IQcent 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

IQcent is an emerging online trading platform that aims to provide a simplified trading experience for binary options and Contracts for Difference (CFDs). It allows users to start trading with a minimum deposit as low as $10, making it an attractive option for beginner and intermediate traders. While it offers rapid system access and a competitive range of more than 100 trading instruments, potential users must tread carefully due to IQcent's unregulated status and mixed reviews—highlighting issues related to fund safety and customer support. This review aims to provide a detailed overview of the potential benefits and significant risks associated with trading on IQcent.

⚠️ Important Risk Advisory & Verification Steps

Caution: Before considering trading on IQcent, understand the following risks associated with this platform:

- Unregulated Status: IQcent operates without oversight from major financial authorities, exposing traders to potential fraud and operational discrepancies.

- Withdrawal Challenges: Numerous users have reported delayed or denied withdrawal requests, indicating possible fund safety concerns.

- Variable User Experiences: Reviews reflect a wide spectrum of user satisfaction, with notable complaints regarding customer support and transparency.

Steps for Self-Verification:

- Verify Regulatory Status:

- Check if there is any regulatory oversight by visiting official regulatory websites such as the NFA or the FCA.

- Read User Reviews:

- Look through credible review sites for testimonials and experiences shared by current or former customers.

- Investigate Withdrawal Policies:

- Clarify the withdrawal process and associated fees outlined in the brokers terms of service.

- Try a Demo Account:

- If risk allows, use a demo account with virtual funds to gauge platform functionality and service quality.

Broker Overview

Company Background and Positioning

Founded in 2017, IQcent is operated by Wave Makers Ltd, registered in Majuro, Marshall Islands. The broker has gained attention for providing accessible trading options focusing on low minimum deposits and a straightforward interface aimed primarily at new traders. Its unregulated operation raises a red flag for potential investors looking for reliability and security in their trading pursuits.

Core Business Overview

IQcent specializes in binary options trading and CFDs. The platform boasts over 100 instruments, including currency pairs, commodities, cryptocurrencies, and stock indices. It claims compliance with certain self-regulatory measures, however, it lacks a license from a notable financial authority, which can pose significant risks for traders.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The trustworthiness of any broker is pivotal in the trading environment. In the case of IQcent, several concerns stand out.

- Analysis of Regulatory Information Conflicts: IQcent operates without regulatory oversight, primarily in a jurisdiction recognized for minimal financial regulation. The lack of credible regulation undermines investor confidence.

- User Self-Verification Guide:

- Visit the official websites of regulators like the FCA or ASIC.

- Use NFA's BASIC database to research the brokers regulatory status.

- Review any associated warnings that may indicate a lack of transparency or regulatory compliance.

- Monitor user reviews for experiences related to fund withdrawals and trading activities.

- Seek third-party information validating the broker's legitimacy.

- Industry Reputation and Summary: Mixed reviews on various trading platforms reflect a concerning reputation. Many users raised alarms about fund safety:

“I tried to withdraw funds multiple times. Each time, I was told it is in the queue... it has been over a week.” – Anonymous user review

Trading Costs Analysis

IQcent presents a duality in its cost structure, appealing yet laden with potential risks.

- Advantages in Commissions: The platform boasts a competitive commission structure, making it cost-effective for smaller trades.

- The "Traps" of Non-Trading Fees: Users must be wary of withdrawal fees and reports of excessive charges.

"I was hit with a $50 fee for withdrawing funds to my bank without prior notice." – Anonymous user review

- Cost Structure Summary: While the low entry cost attracts traders, hidden fees, particularly regarding withdrawals, can diminish profitability for frequent traders.

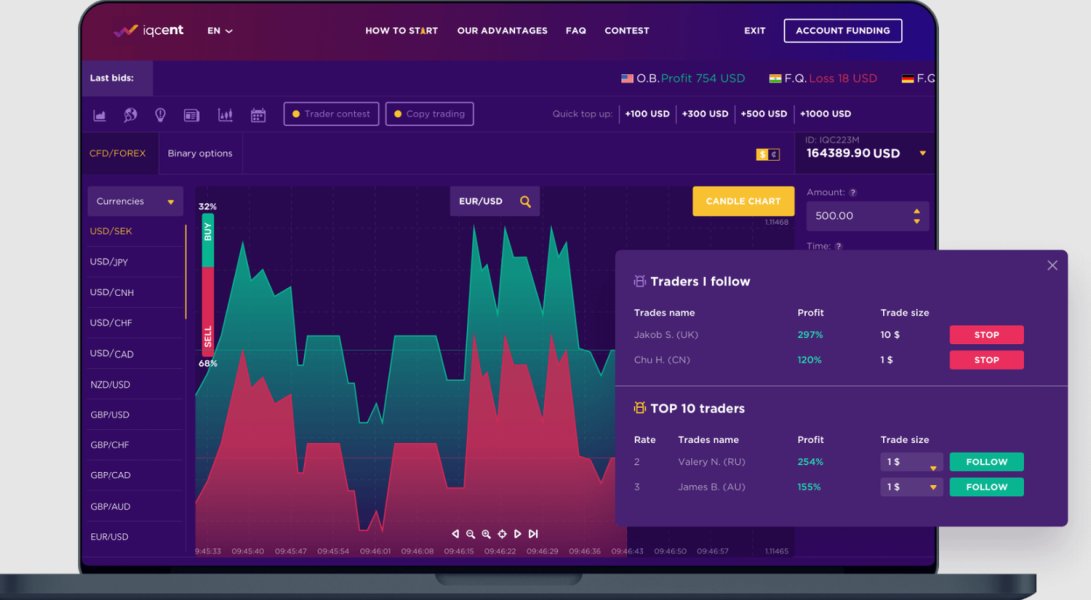

The platform offered by IQcent is designed for accessibility, but it lacks some features found in more established trading platforms.

- Platform Diversity: The web-based trading terminal is user-friendly, avoiding the need for software downloads. However, it lacks integration with popular platforms like MetaTrader, limiting advanced users.

- Quality of Tools and Resources: Basic charting tools are available, but additional resources like educational materials are minimal compared to competitors.

- Platform Experience Summary: While the platform is navigable for beginners, many user reviews expressed disappointment in the lack of robust analytical tools:

“The tools felt underwhelming—especially when I needed insights for quick trades.” – Anonymous user review

User Experience Analysis

IQcent's user experience is a critical aspect that requires scrutiny.

- User Interface Usability: IQcent does provide a straightforward interface but often falls short on helpful features that traders expect.

- Potential Issues: Many users have faced significant operational challenges, particularly with customer service response times.

- General Sentiment: User feedback reflects on-the-ground experiences that many have termed "frustrating," emphasizing slow support combined with operational hiccups.

Customer Support Analysis

The quality of customer support is often the tipping point in user satisfaction, and IQcent struggles in this category.

- Communication Channels: Though customer support is available via email, live chat, and telephone, users report slow and ineffective responses.

- General Sentiment and Complaints: Users frequently mention difficulty getting timely help or resolution for their queries:

“No matter what issue I had, it took a minimum of three days to get a response. It's very frustrating.” – Anonymous user review

Account Conditions Analysis

Lastly, the account conditions offered by IQcent reflect a landscape that is engaging yet complicated.

- Account Types: IQcent offers a variety of account types but mandates different minimum deposits, which may deter some potential traders.

- Withdrawal and Trading Flexibility: The potential for quick withdrawals is heavily touted but realistically can lead to prolonged frustrations due to user experiences with delayed processing.

- Overall Insight into Account Conditions: While attractive to new traders, the stipulations around withdrawal and retained earnings can lead to confusion.

Conclusion

In conclusion, while IQcent presents an attractive facade with its low minimum deposit and user-friendly platform catering to novice traders, significant risks loom due to its unregulated nature and troubling feedback from current users regarding fund safety and customer support. Potential users are advised to engage in thorough due diligence and consider the risks involved before acting on trading aspirations with IQcent. The information provided in this review serves as a cautionary guide, with recommendations to pursue regulated alternatives that ensure better protection and service reliability.