Regarding the legitimacy of EllandRoad forex brokers, it provides FSCA and WikiBit, .

Is EllandRoad safe?

Pros

Cons

Is EllandRoad markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ELLAND ROAD CAPITAL (PTY) LTD

Effective Date: Change Record

2022-02-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

OFFICE 162 FIRST FLOOR , WILLOW BRIDGE CENTRE CARL CRONJE DRIVE, CAPE TOWN , WESTERN 7530Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Elland Road a Scam?

Introduction

Elland Road Capital is a relatively new player in the forex market, having been established in 2022 and claiming to offer a range of trading services including forex, commodities, cryptocurrencies, and CFDs. As the trading landscape continues to evolve, traders must exercise caution when selecting a broker, as the potential for scams and fraudulent activities is ever-present. This article aims to provide a comprehensive analysis of Elland Road Capital, evaluating its legitimacy, regulatory status, trading conditions, and overall reputation based on various sources and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is paramount in assessing its reliability. Elland Road Capital claims to be regulated by the Financial Sector Conduct Authority (FSCA) of South Africa. While regulation is a positive indicator, the quality and enforcement of that regulation can vary significantly.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 52127 | South Africa | Verified |

The FSCA is considered a Tier 2 regulator, which means it may not impose as stringent requirements as Tier 1 regulators like the FCA or ASIC. Some reviews have suggested that Elland Road Capital has exceeded the scope of its license, raising questions about its compliance with regulatory frameworks. The lack of more robust regulatory oversight could potentially expose traders to higher risks, particularly in terms of investor protection and financial security.

Company Background Investigation

Elland Road Capital is owned by Elland Road Capital Pty Ltd, which is registered in South Africa. The company's ownership structure and management team details are not extensively disclosed, which raises transparency concerns. A thorough investigation into the management team reveals a lack of publicly available information regarding their professional backgrounds and experience in the financial sector. This lack of transparency can be a red flag for potential investors, as it can indicate a possible absence of accountability and oversight within the company.

Furthermore, the company's operational history is quite short, having been established in 2022. This limited track record may lead potential traders to question the firm's stability and reliability, especially when compared to more established brokers with proven histories of compliance and customer satisfaction.

Trading Conditions Analysis

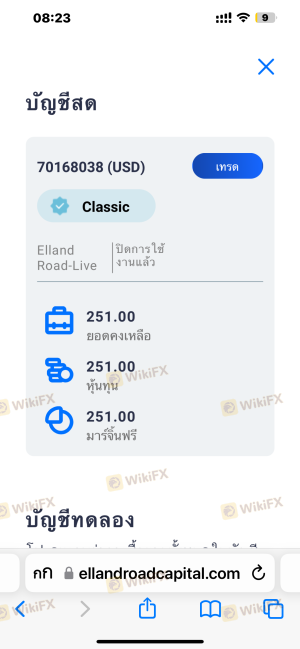

Elland Road Capital's trading conditions are a critical factor in evaluating its overall value proposition. The broker offers a minimum deposit requirement of $250, which is relatively standard in the industry. However, the overall fee structure can be complex and somewhat opaque.

| Fee Type | Elland Road Capital | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.5 pips | 1.5 pips |

| Commission Model | None specified | Varies by broker |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Elland Road Capital, starting at 2.5 pips for major currency pairs, are considered higher than the industry average. Such wide spreads can significantly impact trading profitability, especially for high-frequency traders. Additionally, the broker does not clearly disclose its commission structure, which can lead to unexpected costs for traders.

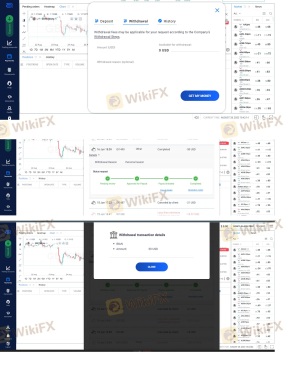

There are reports of withdrawal issues and hidden fees associated with various transactions. These concerns warrant careful consideration as they may indicate potential pitfalls for traders looking to access their funds.

Customer Funds Safety

When it comes to the safety of customer funds, Elland Road Capital claims to implement several protective measures. The broker states that client funds are kept in segregated accounts, which is a standard practice designed to protect traders in the event of the company's insolvency. Additionally, the broker offers negative balance protection, ensuring that traders cannot lose more than their initial investment.

However, there have been numerous complaints regarding withdrawal difficulties, with some users reporting being unable to access their funds. Such incidents raise serious concerns about the broker's commitment to safeguarding client assets and fulfilling withdrawal requests in a timely manner.

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability. A review of user experiences with Elland Road Capital reveals a concerning trend of negative reviews and complaints. Common issues reported by users include difficulties in withdrawing funds, poor customer support, and high-pressure sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Inconsistent |

| Pressure to Deposit More Funds | High | Unresponsive |

One notable case involved a trader who reported losing significant funds due to poor advice from an account manager, who pressured them to increase their investment without adequately explaining the risks involved. This type of behavior raises alarm bells about the broker's ethical practices and commitment to client welfare.

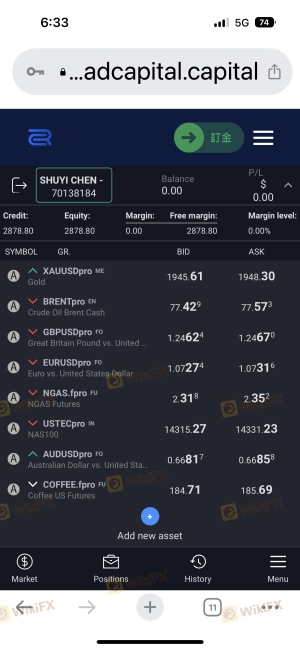

Platform and Execution

Elland Road Capital offers its clients access to the popular MetaTrader 4 (MT4) platform as well as a proprietary web-based trading platform. While MT4 is well-regarded for its user-friendly interface and advanced features, the performance and stability of the proprietary platform remain under scrutiny.

Traders have reported issues related to order execution quality, including slippage and instances of rejected orders. Such problems can severely impact trading outcomes and may suggest a lack of robust infrastructure to support high-volume trading.

Risk Assessment

Utilizing Elland Road Capital comes with inherent risks that potential traders should be aware of. The combination of high leverage, limited regulatory oversight, and numerous negative reviews contributes to an elevated risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Weak oversight by FSCA |

| Withdrawal Risk | High | Reports of difficulties in accessing funds |

| Trading Conditions Risk | Medium | High spreads and unclear fees |

To mitigate these risks, traders should conduct thorough due diligence, consider using smaller amounts for initial trading, and explore alternative brokers with stronger regulatory frameworks and better customer feedback.

Conclusion and Recommendations

In conclusion, while Elland Road Capital is regulated by the FSCA, the numerous complaints and concerns raised by users suggest that potential traders should proceed with caution. The combination of high leverage, poor customer support, and withdrawal issues raises significant red flags that could indicate the broker may not be a reliable option for trading.

For traders seeking more secure and reputable alternatives, it is advisable to consider brokers regulated by Tier 1 authorities such as the FCA or ASIC, which typically offer better investor protection and more transparent trading conditions. Ultimately, conducting thorough research and considering personal risk tolerance is essential before engaging with any broker, particularly one with a mixed reputation like Elland Road Capital.

Is EllandRoad a scam, or is it legit?

The latest exposure and evaluation content of EllandRoad brokers.

EllandRoad Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EllandRoad latest industry rating score is 4.28, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.28 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.