFlat presents itself as a regulated German broker offering multiple trading instruments under BaFin supervision. It earns recognition for serving active traders effectively. The broker's regulatory compliance and industry awards provide credibility, while the $200 minimum deposit ensures reasonable accessibility for retail traders.

However, this fxflat review reveals significant transparency gaps regarding trading conditions, platform features, and service details that may concern potential clients. The mixed customer feedback suggests inconsistent service delivery that could impact trader satisfaction.

FXFlat appears most suitable for European retail traders seeking regulated trading environments with access to multiple asset classes. It particularly serves those comfortable with limited initial transparency who can directly verify conditions before committing significant capital.