KSF 2025 Review: All You Need to Know

Executive Summary

This comprehensive ksf review evaluates a trading entity that has gained attention in the forex market, though not for good reasons. KSF presents a mixed picture with concerning elements that potential traders should carefully consider based on available data and user feedback. The entity operates under FCA oversight, which provides some regulatory framework. However, recent warnings from the Financial Conduct Authority have raised serious questions about its operational legitimacy.

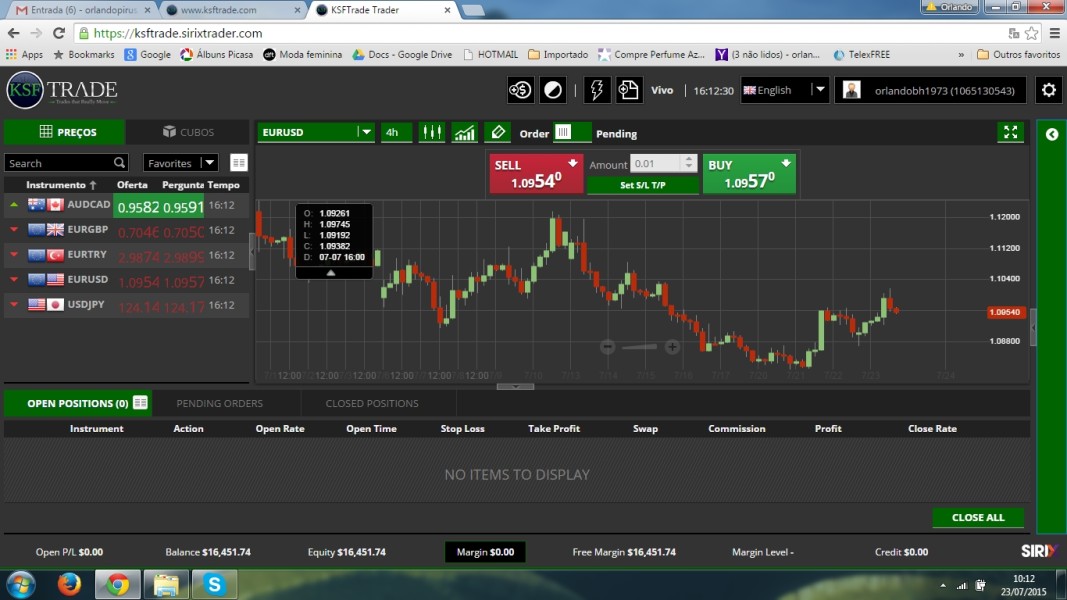

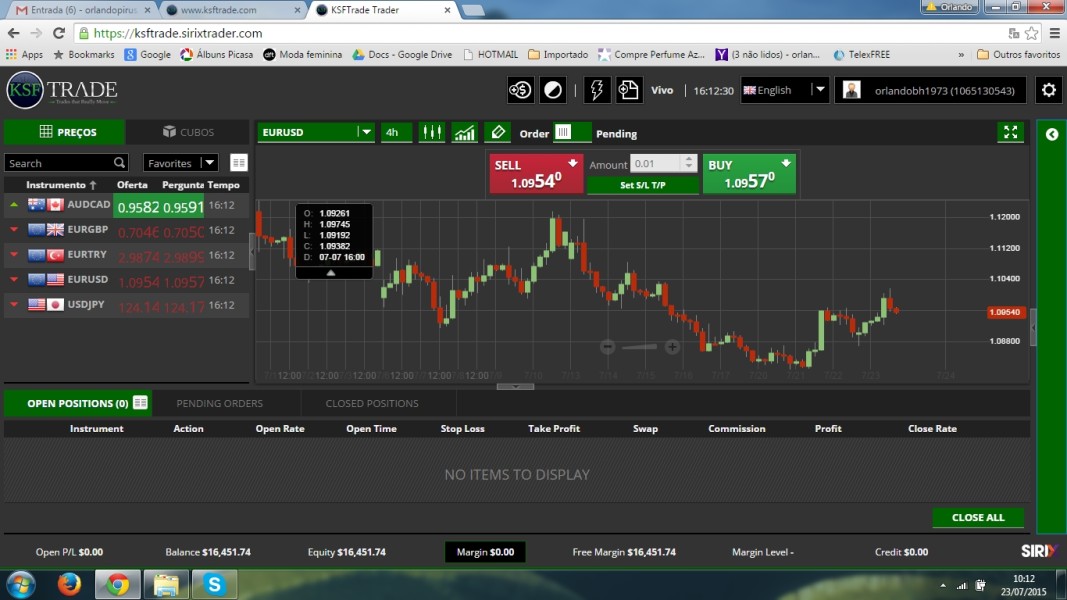

KSF's trading conditions include zero spreads, which might initially appear attractive to cost-conscious traders. The overall user experience and regulatory concerns significantly impact its appeal. According to available information, the entity functions as a multi-strategy trading company focused on identifying and exploiting trading and investment opportunities. Specific details about its operational model remain limited.

The target demographic for KSF appears to be experienced traders with higher risk tolerance. The platform's characteristics and regulatory uncertainties make it unsuitable for novice investors or those seeking conservative trading environments. The combination of regulatory warnings and limited transparency creates an environment that requires careful consideration before engagement.

Important Notice

This evaluation is based on publicly available information and regulatory disclosures as of 2025. Potential traders should be aware that different jurisdictions may have varying regulatory standards and requirements for forex brokers. The regulatory landscape for KSF shows significant complexity, particularly given the FCA's recent warnings about unauthorized activities.

Our assessment methodology incorporates multiple data sources, including regulatory filings, user feedback, and market analysis. However, the limited availability of comprehensive operational data means some aspects of this review rely on partial information. Traders are strongly advised to conduct additional due diligence and verify current regulatory status before making any trading decisions.

Rating Framework

Broker Overview

KSF operates as a multi-strategy trading company with a stated focus on identifying and utilizing various trading and investment opportunities across different market segments. The entity's business model appears to center on providing forex trading services. Specific details about its founding date and corporate structure remain unclear from available public sources. The company's approach suggests a focus on active trading strategies rather than passive investment solutions.

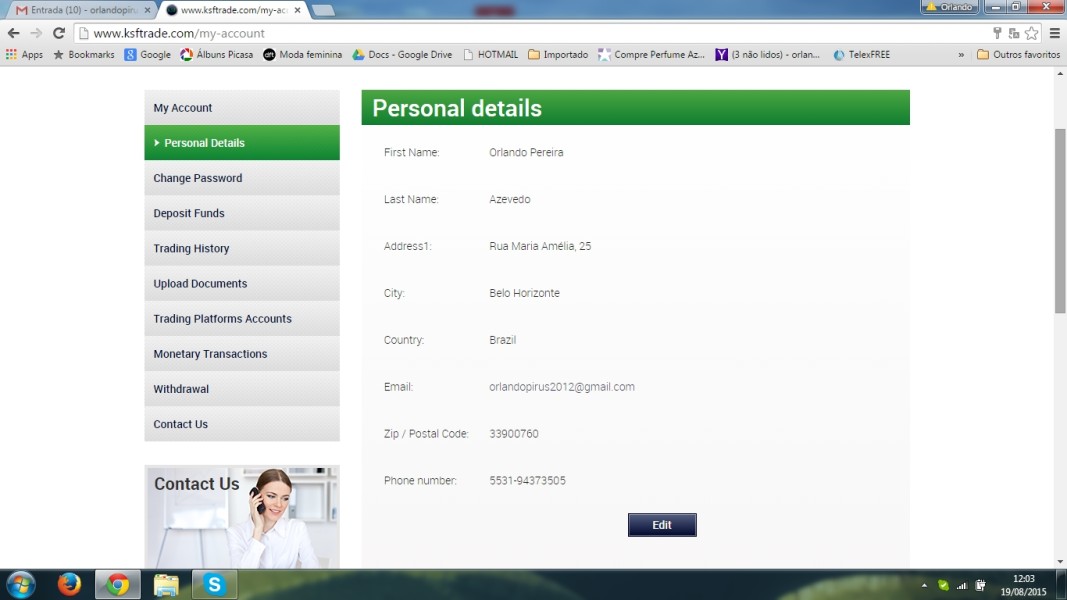

The regulatory framework surrounding KSF involves the UK's Financial Conduct Authority. This relationship has become complicated due to recent regulatory warnings. The FCA has issued cautionary notices regarding KSF Trade, specifically mentioning Marshall Advanced Innovation Ltd in connection with unauthorized forex brokerage activities. This regulatory complexity creates uncertainty about the entity's operational legitimacy and compliance status.

From a trading platform perspective, specific information about the technology infrastructure and platform offerings remains limited in available documentation. The entity's asset coverage and trading instrument variety are not clearly detailed in accessible sources. This raises questions about transparency and operational disclosure practices that professional traders typically expect from legitimate brokers.

Regulatory Status: KSF's regulatory situation involves the Financial Conduct Authority, though recent warnings complicate this relationship. The FCA has specifically cautioned investors about unauthorized activities, creating regulatory uncertainty.

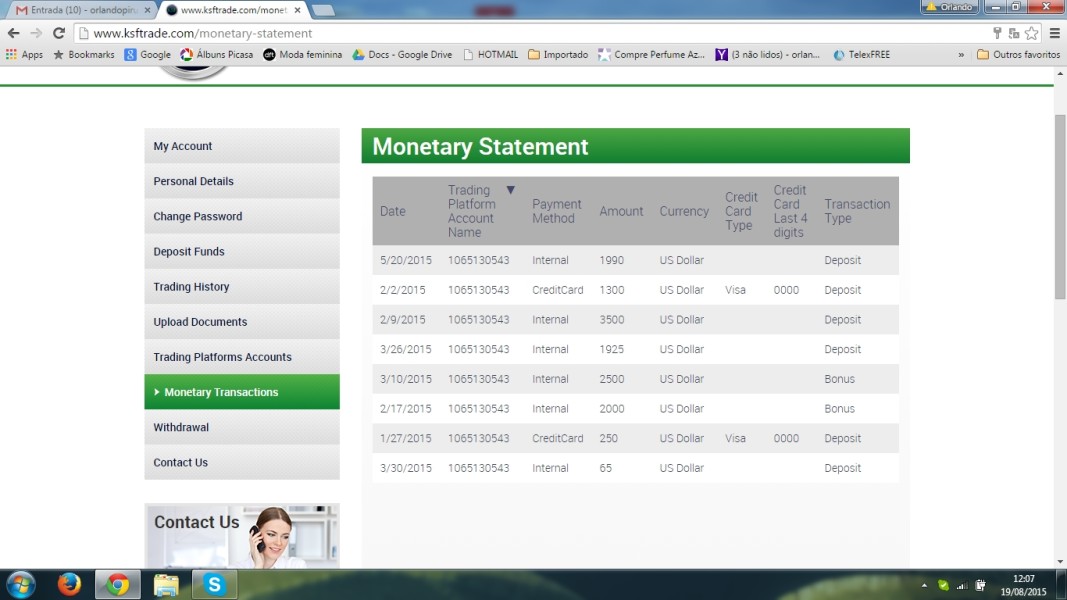

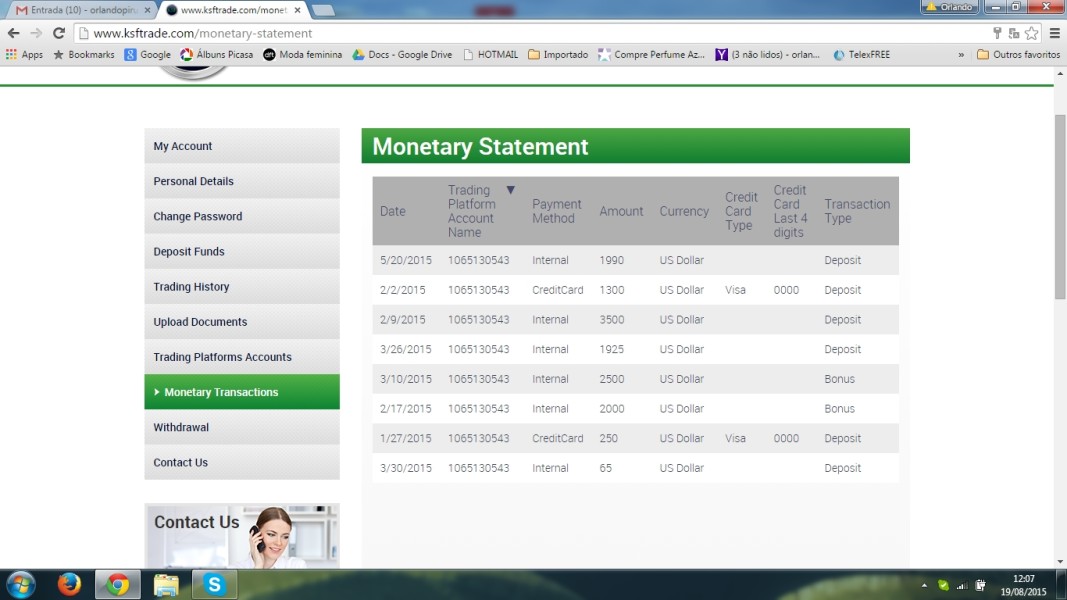

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal processes is not detailed in available sources. This represents a significant transparency gap for potential traders.

Minimum Deposit Requirements: The minimum deposit threshold is not specified in accessible documentation. This makes it difficult for traders to assess entry-level requirements.

Promotional Offers: Details about bonus structures, promotional campaigns, or incentive programs are not available in current public information.

Trading Assets: The range of tradeable instruments and asset classes is not comprehensively detailed in available sources. This limits assessment of portfolio diversification opportunities.

Cost Structure: Available information indicates zero spreads, though commission structures and other trading costs are not clearly specified. This incomplete cost picture makes it difficult to assess true trading expenses.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in accessible sources. This is crucial information for risk management assessment.

Platform Technology: Details about trading platform options, mobile applications, and technical features are not available in current documentation.

Geographic Restrictions: Information about regional availability and jurisdictional limitations is not specified in available sources.

Customer Support Languages: The range of supported languages for customer service is not detailed in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions assessment for this ksf review reveals significant information gaps that impact the overall evaluation. Without clear details about account types, minimum deposit requirements, or specific account features, potential traders face uncertainty about basic operational parameters. This lack of transparency in fundamental account information represents a substantial concern for professional trading environments.

The absence of detailed information about Islamic accounts, VIP tiers, or specialized trading account options suggests either limited offerings or poor disclosure practices. Professional traders typically require comprehensive account information to make informed decisions about platform suitability. The regulatory warnings from the FCA further complicate account safety considerations.

Account opening procedures and verification processes are not clearly documented. This creates additional uncertainty about onboarding experiences. The combination of limited information disclosure and regulatory concerns significantly impacts the account conditions rating, placing it well below industry standards for transparency and clarity.

The evaluation of trading tools and resources reveals substantial gaps in available information about KSF's offerings. Without specific details about analytical tools, research resources, or educational materials, potential traders cannot adequately assess the platform's capability to support informed trading decisions. This information deficit represents a significant weakness in the overall service proposition.

Professional trading environments typically provide comprehensive market analysis, economic calendars, and technical analysis tools. The absence of detailed information about such resources in available documentation suggests either limited offerings or inadequate disclosure practices. Both scenarios represent concerns for serious traders seeking robust analytical support.

Educational resources and training materials are not detailed in accessible sources. This is particularly problematic for platforms serving diverse trader experience levels. The lack of transparency about research capabilities and analytical tools significantly impacts the overall assessment of platform value for active traders.

Customer Service and Support Analysis (3/10)

Customer service evaluation faces substantial limitations due to limited available information about support channels, response times, and service quality metrics. The regulatory warnings from the FCA raise additional concerns about the entity's ability to provide reliable customer support and problem resolution.

Available user feedback suggests negative experiences, though specific details about support interactions are not comprehensively documented. The absence of clear information about support availability, multilingual capabilities, and response time commitments creates uncertainty about service reliability.

Professional trading environments require responsive, knowledgeable customer support to address technical issues and account concerns promptly. The combination of limited service information and regulatory uncertainties significantly impacts confidence in customer support capabilities and overall service reliability.

Trading Experience Analysis (5/10)

The trading experience assessment for this ksf review presents a mixed picture with some positive elements offset by significant concerns. The reported zero spreads represent a potentially attractive feature for cost-conscious traders. However, the absence of detailed information about execution quality and platform stability limits comprehensive evaluation.

Platform reliability and order execution speed are crucial factors for active traders, yet specific performance metrics are not available in accessible documentation. The lack of detailed information about trading platform features, mobile capabilities, and advanced order types creates uncertainty about the overall trading environment quality.

The regulatory warnings from the FCA introduce additional concerns about platform stability and operational continuity. While zero spreads might appear attractive, the broader context of regulatory uncertainty and limited transparency affects the overall trading experience assessment. This keeps it at average levels despite potentially competitive pricing.

Trust and Safety Analysis (4/10)

Trust and safety evaluation reveals significant concerns that impact the overall ksf review assessment. The FCA's warning about unauthorized forex brokerage activities creates substantial regulatory uncertainty that affects trader confidence and safety considerations. This regulatory complexity represents a major concern for risk-conscious investors.

The involvement of Marshall Advanced Innovation Ltd in FCA warnings specifically related to KSF Trade activities raises questions about operational legitimacy and compliance with financial services regulations. These regulatory concerns significantly impact trust assessments and create uncertainty about fund safety and operational reliability.

Without clear information about client fund segregation, insurance coverage, or other safety measures, potential traders face uncertainty about asset protection. The combination of regulatory warnings and limited transparency about safety measures significantly impacts the trust and safety rating. This places it below acceptable levels for conservative investors.

User Experience Analysis (2/10)

User experience evaluation reveals substantial concerns that significantly impact the overall platform assessment. Limited availability of user interface information, registration process details, and platform usability features creates uncertainty about the practical aspects of platform interaction.

The absence of detailed information about mobile applications, web platform functionality, and user interface design suggests either limited development investment or poor disclosure practices. Both scenarios represent concerns for traders seeking modern, user-friendly trading environments.

Available feedback suggests negative user experiences, though specific details about interface problems or usability issues are not comprehensively documented. The combination of limited platform information and regulatory uncertainties creates a challenging environment for positive user experiences. This results in the lowest rating category.

Conclusion

This comprehensive ksf review reveals significant concerns that outweigh potential benefits for most traders. While the entity offers zero spreads, which might initially appear attractive, the combination of regulatory warnings, limited transparency, and poor information disclosure creates an environment unsuitable for most trading objectives.

The FCA's warnings about unauthorized activities represent a fundamental concern that affects all other aspects of the trading relationship. Professional traders require regulatory certainty and operational transparency that KSF currently fails to provide adequately.

Based on this analysis, KSF is not recommended for novice traders, conservative investors, or anyone seeking reliable, transparent trading environments. The significant information gaps and regulatory concerns create risks that exceed potential benefits for most trading strategies and investment objectives.