Regarding the legitimacy of Halcyon Capital forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is Halcyon Capital safe?

Pros

Cons

Is Halcyon Capital markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Halcyon Securities Limited

Effective Date:

2013-01-28Email Address of Licensed Institution:

huihenghenry@halcyon.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.halcyon.com.hkExpiration Time:

--Address of Licensed Institution:

香港灣仔皇后大道東183 號合和中心34 樓 3401 室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Halcyon Capital Safe or Scam?

Introduction

Halcyon Capital, established in 2013, is a Hong Kong-based forex broker that has positioned itself as a significant player in the foreign exchange market. With a focus on providing trading services and financial advisory, it claims to offer a diverse range of financial instruments. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. This article aims to evaluate the legitimacy and safety of Halcyon Capital by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. Our investigation is based on a thorough review of multiple sources, including regulatory disclosures, customer reviews, and expert analyses.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial for ensuring the safety of traders' funds and the integrity of trading practices. Halcyon Capital is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is known for its stringent regulatory standards. The presence of a regulatory authority is generally a positive indicator, as it implies that the broker is subject to oversight and must adhere to specific operational guidelines.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | BAM 857 | Hong Kong | Verified |

Despite its regulatory status, it is essential to note that not all regulatory bodies enforce the same level of scrutiny. While the SFC is a reputable authority, the broker's compliance history should also be considered. Reports indicate that Halcyon Capital has received numerous complaints from users, with 23 complaints logged in the past three months alone. This raises concerns about its operational practices and customer service. A broker's ability to resolve complaints effectively is a vital aspect of its legitimacy, and the number of unresolved issues could indicate potential risks for traders.

Company Background Investigation

Halcyon Capital Limited operates as a corporate finance advisory firm and a forex broker, providing services related to initial public offerings (IPOs), mergers and acquisitions, and compliance advisory. Founded in 2013, the firm has been in the market for about a decade. Understanding the company's ownership structure and management team is critical for assessing its reliability.

The management team of Halcyon Capital consists of individuals with backgrounds in finance and investment, which can lend credibility to the firm's operations. However, transparency in operations is equally important. The company's website provides some information about its services, but details regarding its management team and their professional histories are somewhat limited. A lack of comprehensive information can be a red flag for potential investors, as it may indicate a lack of accountability.

In terms of information disclosure, Halcyon Capital appears to maintain a basic level of transparency, but there is room for improvement. Providing more detailed profiles of its management team and clearer operational guidelines could enhance its credibility in the eyes of potential clients.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is essential. Halcyon Capital's fee structure is a critical aspect of its service offering. The broker claims to provide competitive spreads and various trading platforms, but the specifics of its fee model require careful examination.

| Fee Type | Halcyon Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

While the exact figures for spread and commission are not readily available, user reviews suggest a mixed experience. Some traders have reported unexpected fees, which could indicate a lack of clarity in the broker's pricing model. Transparency in fees is vital for traders to make informed decisions, and any discrepancies may lead to distrust.

Furthermore, the absence of educational resources or guidance on trading costs could hinder novice traders from understanding the full scope of what they might incur. This lack of support could be a significant drawback for those new to forex trading.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading environment. Halcyon Capital claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. Segregation of funds means that clients' money is kept separate from the company's operational funds, which is a standard practice in the industry.

However, the effectiveness of these measures is contingent upon the broker's adherence to regulatory requirements. The SFC mandates that regulated firms must maintain high standards of financial integrity, but any historical issues or disputes related to fund safety could raise concerns.

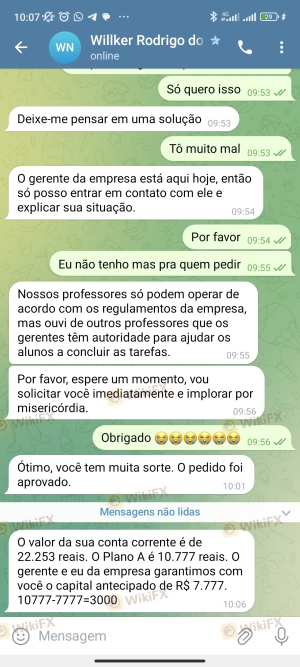

While there have been no significant publicized incidents involving Halcyon Capital regarding fund security, the volume of complaints related to withdrawal issues suggests that there may be operational challenges affecting customer access to their funds. Ensuring that a broker has a robust process for withdrawals and transparent communication regarding fund availability is essential for maintaining client trust.

Customer Experience and Complaints

Customer feedback is a critical indicator of a broker's reliability and service quality. Halcyon Capital has garnered a mixed reputation among its users. While some traders have reported satisfactory experiences, a significant number have voiced complaints, particularly concerning withdrawal difficulties and responsiveness to inquiries.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service | Medium | Inconsistent support |

| Transparency | Medium | Lack of clarity |

Several users have reported instances where their withdrawal requests were delayed or denied, leading to frustration and distrust. For example, one trader recounted a situation where they were asked to complete additional "verification" tasks to access their funds, which raised suspicions about the broker's practices. Such experiences highlight the importance of a broker's responsiveness and willingness to resolve issues promptly.

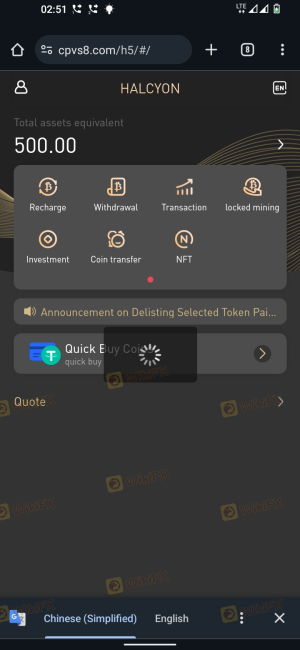

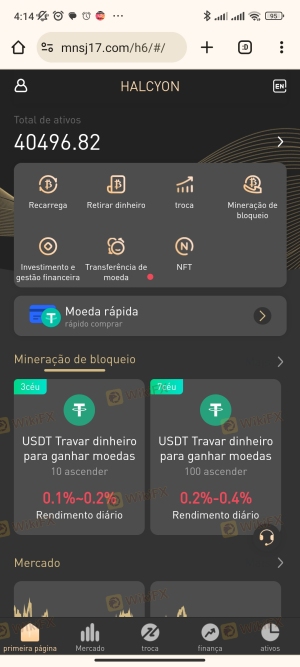

Platform and Execution

The trading platform's performance is another critical factor for traders. Halcyon Capital offers various trading platforms, but user reviews indicate mixed experiences regarding stability and execution quality. Issues such as slippage and order rejections can significantly impact trading outcomes.

The broker's platform is reportedly user-friendly, but traders have expressed concerns over execution speed during volatile market conditions. Delays in order execution can lead to missed opportunities and losses, which are particularly detrimental in the fast-paced forex market.

Moreover, any signs of potential platform manipulation, such as frequent rejections of orders or unusual price movements, should be closely monitored. A transparent and reliable trading environment is essential for fostering trader confidence.

Risk Assessment

Engaging with Halcyon Capital comes with inherent risks, as highlighted by customer complaints and regulatory scrutiny. Evaluating these risks is crucial for potential clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Multiple complaints raised |

| Fund Security | Medium | Segregation, but withdrawal issues |

| Customer Service | High | Poor responsiveness reported |

To mitigate these risks, potential traders should conduct thorough research, utilize demo accounts to test the platform, and ensure that they fully understand the fee structure before committing funds. Additionally, maintaining a cautious approach, especially regarding fund withdrawals, is advisable.

Conclusion and Recommendations

In conclusion, Halcyon Capital presents a complex picture. While it is regulated by the SFC in Hong Kong, the volume of user complaints and issues related to fund withdrawals raises significant concerns about its operational integrity. Traders should be wary of potential risks and exercise caution when engaging with this broker.

For those considering trading with Halcyon Capital, it is essential to conduct thorough due diligence, including testing the platform with a demo account and understanding the fee structure. If you prioritize safety and reliability, it may be prudent to explore other well-established brokers with a stronger track record of customer service and fund security.

In summary, while Halcyon Capital is not outrightly a scam, the presence of multiple red flags suggests that potential clients should proceed with caution and consider alternative options for their trading needs.

Is Halcyon Capital a scam, or is it legit?

The latest exposure and evaluation content of Halcyon Capital brokers.

Halcyon Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Halcyon Capital latest industry rating score is 5.87, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.87 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.