Is KSF safe?

Pros

Cons

Is KSF Safe or a Scam?

Introduction

In the dynamic world of forex trading, KSF has emerged as a broker that claims to offer a variety of trading options to its clients. Established in the United Kingdom, KSF promotes itself as a reliable platform for both novice and experienced traders. However, the increasing number of complaints and regulatory warnings raises significant concerns about its legitimacy. This article seeks to provide a comprehensive evaluation of KSF by examining its regulatory status, company background, trading conditions, client safety measures, customer experiences, and overall risk profile. By doing so, we aim to answer the pressing question: Is KSF safe or a scam?

To ensure a thorough investigation, we analyzed multiple sources, including user reviews, regulatory databases, and industry reports. This multi-faceted approach allows us to present an objective view of KSF's operations, helping traders make informed decisions.

Regulation and Legitimacy

Regulation is a crucial aspect of any forex broker's credibility. KSF claims to be regulated in the United Kingdom, but a closer look reveals that it operates under an investment advisory license rather than a full forex trading license. This distinction is significant as it limits the scope of KSF's operations and suggests potential regulatory shortcomings.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 564603 | United Kingdom | Exceeded scope of business |

The Financial Conduct Authority (FCA) in the UK has issued warnings regarding KSF's operations, indicating that it exceeds the business scope allowed under its investment advisory license. Such regulatory issues can put traders' funds at risk, as the broker may not adhere to the same standards as fully regulated entities. Furthermore, the lack of a robust regulatory framework raises questions about KSF's compliance history, making it essential for potential clients to consider these factors when evaluating whether KSF is safe.

Company Background Investigation

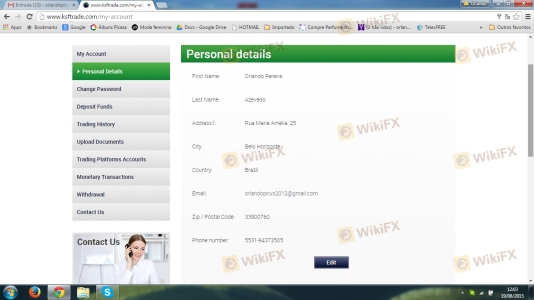

A detailed examination of KSF's company history reveals that it operates under the name K & S Financial Management Limited. Established for approximately 5 to 10 years, KSF's ownership structure is not transparently disclosed, which raises concerns about accountability. The management team behind KSF lacks publicly available information regarding their qualifications and industry experience, further complicating the trustworthiness of the broker.

Transparency is a critical factor in assessing a broker's legitimacy. KSF's website provides limited information about its operations, making it difficult for potential clients to gauge the firm's credibility. In an industry where trust is paramount, KSF's opacity could deter potential investors who are seeking a reliable trading partner. Therefore, this lack of transparency adds to the growing concerns about whether KSF is safe for trading.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. KSF promotes various trading instruments, including forex pairs, commodities, and indices. However, the overall fee structure and trading conditions warrant scrutiny.

| Fee Type | KSF | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low to Medium |

| Commission Model | Not clearly defined | Varies |

| Overnight Interest Range | High | Low |

The spreads offered by KSF are reportedly higher than the industry average, which could significantly impact traders profitability. Additionally, the commission structure is not clearly defined, making it challenging for traders to understand the true cost of trading. This lack of clarity in fees can lead to unexpected charges, further complicating the decision-making process for traders. Therefore, potential clients should carefully consider these factors when assessing whether KSF is safe for their trading activities.

Client Funds Safety

The safety of client funds is paramount in the forex trading industry. KSF claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures is questionable given the broker's regulatory status.

A thorough analysis reveals that KSF does not offer negative balance protection, which could expose traders to significant financial risks. Moreover, historical complaints indicate that clients have experienced difficulties in withdrawing their funds, raising alarms about the broker's financial practices. Such issues underscore the importance of understanding the safety measures in place before engaging with KSF, as they may not provide adequate protection for traders' investments. Thus, it is crucial to evaluate whether KSF is safe in terms of client fund security.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability. A review of user experiences with KSF reveals a pattern of complaints related to withdrawal issues, lack of communication, and aggressive sales tactics.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Support | Medium | Poor |

| Misleading Promotions | High | Poor |

Many users have reported that once they requested withdrawals, their accounts were effectively frozen, and communication from KSF ceased. Such experiences reflect a troubling trend that could indicate a lack of professionalism and accountability. Furthermore, the company's response to these complaints has been inadequate, with many clients feeling ignored and frustrated. This pattern raises significant concerns about whether KSF is safe for traders looking for a reliable broker.

Platform and Trade Execution

The performance of a trading platform is another critical factor in determining a broker's reliability. KSF offers a trading platform that claims to provide a seamless trading experience. However, user reviews suggest that there are issues related to platform stability, order execution quality, and potential slippage.

Traders have reported instances of significant slippage during volatile market conditions, which can adversely affect their trading outcomes. Additionally, concerns about order rejections have been raised, suggesting that the broker may not be executing trades as promised. Such issues can lead to significant losses for traders, further questioning KSF's operational integrity. Therefore, it is essential to consider these factors when determining whether KSF is safe for trading.

Risk Assessment

Engaging with any broker involves inherent risks. In the case of KSF, several risk factors have been identified that potential clients should be aware of:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of full regulatory oversight |

| Financial Risk | High | Difficulty in fund withdrawals |

| Operational Risk | Medium | Platform stability issues |

Given these risks, traders should approach KSF with caution. It is advisable to conduct thorough research and consider alternative options if concerns persist. To mitigate risks, traders may want to start with a small investment or seek brokers with a more transparent operational history.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about KSF's legitimacy and operational practices. The broker's regulatory shortcomings, coupled with a history of customer complaints and issues related to fund safety, suggest that KSF is not safe for trading. Traders should exercise caution and consider seeking alternatives that offer stronger regulatory oversight and a more transparent operational framework.

For those looking for reliable options, consider brokers that are fully regulated by reputable authorities and have a proven track record of positive customer experiences. Always prioritize safety and transparency when choosing a forex broker to ensure a secure trading environment.

Is KSF a scam, or is it legit?

The latest exposure and evaluation content of KSF brokers.

KSF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KSF latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.