Money Partners 2025 Review: Everything You Need to Know

Summary: Money Partners, a Japan-based forex and CFD broker, is regulated by the Financial Services Agency (FSA) of Japan. While it offers a variety of account types and trading platforms, user experiences are mixed, with concerns about language barriers and withdrawal issues.

Note: Its essential to consider that Money Partners primarily serves a Japanese clientele, which may limit accessibility for international traders. This review aims to provide a balanced view based on various sources to ensure fairness and accuracy.

Ratings Overview

We score brokers based on user feedback, regulatory compliance, and overall trading conditions.

Broker Overview

Founded in 2005, Money Partners Co., Ltd. is a regulated broker based in Japan, offering services primarily to local traders. The brokerage is licensed by the Financial Services Agency (FSA) of Japan, ensuring compliance with local financial regulations. The broker provides access to popular trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with its proprietary platform, catering to a diverse range of trading preferences. Traders can engage in various asset classes, including forex, stocks, indices, commodities, and cryptocurrencies.

Detailed Section

Regulated Geographical Areas

Money Partners operates under the jurisdiction of Japan, regulated by the FSA. This regulatory framework is designed to protect traders and ensure that the broker adheres to strict financial standards.

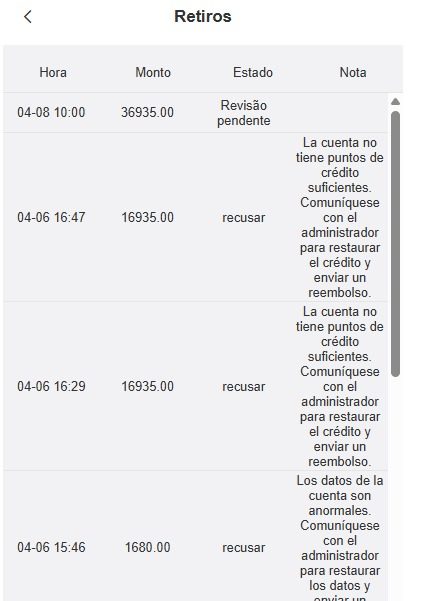

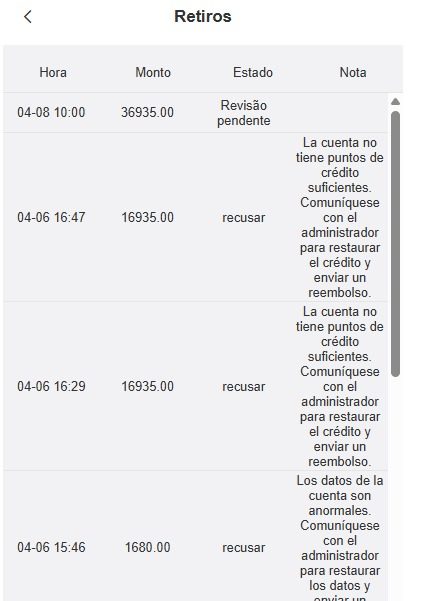

Deposit/Withdrawal Methods

The broker supports several deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets. Notably, while there are no deposit fees, withdrawal fees may apply, such as a ¥550 fee for bank transfers to Japanese accounts.

Minimum Deposit

The minimum deposit requirement varies by account type. For the standard account, the minimum deposit is ¥10,000, which is relatively accessible for beginner traders. However, the raw ECN account requires a higher minimum deposit of ¥100,000.

Information regarding bonuses or promotions is limited. The broker does not prominently advertise any promotional offers, which may be a drawback for traders looking for incentives.

Tradable Asset Classes

Money Partners offers a broad spectrum of tradable assets, including:

- Forex: Access to major and minor currency pairs.

- Stocks: Trading in individual shares of publicly listed companies.

- Indices: Speculation on market indices such as the Nikkei 225 and S&P 500.

- Commodities: Opportunities to trade raw materials like oil and gold.

- Cryptocurrencies: Trading services for digital currencies, although leverage for cryptocurrencies is limited to 1:2.

Costs (Spreads, Fees, Commissions)

The spread varies by account type, with raw ECN accounts starting at 0 pips, while standard accounts have spreads from 1.5 pips. While there are no purchase fees for internet transactions, a fixed rate fee applies to sales. Additionally, monthly account maintenance fees of ¥1,100 may deter some users.

Leverage

Money Partners offers a maximum leverage of up to 1:400 for forex trading, which is competitive compared to other brokers. However, leverage for cryptocurrencies is limited to 1:2, which may restrict trading strategies for crypto enthusiasts.

Traders can choose from MT4, MT5, and Money Partners' proprietary platform. The inclusion of well-known platforms like MT4 and MT5 adds credibility to the trading experience, providing users with familiar tools for analysis and trading.

Restricted Regions

As Money Partners primarily serves the Japanese market, its services may not be available to international clients. The account registration process requires a Japanese ID, limiting access for non-Japanese speakers.

Available Customer Service Languages

Customer support is primarily conducted in Japanese, which can be a significant barrier for non-Japanese speaking traders. The support options include phone support, an inquiry form, and a live chat feature, although the latter is limited to specified hours.

Ratings Breakdown

Account Conditions: 7/10

Money Partners offers multiple account types, including standard, raw ECN, MT4 ECN, and Islamic accounts. The minimum deposit requirements are reasonable, making it accessible for various traders.

While the broker provides educational resources, the lack of comprehensive tools for analysis may hinder some traders. The proprietary platform's features are also less well-known compared to MT4 and MT5.

Customer Service and Support: 5/10

Customer service is limited by language barriers, as support is primarily available in Japanese. Response times for inquiries can also be slow, which may frustrate users.

Trading Setup (Experience): 7/10

The trading experience is generally positive, with a range of asset classes and competitive spreads. However, withdrawal issues reported by users raise concerns about the overall trading environment.

Trustworthiness: 6/10

Despite being regulated by the FSA, some reviews highlight issues with withdrawals and customer complaints, which may affect the broker's reputation among potential traders.

User Experience: 5/10

User experiences vary, with some expressing satisfaction with trading conditions, while others report difficulties with withdrawals and language barriers. This mixed feedback suggests a need for improvement in customer relations.

Conclusion

In conclusion, while Money Partners is a regulated broker with a variety of trading options, potential traders should be cautious, particularly if they do not speak Japanese or if they are outside Japan. The mixed reviews regarding customer service and withdrawal issues should be taken into account when considering this broker for trading activities.