Regarding the legitimacy of BAAZEX forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is BAAZEX safe?

Risk Control

License

Is BAAZEX markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

BAZ Capital Markets Ltd

Effective Date:

--Email Address of Licensed Institution:

hakam@baazex.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.baazex.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 1B, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4373759Licensed Institution Certified Documents:

Is Baazex Safe or Scam?

Introduction

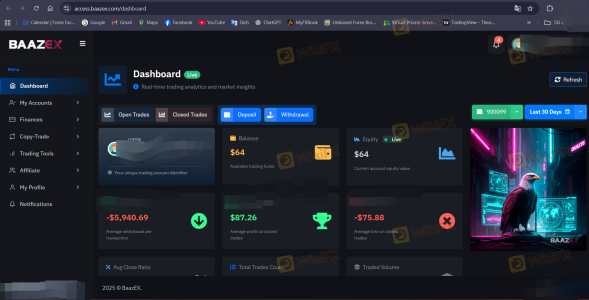

Baazex is a forex broker that has emerged in the financial trading arena since its establishment in 2018. Positioned as an offshore broker, it offers a range of trading services, including forex, CFDs, and cryptocurrencies. The broker claims to provide competitive trading conditions, including high leverage and low minimum deposits, which can be particularly appealing to novice traders. However, the allure of such offers often comes with potential risks, making it crucial for traders to conduct thorough evaluations of any forex broker before committing their funds.

This article aims to provide an objective analysis of Baazex, focusing on its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The evaluation draws from various online reviews and reports to present a comprehensive picture of whether Baazex is a legitimate trading platform or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors that determine its legitimacy and safety for traders. Baazex claims to be regulated by the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. However, the regulatory environment in this jurisdiction is known for its lax standards, which raises concerns about the level of protection afforded to traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA | N/A | Saint Vincent and the Grenadines | Not Verified |

The FSA has no robust regulatory framework for forex brokers, which means that Baazex operates without the stringent oversight that is typical of brokers regulated by higher-tier authorities such as the UK‘s Financial Conduct Authority (FCA) or Australia’s Australian Securities and Investments Commission (ASIC). This lack of stringent regulation is a significant red flag, as it indicates that traders' funds may not be adequately protected.

Moreover, there are reports suggesting that Baazex's licensing claims may not be entirely accurate or could be misleading. The FSA has issued warnings regarding brokers that falsely claim regulatory oversight, which further complicates Baazex's credibility. Therefore, potential traders should exercise caution and consider the risks associated with trading through an unregulated broker.

Company Background Investigation

Baazex operates under the name Baazex International Limited and is registered in Saint Vincent and the Grenadines. Its establishment in 2018 positions it as a relatively new player in the forex market. The company claims to provide a diverse range of trading instruments, including forex, commodities, and cryptocurrencies, through its trading platform.

However, the transparency surrounding Baazex's ownership structure and management team is limited. There is little publicly available information about the individuals behind the company, which raises questions about accountability and trustworthiness. A lack of clear information regarding the management teams qualifications and experience in the financial industry further diminishes confidence in the broker.

The companys website does not provide comprehensive details about its operational history or the legal framework governing its activities, which is a common practice among reputable brokers. Instead, it presents a polished image with attractive offers, potentially masking underlying issues. This opacity is concerning, as it prevents traders from making fully informed decisions about where to invest their money.

Trading Conditions Analysis

Baazex advertises itself with competitive trading conditions, including low minimum deposits and high leverage. However, these enticing offers should be scrutinized closely to understand the overall cost structure associated with trading on this platform.

The broker offers a minimum deposit requirement of just $10, which is exceptionally low compared to industry standards. This can be appealing to new traders looking to enter the market with minimal financial commitment. However, the low entry point may also attract inexperienced traders who may not fully understand the inherent risks of forex trading.

| Fee Type | Baazex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.0 pips | 1.0 - 2.0 pips |

| Commission Model | None specified | $6 per lot (average) |

| Overnight Interest Range | N/A | Varies by broker |

While Baazex claims to offer spreads starting from 1.0 pips, it is essential to note that these rates can fluctuate based on market conditions. Furthermore, the absence of clear information regarding commission structures and overnight fees is concerning, as hidden costs can significantly impact profitability.

Traders should be aware that while high leverage (up to 1:1000) is offered, it also comes with increased risk, potentially leading to substantial losses. The combination of high leverage and low minimum deposits may create an environment where inexperienced traders could quickly find themselves in financial distress.

Client Fund Safety

The safety of client funds is paramount when evaluating any forex broker. Baazex claims to implement various security measures to protect client investments. However, the actual effectiveness of these measures remains questionable.

Baazex does not provide clear information regarding whether client funds are held in segregated accounts, a practice that helps protect traders in the event of a broker's insolvency. Additionally, there is no mention of investor compensation schemes, which are essential for ensuring that clients can recover their funds if the broker fails.

Historically, offshore brokers like Baazex have been associated with numerous security issues, including fund mismanagement and fraudulent activities. As such, the lack of transparency surrounding Baazexs fund safety protocols raises significant concerns for potential investors.

Customer Experience and Complaints

User feedback is a vital component of assessing a broker's reliability. Reviews for Baazex are mixed, with several users reporting issues related to withdrawals, poor customer service, and misleading promotional offers.

Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow or unresponsive |

| Poor Customer Support | Medium | Inconsistent |

| Misleading Promotions | High | No clear resolution |

Many traders have reported difficulties in withdrawing their funds, with some claiming that requests were delayed for extended periods. Additionally, there are allegations regarding misleading promotions that entice traders to deposit more money without clear terms and conditions.

For instance, a trader reported that after depositing funds to take advantage of a promotional bonus, they encountered numerous obstacles when attempting to withdraw their money. This highlights a significant risk associated with trading on platforms like Baazex, where the potential for scams is prevalent.

Platform and Execution

Baazex offers the MetaTrader 5 (MT5) platform, which is widely regarded as a robust trading solution. However, the overall performance, stability, and user experience of the platform can vary based on the broker's infrastructure and support.

Traders have reported mixed experiences regarding order execution quality, with some experiencing slippage and rejected orders during high volatility periods. Such issues can significantly affect trading outcomes, particularly for those employing scalping or high-frequency trading strategies.

The potential for platform manipulation is also a concern, especially given the lack of regulatory oversight. Traders should remain vigilant and monitor their trading experiences closely to identify any irregularities.

Risk Assessment

Using Baazex as a trading platform comes with inherent risks that traders must carefully consider. The combination of unregulated status, opaque business practices, and mixed user experiences contributes to a high-risk environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight from reputable authorities |

| Fund Security Risk | High | No clear protocols for fund protection |

| Execution Risk | Medium | Potential for slippage and rejected orders |

| Customer Service Risk | High | Reports of slow response and resolution |

To mitigate these risks, traders should consider using only regulated brokers with established reputations. Additionally, they should start with small investments, educate themselves on risk management strategies, and remain cautious about promotional offers that seem too good to be true.

Conclusion and Recommendations

In conclusion, the analysis of Baazex raises significant concerns regarding its legitimacy and safety as a forex broker. The lack of robust regulatory oversight, coupled with a history of user complaints and potential fund security issues, suggests that traders should approach this platform with caution.

While Baazex offers appealing trading conditions, the associated risks may outweigh the benefits, particularly for inexperienced traders. It is advisable for potential investors to seek out more reputable brokers that operate under strict regulatory frameworks, such as those regulated by the FCA, ASIC, or CySEC.

For those still considering Baazex, it is crucial to conduct thorough due diligence, start with minimal investments, and remain vigilant for any signs of irregularities. Ultimately, prioritizing safety and transparency should guide traders in their decision-making processes.

Is BAAZEX a scam, or is it legit?

The latest exposure and evaluation content of BAAZEX brokers.

BAAZEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BAAZEX latest industry rating score is 4.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.