Regarding the legitimacy of ADSS forex brokers, it provides SFC, CMA and WikiBit, (also has a graphic survey regarding security).

Is ADSS safe?

Pros

Cons

Is ADSS markets regulated?

The regulatory license is the strongest proof.

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

ADS Securities Hong Kong Limited

Effective Date:

2011-08-09Email Address of Licensed Institution:

hkinfo@ads-securities.comSharing Status:

No SharingWebsite of Licensed Institution:

www.adss.comExpiration Time:

--Address of Licensed Institution:

香港中環德輔道中33號3樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

CMA Forex Trading License (EP)

Capital Market Authority

Capital Market Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

ADS Securities LLC

Effective Date:

2010-09-23Email Address of Licensed Institution:

compliance@adss.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Abu Dhabi - Al Bateen Sector: W10 Plot number: C67 Building Name: CI Tower P.O Box 93894 City Abu DhabiPhone Number of Licensed Institution:

971-26572414Licensed Institution Certified Documents:

Is ADSS A Scam?

Introduction

ADSS, also known as ADS Securities, is a prominent forex and CFD broker based in Abu Dhabi, United Arab Emirates. Established in 2011, it has positioned itself as a significant player in the Middle East and North Africa (MENA) region, offering a variety of trading instruments including forex, indices, commodities, and cryptocurrencies. As the trading landscape becomes increasingly crowded, it is crucial for traders to carefully evaluate the brokers they choose to work with. With numerous reports of scams and fraudulent practices in the forex market, traders must remain vigilant and informed about the legitimacy of their chosen brokers. This article aims to provide an objective analysis of ADSS, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The evaluation is based on a comprehensive review of multiple sources, including regulatory filings, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in determining its legitimacy and safety. ADSS is regulated by the Securities and Commodities Authority (SCA) in the UAE, which is responsible for overseeing financial markets in the region. Regulation by a reputable authority ensures that the broker adheres to strict standards of conduct, safeguarding client interests and promoting transparency.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SCA | 1190047 | UAE | Active |

| FCA | 577453 | UK | Active |

| SFC | AXC847 | Hong Kong | Revoked |

The SCA is known for its stringent regulatory framework, which includes requirements for capital adequacy, client fund segregation, and compliance with anti-money laundering (AML) regulations. However, it is important to note that the Securities and Futures Commission (SFC) in Hong Kong has revoked ADSS's license, raising concerns about its operations in that jurisdiction. This dual regulatory status—active in the UAE and revoked in Hong Kong—presents a mixed picture for potential clients.

ADSS has maintained a relatively clean compliance record under the SCA, with no significant regulatory actions reported. However, the revocation of its Hong Kong license may lead some traders to question its stability and commitment to regulatory compliance. Overall, while ADSS is regulated in the UAE and the UK, the issues with the SFC in Hong Kong warrant caution and further scrutiny.

Company Background Investigation

ADSS has a rich history, having been founded in 2011 with the goal of providing high-quality financial services to clients in the MENA region. The company has expanded its operations internationally, with offices in London and Hong Kong, and serves a diverse clientele of over 20,000 active clients. The ownership structure is not publicly disclosed, but the firm is privately held and has established itself as a significant player in the forex market.

The management team at ADSS consists of experienced professionals with backgrounds in finance and trading, providing a level of expertise that is crucial for navigating the complex financial markets. The company's commitment to transparency is evident in its regular disclosures and updates regarding its operations and services. However, the lack of detailed information about its ownership structure may raise concerns for some traders who prioritize transparency in their broker relationships.

In terms of financial stability, ADSS claims to have a substantial capital base, which is a positive indicator of its ability to meet client obligations. The firm also segregates client funds from its operational capital, further enhancing the safety of client investments. Overall, ADSS appears to have a solid foundation, but potential clients may want to seek additional information regarding its ownership and financial health.

Trading Conditions Analysis

ADSS offers a variety of trading conditions that cater to different types of traders. The fee structure is primarily based on spreads, with no commissions charged on trades. This commission-free model is appealing to many traders, as it simplifies the cost of trading.

| Fee Type | ADSS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips (Classic) | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads offered by ADSS are competitive, starting from 1.2 pips for the classic account and potentially lower for elite accounts. However, these spreads may be considered higher than average, especially for traders accustomed to tighter spreads offered by other brokers. The lack of a commission model can be advantageous for traders who prefer a straightforward pricing structure, but it also means that traders may end up paying higher spreads.

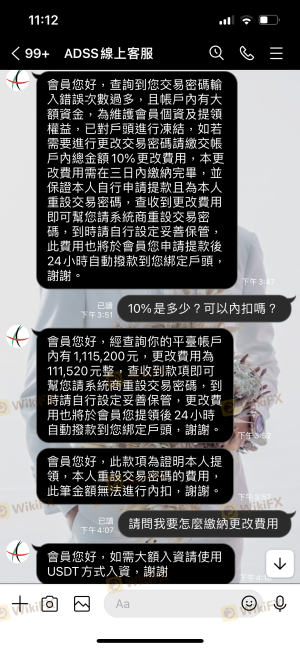

One notable aspect of ADSS's fee structure is the withdrawal fee of $15, which is relatively high compared to other brokers that often offer free withdrawals. This could impact traders who frequently withdraw funds from their accounts. Additionally, traders should be aware of potential fees imposed by payment providers, which may further increase the cost of trading.

Overall, while ADSS provides a commission-free trading environment with competitive spreads, the higher-than-average withdrawal fees and spreads may deter some traders. It is essential for traders to evaluate their trading strategies and preferences when considering ADSS as their broker.

Client Funds Security

The security of client funds is paramount in the trading industry, and ADSS has implemented several measures to protect its clients' investments. The firm segregates client funds from its operational capital, ensuring that client deposits are not used for company operations. This practice is a fundamental requirement of regulatory bodies and is crucial for maintaining client trust.

ADSS does not offer negative balance protection, which means that traders can potentially lose more than their initial deposit. This lack of protection is a significant risk factor for traders, especially those who employ high leverage in their trading strategies. It is essential for traders to be aware of this risk and to implement proper risk management techniques to mitigate potential losses.

In terms of security measures, ADSS employs SSL encryption to protect clients' personal and financial information. The company has also been accredited with the ISO/IEC 27001 certification, which demonstrates its commitment to maintaining high standards of information security management. Despite these positive indicators, the absence of negative balance protection raises concerns about the overall safety of client funds.

Historically, there have been no significant issues reported regarding fund security at ADSS, but potential clients should remain vigilant and conduct thorough research before depositing funds with any broker.

Customer Experience and Complaints

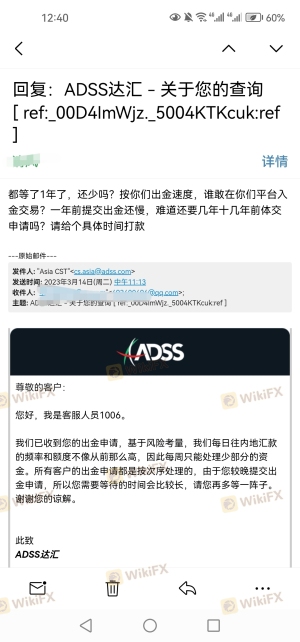

Customer feedback is a crucial aspect of evaluating any broker, and ADSS has received a mix of reviews from its clients. Many traders appreciate the competitive spreads and the user-friendly nature of the trading platforms. However, there are also reports of slow customer service response times and issues with withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Inconsistent quality |

Common complaints include delays in processing withdrawals, with some clients reporting that it took several days to receive their funds. Additionally, the quality of customer support has been criticized, with some users experiencing long wait times to reach a representative. While ADSS does offer multilingual support, the inconsistency in response times may be a red flag for potential clients.

One illustrative case involved a trader who attempted to withdraw a significant amount of funds but faced delays and a lack of communication from the support team. This experience highlights the importance of reliable customer service in maintaining client trust and satisfaction.

Overall, while many clients report positive experiences with ADSS, the recurring issues related to customer support and withdrawal processing times warrant caution. Potential clients should consider these factors when deciding whether to engage with ADSS.

Platform and Trade Execution

ADSS offers two primary trading platforms: the widely-used MetaTrader 4 (MT4) and its proprietary trading platform. The MT4 platform is known for its robust features, including advanced charting tools, automated trading capabilities, and a user-friendly interface. Traders can access a variety of instruments and execute trades efficiently on this platform.

However, there have been reports of execution issues, including slippage and rejections of orders during high volatility periods. These concerns can significantly impact trading performance, especially for strategies that rely on precise entry and exit points. Traders should be aware of the potential for execution delays and should consider testing the platform extensively before committing significant capital.

ADSS's proprietary platform is designed to be intuitive and easy to navigate, catering to both novice and experienced traders. While it offers essential functionalities, some users have noted that it lacks the advanced features available on MT4. This may limit the trading capabilities for more sophisticated traders who rely on advanced tools and custom indicators.

Overall, while ADSS provides reliable trading platforms, the potential for execution issues and the limitations of its proprietary platform may be concerns for traders who prioritize speed and advanced functionality.

Risk Assessment

Using ADSS as a trading broker comes with inherent risks that traders should carefully consider. The absence of negative balance protection is a significant risk factor, as it exposes traders to the possibility of losing more than their initial investment. Additionally, the higher-than-average spreads and withdrawal fees may impact overall profitability.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Mixed regulatory status (active in UAE, revoked in HK) |

| Fund Security Risk | Medium | No negative balance protection |

| Execution Risk | Medium | Potential slippage and order rejections |

Traders should implement risk management strategies, such as setting stop-loss orders and avoiding excessive leverage, to mitigate potential losses. Additionally, conducting thorough research and starting with a demo account can help traders familiarize themselves with the platform and its features before committing real funds.

Conclusion and Recommendations

In conclusion, ADSS presents a mixed picture regarding its legitimacy and safety as a forex broker. While it is regulated by the SCA in the UAE and has a solid reputation in the MENA region, the revocation of its Hong Kong license raises concerns. The absence of negative balance protection and the high withdrawal fees further complicate the decision for potential clients.

For traders who prioritize a regulated environment and are comfortable with the associated risks, ADSS may be a suitable option. However, those seeking lower fees, faster withdrawals, and robust customer support may want to consider alternative brokers. Recommended alternatives include brokers with strong regulatory oversight, competitive trading costs, and a proven track record of customer satisfaction.

Ultimately, traders should conduct their own due diligence and assess their risk tolerance before engaging with ADSS or any other broker.

Is ADSS a scam, or is it legit?

The latest exposure and evaluation content of ADSS brokers.

ADSS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ADSS latest industry rating score is 2.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.