Baazex 2025 Review: Everything You Need to Know

Executive Summary

Baazex is a new player in the forex brokerage world. The company operates under BAZ Capital Markets Ltd and gets regulated by the Seychelles Financial Services Authority. However, this baazex review shows major concerns about the broker's trustworthiness and service quality. The platform says it offers over 1,500 trading instruments with competitive spreads starting from 0.4 pips, but user feedback tells a different story about the broker's reliability.

The broker targets traders who want forex, commodities, indices, and cryptocurrency markets. Multiple sources say Baazex has been operating for 2-5 years but struggles to build a good reputation in the trading community. Users always express doubt about the platform's legitimacy, with several reviews warning potential clients about possible fraud. The broker offers ECN accounts with commission-based pricing and many trading instruments, but the negative sentiment from the trading community raises serious red flags about choosing Baazex as a trading partner.

Important Notice

Regulatory Warning: Baazex operates under the regulation of the Seychelles Financial Services Authority (license number SD134). This provides limited investor protection compared to major regulatory bodies like the FCA, ASIC, or CySEC. The lack of additional regulatory oversight from established financial authorities significantly impacts the broker's credibility and the security of client funds.

Disclaimer: This review is based on publicly available information and user feedback collected from various sources. The information presented may not be comprehensive or entirely up-to-date. Potential traders should conduct their own research before making any investment decisions.

Rating Framework

Broker Overview

Baazex operates as the trading name of BAZ Capital Markets Ltd. This is a financial services company based in Seychelles. The broker has been in operation for about 2-5 years and positions itself as a provider of online trading services across multiple asset classes. Available information shows that Baazex focuses on delivering access to global financial markets through its own trading infrastructure, though specific details about the company's founding date and executive team remain limited in public records.

The broker's business model centers around providing retail and institutional clients with access to over 1,500 trading instruments. These instruments cover various asset categories. Baazex claims to offer competitive pricing structures, including ECN account options with commission-based fees and variable spreads. However, the lack of transparency about the company's operational history and management structure has contributed to skepticism within the trading community about the broker's long-term viability and commitment to client service.

The platform primarily serves traders interested in forex pairs, commodities, stock indices, and cryptocurrency markets. Baazex operates under the regulatory oversight of the Seychelles Financial Services Authority and holds license number SD134. While this provides some level of regulatory compliance, the jurisdiction is considered less strict compared to major financial centers, which has become a point of concern for potential clients seeking strong investor protection measures.

Regulatory Jurisdiction: Baazex holds a license from the Seychelles Financial Services Authority (license number SD134). The company operates within the regulatory framework established by this offshore jurisdiction. This regulatory status provides basic compliance oversight but lacks the comprehensive investor protection mechanisms found in more established regulatory environments.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available sources. This represents a significant transparency gap for potential clients seeking to understand funding procedures.

Minimum Deposit Requirements: The minimum deposit requirements for different account types are not specified in available documentation. This makes it difficult for traders to assess the accessibility of the broker's services.

Bonuses and Promotions: No specific information about promotional offers or bonus programs is mentioned in available sources. This suggests either a lack of such programs or insufficient marketing transparency.

Tradeable Assets: Baazex offers access to over 1,500 trading instruments spanning forex pairs, commodities, stock indices, and cryptocurrencies. This diverse range of assets positions the broker as a multi-asset platform catering to various trading preferences and strategies.

Cost Structure: The broker advertises spreads starting from 0.4 pips, with ECN accounts requiring additional commission payments. However, detailed information about other fees, overnight charges, and withdrawal costs remains unavailable in public documentation. This creates uncertainty about the true cost of trading with this baazex review subject.

Leverage Ratios: Specific leverage offerings are not mentioned in available sources. This represents another area where the broker lacks transparency in its service specifications.

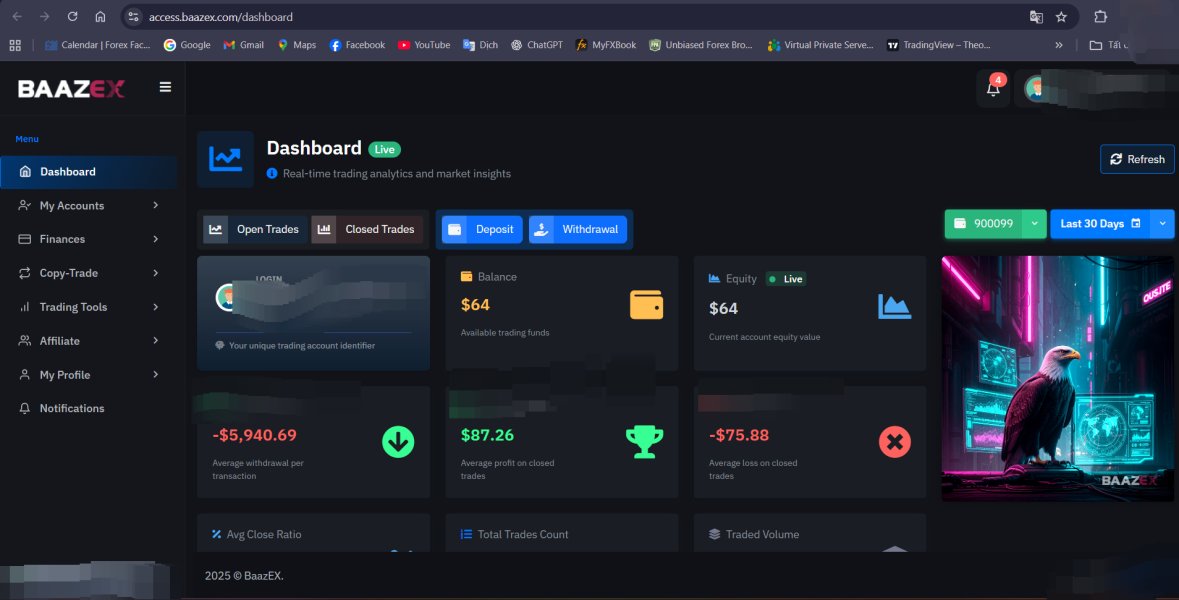

Trading Platforms: Information about specific trading platforms offered by Baazex is not detailed in available sources. This leaves potential clients unclear about the technological infrastructure they would be using.

Geographic Restrictions: Details about regional availability and restrictions are not specified in available documentation.

Customer Support Languages: Information about multilingual support options is not mentioned in available sources.

Detailed Rating Analysis

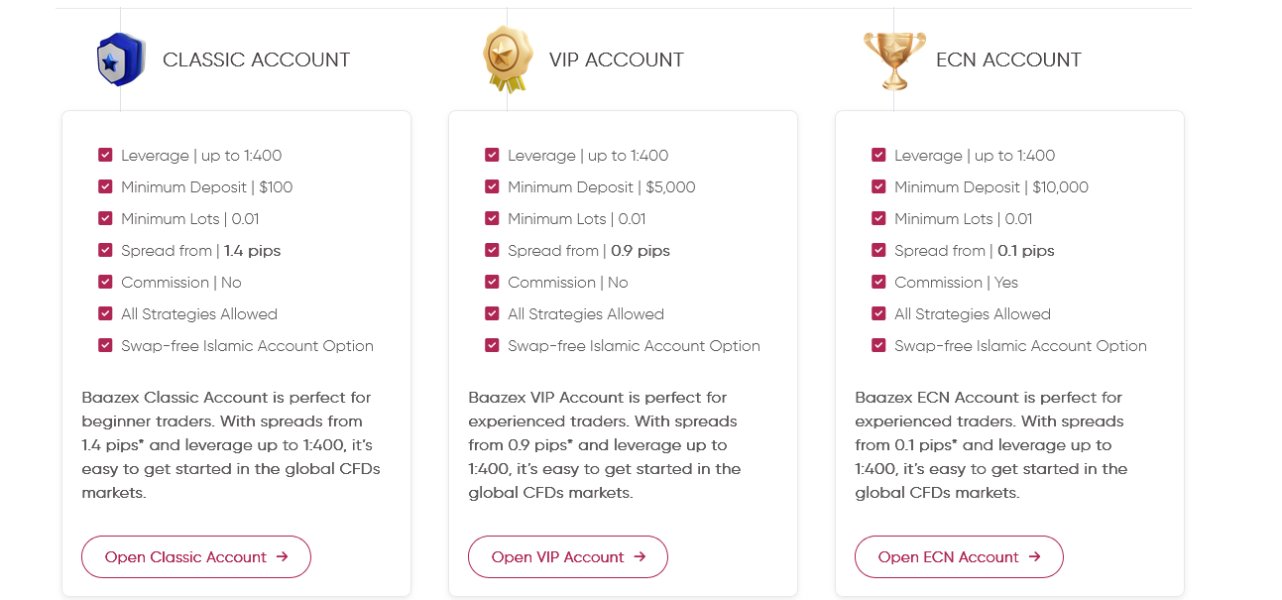

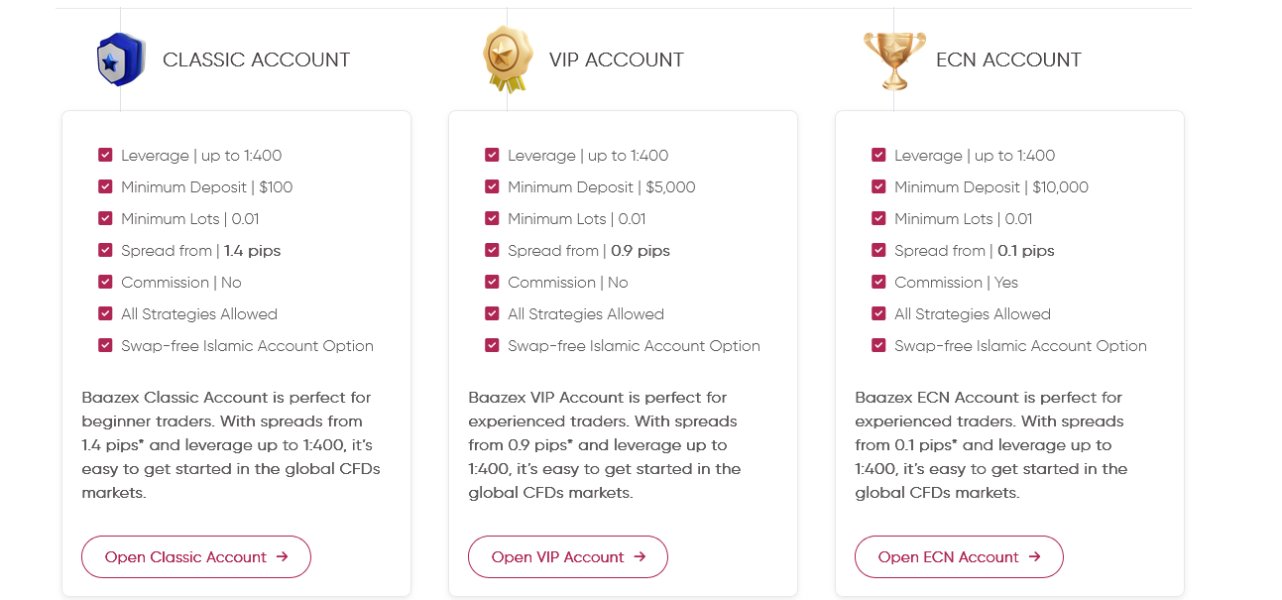

Account Conditions Analysis (Score: 4/10)

Baazex's account conditions show significant gaps in transparency and information availability. The broker mentions ECN account options with commission-based pricing structures. However, it fails to provide comprehensive details about account tiers, minimum deposit requirements, or specific features available to different client categories. This lack of clarity makes it extremely difficult for potential traders to make informed decisions about account selection.

The limited information available suggests that Baazex offers basic account functionality without the sophisticated features typically expected from established brokers. Users have reported confusion about account opening procedures and unclear terms and conditions. This contributes to the overall negative sentiment surrounding the broker's services. The absence of detailed account specifications, such as Islamic account options, VIP services, or institutional account features, further undermines the broker's competitive position.

Multiple sources indicate that users have experienced difficulties with account verification processes and unclear documentation requirements. The lack of transparent account condition information, combined with negative user feedback, suggests that Baazex has not prioritized creating a user-friendly account management experience. This baazex review finds that the broker's approach to account conditions falls significantly below industry standards, particularly when compared to regulated brokers operating under more stringent oversight.

Baazex claims to provide access to over 1,500 trading instruments. This represents a relatively comprehensive offering in terms of market coverage. This extensive range includes forex pairs, commodities, stock indices, and cryptocurrencies, potentially appealing to traders seeking diversified portfolio options. However, the quality and depth of these trading tools remain questionable due to limited user feedback and lack of detailed specifications.

The broker's resource offerings appear limited based on available information. There is no mention of research capabilities, market analysis tools, or educational materials. Professional trading platforms typically provide comprehensive market research, technical analysis tools, and educational resources to support trader development, but Baazex's offerings in these areas remain unclear or potentially absent.

User feedback suggests that while the variety of instruments may be extensive on paper, the actual trading experience and tool quality do not meet expectations. The absence of detailed information about automated trading support, API access, or advanced order types further limits the platform's appeal to sophisticated traders. The lack of transparency regarding research resources and analytical tools represents a significant disadvantage for traders who rely on comprehensive market intelligence to inform their trading decisions.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents one of Baazex's most significant weaknesses. This is based on consistently negative user feedback across multiple review platforms. Users report poor response times, unhelpful support interactions, and difficulty reaching qualified representatives who can address technical or account-related issues effectively. The lack of specified customer service channels or availability hours in public documentation further compounds these concerns.

Multiple user reports indicate frustration with the broker's support quality. They cite instances of unresolved complaints and inadequate assistance with platform-related problems. The absence of comprehensive customer service information, including available contact methods, response time commitments, or multilingual support options, suggests a lack of investment in client service infrastructure.

The negative customer service experiences reported by users align with broader concerns about the broker's legitimacy and commitment to client satisfaction. Professional brokers typically maintain robust customer support operations with multiple contact channels, extended availability hours, and specialized support teams. However, Baazex appears to fall short of these industry standards. This poor customer service reputation significantly impacts the broker's overall reliability and trustworthiness assessment.

Trading Experience Analysis (Score: 5/10)

The trading experience with Baazex presents a mixed picture. Some positive aspects are overshadowed by significant concerns about platform stability and execution quality. Users have acknowledged the competitive spreads starting from 0.4 pips, which could be attractive for cost-conscious traders. However, they have expressed concerns about platform reliability and order execution consistency.

Reports from users suggest issues with platform stability, including connectivity problems and potential execution delays that can impact trading performance. The lack of detailed information about trading platform specifications, mobile trading capabilities, or advanced trading features creates uncertainty about the overall technological infrastructure supporting the trading experience.

While the broker claims to offer ECN execution, user feedback indicates skepticism about the quality of liquidity provision and order handling procedures. Professional traders typically require reliable execution, minimal slippage, and transparent pricing. However, user reports suggest that Baazex may not consistently deliver these essential trading conditions. This baazex review finds that while the cost structure may appear competitive, the overall trading experience reliability remains questionable.

Trustworthiness Analysis (Score: 2/10)

Trustworthiness represents Baazex's most critical weakness. There are widespread user warnings about potential fraudulent activities and questionable business practices. The broker's regulation by the Seychelles Financial Services Authority provides minimal investor protection compared to major regulatory jurisdictions. This contributes to concerns about fund security and regulatory oversight effectiveness.

Multiple independent review sources have flagged Baazex as a potentially duplicitous platform, with users consistently warning others to avoid the broker. The lack of transparency regarding company ownership, operational history, and financial stability further undermines confidence in the broker's legitimacy. Professional brokers typically maintain clear corporate structures, published financial statements, and transparent operational procedures. However, Baazex appears to lack these fundamental trust indicators.

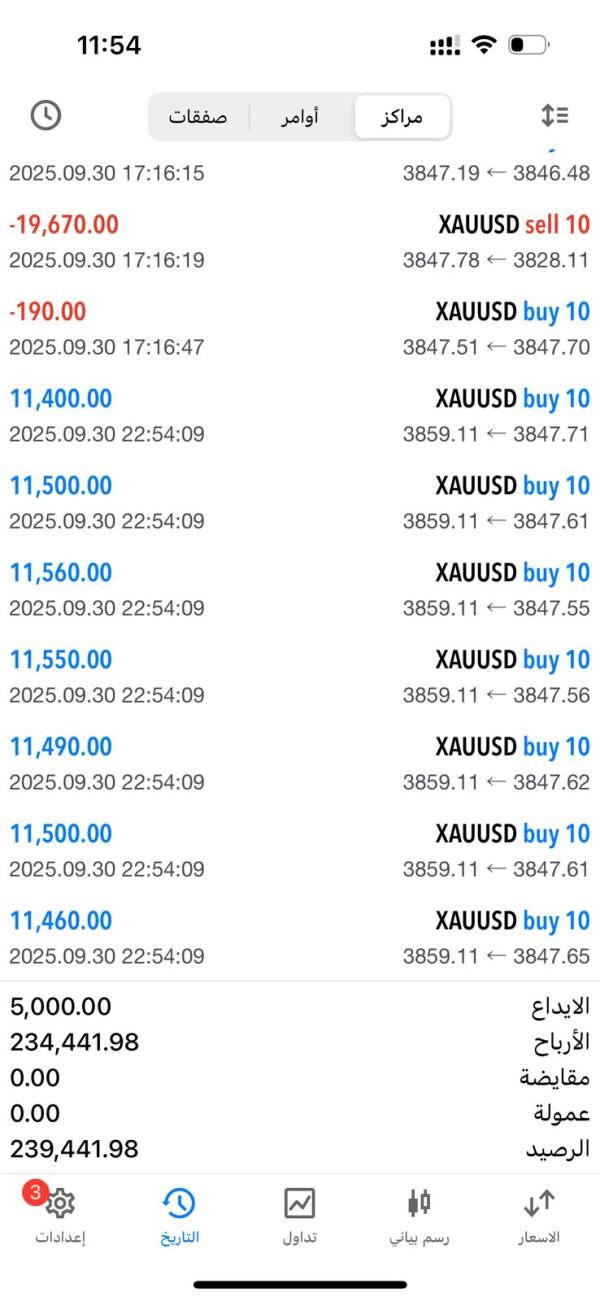

The absence of segregated account information, deposit insurance details, or clear fund protection measures raises serious concerns about client asset security. User reports of difficulty withdrawing funds and unresponsive customer service when addressing account issues compound these trustworthiness concerns. The overwhelming negative sentiment from the trading community, combined with limited regulatory oversight, positions Baazex as a high-risk choice for traders seeking reliable brokerage services.

User Experience Analysis (Score: 4/10)

The overall user experience with Baazex is characterized by significant dissatisfaction and widespread negative feedback across multiple review platforms. Users consistently report poor experiences with account management, customer service interactions, and platform functionality. This creates a pattern of user dissatisfaction that extends across various aspects of the broker's services.

The registration and verification processes appear to be sources of frustration for users, with reports of unclear requirements and lengthy processing times. The lack of detailed information about account opening procedures, verification standards, and onboarding support suggests that Baazex has not prioritized creating a smooth user experience for new clients.

User feedback indicates particular frustration with fund management procedures, though specific details about deposit and withdrawal experiences are limited in available sources. The combination of poor customer service, platform reliability issues, and trustworthiness concerns creates an overall user experience that falls well below industry standards. The negative user sentiment suggests that Baazex has failed to establish the operational excellence and client focus necessary for building a positive reputation in the competitive forex brokerage market.

Conclusion

This comprehensive baazex review reveals a broker that presents significant risks and limitations for potential traders. Baazex offers access to over 1,500 trading instruments and claims competitive spreads starting from 0.4 pips. However, these potential advantages are overshadowed by serious concerns about trustworthiness, customer service quality, and overall reliability.

The broker may only be suitable for highly experienced traders with substantial risk tolerance who can navigate the challenges associated with dealing with a questionable offshore platform. For most traders, the numerous red flags and negative user feedback suggest that better alternatives exist in the market.

The primary advantages include a diverse range of trading instruments and potentially competitive pricing. The significant disadvantages encompass poor trustworthiness ratings, inadequate customer service, limited transparency, and widespread negative user feedback. Traders considering Baazex should carefully weigh these factors and consider more established, well-regulated alternatives that offer better investor protection and service quality.