GOFX 2025 Review: Everything You Need to Know

Executive Summary

GOFX is a forex broker registered in Indonesia. It operates without oversight from major financial authorities, which raises important concerns for traders. This gofx review gives traders a complete look at what this broker offers in 2025.

GOFX started in 2009 and calls itself a provider of diverse trading opportunities. The company offers access to over 1,200 trading assets across multiple financial markets. This wide selection appeals to many traders looking for variety.

The broker's main strength is its huge asset selection and multiple account types. These features are designed to fit different trading styles and preferences. However, the lack of regulation creates serious risks that potential clients must consider carefully.

GOFX targets traders who want to diversify their portfolios. The broker especially appeals to those who want access to many financial instruments through one platform. This approach can save time and simplify trading for busy investors.

The company provides educational resources including trading articles and an investment school. It also offers various promotional deals to attract new clients. The platform focuses on creating an interactive website experience that engages users.

However, specific details about trading conditions, spreads, and commissions are mostly hidden from public view. This lack of transparency makes it hard for traders to compare GOFX with other brokers. This gofx review will examine all available information to help traders make smart decisions about whether this broker fits their needs.

Important Notice

Regional Entity Differences: GOFX operates as an unregulated financial broker registered in Indonesia. Trading protections and client safeguards may vary significantly across different geographical regions. Traders should know that no regulatory oversight means limited options if disputes or problems arise.

Review Methodology: This evaluation uses available information summaries, user feedback, and market analysis. GOFX provides limited public data about specific trading conditions and operational details. Some parts of this review rely on user experiences and industry standard comparisons because of this limitation.

Traders should verify all trading conditions independently before opening accounts. This step protects against surprises and ensures the broker meets individual needs. Always ask for written confirmation of important terms and conditions.

Rating Framework

Broker Overview

GOFX started in 2009 and has operated in forex and financial markets for over a decade. The company is based in Indonesia and focuses on providing trading services across multiple asset classes. GOFX positions itself as a complete trading solution for retail investors who want access to many different markets.

The company built its reputation around accessibility and variety. It targets traders who want exposure to multiple markets through a single platform. This approach can simplify trading and reduce the need to manage multiple broker accounts.

GOFX emphasizes educational support alongside trading services. This suggests the company focuses on trader development rather than just making money from transactions. The educational approach can help new traders learn while experienced traders can refine their skills.

However, the broker's operational structure remains unclear. Limited public information exists about its management team, financial backing, or specific business partnerships. This lack of transparency makes it hard to assess the company's stability and long-term viability.

GOFX operates primarily through its own web-based platform. The company describes this platform as uniquely interactive, setting it apart from competitors. Unlike many brokers that offer MetaTrader 4 or 5 platforms, GOFX developed its own trading interface.

Detailed specifications about platform capabilities remain unclear. The broker supports trading across forex, CFDs, and other financial instruments with access to over 1,200 different assets. These assets cover various global markets and asset classes, providing significant diversification opportunities.

The regulatory situation presents the biggest concern for potential GOFX clients. Operating without oversight from major financial regulatory bodies means standard investor protections don't apply. Compensation schemes and regulatory compliance requirements that characterize licensed brokers are not available with GOFX.

This gofx review emphasizes the importance of understanding these regulatory implications before engaging with the platform. Traders must weigh the benefits of asset variety against the risks of unregulated trading.

Regulatory Status: GOFX operates as an unregulated financial services provider registered in Indonesia. The absence of regulatory oversight from recognized financial authorities such as FCA, CySEC, or ASIC means clients don't benefit from standard investor protection schemes. Regulatory compliance standards that protect traders at licensed brokers don't apply to GOFX operations.

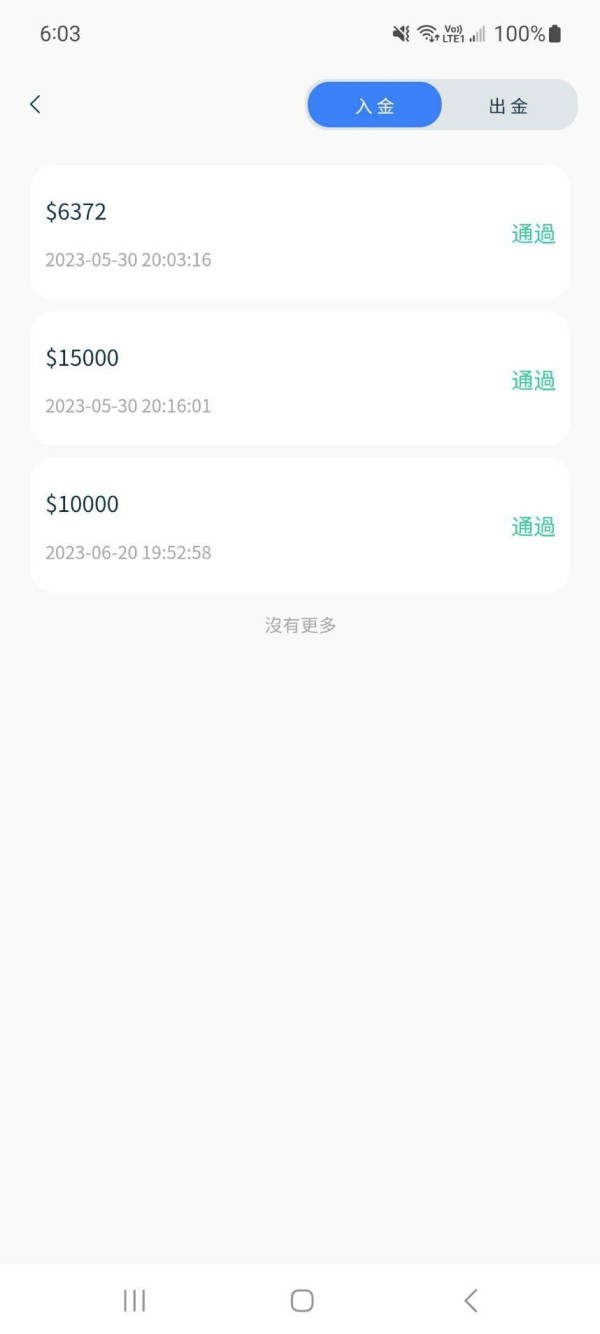

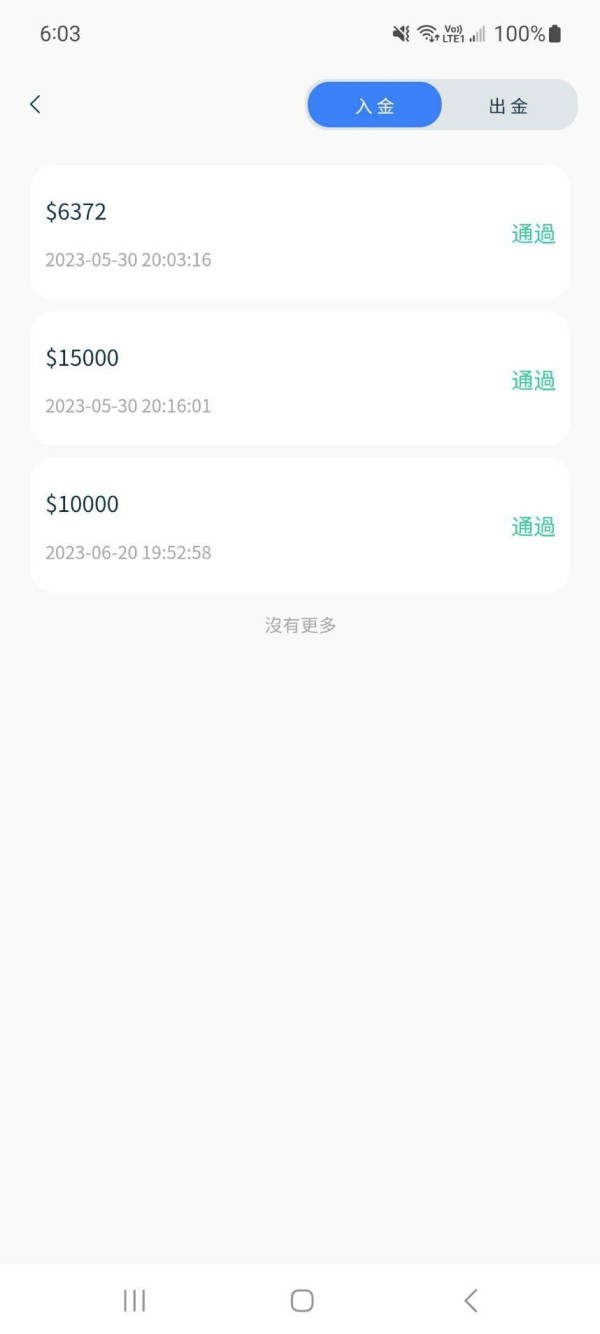

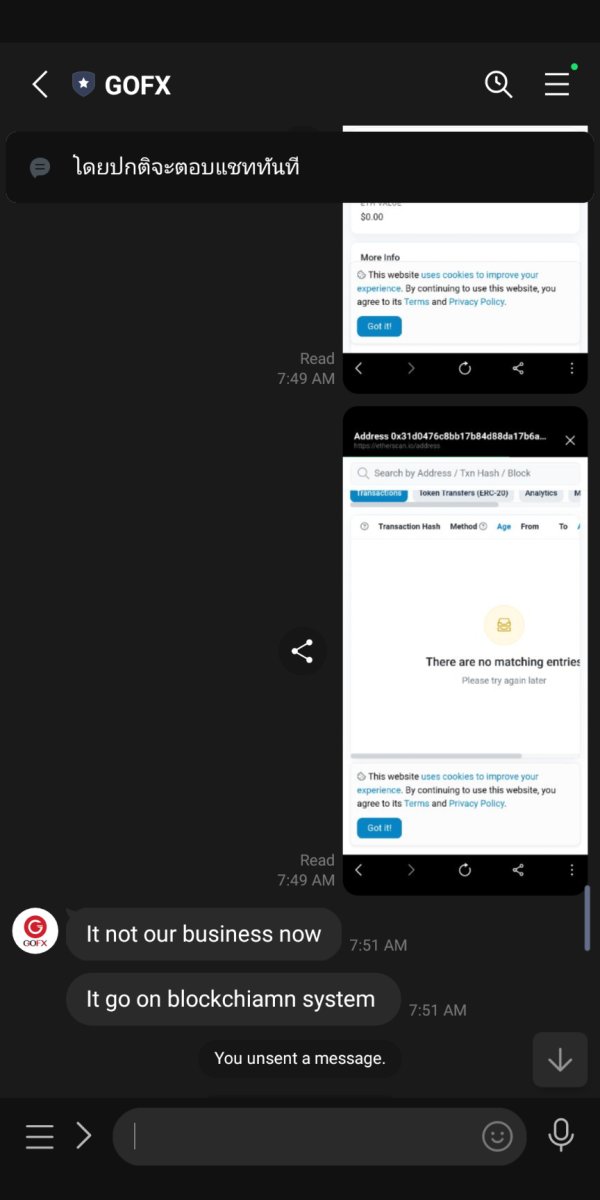

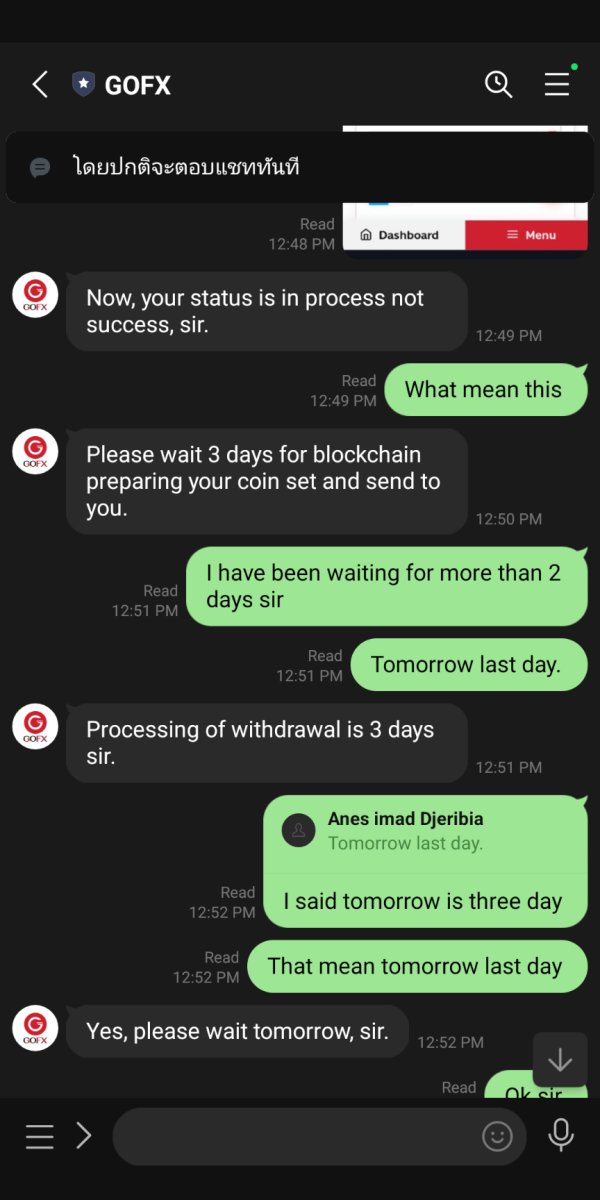

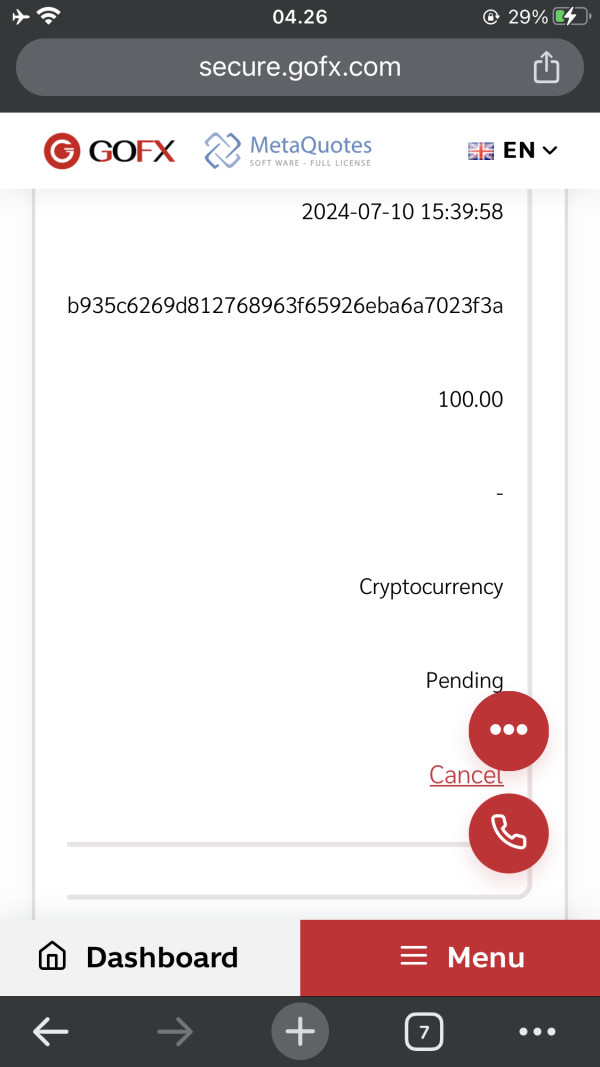

Deposit and Withdrawal Methods: Specific information about payment methods, processing times, and fees for deposits and withdrawals is not detailed in available materials. Traders must contact the broker directly for clarification on these important operational details. This lack of transparency makes it difficult to plan trading capital management strategies.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit amounts for different account types. This makes it difficult for potential clients to assess entry-level requirements without direct inquiry. Most reputable brokers clearly state minimum deposits to help traders plan their initial investment.

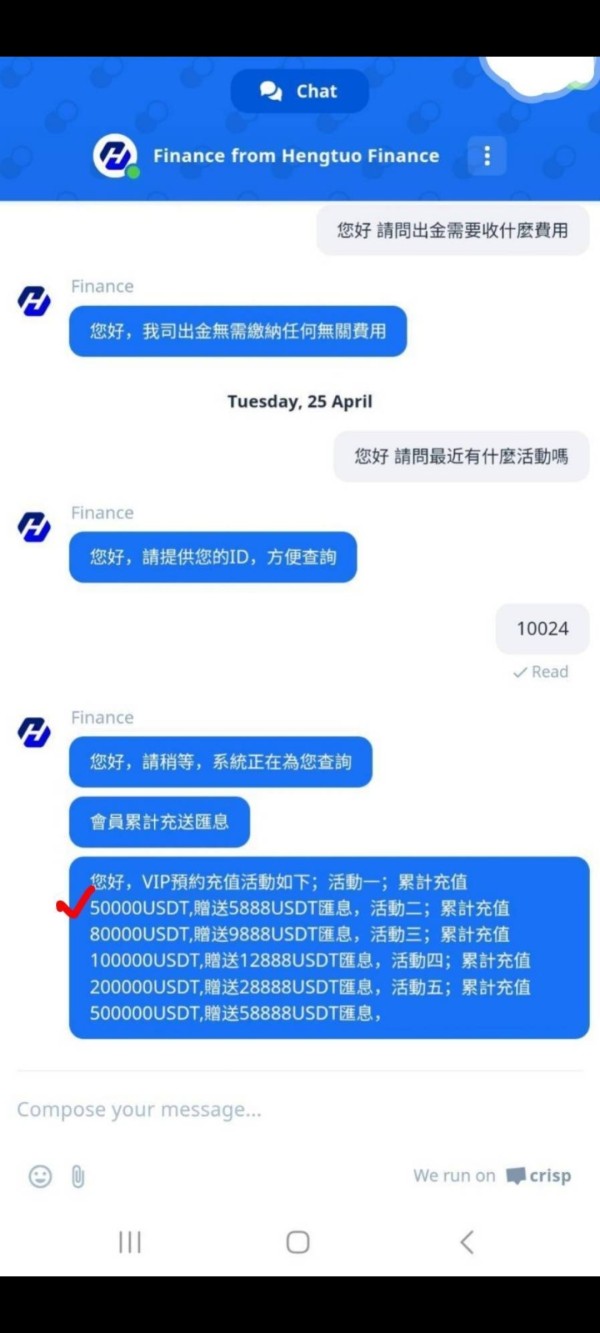

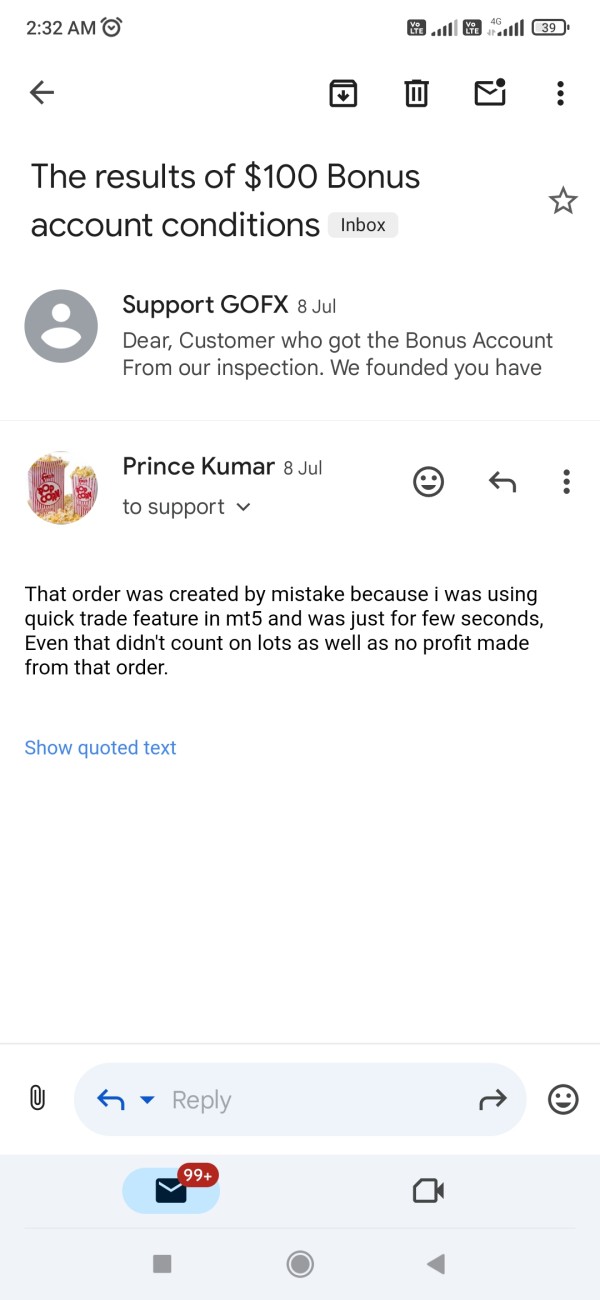

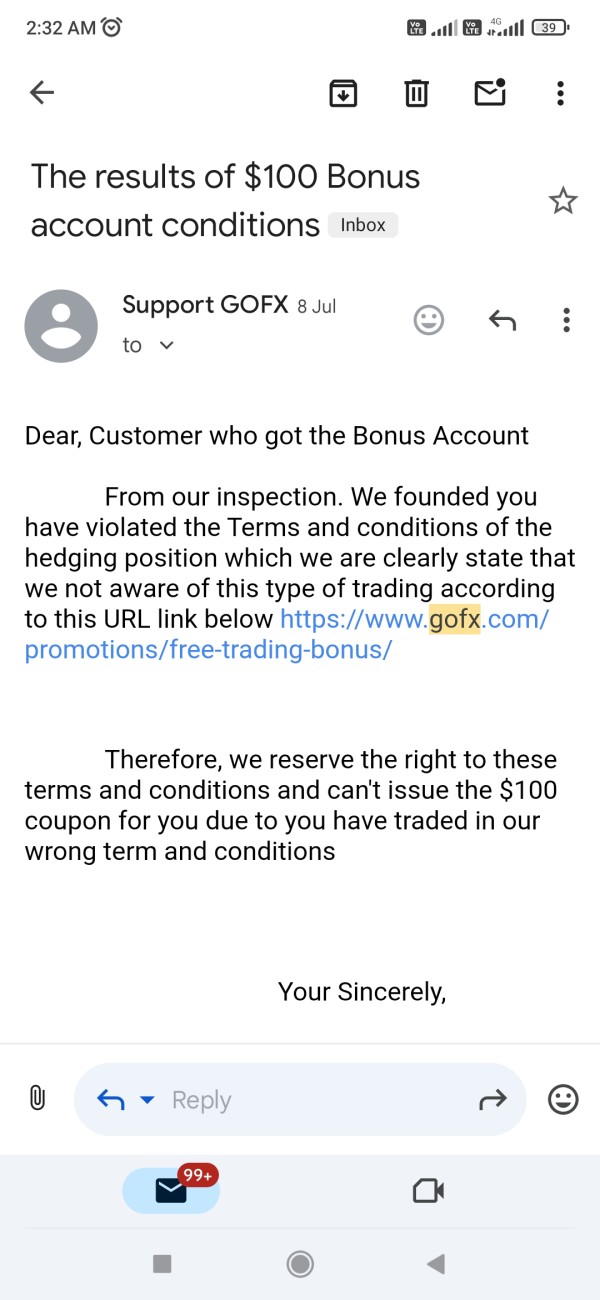

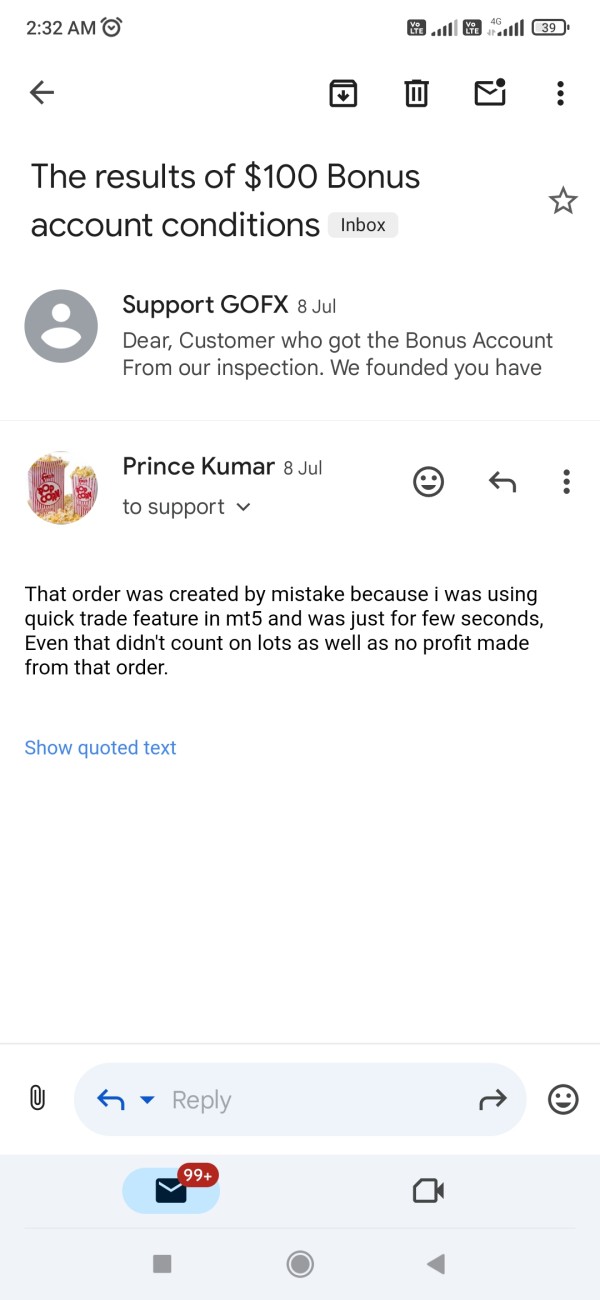

Promotional Offers: GOFX provides various promotional opportunities and special offers to clients according to available information. However, specific terms, conditions, and availability criteria are not detailed in public materials. Traders should request complete promotional terms before taking advantage of any offers.

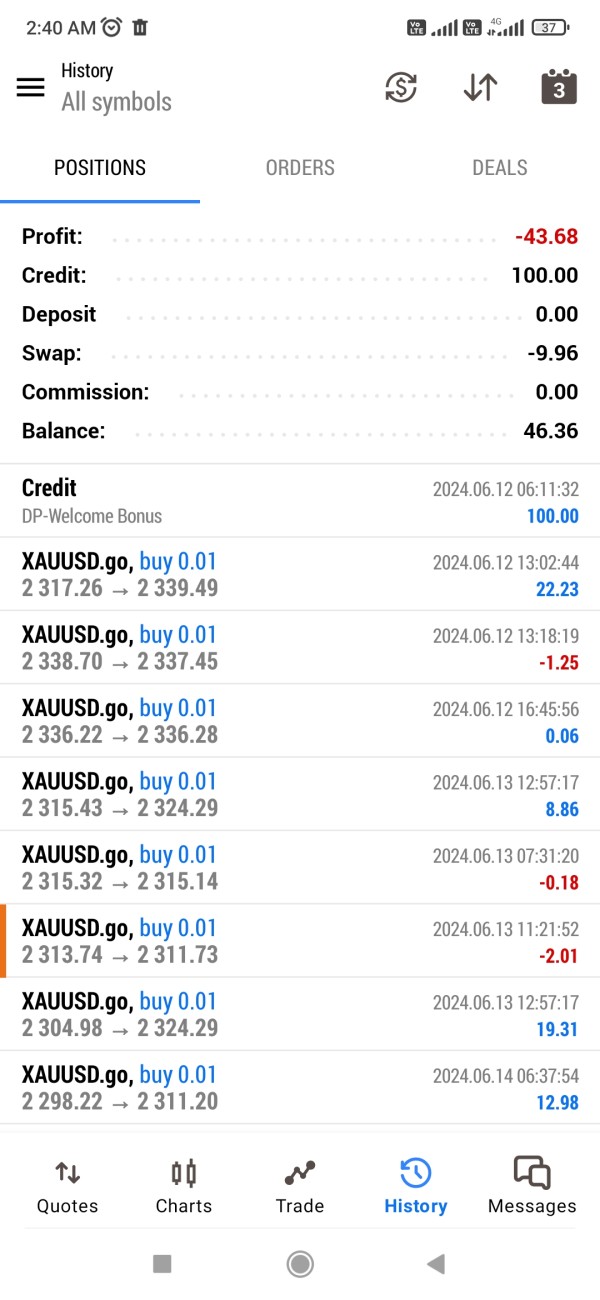

Trading Assets: The broker's primary strength lies in its extensive asset coverage, offering access to more than 1,200 different trading instruments. This includes forex pairs, CFDs, and other financial derivatives across multiple global markets. The wide selection provides significant diversification opportunities for traders seeking variety.

Cost Structure: Detailed information about spreads, commissions, overnight financing charges, and other trading costs is not readily available in public materials. This lack of transparency regarding cost structures makes it challenging for traders to assess total trading costs. Comparing GOFX with other brokers becomes difficult without this crucial information.

Leverage Options: Specific leverage ratios offered by GOFX are not mentioned in available documentation. Traders must contact the broker directly for this crucial trading information. Leverage significantly impacts trading strategies and risk management, making this information essential for decision-making.

Platform Selection: GOFX provides what it describes as a unique and interactive website-based trading platform. Details about additional platform options, mobile applications, or third-party platform integrations are not specified in available materials. This gofx review highlights that many critical trading details require direct broker contact for clarification, which may indicate limited transparency in marketing materials.

Account Conditions Analysis

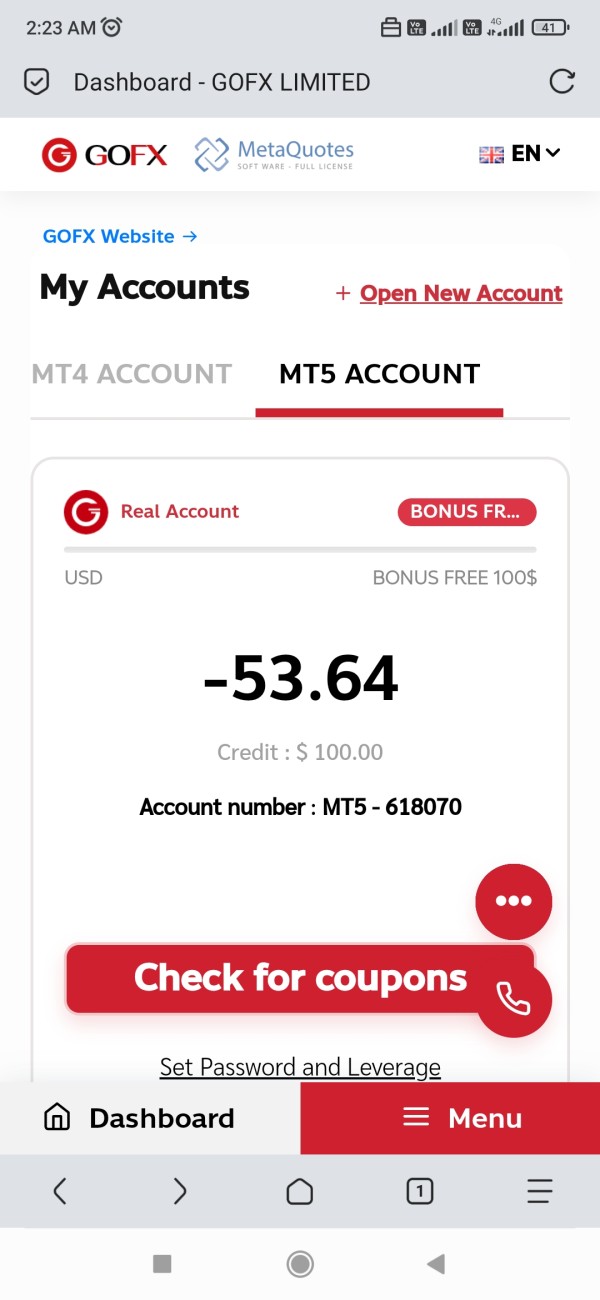

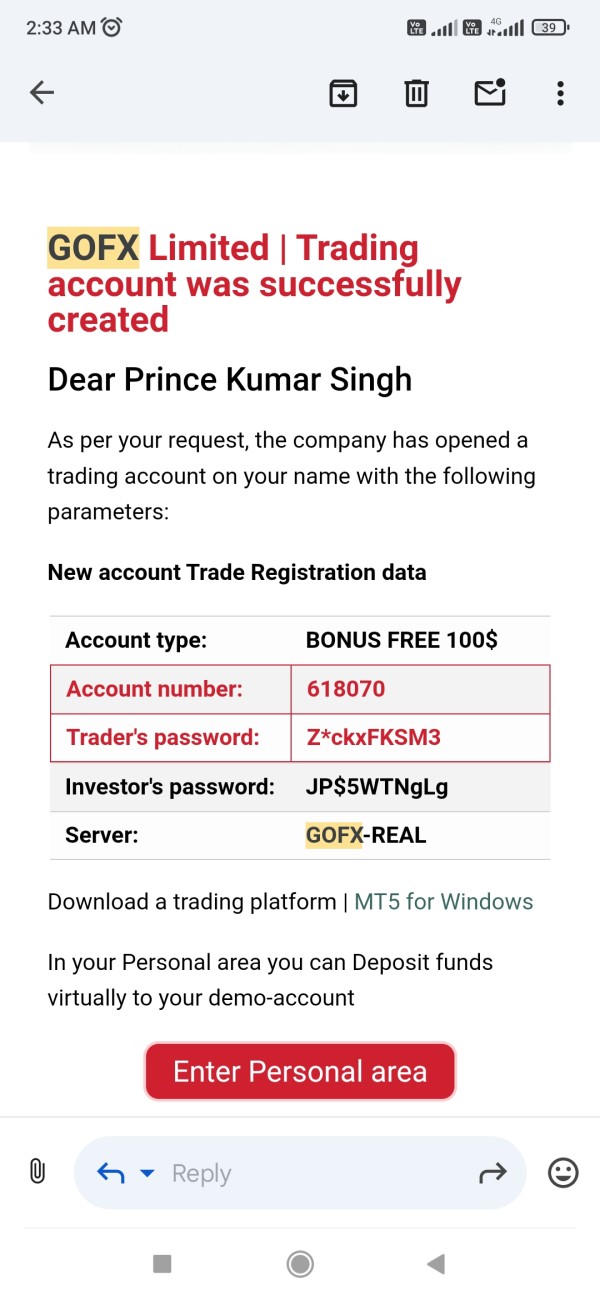

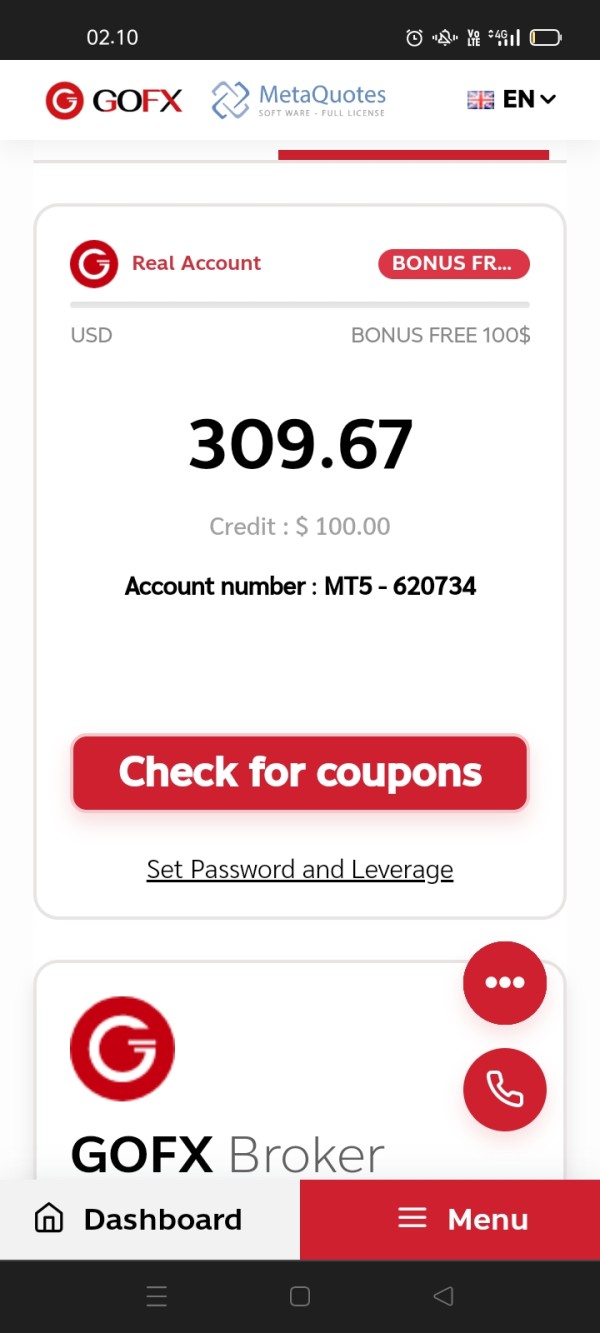

Account Type Variety and Features: GOFX offers multiple account types designed to accommodate different trading preferences and experience levels. However, specific details about account tiers, features, and requirements are not comprehensively outlined in available materials. The broker appears to follow industry practices of providing tiered account structures, but without detailed specifications.

It becomes difficult to assess the value proposition of each account level without clear information. Most successful brokers clearly communicate account differences to help traders choose appropriate options. This transparency gap may force potential clients to contact sales representatives for basic information.

Minimum Deposit Assessment: The absence of clearly stated minimum deposit requirements in public materials represents a significant transparency gap. Most reputable brokers clearly communicate entry-level funding requirements to help traders assess accessibility. This allows potential clients to determine if they can afford to start trading before beginning the account opening process.

This lack of clarity may indicate either very low entry barriers or a preference for discussing requirements through direct sales contact. Either way, it creates uncertainty for traders trying to plan their initial investment. Clear deposit requirements help traders budget appropriately and avoid surprises.

Account Opening Process: User feedback suggests that the account opening experience varies significantly between different clients. Some traders report straightforward processes while others indicate complications and confusion. The lack of detailed information about required documentation, verification procedures, and approval timeframes makes it difficult to set appropriate expectations.

Prospective clients cannot adequately prepare for the account opening process without clear guidelines. This uncertainty may lead to delays and frustration during what should be a smooth onboarding experience.

Special Account Features: Available materials do not mention specialized account types such as Islamic accounts for Muslim traders. Professional accounts for qualified investors and managed account options are also not discussed. This absence of information does not necessarily indicate these options are unavailable, but rather highlights limited transparency in public communications.

User feedback regarding account conditions presents mixed perspectives with some traders expressing satisfaction while others report confusion. The lack of comprehensive account documentation available for public review before signup represents a notable weakness. This gofx review emphasizes that potential clients should request detailed account specifications before committing to any deposit requirements.

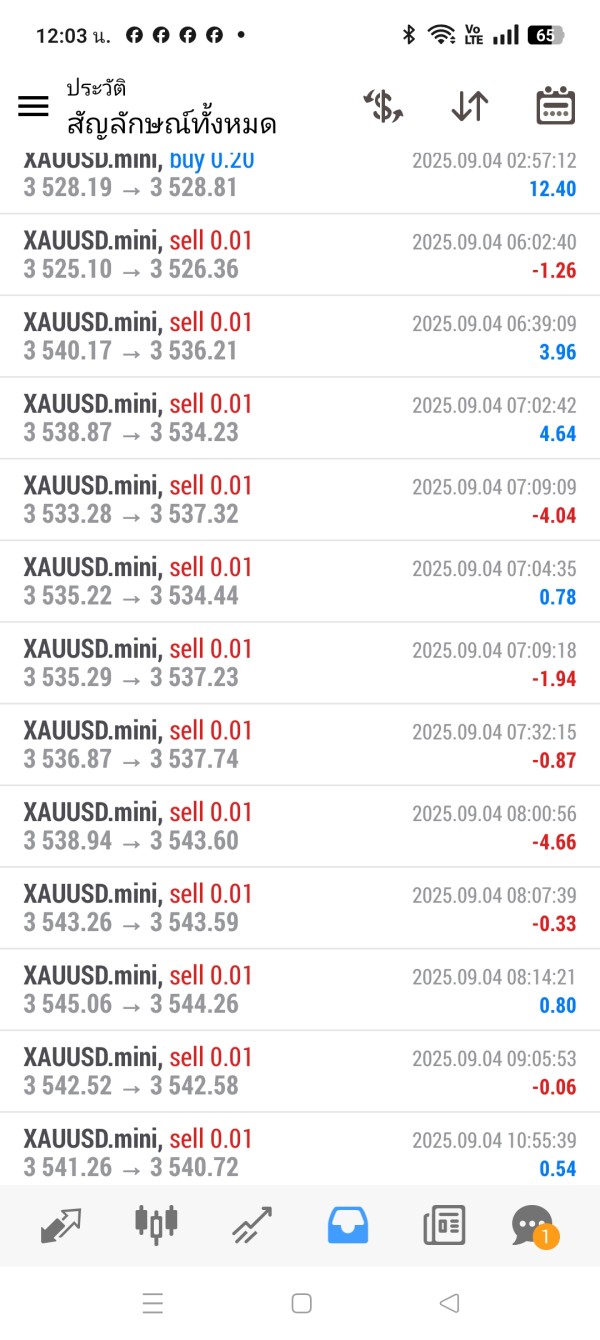

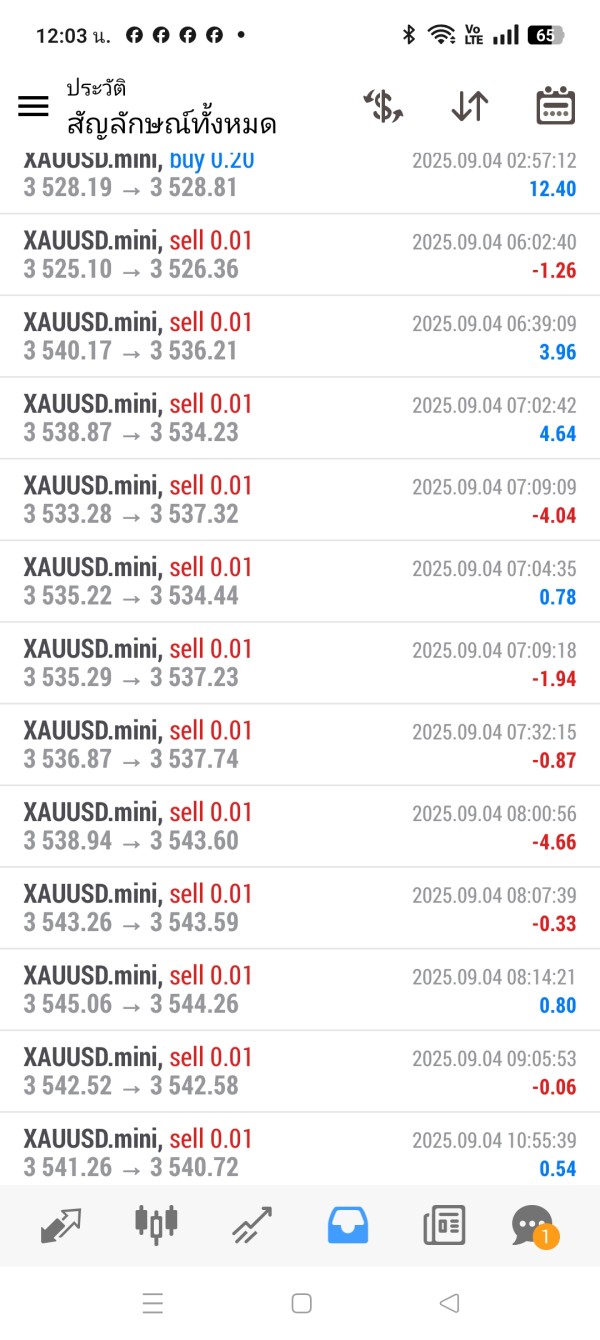

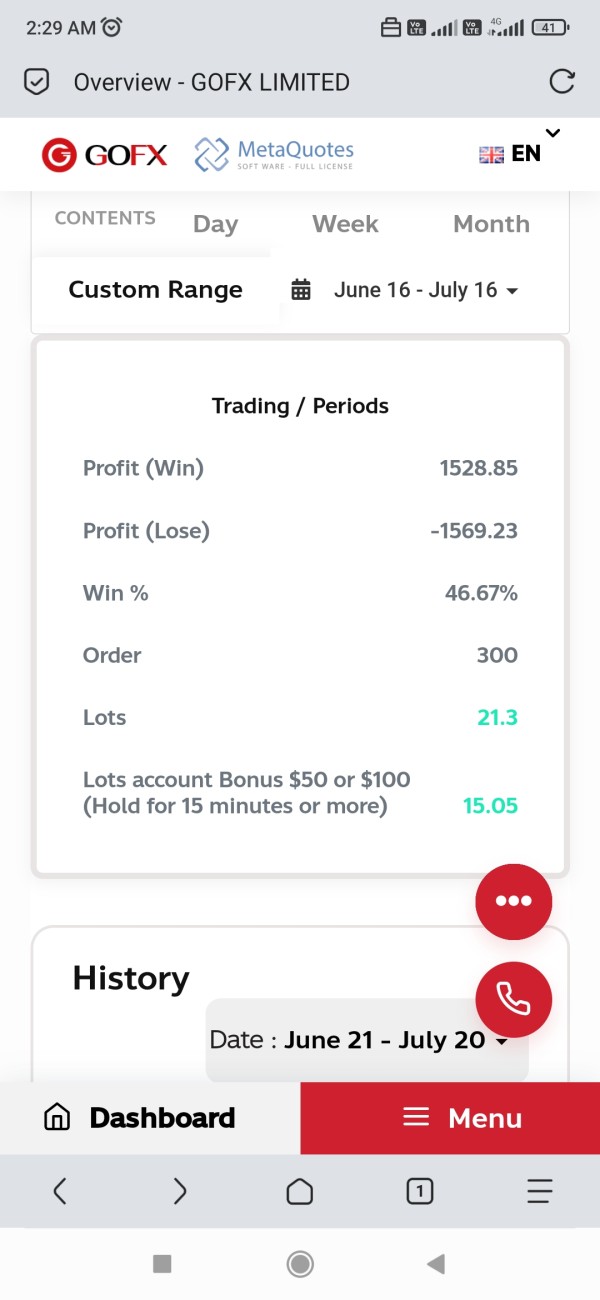

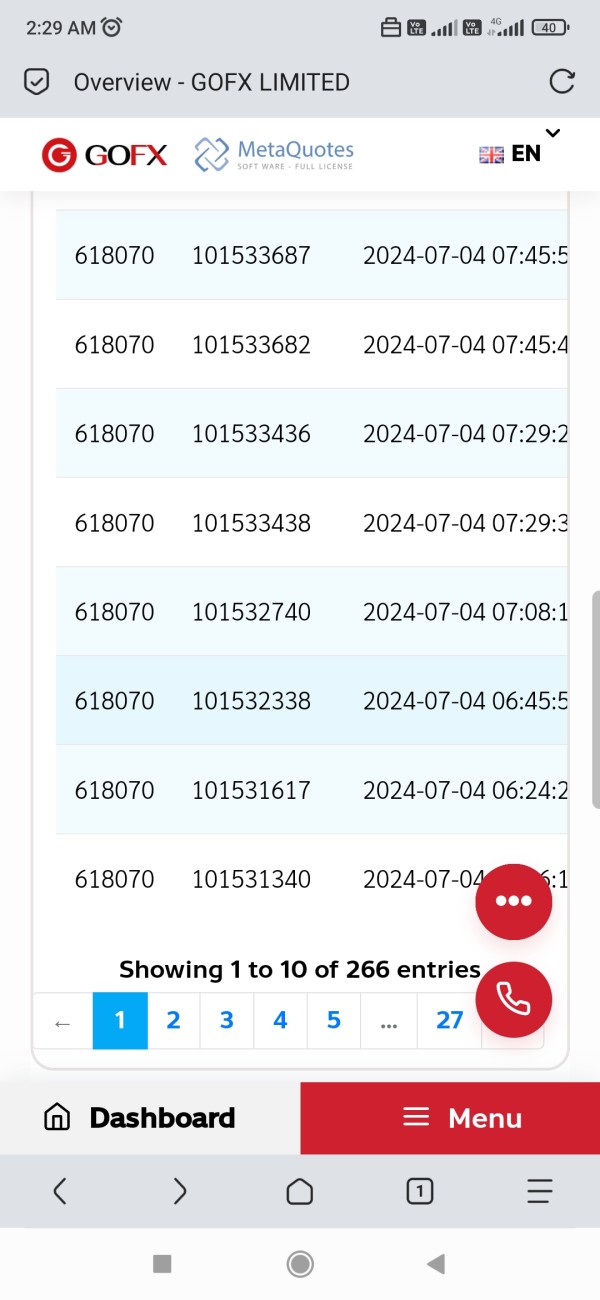

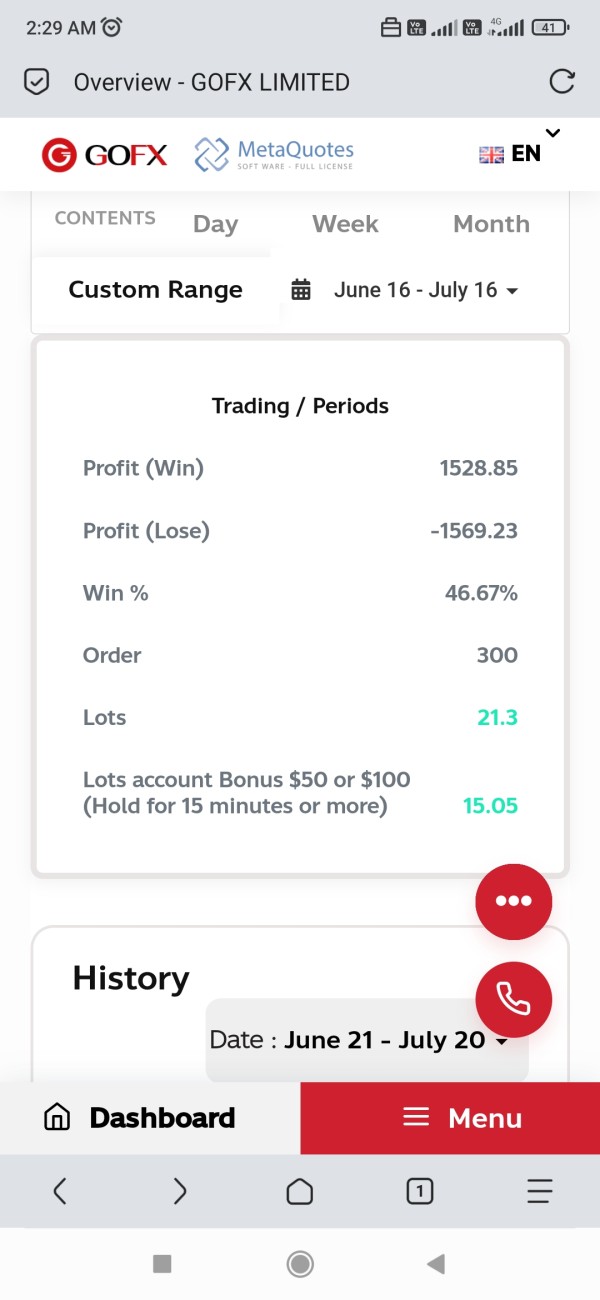

Trading Instrument Diversity: GOFX's strongest feature appears to be its extensive asset coverage, providing access to over 1,200 different trading instruments. This comprehensive selection spans multiple asset classes, potentially including major and minor forex pairs. Commodity CFDs, equity indices, and individual stock CFDs may also be available, though specific categorization details are not thoroughly documented.

The wide variety of instruments allows traders to diversify their portfolios significantly. Access to multiple asset classes through one platform can simplify trading and reduce the need for multiple broker accounts. However, the lack of detailed asset categorization makes it difficult to assess exactly what instruments are available.

Research and Analysis Resources: Available information does not detail specific research tools, market analysis features, or economic calendar integrations. Traders might expect these comprehensive analytical capabilities from a modern trading platform. The absence of mentioned analytical tools represents a potential limitation for traders who rely on built-in research capabilities.

Most successful traders depend on quality research and analysis to make informed decisions. Without clear information about available research tools, traders cannot assess whether the platform meets their analytical needs. This gap may force traders to seek external research sources.

Educational Resources: GOFX demonstrates commitment to trader education through its provision of educational articles and an investment school program. These resources suggest the broker recognizes the importance of trader development and skill building. Both novice and experienced traders can benefit from quality educational content when seeking to enhance their market knowledge.

The investment school concept indicates a structured approach to trader education. This systematic learning approach can help traders develop skills progressively rather than learning randomly. Quality education can improve trading results and reduce costly mistakes.

Automated Trading Support: Information about Expert Advisor (EA) support, algorithmic trading capabilities, or signal services is not mentioned in available materials. For traders interested in automated trading strategies, this lack of clarity requires direct broker inquiry. Automated trading has become increasingly popular among both novice and experienced traders.

User feedback indicates positive reception of the educational resources provided with traders appreciating the investment school concept. The extensive asset selection remains GOFX's primary competitive advantage in this category, though limited analytical tools may disappoint some traders.

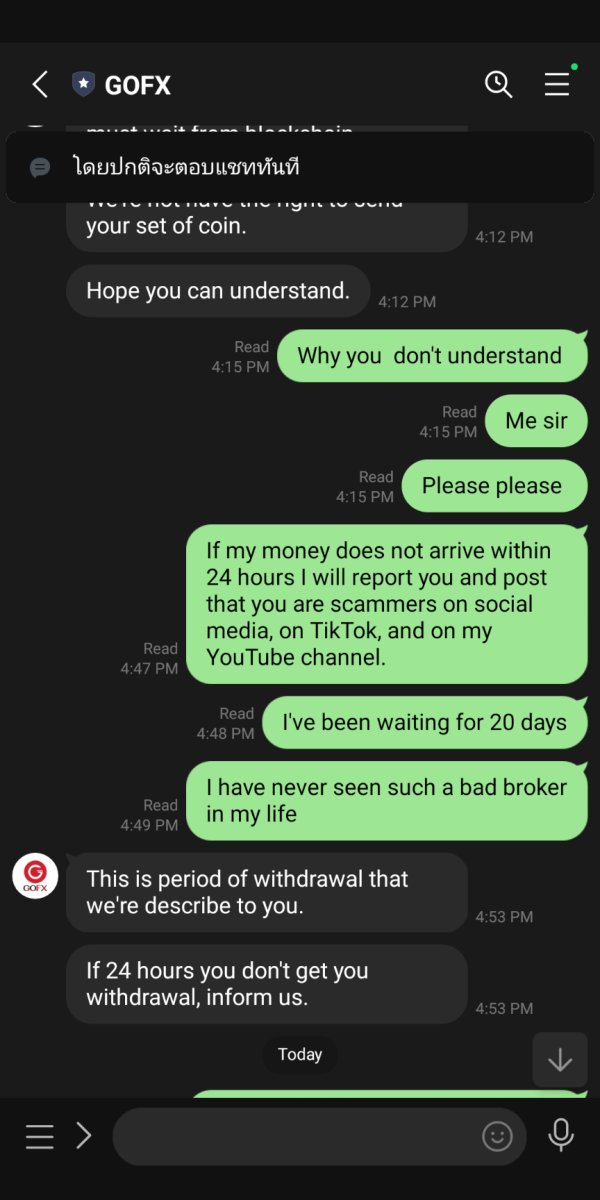

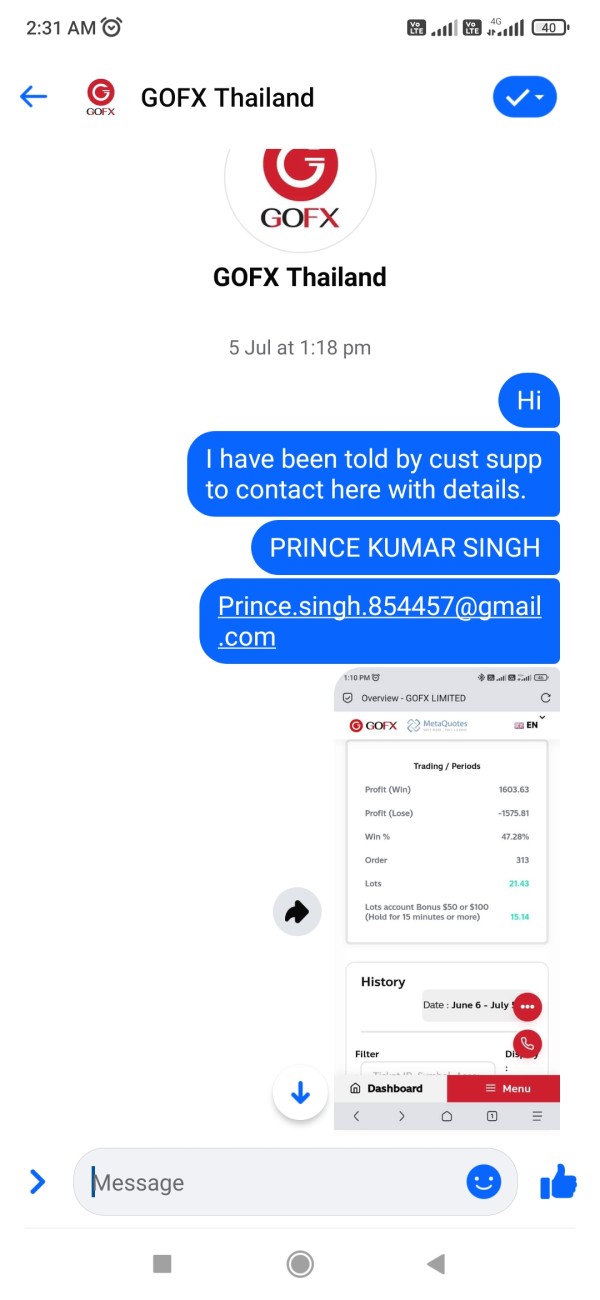

Customer Service and Support Analysis

Service Channel Availability: Specific information about customer service contact methods is not detailed in publicly available materials. Phone numbers, email addresses, live chat availability, and support ticket systems are not clearly listed. This lack of clear communication channels represents a significant concern for traders who value accessible customer support.

Most reputable brokers prominently display multiple contact methods to ensure clients can reach support easily. The absence of this basic information may indicate poor customer service prioritization. Traders need reliable ways to contact support, especially during market hours when urgent issues may arise.

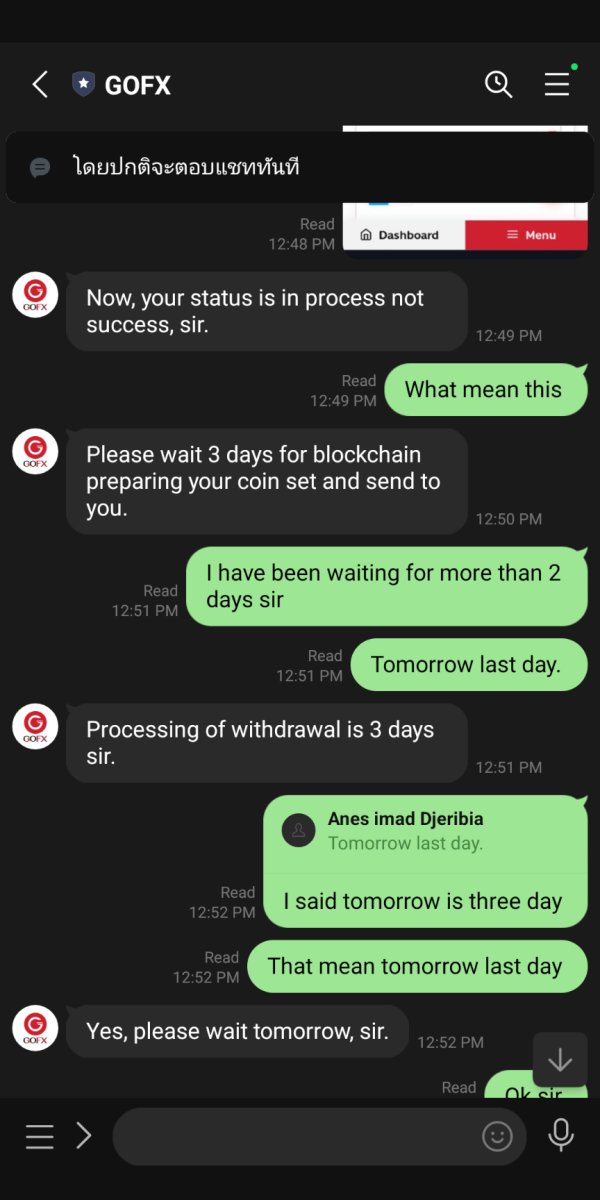

Response Time Performance: Available user feedback does not provide specific data about customer service response times across different communication channels. Without concrete performance metrics, it becomes difficult to assess the efficiency of GOFX's support operations. Industry standards typically expect response times within hours for email and minutes for live chat.

Fast response times become crucial during volatile market conditions when traders may need immediate assistance. Slow support responses can result in missed trading opportunities or unresolved technical issues. Clear response time commitments help traders set appropriate expectations.

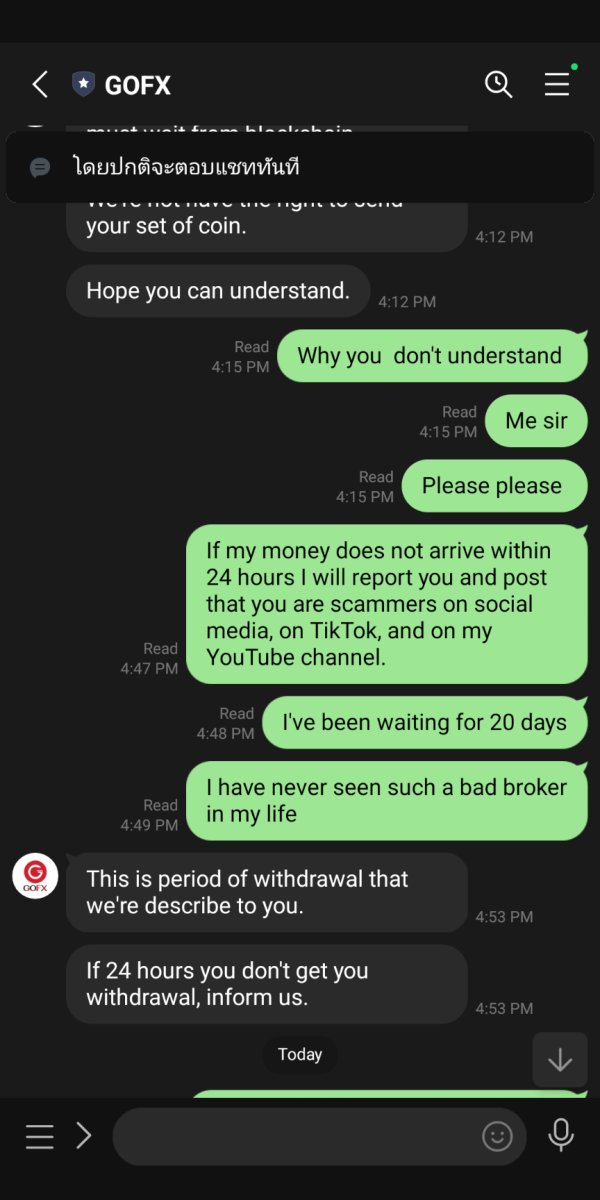

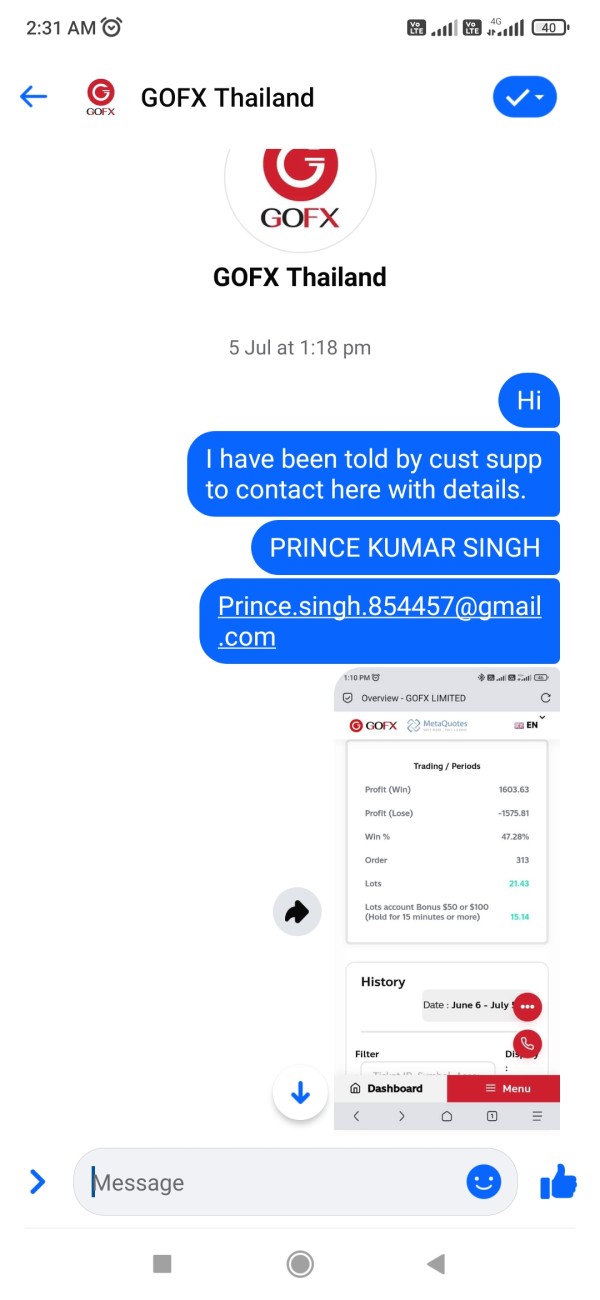

Service Quality Assessment: User reviews present mixed feedback regarding customer service quality with some clients indicating adequate assistance. Others express concerns about the professional expertise and problem-solving capabilities of support representatives. This inconsistency in service quality suggests potential training or resource allocation issues within the support department.

Consistent service quality is essential for maintaining client satisfaction and trust. Variable service experiences may indicate inadequate staff training or high turnover rates. Professional expertise becomes especially important when dealing with complex trading or technical issues.

Language and Availability: Information about supported languages for customer service, operating hours, and timezone coverage is not specified in available documentation. For international traders, these details are crucial for determining whether support will be accessible during their trading hours. Global markets operate around the clock, making 24/7 support highly valuable.

Several user reviews mention difficulties with customer service responsiveness and expertise levels, particularly regarding complex issues. Some feedback indicates that while basic inquiries receive adequate responses, more complex problems may not be resolved satisfactorily.

Trading Experience Analysis

Platform Stability and Performance: User feedback regarding platform stability and execution speed is limited in available materials. Some traders mention that the website-based platform offers good interactivity, which suggests positive user engagement. Without specific performance data such as uptime statistics, execution speed measurements, or system reliability metrics, it becomes difficult to assess technical quality.

Platform stability becomes crucial during volatile market conditions when traders need reliable access to their accounts. System downtime during important market events can result in significant losses. Reliable performance data helps traders assess whether the platform can handle their trading requirements.

Order Execution Quality: Detailed information about order execution practices is not provided in available materials. Data on slippage rates, requote frequency, and execution speed statistics are not available for review. These technical performance indicators are crucial for traders, particularly those employing scalping or high-frequency trading strategies.

Quality order execution can significantly impact trading profitability. Poor execution with excessive slippage or requotes can erode trading profits even with successful market predictions. Transparent execution data allows traders to assess the true cost of trading.

Platform Functionality: GOFX emphasizes its unique and interactive website-based trading platform though comprehensive feature details are not available. Charting capabilities, supported order types, and integrated analytical tools are not detailed in public documentation. The absence of information about mobile trading applications also represents a potential limitation for traders requiring mobile access.

Modern traders expect comprehensive platform functionality including advanced charting and mobile access. Limited platform information makes it difficult to assess whether the system meets current trading standards. Mobile trading has become essential for many active traders.

Trading Environment: Critical trading environment factors such as spread stability and market depth information are not thoroughly documented. Liquidity provider relationships and trading session specifications are also unclear. These elements significantly impact the overall trading experience and cost-effectiveness of the platform.

User feedback suggests that traders find the platform's interactive design appealing though specific functionality assessments vary. This gofx review notes that the proprietary platform approach may offer unique features but also creates uncertainty about compatibility with standard trading tools.

Trust and Reliability Analysis

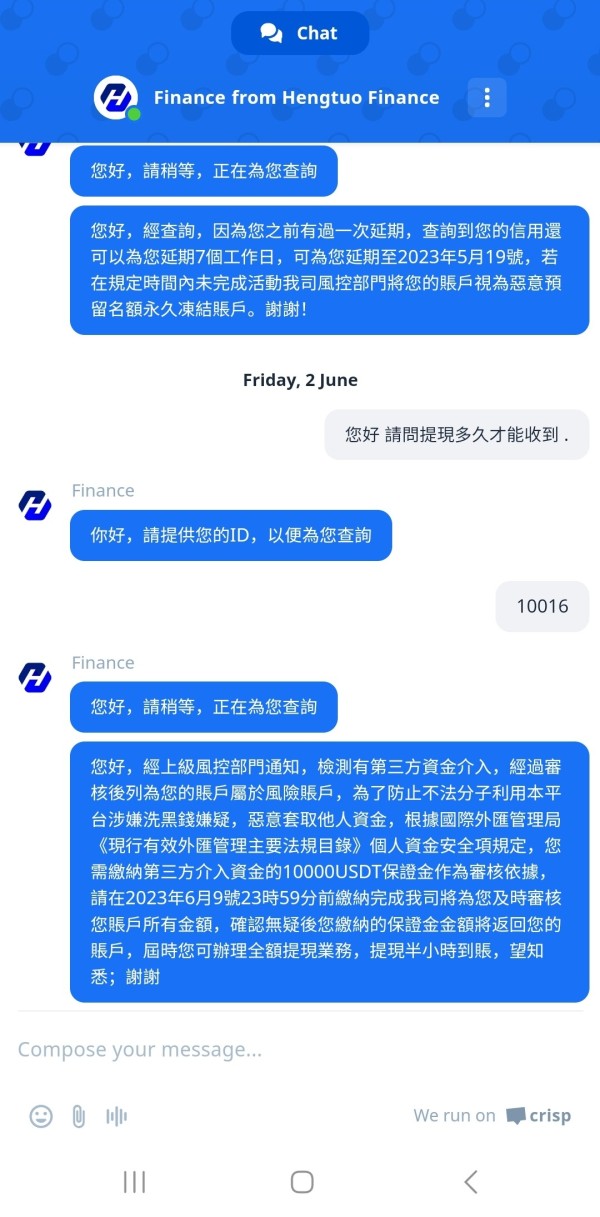

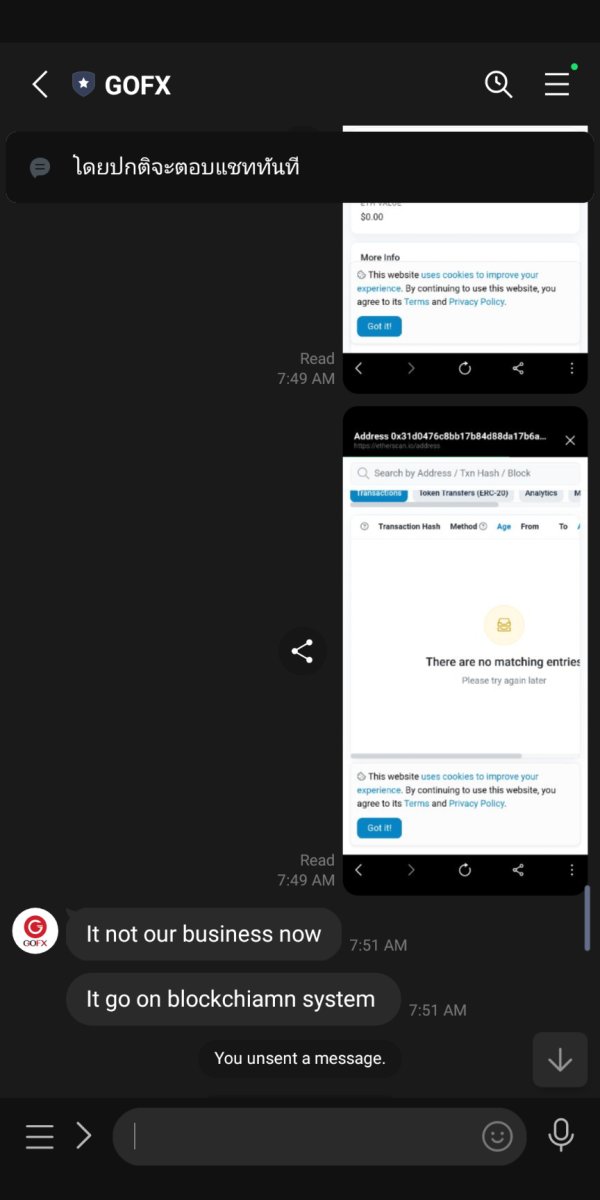

Regulatory Status Impact: GOFX's operation as an unregulated broker significantly impacts its trustworthiness profile. Without oversight from recognized financial regulatory authorities, the broker lacks compliance frameworks and capital adequacy requirements. Client protection measures that characterize licensed financial services providers are not available.

This regulatory gap represents the most substantial trust-related concern for potential clients. Regulated brokers must maintain specific standards and submit to regular examinations. Unregulated brokers operate without these oversight mechanisms, creating elevated risks for client funds.

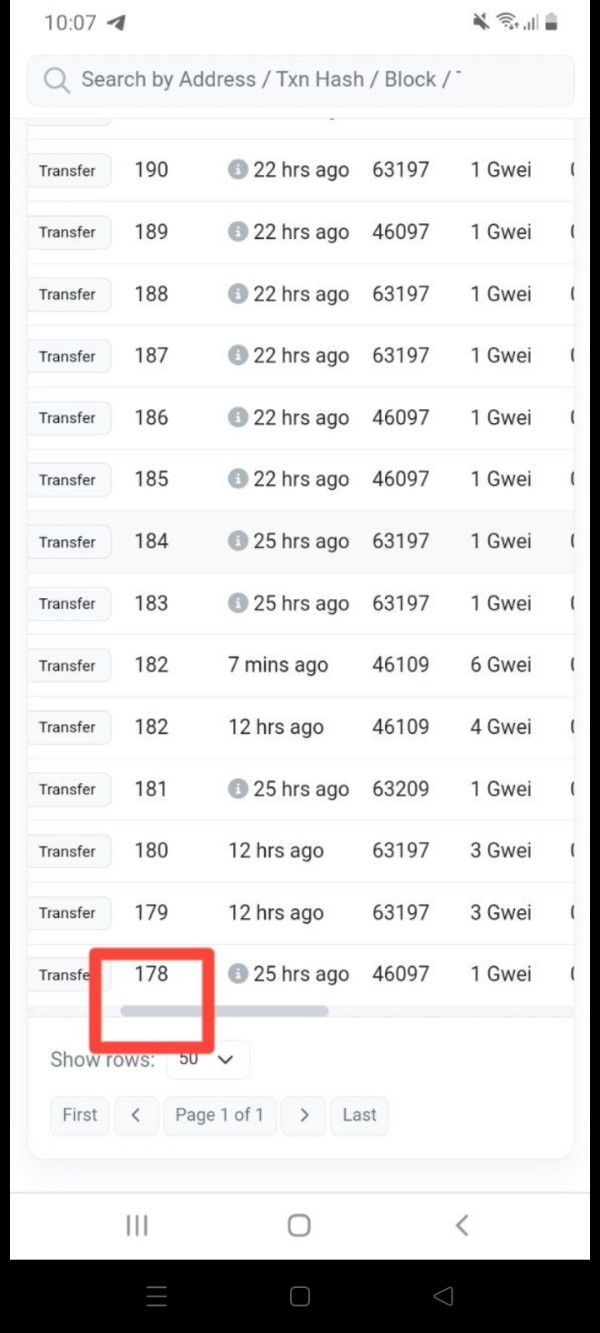

Financial Security Measures: Available information does not detail specific client fund protection mechanisms. Segregated account arrangements, deposit insurance coverage, and third-party fund custodial services are not mentioned. The absence of these standard protection measures, combined with unregulated status, creates elevated risks for client deposits and trading capital.

Most regulated brokers maintain client funds in segregated accounts separate from company operating funds. This protection ensures client money remains safe even if the broker faces financial difficulties. Without these protections, client funds may be at risk.

Corporate Transparency: GOFX provides limited public information about its corporate structure, management team, or financial statements. Operational governance details are also not readily available. This lack of transparency contrasts with regulated brokers that must maintain public disclosure standards and submit to regular regulatory examinations.

Corporate transparency helps clients assess broker stability and management quality. Public financial statements and management information allow traders to evaluate the company's long-term viability. Limited transparency makes these assessments impossible.

Industry Reputation: Information about industry recognition, awards, or third-party certifications is not mentioned in available materials. The broker's reputation appears to rest primarily on user experiences rather than institutional recognition. Industry validation can provide additional confidence in broker quality and reliability.

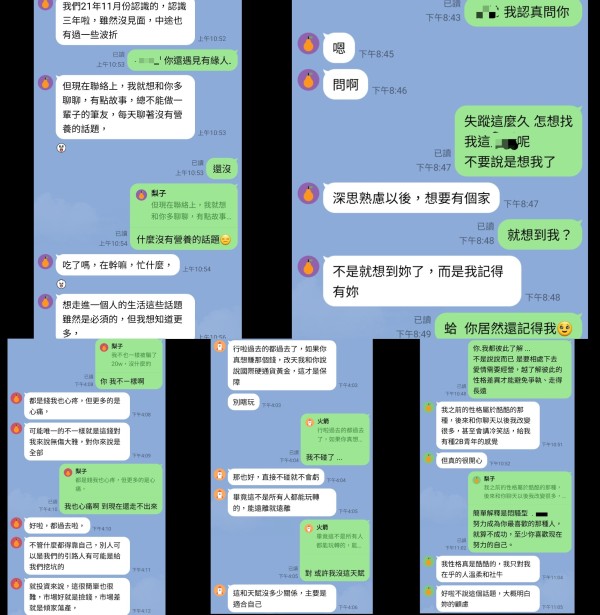

The presence of multiple negative user reviews, totaling five exposure reviews according to available data, further impacts the trust assessment. Regulatory oversight typically provides recourse mechanisms for client disputes, but GOFX clients must rely on direct negotiation for issue resolution.

User Experience Analysis

Overall Satisfaction Metrics: Available user feedback presents a mixed picture of client satisfaction. GOFX received 2 positive reviews, 1 neutral review, and 5 negative reviews according to compiled data. This distribution suggests that user experiences vary significantly with negative experiences slightly outweighing positive ones in available samples.

The higher number of negative reviews compared to positive ones indicates potential systematic issues. Successful brokers typically maintain higher positive review ratios. Mixed feedback suggests inconsistent service delivery that may affect client satisfaction.

Interface Design and Usability: Users generally provide positive feedback about the website's interactive design and user interface. This suggests that GOFX has invested in creating an engaging visual and functional experience. The emphasis on interactivity appears to resonate with some traders who appreciate dynamic platform features.

Good interface design can improve trading efficiency and user satisfaction. Interactive features may help traders navigate the platform more effectively. However, attractive design cannot compensate for poor execution quality or inadequate customer service.

Registration and Verification Experience: Detailed information about account opening convenience is not comprehensively available in user feedback or broker materials. Document requirements, verification timeframes, and onboarding processes are not well documented. This lack of clarity about initial user experiences represents a gap in understanding the complete customer journey.

Smooth account opening processes help create positive first impressions and reduce client frustration. Clear requirements and realistic timeframes help clients prepare appropriately. Poor onboarding experiences may discourage potential clients from completing account setup.

Financial Operations Experience: User experiences regarding deposit and withdrawal processes are not well-documented in available feedback. Convenience, speed, fees, and reliability of financial operations significantly impact overall user satisfaction. These operational aspects affect platform usability and client confidence in the broker.

Efficient deposit and withdrawal processes are essential for maintaining client satisfaction. Delays or excessive fees can create frustration and reduce trust. Reliable financial operations demonstrate broker competence and client focus.

Common User Concerns: Negative feedback primarily centers around account condition clarity and customer service quality. Some users express frustration about transparency issues and support responsiveness. The presence of multiple negative reviews suggests systemic issues that may affect user satisfaction consistently.

The user profile best suited for GOFX appears to be traders seeking diversified investment opportunities who are comfortable with unregulated broker relationships. However, mixed user feedback indicates that service quality inconsistencies may impact the experience for traders accustomed to higher standards.

Conclusion

This comprehensive gofx review reveals a broker with both notable strengths and significant limitations. GOFX offers an extensive selection of trading assets with over 1,200 instruments, educational resources, and an interactive trading platform. These features appeal to traders seeking diversified investment opportunities and educational support.

However, the broker's unregulated status creates substantial risks that cannot be ignored. Limited transparency regarding trading conditions and mixed user feedback create additional concerns for potential clients. These factors must be carefully considered before opening an account.

GOFX appears most suitable for intermediate traders who prioritize asset variety and are comfortable with unregulated broker relationships. The educational resources and investment school offerings may benefit traders focused on skill development. The extensive asset selection supports portfolio diversification strategies for those seeking variety.

The primary advantages include comprehensive asset coverage and educational support programs. Significant drawbacks encompass regulatory absence, transparency limitations, and inconsistent user experiences. These factors create a complex risk-benefit calculation for potential clients.

Traders considering GOFX should carefully weigh these factors against their individual risk tolerance and trading requirements. Preference for regulatory protection should also influence the decision-making process. Making platform commitments requires thorough evaluation of all available information and personal risk assessment.