utrada 2025 Review: Everything You Need to Know

Summary

The utrada review stays a hot topic in the trading world. People can't agree if this broker is real or a scam. utrada gets a neutral rating because reports about it are mixed, especially when it comes to being clear and following rules. One good thing is its referral Introducing Broker program that lets people take out commissions every day. The broker also supports MT4 and MT5, which are MetaTrader platforms that most traders know well. These platforms work great for both new and experienced traders who want to trade forex, commodities, indices, and cryptocurrencies. The Labuan Financial Services Authority watches over utrada, but some important details like minimum deposits and fees are not shared clearly. Based on public data and what users say, people should research carefully before they sign up. utrada has some nice features but also has serious problems that need attention.

Notice

utrada works through different companies in different regions. The Labuan Financial Services Authority regulates it, which means laws and markets can be very different depending on where you live. People should be careful and learn about local rules when they think about using this broker. This review only uses information that anyone can find and feedback from users in reports and regulatory documents. Details like how to deposit money, minimum deposits, and customer service quality are not very clear. People who want to invest should check more sources and compare conditions in their area before they move forward.

Rating Framework

Broker Overview

Utrada is an online trading broker that offers many different trading products. These include forex, commodities, indices, and cryptocurrencies that appeal to various types of investors. The company doesn't say when it started, but it has built a name by targeting individual traders and people who want to invest in multiple assets. The broker has an Introducing Broker program that lets partners earn daily commissions, which helps them get more clients through referrals quickly. utrada wants to offer many asset types to meet what different investors need. Even with these good selling points, important details like minimum deposits and fee structures are not clearly explained, which makes people wonder if the broker can be trusted.

utrada gives clients access to MetaTrader 4 and MetaTrader 5 platforms. These platforms are famous for being strong, having advanced charts, and offering many technical analysis tools that both new and experienced traders like. Besides forex, utrada lets people trade commodities, indices, cryptocurrencies, and stocks, so users can have a diverse portfolio. The Labuan Financial Services Authority regulates the broker, and according to public records, this tries to make sure trading follows certain standards. But because there's not enough clear information about account conditions and fees, potential clients should be careful. This utrada review shows a broker that offers modern trading tools but also has some worrying issues about being transparent.

Regulatory Region:

The Labuan Financial Services Authority regulates utrada. This regulatory system is specific to the Labuan region, so investors should know that local rules and legal requirements can be different. People need to understand the rules that apply in their own area when they think about trading with utrada.

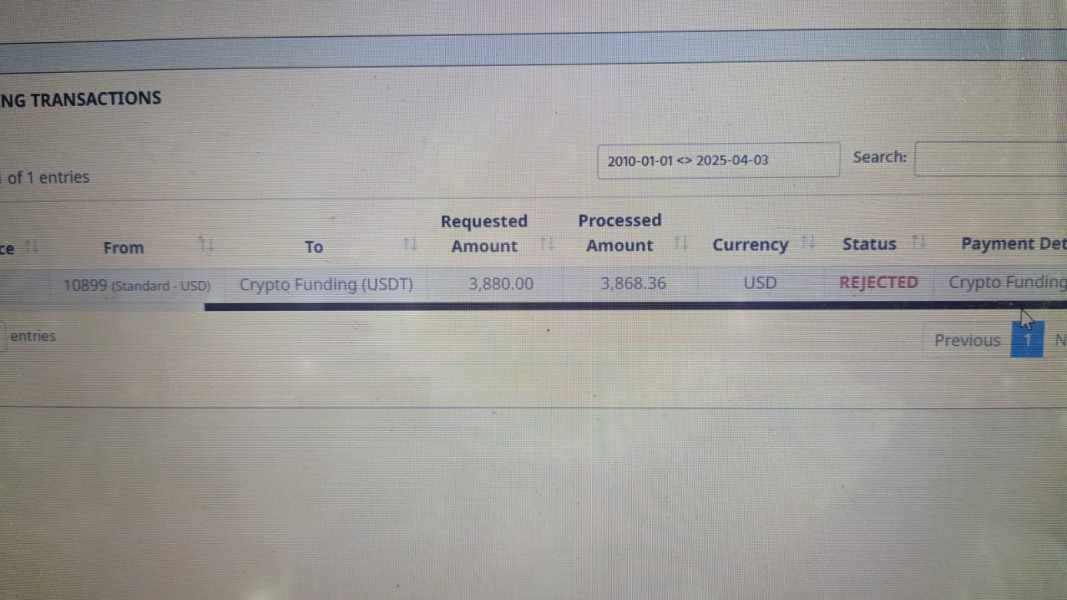

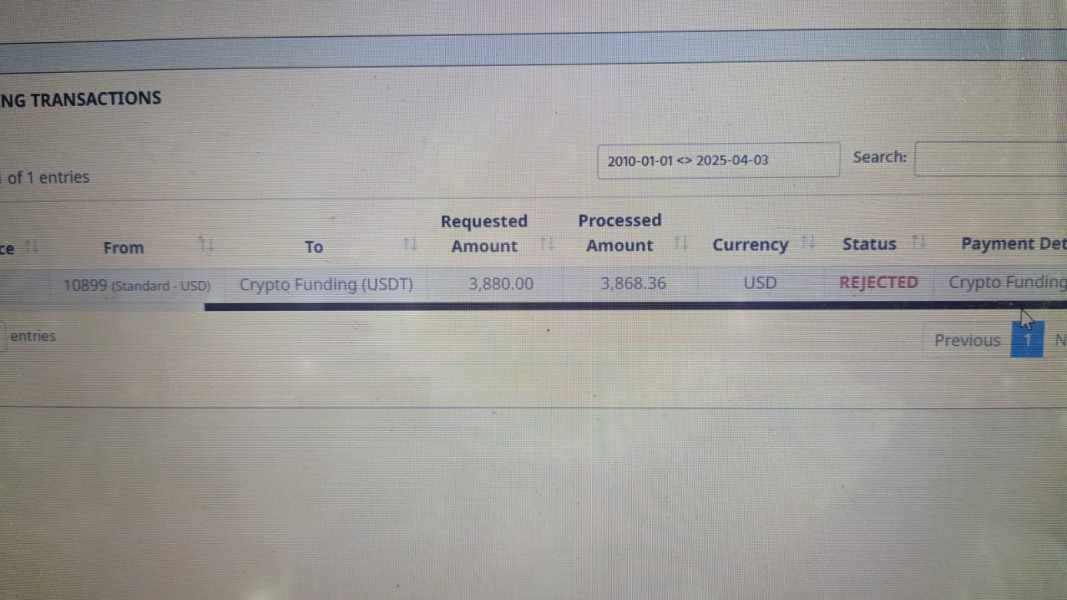

Deposit and Withdrawal Methods:

Information about how to deposit and withdraw money has not been clearly shared. The lack of details about payment options, how long processing takes, or possible fees means users might need to contact utrada directly to learn about these procedures.

Minimum Deposit Requirements:

The available data doesn't give specific details about minimum deposit requirements. This missing information about starting an account makes it hard for potential clients to know how much money they need to begin trading with utrada.

Bonus Promotions:

utrada is promoting an improved Introducing Broker program that claims to have one of the best commission structures in the industry. This bonus feature rewards partners with daily commission withdrawals, which attracts a network of introducing brokers. Even though it promises good returns, users should check the terms and conditions of these bonuses on their own.

Tradable Assets:

utrada offers a fairly wide range of tradable assets. Clients can trade different asset types including forex, commodities, indices, cryptocurrencies, and stocks. This variety lets traders build a balanced portfolio, but details about trading conditions for specific assets are still limited.

Cost Structure:

Unfortunately, utrada doesn't give clear information about its cost structure. Detailed data on spreads, commissions, and extra fees are missing, so potential clients need to ask more questions. The lack of transparency might make traders unsure about the real cost of making trades, which is important when comparing brokers.

Leverage Ratios:

Information about available leverage ratios is not given. The absence of this data means traders who use leverage to increase returns will need to contact utrada for details before opening an account.

Platform Choices:

utrada supports two major trading platforms: MetaTrader 4 and MetaTrader 5. The trading community respects these platforms for being reliable and having extensive features. This two-platform option makes sure clients can use comprehensive charting tools, different order types, and automated trading features.

Geographical Restrictions:

There is no clear information about geographical restrictions on trading. This oversight means potential clients must assume restrictions might apply based on local rules and contact utrada for more details if needed.

Customer Service Languages:

Details about the languages that utrada's customer service team supports have not been specified. Potential users should confirm their preferred language support options directly with the broker before moving forward.

This utrada review highlights several important aspects while also noting significant information gaps that may affect traders' decisions.

Detailed Rating Analysis

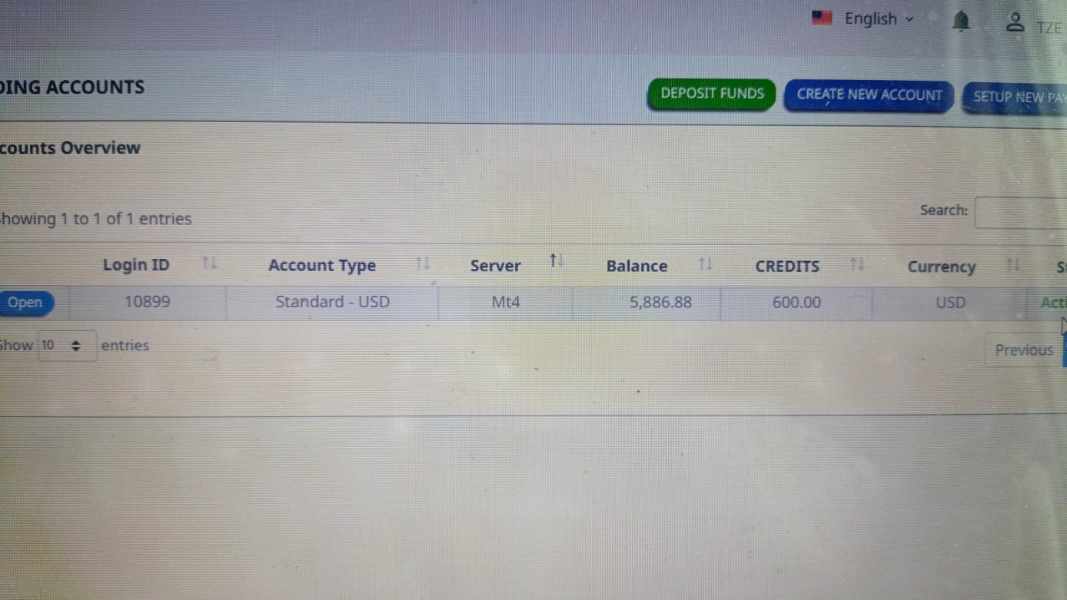

1. Account Conditions Analysis

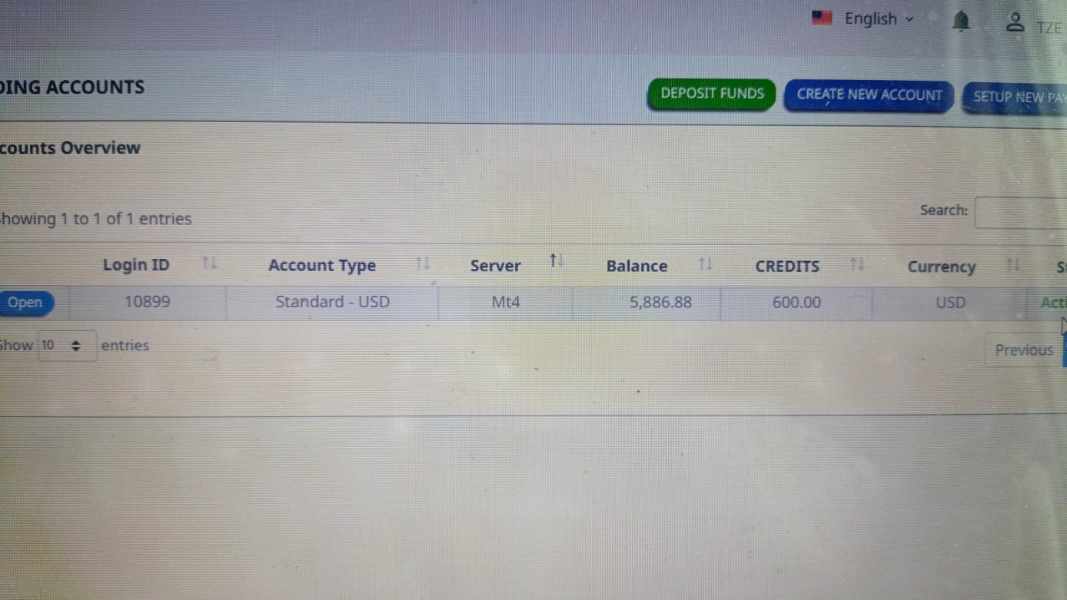

The analysis of account conditions for utrada shows a moderate level of uncertainty. The utrada review points out that there isn't enough detail about account types that the broker provides. Important information like minimum deposit requirements, leverage ratios, and specific account features is clearly missing. Details about the account opening process—like documentation and verification procedures—are also not clearly outlined. This lack of transparency can scare away potential clients who are used to strict disclosure practices from other trusted brokers. User feedback on this aspect is minimal, with no substantial comments on how easy or complex account setup is. Without comparisons to industry standards and competitors, utrada's account conditions seem unclear and need more clarity. The overall impression is that while utrada may offer various account options internally, the publicly available information leaves much to be desired. Potential clients should be careful and seek complete details before putting in money.

When looking at the trading tools and resources offered, utrada's approach seems limited mainly to providing MetaTrader 4 and MetaTrader 5 platforms. These platforms are celebrated industry standards known for being reliable and having comprehensive technical analysis capabilities, but utrada doesn't seem to offer much beyond these core systems. The utrada review shows that additional trading tools—like proprietary analysis software, advanced charting packages, or automated trading solutions beyond the MT platforms—are not mentioned. Research resources and educational tools that leading brokers commonly provide, including webinars, market analyses, or training modules, are clearly absent. For traders who need a strong set of analytical and educational resources, this limitation could be a significant problem. User and expert feedback detailing how well these platforms work and how reliable they are is minimal. While the available tools serve the basic needs of a trader, the overall resource offering remains below average compared to industry leaders. Future updates from utrada might fix these gaps, but as it stands, the trading experience may be seen as functional yet not fully competitive in the broader market.

3. Customer Service and Support Analysis

The utrada review raises concerns about the broker's customer service and support system. There is a notable lack of information on available support channels—whether through live chat, telephone, or email—and on how responsive these channels are. User feedback about customer service is almost nonexistent, and there are no detailed accounts of how well client concerns or complaints are handled. The available information doesn't clarify if the broker provides multi-language support, which is important for global clients. The absence of documented customer support hours or service level guarantees adds to an unclear picture. In the competitive world of online trading, responsive and effective customer service is very important, and utrada's relative silence on this front is concerning. Investors who value prompt and reliable support might find the lack of clear, accessible customer service information disadvantageous. Potential clients should approach this aspect with caution and may need to directly test support channels before fully engaging with the broker.

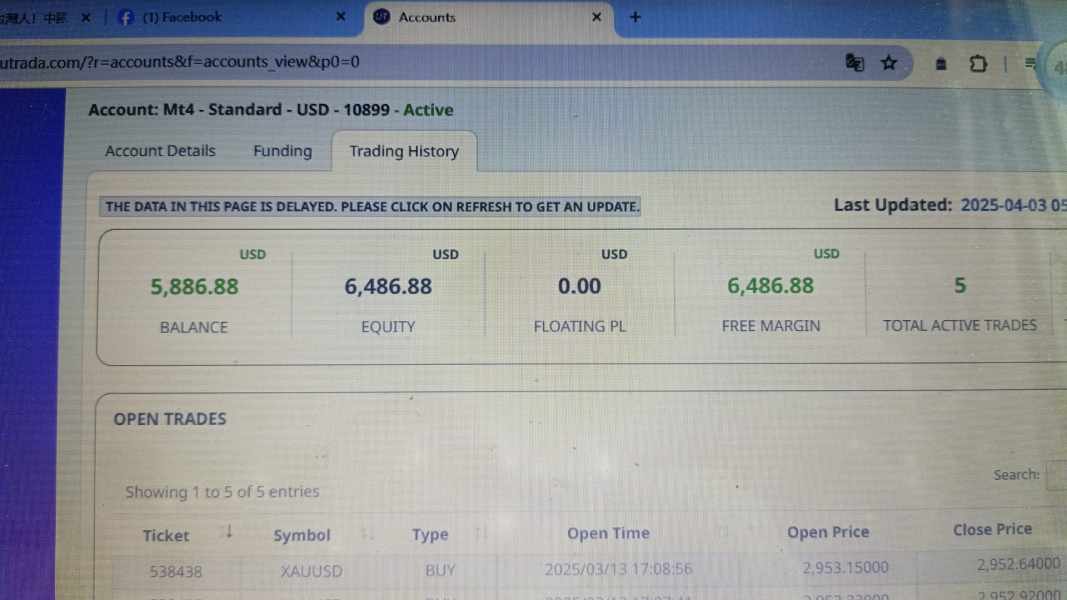

4. Trading Experience Analysis

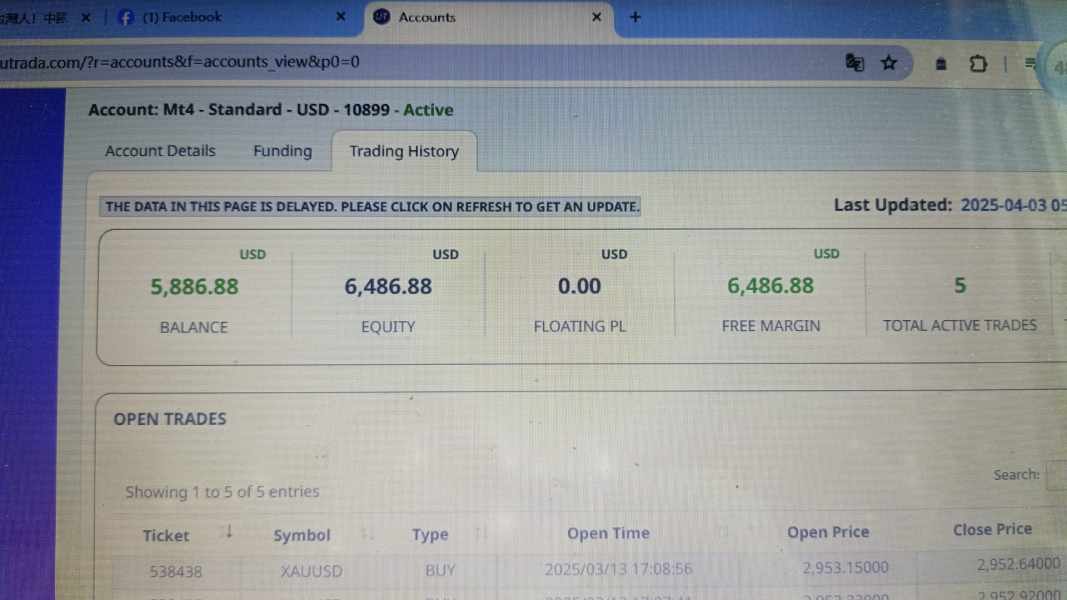

The trading experience offered by utrada presents a mixed scenario. Based on the utrada review, while the broker supports well-known platforms like MT4 and MT5, details about execution quality, order speed, and market liquidity are scarce. There is little publicly available data on whether the platforms deliver consistent and stable performance during high volatility periods. Critical aspects like the stability of spreads, the presence of slippage, and the responsiveness of order execution have not been explained well. The broker's cost structure—including commission fees and any additional trading costs—is also unclear, leaving traders to guess about true trading expenses. This lack of detailed information prevents a comprehensive assessment of the overall trading environment and may cause potential clients to question the fairness of trading conditions. User feedback on the trading experience appears minimal, with no strong evidence collected to confirm a smooth trading journey. While using MT4 and MT5 provides a familiar foundation, the overall trading experience remains uncertain and needs further investigation. Potential traders should request more detailed and transparent data from utrada before starting an account.

5. Trustworthiness Analysis

Trustworthiness remains one of the more controversial aspects of utrada. The Labuan Financial Services Authority regulates the broker, which is meant to protect investors through oversight and structured compliance. However, the utrada review notes that available public data doesn't offer comprehensive information about the company's internal risk management practices or details on how client funds are protected. The incomplete disclosure of important factors—like specific regulatory limits, the presence of segregated accounts, or detailed background on corporate practices—adds to the confusion. There have been discussions and negative comments online about the possibility of utrada being a scam, which has definitely hurt its reputation among some trader groups. Although such concerns are not universally proven, they cannot be completely ignored given the high level of scrutiny in the trading community. The absence of strong user testimonials and third-party verification from well-known financial watchdogs further adds to these doubts. While the regulatory oversight is a point in favor of utrada's legitimacy, the overall trustworthiness is hurt by gaps in transparent reporting and mixed user sentiment. Investors should conduct thorough independent research before engaging with the platform.

6. User Experience Analysis

An assessment of the overall user experience with utrada reveals substantial room for improvement. The utrada review indicates that detailed user feedback about core aspects like platform interface, ease of navigation, and the account opening process is notably sparse. Users have not provided significant insights into whether the trading platforms are intuitive or if the registration and verification processes are efficient. The convenience of fund management—including deposit and withdrawal processes—has not been adequately addressed by the available information. The design and functionality of the trading interfaces, as well as the responsiveness of mobile applications , remain largely undocumented. Such information is critical since a smooth user experience is often a determining factor in a trader's decision to stay with a broker over the long term. The lack of transparency coupled with isolated reports of potential operational problems creates an overall impression of mediocrity. While the broker does offer established platforms, the overall user experience suffers due to insufficient data and sporadic negative feedback about usability. Potential clients should conduct an initial trial of the platform to better gauge its practical ease of use and interface design.

Conclusion

In conclusion, utrada offers a modern online trading experience with access to multiple asset classes and the popular MT4/MT5 platforms. However, the available information shows significant transparency gaps—particularly concerning account conditions, cost structures, and customer service details. Although the Labuan Financial Services Authority regulates the broker and it offers an attractive Introducing Broker program, the concerns raised about trading conditions and negative online discussions suggest that caution is needed. This utrada review ultimately advises that while the broker may suit investors interested in diverse asset trading, a careful approach and additional verification are recommended prior to commitment.