XS 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive xs review evaluates XS as a forex and CFD broker. XS has established itself in the competitive trading landscape through years of consistent service and regulatory compliance. XS is a globally recognized forex and CFD broker that operates under multiple regulatory frameworks, providing traders with access to diverse financial instruments. Founded in 2010 with headquarters in Australia, XS has built over a decade of market experience. This positions the company as a reliable option for forex and precious metals CFD trading.

The broker caters primarily to intermediate and advanced traders seeking comprehensive forex and CFD trading opportunities. With its multi-jurisdictional regulatory approach, XS demonstrates commitment to compliance across different markets, which builds trust among international clients. The company's business model focuses on providing access to foreign exchange markets and contracts for difference on various asset classes, including precious metals. While XS offers a diversified trading experience, potential clients should carefully evaluate the specific terms and conditions that may vary across different regional entities.

Important Notice

XS operates across multiple countries and jurisdictions. This means that regulatory requirements, trading conditions, and available services may differ significantly depending on your location. Different regional entities of XS may offer varying account types, leverage ratios, and regulatory protections. Traders should verify which specific XS entity serves their region and understand the applicable regulatory framework before opening an account.

This review is based on publicly available company information and industry-standard analysis methodologies. The evaluation reflects general market conditions and publicly accessible data about XS's services, ensuring objective assessment. Prospective traders are strongly advised to conduct their own due diligence and verify all information directly with XS before making any trading decisions.

Rating Framework

Broker Overview

XS Group was established in 2010. This marks over a decade of presence in the financial services industry, building experience through various market conditions. Based in Australia, the company has built its reputation as a forex and CFD broker, focusing on providing traders with access to international financial markets. The broker's business model centers on offering contracts for difference and foreign exchange trading services to retail and institutional clients.

According to available information, XS positions itself as a global leader in the forex and CFD trading space. The company emphasizes its commitment to regulatory compliance through oversight by multiple regulatory authorities, which helps protect client interests. This multi-jurisdictional approach suggests the broker's intention to serve clients across various international markets while maintaining appropriate regulatory standards in each jurisdiction.

The company's core business revolves around providing CFD trading opportunities across different asset classes. XS places particular emphasis on forex and precious metals trading, which are among the most popular trading instruments globally. This xs review finds that while XS offers access to essential trading instruments, the specific details about account structures, trading platforms, and comprehensive service offerings require further investigation by potential clients.

Regulatory Oversight: XS operates under the supervision of multiple regulatory authorities. However, specific regulatory bodies and their respective jurisdictions are not detailed in available public information, which may require direct inquiry with the broker. This multi-regulatory approach typically indicates the broker's commitment to maintaining compliance standards across different markets.

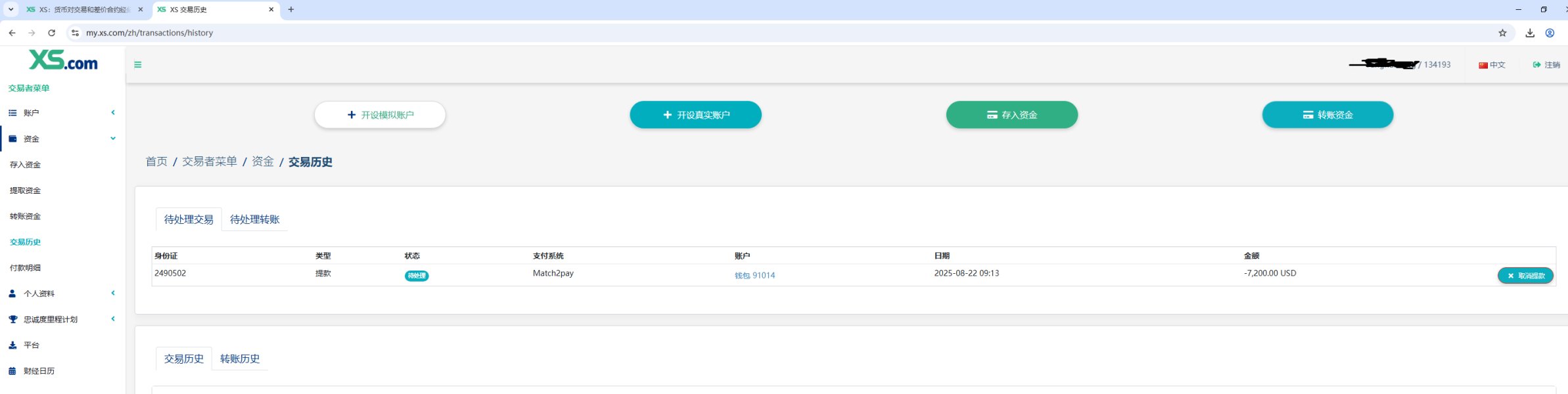

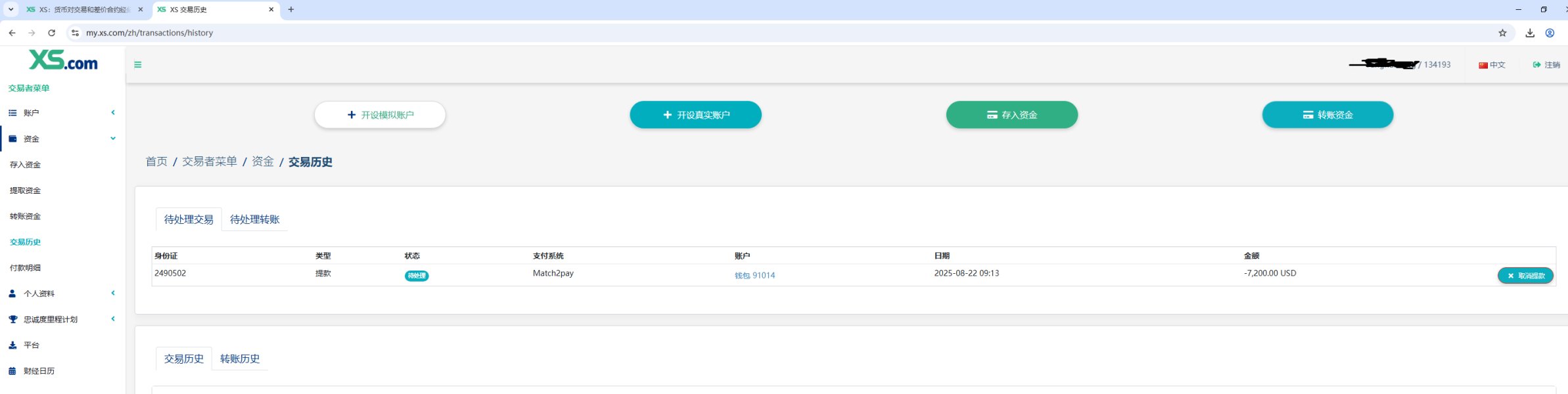

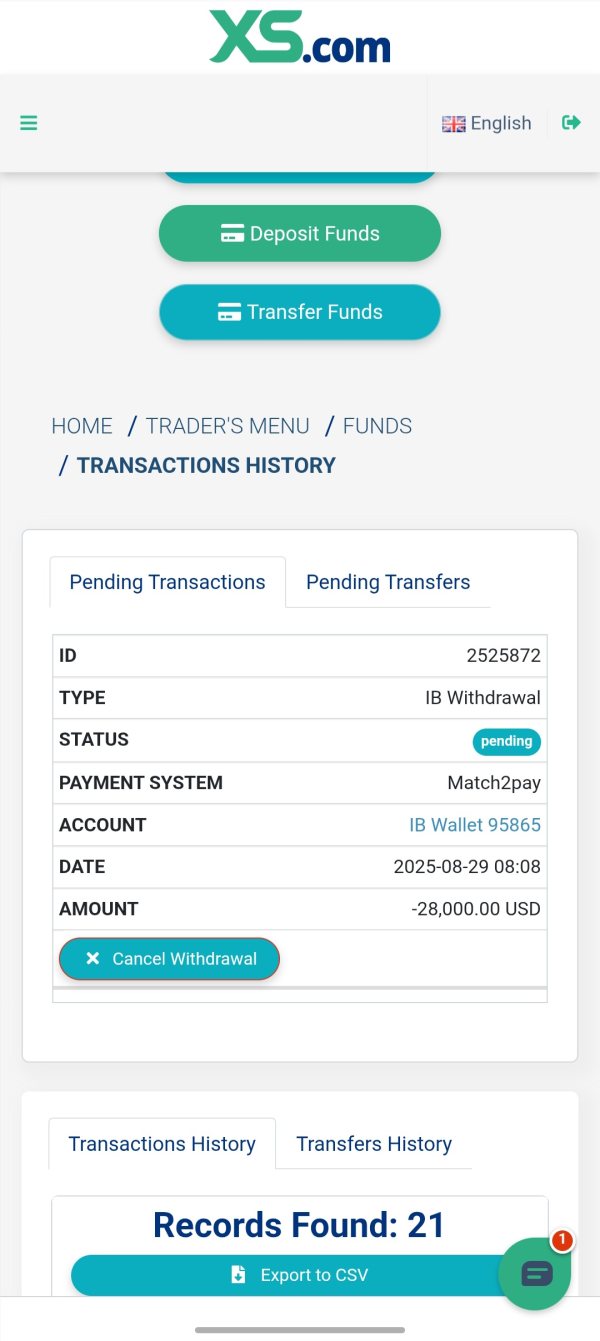

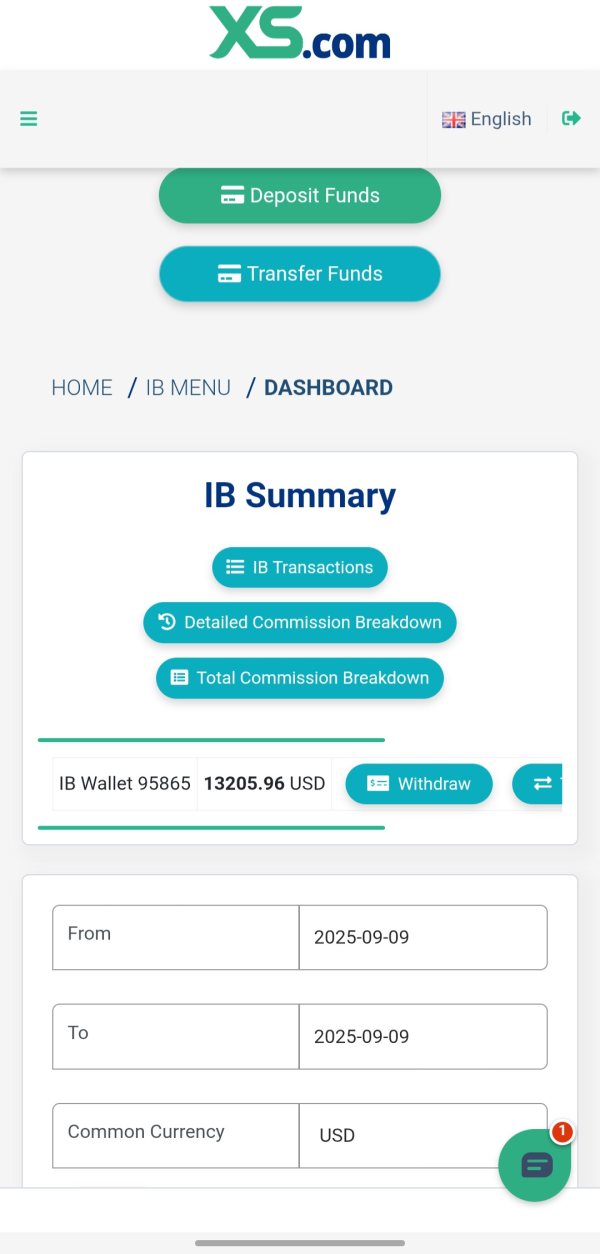

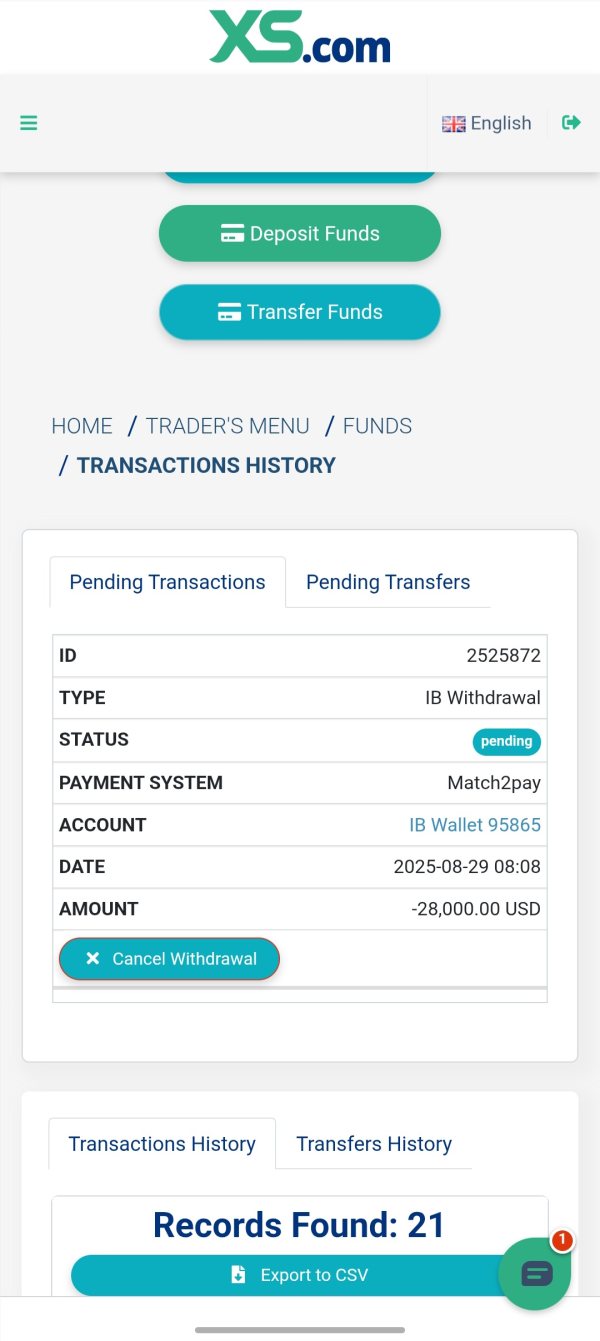

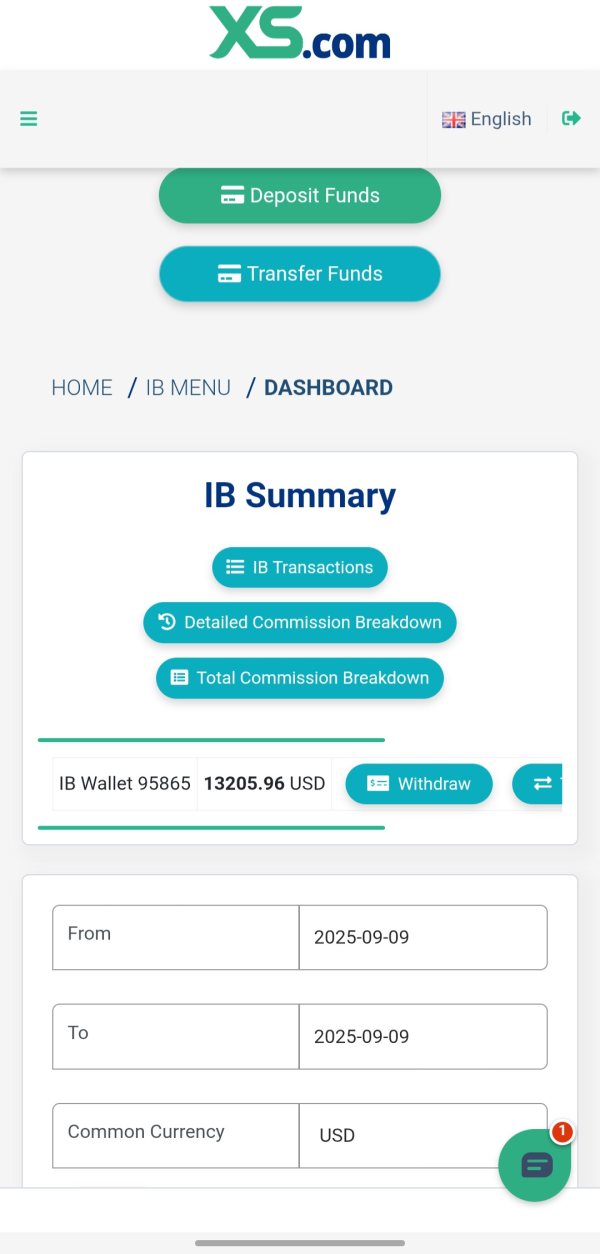

Deposit and Withdrawal Methods: Specific information about available funding methods, processing times, and associated fees is not comprehensively detailed in publicly available sources. Traders should contact XS directly to understand their funding options and any applicable charges.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in the available information. This requires direct inquiry with the broker to determine appropriate starting capital requirements.

Promotional Offers: Details about current bonus programs, promotional campaigns, or special offers are not mentioned in the accessible information. Potential clients should check with XS for any current promotional opportunities.

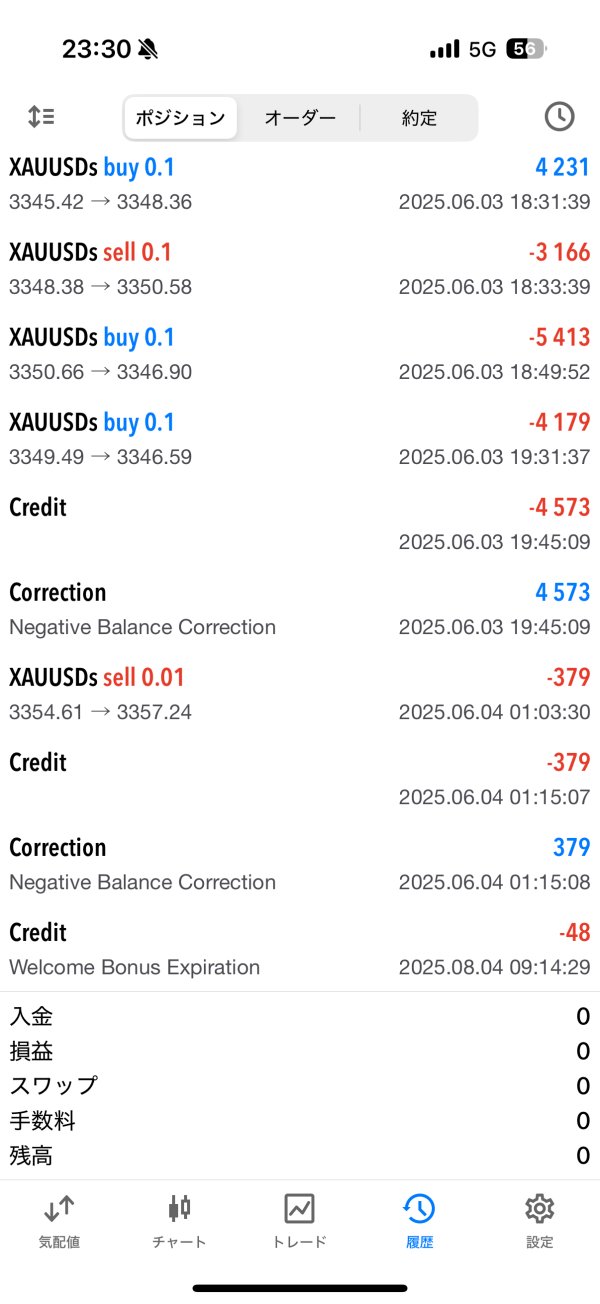

Tradeable Assets: XS provides CFD trading opportunities on forex pairs and precious metals. This offers traders access to these popular asset classes for diversified trading strategies across different market conditions.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not detailed in the available public information. This makes it essential for traders to request comprehensive pricing details directly from the broker before committing to an account.

Leverage Ratios: The maximum leverage offered across different instruments and account types is not specified in the current information. Traders should verify leverage availability based on their location and account type.

Platform Options: The specific trading platforms offered by XS are not detailed in available sources. Potential clients should inquire about platform options and their respective features.

Geographic Restrictions: Information about countries or regions where XS services may be restricted is not provided in accessible sources. Traders should verify service availability in their jurisdiction.

Customer Support Languages: The range of languages supported by XS customer service is not specified in available information. International clients should confirm language support availability.

This xs review notes that many crucial details require direct verification with the broker to ensure accurate and current information.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions evaluation for XS reveals significant information gaps that impact the overall assessment. Without detailed information about account types, their specific features, and associated benefits, it becomes challenging to provide a comprehensive evaluation of what traders can expect from their trading relationship. The lack of publicly available information about minimum deposit requirements across different account tiers makes it difficult for potential clients to plan their initial investment appropriately.

Account opening procedures and verification processes are not detailed in available sources. These typically represent crucial factors in a trader's decision-making process, affecting both convenience and time to market entry. The absence of information about specialized account features, such as Islamic accounts for traders requiring Shariah-compliant trading conditions, further limits the evaluation scope.

The xs review assessment suggests that while XS likely offers standard account structures common in the industry, the lack of transparent, easily accessible information about account conditions may pose challenges for traders seeking to compare options. Potential clients would need to engage directly with XS representatives to obtain comprehensive account details, which could impact the overall user experience during the research phase and delay decision-making.

Without specific data about account benefits, fee structures, or tiered service levels, the account conditions receive a moderate rating. This reflects the need for greater transparency in publicly available information to help traders make informed decisions.

The evaluation of XS's trading tools and resources faces limitations due to insufficient publicly available information about the broker's technological offerings and analytical resources. Modern forex and CFD trading relies heavily on sophisticated tools for market analysis, trade execution, and portfolio management, making this aspect crucial for trader success in competitive markets.

Research and analytical resources form a cornerstone of professional trading support. Yet specific details about XS's market research capabilities, economic calendar integration, or analytical reports are not detailed in accessible sources, limiting assessment possibilities. Educational resources, which serve as valuable support for trader development, also lack comprehensive description in available information.

Automated trading capabilities and expert advisor support represent increasingly important features for modern traders. However, information about XS's support for algorithmic trading strategies is not specified, making it difficult to assess suitability for advanced trading approaches. The absence of details about charting capabilities, technical indicators, and advanced order types makes it challenging to assess the broker's technological competitiveness.

The tools and resources evaluation reflects the need for more comprehensive public information about XS's technological infrastructure and support services. Traders considering XS would need to request detailed demonstrations or trial access to properly evaluate the platform's capabilities and determine suitability for their trading strategies and experience level.

Customer Service and Support Analysis

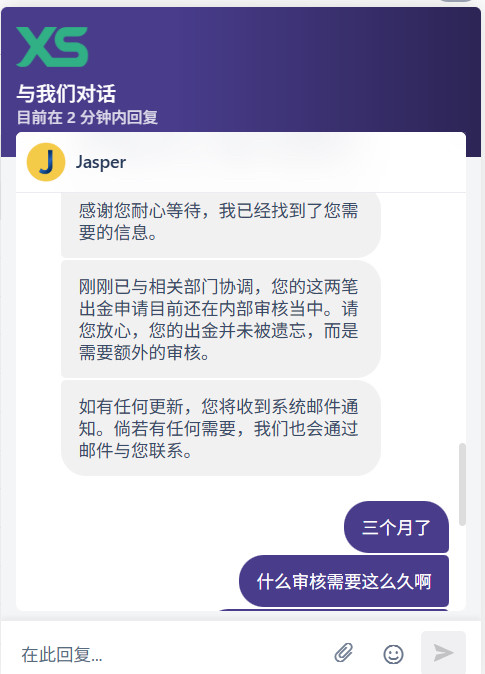

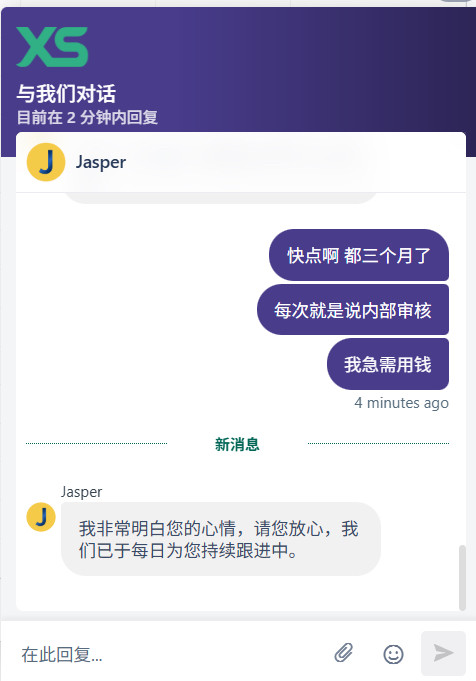

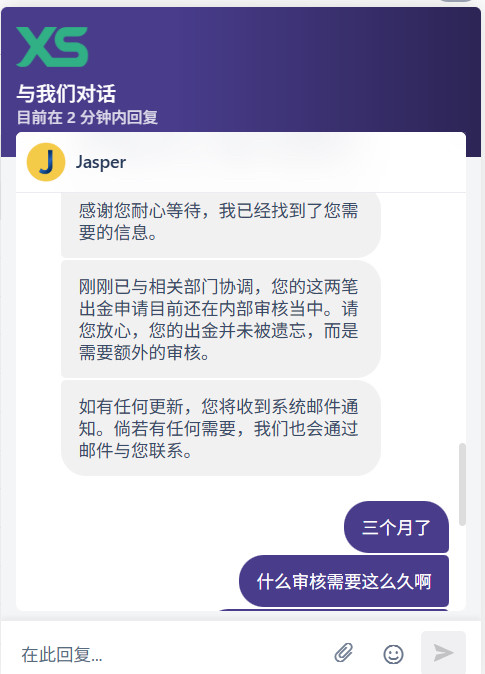

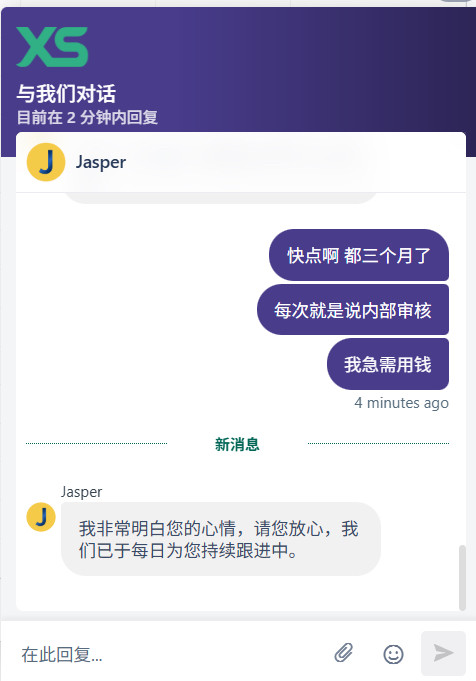

Customer service quality represents a critical factor in forex broker selection. Yet comprehensive information about XS's support infrastructure is not detailed in available public sources, making thorough evaluation challenging. The evaluation of customer service channels, availability hours, and response times requires specific data that is not currently accessible through standard research methods.

Multi-channel support options, including live chat, email, and telephone support, typically form the backbone of professional broker customer service. However, specific information about which channels XS offers and their respective availability schedules is not detailed in accessible sources, limiting assessment capabilities. Response time benchmarks and service quality metrics also lack comprehensive documentation.

Multilingual support capabilities often determine a broker's accessibility to international clients. But information about the languages supported by XS customer service teams is not specified, which could affect service quality for non-English speaking traders. The geographic distribution of support centers and local support availability for different regions also requires clarification.

Problem resolution procedures and escalation processes represent important aspects of customer service quality. Yet specific information about how XS handles client issues and disputes is not detailed in available sources, making it difficult to assess support effectiveness. The absence of customer service quality indicators makes it challenging to assess the broker's commitment to client support excellence.

Trading Experience Analysis

The trading experience evaluation for XS encounters limitations due to insufficient publicly available information about platform performance, execution quality, and overall trading environment. Platform stability and execution speed represent fundamental aspects of trading experience, yet specific performance metrics and reliability data are not detailed in accessible sources, making comprehensive assessment difficult.

Order execution quality, including fill rates, slippage statistics, and rejection rates, typically provide crucial insights into a broker's trading environment quality. However, comprehensive execution quality data for XS is not available through standard research channels, making it difficult to assess the broker's performance in this critical area that directly affects trading profitability.

Platform functionality and feature completeness significantly impact trader satisfaction and effectiveness. The xs review notes that specific information about trading platform capabilities, advanced order types, and analytical tools integration is not comprehensively detailed in available sources, limiting evaluation depth.

Mobile trading experience has become increasingly important for modern traders who need flexibility and mobility. Yet information about XS's mobile platform capabilities, features, and performance is not specified in accessible documentation. The overall trading environment assessment, including market access, instrument availability, and trading conditions, requires more detailed information than is currently accessible.

Trust and Reliability Analysis

Trust evaluation for XS benefits from the broker's multi-regulatory oversight structure. This provides some foundation for confidence in the company's operational standards and commitment to industry best practices. Multiple regulatory authorities typically ensure adherence to industry standards and client protection measures, though specific regulatory bodies and their respective requirements are not detailed in available information.

Fund safety measures and client money protection protocols represent crucial trust factors for any financial services provider. Yet specific information about segregated accounts, deposit insurance, or compensation schemes is not comprehensively detailed in accessible sources, limiting trust assessment capabilities. Transparency in company operations and financial reporting also impacts trust assessment, but detailed transparency metrics are not available through standard research.

Industry reputation and peer recognition often indicate broker reliability and standing within the financial services community. But comprehensive industry standing information for XS is not detailed in accessible sources, making peer comparison difficult. The handling of negative events or regulatory issues, when they occur, typically demonstrates a broker's commitment to proper business conduct, though specific historical examples are not available for evaluation.

Third-party validations, industry certifications, and external audits often support trust assessments by providing independent verification of business practices. But information about such validations for XS is not specified in available sources, limiting comprehensive trust evaluation. The overall trust evaluation reflects the positive impact of regulatory oversight while acknowledging the need for more comprehensive transparency information.

User Experience Analysis

User experience evaluation for XS faces significant limitations due to insufficient publicly available feedback and detailed user interface information. Overall user satisfaction metrics, which typically provide valuable insights into broker performance from the client perspective, are not comprehensively available through standard research channels, making assessment challenging.

Interface design and platform usability significantly impact trader effectiveness and satisfaction in daily trading activities. However, detailed information about XS's platform design philosophy, user interface quality, and ease of navigation is not specified in accessible sources, limiting evaluation possibilities. The learning curve for new users and platform intuitiveness also lack comprehensive documentation.

Registration and account verification processes represent initial user experience touchpoints that significantly impact first impressions and onboarding satisfaction. Specific information about XS's onboarding procedures, verification requirements, and account activation timelines is not detailed in available sources, making it difficult to assess initial user experience quality.

Funding and withdrawal experience often determines ongoing user satisfaction and operational convenience for active traders. Yet comprehensive information about transaction processes, processing times, and user feedback regarding financial operations is not available through standard research channels. Common user complaints and their resolution, which provide valuable insights into areas for improvement, are not documented in accessible sources.

Conclusion

This comprehensive xs review reveals XS as a forex and CFD broker with over a decade of market presence and multi-regulatory oversight. This suggests a foundation for reliable trading services built through years of market experience and regulatory compliance. The broker's focus on forex and precious metals CFD trading provides access to popular asset classes for traders seeking diversified opportunities.

XS appears most suitable for intermediate to advanced traders who prioritize regulatory compliance and are comfortable conducting detailed due diligence before committing to a trading relationship. The broker's multi-jurisdictional regulatory approach may appeal to traders seeking internationally compliant trading environments with appropriate oversight and protection measures.

However, the evaluation reveals significant information gaps regarding account conditions, trading costs, platform features, and user experience details. While XS's regulatory oversight provides some confidence foundation, prospective clients should engage directly with the broker to obtain comprehensive information about trading conditions, costs, and service offerings before making decisions that could significantly impact their trading success.