halcyon capital 2025 Review: Everything You Need to Know

1. Abstract

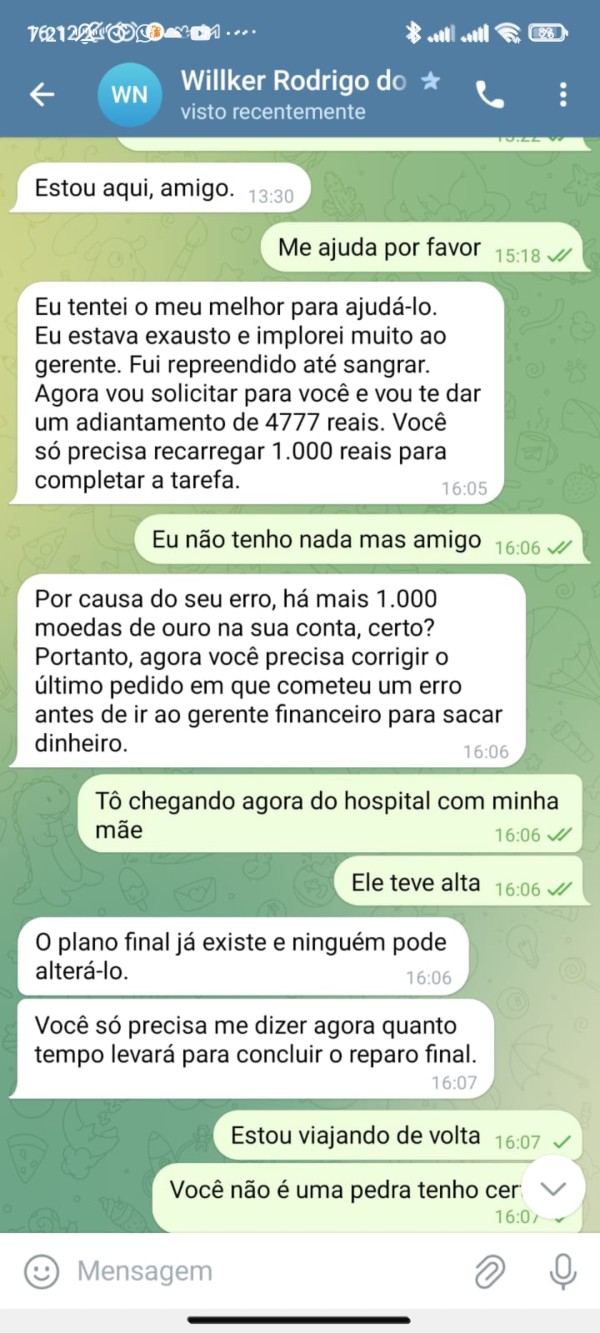

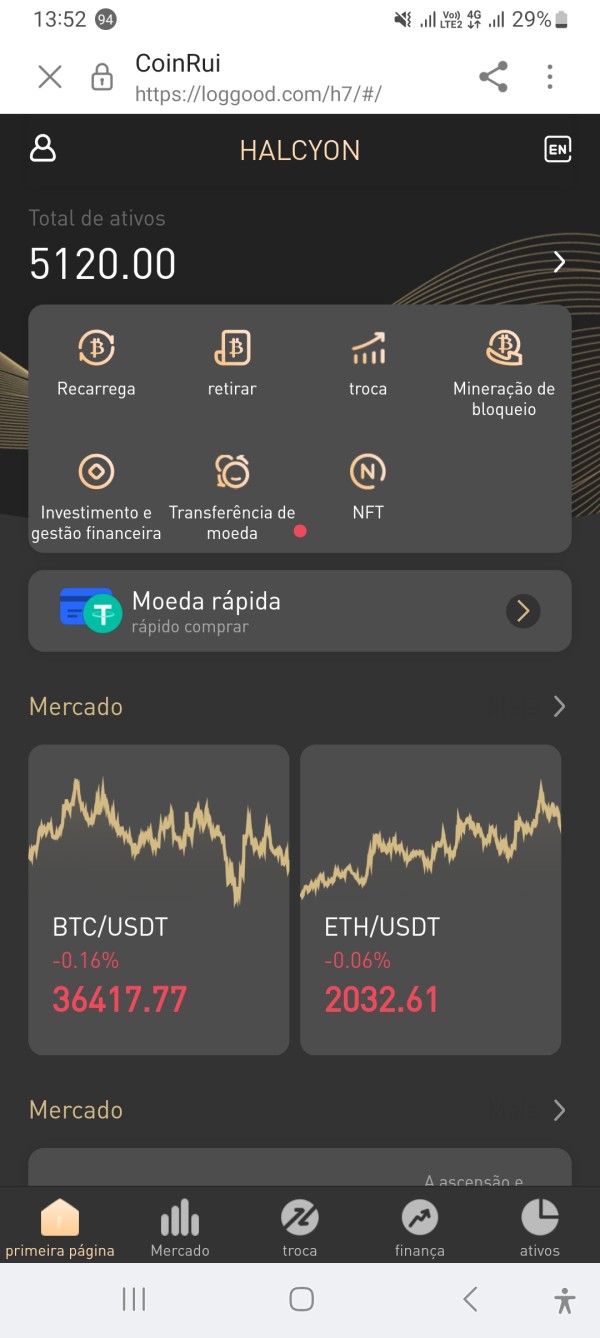

Halcyon Capital is a new forex broker. It has quickly caught attention in the competitive financial services industry, despite having limited details on specific regulatory licensing and comprehensive trading conditions. The firm stands out because of its clear approach and excellent customer service. According to user reviews, an impressive 83% of clients have given Halcyon Capital a 5-star rating, while 17% have given a 1-star rating. This shows both high satisfaction and some concerns about areas that are not disclosed. The broker focuses mainly on commercial finance and mortgage brokerage. It serves business clients who need funding solutions and active forex traders. This halcyon capital review shows the broker's commitment to making financing options easy and providing reliable advisory services. However, important information about account conditions, deposit structures, and platform details remains limited in public documents. While the broker looks promising in many areas, potential users must consider that not all trading conditions have been made fully clear at this stage.

2. Caveats

Halcyon Capital is registered in Hong Kong. Its services may be affected by regulatory requirements that change by region, so clients should be careful and do thorough research about local regulations before using their services. This review is based only on publicly available information and user feedback. This means some key details like account specifics, trading platform performance, and deposit or withdrawal methods have not been fully disclosed. The data presented here reflects what is available now and may not capture every detail of the broker's operations.

3. Rating Framework

4. Broker Overview

Halcyon Capital Limited was founded in 2021. It is registered in Hong Kong as a corporate finance advisory firm, and the company is licensed by the Securities and Futures Commission of Hong Kong. The firm has received approval from the Hong Kong Stock Exchange to provide sponsorship and professional financial advisory services. Halcyon Capital focuses clearly on offering financing solutions and serves clients who need both commercial finance and mortgage brokerage services. The company's background in corporate financing and its location in Hong Kong make it a notable player for entities that need custom financial advisory and funding solutions. This halcyon capital review shows the firm's early success and highlights its focus on transparency and customer service, even though some operational details remain undisclosed.

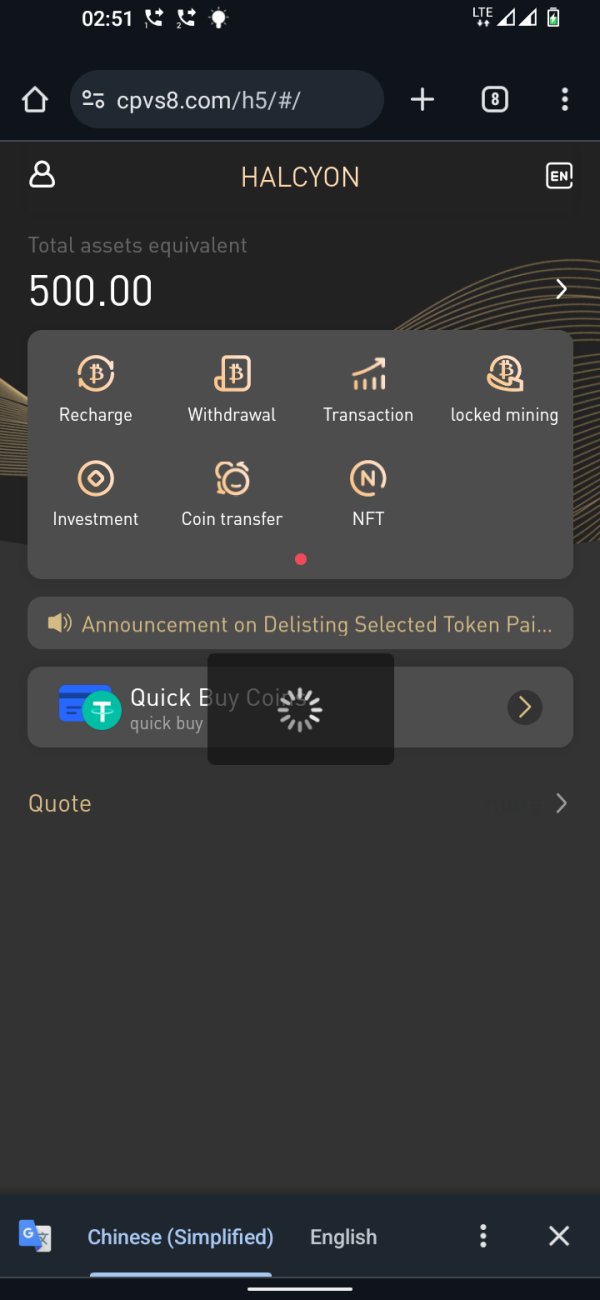

Halcyon Capital has also expanded to include forex and CFD trading. It aims to serve both individual traders and business-oriented clients, though the broker has not yet provided detailed information about the specific trading platforms it uses. The asset classes reportedly include forex pairs and various CFDs, which aligns with current market demands. While the regulatory oversight for trading operations is not explained in detail, the firm's commitment to compliance through its Hong Kong licensing adds institutional credibility. This dual focus on traditional finance and modern trading shows that Halcyon Capital is positioning itself to bridge classic corporate finance with the dynamic demands of the trading community. Overall, the halcyon capital review highlights both the promise and the current limitations of the firm's publicly available operational information.

The regulatory framework for Halcyon Capital has limited disclosure. Specific details on oversight beyond its Hong Kong registration are not clearly stated, which leaves potential clients uncertain about the full extent of regulatory protection. The review does not provide specifics on available payment options for deposits and withdrawals, making it hard to determine the convenience and flexibility of its funding processes. While the minimum deposit requirement is a common benchmark across the industry, there is no provided data about the initial investment threshold for new traders.

Bonus promotions and incentives are also not discussed in available materials. This lack of information extends to the range of tradable assets, and while Halcyon Capital is said to offer forex and CFD products, the exact instruments like indices, commodities, or cryptocurrencies remain unspecified. The cost structure is another area with gaps since details on spread, commission, or any other fees that might apply have not been fully disclosed. This leaves prospective users to guess about the true trading costs.

Leverage ratios are a critical aspect for many traders, but the available information does not indicate whether competitive leverage options are offered. There is also no explanation about the variety of trading platforms, and no specific choices such as MetaTrader or proprietary systems are mentioned. Geographic restrictions and the spectrum of supported languages for customer service are similarly underreported. The comprehensive nature of this halcyon capital review is limited by the general absence of these crucial details, which urges potential users to seek further information directly from the broker before making any commitments.

6. Detailed Scoring Analysis

6.1 Account Conditions Analysis

The evaluation of account conditions for Halcyon Capital shows a significant information gap. There is no disclosure about the types of accounts offered, whether they include standard, premium, or specialized account options such as Islamic accounts. Essential details like the minimum deposit requirements remain unclear, which makes it difficult to determine whether the broker's account conditions are competitive within the forex industry. Without clear disclosure on the account opening process, verification procedures, and any specific account benefits or limitations, it becomes challenging to fully assess the broker's offerings. This halcyon capital review indicates that while the absence of comprehensive account details might be acceptable for new advisory firms, it also poses potential risks for clients who require clarity before committing funds.

Future updates should ideally provide a more detailed breakdown of account types, deposit thresholds, and any associated benefits. In the context of evolving market demands and growing regulatory expectations, the current lack of information on account conditions is a notable shortcoming. Therefore, potential clients are encouraged to directly contact Halcyon Capital for clarification on these aspects before proceeding with account opening.

The available materials offer limited insight into what Halcyon Capital provides to its traders in terms of tools and resources. There is no detailed list of trading platforms, charting software, or analytical services that are crucial for effective market analysis. Essential components such as automated trading support, educational materials, or in-depth research reports are not mentioned, leaving a void for users who rely on sophisticated tools to guide their trading decisions. While many modern brokers invest heavily in diverse platforms and resource libraries, this halcyon capital review encounters sparse data on these fronts.

There is no commentary on whether the platform supports advanced order types or algorithmic trading strategies. Without such information, traders must speculate about the overall quality and usability of the technological resources available at Halcyon Capital. This lack of detailed resource allocation potentially undermines the broker's appeal for novice and professional traders alike, who often prioritize robust technological support along with transparent information regarding trading tools and educational resources.

6.3 Customer Service and Support Analysis

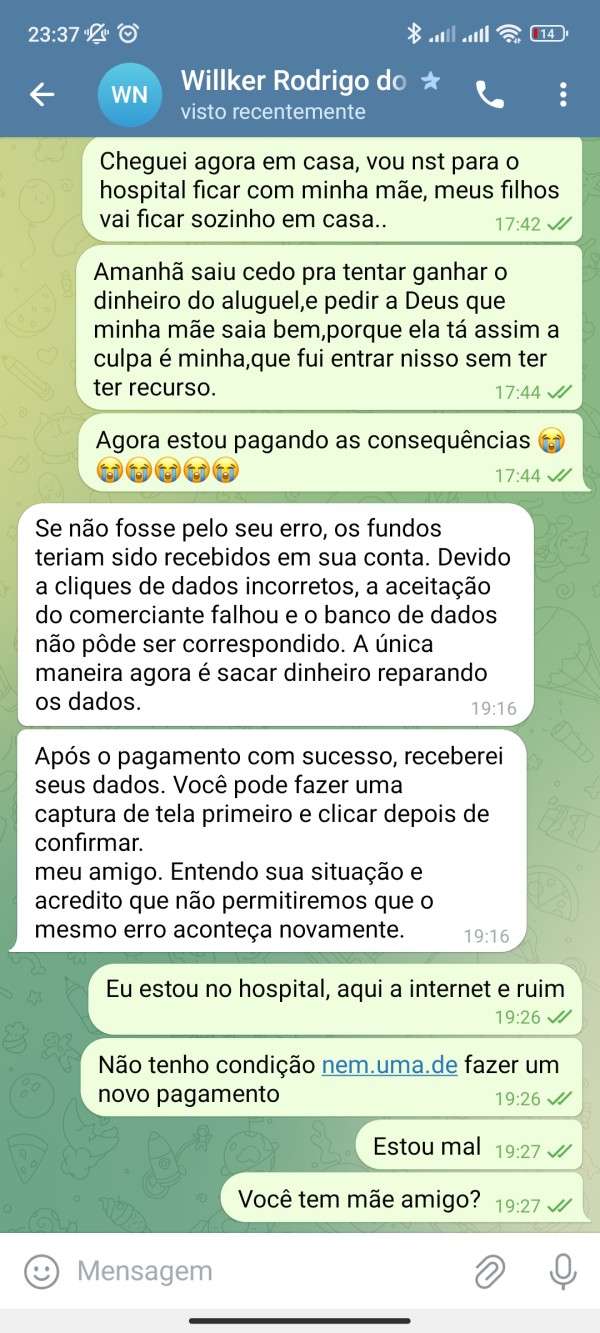

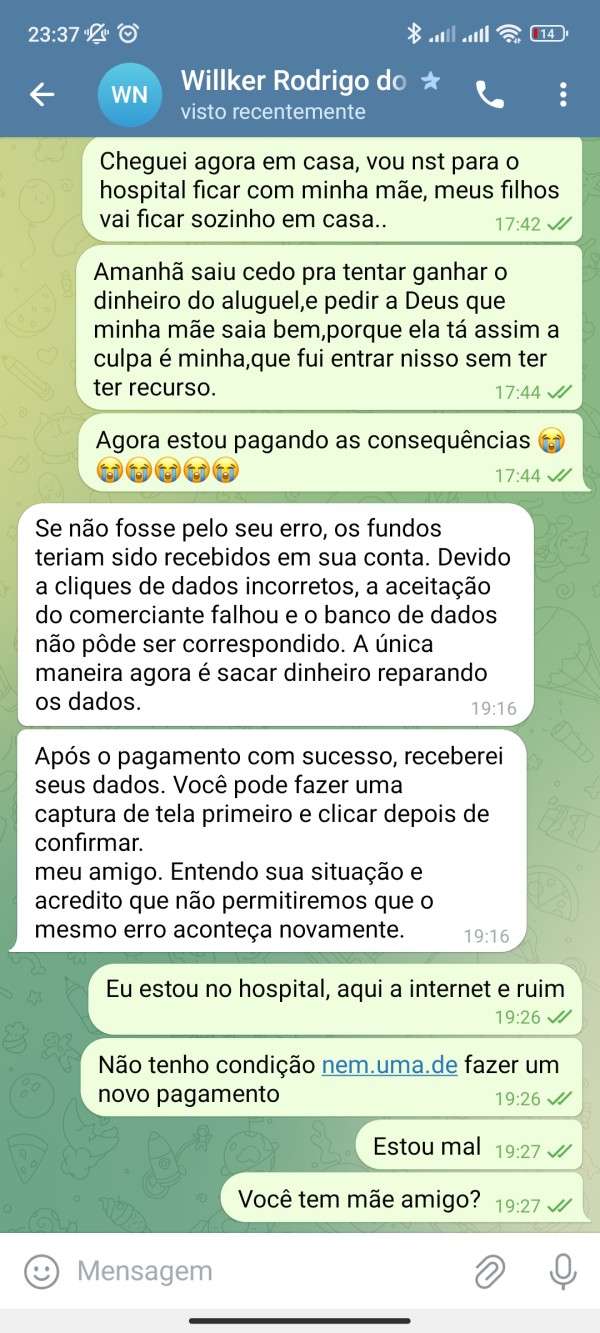

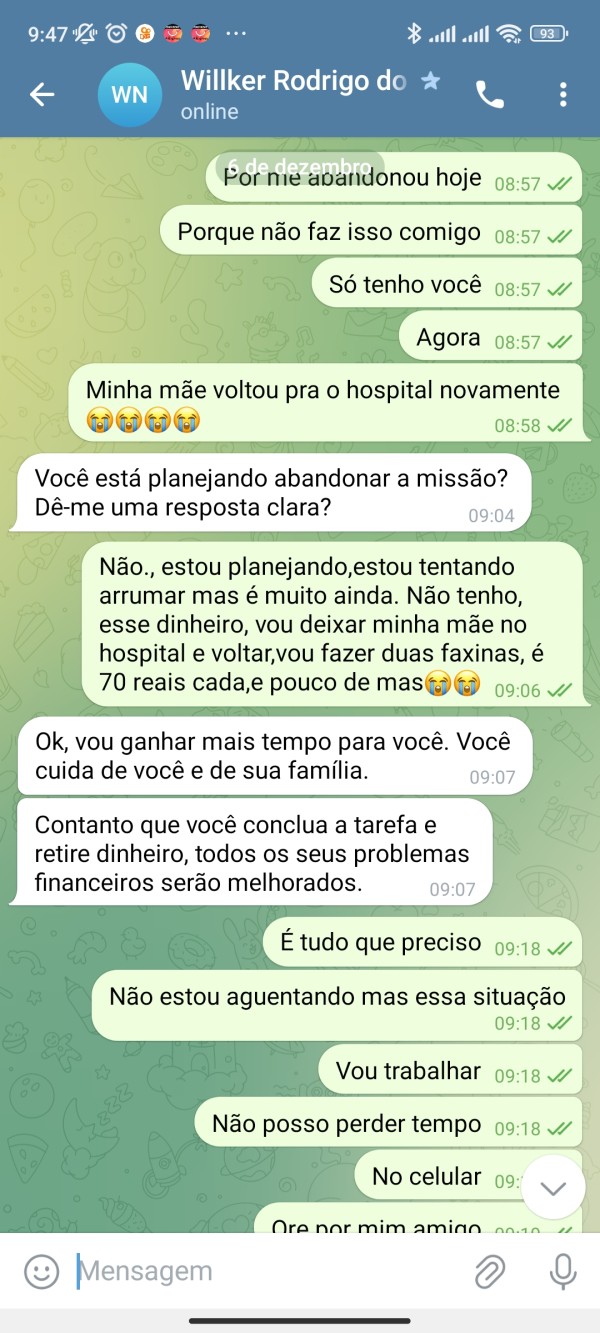

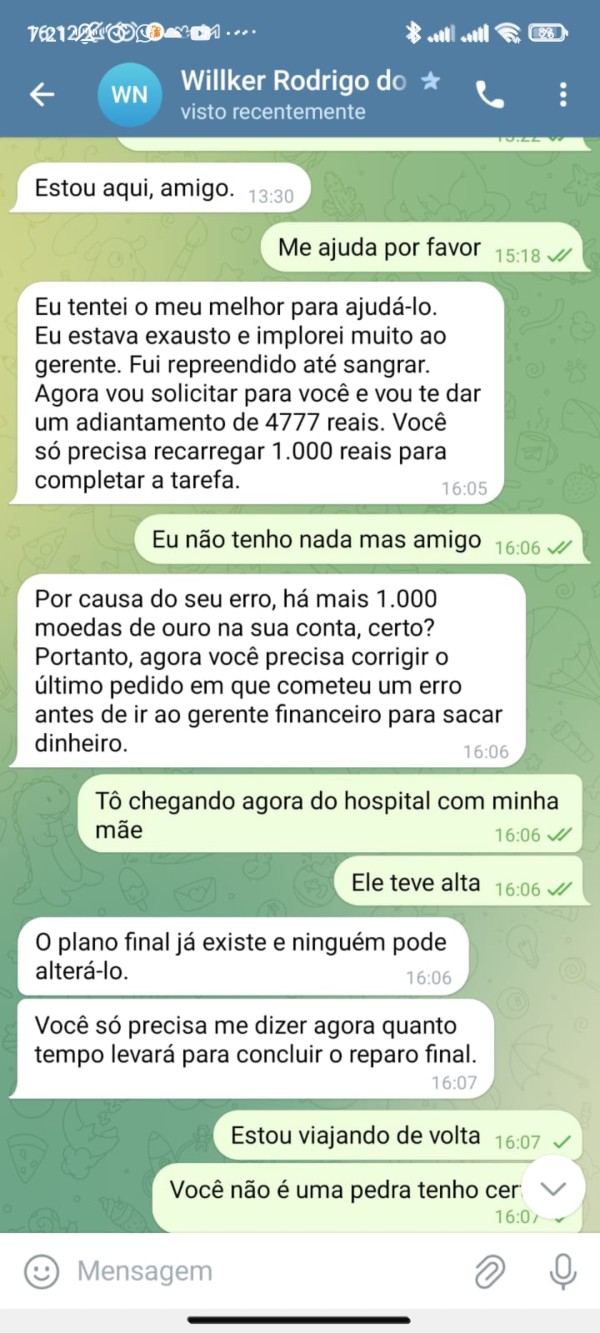

Customer support emerges as the one area where Halcyon Capital appears to excel. Based on user feedback, 83% of clients have awarded the broker a 5-star rating primarily due to the prompt and professional customer service responses. The available insights suggest that the support team is highly responsive, with a focus on resolving issues quickly, which is a significant advantage in the fast-paced forex trading environment. Although specifics about the channels of communication, such as email, phone, or live chat, have not been clearly outlined, the consistently positive user ratings point towards effective customer support management.

Details on support hours or multi-language availability are absent, but strong customer service ratings indicate that the quality, courtesy, and expertise of the team meet high expectations. This halcyon capital review reinforces that excellent client support can significantly contribute to overall user satisfaction even when other operational details are sparse. The broker's commitment to positive customer engagement is a pivotal asset, particularly for those looking to resolve issues swiftly in trading and financing scenarios.

6.4 Trading Experience Analysis

The trading experience offered by Halcyon Capital is another critical parameter where detailed insights are lacking. No explicit information on trading platform stability, execution quality, or interface design has been provided, leaving potential traders uncertain about the ease of use and efficiency of the trading environment. There is no commentary on features such as order types, charting capabilities, or mobile trading support, which are essential for a seamless trading experience. Although the technical infrastructure is presumed to be functional given the broker's market entry, the absence of empirical data or user feedback related to platform performance makes it difficult to form a comprehensive perspective.

This halcyon capital review underscores that while customer service is robust, the trading experience remains an area where further details are needed. Factors such as transaction speed, order execution precision, and overall system reliability need assessment, but without these specifics, it is challenging for prospective users to determine if the platform meets the high-performance standards demanded by experienced forex traders. Further clarity on the operational aspects of the trading platform would greatly enhance user confidence.

6.5 Trust Analysis

Trust is a fundamental consideration for any broker, yet in the case of Halcyon Capital, there remains considerable uncertainty. While the firm is registered in Hong Kong and licensed by local regulatory bodies, the broader details of its regulatory oversight and specific security measures have not been fully disclosed. Critical information about fund segregation, risk management practices, and third-party audits are either minimally addressed or not mentioned at all in the public domain. This lack of transparency makes it challenging for potential clients to fully evaluate the safety and integrity of their investments.

Different sources offer varying degrees of detail on the broker's operational transparency. This halcyon capital review highlights that there is a significant reliance on assumed regulatory compliance rather than comprehensive disclosure, and in an era where traders highly value transparency and robust risk management frameworks, the current insufficiency of detailed trust-related practices is a considerable drawback. Prospective clients are advised to seek additional verification of security protocols and regulatory standing before engaging with the broker.

6.6 User Experience Analysis

User experience, as reflected through available reviews and overall satisfaction scores, is mixed for Halcyon Capital. On one hand, an impressive 83% of users have rated the broker 5 stars, which strongly suggests that clients appreciate the service quality, particularly the customer support. However, around 17% of users have reported dissatisfaction by awarding a 1-star rating, indicating that there may be underlying issues not fully addressed by the broker.

Specific details about the platform's interface, registration process, and ease of transaction have not been provided, but the general sentiment points to high user satisfaction in areas such as customer service and responsiveness. This halcyon capital review suggests that while the operational aspects of the trading experience may require further refinement and transparency, the overall user experience remains favorable for those whose primary interaction with the broker is through efficient client support channels. Future improvements in providing a more streamlined user interface and transparent account management processes could help convert the mixed ratings into consistently positive feedback.

7. Conclusion

Halcyon Capital emerges as a promising yet still developing forex broker. While the firm excels in customer service, as evidenced by the high percentage of 5-star ratings, it falls short in providing comprehensive details about trading conditions, account specifics, and the overall technological infrastructure. This halcyon capital review indicates that the broker's transparency and reliability in client support make it suitable for business clients seeking financing solutions and forex traders willing to navigate some information gaps. Prospective users should weigh the benefits of excellent customer service against the current lack of detail in other critical operational areas before committing to Halcyon Capital.