Regarding the legitimacy of Vantage FX forex brokers, it provides ASIC, FCA, CIMA and WikiBit, .

Is Vantage FX safe?

Pros

Cons

Is Vantage FX markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

VANTAGE GLOBAL PRIME PTY LTD

Effective Date: Change Record

2012-12-21Email Address of Licensed Institution:

compliance@vantagemarkets.com.auSharing Status:

No SharingWebsite of Licensed Institution:

https://www.vantagemarkets.com/en-au/Expiration Time:

--Address of Licensed Institution:

L 12 15 CASTLEREAGH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

+6594567234Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Vantage Global Prime LLP

Effective Date:

2013-07-01Email Address of Licensed Institution:

compliance@vantagemarkets.co.uk, complaints@vantagemarkets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.vantagemarkets.co.ukExpiration Time:

--Address of Licensed Institution:

Centurion House 37 Jewry Street London City Of London EC3N 2ER UNITED KINGDOMPhone Number of Licensed Institution:

+442070435050Licensed Institution Certified Documents:

CIMA Derivatives Trading License (EP)

Cayman Islands Monetary Authority

Cayman Islands Monetary Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Vantage International Group Limited

Effective Date:

2018-05-25Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Vantage FX A Scam?

Introduction

Vantage FX is an Australian-based online forex and CFD broker that was established in 2009. Known for its competitive trading conditions and user-friendly platforms, Vantage FX has positioned itself as a significant player in the forex market, catering to both retail and institutional clients. However, given the prevalence of scams and fraudulent activities in the online trading sector, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to objectively analyze whether Vantage FX is a trustworthy broker or if it raises any red flags that potential users should be aware of. Our investigation is based on a comprehensive review of regulatory compliance, company background, trading conditions, client experiences, and overall safety measures.

Regulation and Legitimacy

The legitimacy of a forex broker heavily relies on its regulatory status. Vantage FX is regulated by several reputable authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK. These regulators impose strict compliance standards to ensure that brokers operate fairly and transparently. Below is a summary of Vantage FX's regulatory information:

| Regulator | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| ASIC | AFSL 428901 | Australia | Verified |

| FCA | 590299 | UK | Verified |

| CIMA | 1383491 | Cayman Islands | Verified |

| VFSC | 700271 | Vanuatu | Verified |

Vantage FX's regulation under ASIC and FCA indicates a high level of oversight, which is crucial for protecting client funds. ASIC is known for its stringent regulations, ensuring that brokers maintain sufficient capital reserves and segregate client funds from their operational funds. The FCA similarly provides robust investor protection schemes, although it is important to note that Vantage FX's investor protection applies primarily to UK clients. Thus, while the regulatory framework appears solid, potential clients from other jurisdictions should assess the lack of similar protections.

Company Background Investigation

Vantage FX was founded in 2009 by a team of finance and technology professionals who aimed to provide transparent access to the forex markets. Over the years, the broker has expanded its operations and now serves clients globally, although it does not accept clients from certain jurisdictions, including the United States and Canada. The company's ownership structure is clear, with Vantage Global Prime Pty Ltd being the primary entity operating under the Vantage FX brand.

The management team at Vantage FX is composed of individuals with extensive backgrounds in finance and trading, which adds credibility to the broker's operations. The company emphasizes transparency and regularly publishes financial reports, ensuring that clients are informed about its performance and compliance status. However, there have been some past incidents where the company faced scrutiny regarding its practices, including complaints about withdrawal delays and alleged price manipulation.

Overall, Vantage FX appears to maintain a transparent approach, but potential clients should remain vigilant and consider the broker's historical context when evaluating its trustworthiness.

Trading Conditions Analysis

Vantage FX offers a variety of trading accounts, each with different fee structures and conditions. The broker employs a mixed pricing model, where some accounts charge spreads while others charge commissions. The overall cost structure is competitive, but it is important to highlight any unusual fees that may arise. Below is a comparison of core trading costs:

| Fee Type | Vantage FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.4 pips | 1.2 pips |

| Commission Model | $3 per lot (Raw ECN) | $4 per lot |

| Overnight Interest Range | Varies by position | Varies by broker |

While the spreads on the standard account start at 1.4 pips, which is slightly above the industry average, the raw ECN account offers more competitive spreads starting from 0.0 pips, albeit with a commission. This flexibility allows traders to choose an account type that aligns with their trading strategies.

However, it is crucial to note that some users have reported unexpected fees or higher-than-expected spreads during volatile market conditions. Such experiences can be concerning for traders, especially those who rely on tight spreads for their trading strategies. Therefore, potential clients should carefully review the fee structure and consider their trading style before committing to Vantage FX.

Client Funds Safety

The safety of client funds is a paramount concern for any trader. Vantage FX employs several measures to ensure the security of its clients' funds. The broker holds client funds in segregated accounts at the National Australia Bank (NAB), one of the largest and most reputable banks in Australia. This practice is in line with ASIC regulations, which mandate that client funds be kept separate from the broker's operational funds.

Additionally, Vantage FX provides negative balance protection, ensuring that clients cannot lose more money than they have deposited in their accounts. This feature is particularly important in the volatile forex market, where sudden price swings can lead to significant losses. However, it is worth noting that this protection is primarily applicable to retail clients under ASIC regulation, and clients trading under other jurisdictions may not have the same level of protection.

Despite these safety measures, there have been historical complaints regarding fund withdrawals, which can raise concerns about the broker's reliability. Traders should consider these factors when assessing the overall safety of their funds with Vantage FX.

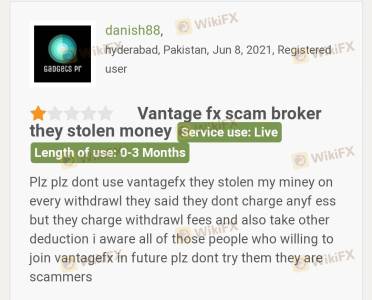

Client Experience and Complaints

Analyzing client feedback is essential in determining the overall reputation of a broker. Vantage FX has received a mixed bag of reviews from its users. While many clients praise the broker for its competitive trading conditions and responsive customer support, there are also notable complaints regarding withdrawal processes and execution issues.

Common complaint types include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Execution Issues | Medium | Addressed but inconsistent |

| Customer Support | Medium | Generally responsive |

For instance, some users have reported delays in withdrawing their funds, which can be a significant concern for traders who prioritize quick access to their capital. In one case, a trader experienced multiple delays in processing a withdrawal request, leading to frustration and negative feedback. While Vantage FX has addressed these issues in some instances, the inconsistency in response times can be a red flag for potential clients.

Overall, while many traders report positive experiences with Vantage FX, the recurring complaints about withdrawals and execution issues warrant careful consideration.

Platform and Trade Execution

Vantage FX offers its clients access to popular trading platforms, including MetaTrader 4 and MetaTrader 5, which are known for their reliability and advanced features. The broker claims to provide fast execution speeds and low latency, which are critical for traders who rely on timely order placements.

However, there have been reports of slippage and rejected orders during high volatility periods, which can significantly impact trading performance. Traders should be aware of these risks when trading with Vantage FX, particularly during major economic announcements or market events.

The overall user experience on the platforms is generally positive, with many users appreciating the intuitive interface and availability of various analytical tools. However, potential clients should remain vigilant and consider the execution quality when deciding whether to trade with Vantage FX.

Risk Assessment

Engaging with any forex broker comes with inherent risks. When evaluating Vantage FX, it is essential to consider several key risk factors:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by ASIC and FCA |

| Withdrawal Risk | Medium | Historical complaints about delays |

| Execution Risk | Medium | Reports of slippage and rejected orders |

| Transparency Risk | Low | Generally transparent operations |

To mitigate these risks, traders should conduct thorough research, maintain a diversified trading portfolio, and utilize risk management strategies such as setting stop-loss orders. Additionally, it is advisable to start with a demo account to familiarize oneself with the broker's platform and trading conditions before committing real funds.

Conclusion and Recommendations

Based on the evidence gathered, Vantage FX appears to be a legitimate broker with a solid regulatory framework and competitive trading conditions. However, potential clients should be aware of the historical complaints regarding withdrawal issues and execution quality. While there are no significant red flags indicating that Vantage FX is a scam, traders should remain cautious and conduct their due diligence.

For novice traders or those seeking a reliable broker, Vantage FX can be a suitable option, provided they are comfortable with the associated risks. However, traders looking for alternative options may consider brokers with a more extensive track record of positive client experiences and fewer complaints regarding withdrawals.

In summary, while Vantage FX is not a scam, potential clients should carefully evaluate their trading needs and preferences before making a decision.

Is Vantage FX a scam, or is it legit?

The latest exposure and evaluation content of Vantage FX brokers.

Vantage FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Vantage FX latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.