Regarding the legitimacy of Octa forex brokers, it provides BAPPEBTI and WikiBit, (also has a graphic survey regarding security).

Is Octa safe?

Pros

Cons

Is Octa markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. OCTA INVESTAMA BERJANGKA d/h PT. MULTI MULIA INVESTAMA BERJANGKA

Effective Date:

--Email Address of Licensed Institution:

support@octa.co.idSharing Status:

No SharingWebsite of Licensed Institution:

www.octa.co.idExpiration Time:

--Address of Licensed Institution:

Gedung Millennium Centennial Center Lt.37 C-H, Jl. Jenderal Sudirman Kav.25, Karet Kuningan, Setiabudi, Jakarta Selatan DKI Jakarta 12940Phone Number of Licensed Institution:

021 39708801Licensed Institution Certified Documents:

Is Octa A Scam?

Introduction

Octa, formerly known as OctaFX, has established itself as a notable player in the forex trading market since its inception in 2011. With a presence in over 180 countries and millions of accounts opened, Octa aims to provide a user-friendly trading experience with low fees and a variety of trading instruments. However, as the forex market is rife with potential scams and unreliable brokers, it is essential for traders to conduct thorough evaluations of any trading platform they consider. This article aims to provide an objective analysis of Octa's credibility, focusing on its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. The assessment is based on a comprehensive review of available online resources, user feedback, and regulatory information.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy and safety. A well-regulated broker is more likely to adhere to strict operational standards and provide a secure trading environment. Octa is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) in South Africa, as well as the Mwali International Services Authority (MISA) in Comoros. Below is a summary of Octa's regulatory information:

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 372/18 | Cyprus | Verified |

| FSCA | 51913 | South Africa | Verified |

| MISA | T2023320 | Comoros | Verified |

CySEC is considered a tier-2 regulator, providing a moderate level of investor protection, including a compensation fund for clients in the event of broker insolvency. While the FSCA also offers regulatory oversight, it lacks the same level of investor protection as tier-1 regulators like the FCA or ASIC. The MISA, on the other hand, is categorized as a low-tier regulator, which may not provide adequate protections for clients. Overall, while Octa is regulated, the quality and comprehensiveness of its regulatory oversight are mixed, with potential gaps in protection for clients trading under its offshore entity.

Company Background Investigation

Octa has a relatively brief history in the forex industry, having been founded in 2011. The company operates under multiple entities, including Octa Markets Ltd, which is based in Saint Vincent and the Grenadines, and Octa Markets Cyprus Ltd, which serves European clients. The ownership structure of Octa includes a diverse management team with backgrounds in finance and technology, contributing to its operational capabilities. The company's transparency is bolstered by its public disclosures regarding regulatory compliance and operational practices.

However, the presence of an offshore entity raises concerns about the level of client protection available to traders outside of regulated jurisdictions. While the company has received numerous awards for its services, including recognition for customer support and trading conditions, the lack of additional tier-1 regulatory licenses may deter some traders from fully trusting the platform. Overall, Octa appears to maintain a transparent approach to its operations, but the mixed regulatory landscape should prompt potential clients to exercise caution.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is crucial. Octa provides a competitive fee structure, with no commissions on trades and spreads starting from 0.6 pips for major currency pairs. The broker operates a spread-only model, meaning that all trading costs are incorporated into the spread. Below is a comparison of Octa's core trading costs against industry averages:

| Cost Type | Octa | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0% | 0.5% - 1.0% |

Octa's competitive spread and commission-free trading model make it appealing for both novice and experienced traders. However, the broker's limited range of tradable instruments—primarily forex, indices, commodities, and cryptocurrencies—may restrict trading opportunities for some users. Furthermore, the absence of stock trading and other asset classes could be a significant drawback for traders looking for a diversified portfolio.

Customer Fund Security

The safety of customer funds is paramount in the forex trading environment. Octa implements several measures to protect client funds, including segregated accounts, which ensure that client funds are kept separate from the company's operational capital. This segregation is crucial for safeguarding client assets in the event of financial difficulties faced by the broker. Additionally, Octa offers negative balance protection, which ensures that traders cannot lose more than their initial investment.

Despite these protections, potential clients should be aware of the varying levels of security depending on the entity under which they are trading. Clients serviced by the CySEC-regulated entity enjoy the highest level of protection, while those trading through the offshore entity may face increased risks. Overall, Octa demonstrates a solid commitment to fund safety, but traders should remain vigilant and understand the implications of trading under different regulatory jurisdictions.

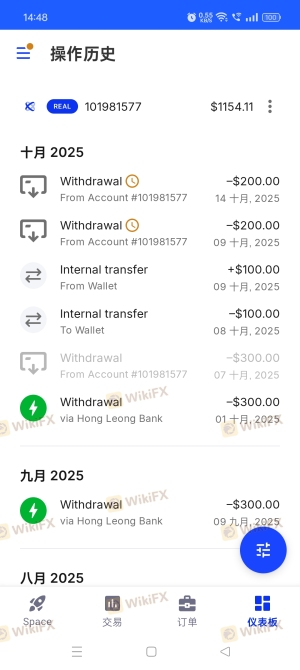

Customer Experience and Complaints

User feedback is an essential component in evaluating a broker's reliability. Octa has received a mix of positive and negative reviews from its users. Many traders praise the platform for its user-friendly interface, low fees, and responsive customer support. However, common complaints include issues with withdrawal processing times and a lack of available trading instruments. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| Limited Trading Instruments | Low | Acknowledged |

For example, some users have reported delays in processing withdrawals, leading to frustration. However, the company's customer support team has generally been responsive in addressing these concerns, which may alleviate some of the dissatisfaction. Overall, while there are areas for improvement, the general sentiment towards Octa's customer service appears to be positive.

Platform and Trade Execution

The performance and stability of the trading platform are critical for a successful trading experience. Octa offers several trading platforms, including the widely-used MetaTrader 4 and 5, as well as its proprietary Octa Trader platform. Users have reported that the platforms are generally stable, with quick order execution and minimal slippage. However, there have been some concerns regarding the potential for order rejections during periods of high volatility.

In terms of execution quality, Octa claims to provide a high level of service, with 97.5% of executed orders reported to have no slippage. This level of execution quality is commendable and indicates that traders can expect reliable performance during their trading activities. Nevertheless, traders should remain cautious and monitor their trading experience, particularly during significant market events.

Risk Assessment

Using Octa as a trading platform comes with certain risks, which are essential to consider before opening an account. Below is a summary of the key risk areas associated with trading on Octa:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Limited tier-1 regulation |

| Fund Security Risk | Medium | Varies by trading entity |

| Trading Instrument Risk | High | Limited asset diversity |

While Octa has implemented various safety measures, the lack of tier-1 regulatory oversight and the potential risks associated with its offshore entities should prompt traders to exercise caution. To mitigate risks, it is advisable for traders to conduct thorough research, utilize demo accounts for practice, and only invest funds they can afford to lose.

Conclusion and Recommendations

In conclusion, Octa presents itself as a credible forex broker with several strengths, including competitive trading conditions, user-friendly platforms, and a commitment to customer fund security. However, the mixed regulatory landscape, limited range of tradable instruments, and some customer complaints warrant a cautious approach. While there are no overt signs of fraudulent activity, potential clients should be aware of the risks associated with trading on Octa, particularly if they are trading under its offshore entity.

For traders who prioritize regulatory protection and a broader selection of instruments, it may be worthwhile to consider alternative brokers with stronger regulatory oversight and a more extensive range of trading options. Overall, Octa can be a viable choice for traders seeking low-cost forex trading, but it is essential to weigh the pros and cons carefully before proceeding.

Is Octa a scam, or is it legit?

The latest exposure and evaluation content of Octa brokers.

Octa Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Octa latest industry rating score is 5.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.