Is Rox Capitals safe?

Pros

Cons

Is Rox Capitals A Scam?

Introduction

Rox Capitals is a forex brokerage that positions itself as a competitive player in the online trading market, offering a range of financial instruments including forex, commodities, indices, and cryptocurrencies. With the rise of online trading platforms, traders are increasingly seeking accessible and profitable trading opportunities. However, the influx of unregulated and potentially fraudulent brokers necessitates a cautious approach to evaluating these platforms. As such, it is crucial for traders to conduct thorough due diligence before committing their funds. This article aims to provide an objective analysis of Rox Capitals, examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. The findings are based on a comprehensive review of multiple sources, including user reviews, regulatory databases, and industry reports.

Regulatory and Legitimacy

Understanding a broker's regulatory status is fundamental for assessing its legitimacy and safety. Rox Capitals claims to be regulated under the Financial Crimes Enforcement Network (FinCEN) in the United States, but it lacks oversight from more stringent regulatory bodies like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This raises concerns regarding the broker's accountability and the protection of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | Not Applicable | United States | Unverified |

The absence of a robust regulatory framework can lead to significant risks for traders, as unregulated brokers often lack the necessary safeguards to protect client funds. Additionally, the lack of transparency regarding Rox Capitals' operational history and compliance raises red flags. Regulatory bodies are crucial in enforcing standards that ensure fair trading practices and protect investors from potential fraud.

Company Background Investigation

Rox Capitals was established in 2020 and claims to operate from the United Kingdom, although its actual registration appears to be in Comoros. This discrepancy raises questions about the broker's transparency and operational legitimacy. The company's ownership structure is not clearly disclosed, which is a common trait among potentially fraudulent brokers.

The management team‘s background is also a critical factor in assessing the broker's credibility. Unfortunately, there is limited publicly available information about the team’s qualifications and experience in the financial sector. This lack of transparency can be concerning for potential investors, as it makes it difficult to ascertain the brokers reliability and the expertise of those managing the platform.

Trading Conditions Analysis

Rox Capitals offers a variety of trading conditions, including a minimum deposit requirement of $10 and leverage up to 1:500. However, the specifics of their fee structure raise concerns. The broker advertises tight spreads and no commissions on certain accounts, but it is essential to examine whether these claims hold up against industry standards.

| Fee Type | Rox Capitals | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | None | $6 per lot |

| Overnight Interest Range | Varies | Varies |

The spread for major currency pairs at Rox Capitals is higher than the industry average, which could impact profitability for traders. Moreover, the lack of clarity around overnight interest rates and potential hidden fees could lead to unexpected costs, further complicating the trading experience.

Client Fund Safety

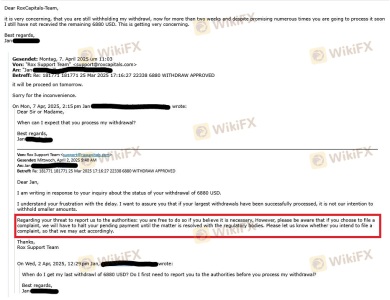

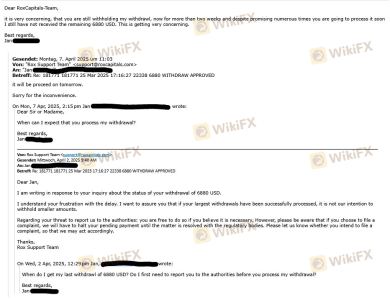

The safety of client funds is paramount when evaluating a broker. Rox Capitals has not provided substantial information regarding its fund safety measures, such as segregated accounts or investor protection schemes. The absence of these safeguards poses a risk to traders, as their funds may not be secure in the event of the broker's insolvency.

Historically, unregulated brokers have been known to engage in practices that jeopardize client funds, such as misappropriation or failure to honor withdrawal requests. This lack of accountability can lead to significant financial losses for traders, making it imperative to choose a broker with a proven track record of fund safety.

Customer Experience and Complaints

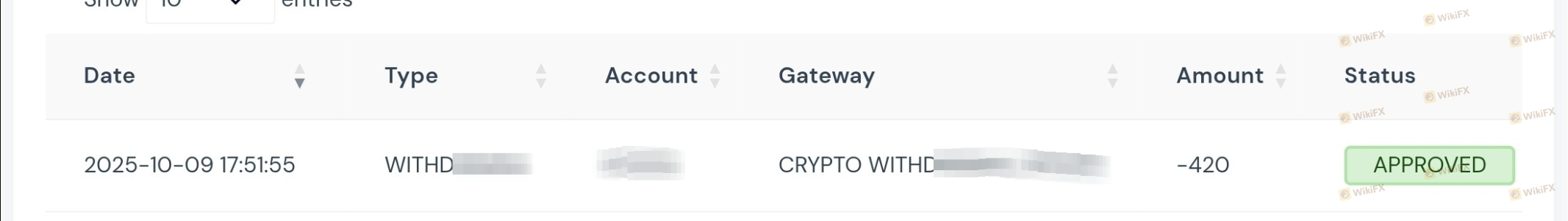

Customer feedback is an essential component of evaluating any brokerage. Reviews for Rox Capitals indicate a mix of experiences, with many users reporting difficulties in withdrawing funds and slow customer service responses. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Average |

| Misleading Promotions | High | Poor |

Several users have reported that their withdrawal requests were either delayed or denied, which is a critical concern for any trader. The overall response from the company to these complaints appears inadequate, further eroding trust in the broker.

Platform and Execution

Rox Capitals utilizes the widely recognized MetaTrader 5 platform, which offers a robust trading environment. However, concerns regarding the platform's stability and execution quality have been raised. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The presence of any signs of platform manipulation, such as unusual price movements or execution delays, can further undermine the broker's credibility. A reliable trading platform should ensure quick and efficient order execution, which is crucial for successful trading.

Risk Assessment

Engaging with Rox Capitals comes with inherent risks, primarily due to its unregulated status and the lack of transparency in its operations.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight from credible authorities |

| Fund Safety Risk | High | No clear fund segregation or protection |

| Execution Risk | Medium | Reports of slippage and order rejections |

To mitigate these risks, traders should approach this broker with caution. It is advisable to start with a minimal deposit and to utilize risk management strategies to protect capital.

Conclusion and Recommendations

In conclusion, the evidence suggests that Rox Capitals exhibits several characteristics commonly associated with unregulated and potentially fraudulent brokers. The lack of robust regulatory oversight, transparency regarding company operations, and numerous customer complaints indicate a need for caution.

Traders should be wary of investing with Rox Capitals and consider alternative brokers that offer better regulatory protections and customer service. Reliable options include brokers regulated by reputable authorities like the FCA or ASIC, which provide a higher level of security and accountability.

Ultimately, while Rox Capitals may offer attractive trading conditions, the associated risks and lack of transparency make it a questionable choice for traders seeking a safe and reliable trading environment.

Is Rox Capitals a scam, or is it legit?

The latest exposure and evaluation content of Rox Capitals brokers.

Rox Capitals Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Rox Capitals latest industry rating score is 2.09, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.09 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.