Regarding the legitimacy of Retela forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is Retela safe?

Pros

Cons

Is Retela markets regulated?

The regulatory license is the strongest proof.

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

リテラ・クレア証券株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都中央区京橋1-2-1Phone Number of Licensed Institution:

03-6385-0601Licensed Institution Certified Documents:

Is Retela Safe or Scam?

Introduction

Retela is a forex broker based in Japan, known for its diverse offerings in trading various financial instruments, including forex, stocks, and investment trusts. As the forex market continues to grow, it is crucial for traders to thoroughly evaluate brokers before committing their funds. The potential for scams and fraud in the forex industry necessitates a careful assessment of a broker's legitimacy, regulatory status, and overall reliability. In this article, we will investigate whether Retela is safe for traders by analyzing its regulatory framework, company background, trading conditions, client fund security, customer experiences, and overall risk profile.

To conduct this assessment, we reviewed multiple sources, including regulatory filings, customer reviews, and expert analyses. Our evaluation framework focuses on key factors that influence a broker's safety and trustworthiness, providing a comprehensive overview of Retela's standing in the forex market.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical indicators of its legitimacy. Retela operates under the regulation of the Financial Services Agency (FSA) of Japan, which is known for its stringent oversight of financial institutions. This regulatory framework enhances the credibility of Retela and provides a level of assurance to traders regarding the safety of their investments.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Agency (FSA) | Not specified | Japan | Verified |

The FSA's role is to ensure that brokers adhere to strict standards of conduct, including the segregation of client funds, transparency in operations, and compliance with financial regulations. Retela's adherence to these regulations is crucial in mitigating concerns of fraudulent activities. While no broker is entirely free from risk, the FSA's oversight significantly reduces the likelihood of scams, making Retela a safer choice for traders.

Company Background Investigation

Retela was founded in 1999, initially operating as Imagawami Saway Securities before rebranding to its current name. The company has a long-standing presence in the Japanese financial market, which is a positive indicator of its stability and reliability. Retela has successfully navigated through various market challenges, establishing itself as a reputable entity in the industry.

The management team at Retela comprises experienced professionals with extensive backgrounds in finance and trading. Their expertise contributes to the company's operational transparency and commitment to customer service. Retela has made efforts to provide relevant information regarding its operations and financial health, enhancing its credibility among traders.

However, potential clients should be aware of the company's focus on the Japanese market, which may limit global investment opportunities. Moreover, the language barrier could pose challenges for non-Japanese speakers seeking to trade with Retela. Overall, the company's history and management team suggest that Retela is a legitimate broker, but prospective clients should conduct their due diligence.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. Retela provides competitive trading conditions, including low spreads and various account types. However, traders should be mindful of any unusual fees that may arise.

Retela's fee structure is as follows:

| Fee Type | Retela | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Starting from 0.1 pips | 1.0 - 2.0 pips |

| Commission Structure | Varies by account type | Typically $5 - $10 per trade |

| Overnight Interest Range | Competitive | Varies widely |

While Retela's spreads are competitive, the complexity of its fee structure can be confusing for some traders. It's important to clarify any potential commissions or additional fees that may apply, especially for premium account holders. Transparency regarding these costs is vital for traders to make informed decisions.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Retela takes several measures to ensure the security of its clients' investments. The broker adheres to strict regulations set by the FSA, which requires the segregation of client funds from the company's operational funds. This practice minimizes the risk of client funds being misused or lost in the event of financial difficulties.

Additionally, Retela provides investor protection measures, although specific details regarding coverage limits were not readily available. The broker's commitment to maintaining a secure trading environment is a positive aspect, but potential clients should inquire further about the specifics of these protections.

Historically, Retela has not faced major controversies regarding client fund security, which further enhances its reputation. However, traders should remain vigilant and conduct their research to ensure their funds are adequately protected.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Retela has received a mix of reviews from its clients, with some praising its trading conditions and customer service, while others have expressed concerns regarding responsiveness and account management.

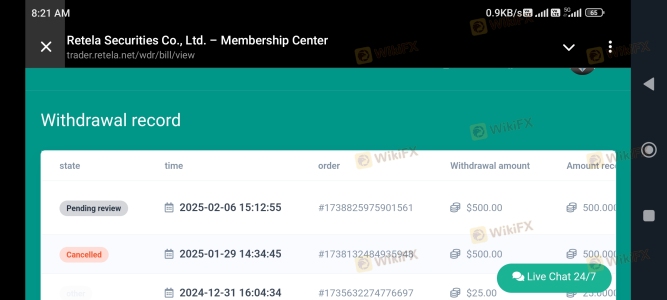

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | Moderate | Mixed responses |

| Customer Support | Low | Generally responsive |

| Fee Transparency | High | Needs improvement |

Common complaints include challenges with withdrawals and a lack of clarity regarding fees. While Retela has generally been responsive to customer inquiries, there is room for improvement in addressing withdrawal issues and enhancing transparency concerning fees.

For instance, one user reported difficulty withdrawing funds, which led to frustration. In contrast, another user highlighted positive experiences with the company's support team. These mixed reviews suggest that while Retela is not a scam, potential clients should be prepared for some challenges and ensure they fully understand the terms of service before opening an account.

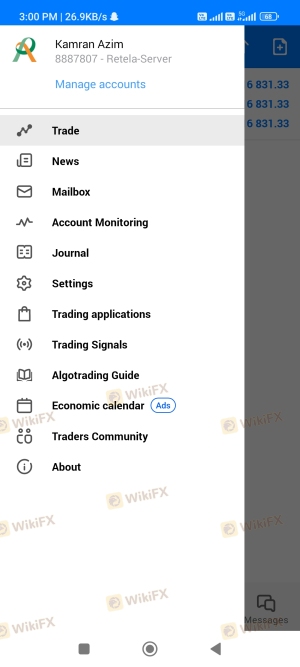

Platform and Trade Execution

The trading platform provided by Retela plays a crucial role in the overall trading experience. The broker offers a user-friendly interface with advanced charting tools and technical indicators. However, the platform's performance and stability are essential for ensuring smooth trade execution.

Traders have reported varying experiences with order execution, including instances of slippage and rejected orders. While some users have noted satisfactory execution speeds, others have expressed concerns about potential manipulation or delays during high volatility periods.

Overall, while Retela's platform is generally reliable, traders should remain cautious and monitor their orders closely, especially during critical market events.

Risk Assessment

Using Retela comes with inherent risks, as with any forex broker. It is essential for traders to understand these risks and take appropriate measures to mitigate them.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Market Risk | High | Exposure to market fluctuations |

| Regulatory Risk | Medium | Compliance with local regulations |

| Operational Risk | Medium | Potential issues with platform performance |

To reduce risks, traders should consider implementing risk management strategies, including setting stop-loss orders and diversifying their portfolios. Additionally, being aware of market conditions and understanding the broker's policies can help traders navigate potential challenges effectively.

Conclusion and Recommendations

In conclusion, Retela is a regulated forex broker with a solid reputation in the Japanese market. While it offers competitive trading conditions and a secure environment for clients, potential traders should be aware of the inherent risks involved and the mixed reviews regarding customer experiences.

Overall, is Retela safe? The evidence suggests that it operates legitimately under the oversight of the FSA, but traders should exercise caution and conduct thorough research before committing their funds. For those who may have concerns about Retela, it is advisable to explore alternative brokers with strong reputations and robust customer support, such as those regulated by top-tier authorities like the FCA or ASIC.

Is Retela a scam, or is it legit?

The latest exposure and evaluation content of Retela brokers.

Retela Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Retela latest industry rating score is 7.87, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.87 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.