Octa 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Octa review presents an in-depth analysis of one of the prominent international multi-asset CFD brokers in today's competitive forex landscape. Octa started in 2011. The company has built a substantial presence across 180 countries, serving over 40 million trading accounts while maintaining regulatory compliance under the Cyprus Securities and Exchange Commission (CySEC) and South Africa's Financial Sector Conduct Authority (FSCA).

According to multiple user testimonials and industry reports, Octa distinguishes itself through fast withdrawal processing and zero deposit/withdrawal fees. This makes it particularly attractive for cost-conscious traders. The broker's commitment to providing commission-free trading with competitive spreads has garnered positive feedback from both novice and experienced traders. Users consistently highlight the platform's stability, comprehensive educational resources, and professional customer support across multiple languages.

Octa caters to a diverse user base, from beginners seeking educational guidance to sophisticated traders requiring advanced analytical tools. The broker offers over 300 financial instruments across major asset classes. Combined with access to both MT4 and MT5 platforms, this positions it as a versatile solution for various trading strategies. Industry analysis suggests that Octa's regulatory framework and transparent operational approach contribute significantly to user satisfaction and trust levels.

Important Disclaimer

Regional Entity Differences: Octa operates under multiple regulatory jurisdictions, including CySEC in Cyprus and FSCA in South Africa. Traders should know that legal protections, compensation schemes, and available services may vary significantly between different regional entities. Specific terms and conditions, including leverage limits and client categorization, depend on the regulatory framework governing your account registration location.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback, publicly available information, regulatory filings, and industry reports. Our assessment aims to provide objective insights while acknowledging that individual trading experiences may vary based on account type, trading volume, and regional regulations.

Rating Framework

Broker Overview

Company Foundation and Global Presence

Octa emerged in the forex industry in 2011. The company established itself as a comprehensive international multi-asset CFD broker with an impressive global footprint. The company has successfully expanded its operations to serve clients across 180 countries, accumulating over 40 million trading accounts throughout its operational history. This substantial user base reflects the broker's commitment to accessible forex and CFD trading services.

The broker's business model focuses primarily on providing foreign exchange and contracts for difference (CFD) trading services. Octa emphasizes user-friendly access to global financial markets. The company's operational philosophy centers on delivering transparent pricing, educational support, and technological reliability to accommodate traders with varying experience levels and capital requirements.

Platform Infrastructure and Asset Coverage

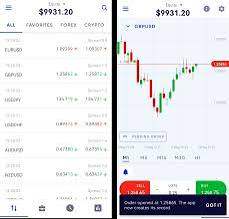

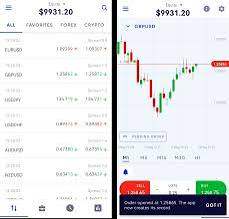

Octa provides access to industry-standard MetaTrader 4 and MetaTrader 5 trading platforms. This ensures traders can utilize familiar and robust trading environments. The broker's instrument selection spans over 300 financial products across major asset categories, including currency pairs, commodities, indices, and other derivative instruments. This comprehensive asset coverage allows traders to diversify their portfolios and implement various trading strategies within a single brokerage relationship.

The regulatory framework governing Octa's operations includes oversight from the Cyprus Securities and Exchange Commission (CySEC) and South Africa's Financial Sector Conduct Authority (FSCA). This dual regulatory approach provides clients with regulatory protection while enabling the broker to serve international markets effectively. The regulatory compliance demonstrates Octa's commitment to maintaining operational standards and client fund protection measures required by established financial authorities.

Regulatory Jurisdiction and Compliance

Octa operates under the regulatory supervision of CySEC in Cyprus and FSCA in South Africa. This ensures adherence to strict financial service standards and client protection protocols. These regulatory bodies require segregated client fund storage, regular financial reporting, and compliance with international anti-money laundering standards.

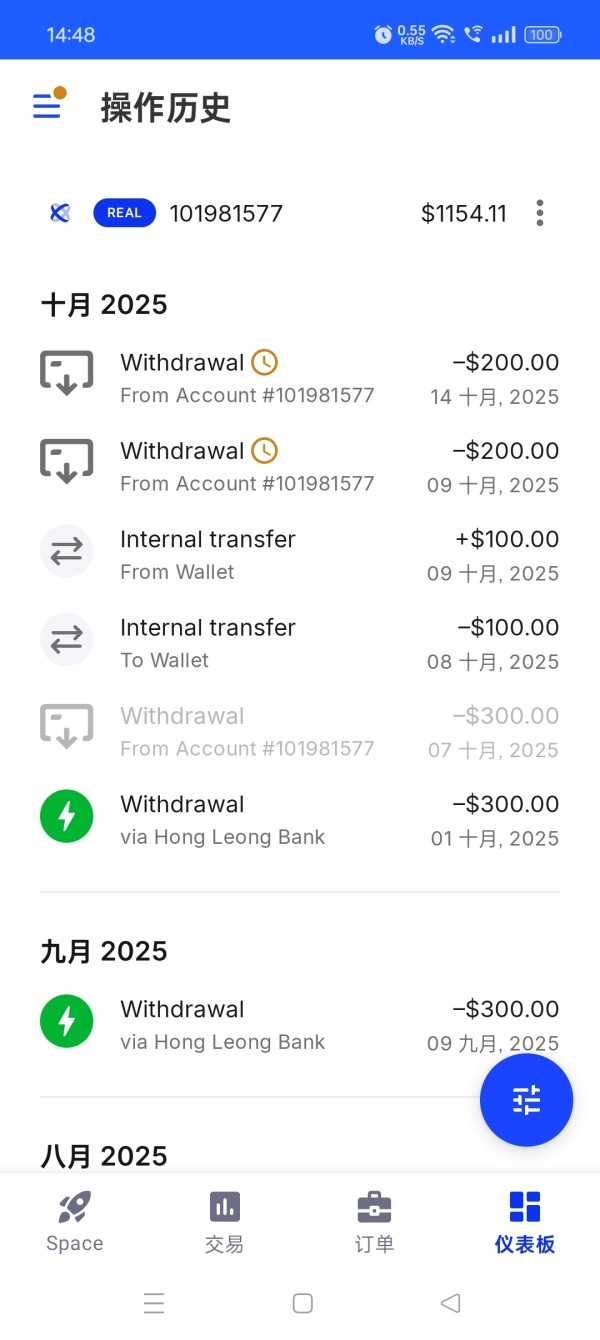

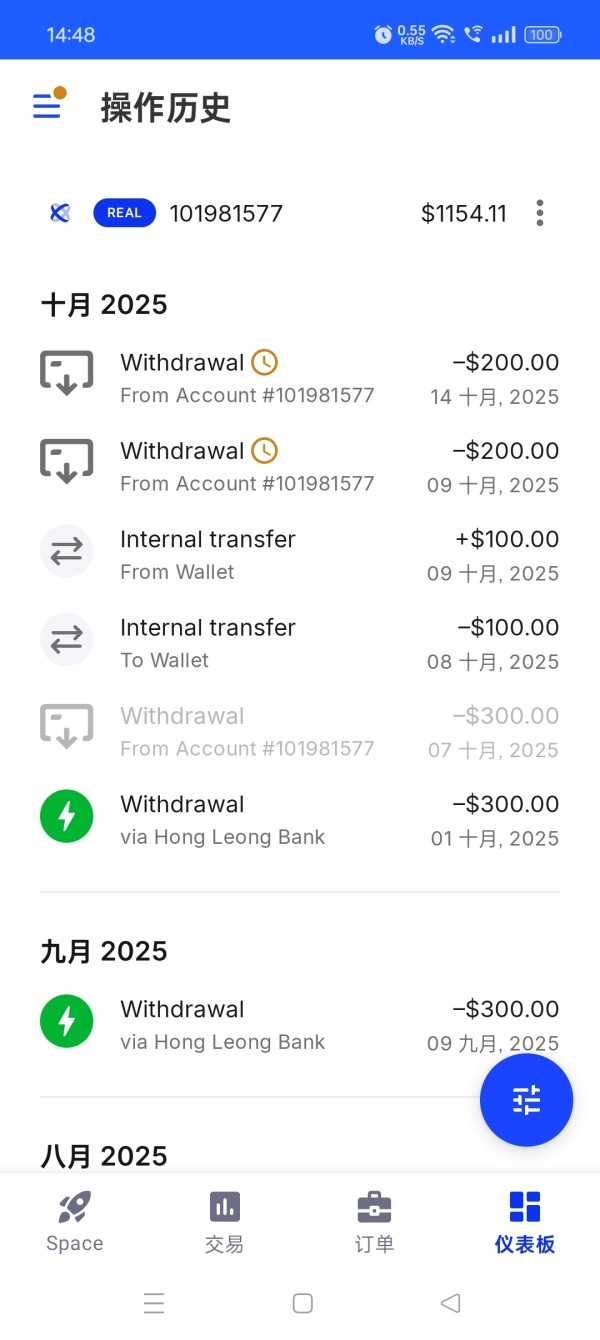

Banking and Payment Solutions

The broker offers multiple deposit and withdrawal methods with a notable advantage of zero deposit and withdrawal fees. According to user reports, Octa processes withdrawal requests rapidly. The company often completes transactions within the same business day. Payment options typically include bank transfers, credit cards, and various electronic payment systems.

Minimum Capital Requirements

Specific minimum deposit requirements are not detailed in available documentation. This suggests flexible entry points for different trader categories. Prospective clients should verify current minimum deposit requirements during the account opening process.

Trading Costs and Fee Structure

Octa implements a commission-free trading model with competitive spread pricing across its instrument range. User feedback consistently indicates satisfaction with the cost structure. Clients particularly note the absence of deposit and withdrawal fees as a significant advantage compared to industry competitors.

Leverage and Risk Management

The broker provides high leverage options, though specific ratios vary by jurisdiction and account type due to regulatory requirements. Leverage availability depends on client categorization and regional regulatory limits. CySEC and FSCA impose different maximum leverage restrictions.

Platform Technology and Accessibility

Trading platform access includes both MetaTrader 4 and MetaTrader 5. This supports diverse trading strategies from manual execution to automated algorithmic trading. The platforms support expert advisors, custom indicators, and comprehensive charting capabilities suitable for technical analysis approaches.

Geographic Service Limitations

While Octa serves clients in 180 countries, specific geographic restrictions may apply based on local regulations and compliance requirements. Potential clients should verify service availability in their jurisdiction during account registration.

Customer Support Languages

Customer service operates in multiple languages including English and other major international languages. This facilitates communication for the broker's diverse global clientele.

This comprehensive Octa review indicates that the broker maintains competitive positioning through regulatory compliance, cost-effective fee structures, and comprehensive service offerings. These features appeal to international traders seeking reliable market access.

Detailed Rating Analysis

Account Conditions Analysis (Score: 8/10)

Account Variety and Structure

Octa provides multiple account types designed to accommodate different trading preferences and capital levels. According to available information, the broker structures its accounts to serve both retail and more sophisticated traders. However, specific account tier details require verification during the registration process. User feedback suggests that account opening procedures are streamlined and accessible, particularly benefiting newcomers to forex trading.

Minimum Deposit Accessibility

While specific minimum deposit amounts are not detailed in current available documentation, user testimonials indicate that Octa maintains reasonable entry barriers. The absence of deposit fees enhances the value proposition for traders operating with smaller initial capital. This benefit is reported by multiple user reviews across various platforms.

Account Opening and Verification Process

Client feedback consistently highlights the straightforward nature of Octa's account registration process. Users report efficient document verification procedures and timely account activation. This contributes to positive initial experiences. The broker appears to have optimized its onboarding process to reduce friction for new clients while maintaining necessary compliance checks.

Competitive Advantages

The commission-free trading structure represents a significant competitive advantage, particularly for active traders who would otherwise face substantial transaction costs. When compared to industry peers, Octa's elimination of deposit and withdrawal fees provides tangible cost savings that directly impact trading profitability. This Octa review finds that these account conditions particularly benefit traders who frequently move funds or maintain multiple trading strategies requiring regular capital adjustments.

Trading Tool Diversity and Quality

Octa provides comprehensive analytical tools and trading indicators through its MetaTrader platform integration. The broker supports advanced charting capabilities, technical analysis tools, and market scanning features. These enable traders to implement sophisticated trading strategies. User reports indicate high satisfaction with the breadth and reliability of available analytical resources.

Research and Market Analysis Resources

According to industry assessments, Octa offers extensive market analysis materials including daily market commentary, economic calendar integration, and fundamental analysis reports. These resources help traders stay informed about market conditions and potential trading opportunities across various asset classes.

Educational Content and Learning Resources

The broker maintains a robust educational program featuring webinars, tutorials, and comprehensive guides covering both basic and advanced trading concepts. User feedback particularly praises the quality and accessibility of educational materials. Clients note their effectiveness for skill development across different experience levels. The educational resources include practical trading strategies, risk management guidance, and platform training materials.

Automated Trading and Signal Services

Octa supports Expert Advisor (EA) functionality and algorithmic trading through its MetaTrader platforms. The broker accommodates automated trading strategies and provides access to signal services. This enables traders to implement systematic approaches to market participation. Industry experts recognize this comprehensive tool set as particularly valuable for traders seeking to optimize their trading processes and reduce manual intervention requirements.

Customer Service and Support Analysis (Score: 8/10)

Support Channel Availability and Accessibility

Octa maintains multiple customer service channels including telephone support, email correspondence, and live chat functionality. The multi-channel approach ensures that clients can reach support staff through their preferred communication method. This accommodates different urgency levels and inquiry types.

Response Time and Resolution Efficiency

User feedback consistently reports rapid response times and effective problem resolution from Octa's customer service team. Clients note that support staff demonstrate strong technical knowledge. They can address both platform-related issues and account management questions efficiently. The quality of support contributes significantly to overall user satisfaction levels.

Service Quality and Professional Standards

Customer service representatives receive positive evaluations for their professionalism and ability to provide clear, actionable guidance. Users report that support staff can effectively communicate complex trading concepts and platform features. This particularly benefits less experienced traders who require additional assistance.

Multilingual Support Capabilities

The broker's international focus is reflected in its multilingual customer support capabilities. Support staff can communicate in English and several other major languages. This facilitates effective communication for Octa's diverse global client base. The language diversity removes communication barriers that might otherwise limit service quality for international clients.

Trading Experience Analysis (Score: 8/10)

Platform Stability and Performance

User testimonials consistently highlight the stability and reliability of Octa's trading platforms. Traders report minimal downtime and smooth platform operation during both normal and high-volatility market conditions. The technical infrastructure appears robust enough to handle substantial trading volumes without significant performance degradation.

Order Execution Quality and Speed

Client feedback indicates high satisfaction with order execution quality, with users reporting minimal slippage and fast execution speeds. This execution quality is particularly important for active traders and those implementing time-sensitive strategies. The broker's execution standards appear to meet professional trading requirements across various market conditions.

Platform Functionality and Feature Completeness

Both MT4 and MT5 platforms provide comprehensive functionality including advanced charting, technical indicators, and order management tools. Users appreciate the familiar interface and extensive customization options available through these industry-standard platforms. The platform selection accommodates different trading styles from scalping to long-term position trading.

Mobile Trading Experience

Mobile application functionality receives positive user feedback for its comprehensive feature set and user-friendly design. Traders report effective mobile platform performance for both monitoring positions and executing trades while away from desktop computers. The mobile experience maintains most desktop functionality while optimizing for smaller screen navigation.

This Octa review analysis indicates that the trading experience meets professional standards. It remains accessible to less experienced traders through intuitive interface design and comprehensive support resources.

Trust and Reliability Analysis (Score: 9/10)

Regulatory Compliance and Authorization

Octa's regulatory standing under CySEC and FSCA supervision provides substantial credibility and client protection. These regulatory authorities impose strict operational standards, capital requirements, and client fund protection measures. This significantly enhances the broker's trustworthiness. The dual regulatory approach demonstrates Octa's commitment to maintaining high operational standards across different jurisdictions.

Fund Security and Protection Measures

The broker implements segregated client account structures as required by its regulatory authorities. This ensures that client funds remain separate from company operational capital. The segregation provides crucial protection for trader deposits and helps maintain fund security even in adverse business scenarios. Additional insurance coverage and compensation schemes vary by regulatory jurisdiction.

Corporate Transparency and Disclosure

Octa maintains transparent operational practices through regular regulatory reporting and clear disclosure of trading conditions. The company provides accessible information about its management structure, financial standing, and operational policies. This contributes to overall transparency and client confidence.

Industry Recognition and Reputation

Industry reports and user reviews indicate that Octa has established a positive reputation within the forex brokerage sector. The broker has received various industry awards and recognition for its services. This reflects professional acknowledgment of its operational quality and client service standards. Third-party assessments consistently rate Octa favorably for reliability and service quality.

User Experience Analysis (Score: 8/10)

Overall Client Satisfaction Levels

Comprehensive user feedback analysis reveals generally high satisfaction levels with Octa's services. Clients express particular appreciation for the broker's cost structure, platform reliability, and customer service quality. The positive feedback spans different trader categories, suggesting that Octa successfully serves diverse client needs.

Interface Design and Navigation Efficiency

Platform interfaces receive praise for their intuitive design and efficient navigation structure. Users report that both new and experienced traders can quickly adapt to the platform layout and access necessary features without extensive learning curves. The user-friendly design contributes to overall positive trading experiences.

Registration and Account Verification Process

The account opening process receives consistent positive feedback for its simplicity and efficiency. Users report streamlined documentation requirements and rapid account verification. This enables quick access to trading services. The efficient onboarding process particularly benefits traders eager to begin market participation.

Fund Management and Transaction Experience

Deposit and withdrawal processes receive high user satisfaction ratings, with particular appreciation for the absence of fees and rapid processing times. Users report smooth fund management experiences that enhance overall platform usability and reduce operational friction.

Areas for Potential Enhancement

While overall feedback remains positive, some users suggest opportunities for enhanced educational content and expanded analytical tools. However, these suggestions represent incremental improvements rather than fundamental service deficiencies. User feedback indicates that Octa continues to evolve its service offerings based on client needs and market developments.

Conclusion

This comprehensive Octa review reveals a well-established forex and CFD broker that successfully balances regulatory compliance, competitive pricing, and comprehensive service offerings. Octa's dual regulatory oversight by CySEC and FSCA provides substantial credibility. Its commission-free trading model and zero deposit/withdrawal fees deliver tangible value to traders across all experience levels.

Recommended User Categories: Octa appears particularly well-suited for beginning traders seeking educational support and transparent pricing. It also serves experienced traders requiring reliable execution and comprehensive analytical tools. The broker's multilingual support and global accessibility make it especially appropriate for international traders seeking regulated market access.

Key Advantages: The broker's primary strengths include its cost-effective fee structure, regulatory compliance, platform stability, and responsive customer service. The combination of educational resources and professional trading tools creates value for traders seeking both learning opportunities and advanced functionality.

Considerations for Improvement: While this analysis reveals predominantly positive aspects, potential clients should verify specific account terms and regional service availability during registration. Some details vary by jurisdiction and account type.