Retela 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive retela review gives you a fair look at a broker that has been running since 1947. The company started as Misawaya Securities and later joined with Imagawa Securities before becoming Retela Crea Securities in 2001, showing it has been around for a long time in the financial world.

The broker's current user trust rating is 50%. This shows that about half of its clients feel confident about the company. According to WikiFX data, Retela has 7 positive user reviews and 2 negative reports, which means most users have good experiences but some don't.

The company works under Japanese Financial Services Authority rules. This gives clients protection when they want to trade in Japanese markets. This review shows that Retela tries to focus on helping its clients, though we need more details about trading costs and platform features.

The broker works best for traders who want to access Japanese financial markets through a regulated company. It has decades of experience in the business.

Important Disclaimers

This retela review uses information that anyone can find online and feedback from users on different financial websites. You should know that rules and service quality can be very different depending on where you live, especially since this broker focuses mainly on Japanese markets under FSA watch.

We got our information from WikiFX systems, user comments, and company details that are available to everyone. However, you should check trading conditions, fees, and platform features directly with the broker because these things change often and might be different based on where you live and what type of account you have.

Rating Framework

Broker Overview

Retela started back in 1947 as Misawaya Securities. This means the company has been working in financial services for almost eighty years. The company changed a lot when it joined with Imagawa Securities and became Retela Crea Securities in 2001.

This change shows how the broker adapted to new market conditions and rules in Japan. The company works as a full foreign exchange brokerage firm that offers many trading services beyond just forex. Japan's Financial Services Authority watches over Retela, which means the company follows strict Japanese financial rules.

The broker's business includes different types of investments like foreign exchange, stocks, and bonds. This makes it a diverse financial services provider rather than just a forex-only company. According to available data, the firm has built a moderate reputation in the trading community, though we don't have many details about its trading systems or technology.

Regulatory Framework: Retela works under Japanese Financial Services Authority supervision. This gives clients protection that meets Japanese financial standards and access to Japan's investor protection and dispute resolution processes.

Asset Coverage: The broker lets you trade multiple types of investments including foreign exchange pairs, stocks, and bonds. However, we don't have detailed information about specific instruments, exotic currency pairs, or special trading products.

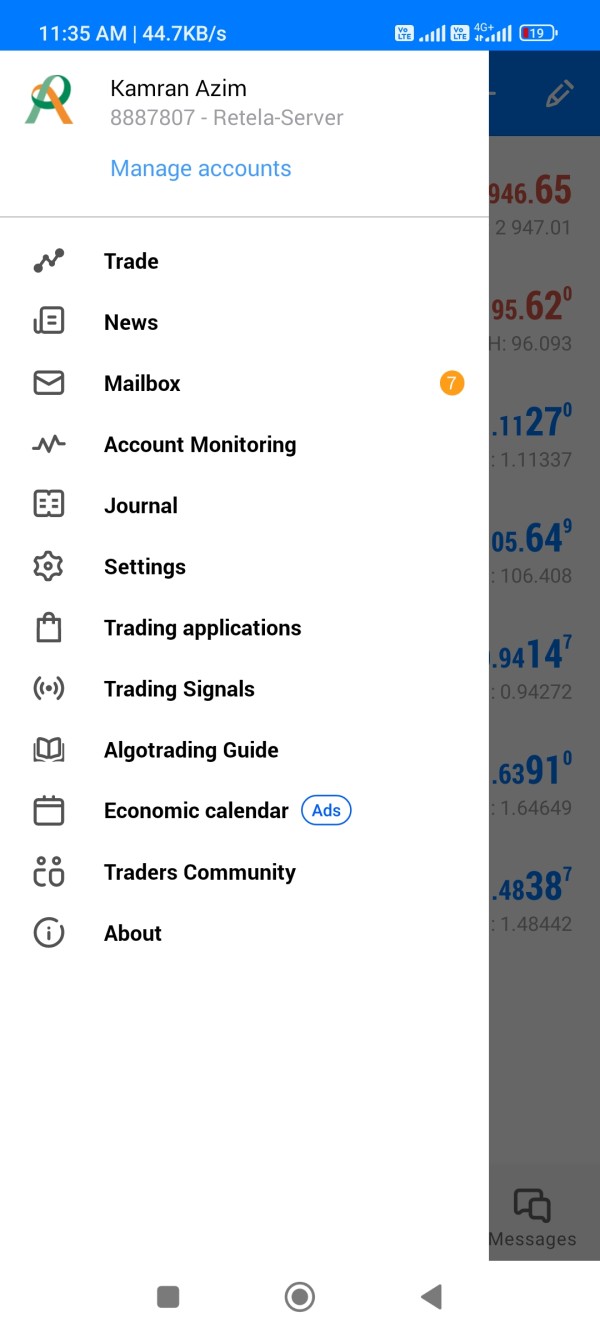

Trading Infrastructure: Available information doesn't tell us about the trading platforms, execution models, or technology features the company offers. Without detailed platform information, we can't judge how well the broker competes with others in terms of technology.

Cost Structure: We don't have specific information about spreads, commission rates, overnight charges, and other trading costs. This is a big information gap for potential clients who want to compare costs.

Account Requirements: Minimum deposit amounts, account types, and eligibility rules are not specified in available documents. You need to ask the broker directly for accurate information.

Geographic Restrictions: We don't know clearly which countries can use the service and what territorial limits exist.

This retela review shows major information gaps that potential clients should fill by talking directly with the broker's representatives.

Account Conditions Analysis

We can't fully evaluate Retela's account conditions because there isn't enough public information about specific account structures and requirements. The broker's long history suggests it has established account management systems, but we can't assess how it compares to competitors without detailed information.

Available sources don't tell us if Retela offers different account levels with different minimum deposits, trading conditions, or service levels. We also don't know about Islamic accounts, professional trader accounts, or special account types, which makes it hard to see if the broker meets different client needs.

We don't have details about account opening procedures, required documents, or how long verification takes. This is especially important for international clients who might face extra compliance requirements when using Japanese-regulated financial services.

Without specific data on account fees, inactivity charges, or minimum balance requirements, potential clients can't figure out the total cost of keeping an account with Retela. This retela review recommends talking directly with the broker to get complete account details before making any decisions.

We can't fully assess Retela's trading tools and educational resources because there isn't enough detailed information available. The broker has been around since 1947, which suggests it has developed good services, but we don't have specific details about analytical tools, research capabilities, and educational materials.

Available information doesn't tell us if Retela provides its own analytical tools, third-party research, or automated trading system support. We don't know about charting capabilities, technical indicators, or fundamental analysis resources, so we can't judge the quality of the broker's analytical tools.

We don't know what educational resources are available, like webinar programs, educational articles, market commentary, or trading tutorials. For traders who want comprehensive learning support, this missing information creates a big problem for evaluation.

We also don't have details about research and analysis support, such as daily market updates, economic calendar integration, or expert market commentary. The lack of information about signal services, trade ideas, or market sentiment tools makes it even harder to assess what extra services Retela offers.

Customer Service and Support Analysis

It's hard to evaluate Retela's customer service because we don't have specific information about support channels, response times, and service quality in available sources. While user feedback shows some positive experiences, we don't have comprehensive service documentation.

Available sources don't tell us about customer support channels like live chat, phone support hours, email response times, or multilingual support. This missing information is especially important for international clients who might need support in languages other than Japanese.

We don't know about response time promises, support availability during different market hours, or procedures for handling complex issues. Without specific service agreements or quality metrics, we can't objectively assess the broker's customer service standards.

User feedback shows 7 positive reviews against 2 negative reports, which suggests generally good service experiences among existing clients. However, the small sample size and lack of detailed service metrics prevent us from fully evaluating support effectiveness across different client situations and issue types.

Trading Experience Analysis

We can't fully assess Retela's trading experience quality because we don't have detailed information about platform performance, execution quality, and user interface capabilities. The broker's regulatory status under FSA supervision suggests it follows execution standards, but specific performance data isn't publicly available.

We don't have information about platform stability, order execution speed, and system reliability. Without data on slippage rates, requote frequency, or execution quality during high-volatility periods, we can't comprehensively evaluate the trading environment quality.

Available sources don't detail mobile trading capabilities, platform customization options, and advanced order types. This information gap is especially important for active traders who need sophisticated trading tools and flexible platform access across multiple devices.

We don't know about trading environment features like one-click trading, algorithmic trading support, or social trading integration. Without detailed platform functionality descriptions, we can't assess how well Retela competes in terms of trading experience quality.

This retela review shows the need for direct platform demonstration or trial access to properly evaluate the trading experience Retela offers.

Trust Rating Analysis

Retela's trust assessment shows a moderate confidence level with a 50% user trust rating. This reflects mixed client feelings about the broker's reliability and service quality, meaning half of evaluated users maintain confidence in the broker's operations and service delivery.

The regulatory framework provided by Japan's Financial Services Authority offers substantial credibility to Retela's operations. FSA regulation is known for its strict oversight requirements and strong investor protection mechanisms, giving clients access to established dispute resolution processes and regulatory safeguards.

The broker's operational history since 1947 adds positively to its trust profile. This shows institutional stability through multiple market cycles and regulatory changes, suggesting established risk management practices and business continuity capabilities that support client confidence.

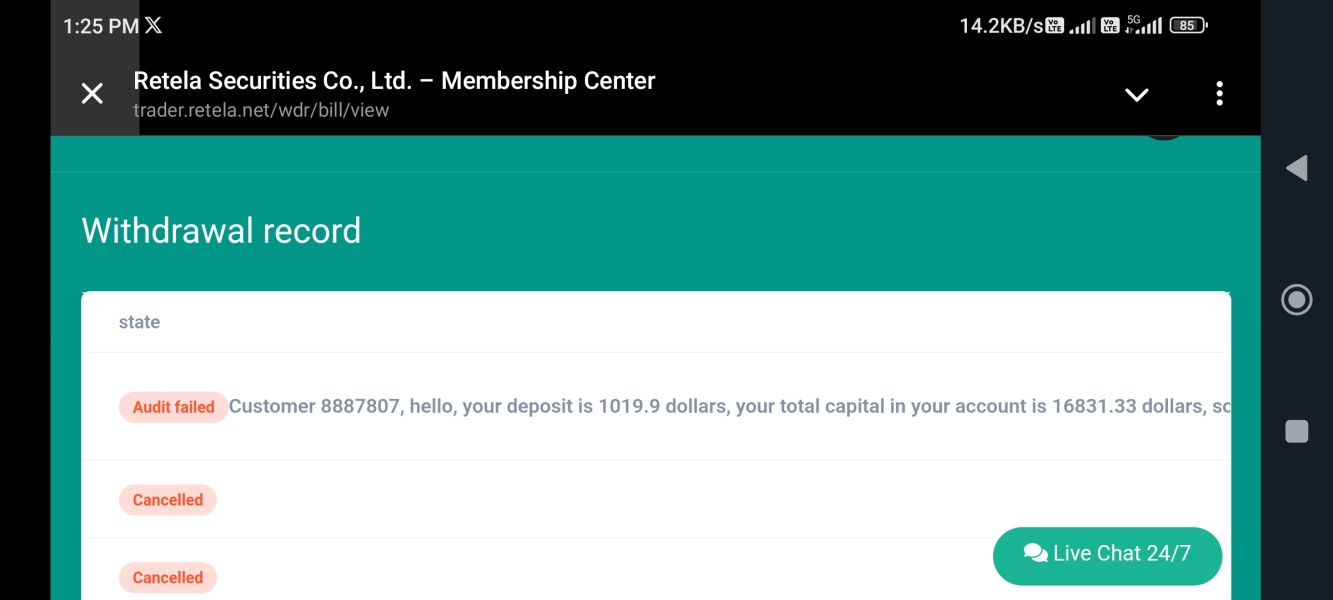

User feedback analysis shows 7 positive reviews compared to 2 negative exposure reports. This indicates that most documented user experiences lean toward satisfaction, but the 50% trust rating suggests that concerns exist among some users, though we don't have specific details about these concerns.

We don't have detailed information about client fund segregation, insurance coverage, or additional safety measures. This limits our comprehensive assessment of Retela's trustworthiness beyond regulatory compliance and user feedback metrics.

User Experience Analysis

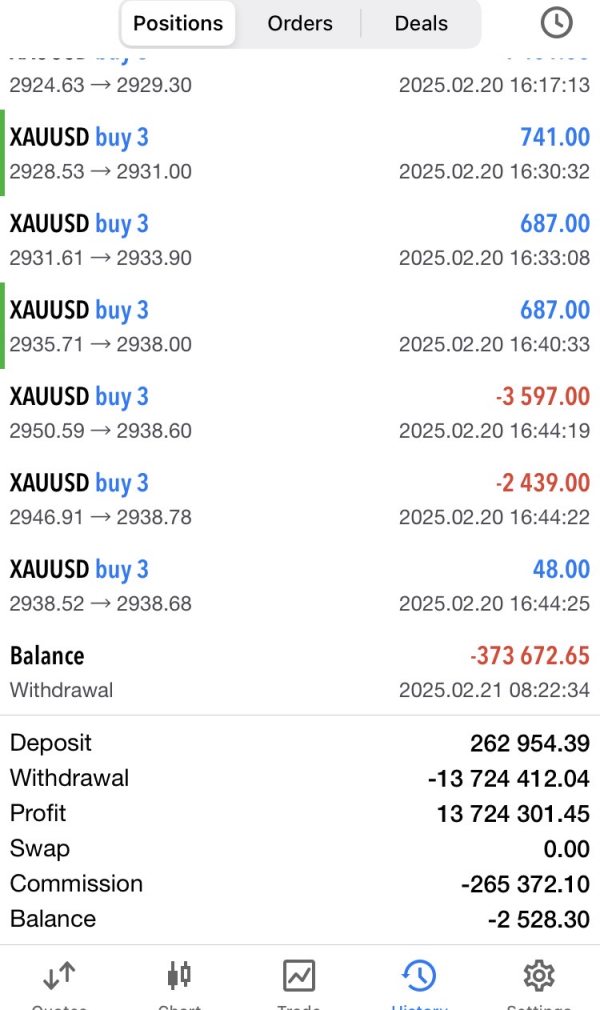

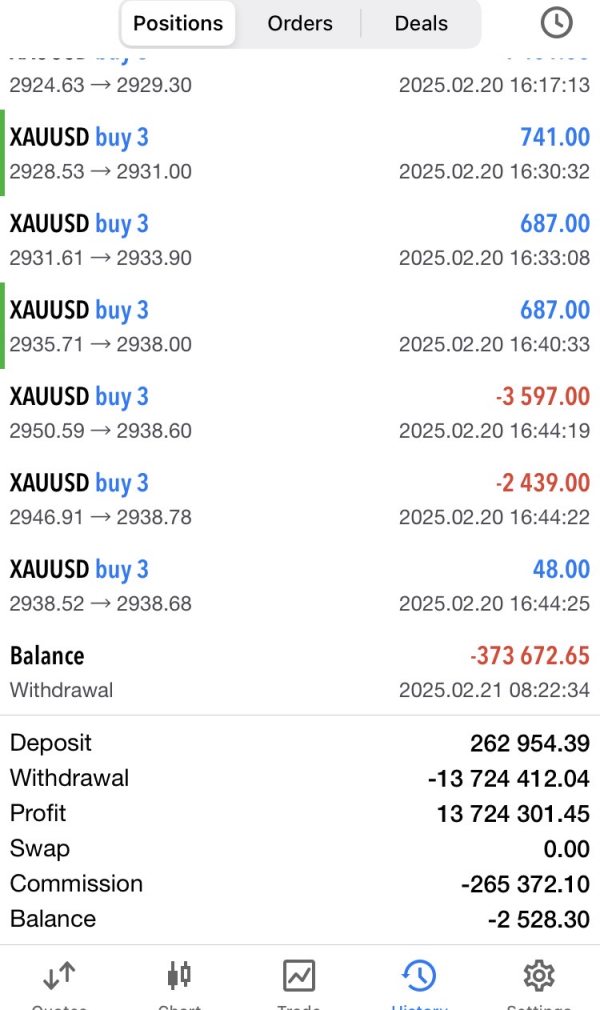

User experience evaluation for Retela presents a mixed picture based on available feedback and operational indicators. The compilation of 7 positive reviews against 2 negative exposure reports suggests that most clients who provide feedback experience satisfactory service levels, though the limited sample size prevents comprehensive user satisfaction assessment.

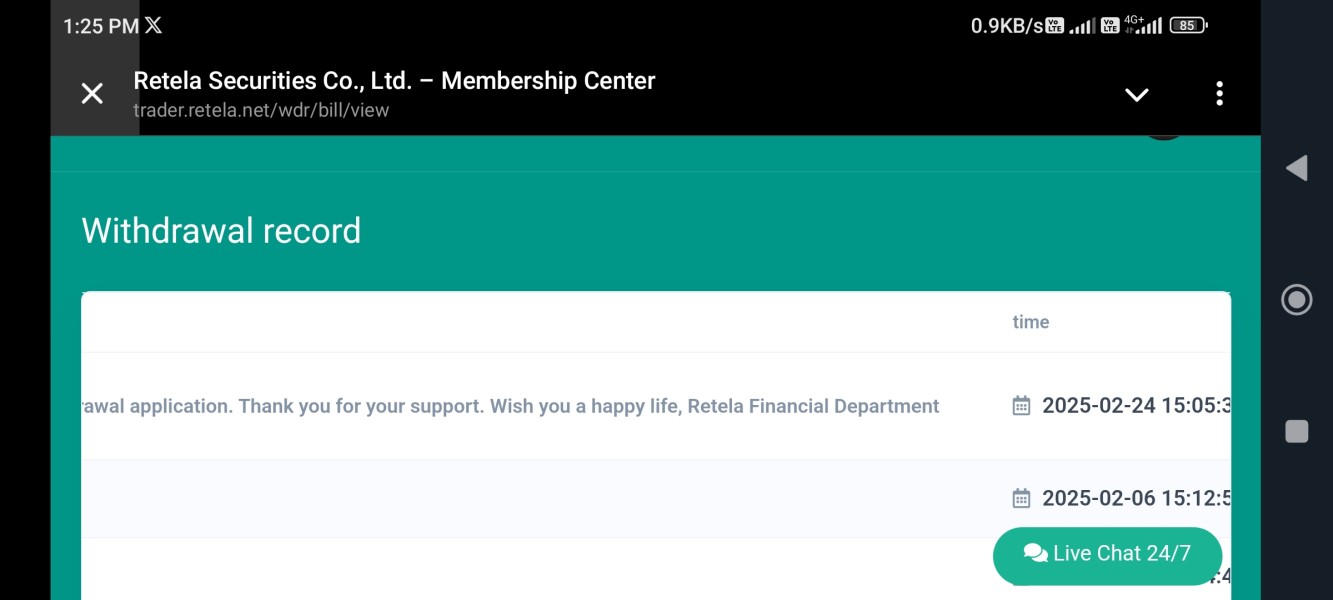

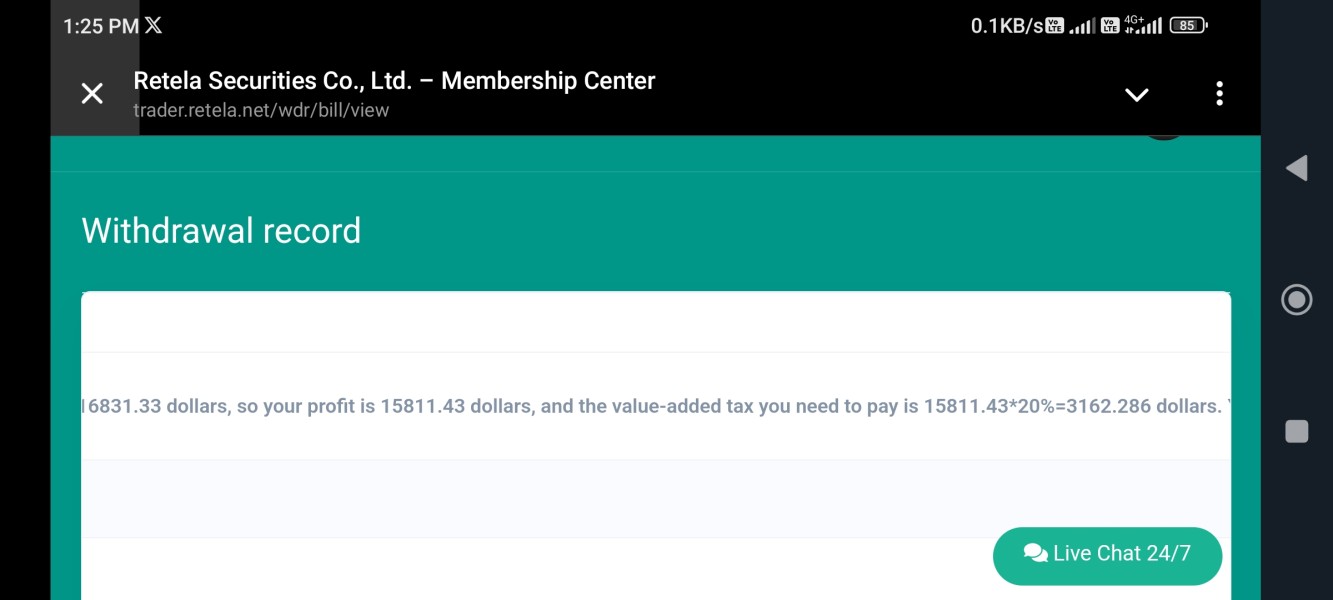

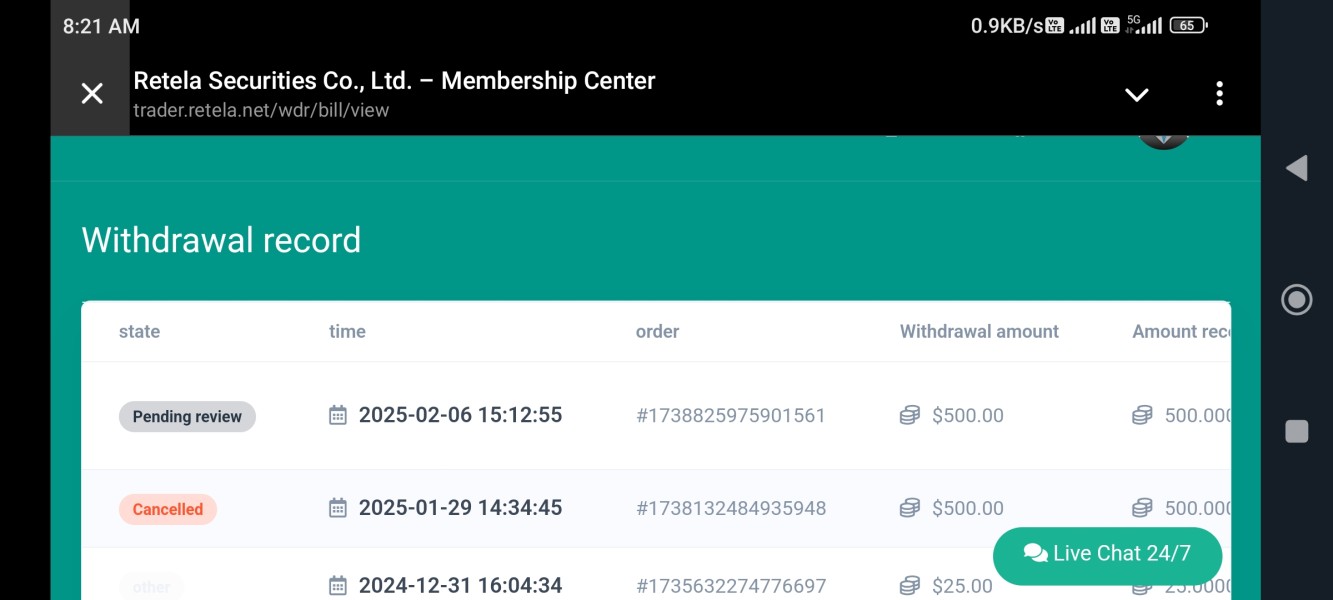

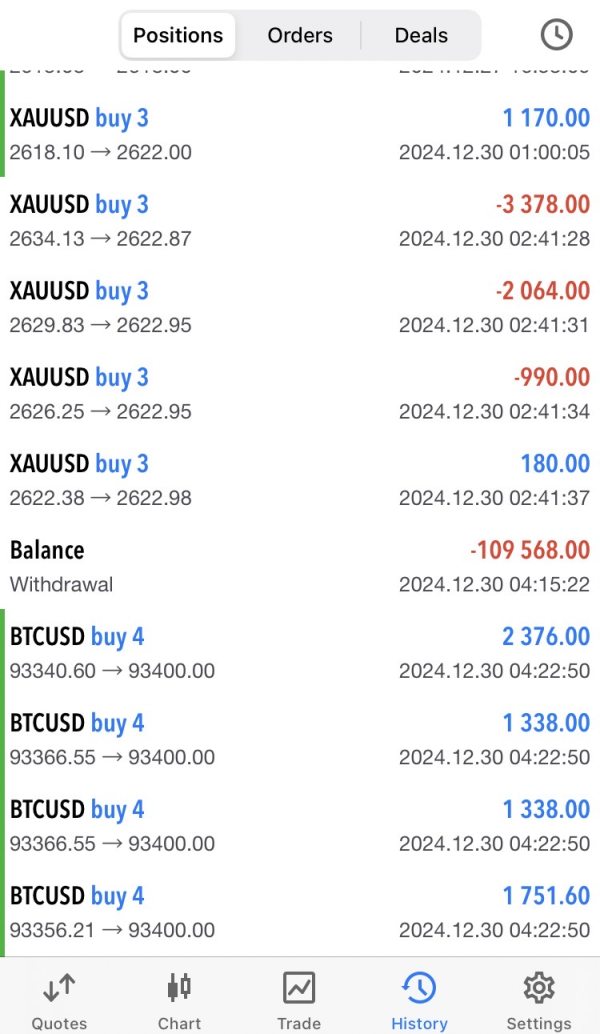

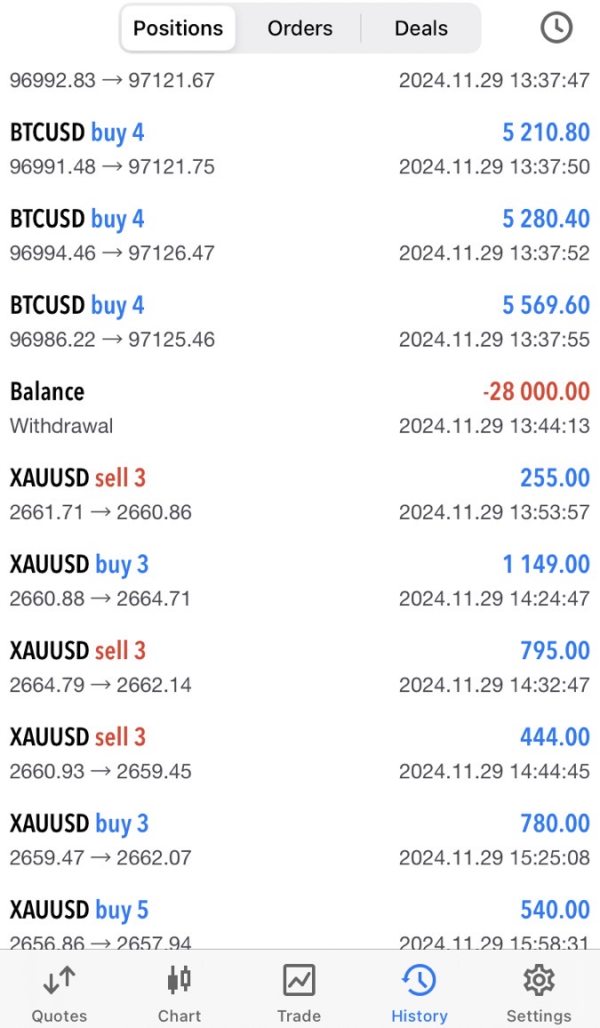

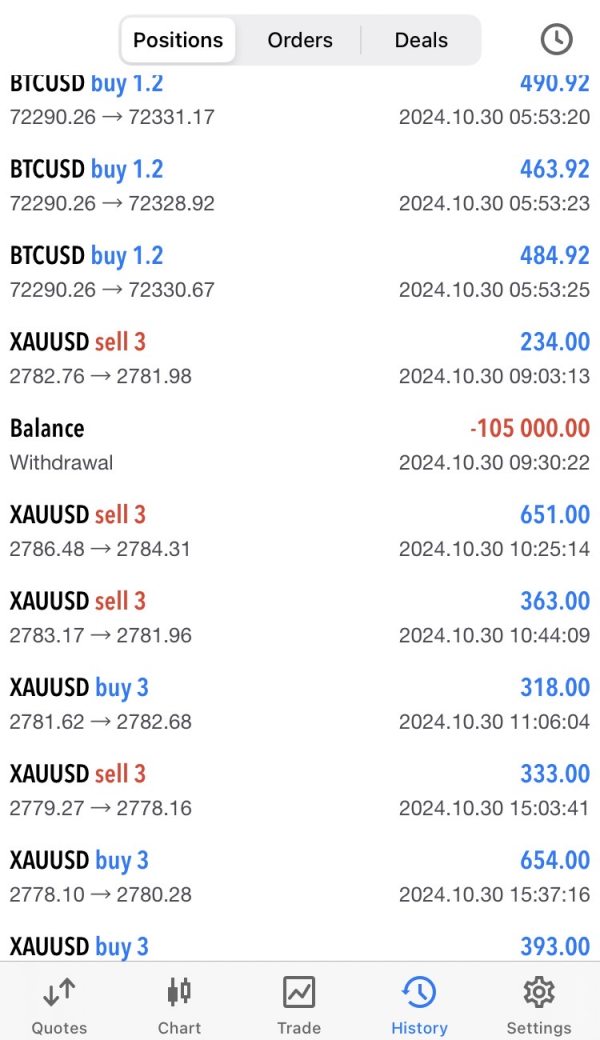

Available user testimonials include positive comments about profit generation and withdrawal processing. One user noted "joined this broker for more than a month, the profit is very considerable, and there is no problem in withdrawing money," which suggests satisfactory core operational functionality for basic trading and fund management needs.

However, the 50% trust rating indicates that user confidence remains moderate. This suggests that while basic services work adequately, some aspects of the user experience may not meet all client expectations, though we don't know the specific nature of user concerns contributing to this moderate trust level.

We don't have specific information about interface design quality, registration process efficiency, and overall platform usability in accessible user feedback. The absence of detailed user experience metrics regarding platform navigation, feature accessibility, or customer onboarding processes limits comprehensive evaluation of the overall client experience quality.

Conclusion

This comprehensive retela review presents a neutral assessment of a broker with significant operational history but limited publicly available detailed information. Retela's establishment in 1947 and regulatory compliance under Japan's Financial Services Authority provides institutional credibility, while the 50% user trust rating and mixed user feedback indicate moderate client satisfaction levels.

The broker appears most suitable for traders specifically interested in accessing Japanese financial markets through an established, regulated institution. However, the substantial information gaps regarding trading conditions, platform capabilities, and service specifications require potential clients to conduct direct inquiries to obtain comprehensive service details.

Primary advantages include regulatory oversight, operational longevity, and generally positive user experiences regarding core trading functions. Key limitations involve insufficient publicly available information regarding competitive trading conditions and comprehensive service offerings, necessitating direct broker consultation for informed decision-making.