RedMars 2025 Review: Everything You Need to Know

Summary

RedMars is a new broker in the forex market. This company operates under the brand name RM Markets and has built a strong foundation in the regulated trading world. The Cyprus-based investment firm positions itself as a trusted investment partner, providing top-tier brokerage and financial services within a fully regulated European Union framework. This redmars review reveals a broker with solid regulatory foundations and investor protection measures that cater to traders seeking security and compliance.

The broker stands out with its authorization by the Cyprus Securities and Exchange Commission under license number 396/21. This ensures adherence to strict European financial regulations that protect traders from many common risks. Additionally, RedMars provides enhanced security through the Investor Compensation Fund protection, offering traders an extra layer of financial safety. This regulatory framework makes RedMars particularly suitable for individual and institutional investors who prioritize trading within a regulated environment and seek the protections afforded by EU financial oversight.

RedMars has a Trust Score of 77, which indicates a medium-high trust rating. This score demonstrates credibility in the competitive forex market where many brokers struggle to establish trust with traders. The broker primarily targets European Union residents and investors who value regulatory compliance and investor protection over potentially higher leverage or promotional offerings available from less regulated competitors.

Important Notice

Traders should know that different regional entities may operate under varying legal and regulatory requirements. This could affect trading conditions and user experience depending on your jurisdiction and local laws. The regulatory landscape in Cyprus and the broader EU framework provides specific protections and limitations that may differ from brokers operating under other jurisdictions.

This review is based on publicly available information and user feedback collected from various sources. The assessment reflects the current state of available data regarding RedMars' services, regulatory status, and market position, though some information remains limited. Traders should conduct their own due diligence and consider their individual trading needs and risk tolerance when evaluating any brokerage service.

Rating Framework

Broker Overview

RedMars operates as the trading brand of RM Markets. This Cyprus Investment Firm has established itself as a provider of comprehensive brokerage and financial services that meet strict European standards. The company has positioned itself strategically within the European Union's regulatory framework, ensuring full compliance with EU financial directives and standards. This positioning reflects the broker's commitment to transparency and regulatory adherence, characteristics that appeal to risk-conscious traders who prioritize security over potentially more aggressive trading conditions offered by less regulated competitors.

The broker's foundation in Cyprus provides access to the European Economic Area through passporting rights. This allows it to serve clients across multiple EU jurisdictions under a single regulatory umbrella that simplifies compliance and protection. This redmars review indicates that the company has chosen a business model that emphasizes regulatory compliance and investor protection rather than pursuing the offshore route that some competitors have adopted.

RedMars focuses primarily on forex trading services. The company provides clients with access to currency markets through what the company describes as powerful trading platforms that meet modern trading needs. The broker's regulatory status under CySEC license number 396/21 ensures compliance with MiFID II directives, including investor protection measures, segregation of client funds, and participation in the Investor Compensation Fund. This regulatory framework provides compensation of up to €20,000 per client in the unlikely event of firm failure, adding an important safety net for traders.

Regulatory Jurisdiction: RedMars operates under the supervision of the Cyprus Securities and Exchange Commission with license number 396/21 and registration number HE 401317. This authorization provides the broker with European Union passporting rights and ensures compliance with MiFID II regulations that protect traders across the EU.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available materials. As a CySEC-regulated entity, the broker must offer segregated client accounts and comply with EU banking standards that protect client funds.

Minimum Deposit Requirements: The minimum deposit requirements for opening an account with RedMars are not specified in the available information. Potential clients must contact the broker directly for this information, which may indicate a personalized approach to account setup.

Bonuses and Promotions: Current promotional offerings and bonus structures are not detailed in available materials. EU regulations generally limit promotional activities for CySEC-regulated brokers, which may explain the lack of aggressive marketing offers.

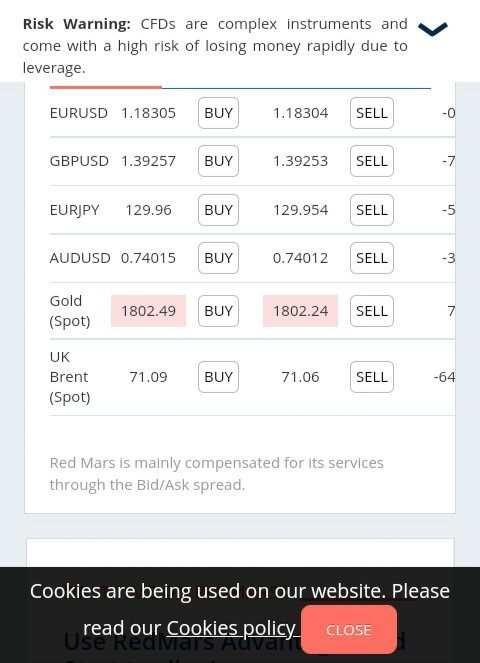

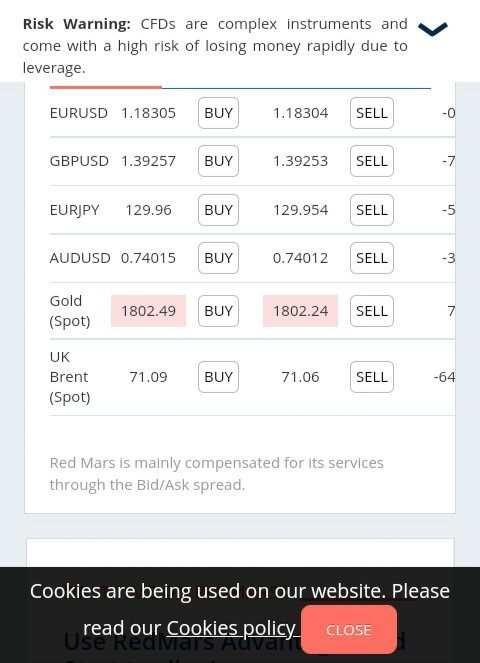

Tradeable Assets: RedMars primarily focuses on forex trading. The broker provides access to major, minor, and exotic currency pairs that cover most global trading opportunities. The specific range of available instruments within the forex market is not detailed in current materials.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not provided in available materials. This redmars review notes that specific pricing information would need to be obtained directly from the broker through personal consultation.

Leverage Ratios: Available information does not specify the leverage ratios offered by RedMars. As a CySEC-regulated broker, maximum leverage would be subject to ESMA restrictions that limit risk exposure for retail traders.

Platform Options: RedMars advertises powerful trading platforms for its clients. Specific platform details, including whether they offer MetaTrader 4, MetaTrader 5, or proprietary platforms, are not specified in available materials.

Regional Restrictions: Specific regional restrictions are not detailed in available information. EU regulatory requirements may limit services to certain jurisdictions based on local laws and compliance requirements.

Customer Service Languages: Available customer service languages are not specified in current materials. This information would need to be confirmed directly with the broker during the account opening process.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by RedMars remain largely unspecified in available public materials. This presents a significant information gap for potential clients conducting due diligence before choosing a broker. What is known is that as a CySEC-regulated entity, the broker must comply with European Union standards for client account management, including segregation of client funds from company operational funds and adherence to MiFID II investor protection protocols.

The lack of publicly available information regarding account types, minimum deposit requirements, and account-specific features suggests that RedMars may operate a more consultative approach to client onboarding. This approach requires direct contact for detailed account information, which may offer more personalized service but could frustrate traders who prefer immediate access to account details. Without specific details about account tiers, Islamic account availability, or special account features, this redmars review cannot provide a comprehensive assessment of how competitive RedMars' account conditions are relative to industry standards.

The regulatory framework does ensure that whatever account conditions are offered must meet EU investor protection standards. This provides some baseline assurance of fairness and transparency that traders can rely on regardless of specific terms. The absence of clear account condition information represents a potential barrier to client acquisition, as modern traders typically expect detailed account specifications to be readily available during their broker selection process.

Available information does not provide specific details about the trading tools and resources offered by RedMars. This creates uncertainty about the broker's technological capabilities and support infrastructure that modern traders expect. The company mentions providing "powerful trading platforms" but does not specify whether these include popular options like MetaTrader 4 or 5, or if they have developed proprietary trading solutions.

The lack of detailed information about research and analysis resources, educational materials, or market commentary services makes it difficult to assess how well RedMars supports trader development and decision-making. Modern forex traders typically expect access to economic calendars, market analysis, trading signals, and educational resources as standard broker offerings that help them make informed trading decisions. Without specific information about automated trading support, API access, or advanced order types, traders cannot determine whether RedMars provides the technological sophistication required for advanced trading strategies.

The absence of details about mobile trading capabilities also leaves questions about the broker's commitment to modern, flexible trading solutions. The limited public information about tools and resources suggests that RedMars may be focusing on basic service provision rather than competing on technological innovation or comprehensive trader support services.

Customer Service and Support Analysis

Customer service information for RedMars is notably absent from available materials. This leaves significant questions about support quality, availability, and accessibility when traders need help with their accounts or trading issues. The lack of specified customer service channels, response time expectations, or service quality metrics makes it impossible to assess how well the broker supports its clients when issues arise.

Without information about multilingual support capabilities, trading hours for customer service, or specialized support for different account types, potential clients cannot evaluate whether RedMars provides adequate support for their specific needs and time zones. This is particularly important for forex traders who may need assistance during various global market hours when different currency pairs are most active. The absence of user feedback regarding customer service experiences means this review cannot provide insights into real-world support quality or problem resolution effectiveness.

Modern traders typically expect multiple contact channels including live chat, email, and phone support, but RedMars' available channels are not specified. The lack of transparent customer service information may indicate either a preference for direct client relationships or potentially inadequate investment in customer support infrastructure, though without specific data, this remains speculative.

Trading Experience Analysis

The trading experience offered by RedMars remains largely undefined in available materials. This creates uncertainty about platform performance, execution quality, and overall trading environment that directly affects trader success. While the broker mentions providing "powerful trading platforms," specific details about platform stability, execution speed, or order processing capabilities are not provided.

Without information about average execution times, slippage rates, or platform uptime statistics, traders cannot assess whether RedMars provides the reliable trading environment necessary for effective forex trading. The absence of details about mobile trading capabilities also raises questions about platform accessibility and flexibility for traders who need to manage positions on the go. Available materials do not specify whether RedMars offers advanced order types, one-click trading, or other features that enhance trading efficiency.

The lack of information about platform customization options or advanced charting capabilities leaves questions about whether the trading environment meets modern trader expectations. This redmars review notes that without user feedback about actual trading experiences, platform performance, or execution quality, it's impossible to provide meaningful assessment of how RedMars performs in real trading conditions versus marketing claims.

Trust and Reliability Analysis

RedMars demonstrates solid regulatory credentials through its authorization by the Cyprus Securities and Exchange Commission under license number 396/21. This regulatory status provides important investor protections including segregation of client funds, participation in the Investor Compensation Fund, and adherence to MiFID II directives that govern European financial services and protect trader interests. The Investor Compensation Fund protection offers coverage up to €20,000 per client in the event of firm failure.

This provides an important safety net that distinguishes regulated brokers from offshore alternatives that may not offer such protection. This protection, combined with CySEC's ongoing supervision and compliance requirements, establishes a foundation of trust for clients prioritizing security over potentially more aggressive trading conditions. With a Trust Score of 77, RedMars achieves a medium-high rating that reflects its regulatory standing and institutional framework.

However, the relatively new presence in the market means the broker has not yet established the long-term track record that builds deeper market confidence and recognition among experienced traders. The company's positioning as "Your Trusted Investment Partner" aligns with its regulatory approach and commitment to compliance. The limited public information about company history, management team, or operational transparency leaves some questions about deeper institutional credibility beyond regulatory compliance.

User Experience Analysis

Comprehensive user experience information for RedMars is not available in current materials. This makes it difficult to assess how well the broker serves its clients in practical, day-to-day interactions that determine overall satisfaction. Without specific feedback about website usability, account opening procedures, or overall client satisfaction, this review cannot provide meaningful insights into user experience quality.

The absence of detailed information about the registration and verification process leaves questions about how efficiently new clients can begin trading. Modern traders expect streamlined onboarding procedures with clear documentation requirements and reasonable processing times, but RedMars' approach to these processes is not specified in available materials. Without user feedback about fund deposit and withdrawal experiences, platform navigation, or overall service satisfaction, potential clients cannot gauge whether RedMars provides the smooth, professional experience expected from a regulated broker.

The lack of publicly available user testimonials or case studies further limits insight into real-world user experiences. The limited public information about user experience may reflect either a preference for private client relationships or potentially insufficient focus on user experience optimization and feedback collection.

Conclusion

RedMars presents itself as a regulated forex broker operating under solid European Union oversight through CySEC authorization. The broker's commitment to regulatory compliance and investor protection through the ICF makes it potentially suitable for traders who prioritize security and regulatory oversight over more aggressive trading conditions or promotional offerings that may carry higher risks.

However, this redmars review reveals significant information gaps regarding account conditions, trading tools, customer service, and user experience that may concern potential clients seeking comprehensive broker evaluation. The lack of detailed public information about core service elements suggests that RedMars may require direct contact for thorough due diligence, which could slow the account opening process for some traders. The broker appears most suitable for EU-based individual and institutional investors who value regulatory protection and are willing to engage directly with the broker to obtain detailed service information.

The main advantages include strong regulatory foundations and investor compensation protection that provide peace of mind for security-conscious traders. The primary limitation lies in the lack of transparent, readily available information about trading conditions and service specifics that modern traders expect when comparing brokers.